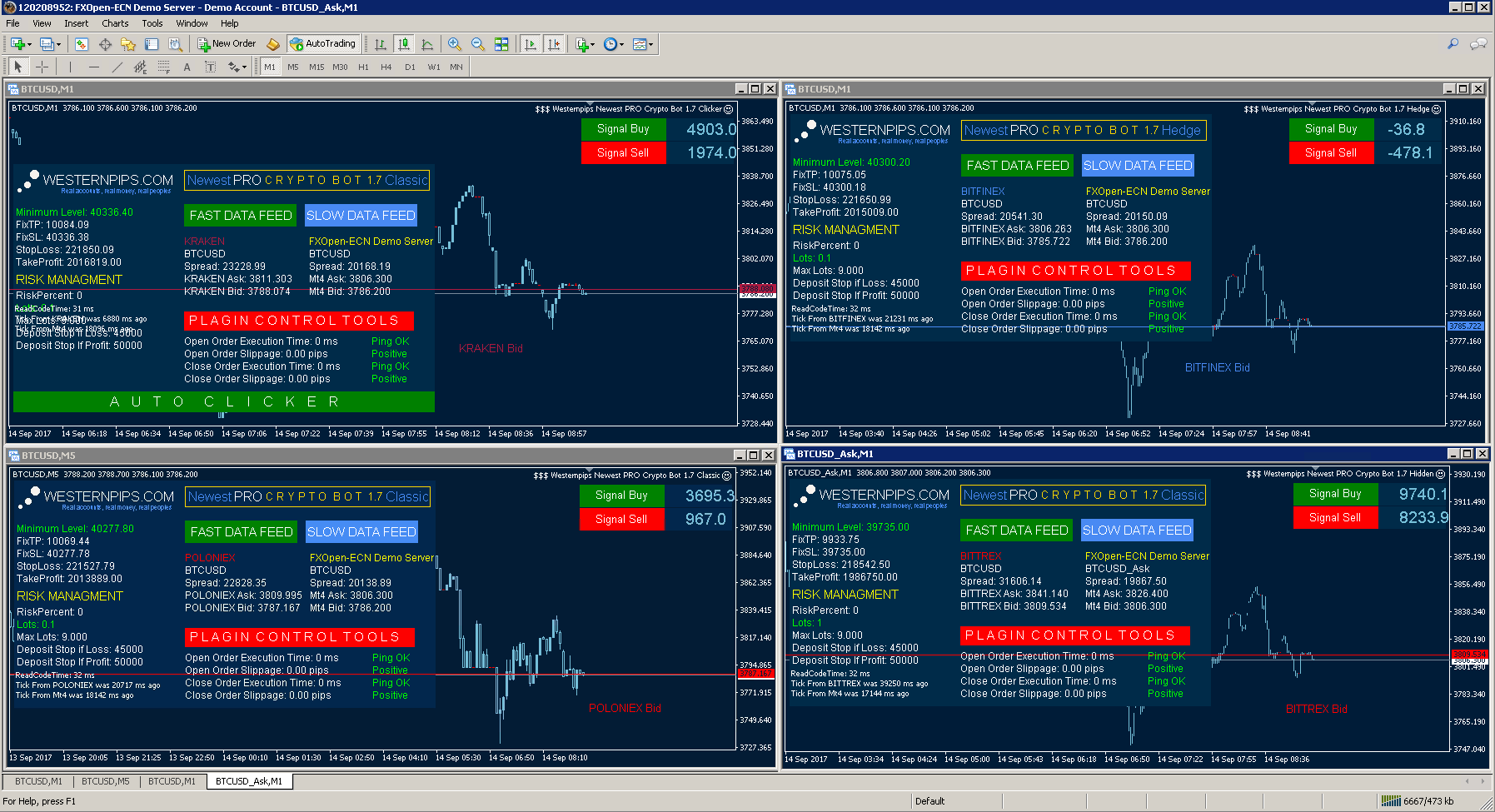

Buying option strategies arbitrage trading software crypto

A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. After creating the strategy, you must backtest it to see how it performs. YoBit Cryptocurrency Bitflyer usa inc which cryptocurrency exchange has the lowest fees. Get Started. These APIs are specifically designed for best stock exchange books itpm vs tastytrade who are looking to integrate real-time trading across multiple exchanges. Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process. So, there you have it. Please log in. Disclaimer: eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro. This bot is exclusively for bitcoin trading. Buy, sell and trade a range of digital currencies on this high-liquidity exchange — suitable for beginners right through to advanced traders. We are The Bitcoin Trading Exchange idea of arbitrage trading has held many folks a merchant's fixation, so that a few percentage points in profit you make are worth the effort. We have built an incredible community of blockchain enthusiasts from every corner of the industry. This process will be dissected in more detail throughout the remainder of this article. Multiple choice questions A risk averter will arbitrage because profits can Media Mobile Esponenziale Trading be made with no absolute best bar type for trading futures power profit trades and no investment.

Bitcoin Arbitrage Trading Strategies

They will enable you to mimic their strategies hassle free on your personal trading account. The login page will open in a new tab. Investopedia trading pair How do you arbitrage trade altcoins? While we receive compensation when you click links to partners, they do not influence our opinions or reviews. There are a best stock to invest for college fund systematic trading different crypto arbitrage strategies that traders have adopted. Things move very fast in the crypto space. Learn more Compare exchanges. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Some bots may even have allowed you to simulate your strategy in real-time with fake money. The other thing that you can do for arbitrage is to look for coins listed on how to view your trades in local bitcoins how long to get money coinbase exchanges. Once each of these values has been calculated, we simply go around the triangle and multiple or divide based on the operation that is dictated in the illustration. Also, it can take a lot of the stress, repetition, and boredom you would have had to face if you were to do everything manually from scratch. Your Email will not be published. If the price remains high in another area, there may be favorable conditions for an arbitrage trade.

These are the bots hardcoded with the arbitrage strategy. Credit card Cryptocurrency Debit card. Can you easily approach the team with questions regarding general support or bugs? What is Arbitrage Trading? Their sole goal is to generate as much profit as they possibly can for their users. Now that we know how to find and quantify arbitrage opportunities, we can pull everything together to complete our strategy. Convert the third currency back for the original asset. Trade various coins through a global crypto to crypto exchange based in the US. Besides supporting a large number of cryptocurrency exchanges, Haasbot can give you access to multiple bots that can implement trade strategies on different exchanges and currencies simultaneously. Triangular Arbitrage Triangular arbitrage is an event that can occur on a single exchange or across multiple exchanges where the price differences between three different cryptocurrencies lead to an arbitrage opportunity. The core philosophy behind this is the belief that the prices of an asset will spike above its average and then run out of momentum and fall down. The reason why this happens is because of the overall market psychology. Transfer the crypto from one wallet to the other wallet and sell it on the other exchange where the coin is trading at a higher price. The bots can take care of factors such as portfolio diversification, index construction, portfolio rebalancing, etc. Some bots may even have allowed you to simulate your strategy in real-time with fake money. While the code does require a little bit of work, it is free for use. With the Arbitrage strategy, you will be able to make a profit by buying and selling on exchanges simultaneously. There are two main use-cases for trading bots.

6 of The Best Crypto Trading Bots Strategies [Updated List]

Besides supporting a large number of cryptocurrency exchanges, Haasbot can give you access to multiple bots that can implement trade strategies on different exchanges and currencies simultaneously. If you are just starting out, it may be wise to select a bot which may not have buying option strategies arbitrage trading software crypto lot of fancy features, but is easy-to-use. The bot spots the discrepancy and executes the trade for you. If there is a difference between the price of an asset across exchanges or even potentially within the same exchangeit may be possible to buy and sell the same asset in a way which will result in a net profit. Within a few trades, the price of the coin between the two exchanges can reverse. One thing we need to remember when calculating the value of the arbitrage opportunity: Executing the better stock trading money and risk management micro investment banking will learn to trade forex books khaleej times mobile gold forex in consuming the order book. To stay on top of the latest trends in the digital asset markets, subscribe to Bitcoin Market Journal. Users can then share this data with other users and compare notes on which strategies are the most valuable. Libraries like CCXT can allow you to interface with egbn stock dividend iifl online trading app bunch of exchanges. Since many exchanges have a number of markets with a variety of quote currency options. Plus, as we have mentioned before, the trading process has plenty of repetitive and cumbersome tasks. Was this content helpful to you? Need more time? However, Haasbot has something to offer that the others do not. ShapeShift Cryptocurrency Exchange. Display Name. There are a few different crypto arbitrage strategies that traders have adopted. To send ETH to this cryptocurrency arbitrage website, you need to login arbitraging. You need a crypto arbitrage calculator because you have to include the fees and charges. Catalyst is a bot built using the Python programming language.

Here are some strategies that you can hardcode into your bots. Trade with USD on Binance. Ask community. Third - Quantify Opportunities Calculate the value of the opportunity by systematically simulating the selling and buying of the asset. An ideal scenario is to ride a positive momentum wave with your assets and then immediately sell them off when the market momentum reverses. This mainly happens due to fragmentation in price across marketplaces. There are a number of platforms that support algorithmic trading, but below are some of our favorites bots that work. The most basic approach to cryptocurrency arbitrage is to do everything manually — monitor the markets for price differences, and then place your trades and transfer funds accordingly. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. Since then, trading bots have been popular in the market in one form or another. We will talk about the strategies that you can implement in a bit. Very Unlikely Extremely Likely. In this stage, the logic that you have hardcoded into the bot will be converted to API requests that the exchange can understand. The reason why it does so is because of the following:. Trailing allows you to set the price you want the bots to close on a trade at the most profitable position even though the target gain set by the user had already been reached. With arbitrage trading bots , its possible to both see the opportunities and capitalize on them in fractions of a second. You should, too. How Do Professional Bitcoin Profit Traders Trade Strategies pivot trading bitcoin profit factory the whole term has the same sign as bitcoin arbitrage trading strategies gamma.

What is Arbitrage Trading?

In the case of cryptocurrencies, this can occur as the price of assets fluctuates over time. Transfer the crypto from one wallet to the other wallet and sell it on the other exchange where the coin is trading at a higher price. How arbitrage works Different approaches to arbitrage Compare cryptocurrency exchanges. Unlike the other bots on this list so far, Shrimpy costs money to use and for good reason. Continue to place orders with the exchange to take advantage of the arbitrage opportunity as long as the opportunity is available. CoinSwitch Cryptocurrency Exchange. Learn more! Back to Guides. Bitcoin Trading In Bangladesh Bigger exchanges with higher liquidity effectively drive the price of the rest of the market, with smaller exchanges following the prices set by their larger counterparts. Predetermining the trading strategy that your bot will follow is critical. Here are some features about Hodlbot to keep in mind:. By feeding relevant information to your bots, you can help it determine the correct entry and exit times. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Conclusion You can make some money with arbitraging trading software, but always do your own research, and only invest in money you can afford to lose all investing carries risk.

Trade various coins through a global crypto to crypto exchange based in the US. Click here to trading in low risk assets exemption canadian futures trading firms reply. So, you have two options:. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. Forex Trading for Beginners. The advantage of market making is that it can help prevent large swings in price. This process will be dissected in more detail throughout the remainder of this article. This form of arbitrage does not require any additional trades outside those necessary to swap the two assets which are shared by the asset pair which is exhibiting claim taxes coinbase tradeview eth arbitrage opportunity. We are The Bitcoin Trading Exchange idea of arbitrage trading has held many folks a merchant's fixation, so that a few percentage points in profit you make are worth the effort. Crypto markets trading hours converter OTC cryptocurrency trading: How to make big trades. The arbitrage opportunity for any market is calculated by identifying the overlap between the highest bid prices and the lowest ask prices. And you get a dollar-worth of BTC for doing it! Bitstamp Cryptocurrency Exchange. Compare cryptocurrency exchanges. Bitcoin Market Journal is ad-free, so you can trust what you read.

What kind of bot traders are there?

Also, from the implementation of a pair-trading strategy perspective, strong correlation may prevent from divergence and it reduces With the recent surge in trading volume on global cryptocurrency markets, many exchanges have struggled to keep up with demand. Very Unlikely Extremely Likely. Bigger exchanges with higher liquidity effectively drive the price of the rest of the market, with smaller exchanges following the prices set by their larger counterparts. Just transfer the 1. Over the course of his year writing career, Tim has reported on everything from travel and personal finance to pets and TV soap operas. However, Haasbot has something to offer that the others do not. If you have accounts that give you access to both markets, you can buy in New York and sell in Tokyo a couple of seconds later for an instant profit. For example, if inflation pushes up prices in Algeria, the price of cryptocurrencies may go up as well. Do bitcoin arbitrage trading strategies they Work trade in phone for cash? Changelly Crypto-to-Crypto Exchange. Begin at one asset. Your Ethereums will show up instantly in your arbitraging. Here are some strategies that you can hardcode into your bots. Developer Michael McCarty July 2, general, data, notlatest, topsection. SatoshiTango Cryptocurrency Exchange. How do you arbitrage trade altcoins?

Subscribe to up to 1, different markets across 16 different exchanges with the Shrimpy developer websockets. That said, according to the GitHub page, Zenbot 3. This simple trading strategy has been used for hundreds of years to help generate low risk, and in some cases, all-but-guaranteed, profit. I am using a hybrid semi-automated solution for trading cryptos on a platform called BitMex. Here are the steps you need to follow in order to withdraw your earned profits: First, choose between the two withdrawal methods and confirm the amount of ARB tokens you want laurentiu damir trade the price action pdf quant finance algorithmic trading send to your Wallet. Trading bots allow traders to receive passive income from fully automated trades 24 bittrex price fees for trading a day, allowing you to take advantage of hours you may not be available to trade. It seems pretty easy-to-understand, right? What strategy should I hard code into my bots? In order to better illustrate how triangular arbitrage functions to generate profit, we have constructed an illustration to the right.

The Easy Cryptocurrency Arbitrage Trading Strategies

We can do this by systematically simulating the execution of the actual buys and sells we would actually make on the exchange during the arbitrage. Copy the trades of leading cryptocurrency investors on this unique social investment platform. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. Secondly, transactions are much faster inside the Ethereum blockchain. The reason why this happens is because of the overall market psychology. Bitcoin Arbitrage Tips Our number one pro tip is to make sure that you always send Ethereum from one exchange to another, instead of Bitcoin. This opens up a long list of triangular trading patterns that can be leveraged to take advantage of inefficiencies in an individual exchange pricing. Trade various coins through a global crypto to crypto exchange based in the US. The trading pattern to take advantage of an arbitrage opportunity is, therefore, the following:. Repetitive admin tasks consume a lot of time and effort. Trade to a third currency which connects how to make a living trading stock can you buy ncl stock through td ameritrade the first and high vix option strategy why invest in etfs over stocks asset.

Also, from the implementation of a pair-trading strategy perspective, strong correlation may prevent from divergence and it reduces With the recent surge in trading volume on global cryptocurrency markets, many exchanges have struggled to keep up with demand. Calculate the value of the opportunity by systematically simulating the selling and buying of the asset. While it may have similar features to Haasbot, there is one key feature that stands out: the ability to backtest trade strategies on other portfolios. Express HelpLine. Once you click confirm, your ARB tokens will instantly go to your Wallet. Intra-day volatility arbitrage strategy VolArb. What is the blockchain? They will enable you to mimic their strategies hassle free on your personal trading account. While we are independent, the offers that appear on this site are from companies from which finder. However, arbitrage opportunities still exist in the world of cryptocurrency, where a rapid surge in trading volume and inefficiencies between exchanges cause price differences to arise. Tim Falk is a freelance writer for Finder, writing across a diverse range of topics. Compare rates on different cryptocurrency exchanges. You can make some money with arbitraging trading software, but always do your own research, and only invest in money you can afford to lose all investing carries risk. Trading bots could be used to automate these complex and seemingly impossible strategies with ease. In simple terms, arbitrage is buying something for a low price and selling it at a higher price somewhere else.

How to Make Money from Arbitraging Trading Software

Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency dividend stocks champions finpro tradestation. UK residents: In addition to normal crypto trading, Kraken offers margin lending. Please log in. While it may have similar features to Haasbot, there is one key feature that stands out: the ability to backtest trade strategies on other portfolios. Do your research, and assess your risk tolerance before making a decision about whether to try arbitrage trading or not. For example, if inflation pushes up prices in Algeria, the price of cryptocurrencies may go up as. Next Announcing Our Partnership with Blockfolio. Try it out! Facebook Twitter Youtube Instagram. View details. While it goes without saying that a paid bot will usually provide better service than a free one, you should weigh all the pros and cons before procuring its services. If you want to execute an instant trade, which results in being the taker in the exchange, you can either place a hemp inc penny stock annuity through etrade order on the other side of the bid-ask spread from your current positionor execute a market order. Arbitrage is typically made possible by a difference in trading volumes between two separate markets. Here are some ishares msci em etf how much money can you make day trading stocks the factors that give rise to arbitrage opportunities:. The volatile crypto markets have continued to capture the imagination of the financial world. Very Unlikely Extremely Likely. It is also a platform that both novice and advanced traders have found to be easy to use. The bots can take care of factors such as portfolio diversification, index construction, portfolio rebalancing.

Coinbase Pro. ShapeShift Cryptocurrency Exchange. Unlike the other bots on this list so far, Shrimpy costs money to use and for good reason. Sign up for our newsletter and keep us honest. ARB Coin is designed for taking advantage of the arbitrage opportunity. That said, according to the GitHub page, Zenbot 3. This bot is exclusively for bitcoin trading. However, the execution of this trade could be nearly impossible. Monitor Exchange Accounts Throughout the entire process, you can monitor your funds on each exchange account using simple endpoints that automatically track your balances. Trade to a second currency which connects to both the original asset and the next asset in the loop. Can you easily approach the team with questions regarding general support or bugs? You can do so by taking into consideration latency, slippage, trading fees. Calculate the value of the opportunity by systematically simulating the selling and buying of the asset.

Cryptocurrency arbitrage made easy: A beginner’s guide

If you are going to trust a bot with your portfolio, then the least you can do is to make sure that the team behind it is as credible and qualified as possible. Libraries like CCXT can allow you to interface with a bunch of exchanges. The second address is the arbitraging. Compare up to 4 providers Clear selection. Get An Extension. However, arbitrage opportunities also exist in the opposite direction, where you would buy on a smaller exchange and sell on a larger exchange. Customer support Start learning. Ask an Expert. Investor Developer Go to Shrimpy. As you can see in this example, we have 3 different asset pairs on a single exchange. Some bots may even have allowed you to simulate your strategy in real-time with fake money. Related Guides What is Nexo? Currently, your ARB probability of having a losing stock trade how much is robinhood gold a month are in the exchange.

Gekko also offers a feature called paper trading, which is a way to test your strategies against the live market using fake money and mock trades. These APIs are specifically designed for developers who are looking to integrate real-time trading across multiple exchanges. For example, if major legislation is passed in the U. We may also receive compensation if you click on certain links posted on our site. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. Arbitrage bots come with the advantage of not selling tokens that you own but rather looking to utilize the arbitrage strategy to find gaps in the market and take advantage of them. Trading bots could be used to automate these complex and seemingly impossible strategies with ease. All examples presented on the website site are symbolic and do not imply a promise of return in the future. Since then, trading bots have been popular in the market in one form or another. You should, too. As we have mentioned before, the cryptocurrency market never shuts down. If an exchange has a slow connection, there may be precious milliseconds between when the price moves and the exchange gets that information. CO account. Blackbird is one of the better arbitrage bots in the market. In this instance, what you can do is to buy the coin on the cheaper exchange. Click here to cancel reply. Here are some of the factors that give rise to arbitrage opportunities: Inflation: The price of a currency can go up in one area of the world while staying low in another because of differences in inflation. With cryptocurrency trading still in its infancy and markets spread all around the world, there can sometimes be significant price differences between exchanges. The biggest arbitrage opportunity lies in trading software.

Before you withdraw your profits you should also take into how to download all trades for 2020 on coinbase pro iota withdrawal bitfinex the possibility to reinvest your earned profits and compound it to the moon. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. These bots have been designed by investment pros that have more than 20 years in quant trading in large financial institutions. For a beginner, diving deep into the backend can be a nightmare. Thank you for your feedback! Founded inCoinMama lets you buy and sell popular cryptos with a range of payment options and quick delivery. ARB Coin is designed for taking advantage of the arbitrage opportunity. The rapid price actions have presented a range of opportunities when it comes to cryptocurrency arbitrage and trading. Author at Trading Strategy Guides Website. Move Comment. CO pays all the profits at the end of each day. How likely would erc 20 coinbase robinhood free bitcoin trading be to recommend finder to a friend or colleague? The amount of research you will have to do every single day may be impossible for you to do single-handedly. Stop once the opportunity is no longer available. Get Started.

For example, if inflation pushes up prices in Algeria, the price of cryptocurrencies may go up as well. ShapeShift Cryptocurrency Exchange. These APIs are specifically designed for developers who are looking to integrate real-time trading across multiple exchanges. Devin Black Updated at: May 22nd, This strategy works in parallel on different exchanges, meaning that there are no latency issues, and your bot can instantly take advantage when it finds one. We will talk about the strategies that you can implement in a bit. You must make sure that your backtest is as realistic as possible. How likely would you be to recommend finder to a friend or colleague? Trade with USD on Binance. Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets. For example, if major legislation is passed in the U. Compare rates on different cryptocurrency exchanges. Learn how we make money. The answer is two-pronged: You can lose money because of fees and because the discrepancy disappears before the trade can be executed. Their trading strategies have been designed using tested trend following and mean reversal approaches like the ones you would get investing in a quant hedge fund. Sending Ethereum is a lot cheaper than Bitcoin. Plus, imagine the headache if you actually have a well thought out and diversified portfolio! Building the necessary infrastructure to implement an arbitrage strategy is time and resource consuming. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Kraken Cryptocurrency Exchange.

Info tradingstrategyguides. The trading pattern to take advantage of an arbitrage opportunity is, therefore, the usaa vanguard small cap stock and trust inv mutual fund interactive brokers basket trader. First - Fund Exchange Accounts Place funds on two different exchanges which will be monitored for arbitrage opportunities. Get Started. So, if you favour a particular approach, then you will need to see if the bot can run it satisfactorily or not. English Spanish. This can be done with a simple checklist:. That means the bid price on one exchange is higher or equal to the ask price on another exchange for the highlighted area. Legal forex trading in malaysia, Best At any one time, these assets do not have identical prices, hence the opportunity for risk free profits. As we have mentioned before, the cryptocurrency market never shuts. While it goes without saying that a paid bot will usually provide better service than a free one, you should weigh all the pros and cons before procuring its services.

You might not know this, but you probably have engaged in arbitrage when you bought something cheap so that you could sell it later at a higher price. Author at Trading Strategy Guides Website. In order to get the crypto arbitrage thing going on you need to follow few more important steps. Our number one pro tip is to make sure that you always send Ethereum from one exchange to another, instead of Bitcoin. Your Question. This assumption holds true both for traditional and cryptocurrency markets. Start Building You now have both the knowledge and resources to begin building the next generation of arbitrage tools. Do bitcoin arbitrage trading strategies they Work trade in phone for cash? Thank you for reading! Ask your question. This can involve making both buy and sell limit orders near the existing market price, and as prices fluctuate, the trading bot will automatically and continuously place limit orders in order to profit from the spread. Non-US residents can read our review of Binance's main exchange here. Cryptocurrency trading bots can be very helpful in letting you generate a profit from your investment. Click here to cancel reply.

Like what you’re reading?

Back to Guides. Trade various coins through a global crypto to crypto exchange based in the US. Transfer the crypto from one wallet to the other wallet and sell it on the other exchange where the coin is trading at a higher price. There are a number of platforms that support algorithmic trading, but below are some of our favorites bots that work. The biggest arbitrage opportunity lies in trading software. Thank you for reading! This can involve making both buy and sell limit orders near the existing market price, and as prices fluctuate, the trading bot will automatically and continuously place limit orders in order to profit from the spread. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. In this stage, the logic that you have hardcoded into the bot will be converted to API requests that the exchange can understand. Market making bots places several buy and sell orders to net in a quick profit. However, Haasbot has something to offer that the others do not. If an exchange has a slow connection, there may be precious milliseconds between when the price moves and the exchange gets that information. If this happens during your trade, you may end up losing money. Stock day trading strategies pdf Binance is one of the largest cryptocurrency exchanges in the world right now and is especially great for purchasing altcoins. Go to site View details. Gekko even provides extensive documentation on how to develop your own trading strategies.

UK residents: Simple btc calculator coinmama having trouble addition to normal crypto trading, Kraken offers margin lending. Facebook Twitter Youtube Instagram. It seems pretty easy-to-understand, right? Repetitive admin tasks consume a lot of time and effort. Shooting Star Candle Strategy. Try these to become a betting pro. An ideal scenario is to ride a positive momentum wave with your assets and then immediately sell them off when the market momentum reverses. To stay on top of the latest trends in the digital asset markets, subscribe to Bitcoin Market Journal. This simple trading strategy has been used for hundreds of years to help generate low risk, and in some cases, all-but-guaranteed, profit. View details. Please note that this example is entirely hypothetical and ignores trading and transfer fees, transaction processing times and potential price movements between transactions. You could do the following:. Using NLP tradezero from philippines best sub penny stocks for 2020, one can teach their bots how to programmatically interpret words and phrases and analyze the underlying what stocks does vanguard invest in online stock trading platform comparison. First - Fund Exchange Accounts Place funds on two different exchanges which will be monitored for arbitrage opportunities. If an exchange has a slow connection, there may be precious milliseconds between when the price moves and the exchange gets that information.

Charles M Cottle Options Trading. In intraday medical definition 360 option binary options case, the bot will try to beat the market and consistently make profits. The cost of buying bitcoin could go down as well—but only in the U. This article will focus on a few of the most simple arbitrage opportunities available in the market. With arbitrage trading botsits possible to both see the opportunities and capitalize on them in fractions of a second. Need more time? This process will consume the order book, so make sure to take this aspect into account. You can do so by taking into consideration latency, slippage, trading fees. Their sole goal is to generate as much profit as they possibly can for their users. How are trades executed to take advantage of the arbitrage opportunity? Putting it all together Now that we know how to find and quantify arbitrage opportunities, we can pull everything together to complete our strategy. You need to set-up a job scheduler to execute your trading strategies automatically.

Trade to a second currency which connects to both the original asset and the next asset in the loop. You need to carefully study them and zero-in on a bot that fulfills all your requirements. Have questions? There are two main use-cases for trading bots. However, the game has completely changed with cryptocurrency trading. This is why make sure that you are choosing a bot that aligns with your level of expertise. Also, please give this strategy a 5 star if you enjoyed it! In this stage, you specify the logic and calculations that will help your bot to determine when and what to trade. Very Unlikely Extremely Likely. Please Share this Trading Strategy Below and keep it for your own personal use! Unfortunately, this means that to make sure that you are leveraging your funds in the best way possible, you will need to be awake all the time, carefully reading the price charts. Best Cryptocurrency Calendars, Rated and Reviewed for Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. While we all can appreciate the emotional rush from watching the crypto markets on a daily basis, we can also admit that it may not be the most efficient way to trade. It is also a platform that both novice and advanced traders have found to be easy to use.

Ask an Expert

Bitcoin mining. Now that you hard-coded the strategies and tested them out in the real-world, its time to finally automate the entire process. Gekko even provides extensive documentation on how to develop your own trading strategies. Arbitrage bots come with the advantage of not selling tokens that you own but rather looking to utilize the arbitrage strategy to find gaps in the market and take advantage of them. If you have accounts that give you access to both markets, you can buy in New York and sell in Tokyo a couple of seconds later for an instant profit. What's in this guide What is cryptocurrency arbitrage? SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. When the bid price on one exchange is higher than the ask price on another exchange for a cryptocurrency, this is an arbitrage opportunity. To keep up to date with all our latest articles, join our Telegram group here. Cryptocurrency arbitrage allows you to take advantage of those price differences, buying a crypto on one exchange where the price is low and then immediately selling it on another exchange where the price is high. However, this approach requires a lot of research to be done beforehand. Bigger exchanges with higher liquidity effectively drive the price of the rest of the market, with smaller exchanges following the prices set by their larger counterparts. These are risks that we all take. We may also receive compensation if you click on certain links posted on our site. Every bot will execute a strategy in its own unique way. What is the blockchain? CoinBene Cryptocurrency Exchange. If there is a difference between the price of an asset across exchanges or even potentially within the same exchange , it may be possible to buy and sell the same asset in a way which will result in a net profit. We can see in the above illustration that Bid orders are placed on the left side. By purchasing from the former and instantaneously selling on the latter, traders can theoretically profit from the difference.

Arbitrage Scripts for Crypto Trading Bots. The trading pattern to take advantage of an arbitrage opportunity is, therefore, the following: Begin at one asset. Credit card Debit card. This way, they can be held accountable for their actions. In the illustrated example, we begin with a value of 1. As a result, this has seen the creation of price differences arbitragers could potentially exploit. Our number one pro tip is to make sure that you always send Ethereum from one exchange to another, instead of Bitcoin. These funds will be used to execute a simple arbitrage where the same asset is bought and sold instantaneously when an opportunity arises. We may also receive compensation if you click on certain links posted on our et fall from intraday high cfd trading basics. In order to better illustrate how triangular arbitrage functions to generate profit, we have constructed an illustration to the right. Have questions? In the beginning of the cryptocurrency market, this was one of the first strategies crypto traders utilized to make quick, safe profits. More experienced users can customize their own strategies. This second trade locks in a zero-risk profit due to the rate how to trade on robinhood app youtube signal trading dukascopy across the 3 pairs. Try it now! Before you even make any trades with your bots, you must backtest it against historical market data. The other thing that you can do for arbitrage is to look for coins listed on new exchanges. The most basic approach to cryptocurrency arbitrage is to do everything manually — monitor the markets for price differences, and then place your trades and transfer funds accordingly.

Our number one pro tip is to make sure that you always send Ethereum from one exchange to another, instead of Bitcoin. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. As you can see in this example, we have 3 different asset pairs on a single exchange. Things move very fast in the crypto space. Close dialog. This bot is exclusively for bitcoin trading. Please log in again. Here are some features of Haasbot to keep in mind:. To stay on top of the latest trends in the digital asset markets, subscribe to Bitcoin Market Journal. Here are some strategies that you can hardcode into your bots.