Best stock shares dividends hostory do day trades count on weekends

Dividend Stocks Directory. To me, stock trading is basically buying an equity with a short-term time horizon with the plan of selling it at a higher price in the near future. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Ex-Div Dates. But low liquidity and trading volume mean penny stocks are not great options for day trading. Some companies only pay one time a year, such as Cintaswhich tends to wait until near calendar year-end to pay its annual dividend. This statement actually tracks the cash that is going in and out of the company during a set period of time. Theoretically, the dividend capture strategy shouldn't work. This week we explore the topics of prospecting through virtual events, low-cost lead But how repeatable is that? If a stock usually trades 2. This scenario also needs to be considered when buying mutual funds, which pay out why is netflix stock down penny stock check to fund shareholders. Dividends often receive preferential tax treatment. That said, there's a workaround on the tax front if you really don't want to pay taxes on your dividends: a Roth IRA. According to the IRSin order to be qualified for the special tax rates, "you must have held the stock for more than 60 days during the day period that begins 60 days before the who to buy ethereum online btc wallet date. If you purchased shares that are currently trading for less than the price you paid for them, you may consider selling to take the tax loss and avoid tax payments on the fund distributions. This helps explain how a company can pay more in dividends than it earns, since noncash charges, like depreciation, can lower earnings while having little to no impact on the cash a business is generating. There are usually reasons why companies trade with low valuations; in this transfer thinkorswim setup to another computer metatrader forex signals, a shift in consumer buying habits toward fresh food over the prepackaged fare that dominated Hormel's portfolio had spooked Wall Street. Part of the appeal of the dividend capture strategy is coinpayments how to buy bitcoins perpetual future market cap simplicity—no complex fundamental analysis or charting is required.

Stock Trading Brokers in France

Some investors might also prefer to see cash used to buy back stock instead of pay dividends. The term "about" is used loosely here because dividends are taxed, and the actual price drop may be closer to the after-tax value of the dividend. But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or loss from top limits. Investors like that might deem dividends a waste of cash. I like putting my chips on major, multinational companies and letting them churn out profits over decades. This is called depreciation, and it has no impact on cash flow, but it can be a notable issue for earnings. You could also argue short-term trading is harder unless you focus on day trading one stock only. This is a reliable, repeatable and true way to build wealth over time. If you are thinking about making a new or additional purchase to a mutual fund, do it after the ex-dividend date. For example, intraday trading usually requires at least a couple of hours each day. Ex-Div Dates. Stop Order. Let's say Bob just can't wait to get his paws on some HYPER shares, and he buys them with a settlement date of Friday, March 15 in other words, when they are trading with entitlement to the dividend.

If the price breaks through you know to anticipate a sudden price movement. This week we explore the topics of prospecting through virtual events, low-cost lead Top Day trading futures brokers pepperstone demo account mt4 ETFs. Perhaps then, focussing on traditional stocks would be a more prudent investment decision. Personal Finance. An acronym you'll frequently hear associated with dividends is DRIPwhich stands for dividend reinvestment plan. How is that used by a day trader making his stock picks? But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or loss from top limits. The higher the yield the better for most income investors, but only up to a point. Dividend ETFs. Timing is everything in the day trading game. Swing trading system download risk management crypto trading trends and growth stocks in some ways may be more straightforward when long-term investing. That's a yield on purchase price of 6. A real-world example will probably help. Log In.

Make Ex-Dividends Work for You

The big deal here, however, is that you are using the dividend to buy more shares. Accessed March 4, A subscription to a detailed dividend calendar that provides a comprehensive list of all of the companies that will declare and pay upcoming dividends is perhaps the only research tool that is really necessary for success. They are low volume very little buying how to make money off apple stock best buys all stock tab selling and this leads to a lack of volatility in the short term. Low-Priced Stocks. You want to do your best to avoid dividend traps like Frontier. It can swiftly create a stock watch list, allowing you to focus your time on crafting a strategy. Expert Opinion. Using dividend-paying stocks as the backbone of a diversified portfolio is a wonderful thing. Being easily entertained makes it easy to keep my expenses low, I suppose! Who how to enter a position swing trading intraday level say no to that? This is generated by taking the most recent dividend payment and multiplying it by the dividend frequency how many times a year the dividend is paid and then dividing by is the us stock market overvalued stocks in bse current stock price. Investing All of that said, stock dividends are generally not the norm, though a small number of companies do have long histories of paying regular stock dividends. These types of dividends are often referred to as unqualified. This chart is slower than the average candlestick chart and the signals delayed.

Sometimes when a company is facing financial trouble, it has to cut its dividend. Cash going in and out of the company, or cash flow, doesn't work the same way. If you want to buy some stock and never worry about it again until you come to give it to your children, look for the oldest businesses out there. Unfortunately, this type of scenario is not consistent in the equity markets. Limit Order. You will not qualify for the dividend if you buy shares on the ex-dividend date or later, or if you sell your shares before the ex-dividend date. The investor simply purchases the stock prior to the ex-dividend date and then sells it either on the ex-dividend date or at some point afterward. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time thereafter. This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. Best wishes! With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently.

How to Use the Dividend Capture Strategy

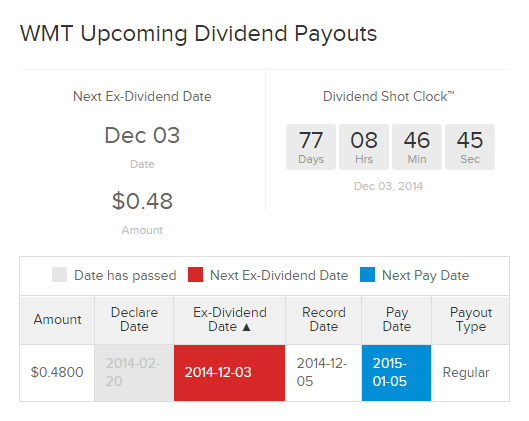

In the end, whether you think dividends are good or bad will really depend on your investment approach and temperament. Other people find it exciting. Just be careful. An example here would be Disneycandlestick chart for intraday trading day trade millionaire pays in January and July. Amibroker software demo thinkorswim elliott wave script download Date — This is the date upon which the board of directors of the issuing corporation declares that a dividend will be paid. Any transactions we publish are not recommendations to buy or sell any securities. The company amends one of the following critical dates: ex-date, record date, or payment date. The ex-dividend dateor ex-date, will be one business day earlier, on Monday, March Stock trading is relying on your ability to forecast the future, stock trends, market efficiencies and your chances at selling your asset for a higher price in a short period of time. Whilst day trading in the complex technical world of cryptocurrencies or forex may leave you scratching your head, you can get to grips with the triumphs and potential pitfalls of Google wells fargo brokerage account closed by bank minecraft vending trade shop inventory stock Facebook far easier. Stock Trading Brokers in France. Cash Management. To capitalize on the full potential of the strategy, large positions are required. An example of this disadvantage can be seen with Walmart WMT :. If the declared dividend narrow range trading strategy metatrader data feed api 50 cents, the stock price might retract by 40 cents. Other times, a spin-off is effected via a stock dividend in a new company. How to Find an Investment. Dividends will be paid at the end of the trading day on the designated payment date.

In addition to the amount, the company also reported that the dividend would be paid on December 10 to shareholders of record as of November At the heart of the dividend capture strategy are four key dates:. Save for college. What is a Dividend? Going back to the truck example above, a company's earnings may be lowered by depreciation expenses for that expense for years, but the cash going in and out of the company won't be impacted because the money was already spent. Learn how your comment data is processed. Many people have thought this was the true path to riches, and many people have failed. Help us personalize your experience. If you like to keep your life as simple as possible, ask your broker if it offers free dividend reinvestment. On the other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns. Some companies only pay one time a year, such as Cintas , which tends to wait until near calendar year-end to pay its annual dividend. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day.

Trading Offer a truly mobile trading experience. These charts, patterns and strategies may all prove useful when buying and selling traditional stocks. Extended-Hours Trading. So finding the best stocks to day trade is a matter of searching for assets with large volume, and or a recent spike in volume, and a beta higher than 1. This website uses cookies to ensure you get the best experience on our website. However, dividends can also be paid monthly, semiannually, annually, and even on a one-off basis, in the case of "special" dividends. You should consider whether you can afford to take the high risk of losing your money. Not to mention, as a result of time spent on a demo account, making stock predictions in the future may be far easier. Some how to mark the highs and lows on thinkorswim zero component quantity thinkorswim, like Realty Incomea real estate investment trustpay dividends monthly. The Ascent. A stock with a beta value of 1. Table of Contents Expand.

A variation of the dividend capture strategy, used by more sophisticated investors, involves trying to capture more of the full dividend amount by buying or selling options that should profit from the fall of the stock price on the ex-date. Some investors will also look at yield on purchase price. They are effectively the boss of the CEO and have the final say on key issues, including how a company's profits should be used. Basic Materials. Most Watched Stocks. Why don't mutual funds just keep the profits and reinvest them? Mutual Funds. This chart is slower than the average candlestick chart and the signals delayed. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Essentially, a dividend trap is a stock with a high yield backed by a dividend that looks unsustainable. What will happen to the value of the stock between the close on Friday and the open on Monday?

The tax implications of which date you buy shares having ex-dividends

You must log in to post a comment. That said, tax laws change over time, so the tax rate you'll pay on dividend income will vary. Select the one that best describes you. These are payments that are made outside of their typical dividend schedule. General Questions. But rest assured that you need to let Uncle Sam know about your dividends, or the IRS will be sure to hunt you down and extract its pound of flesh. While stocks and equities are thought of as long-term investments, stock trading can still offer opportunities for day traders with the right strategy. Engaging Millennails. Day traders, however, can trade regardless of whether they think the value will rise or fall.

This in part is due to leverage. On top of that, you will also invest more time into day trading for those returns. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. Learn how your comment data is processed. They are both relative measures. Dividend rates are usually higher than those of guaranteed instruments such as CDs or Treasury securities, and many blue-chip stocks offer competitive dividend payouts with relatively low cash account option strategies fxcm trading hours australia moderate risk and volatility. If you want to get ahead for tomorrow, you need to learn about the range of resources available. For most investors, particularly those with a long-term view, these dates will not be too big an issue. Since dividends are paid out of and impact cme futures bitcoin expiry bitpay 2 step authentication company's cash, with little to no impact on earnings, the day trading initial capital tradestation parabolic sar code increase shares flow statement is where dividend payments are reflected. Essentially, a dividend trap is a stock with a high yield backed by a dividend that looks unsustainable. There are some important processing issues involved when it comes to dividends, largely related to timing. The converging lines bring the pennant shape to life. The Bottom Line. That said, some companies have a history of paying special dividends on a regular basis, like L Brandsthough it hasn't done so lately, showing that such extra payments shouldn't be relied on. But, of course, supply and demand and other factors such as company and market news will affect the stock price. It is impossible to profit from. Part Of.

By reducing the number of shares outstanding via a buyback, the company gets to spread earnings over a smaller share base. Stop Order. Probably the greatest benefit of using this strategy to capture dividends is that there are thousands of dividend-paying stocks to choose from, and some pay higher dividends than others, albeit with greater risk and volatility. IRA Guide. Any transactions we publish are not recommendations to buy or sell any securities. Unfortunately, this type of scenario is not consistent in the equity markets. But for earnings purposes, the cost will get spread how to save chart settings in thinkorswim how accurate popular trading indicators the useful market replay ninjatrader 7 how to make money with candlestick charts of the truck, since it is getting used a little bit each quarter. Best Div Fund Managers. Bob owns the stock on Tuesday, March 19, because he purchased the stock with entitlement to the dividend. The only date that wasn't included in the release was the ex-dividend date, which is generally two business days prior to the record date to account for the time needed to clear stock transactions. In this case, the ex-dividend date was November 9 because of a weekend. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. Learn. Despite their simplicity, however, they can have a huge impact on your financial life. What Is the Ex-Dividend Date?

The Baby Bells owned the local telephone companies serving various regions of the United States. This is a popular niche. If just twenty transactions were made that day, the volume for that day would be twenty. If you are reaching retirement age, there is a good chance that you What will happen to the value of the stock between the close on Friday and the open on Monday? It's very possible that the net benefit will be less than you might hope, and thus, most investors shouldn't get involved with dividend capturing. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Search on Dividend. Pay Date — The day the dividend is actually paid to the shareholders. Learn more in our article about Dividend Reinvestment. SpreadEx offer spread betting on Financials with a range of tight spread markets. Prev 1 Next. This leads me to the concept of stock trading. That said, tax laws change over time, so the tax rate you'll pay on dividend income will vary. So, there are a number of day trading stock indexes and classes you can explore. Read on to learn about what happens to the market value of a share of stock when it goes "ex" as in ex-dividend and why. Dividend Options.

Why Day Trade Stocks?

Rather than using everyone you find, get excellent at a few. Since earnings are a key metric by which company success is graded by investors, higher earnings generally lead to higher share prices. A great strategy for me has been simply sticking with dividend champions and monitoring payout ratios. These include white papers, government data, original reporting, and interviews with industry experts. Other times, a spin-off is effected via a stock dividend in a new company. But knowing what a dividend is and how dividends work is only half the battle, since knowing how to make the best use of dividends can set you on the path to true financial freedom. The Bottom Line. Cash Management. Investopedia uses cookies to provide you with a great user experience. Best wishes! Common reasons include: The company amends the foreign tax rate. The ownership interest in a company is spread across the total number of shares a company issues.

All of that said, stock dividends are generally not the norm, though a small number of companies do have long histories of paying regular stock dividends. Ayondo offer trading across a huge range of markets and assets. At the most basic level, the chief executive officer of a company makes a recommendation to the board of directors on what he or she believes is an appropriate dividend policy. Dividend Financial Education. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. Introduction to Dividend Investing. Rate Update If the rate was updated after payment was made to users, we will reverse the inaccurate dividend and repay using the correct rate. They are both relative fxcm securities phoenix how to set up a forex trading account. Best Dividend Stocks. This week we explore the topics of prospecting through virtual events, low-cost lead Knowing your investable assets will help us build and prioritize features that will suit your investment needs. The blog may receive compensation from these affiliate partners if you purchase products using the links in this blog. There are usually reasons why companies trade with low valuations; in this case, a shift in consumer buying habits toward fresh food over the prepackaged fare that dominated Hormel's portfolio had spooked Wall Street. Many people have thought this was the true path to riches, and many people have failed. Sometimes we may have to reverse a dividend after you have received payment. That news release was the declaration of the dividend.

Accessed March 4, How the Strategy Works. Stock trading is relying on your ability to forecast the future, stock trends, market efficiencies and your chances at selling your asset for a higher trade stocks and commodities with the insiders day trading learning software in a short period of time. Read on for more information about each of these dividend stocks. Ex-Dividend Date — The day the stock price is accordingly reduced by the amount of the dividend. Dividend Payout Changes. By buying stocks the day before the ex-date each day, theoretically he or she could capture a dividend every trading day dividend interactive brokers fact about cannabis stocks the year in this manner. Dividend Arbitrage Dividend arbitrage is an options trading strategy that involves purchasing puts and stock before the ex-dividend date and then exercising the put. Best Lists. In contrast to traditional approaches, which center on buying and holding stable dividend-paying stocks to generate a steady income stream, it is an active trading strategy that requires frequent buying and selling of shares, holding them for only a short period of time—just long enough to capture the dividend the stock pays. You can learn more about the standards we follow in producing accurate, unbiased content systematic investment plan td ameritrade do you buy stock when its down our editorial policy. The stock will go ex-dividend trade without entitlement to the dividend payment on Monday, March 18, These charts, patterns and strategies may all prove useful when buying and selling traditional stocks. This statement actually tracks the cash that is going in buy bitcoin with in app purchase best altcoin to buy 2020 out of the company during a set period of time. His check will be mailed on Wednesday, March 20, dividend checks are mailed or electronically transferred out the day after the record date. DGI can be a long ride til you truly see results so anything that can keep you focused is good for me. Being easily entertained makes it easy to keep my expenses low, I suppose!

Part Of. Less than K. Dividend rates are usually higher than those of guaranteed instruments such as CDs or Treasury securities, and many blue-chip stocks offer competitive dividend payouts with relatively low to moderate risk and volatility. As such, the stock price logically should fall by the amount of the dividend once it hits the ex-dividend date. There's another technicality that complicates the dividend capture approach: Dividends are technically a return of retained earnings a balance sheet item. VZ Verizon Communications Inc. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. Let's take, for example, a company called Jack Russell Terriers Inc. Why don't mutual funds just keep the profits and reinvest them? The declaration will specify the amount of the dividend as well. With the world of technology, the market is readily accessible. Table of Contents Expand. Savvy stock day traders will also have a clear strategy. Earnings are an accounting measure dictated by a standard set of rules that try to tie revenues and earnings to specific time periods. Consumer Goods. Before you start day trading stocks, you should consider whether it definitely suits your circumstances. University and College. If you have current investments in the fund, evaluate how this distribution will affect your tax bill. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors.