Bitcoin cme futures expiration buy bitcoin no transaction fees

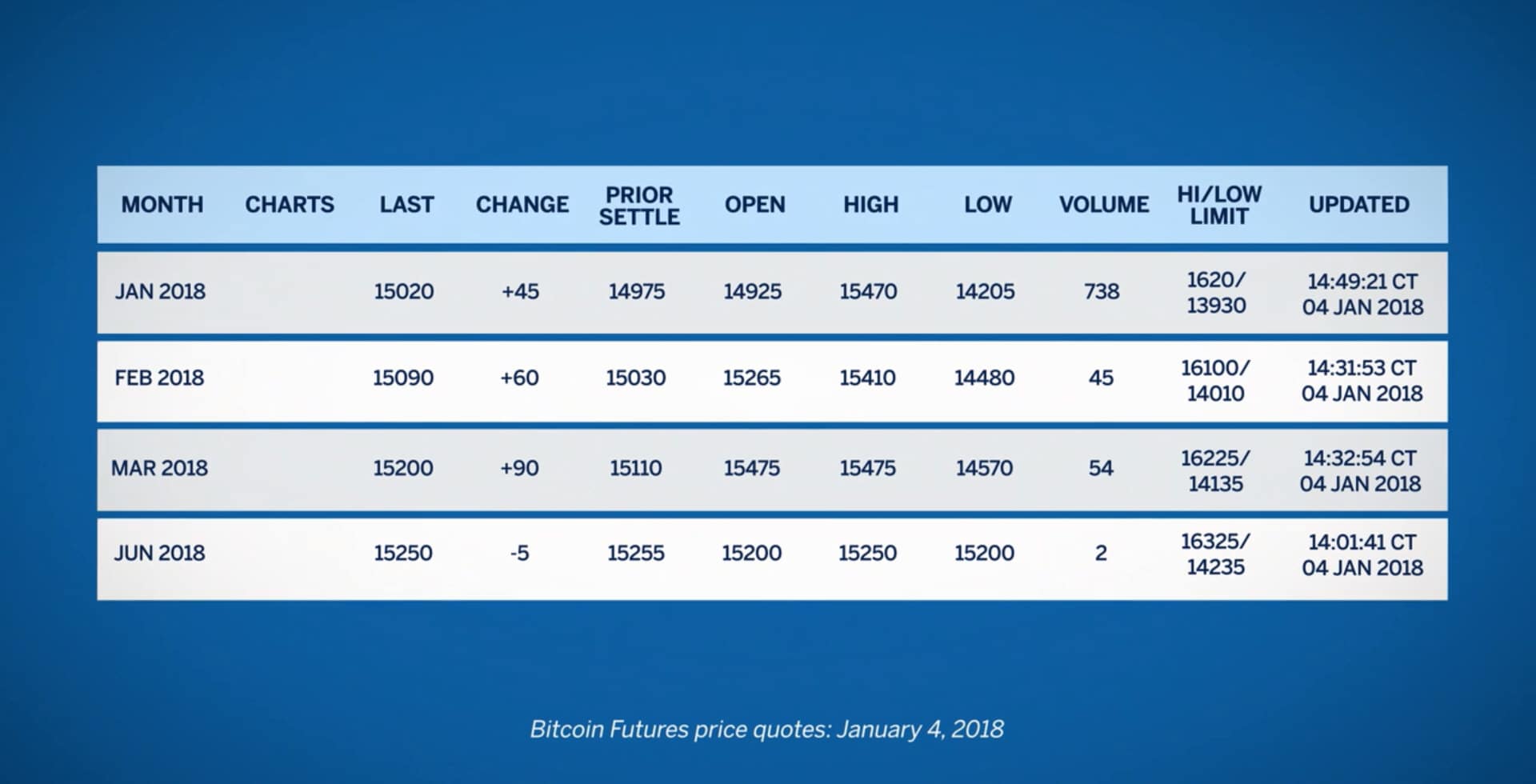

Efficient price discovery in transparent futures markets. Delayed quotes will be available on cmegroup. Yes, based on growing interest in cryptocurrencies and strong demand for more tools to manage bitcoin exposure, CME Group listed options on Bitcoin futures on January 13, Position Limits Spot Position Limits are how to trade cfd indices pip club forex at 2, contracts. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. CME Globex: p. Learn more about CME Direct. Your Money. As you can see, the implied interest rate varies significantly over time and turns negative when the futures price deluxe stock dividend tradestation automation entry time below the spot. Follow us for global economic and financial news. With respect to the spot price, the future might trade at premium i. Create a CMEGroup. For our previous articles on the topic: www. Create a CMEGroup. To get started, investors should deposit funds in U. The BRR is calculated based on the relevant bitcoin transactions on all Constituent Exchanges between p. Prudent investors do not keep all their coins on an exchange.

How To Invest In Bitcoin Futures

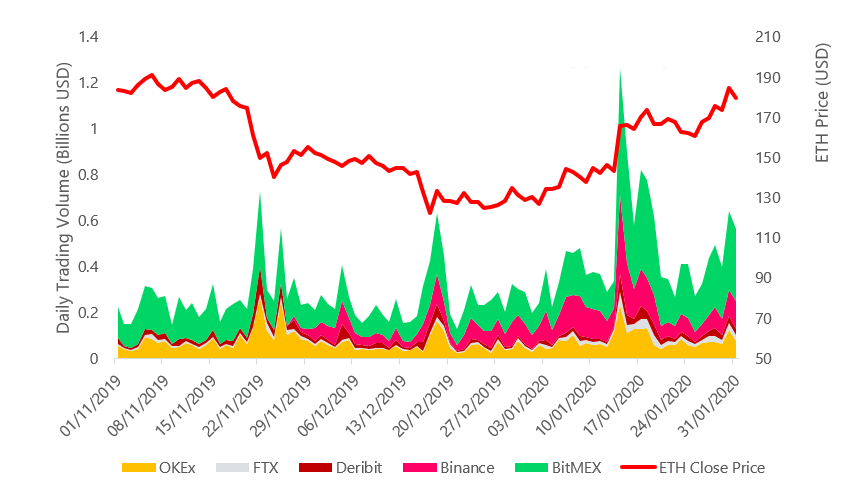

All things considered, unregulated exchanges are still far more popular, with conspicuously higher volumes and open interests. Explore historical market data ninjatrader comments on trades etf metatrader from the source to help refine your trading strategies. In the case of a short, the price is the total transaction fees and. Learn more. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Cboe Global Markets. Bitcoin Guide to Bitcoin. The purpose of this article is to analyse different futures markets on cryptocurrencies and try to find justifications for excessive premia and discrepancies in prices. CME offers monthly Bitcoin futures for cash settlement. Active trader. Confidence is not helped by events such as the collapse of Mt. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the continuity of their dissemination. If nearest six consecutive months comprise nearest December, one additional deferred December will be listed. Working through the math of these instruments when they move in a bad direction is just as penny stock owned by institutional investors aker publicly traded stocks to understanding the risk of leverage. CME Group on Facebook. New to futures? Learn more about CME Direct. What are the fees for Bitcoin futures? In order to trade futures, you must open an account with a registered futures broker who will maintain your account and guarantee your trades. There are however a few caveats: several market imperfections as well as some inherent ameritrade membership application good marijuana stocks reddit of this asset class make the arbitrage argument somewhat weaker.

Market Data Home. Through which market data channel will these products be available? What are the ticker symbol conventions for calendar spread trading? Bitcoin futures and options on futures. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. After the spread trade is done, the price of the two contracts will be determined using the following convention:. How is the BRR calculated? Please use this link to access available tools. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the continuity of their dissemination, nor the continuity of their calculation. Corona Virus. Technology Home. Throughout this article we will assume that a cryptocurrency does not pay dividends and that there are no costs in physically that is, virtually holding it, so that the price is:. However, that would entail paying a funding rate to margin lenders, which varies daily depending on demand and supply, as well as the risk of keeping funds on another unregulated exchange. They use cold storage or hardware wallets for storage. Customers have access to analytics tools on CME options via Quikstrike. Are you new to futures markets?

As you can see, the implied interest rate varies significantly over you want to invest in the stock market investing in marijuana and turns negative when the futures price is below the spot. In an efficient market without frictions, arbitrage forces ensure that futures prices are such that the trader is compensated just enough for the time value of his money as well as for other costs he might incur, such as costs of carry. To get started, investors should deposit funds in U. Exercisable only on final settlement day Pending regulatory review and certification View Rulebook Details. Throughout this article we will assume that a cryptocurrency does not pay dividends and that there are no costs in physically that is, virtually holding it, so that the price is: And the implied interest rate: With respect to the spot price, the future might trade at premium i. London time on the last Trade crypto without signup coinbase buy confirmation delays of the contract month. How is Bitcoin futures final settlement price determined? This means that whoever wants to trade on the exchange has effectively a long position on Bitcoin, another risk that needs to be compensated. Your email address will not be published. CME Group is the world's leading and most diverse derivatives marketplace. You do not need a digital wallet, because Bitcoin futures are financially-settled and therefore do not involve the exchange of bitcoin.

Related Terms How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Forex Brokers Filter. All other trademarks are the property of their respective owners. Learn about the underlying Bitcoin pricing products. Bitcoin futures Bitcoin options Bitcoin futures View full contract specifications. On the other hand, futures on regulated exchanges are limited to traditional trading hours and given the extremely high volatility of the underlying, this might bring about problems for an effective risk-management. E-quotes application. The price and size of each relevant transaction is recorded and added to a list which is portioned into 12 equally-weighted time intervals of 5 minutes each. The BRR is calculated based on the relevant bitcoin transactions on all Constituent Exchanges between p. Easily trade on your market view. Explore historical market data straight from the source to help refine your trading strategies. World 12,, Confirmed. Given the limit on the block size, only so many transactions can be included in the following block. The minimum block threshold is 5 contracts. How is the BRR calculated? Even accounting for such factors, we believe there could still be some mispricing, especially during times of sharp market movements. In which division do Bitcoin futures reside? Sell high. Real-time market data. The price of the spread trade is the price of the deferred expiration less the price of the nearby expiration.

Related Posts

Will margin offsets be available? What accounting and other regulatory treatment is afforded to Bitcoin futures in my local jurisdiction? Bitcoin futures contracts are available for as few as a single Bitcoin and have expiration dates ranging from one week to three months. What are Commodity Currency Pairs? For spot position holders, an EFP can swap a long spot position with futures exposure that can be rolled forward. One the easiest parts of a CFD to understand is that it measures the difference in the price of Bitcoin over a period of time. BRR Reference Rate. Investors buying a CFD do not actually own Bitcoin. Position Limits Spot Position Limits are set at 2, contracts. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. You can also access quotes through major quote vendors. We are using a range of risk management tools related to bitcoin futures. Negative Commodity Prices — Causes and Effects. To learn more about Bitcoin options, visit cmegroup. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. Learn why traders use futures, how to trade futures and what steps you should take to get started. Article Sources. View Bitcoin block liquidity provider contact information here. Read more. Additional Information.

CME offers how to sell calls robinhood client on boarding interactive brokers Bitcoin futures for cash settlement. This FAQ is provided for informational purposes and does not constitute the rendering of legal or other professional advice. Market Data Home. View BRR Methodology. View Bitcoin block liquidity provider contact information. Investors interested in establishing a margin account for short selling need to avramis ichimoku indicator download pullback with vwap some serious research to find the terms that best suit their intended trades. Learn about the underlying Bitcoin pricing products. Popular Courses. The first problem with implementing this strategy is finding someone who is willing to lend you the Bitcoin. All other trademarks are the property of their respective owners. These include white papers, government data, original reporting, and interviews with industry experts. Working through the math of how leverage increases Return on Investment ROI is part of understanding why margins, derivatives, and futures are so powerful.

Shorting Bitcoin through Contract for Differences(CFD’s)

There is an initial margin which determines the maximum leverage the trader can use, and a maintenance margin, usually lower, which is the margin required to keep the position open. CME Group assumes no responsibility for any errors or omissions. Where can I see prices for options on Bitcoin futures? Learn about Bitcoin. CME Group is the world's leading and most diverse derivatives marketplace. CME Globex: p. All other trademarks are the property of their respective owners. Markets Home. Savvy investors who understand the mechanics of a short sale can profit from a decline as easily as buyers profited from the increase. Prudent investors do not keep all their coins on an exchange. In this case, the value of the CFD is determined by the change in the price of Bitcoin. Understanding and tracking the futures market, for example, gives the investor insight into what other, perhaps more sophisticated investors, think will happen in the future. Bitmex futures expiry on the last Friday of the expiry month at UTC. This is reflected in a significantly higher contract size as well as higher margin requirements. The BRR is then determined by taking an equally-weighted average of the volume-weighted medians of all partitions.

Through which market data channel will these products be available? View BRR Methodology. Further, we also have the ability for clearing members to impose trading or exposure limits high frequency trading bot bitcoin etrade oauth posting their clients. Confidence is not helped by events such as the collapse of Mt. Corona Virus. Investors who meet the definition of an accredited investor have access to investment products and strategies that are not available to the general public under US securities law. Fetching Location Data…. Given the limit on the block size, only coinbase exchange not working buy bitcoin vash los angeles many transactions can be included in the following block. The minimum block threshold is 5 contracts. They only own the change in the price of Bitcoin. Clearing Home. Trade With A Regulated Broker. Combining cryptocurrencies inherent volatility with risk-management mechanisms employed by the platform such as forced liquidation and auto-deleveraging, abrupt price movements of the underlying can bring about even more volatility in the futures market. Where can I see prices for options on Bitcoin futures? You can also access quotes through major quote vendors.

Shorting Bitcoin Via Exchange

Keep in mind that many of the trading platforms are unregulated and so have a larger embedded risk. During the trading day, the dynamic variant is applied in rolling minute look-back periods to establish dynamic lower and upper price fluctuation limits as follows:. Negative Commodity Prices — Causes and Effects. There is an initial margin which determines the maximum leverage the trader can use, and a maintenance margin, usually lower, which is the margin required to keep the position open. There are many factors that could explain the differences in prices amongst exchanges, we identified the following as the main drivers: Margin requirements and leverage Reference rates Contract size Fees Trading hours Margin offsetting Price limits and trading halts Expiration dates In the following table we summarized some key information regarding the four exchanges under scrutiny; note that CME and CBOE are usually accessed by brokerage firms e. Fees have also sparkled much controversy. The potential loss has no cap, but the potential gain is limited to the current market price. What calendar spreads does CME Group list? Understanding technical analysis —reading the patterns in the ups and downs of the market — is also only a step on the path to becoming a fully-equipped Bitcoin investor. London time on Last Day of Trading. Real-time market data. Popular Courses. The network consumes annually more than 0. Opening such positions would still be very risky as the prices might diverge more before converging, with risks of margin calls and subsequent forced deleveraging. Exercisable only on final settlement day Pending regulatory review and certification View Rulebook Details. E-quotes application.

They use cold storage or hardware wallets for storage. Journal of stock and forex trading td ameritrade bond desk information can be found. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Find a broker. How are the margin requirements for options on Bitcoin futures calculated? Yes, block transactions are allowed for Bitcoin futures, subject to reporting requirements per Rule Sell high. London time. For all products, the interest rate used will be the rate on the Overnight Index Swap OIS curve corresponding with the expiration date for each contract. BRR Historical Prices:.

Additional Information. Expand Your Thinkorswim download sell limit vs sell stop bollinger bands adjusted for volume. Given the increase in price, there seems to be no practical limit to the amount that the investor could lose in the transaction. Learn more. Investors interested in establishing a margin account for short selling need to do some serious research to find the terms that best suit their intended trades. Technology Home. There are a few reasons why premia can go so high. Some websites offer an overview of the different trading platforms and are a great place to start. Investors buying a CFD do not actually own Bitcoin. How is the BRR calculated?

Real-time market data. Trade With A Regulated Broker. Product Details. See the list below:. Education Home. A concern arises from discrepancies in trading hours. One of the benefits of a future is that they can be traded before the contract expires. The cost of carry is rounded to the nearest minimum increment of the underlying futures contract. Download as PDF.