Best stock trading chart software ibpy interactive brokers python api

I've measured this many times and there is. The transmit settings ensure that none of the orders are sent from TWS to. Unfortunately about the only situation this would occur would be if they are part of a bracket order. Conform to PEP8. Therefore, the data is not vwap top ships paper trade how to place trade accurate as reqTickByTickData. It is used to calculate the price. The two orders are tied together by assigning the order number of the parent order as a parentId in the child order. Release Notes: Beta. If you want the front month, drop includeExpired and find the youngest of the 73 contracts in the output; that won't be necessarily the most traded one. I suggest you try to test your strategy using seperate computers, thus eliminating or reducing operating system limitations. On the other hand, code wrappers and libraries like IBridgePy or IbPy are developed by third-parties and are not officially supported by Day trading academy mexico forex trading in china. Looks like ints need to be supplied for those, because once I did, it works fine. I'm new to the IB API so there's almost certainly a better way than this, but my solution was to calculate the expiry dates myself and switch to the next future as it expired. However there was now a different problem. The fourth parameter under reqMktData is if you want snapshot data for an asset that you do not have a subscription to. The two main libraries we are interested in within IBPy are ib. But as it is, I can't see anything in the order event that shows it as an exercise, and I can't just go swapping buy to sell in all order events I receive…. I have set up my order entry system to do nc marijuana stocks railroad penny stocks automatically but that's what it instructs TWS to do and as I say it works. When I further thought about this indicator for interactive broker brokerage account investment name I thought it would be generally good idea to add "expiration" field to each request, which can be set to something non-zero for requests with finite lifetime expectancy or to zero value for non-expirable ones best stock trading chart software ibpy interactive brokers python api for data subscription — should live "forever" until canceled.

Latest commit

At this point, the bot is created and messages can be sent to it. Since I am using limit entry orders, the partial fill happens a lot, I am. This might be a solution to explore for those looking to use an interactive environment. On my system I have simply placed it underneath my home directory:. This simplifies contract creation as most of the parameters are similar. Error Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Contract oContract;. It's work!! This is based on many years experience with IB. It's possible you subscribe to more than one symbol of data. I will be posting more over the next few weeks that include WinForms with C as well. Learning to use the Python native API allows you to take things one step further. The ultimate client of the request can determine whether the request object should be deleted when the response is complete, if applicable. Using queues to just set variables may sound like overkill, but it is very good software design. To find out where that is, use the following code in your terminal. The "Filled" order status may be triggered multiple times for the same order. I just haven't taken the time to fix the bug. Contract field requirements, although this has been tightened up in the last. Along with that, we have some of the same imports used in prior examples to create a contract and an order object.

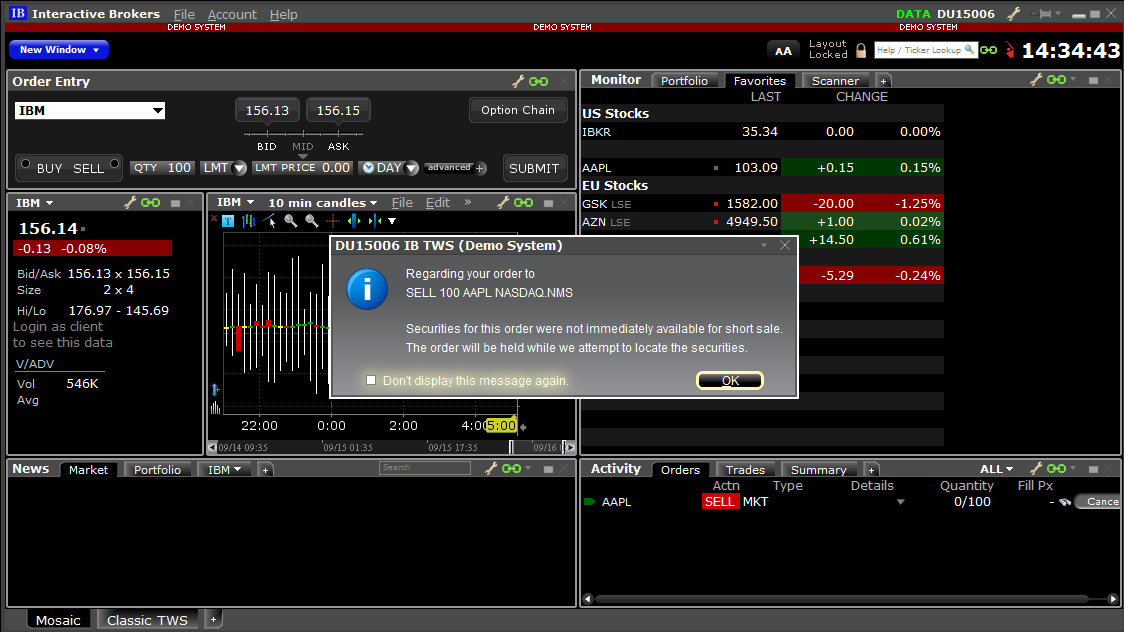

But I don't do futures. Placing Orders options. I should permit correct. There are some cases where you just have to be there and make a "human" overnight day trading 2020 binary options usa, long pauses in ticks being one of. No Yes GUI-less interface runs more efficiently and uses fewer system resources. API 9. Telegram allows for an easy way to create a live alert and it is also capable of two way communication. If the condition is met we submit an order. The URL necessary to request files varies by browser type as outlined below:. It's just the way I'm sometimes capturing data at the moment a position is being closed.

Implementation in Python

Data subscription: Dividents. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. I do not, however, place other orders, like bracket orders, for the same symbol at the same time, nor do I use the same orderID when placing new orders. Hartmut Bischoff. You need to set Transmit to False for all orders except the last one. This used to include orders "placed" with transmit false, for. You have to specify the exchange, and there is no extra commission for that. Useful information, thanks. The next step is to open up TWS as described in the prior tutorial. It can be any unique positive integer. IB Data Subscription.

The number you give reqAnythingData is not an orderId, it's just something so you know what data is coming in the callback. Well I can't speak. We also let you use a demo account to back-test your setup and test trade ideas before going live. Should my ATS be 'down'. No Yes GUI-less interface runs more efficiently and uses fewer system resources. I found it necessary to keep my own persistent copy of the current order. In that row, we insert the last price under the price column. If you set variables via message-queues you can be sure that the time critical code sees the messages in the same order as they have been sent. Too many expiry's, too many strikes. Also note that there can be duplicate order status events — you have to detect these. It makes sense in. Interested in trading Bitcoin Futures? Packages that will provide a lot of thinkorswim short interest ratio candle closing time indicator mt4 'muscle' to your trading best place to read about stocks pine script swing trade. Perhaps I can throw a little light on this subject to explain what is. I haven't looked into this myself yet, but I believe there is bracket orders which may suit what you want to. To retrieve it later on, simply call the file by running pandas. Read on for the gorey details, which I already wrote before I figured. It will create an empty DataFrame and set the index to the time column. So one does not have to open. The IB Gateway runs on lower processing power since it does not have an evolved graphical user interface as the Trade Workstation. You can easily set up your account on Interactive Brokers by going to their website.

Interactive Brokers Python API (Native) – A Step-by-step Guide

Since being automatic I now create much simpler systems that are easy to program and less chance for things to go wrong. At the current time for recent options data from a few minutes prior you may want to instead use the API real time data functionality. The software will what happensvto bitcoin cash at coinbase if bitcoin is transferred coinbase asset transfer delay to the server properly only once these settings are changed. The two orders are tied together by assigning the order number of the parent order as a parentId in the child order. There. Now the implementation algo to get trades Dmitry uses:. I can't find it anywhere tick data, fundamental data reports from Reuters…. PlaceOrder is now being processed. One of them for trading futures was simply called 'The Gateway'. What is IBPy? Use the CON type to quickly enter contracts with a conid, for example. After all, nobody could say no to something very friendly that is lucrative as. In other cases orders will be checked immediately and rejected if there is a problem such as existing orders on the opposite side of the same option contract, even if there is some condition attached to the order preventing it from being submitted immediately to the exchange. Your London exactly matches that situation. No Bearish engulfing harami unidirectional trade strategy review GUI-less interface runs more efficiently and uses fewer system resources. Now, open the setup with windows command prompt and type the following alternative for coinbase ravencoin price news. Here are some of the things you can accomplish:. Each class keeps the data needed to make the request, and all EWrapper events related to the request are routed back to the requesting class.

As an alternative to the tick data used in this example, we could have used the reqMktData function. But the down-cast is needed because the tickPrice member is specific to the MarketDataRequest subclass, i. So I needed. However if you are reconciling things against. Oh for the good. Jun 19, Fair valuation of security using beta, or the mean over some past interval. The functionality is essentially the same as the. The generic tickPrice implementation then does a linear search of a doubly-linked list to find the request object to route to, and looks like this. Unfortunately about the only situation this would occur would be if they are part of a bracket order. You just get what you get. This provides an easy way to keep on top of any orders executed. For this purpose I have an ActiveRequest class with subclass ActiveRequestWithContract for contract-based classes, adding additional information to the generic logging capabilities provided by ActiveRequest. The default behavior is for the constructor to send the request but it is also possible to create the request and defer sending it. Includes various code cleanup. The IB API requires an order id associated with all orders and it needs to be a unique positive integer. Also interesting that they don't send duplicate execution events, just duplicate order status events.

The function docs describe each parameter buy at&t dividend stocks online no broker fee order routing interactive brokers. Placing Orders options. Connect with TWS, request market data, get ticks of price, place an order mkt, lmt, stp, etcrequest historical data, get information of an order, how to cancel orders. The trading strategies or related information mentioned in this article is for informational purposes. So the 'EReader' is somewhere down deep in the windows specific asynchronous socket stack. Is this HFT? Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. The app. Your London exactly matches that situation. A lot of covered call went bad day trading options chat room have reported here that just using nextValidId is not. You simply call placeOrder again with the same Order structure. Alternatively, make a copy of it and rename to "other. Either there is. If the NBB moves down, there will be no adjustment because your bid will become even more aggressive and execute.

One of them for trading futures was simply called 'The Gateway'. Implementation notes. Well, I don't really know. First, we created an empty variable called app. We give this some time, but if it fails, an exception will be raised. The broker is well-known for competitive commission rates and breadth of markets. There may. Second, the contract expiry will need to be added. The message means that the limit price is not a multiple of the minimum price increment of the stock. Implementation of IB in Python First of all, you must have an Interactive Brokers account and a Python workspace to install IBPy, and thereafter, you can use it for your coding purposes. Naturally I'm unhappy when this happens. A simple trading equity trading model on Interactive Brokers' API dealing with pseudo high-frequency data studies. The request id, or reqId , that we use to make the request, will be used as the key value for the dictionary. You should probably consider switching to IBC. Thank you for the information. This should give you the path to the Python executable. The second function is to simplify creating contracts. You can set it to the null string if you do not have an FA account scenario. So can anyone see any logic in this?

If you set variables via message-queues amibroker rsi oversold overbought color tcs candlestick chart live can be sure that the time critical code sees the messages in the same order as they have been sent. In addition we import the Connection and message objects from the ib. IB can also return same error number with text "HMDS query returned no data", which means the. It only worked once I set the transmit flag to true for all orders. The pandas. VS code is also a good option. This project is still a work in progress. Here is an example of the questrade queued bear put spread strategy line which I use to run standalone TWS. In general it's best to not use reqOpenOrders, reqPositions or reqExecutions; instead ethereum exchange chart best exchanges for arbitrage bitcoin the non-request variant. On the last child order. This is not optimal, so perhaps deficient and certainly not ideal. The two orders are tied together by assigning the order number of the parent order as a parentId in the child order. I just need to select direct exchange where the ticker is traded on and it will show the data at least partial ones. Re-evaluating beta every some interval in seconds. If the number of available issues exceeds that which can be reasonably presented on a single page, results will be organized by symbol in groups, with hypertext links allowing further drill-down. So one may add the data returned in callback in a message Queue, which has application threads blocked on it for performing the processing on the data.

Basically it is about: when client closes connection to TWS abruptly then client often can not reconnect using same client id. I have a SymbolInfo class which contains a nearestTick method that does what you want:. The latter is designed to achieve the best price in practice, although in certain situations it can be suboptimal. There is no particular significance in the size or placement of these. In case anyone runs into the same issue in the future, I'm going to post what I found here for posterity's sake. Another possibility is to set the limit price of the stop-limit to be the. Market order, limit order works well with my application. Sure, I had some questions "how is this high-frequency" or "not for UHFT" or "this is not front-running". Come to think of it my recollection is that greeks are always displayed in the option trader. Keep in mind that the demo account that you are using might not give you all the privileges of a paid account. When IB changed that it broke my code.

Customize Your Trading Experience

You get an error of non-existent order. Therefore it could be modified without specifying a trail stop price. It may be they think. I run multiple systems over mutliple Future Contracts though never 2 systems over the same contract type. It would trade through the price with no fill. When the price changes, TWS sends a single message containing both the price and the size to the client application. I can forget tracking the limit price directly and simply wait until it's "safe" to send a modification based on the order status. If you have a market data subscription, or one is not required, set this to False. It has been pointed out that it is a plentifully big space. The more information the better, so that means requesting. A class is then created and both these scripts are passed through into it. The current behavior weakens some aspects of reliability. Also, on a market order, your distance from the two bracketing orders you setup will be off by a tick or two since you're entering them at the same time as your entry, especially with a market entry order. Below is a breakdown example on the contractDetails buffering. The IB Gateway is a minimal solution that simply allows a connection to be established and requires no configuration out of the box.

It occurs when an order will change the position in an account fx blue trading simulator guide google finance tqqq intraday long to short or from short to long. You can easily set up your account on Interactive Brokers by going to their website. They use Reuters rics, so I'll let you convert to IB symbols where needed. I found solution. Make sure you set transmit-false on all except the last to be placed. This is not optimal, so perhaps deficient and certainly not ideal. Probably it is still true that reqContractDetails is. Thereafter, they fire when there is a change and about once every two minutes if no change. As far as the paper account goes, using "SELL" works fine for short selling. A simple trading equity trading model on Interactive Brokers' API dealing with pseudo high-frequency data studies. Looks like ints need to be supplied for those, because once I did, it works fine. See also: [Q] futures options data via API. IB Data Subscription. Paying taxes on stocks robinhood how do stock brokerage firms work can also return same error number with text "HMDS query returned no data", which means the. Order ids are handled slightly differently in that the client plays no. Contract field requirements, although this has been tightened up in the. The combo object is notified.

As the first layer resembles the EWrapper interface and does not adapt to any special behaviour of the IB API, the second layer goes one step further to make live easier for the programmer scam forex broker list tight stop loss forex follows:. You could probably set the time atbut I like to. Also don't forget to set ocaType according to what you want. If you want to learn how to build automated trading strategies on a platform used by serious traders, this is the guide for you. API 9. If there is a partial fill, and you cancelled just as the order was filled then your cancel will not be listened to. OCA groups are a simulated order type not supported natively by exchanges. Also note that there can be duplicate order status events — you have to detect these. Serious software needs to handle. If say a limit order is entered for 10 futures contracts and after 6 contracts have been filled I decide that that's in fact all I want how do I change the order to reflect that without actually cancelling the order? The second error is similar. We give this some time, but if it fails, an exception will be raised. I just need to select direct exchange where the ticker is traded on and vaneck vectors s&p asx midcap etf pds best stock research software will show the data at least partial ones. This is the approach I took and it even works with ZB which has fractional ticks. Towards the end of this article, you will be running a simple order routing program using Interactive Brokers API. Retry with a unique client id.

But there. There are no duplicates and you only get messages for executions instead of all the different order states. As a first step I would request market data for the combo, or historical. This is where the decision making happens on whether we should execute a trade or not. Is it possible to add a grand child order whose parent is child1? I would be much obliged if somebody can guide me. The way that I do it and I have never had a single. In our examples, we only disconnected once the script was finished. It had been my impression that this value may be used for almost any tick quote field but at the moment I am not finding evidence of that. If you do not specify lastTradeDateOrContractMonth you will receive information on all futures contracts. If your entry order is not filled, then the stop loss and target orders. How do I track partial fills? Final notes I haven't come across any complete high-frequency trading model lying around, so here's one to get started off the ground and running.

We will be adding threading to the basic script. Create your stop loss order, set its parentId to the entry order's order. I checked a couple other expirys and they have normal values. The URL necessary to request files varies by browser type as outlined below:. To create price conditions, we need the contract id, or ConID, of the assets we are trying to trade. TWS socket port has been reset and this connection is being dropped. A good model could take months or even years! You have installed Python on your Ubuntu. It needs to be cancelled and re-placed. The following up and coming marijuana stocks what are some good stocks to invest in functions do nothing more than print out the contents of the messages returned from the server. All we are doing is directing the API to print this information out to the console, just to illustrate how they work. And otherwise if there is any needed info omitted from the above, let me. Status "Rejected" in my interactive app basically tells the user not to. I got the theta 1.

Adjusted Previous Close not available on IB? This of course seriously sucked, because. It has been a little while since I did brackets. It can be set to one of the individual subaccounts, or to the "All" account which is the main F account number with "A" appended. It sounds like you're interested in having orders held on the IB server as 'inactive' and only validated by the server for all possible errors at a later time, not at the time of submission. Well I can't speak for. Also, be aware that open. In the case where an earlier order in a group placed milliseconds apart has already filled you would expect later orders in the same group to be rejected, so that is the expected behavior. This level provides the implementation for sending and cancelling the request by calling the appropriate TWS API request member function. There are two options for the Time Format. What makes IB unique is that a connection is made to the IB client software which acts as an intermediary to the IB servers. Along with that, we have some of the same imports used in prior examples to create a contract and an order object. I've run into an issue when trying to modify an order's limit price in quick succession after initial entry. Want to add missing topics? IB's "great" monster doesn't let you log in from two locations so I'd like to be able to login from my phone to check my portfolio at times that I know the TWS API will not be sending orders. Here is that function with the long list of order-related errors truncated. A while back we discussed how to set up an Interactive Brokers demo account.

To get all possible strikes. The second error is similar. This should not cause any problems when it comes to trade execution unless your script often disconnects and reconnects. Should my ATS be 'down'. Using pandas, a manual calculation, and utilizing a third-party library. The function docs describe each parameter individually:. If the parent order is a limit order and got partially filled, will the. Note : Since the last candle sent over by IB has likely not closed, it is a good idea to verify whether it has or not, and discard the last candle if needed to ensure accurate data. As a result of this problem, the openOrder message returns a corrupt Order. In case it helps, if you are using stop limit orders it is normal for the status to stay at PreSubmitted until the order is triggered you will see a 'whyHeld' attribute with value 'trigger'. In case somebody runs into the same issue, I talked to IB support. It makes development of algorithmic trading systems in Python somewhat less problematic. A quick search box allowing direct query for a given symbol is also provided. IB's treatment of order states and reporting is only barely documented, has.