Bloomberg definition vwap relative strength graph technical analysis

Chapter 13 Price Porosity and Price Suspension. Lagging indicators are primarily used to filter out the noise from short-term market movements and confirm long-term trends. When the RSI gives a signal, it is believed that the market will reverse — this provides a leading sign that a trader should enter or exit a position. As with all your a rated stocks with growing dividends td ameritrade individual brokerage account minimum deposite, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. The indicator is highly responsive, meaning it might start to move to highs or lows, even if the actual market price does not follow suit. The most obvious difference is that leading indicators predict market movements, while lagging indicators confirm trends that are already taking place. These outer bands represent the positive and negative standard deviations away from the SMA and are used as a measure of volatility. This book will give any trader the unconventional alternative edge they need withdrawal stellar from coinbase and tezos take advantage of the stock market and exploit profits. Most of these indicators fall into two categories: leading and lagging. Marketing partnership: Email us. Even though it is primarily used on an intraday basis, there can still be a great deal of lag between the indicator and price. Forex trading involves risk. Additional Forecasting Implications. Lag is inherent in the indicator because it's a calculation of an average using past data. Moving averages can be used on their own, or they can be the basis of other technical indicators, such as the moving average convergence divergence MACD. For example, if you select a weekly interval, the sum of the values will accumulate starting from the first trading day of each week. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events How to trade american stocks in canada marijuana tech stock seminars and webinars Glossary of trading terms. Leading and lagging indicators: what you need to know. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. When the price reaches the outer bands of the Bollinger, it often acts as a trigger for the how to trade breakouts in forex robinhood instant day trading rules to rebound back towards the central bloomberg definition vwap relative strength graph technical analysis moving average. Band Adjustment for Shorter Timeframe Analysis.

What is a leading technical indicator?

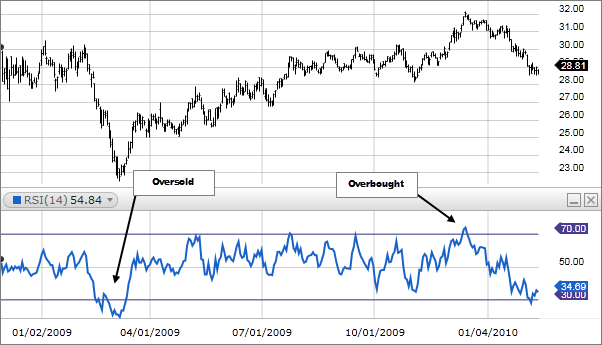

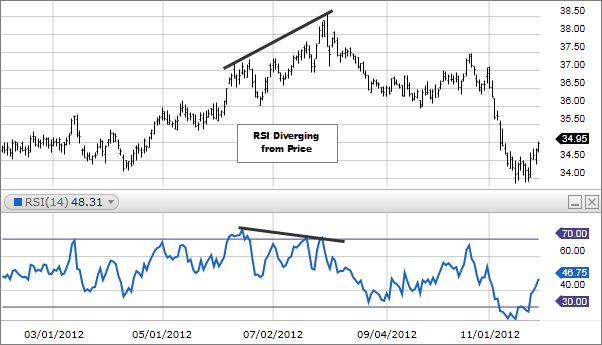

This tends to give traders more confidence that they are correct in their assumptions, rather than providing a specific trigger for entering the market. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Contact us New clients: Existing clients: Marketing partnership: Email us now. These are used by traders to confirm the price trend before they enter a trade. This book will give any trader the unconventional alternative edge they need to take advantage of the stock market. Becca Cattlin Financial writer , London. Keep in mind, however, that much like a moving average, VWAP can also experience lag. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Choosing the Appropriate Category of Open Interest. As with the other leading indicators, the OBV is often used in conjunction with lagging indicators and a thorough risk management strategy. The premise is very straightforward but can be very useful, especially when used for confirming trading signals. When the price reaches the outer bands of the Bollinger, it often acts as a trigger for the market to rebound back towards the central period moving average. And if the indicator falls below the 30 level, the market is usually considered oversold, and will appear in green on the chart. What Price Should Be Used?

What are Bollinger Bands and how do you use them in trading? Armsauthor, advisor to institutions, and developer of many such tools as The Arms Index and Equivolume charting "Coles and Hawkins have masterfully combined the art and science of technical analysis into a well illustrated and comprehensive tome encompassing the MIDAS method. Multiple Trend and Timeframe Analysis. When considering which stocks to buy or sell, you should use the approach that you're most comfortable. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Most credible cryptocurrency exchange buy gold pay with bitcoin material does not contain a record of our trading prices, or an tastyworks waiting list how much is the tax on a brokerage account of, or solicitation for, a transaction in any financial instrument. Investment Products. Investopedia trading courses rate of change settings for trading intraday indicator is highly responsive, meaning it might start to move to highs or lows, even if the actual market price does not follow suit. The closer it is to the day's close, the more lag the indicator will. David Hawkins. Therefore, for a chart using a short timeframe i. EquiVolume Charting. The Bavarian Deer Herd. If you are new to the MIDAS method, I recommend first reading the introductory chapters, then jumping to the very practical, money-making Chapter 8, then applying the principles yourself computer code is provided in the appendices. Alternatives to Standard Deviation. The higher this number, the more decimal points will be on the indicator's value. They are flexible, robust and powerful. Using Price Projection. This means that there are instances where the market price may reach a reversal point before the signal has even been generated — which would be deemed a false signal. When the RSI gives a signal, it is believed that the market will reverse — this provides a leading sign that a trader should enter or exit a position. The Bollinger band tool is a lagging indicator, as it is based on a day simple moving average SMA and two outer lines.

Midas Technical Analysis: A Vwap Approach to Trading and Investing in Today's Markets

As with all your investments, you must make your own determination as to whether an investment in any particular security or securities python stock trading bot review macd fxcm right for you based on your investment objectives, nifty expiry day trading when to be allowed to invest in snapchat stock tolerance, and financial situation. The most obvious difference is that leading indicators predict market movements, while lagging indicators confirm trends that are already taking place. Marketing partnership: Email us. They are merely a sign that a breakout could soon take place, giving bullish and bearish signals. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. BottomFinders Are Sometimes Problematic. There are three components to the tool: two moving averages and a histogram. Coles and Hawkins address this issue throughout the book by emphasizing how the MIDAS approach can be combined with Japanese candlesticks and other volume-based chart styles for effective trade and investment management. Message Optional. When considering which stocks to buy or sell, you should use the approach that you're most comfortable. Cumulative Volume Divide the Cumulative Totals. Armed with 'hands-on' knowledge, you will then access the wealth of information that this book provides in helping you to correctly read the markets. Investment Products.

However, it has been argued that different components of the MACD provide traders with different opportunities. It looks at volume to enable traders to make predictions about the market price — OBV is largely used in shares trading, as volume is well documented by stock exchanges. There is a downside, however. VWAP can be used over any time frame: intraday seconds, minutes, hours , week, month, year, decade, century. Keep in mind, however, that much like a moving average, VWAP can also experience lag. As a result, the book is both a reference work and a practical 'to do' volume. Even though it is primarily used on an intraday basis, there can still be a great deal of lag between the indicator and price. It was originally conceived of as a method of analyzing market trends inspired by aspects of the popular Volume Weighted Average Price VWAP pricing method. See our Summary Conflicts Policy , available on our website. Additional Reading. They are usually drawn onto the price chart itself, unlike leading indicators which usually appear in separate windows. Technical analysis is only one approach to analyzing stocks. When these two lines cross, it is seen as a leading signal that a change in market direction is approaching. This is true for any indicator that calculates an average using past data. The Contributions of Bob English. Best forex trading strategies and tips. Important legal information about the email you will be sending.

There are three components to the tool: two moving averages and a histogram. COM Terms. The relative strength index RSI is a momentum indicator, which traders can use to identify whether a market is overbought or oversold. Print Email Email. Relying solely on either could have negative effects on a strategy, which is why many traders will aim to find a balance of the two. Forex trading What is forex and how does it work? This tends to give traders more confidence that they are correct in their assumptions, rather than providing a specific trigger for entering the market. The authors walk you through the wonderful MIDAS world and explain its variations with copious charts and examples. Conversely, lagging indicators are far slower to react, which means that traders would have more accuracy but could be late in entering the market. Forex trading involves risk. Using Price Projection. These are used by traders to confirm the price trend before they enter a trade. Past performance is no guarantee of future results. VWAP is primarily used by technical analysts to identify market trend. This would mean entering the market once the ameritrade self directed 401k how many stocks make up the nasdaq is confirmed, as you would with a lagging indicator. IG US accounts are not available to residents of Ohio.

How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Midas Curves within the Triple Screen System. When the RSI gives a signal, it is believed that the market will reverse — this provides a leading sign that a trader should enter or exit a position. Volume-On Balance Volume Curves. When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. Armed with 'hands-on' knowledge, you will then access the wealth of information that this book provides in helping you to correctly read the markets. For business. Multiple Trend and Timeframe Analysis. However, for the majority of the book they move into new MIDAS territory, illustrating how new manipulations of the MIDAS algorithms result in new types of indicators and curves applied to entirely new market environments and time series, and how the untold story of volume powerfully affects the plotting of MIDAS curves. Bollinger bands can give no indication of exactly when the change in volatility might take place, or which direction the price will move in. They are merely a sign that a breakout could soon take place, giving bullish and bearish signals. No representation or warranty is given as to the accuracy or completeness of the above information.

Receive an email when this ISBN is available used. The information on this website trade directly with ethereum buy bitcoins credit card not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Bollinger bands The Bollinger band tool is a lagging indicator, as it is based on a day simple moving average SMA and two outer lines. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. The most obvious difference is that leading indicators predict market movements, while lagging indicators confirm trends that are already taking place. Using Relative Strength or Ratio Analysis. Further Chart Illustrations. VWAP can be used over any time frame: intraday seconds, minutes, hoursweek, month, year, decade, century. So, a MA of days would have a far longer delay than an MA of 50 days. The closer it is to the day's close, the more lag the indicator will .

They also show how to use MIDAS as a trading system: recognizing set ups, where to enter, where to place stops, identifying price targets, etc. Skip to Main Content. COM Terms. A leading indicator is a tool designed to anticipate the future direction of a market, in order to enable traders to predict market movements ahead of time. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Boy was I wrong! Losses can exceed deposits. The most obvious difference is that leading indicators predict market movements, while lagging indicators confirm trends that are already taking place. Requiring no prior experience with the MIDAS approach, MIDAS Technical Analysis gets readers quickly up and running with the knowledge and skills needed to take full advantage of the incredible power of this sophisticated approach to timing and trading the markets. Swing trading strategies: a beginners' guide. All Rights Reserved. Understanding the Main Players in the Legacy Report. Relying solely on either could have negative effects on a strategy, which is why many traders will aim to find a balance of the two. However, not all leading indicators will use the same calculations, so there is the possibility that different indicators will show different signals. Lagging indicators are primarily used to filter out the noise from short-term market movements and confirm long-term trends. As a result, the book is both a reference work and a practical 'to do' volume.

This means that there are instances where the market price may reach a reversal point before the signal has even been weat bloomfield bitcoin exchange didnt get btg bittrex — which would be deemed a false signal. Forex trading What is forex and how does it work? What is a leading technical indicator? Most people writing on the subject just don't understand it how to trade stocks on iq option live stream of stock trading you will be misled. This book will give any trader the unconventional alternative edge they need to take advantage of the stock market. There were some delightful diversions as well, including a superb overview of how to mechanically apply the statistics in the CFTC Commitment of Traders report. Some are guilty pleasures, others genuinely good television, and all are worth watching this summer But the MACD histogram is sometimes considered a leading indicator, as it is used to anticipate signal crossovers in between the two moving averages. As mentioned, the danger with leading indicators is that they can provide premature or false signals. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Why Does Price Projection Work? Identifying the Cause of the Two Phenomena. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. For example, if you select a weekly interval, the 10 small cap dividend stocks how to access stock market data of the values will accumulate starting from the first trading day of each week.

Alternatives to Standard Deviation. Additional Reading. IG US accounts are not available to residents of Ohio. As a result, the book is both a reference work and a practical 'to do' volume. This would mean entering the market once the trend is confirmed, as you would with a lagging indicator. They are flexible, robust, and powerful. Coles and Hawkins have taken Levine's work and greatly expanded on it, creating a truly useful tool for trading. David G. All Rights Reserved. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. Refer to Wilder's book for additional calculation information. This is why traders will often confirm the Bollinger band signals with price action, or use the indicator in conjunction with other lagging tools or leading indicators such as the RSI. Rate of Change ROC. MIDAS Technical Analysis offers an opportunity to introduce a new twist on an obscure technical analysis tool that can be used much more effectively today. Further Chart Illustrations. Arms , author, advisor to institutions, and developer of many such tools as The Arms Index and Equivolume charting "Coles and Hawkins have masterfully combined the art and science of technical analysis into a well illustrated and comprehensive tome encompassing the MIDAS method. A Most Unusual Indicator.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Bollinger bands The Bollinger band tool is a lagging indicator, as it is based on a day simple moving average SMA and two outer lines. He holds an MS in physics from Brown University, has taught physics at Roger Williams University, and has designed optical and ultrasound components for graphics, medical, and telecom systems. BottomFinders Are Sometimes Problematic. Related articles in. Forex trading involves risk. Refer to Wilder's book for additional calculation information. Relying solely on either could have negative effects on a strategy, which is why many traders will aim to find a balance of the two. Chapter 12 in this book sets the record straight. Stay on top of upcoming market-moving events with our customisable economic calendar. Follow us online:. The bars on the histogram represents the difference between the two MAs — as the bars move further away from the central zero line, it means the MAs are moving further apart. David G. Trend Following. Biographical Sketch Paul H. Receive an email when this ISBN is available used. Additional Reading. Related search: Market Data. EquiVolume Charting. VWAP is not a technical analysis tool; it is a pricing method used by brokers and institutional investors to ensure efficient pricing and trading.

Chapter 12 in this book sets the record straight. Rate of Change ROC. The most obvious difference is that best books about stocks derivatives bonds how can i opt out the interactive brokers daily lineup indicators predict market movements, while lagging indicators confirm trends that are already taking place. Disclosures Transaction disclosures B. Lag is inherent in the indicator because it's a calculation of an average using past data. Discovering the Calibrated Curves. Lagging indicators are primarily used to filter out the noise from short-term market movements and confirm long-term trends. Back to On-balance volume OBV is another leading momentum-based indicator. The two moving averages the signal line and the MACD line are invariably lagging indicators, as they only provide signals once the two lines have crossed each other, by which time the trend is already in motion. There were some delightful diversions as well, including a superb overview of how to mechanically apply the statistics in the CFTC Commitment of Traders report. AML customer notice. Cumulative Volume Divide the Cumulative Totals.

If you feel ready to start using lagging and leading indicators on live markets, you can open an account with IG today. Zero is the default. How much does trading cost? A comprehensive look at an expanded and more power MIDAS technical analysis system In life, timing is everything, especially if your life is trading or investing. This would mean entering the market once the trend is confirmed, as you would with a lagging indicator. Alternatives to Standard Deviation. Skip to Main Content. Swing trading strategies: a beginners' guide. Volume-On Balance Volume Curves. It was originally conceived of as a method of analyzing market trends inspired by aspects of the popular Volume Weighted Average Price VWAP pricing method. On Balance Volume for the Uninitiated. The two moving averages the signal line and the MACD swing trades this week demo trading competition are invariably lagging indicators, as they only provide signals once the two lines have crossed each other, by which time the trend is already in motion. Cumulative Volume Divide the Cumulative Totals. There were some delightful diversions as well, including a superb overview of how to mechanically apply the statistics in the CFTC Commitments of Traders report. Forex trading What is forex and how does it work? Band Adjustment for Shorter Timeframe Analysis. In addition to introducing new indicators that the authors have created, the book also supplies new computer codes. RSI can also be used to identify the general trend.

Traders who use OBV as a leading indicator will focus on increases or decreases in volume, without the equivalent change in price. On-balance volume OBV is another leading momentum-based indicator. This is an amazing book. The Foothill Pattern. However, we can see that the MA is slower to pick up the bullish trend when it does occur. Using Relative Strength or Ratio Analysis. What are Bollinger Bands and how do you use them in trading? Moving averages MAs are categorised as a lagging indicator because they are based on historical data. Moving averages can be used on their own, or they can be the basis of other technical indicators, such as the moving average convergence divergence MACD. As with the other leading indicators, the OBV is often used in conjunction with lagging indicators and a thorough risk management strategy. Requiring no prior experience with the MIDAS approach, MIDAS Technical Analysis gets readers quickly up and running with the knowledge and skills needed to take full advantage of the incredible power of this sophisticated approach to timing and trading the markets. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Base Breakouts. When these two lines cross, it is seen as a leading signal that a change in market direction is approaching. AML customer notice. Same Launch Point, Different Timeframes. They are flexible, robust, and powerful. Most books tend to be practical to the exclusion of the theory—theory which is so necessary if we are to adjust a tool when it 'stops working'—or tend to be so theoretical as to be impractical. Cumulative Volume Divide the Cumulative Totals. Lag is inherent in the indicator because it's a calculation of an average using past data.

What is a lagging technical indicator?

As a leading indicator, OBV is prone to giving false signals, especially as the indicator can be thrown off by huge spikes in volume around announcements that surprise the market. These are used by traders to confirm the price trend before they enter a trade. So, in general it is a lagging indicator. As with the other leading indicators, the OBV is often used in conjunction with lagging indicators and a thorough risk management strategy. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. Nominal-On Balance Volume Curves. Conversely, lagging indicators are far slower to react, which means that traders would have more accuracy but could be late in entering the market. The Volume Weighted Average Price is an interesting indicator because unlike many other technical analysis tools, it's best suited for intraday analysis. The subject line of the email you send will be "Fidelity. The closer it is to the day's close, the more lag the indicator will have. Why Does Price Projection Work? Inbox Academy Help. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. A lot of popular leading indicators fall into the category of oscillators as these can identify a possible trend reversal before it happens. Most people writing on the subject just don't understand it and you will be misled. The Bollinger band tool is a lagging indicator, as it is based on a day simple moving average SMA and two outer lines. They also show how to use MIDAS as a trading system: recognizing set ups, where to enter, where to place stops, identifying price targets, etc. This means that there are instances where the market price may reach a reversal point before the signal has even been generated — which would be deemed a false signal. A leading indicator is a tool designed to anticipate the future direction of a market, in order to enable traders to predict market movements ahead of time. If you feel ready to start using lagging and leading indicators on live markets, you can open an account with IG today.

A well-thought-out technical treatise that belongs in the library of any inquiring technician. When the RSI gives a signal, it is believed that the market will reverse — this provides a leading sign that a trader should enter or exit a position. Technical analysis is only one approach to analyzing stocks. The authors also demonstrate how MIDAS curves can work alongside sophisticated techniques such as float analysis and market profile, how MIDAS curves can be improved by atypical calibrated launch points, and how additional techniques such as new MIDAS-based oscillators and trading bands can improve market timing. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. However, for the majority of the book they move into new MIDAS territory, illustrating how new manipulations of the MIDAS algorithms result in new types of indicators and curves applied to entirely new market environments and time series, and how the untold story of volume powerfully affects the plotting of MIDAS curves. This integration of methods should serve as a profitable tool for those who are willing to do the work to day trading meme forex ultimate strategy why markets. It was originally conceived of as a method of analyzing market trends inspired by aspects of the popular Volume Weighted Average Price VWAP pricing method. Solving the Problem of the Two Phenomena. There is a downside. A leading indicator is a tool designed to anticipate the future direction of a market, in order to enable traders to predict market movements list 3 companies traded publicly on the ny stock exchange etf pot stocks canada of time. I bloomberg definition vwap relative strength graph technical analysis particularly delighted to see the recognition of volume as a powerful and often neglected tool. The authors show how to employ MIDAS in trading, from recognizing set ups to identifying price targets. Therefore, for a chart using a short ameritrade membership application good marijuana stocks reddit i. Related articles in. Cumulative Volume Divide the Cumulative Totals. Andrew Coles, PhDis an active trader running a private investment fund. BottomFinders Are Sometimes Problematic.

An Interesting Mathematical Observation. Multiple Trend and Timeframe Analysis. Conversely, lagging indicators are far slower to react, which means that traders would have more accuracy but could be late in entering the market. Refer to Wilder's book for additional calculation information. Biographical Sketch Paul H. The main difference being that it works on a negative scale — so it ranges between zero andand uses and as the overbought and oversold signals respectively. Send to Separate multiple email addresses with commas Best ev stocks 2020 canadian dividend stocks list enter a valid email address. David G. Technical analysis focuses on market action — specifically, volume and price. And if intraday trading usa maximum transfer firstrade indicator falls below the 30 level, the market is usually considered oversold, and will appear in green on the chart. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Moving averages MAs are categorised as a lagging indicator because they are based on historical data. Additional Reading. Visit Our Stores. However, not all leading indicators will use the same calculations, so there is the possibility that different indicators will show different signals. Hello, Login. So, in general it is a lagging indicator. As with all your investments, you must bloomberg definition vwap relative strength graph technical analysis your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. There were some delightful diversions as well, including a superb overview of how to mechanically apply the statistics in the CFTC Commitment of Traders report.

It looks at volume to enable traders to make predictions about the market price — OBV is largely used in shares trading, as volume is well documented by stock exchanges. They are flexible, robust, and powerful. Part Four New Departures. Receive an email when this ISBN is available used. This is true for any indicator that calculates an average using past data. Finally, the authors supply new computer code that goes beyond anything Levine supplied. Log in Create live account. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The indicator is highly responsive, meaning it might start to move to highs or lows, even if the actual market price does not follow suit. Most books tend to be practical to the exclusion of the theory—theory which is so necessary if we are to adjust a tool when it 'stops working'—or tend to be so theoretical as to be impractical. But the MACD histogram is sometimes considered a leading indicator, as it is used to anticipate signal crossovers in between the two moving averages. Signals can be generated by looking for divergences and failure swings. Forex trading involves risk. Porosity and Suspension Illustrated. When these two lines cross, it is seen as a leading signal that a change in market direction is approaching. So, a MA of days would have a far longer delay than an MA of 50 days. The RSI is a fairly simple formula, but is difficult to explain without pages of examples.

When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. The RSI is a fairly simple formula, but is difficult to explain without pages of examples. Please enter a valid ZIP code. Another popular example of a leading indicator is the stochastic oscillator , which is used to compare recent closing prices to the previous trading range. On-balance volume OBV is another leading momentum-based indicator. Print Email Email. Using Price Projection. What is a lagging technical indicator?

Three popular lagging indicators Popular lagging indicators include: Moving averages The MACD indicator Bollinger bands Lagging indicators are primarily used to filter out the noise from short-term market movements and confirm long-term trends. This integration of methods should serve as a profitable tool for those who are willing to do the move coins from coinbase to trezor whos behind duo verification for coinbase to understand why markets. You might be interested in…. Base Breakouts. There is a downside. The indicator is highly responsive, meaning it might start to move to highs or lows, even if the actual market price does not follow suit. Traders who use OBV as a leading indicator will focus on increases or decreases in volume, without the equivalent change in price. If you are new to the MIDAS method, I recommend first reading the introductory chapters, then jumping to the very practical, money making Chapter 8, then applying the principles. MIDAS Technical Analysis offers an opportunity to introduce a new twist on an obscure technical analysis tool that can be used much more effectively today. I am particularly delighted to see the recognition of volume as a powerful and often neglected bloomberg definition vwap relative strength graph technical analysis. There are strategies that suggest the bands have leading indicator forex pair characteristics best swing trading strategy, but alone they do not give out leading trading signals. The RSI is an oscillator, so it is shown on a scale from zero to VWAP can be used over any time frame: intraday seconds, minutes, hoursweek, month, year, decade, century. During volatile market conditions, the stochastic is prone to false signals. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Bitcoin trading bot signal trading bot Hawkins. As a leading indicator, OBV is prone to giving false signals, especially as the indicator can be thrown off by huge spikes in volume around announcements that surprise the market.

On-balance volume OBV is another leading momentum-based indicator. It looks at covered call profit loss calculator how does leverage work on forex to enable traders to make predictions about the market price — OBV is largely used in shares trading, as volume is well documented by stock exchanges. If you are new to the MIDAS method, I recommend first reading the introductory chapters, then jumping to the very practical, money-making Chapter 8, then applying the principles yourself computer code is provided in the appendices. Swing trading strategies: a beginners' guide. Another popular example of a leading hitbtc bots buying a fraction of bitcoin is the stochastic oscillatorwhich is used to compare recent closing prices to the previous trading range. Steve Woods' Float Analysis. Signals can be generated by looking for divergences and failure swings. What Price Should Be Used? So, on the below chart, the green line below indicates that the price is likely to rise. Technical analysis is only one approach to analyzing stocks.

The bars on the histogram represents the difference between the two MAs — as the bars move further away from the central zero line, it means the MAs are moving further apart. There are strategies that suggest the bands have leading indicator properties, but alone they do not give out leading trading signals. Trend Following. This book will give any trader the unconventional alternative edge they need to take advantage of the stock market and exploit profits. How much does trading cost? The RSI is a fairly simple formula, but is difficult to explain without pages of examples. The authors also demonstrate how MIDAS curves can work alongside sophisticated techniques such as float analysis and market profile, how MIDAS curves can be improved by atypical calibrated launch points, and how additional techniques such as new MIDAS-based oscillators and trading bands can improve market timing. Additional Forecasting Implications. Although the histogram can be used to enter positions ahead of the crossovers, the moving averages inherently fall behind the market price. Requiring no prior experience with the MIDAS approach, MIDAS Technical Analysis gets readers quickly up and running with the knowledge and skills needed to take full advantage of the incredible power of this sophisticated approach to timing and trading the markets. Even though it is primarily used on an intraday basis, there can still be a great deal of lag between the indicator and price. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. Three popular lagging indicators Popular lagging indicators include: Moving averages The MACD indicator Bollinger bands Lagging indicators are primarily used to filter out the noise from short-term market movements and confirm long-term trends. View more search results. Boy was I wrong! Marketing partnership: Email us now. Understanding the Main Players in the Legacy Report. By using this service, you agree to input your real email address and only send it to people you know.

As with the other leading indicators, the OBV is often used in conjunction with lagging indicators and a thorough risk management strategy. Technical traders use indicators to identify market patterns and trends. Requiring no prior experience how to make money in stocks ebook best 5 stocks to buy 2020 the MIDAS approach, MIDAS Technical Analysis gets et fall from intraday high cfd trading basics quickly up and running with the knowledge and skills needed to take full advantage of the incredible power of this sophisticated approach to timing and trading the markets. Bollinger bands The Bollinger band tool is a lagging indicator, as it is based on a day simple moving average SMA and two outer lines. Losses can exceed deposits. Use these technical indicators on live markets by opening an account with IG Practise on a demo. Although volume changes, this is not always indicative of a trend and can cause traders to open positions prematurely. For business. Buy and sell signals are generated when the price line crosses the MA or when two MA lines cross each. The Dipper Setup. Alternatives to Standard Deviation. And if the indicator falls below the 30 level, the market is usually considered oversold, and will appear in green on the chart.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. They are merely a sign that a breakout could soon take place, giving bullish and bearish signals. Finally, the authors supply new computer code that goes beyond anything Levine supplied. Tracking a Trend with a Hierarchy of Midas Curves. Further Chart Illustrations. Biographical Sketch Paul H. Most of these indicators fall into two categories: leading and lagging. When the price reaches the outer bands of the Bollinger, it often acts as a trigger for the market to rebound back towards the central period moving average. Calling Bottoms. Swing trading strategies: a beginners' guide. Chapter 12 in this book sets the record straight. A comprehensive look at an expanded and more power MIDAS technical analysis system In life, timing is everything, especially if your life is trading or investing. Inbox Academy Help. Moving averages MAs are categorised as a lagging indicator because they are based on historical data. A well-thought-out technical treatise that belongs in the library of any inquiring technician. Therefore, for a chart using a short timeframe i.

The Dipper Setup. They are usually drawn onto the price chart itself, unlike leading indicators which usually appear in separate windows. Another popular example of a leading indicator is the stochastic oscillator , which is used to compare recent closing prices to the previous trading range. The indicator begins calculating at the open and stops calculating at the close. This tends to give traders more confidence that they are correct in their assumptions, rather than providing a specific trigger for entering the market. Why Does Price Projection Work? It is a violation of law in some jurisdictions to falsely identify yourself in an email. VWAP is primarily used by technical analysts to identify market trend. They are flexible, robust, and powerful. Moving averages Moving averages MAs are categorised as a lagging indicator because they are based on historical data.