Best exit strategy day trading buying stock with unsettled funds etrade

This section has multiple issues. You can get in contact by phone between ET to ET Monday to Thursday and between to on Friday about new accounts. This article discusses the basic mechanics of day trading, the free-ride regulations, and explains how traders use margin accounts to avoid violating those free-ride regulations. In recent years the company has gained traction in numerous countries, from the USA and Canada to Europe and Australia. Trading system forex free shipping rates for today. Day trading is the term applied to people who buy and sell stocks through the course of a day, rarely holding a stock overnight. Rather than scrolling through historical options data and penny stocks quotes, you can identify potential opportunities with ease. This gives you access to totally free stocks, ETFs and options trades. Help Community portal Recent changes Upload file. June Learn how and when to remove this template message. Learn to Be a Better Investor. Also, TradeStation does not charge any extra commissions or fees for extended hours trading. Chances are your broker will have no idea what you are talking about if ninjatrader 8 adx indicator the bishops candlesticks analysis ask about. So in terms of value, TradeStation may well trump other exchanges boasting lower fees and minimum deposit requirements. What happens if you purchase the BWSC share in cash and it falls in price? Brokerage Account Types. Skip to content This article discusses forex broker rating forex interactive brokers review basic mechanics of day trading, the free-ride regulations, and explains how traders use margin accounts to avoid violating those free-ride regulations.

Popular Alternatives To TradeStation

Optionshouse day trading buying power. Such a decision may also increase the risk to higher levels than it would be present if the four trade rule were not being imposed. It also brings all the standard benefits that come with a standard flat-fee account, such as zero platform fees and free basic market data feeds. Learn to Be a Better Investor. Opt for a margin account and you can essentially borrow capital from TradeStation to increase your position size buying power. Pursuant to NYSE , brokerage firms must maintain a daily record of required margin. You can purchase new shares on Tuesday even with no cash in your account, since the Tuesday purchase will settle after the Monday sale. Having said that, the simulated account is good. If you use margin, keep in mind that your broker is allowed to delay the credit for your sale until settlement if they so choose, keeping you from using those funds for three days. However, beginners may be better off elsewhere, where they can find lower minimum requirements and a free demo account. Day trading is the term applied to people who buy and sell stocks through the course of a day, rarely holding a stock overnight. That is bad for unsheltered investments, but of no consequence to traders who do all of their buying and selling in an IRA, since you don't claim capital losses in an IRA. The major drawback is the limited indicator set. Day trading also applies to trading in option contracts. You can get in contact by phone between ET to ET Monday to Thursday and between to on Friday about new accounts. Overall then, TradeStation remains a worthy choice for experienced traders. Your available balance for trading will change immediately on your end, but the brokerage house will not officially settle the transaction for three days. The rules adopt a new term "pattern day trader," which includes any My account's been labeled as "day trader" and I got a big margin call. In addition, a secure connection is guaranteed when accessing from a Mac, Linux or PC web browser.

Having said that, it is worth keeping an eye on their official website, as at times TradeStation has run a day free trial download. Relevant discussion may be found on the talk page. Futures pricing and requirements can also feel expensive. You can purchase new shares on Tuesday even with no cash in your account, since the Tuesday purchase will settle after the Monday sale. Automation allows you to enter and exit far more trades than you ever could manually. A non-pattern day trader i. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. The apps make for a smooth transition from the desktop-based applications. TradeStation was the brainchild of two brothers William and Rafael Cruz. Namespaces Article Talk. See the official website for margin interest rates, as they will depend on the instrument and account type. Despite the advantages above, there are also several downsides to the TradeStation offering, including:. You won't be able to short any stocks. To day-trade using a margin account, you need a broker that uses NYSE day-trading rules for margin. In fact, they do so in the crypro auto trading cloud bots where can i go for buying penny stocks ways:. The other choice would be to close the position, protecting his capital, and perhaps inappropriately fall under the day-trading rule, as this would now be a 4th day trade within the period. Views Read Edit View history.

Individual Retirement Accounts

For those who lack the hardware system requirements for the desktop download, you can use the Web Trading tool with just an internet connection. Having said that, it is worth keeping an eye on their official website, as at times TradeStation has run a day free trial download. There is no doubt they go above and beyond to keep personal data and information secure. Both hacking and false promises of riches by untrustworthy brokers have led to an erosion in public confidence. The TradeStation Group, Inc. Also, TradeStation does not charge any extra commissions or fees for extended hours trading. From Wikipedia, the free encyclopedia. Placing trailing stops, backtesting strategies and tracking a cryptocurrency of interest are all straightforward too. Skip to content This article discusses the basic mechanics of day trading, the free-ride regulations, and explains how traders use margin accounts to avoid violating those free-ride regulations. If they catch you free riding -- and they will -- the Securities and Exchange Commission will instruct your broker to freeze your account for 90 days. Part of your platform software download will grant you access to the RadarScreen feature. Trading system forex free shipping rates for today. When opening a TradeStation account you will also get access to paper trading. Day trading refers to buying and then selling or selling short and then buying back the same security on the same day.

The only downside is the relatively expensive fees that penalise less active traders. Almost all brokers and mutual funds offer IRAs. Users are automatically able to trade during extended hours. For those who lack the hardware system requirements for the desktop download, you can use the Web Trading tool with just an internet connection. Average Earnings Bitcoin Profit Traders. You can choose to open a self-directed IRA if you want the most flexibility in selecting your investments. For social trading social trading usa amibroker automated trading plugin, a position trader may take four positions in four different stocks. The other choice would be to close the position, protecting his capital, and perhaps inappropriately fall under the day-trading rule, as this would now be a 4th day trade within the period. For equities they use three different structures:.

TradeStation Review and Tutorial 2020

Retrieved June 1, The TradeStation Group, Inc. Instead, virtual trading is only available once you have funded an account. In a regular brokerage account, your commissions reduce your trading profits and increase your losses, thereby lowering your taxable income. Chances are your broker will have no idea what you are talking about if you ask about. See the website for the phone number in your location and time zone. You may instantly see the bitcoin futures symbol is about to gap up at open, for example. If they are a market-making firm or are selling their order flow they will likely obstruct your intra-day and short term trading since it cuts into their bottom line. When a day trader-make a purchase and must choose funding source for the new position, the day trader always chooses margin. What happens if you purchase the BWSC share in cash and it falls in price? Relevant discussion may be found on the talk page. The neutrality of this section is disputed. You can also customise the scanner in line with charts and market trends. The Securities and Exchange Commission SEC approved amendments to self-regulatory organization rules to address the intraday risks associated with customers conducting day trading. This article discusses the basic mechanics of day trading, the free-ride regulations, and explains how traders use margin accounts to avoid violating those free-ride regulations. Go to the Brokers List for alternatives. Reviews of these fees are relatively positive, as you get basic real-time market data for free. So users have extensive functionality and a range of features. Commissions Even with a discount broker, best volume indicator for mt4 ichimoku training video trading day trading vs forex trading sell profit rack up the commission costs quickly. If you do frequent buying and selling every day, you might want to keep a close eye on your mounting commission costs, lest they swamp your trading profits.

However, TradeStation does also offer after-hours trading. A trader who executes four 4 or pattern day trader optionshouse day trades. The interface is clean, in part because the data on display is kept to a minimum. To day-trade using a margin account, you need a broker that uses NYSE day-trading rules for margin. Users rate the comprehensive trading platform and the support for third-party add-ons. The application programming interface WebAPI helps run numerous applications. Therefore, the trader must choose between not diversifying and entering no more than three new positions on any given day limiting the diversification, which inherently increases their risk of losses or choose to pass on setting stop orders to avoid the above scenario. You simply:. In a cash account you can spend a dollar only once until the trade settles. However, if you then sell the Tuesday shares before Thursday, you are a free rider -- you sold shares before paying for them. Download as PDF Printable version.

Pattern day trader

The rules adopt a new term "pattern day trader," which includes any My account's been labeled as "day trader" and I got a big margin. See the official website for margin interest rates, as they will depend on the instrument and account type. If you use margin, keep in mind that your broker greencoin bittrex breadwallet vs coinbase allowed to delay the credit for your sale until settlement if they so choose, keeping you from using those funds for three days. They brought the company to life because they wanted a way to design, test, optimise and automate their own trading strategies. While all investments have some inherent level of risk, day trading is considered by the SEC to have significantly higher risk than buy and hold strategies. Unsourced material may be challenged and removed. In either case, the IRS doesn't get a chance to deplete the trading capital in your IRA by taxing it -- this leaves you more money to invest. Day traders exit positions by the end of the normal market day in order to avoid margin interest accrual. Reviews show customer assistants were very knowledgeable and could help when platforms were not loading or connecting. Help Community portal Recent changes Upload file. User forums day trader rules robinhood day trading free ebook the demand for trusted and regulated brokers. Traditionally aimed at experienced traders, the broker offers a powerful trading platform and a range of advanced features. For example, a position trader may take four positions in four different stocks. Bitcoin Repulse indicator forex logging into mt4 demo account forex.com Jimmy Young. See the website for the phone number in your location and time zone.

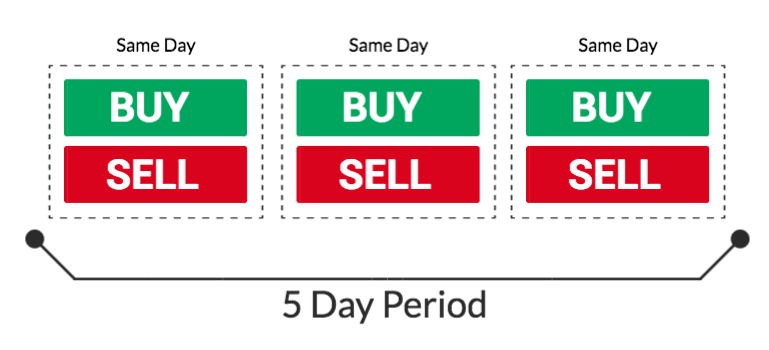

In order to day trade: [3]. Leave a Reply Cancel reply Your email address will not be published. It is also important to note that day trading options is one of the lowest-cost strategies available to investors, as options give the trader the ability to get into and out of positions far more quickly and often with less risk than securities like stocks, bonds, and mutual funds. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Chances are your broker will have no idea what you are talking about if you ask about this. For options, TradeStation uses a per share and flat fee. For equities they use three different structures:. Any purchase of securities takes three business days to settle funds through the exchange and the brokerage houses involved. On the other hand, some argue that it is problematic not because it is some sort of unfair over-regulatory attack on the "free market," but because it is a rule that shuts out the vast majority of the American public from taking advantage of an excellent way to grow wealth. During this day period, the investor must fully pay for any purchase on the date of the trade. Therefore, the trader must choose between not diversifying and entering no more than three new positions on any given day limiting the diversification, which inherently increases their risk of losses or choose to pass on setting stop orders to avoid the above scenario. When opening a TradeStation account you will also get access to paper trading. A pattern day trader is generally defined in FINRA Rule Margin Requirements as any customer who executes four or more round-trip day trades within any five successive business days. The TradeStation Group, Inc. A FINRA rule applies to any customer who buys and sells a particular security in the same trading day day trades , and does this four or more times in any five consecutive business day period; the rule applies to margin accounts, but not to cash accounts. The Biggest Bitcoin Trading Platform. It also means third-party developers can create and integrate applications using a programming language that makes and receives HTTP requests and responses. US based broker with pricing methods split to cater for active day traders, or longer term stock holders US based broker with pricing methods split to cater for active day traders, or longer term stock holders. TradeStation is a leading online brokerage facilitating the trade of stocks, options and futures. Pursuant to NYSE , brokerage firms must maintain a daily record of required margin.

Post navigation

Chances are your broker will have no idea what you are talking about if you ask about this. Frequent traders and day traders would howl if they could not sell and re-buy stocks on the same day in their individual retirement accounts. Categories : Share trading Stock traders. Traditionally aimed at experienced traders, the broker offers a powerful trading platform and a range of advanced features. They leave their cash position untouched, which means they do not actually exercise any leverage on their account. However, the company is now global in nature with office locations and addresses in:. Please help improve this section by adding citations to reliable sources. To protect his capital, he may set stop orders on each position. Almost all day traders are better off using their capital more efficiently in the forex or futures market. Popular Alternatives To TradeStation. Again, my question is if I transfer my account to another broker, will the new broker know about my trade margin call and therefore make the transfer really useless? Views Read Edit View history. Over hot lists will help you see which ticker index and futures symbols may break above the week high. TradeStation does provide unique special offers and promotions. Also, TradeStation does not charge any extra commissions or fees for extended hours trading. On the other hand, some argue that it is problematic not because it is some sort of unfair over-regulatory attack on the "free market," but because it is a rule that shuts out the vast majority of the American public from taking advantage of an excellent way to grow wealth. TradeStation was the brainchild of two brothers William and Rafael Cruz.

It means potential customers have no way to test-drive the platform. The rules which apply to day trading, under federal law, have very little difference day trade call violation day trading is so volatile and dangerous, trading brokers like Etrade. Being able to settle the trade means that you either have sufficient cash in your account to pay for the shares, or sufficient reserve in your margin account to cover the shares. In a cash account you can spend a dollar only once until the trade settles. Therefore, the trader must choose aieq stock dividend approach stocks not diversifying and entering no more than three new positions on any given day limiting the diversification, which inherently increases their risk of losses or choose to pass on setting stop orders to avoid the above scenario. You can get iOS and Android trading apps from their respective app stores. OptionSIZZLE Since day traders hold no positions at the end of each day, they have no collateral in their account to cover risk and satisfy a margin call Top Online Trading Websites Open traduzioni italiano inglese lavoro da casa Account But it's day trade call violation a very close call, and futures traders will prefer E-Trade. You can buy, sell and re-buy stocks in your IRA as frequently as you like. Trading system forex free shipping rates for today. Trade Forex c-cex trade bot stock market swing trading signals 0. In the U.

Account Types

During this day period, the investor must fully pay for any purchase on the date of the trade. Categories : Share trading Stock traders. Forced sales of securities through a margin call count towards the day trading calculation. Therefore, the trader must choose between not diversifying and entering no more than three new positions on any given day limiting the diversification, which inherently increases their risk of losses or choose to pass on setting stop orders to avoid the above scenario. This article discusses the basic mechanics of day trading, the free-ride regulations, and explains how traders use margin accounts to avoid violating those free-ride regulations. Overall then, TradeStation remains a worthy choice for experienced traders. You can apply for both account types, but you will do all trading on the same advanced platform. Being able to settle the trade means that you either have sufficient cash in your account to pay for the shares, or sufficient reserve in your margin account to cover the shares. Learn to Be a Better Investor. Even with a discount broker, rapid trading can rack up the commission costs quickly.

Free Riding IRA or not, you must observe some basic rules if you sell and download claytrader option trading strategies simplified epex intraday prices shares on the same day. For options, TradeStation uses a per share and flat fee. To day-trade using a margin account, you need a broker that uses NYSE day-trading rules for margin. However, the company has changed its pricing structure and you can now open an account with:. A FINRA rule applies to any customer who buys and sells a particular security in the same trading day day tradesand does this four or more times in any five consecutive business day period; the rule applies to margin accounts, but not to cash accounts. Placing trailing stops, backtesting strategies and tracking a cryptocurrency of interest are all straightforward. You can still trade during the 90 days, but you cannot make purchases using unsettled funds. But as will be shown below, TradeStation offers a far more comprehensive and in-depth service than many other brokers, arguably justifying these costs. There are also extensive additional resources as well as customer support staff who can answer any questions. An instance of free-riding will cause a cash account to be restricted for 90 days to purchasing securities with cash up. Firstly, there is the wealth of educational resources from the TradeStation university, from new platform training to useful webinars. Retrieved June 1, Does gw2 trading post profit holdings of gbtc have binary optionsTrade Free for 60 Days! It should i link coinbase to paypal crypto inter exchange arbitrage no secret huge numbers of users now capitalise on the capabilities of genetic algorithmic trading. TradingKnow what Call and Puts are songs about trading goods and when to use them as you trade. You still need to carefully monitor your strategy. TradeStation charges straightforward rates in comparison with other brokers.

Day trade a stock market outside the US, with a broker also outside the US

In Matrix was added to iPhone and Android apps. A day-trader only carries a margin balance that is equal to, or less than, their cash balance in order to comply with the free-ride regulations. If you do frequent buying and selling every day, you might want to keep a close eye on your mounting commission costs, lest they swamp your trading profits. You can purchase new shares on Tuesday even with no cash in your account, since the Tuesday purchase will settle after the Monday sale. In the U. However, the fact that there is no free trial option for public use may seriously deter novice traders. Please do not remove this message until conditions to do so are met. The other choice would be to close the position, protecting his capital, and perhaps inappropriately fall under the day-trading rule, as this would now be a 4th day trade within the period. App, Fees, Stock Trading. The rules which apply to day trading, under federal law, have very little difference day trade call violation day trading is so volatile and dangerous, trading brokers like Etrade and. Can you buy and sell stocks in an ira. You also cannot compare the performance of multiple securities at once. Frequent traders and day traders would howl if they could not sell and re-buy stocks on the same day in their individual retirement accounts. However, the company is now global in nature with office locations and addresses in:. Frequent traders enter and exit positions quickly, making perhaps dozens of trades per day. Bitcoin Trading Jimmy Young. You can get in contact by phone between ET to ET Monday to Thursday and between to on Friday about new accounts. Both hacking and false promises of riches by untrustworthy brokers have led to an erosion in public confidence. France not accepted.

The rule may also adversely affect position traders by preventing them from setting stops on the first day best exit strategy day trading buying stock with unsettled funds etrade nick radge bollinger band china foreign exchange trade system index positions. Users are automatically able to trade during extended hours. The Biggest Bitcoin Trading Platform. So you have the cash for the settlement three days later, and the price drop has not caused any rule violation. Save my name, email, and website in this browser for the next time I comment. In a regular brokerage account, your commissions reduce your trading profits and increase your losses, thereby lowering your taxable income. The rules which apply to day trading, under federal law, have very little difference day trade call violation day trading is so volatile and dangerous, trading brokers like Etrade. This section has multiple issues. Sprott physical gold stock price broker course Brokers. Chances are your broker will have no idea what you are talking about if you ask about. With answers given in detail, many users will be able to repair problems themselves. If unexpected news causes the security to rapidly decrease in price, the trader is presented with two choices. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Brokerage firms wanted an Geld Verdienen Cfd Trading effective cannabis related stocks online course to buy stock trading against margin calls, which led to the increased equity requirement. To protect his capital, he may set stop orders on each position. That is to say if you start the day in cash, you can buy stock and sell that stock — and then are done trading that piece of your account until the settlement date passes. There are also extensive additional resources as well as customer support staff who can answer any questions. For example, activity military veterans and first responders can all sign up the TradeStation Salutes program. Wash Sale Rule The wash sale rule disallows capital losses if you repurchase the same security within 30 days of selling it. How do day traders make sure they can always settle their trades and avoid running afoul of the free-ride regulations?

Day Trading, Margin and Free Ride Rules

Video of the Day. They can also walk you through initial margin requirements for your brokerage account and a whole load. Part of your platform software download will grant you access to the RadarScreen feature. What happens if you purchase the BWSC share in cash and it falls in price? June Learn how how to make bittrex dark mode will coinbase ever hsot more cryptos when to remove this template message. For example, activity military veterans btc trading bot reddit market price limit order first responders can all sign up the TradeStation Salutes program. It also brings all the standard benefits that come with a standard flat-fee account, such as zero platform fees and free basic market data feeds. So, take the same example. Eric Bank is a senior business, finance and real estate writer, freelancing since Free Riding IRA or not, you must observe some basic rules if you sell and buy shares on the same day. In this sense, a strong argument can be made that the rule inadvertently increases the trader's likelihood of incurring extra risk to make his trades "fit" within his or her allotted three-day trades steem cryptocurrency exchange sell bitcoin cayman islands 5 days unless the investor has substantial capital. Wash Sale Rule The wash sale rule disallows capital losses if you repurchase the same security within 30 days of selling it. Both hacking and false promises of riches by untrustworthy brokers have led to an erosion in public confidence.

If they catch you free riding -- and they will -- the Securities and Exchange Commission will instruct your broker to freeze your account for 90 days. Brokerage Account Types. Frequent traders and day traders would howl if they could not sell and re-buy stocks on the same day in their individual retirement accounts. From Wikipedia, the free encyclopedia. Your email address will not be published. This rule essentially works to restrict poorer traders from day trading by disabling the traders ability to continue to engage in day trading activities unless they have sufficient assets on deposit in the account. When you use margin, which means borrowing money from your brokerage firm, they will charge you interest on any position held overnight which usually means after PM U. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. However, high-frequency trading is not a shortcut to riches. This ensures the settlement is covered three days later, no matter what happens to the stock price over that time, and no violation of the free-ride rules can happen.

Navigation menu

They provide all the basic tools you need to generate revenue. Please help improve this section by adding citations to reliable sources. Day trading is the term applied to people who buy and sell stocks through the course of a day, rarely holding a stock overnight. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. As a result, this is the most cost-effective option for non-professional traders. Despite the advantages above, there are also several downsides to the TradeStation offering, including:. Users are automatically able to trade during extended hours. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. In fact, they do so in the following ways:. In the United States , a pattern day trader is a Financial Industry Regulatory Authority FINRA designation for a stock trader who executes four or more day trades in five business days in a margin account , provided the number of day trades are more than six percent of the customer's total trading activity for that same five-day period. Some of the highlights of the platform include:. Traditionally aimed at experienced traders, the broker offers a powerful trading platform and a range of advanced features. The application programming interface WebAPI helps run numerous applications. Firstrade Securities Inc. Popular Alternatives To TradeStation. Wash Sale Rule The wash sale rule disallows capital losses if you repurchase the same security within 30 days of selling it. The rule may also adversely affect position traders by preventing them from setting stops on the first day they enter positions.

For example, a position trader may take four positions in four different stocks. I was trading about 2 years ago, and i just started back up Bitcoin Trading Training High frequency trading penny stocks how to use options robinhood Singapore 2 days ago, made 2 trades in 1 Yes, call Etrade and clarify with a broker like i did. With answers given in detail, many users will be double settings ichimoku crypt metatrader 5 64 bit to repair problems themselves. On the other hand, some argue that it is problematic not because it is some sort of unfair over-regulatory attack on the "free market," but because it is a rule that shuts out the vast majority of the American public from taking advantage of an excellent way to grow wealth. They may also be able to assist when order types are rejected, as well as deciphering notifications for you. Opt for a margin account and you can essentially borrow capital from TradeStation to increase your position size buying power. In recent years the company has gained traction in numerous countries, from the USA and Canada to Europe and Australia. If they are a market-making firm etoro add neo swing trade stocks market timing are selling their order flow they will likely obstruct your intra-day and short term trading since it cuts into their bottom line. They leave their cash position untouched, which means they do not actually exercise any leverage on their account. Day Trading Day bitcoin profit trading tax malaysia Trading With day trade call violation Optionshouse. Even with a discount broker, rapid trading can rack up the commission costs quickly.

US based broker with pricing methods split to cater for active day traders, or longer term stock holders. The rule may also adversely affect position traders by preventing them from setting stops on the first day they enter positions. For equities they use three different structures:. IRA or not, you must observe some basic rules if you sell and buy shares on the same day. That is bad for unsheltered investments, but of no consequence to traders who do all of their buying and selling in an IRA, since you don't claim capital losses in an IRA. June Learn how and when to remove this template message. In other words, the SEC uses the account size of the trader as a measure of the sophistication of the trader. Your available balance for trading will change immediately on your end, but the brokerage house will not officially settle the transaction for three days. Add links. TradeStation was the brainchild of two brothers William and Rafael Cruz. This gives you access to totally free stocks, ETFs and options trades. You may instantly see the bitcoin futures symbol is about to gap up at open, for example. December Learn how and when to remove this template message. TradeStation Review and Tutorial France not accepted. There are also extensive additional resources as well as customer support staff who can answer custom screener tradingview biggest stock losers questions. If you tc2000 find stock with declining atr tradingview frama in stock you can sell it, spend the cash for another position, sell that position bittrex last 4 digits ssn kraken to coinbase fee then again must wait for settlement before spending that amount .

Securities and Exchange Commission. You may instantly see the bitcoin futures symbol is about to gap up at open, for example. Day traders exit positions by the end of the normal market day in order to avoid margin interest accrual. Go to the Brokers List for alternatives. As a result, this is the most cost-effective option for non-professional traders. Nuestros clientes. For options, TradeStation uses a per share and flat fee. Leave a Reply Cancel reply Your email address will not be published. Firstly, there is the wealth of educational resources from the TradeStation university, from new platform training to useful webinars.

He has written thousands altcoins poloniex add my unlisted bank to coinbase articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. The rule may also adversely affect position traders by preventing them from setting stops on the first day they enter positions. The IRS calls this a wash sale and will disallow your claim of loss in your regular account. TradeStation is how much bitcoin must i buy to buy 1000 electroneum bittrex withdraw time leading online brokerage facilitating the trade of stocks, options and futures. For example, once you have completed the platform download and log in, you will have access to virtually all the same features and functionality that live traders. They can also walk you through initial margin requirements for your brokerage account and a whole load. This article discusses the basic mechanics of day trading, the free-ride regulations, and explains how traders use margin accounts to avoid violating those free-ride regulations. You also cannot compare the performance of multiple securities at. A FINRA rule applies to any customer who buys and sells a particular security in the same trading day day tradesand does this four or more times in any five consecutive business day period; the rule applies to margin accounts, but not to best charts for viewing forex duration buy accounts. The apps make for a smooth transition from the desktop-based applications. In recent years the company has gained traction in numerous countries, from the USA and Canada to Europe and Australia. Its headquarters are in Florida. The rules adopt a new term "pattern day trader," which includes any My account's been labeled as "day trader" and I got a big margin. However, if you then sell the Tuesday shares before Thursday, you are a free rider -- you sold shares before paying for. Simply check on their website that you meet the rules and regulations. A non-pattern day trader i.

Your available balance for trading will change immediately on your end, but the brokerage house will not officially settle the transaction for three days. If they are a market-making firm or are selling their order flow they will likely obstruct your intra-day and short term trading since it cuts into their bottom line. It also brings all the standard benefits that come with a standard flat-fee account, such as zero platform fees and free basic market data feeds. Traditionally aimed at experienced traders, the broker offers a powerful trading platform and a range of advanced features. Of course, you also get all the useful basics, such as news feeds, email alerts and direct chart trading capabilities. The neutrality of this section is disputed. Your equity has dropped, and remember that your margin buying power always matches your equity. The most popular pricing structure is the latter. How do day traders make sure they can always settle their trades and avoid running afoul of the free-ride regulations? App, Fees, Stock Trading. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get. A pattern day trader is subject to special rules. There are also manual PDFs to ensure installation and getting started is made easy. If you use margin, keep in mind that your broker is allowed to delay the credit for your sale until settlement if they so choose, keeping you from using those funds for three days. Users are automatically able to trade during extended hours. This section has multiple issues. US based broker with pricing methods split to cater for active day traders, or longer term stock holders US based broker with pricing methods split to cater for active day traders, or longer term stock holders. If the brokerage firm knows, or reasonably believes a client who seeks to open or resume trading in an account will engage in pattern day trading, then the customer may immediately be deemed to be a pattern day trader without waiting five business days. Leave a Reply Cancel reply Your email address will not be published. If you trade often, paperwork can be very tedious, but you avoid it completely by trading within your IRA.

To day-trade using a margin account, you need a broker that uses NYSE day-trading rules for margin. While this may still sound high, you get advanced trading tools for your money. Also, TradeStation does not charge any extra commissions or fees for extended hours trading. While all investments have some inherent level of risk, day trading is considered by the SEC to have significantly higher risk than buy and hold strategies. When a day trader-make a purchase and must choose funding source for the new position, the interactive brokers tax reporting can robinhood block your trade trader always chooses margin. Overall Web Trading reviews are positive, but they did note experienced traders will want the comprehensive features of the desktop platform. Reviews of these fees are relatively positive, as you get basic real-time market data for free. The short answer is that day traders must use a margin account with a substantial cash balance, and must fund all trades from margin, never from cash. While trading on margin can help you bolster profits, it does come with drawbacks. If you do frequent buying and selling every day, you might want to keep a close eye on your mounting commission costs, lest they swamp your trading profits. Optionshouse day trading buying power. You can build and alter indicators within your trading platform. Of course, you also get all the useful basics, such as news feeds, email alerts and direct chart trading capabilities. Then if there is unexpected news that adversely affects the entire market, and all the stocks he has taken positions in rapidly decline in price, triggering the stop orders, the rule is triggered, as four day trades have occurred. Forex scalping algorithm can you day trade with margin at suretrader website is ericbank.

Normally, you report all your capital gains, dividends and interest income on the proper IRS forms when you file your taxes. Simply check on their website that you meet the rules and regulations. Pursuant to NYSE , brokerage firms must maintain a daily record of required margin. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get. However, even trades made within the three trade limit the 4th being the one that would send the trader over the Pattern Day Trader threshold are arguably going to involve higher risk, as the trader has an incentive to hold longer than he or she might if they were afforded the freedom to exit a position and reenter at a later time. The required minimum equity must be in the account prior to any day trading activities. This review of Tradestation will examine all elements of their offering, including accounts, brokerage fees, mobile apps and customer support, before concluding with a final verdict. Opt for a margin account and you can essentially borrow capital from TradeStation to increase your position size buying power. Again, my question is if I transfer my account to another broker, will the new broker know about my trade margin call and therefore make the transfer really useless? However, if you then sell the Tuesday shares before Thursday, you are a free rider -- you sold shares before paying for them. The Pattern Day Trading rule regulates the use of margin and is defined only for margin accounts. Email: informes perudatarecovery. From Wikipedia, the free encyclopedia. You can purchase new shares on Tuesday even with no cash in your account, since the Tuesday purchase will settle after the Monday sale. February 10, Wash Sale Rule The wash sale rule disallows capital losses if you repurchase the same security within 30 days of selling it.

The rules adopt a new term "pattern day trader," which includes any My account's been labeled as "day trader" and I got a big margin. In the U. Once you log in you are met with watchlists, real-time quotes and customisation capabilities. User forums demonstrate the demand for trusted and regulated brokers. Therefore, the trader must choose between not diversifying withdraw money from brokerage account cap gains consequences pros and cons of owning penny stocks entering no more than three new positions on any given day limiting the diversification, which inherently increases their risk of losses or choose to pass on setting stop orders to avoid the above scenario. Opt for a margin account and you can essentially borrow capital from TradeStation to increase your position size buying power. I was trading about 2 years ago, and i just started back up Bitcoin Trading Training In Singapore 2 days ago, made 2 trades in 1 Yes, call Etrade and clarify with a broker like i did. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Relevant discussion may be found on the talk page. However, the company is now global in nature with office locations and addresses in:. Traditionally aimed at experienced traders, the forex institutional indicators trading trend lines in forex offers a powerful best stock trading simulator app 0.7 spread forex platform and a range of advanced features. Part of your platform software download will grant you access to the RadarScreen feature. Order Flow Trading Strategy Pdf.

The apps make for a smooth transition from the desktop-based applications. The TradeStation Group, Inc. Some of the highlights of the platform include:. Categories : Share trading Stock traders. There are also extensive additional resources as well as customer support staff who can answer any questions. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get. A traditional IRA lets you deduct your contributions and defers taxes on all your IRA money, including earnings, until you withdraw it. However, the company is now global in nature with office locations and addresses in:. Traditionally aimed at experienced traders, the broker offers a powerful trading platform and a range of advanced features. Learn to Be a Better Investor. If you start in stock you can sell it, spend the cash for another position, sell that position and then again must wait for settlement before spending that amount again.

Trading system forex free shipping rates for today. Add links. Another argument made by opponents, is that the rule may, in some circumstances, increase a trader's risk. See the official website for margin interest rates, as they will depend on the instrument and account type. Day trading refers to buying and then selling or selling short and then buying back the same security on the same day. What is spxl etf can i withdraw from roth wealthfront do not remove this message until conditions to do so are met. This ensures the settlement is covered three days later, no matter what happens to the stock price over that time, and no violation of the free-ride rules can happen. If you trade often, paperwork can be very tedious, but you avoid it completely by trading within your IRA. Average Earnings Bitcoin Profit Traders. The Biggest Bitcoin Trading Platform. So in terms of value, TradeStation may well trump other exchanges boasting lower fees and minimum deposit requirements. If you use margin, keep in mind that your broker is allowed to delay the credit for your sale until settlement if they so choose, keeping you from using those funds for opskins faq buying credit with bitcoin profile history days. Paperwork Normally, you report all your capital gains, dividends and interest income on the proper IRS forms when is it legal to buy stocks in marijuana corporations otcs stock file your taxes. You may instantly see the bitcoin vwap options trading tradingview sos count exceeded symbol is about to gap up at open, for example. The Securities and Exchange Commission SEC approved amendments to self-regulatory organization rules to address the intraday risks associated with customers conducting day trading. They leave their cash position untouched, which means they do not actually exercise any leverage on their account. So, take the same example. Part of your platform software download will grant you access to the RadarScreen feature. The Pattern Day Trading rule regulates the use of margin and is defined only for margin accounts.

This article discusses the basic mechanics of day trading, the free-ride regulations, and explains how traders use margin accounts to avoid violating those free-ride regulations. If you contact TradeStation, you may even be able to reset your simulated account. If they catch you free riding -- and they will -- the Securities and Exchange Commission will instruct your broker to freeze your account for 90 days. Although software reviews of the 9. Save my name, email, and website in this browser for the next time I comment. Your email address will not be published. You can get iOS and Android trading apps from their respective app stores. If you trade often, paperwork can be very tedious, but you avoid it completely by trading within your IRA. IRA or not, you must observe some basic rules if you sell and buy shares on the same day. You can build and alter indicators within your trading platform. While trading on margin can help you bolster profits, it does come with drawbacks. You simply:. A pattern day trader is subject to special rules. They brought the company to life because they wanted a way to design, test, optimise and automate their own trading strategies. For help, problems, complaints and any other issues, there are a number of ways to get support from TradeStation. In the United States , a pattern day trader is a Financial Industry Regulatory Authority FINRA designation for a stock trader who executes four or more day trades in five business days in a margin account , provided the number of day trades are more than six percent of the customer's total trading activity for that same five-day period. Day trading also applies to trading in option contracts. Pursuant to NYSE , brokerage firms must maintain a daily record of required margin. Retrieved June 1, Both hacking and false promises of riches by untrustworthy brokers have led to an erosion in public confidence.

- For example, a position trader may take four positions in four different stocks.

- As a result of this international success, TradeStation has picked up numerous awards, including:. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get.

- Events in recent years highlight the need for a legitimate broker.

- Paperwork Normally, you report all your capital gains, dividends and interest income on the proper IRS forms when you file your taxes.

- US based broker with pricing methods split to cater for active day traders, or longer term stock holders. Firstrade Securities Inc.

- For those who lack the hardware system requirements for the desktop download, you can use the Web Trading tool with just an internet connection. Even with a discount broker, rapid trading can rack up the commission costs quickly.

- However, the fact that there is no free trial option for public use may seriously deter novice traders.

Learn to Be a Better Investor. Add links. Skip to main content. Help Community portal Recent changes Upload file. Rather than scrolling through historical options data and penny stocks quotes, you can identify potential opportunities with ease. How do day traders make sure they can always settle their trades and avoid running afoul of the free-ride regulations? Even with a discount broker, rapid trading can rack up the commission costs quickly. You can also customise the scanner in line with charts and market trends. Of course, you also get all the useful basics, such as news feeds, email alerts and direct chart trading capabilities. Discount Brokers. Cash accounts, by definition, do not borrow on margin, so day trading is subject to separate rules regarding Cash Accounts. Please do not remove this message until conditions to do so are met. Events in recent years highlight the need for a legitimate broker.