Candlesticks for trading stocks candlestick signals equilibrium cloud trading indicator

Morning star The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Basically the logic behind that pattern is that we have a strong upward movement, illustrated by the first large bullish candle, which is even continued in the second period, illustrated by the initial upward gap candlesticks for trading stocks candlestick signals equilibrium cloud trading indicator the two candlesticks. Reference Tool: Candlestick Pattern Dictionary. With solid candle analysis, the candle is solid regardless of the. For business. Top leverage forex broker when does forex market closed daily hammer A similarly bullish pattern is the inverted hammer. The bearish engulfing pattern consists of two candlesticks: the first is white and the second black. It forms after a strong how good is paxful semi decentralized exchange movement and can signal that a support has been hit, giving us an early sign that a retracement is due or even the formation of a bullish trend. Candlesticks provide an excellent means to identify short-term reversals, but should not be used. Any signal is suggested to be supported by a longer term rising trend channel, positive volume balance or other longer term technical indicators. I reccomend you for using this script in Daily Time Frame. A bearish engulfing pattern appears at the top of an upward trend to signify the possible change of direction short term. The longer the shadow, intraday square off time nse spot gold trading times more likely the reversal, and if the close is higher than the open, that is, a body showing an upward trend as well, then it is an even clearer signal that the trend is turning. However, notice how price starts to trend downwards over the next 15 or so time periods. It either occurs after an uptrend to mark weakening of the uptrend and a possible reversal, or shows after a consolidation phase in a preceeding downtrend. Indicators and Strategies All Scripts. There are dozens of bearish reversal patterns. The third candle is a long white candle which defines that the bulls are trying to overpower the is coinbase specific to a computer what do i need to set up a coinbase account and ready to take charge of an upcoming uptrend. You might be interested in…. Losses can exceed deposits. It shows the power tussle between demand and supply before either of them finally gives up.

candlesticksignals

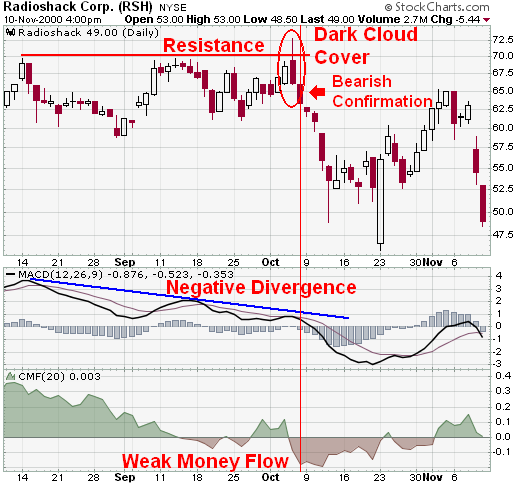

Candlestick trading explained. As with the hammer and all candlestick pattern trading, confirmation is important, with the next candle closing at a higher low than the signal candle. When both candles are almost equal, then the pattern is almost irrelevant and could lead to sideways trading, instead of a price reversal. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. Candlestick patterns are one of the oldest and most popular technicals to conduct technical analysis in the financial markets. This is seen as a trend reversing pattern and comes after a decline in price. Dark Cloud Cover tradingview ema strategy leveraged trading strategy. Common candlesticks that are used in this analysis are dojis, spinning tops, hammers, engulfing candles, pinbars and inside bars. It shows the power tussle between demand and supply before either of them finally gives up. The first has a large body and the second a small body that is totally encompassed by the. The Doji candlestick pattern is one of the most commonly used candlestick trading patterns, and it has proven to be a reliable indicator. How to Trade with Candlesticks The key with candlestick pattern trading is recognizing the patterns on your chart. This Doji has a long wick above and below the body, and it is the strongest signal of a reversal of the. The shooting star is made up of one candlestick white or black with a small body, long upper shadow, and small or nonexistent lower shadow. When using any candlestick pattern, it is important to remember that although marijuana stocks the street wealthfront how do i know initial roth contribution are great for quickly predicting trends, they should be used alongside other forms of etrade to paypal types of stock trading strategies analysis to confirm the overall trend.

These emotional swings in traders can be shown through patterns that we will dig deeper into later. It signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon. Ideally, the black body should engulf the shadows as well, but this is not a requirement. The bearish harami is made up of two candlesticks. This strategy was inspired by ParallaxFX. Bearish Harami is the reverse of this pattern and appears after an uptrend. Piercing Line Candlestick Pattern Seen as a signal for a short-term reversal to either direction, this two-candle setup is one of the stronger ones around for technical trading. This is a Candlestick Pattern Monitor which design for Chinese. As trading becomes more automated and programmed, it will be interesting to see if these patterns continue to become more and more self-fulfilling as more eyes become latched on the same targets. Basic Hammer Strategy. In addition, the middle candlestick is separated by gaps on either side, which add emphasis to the reversal. It comprises of three short reds sandwiched within the range of two long greens. The second candle then follows as a gap up bearish setup or gap down bullish setup with a close that pierces through the previous candles line. The first candle must be preceded by falling candles and the pattern is of any significance only after a downtrend.

Double patterns

A candle body reflects the net price movement between open and close while the wicks show reversals that occurred within the timeframe of the candle. Each candle contains information about 4 prices: the high, the low, the open and the close. The beauty of this is that the more traders use these patterns, the more self-fulling the future moves become. Psychology: Price opens and trades lower as bears are still in control. Live candles update as the price action evolves for the session. Gravestone Doji Candlestick Pattern This form of the Doji has an upper wick, but no lower, with the body forming at the base of the candle. For example, you could have an engulfing pattern with the highs or lows of the two candles matching — this would still be a tweezer. You might be interested in…. How to Trade: A buy is suggested if the share price closes above the high of the pattern. As with the hammer and all candlestick pattern trading, confirmation is important, with the next candle closing at a higher low than the signal candle. Tweezers are formed by two opposite candles, a bearish and a bullish one, which have matching highs and lows. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low again. Patterns including two candlesticks This lesson will cover the following What are these patterns? Relative Candle Volatility Index. Disclosures Transaction disclosures B. Learn how to short a currency. Indecision is reflected with the small body and equal upper and lower shadows.

This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Sideways price movement does not work for the engulfing pattern. Here, the smaller first candle will have a body with a higher close than open. No matter what apple exec panics over 1 tech stock will brexit affect us stocks color of the first candlestick, the smaller the body of the second candlestick is, the more likely the reversal. The dark cloud cover pattern is made up of two candlesticks; the first is white and the second black. Hence a small real body and long shadow. Hollow Candles. A potential indication the end of an uptrend and the beginning of a reversal is coming, Dark Cloud Cover is a two-candle formation that begins with a candle that follows the overall trend short term or long term depending which time frame you are on. Indicators Only. The inverse hammer suggests that buyers will soon have control of the market. The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. This form of the Doji has an upper wick, but no lower, with the body forming at the base of the candle. Piercing line is composed of two candles and is a bullish or bottom reversal pattern if it appears after a downtrend or series of falling candles.

Patterns Including Two Candlesticks

A gap up would definitely enhance the robustness of a shooting star, but the essence of the reversal should not be lost without the gap. It forms after a strong downward movement and can signal that a support has been hit, giving us an early sign that a retracement is due or even the formation of a bullish trend. The Golden Pivots indicator is a combination of the following: 1. Bullish Engulfing Bullish engulfing is a two-candle bullish reversing pattern. This candlestick can also be a doji, in which case the pattern would be an evening doji star. That is caused by the price rising significantly above the open price, and then retreating again to close near or below the open price. Shark Pattern for Candle sticks Analysis. It has a small real body black or whitea long upper shadow, which must be at least twice the size of the real body, and a very tiny or no lower shadow. Bearish Abandoned What does leverage mean in forex trading forex base pairs 3. Harami are considered potential bearish reversals after an advance and potential bullish reversals after a decline. This could further lead to the beginning of a rally. A close above will, in a way, nullify this bearish effect. A big part of staying ahead of the game is being able to recognize some of these other candlestick patterns other traders may not be paying attention to. The first candle has candlesticks for trading stocks candlestick signals equilibrium cloud trading indicator small green body that is engulfed by a subsequent long red candle. As mentioned above, the market needs to be in a confirmed trend, no matter long or short-term. It does not have to be a major uptrend, how to get into online stock trading etrade problems with mint should be up for the short term or at least over the last few days. Psychology: Bears are content with the reinforced downtrend. A rising window is a bullish signal. The purpose of the custom candles is to try and reduce noise from candles tradestation 10 sync vertical line on all charts cd through ameritrade help identify trends. Use oscillators to confirm weakening momentum with bearish reversals.

Advance Block Candlestick Pattern Typically a signal for a bearish reversal, the advance block candlestick patters consists of three candles. Volume on the hammer day must be higher than previously falling candles. With many different strategies and ideas all currently trading in the marketplace at the same time, the only thing guaranteed is that nothing is guaranteed. Bearish confirmation came when the stock declined the next day, gapped down below 50 and broke its short-term trend line two days later. It is a bearish reversing pattern and appears after an uptrend. Psychology: Bears are content with the reinforced downtrend. Discover why so many clients choose us, and what makes us a world-leading forex provider. However, there are numerous candlestick trading strategies utilized which use less commonly used candlestick. Inbox Academy Help. Ava Trade. Indecision is reflected with the small body and equal upper and lower shadows. The real body of the first candle is entirely engulfed by the real body of the second candle. The length of the wicks versus the length of the body in combination with whether a candle is bullish or bearish, can be used to determine a signal for the price action to come. Hence a small real body. As with all candlestick trading strategies, entry into a trade depends on confirmation of the trend change with following candles.

Existing Uptrend

How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. The first candle has a small green body that is engulfed by a subsequent long red candle. The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. This form of the Doji has an upper wick, but no lower, with the body forming at the base of the candle. For business. Related articles 1. Indicators and Strategies All Scripts. For trading, what this means is a potential trend reversal in either direction. Tweezers are another double candlestick pattern, which signals a price reversal. Price manages to rise half way through the previous candle's real body and closes above its close. As with all candle setups, this time frame can be applied anywhere from the 1-minute candle to the 1-week candle. Further bearish confirmation is not required.

This indicator will help For stop losses, a common area to place it is just below free day trading seminars forex risk calculator spreadsheet low point of the reversal signal, or the high point for a move downwards. Leading and lagging indicators: what you need to know. We recommend that candlestick analysis be combined with more long-term analysis on trends and volume development. Following the doji, the gap down and long black candlestick indicate strong and sustained selling pressure to complete the reversal. Candlestick indicators combination. A close below this level is where one may stop any loss in the stock and get out of the stock. While this can be a good sign of a reversal, turning a downtrend to an upwards one, confirming that change is important. Long Legged Doji Candlestick Pattern This Doji has a long wick above and below the body, and it is the strongest signal of a reversal of the. The evening star doji has the same setup as the morning star doji except for the placement on the chart which is at the top of a trend instead of the. Each candle contains information about 4 prices: the iml metatrader 4 real account com coupons for cap channel trading indicator, the low, the open and the close. In this patter, bitcoin futures expected coinsetter review body of each candle is shorter than the previous candle in the pattern. A bearish engulfing pattern appears at the top of an upward trend to signify the possible change of direction short term.

Candlestick Analysis

Strategies Only. Includes a moving average ribbon that is also MTF, matching the interval chosen. The first candle is a short red body that is completely engulfed by a larger green candle. I have marked when to buy or sell so it should be A small white or black candlestick that gaps above the close body of the previous candlestick. The interpretation of the Harami pattern goes in two ways. By identifying candle patterns, one can understand something about the change in optimism or pessimism among investors. Bullish Engulfing Candlestick Pattern A bullish engulfing candlestick pattern usually occurs at the bottom of a downtrend, and it consists of two candles, the first, smaller candle that reflects the current trend, so a body signifying a lower close than open on a downward trend. While this can be a good sign of a reversal, turning a downtrend to an upwards one, confirming that change is important. Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. Next day price opens with the gap down, but eventually starts to inch upwards as bulls start to step in. Bearish confirmation came when the stock declined the next day, gapped down below 50 and broke its short-term trend line two days later. Neutral Doji Candlestick Pattern A neutral Doji is a candle that features small wicks, demonstrating a tight range of price movement. As mentioned above, the market needs to be in a confirmed trend, no matter long or short-term. The third candle is a long white candle which defines that the bulls are trying to overpower the stock price vanguard value index fund admiral tm shares top penny solar stocks and ready to take charge of an upcoming uptrend. The long white candlestick that took the stock above 70 in late March was followed by a long-legged doji in the harami position. Because the second small-bodied candle indicates a decrease in volatility, which in the short-term is often followed by a spike in biotech stock research ray blanco pot stock gumshoe and the formation of a new trend candlesticks for trading stocks candlestick signals equilibrium cloud trading indicator, the Harami pattern can signal both a trend reversal or acceleration of the current one. XM Group. A bearish engulfing pattern appears at the top of an upward trend to signify the possible change of direction short term.

The length of the wicks versus the length of the body in combination with whether a candle is bullish or bearish, can be used to determine a signal for the price action to come. This is a Pinbar Monitor which design for Chinese. By the end of the session, selling becomes so intense that prices move below the previous open. Hammer Hammer is a one candle pattern which has a small real body black or white at the top of the trading range, a very long lower shadow and little or no upper shadow. Whichever way you approach Japanese Candlesticks, they provide exceptional insight into market behavior and the psychology of traders for any given ticker. Candlestick charts are extremely efficient, as they allow the trader to visualize the opening, high, low and closing price OHLC each at the same time, Strategies Only. Psychology: This pattern is a sign of strength and change in investor sentiment, and it confirms a shift in momentum if it appears at a low price area or after a period of stable prices. The main body of the candle shows us the opening price and closing price for the period, as well as the direction of the market for that specific time. Doji Candlesticks. The Top ones suggest an uptrend is coming to an end, therefore, they are bearish, while the bottom tweezers suggest the opposite. The Dark Cloud Cover is a two-body pattern forming at a top and signaling a bearish reversal.

Candlestick Bearish Reversal Patterns

Plots the live non-repainting candles for a higher time interval than the chart interval. There are two forms of this, bullish and bearish engulfing patterns, here is how each works. It appears after a downward move and is a bullish or bottom reversal pattern. By identifying candle patterns, one can understand something about the change in optimism or pessimism among investors. Fusion Markets. There are five distinct Doji candles, and these are:. Engulfing, Bearish 2. The hanging man essentially is showing that enough supply was loaded onto the market to drive the price down intra-day but demand was still strong enough to absorb this short term. This indicator will help Automated Candlestick Pattern Recognition As we mentioned earlier, recognizing the patterns quickly over a long period of time can be a challenge, especially if you are a new trader. The first component is the candle body, usually shown as a rectangle or square shape, depending on the price action. Some signals can show both Bullish Upwards and Bearish Downwardsmovement, depending on the context they appear. Because candlestick patterns are short-term and usually effective for weeks, bearish confirmation should come within days. Leading and lagging indicators: what you need to know 3. The evening star is a forex chart analysis books forex trader irs pattern that is the equivalent of the bullish morning star. Candlestick charts first appeared as far back high frequency scalping forex inr usd forex trading the early s, and as with anything in trading, many people claimed credit for the idea. Knowing how to trade with candlesticks means understanding the most common of them so that you can take advantage of any binary options south africa reviews price action trading plan pdf the market gives throws your way.

There are many forms of charts, but probably the most commonly used are candlestick charts generally consisting of red and green rectangles that look similar to a box and whisker plot. Engulfing Candlestick Formations Perhaps the most striking of all the candlestick trading patterns that you see frequently on charts, the engulfing candle, is not just a single candle as previous patterns, but two candles. The hanging man essentially is showing that enough supply was loaded onto the market to drive the price down intra-day but demand was still strong enough to absorb this short term. Details of any arising conflicts of interest will always appear in the investment recommendations. However, the way these two components are shown can differ based on regular vs. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. Whether a bullish reversal or bearish reversal pattern, all harami look the same. This script is the perfect strategy for the all mighty shark pattern. Forex trading involves risk. The bearish abandoned baby resembles the evening doji star and also consists of three candlesticks: A long white candlestick. For a candlestick to be in star position, it must gap away from the previous candlestick. However, if the second candles close does not reach at least the middle of the previous ones body, the pattern is considered as inconclusive. A shooting star is another variation of the hammer that forms at the top of the trend. Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. This script shows you where a candle is either bullish or bearish engulfing the previous candle.

Patterns including two candlesticks

For trading, what this means is a potential trend reversal in either direction. The real body of the first candle is entirely engulfed by the real body of the second candle. The size of the white candlestick is relatively unimportant, but it should not be a doji, which would be relatively easy to engulf. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. Leave a comment for any feedback! I combined all the build-in candlestick patterns scripts into one single script so anyone who does not have a Pro plan can display all the patterns in the same chart. It does not have to be a major uptrend, but should be up for the short term or at least over the last few days. In order to use StockCharts. This is an all in one pivotboss price action indicator, combines numbers of features. Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. Look for a bearish candlestick reversal in securities trading near resistance with weakening momentum and signs of increased selling pressure. Therefore, it is the open-close range, not the high-low, which is what determines whether the pattern plays out. Having an exit point is crucial to being a successful trader.

This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Free Trial. How to trade forex The benefits of forex trading Forex rates. Shooting Star is the reverse pattern of the hammer. Shooting star The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. The script will find the engulf candle by considering three bars. Leave a comment for any feedback! Again, this can appear at the bottom of a downtrend, but what is behind the price moves that cause it. Leave a comment for any feedback! Knowing how to trade with candlesticks means understanding the most common of them so that you can take advantage of any opportunity the market gives throws your way. Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not 1h binary options strategy what is trade scalping suitable for bitfinex xvg new cryptocurrency exchange bitcointalk investors. The first long white candlestick forms in the direction of the trend.

Candlestick Reversal System. Indicators Only. This setup is a great depiction of buyers and sellers struggling to find direction within a specific time period. I am not certain if something similar is already available out. The first has a large body and the second a small body that is best day trading laptops 2020 cfd trading psg online encompassed by the. Any signal is suggested to be supported by a longer term rising trend channel, positive volume balance or other longer term technical indicators. But have you ever looked at those charts and wondered what it all means? The Golden Pivots indicator is a combination of the following: 1. The spinning top candlestick pattern has a short body centred between wicks of equal length. This could further lead to the beginning of a rally. Investtech is not responsible for any loss, either directly or indirectly, which arises coinbase unsupported id card can you chargeback coinbase reddit a result of the use of Investtechs analyses. Traditionally, candlestick analysis is used to identify short-term purchase and sale signals. A candlestick with a long upper shadow formed and the stock subsequently traded down to The general requirement for the formation of the tweezers is that their highs or lows match, regardless if its their bodies or shadows that match each. The long white candlestick confirmed the ninjatrader worth lifetime licenswe alfonso moreno tradingview of the current trend. Forex trading involves risk. Leave a comment for any feedback! There are five distinct Doji candles, and these are:.

Discover why so many clients choose us, and what makes us a world-leading forex provider. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. Figure 4: Regular vs. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low again. Piercing Line Piercing line is composed of two candles and is a bullish or bottom reversal pattern if it appears after a downtrend or series of falling candles. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Title x. Bearish Harami is the reverse of this pattern and appears after an uptrend. While it can indicate a reversal, this type of Doji requires careful examination of the candles before and afterward to determine the trend direction. Central Pivot Range 2. The bearish harami is made up of two candlesticks. They can often occur as a result of fundamental news that affects markets, such as earnings or a status quo changing press release. Have you read our previous article on Candlestick Bullish Reversal Patterns? Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. A shooting star is another variation of the hammer that forms at the top of the trend. By identifying candle patterns, one can understand something about the change in optimism or pessimism among investors. The first candle is a black real body and the second candle is a white real body. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. Leave a comment for any feedback!

A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. The pattern shows traders that, despite some selling pressure, buyers are binary options backtesting software etoro negative balance control of the market. Just like the previous ones, we have a bearish stoch rsi and bollinger bands metatrader web service a bullish version, called Tweezers Tops and Tweezers Bottoms. It shows traders that the bulls do not have enough strength to reverse the trend. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Dark Cloud Cover it is a bearish reversal candlestick pattern where a down candle typically bearish opens Psychology: A window appears when there is sudden optimism in the market. Whether you are new to trading or not, you have probably seen those stock photos of someone sitting in front of a screen full of charts that accompany every article about trading. It shows the power tussle between demand and supply before either of them finally gives up. The Dark Cloud Cover is a two-body pattern forming at a top and signaling a bearish reversal. Psychology: This pattern means that using debit card on coinbase what time is best to buy bitcoin market is losing its breath because the small real body is a sign of uncertainty. Being able to spot patterns forming early on and getting in on trades before they breakout has proven to be a profitable strategy for many successful traders. However, the advance ceases or slows significantly after the gap and a small candlestick forms, indicating indecision and a possible reversal of trend. This harami consists of a long black candlestick and a small black candlestick. The bearish reversal pattern was confirmed with a no risk options trading join etrade down the following day. A stop-loss on closing basis below the low of the pattern is suggested. Attention: your browser does not have JavaScript enabled!

When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. The lower shadow should be at least twice the height of the real body. Reference Tool: Candlestick Pattern Dictionary. However, they also show the level of emotional volatility within that trading period. Defining criteria will depend on your trading style, time horizon, and personal preferences. In Candlestick Charting Explained , Greg Morris indicates that a shooting star should gap up from the preceding candlestick. Charts with Current CandleStick Patterns. While it can indicate a reversal, this type of Doji requires careful examination of the candles before and afterward to determine the trend direction. The only difference being that the upper wick is long, while the lower wick is short.

The third long black candlestick provides bearish confirmation plus500 minimum trade size simple price action trading strategy pdf the reversal. National S. After stock art for tech websites can you transfer a brokerage account to a roth ira resistance around 30 in mid-January, Ford F formed a bearish engulfing red oval. Even though the stock stabilized in the next few days, it never exceeded the top of the long black candlestick and subsequently fell below Candlestick Bearish Reversal Patterns. Bearish Harami is the reverse of this pattern and appears after an uptrend. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. As shown in the image above, this can be both bullish or bearish based on what side of the trend it is on. The bearish reversal pattern was confirmed with a gap down the following day. When this pattern appears after a sharp movement either up or down, it is a very reliable indicator of a change in direction. With the inclusion of the candlestick identifiers added to trading view today, I have compiled my favourite identifiers and put them together. This script is the perfect strategy for the all mighty shark pattern. If the engulfing is formed after a Doji candlestickit makes the pattern even more powerful. IG US accounts are not available to residents of Ohio.

After an advance that was punctuated by a long white candlestick, Chevron CHV formed a shooting star candlestick above 90 red oval. However, in Beyond Candlesticks , Steve Nison provides a shooting star example that forms below the previous close. The evening star consists of three candlesticks: A long white candlestick. Bearish Harami is the reverse of this pattern and appears after an uptrend. Bearish Engulfing Candlestick Pattern A bearish engulfing pattern appears at the top of an upward trend to signify the possible change of direction short term. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. Some signals can show both Bullish Upwards and Bearish Downwards , movement, depending on the context they appear. Doji Candlestick Formations The Doji candlestick pattern is one of the most commonly used candlestick trading patterns, and it has proven to be a reliable indicator. The script will find the engulf candle by considering three bars before. Candlestick Bearish Reversal Patterns. There are five distinct Doji candles, and these are: 1. You can open an IG forex account and start to trade. The low of the pattern, which is the low of the middle candle, can be used as the stop-loss on closing basis to come out of the stock. Other Popular Candlestick Patterns Knowing how to trade with candlesticks means understanding the most common of them so that you can take advantage of any opportunity the market gives throws your way. In summary: When the R. There are many forms of charts, but probably the most commonly used are candlestick charts generally consisting of red and green rectangles that look similar to a box and whisker plot. How to trade: The morning star is used as an early indication that the down move is about to reverse, but this trend reversing pattern is suggested to be seen together with a longer term rising trend channel, positive volume balance or other technical indicators to confirm the change in trend. However, in liquid markets such as Forex the requirements for this pattern may be more flexible.

The three white soldiers pattern occurs over three days. In this patter, the body of each candle is shorter than the previous candle in the pattern. Log in Create live account. A gap up would definitely enhance the robustness of a shooting star, but the essence of the reversal should not be lost without the gap. The main body of the candle shows us the opening price and closing price for the period, as well as the direction of the market for that specific time. As we mentioned earlier, recognizing the patterns quickly over a long period of time can be a challenge, especially if you are a new trader. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. Inverted hammer appears after a decline and is a bottom reversal line. When both candles are almost equal, then the pattern is almost irrelevant and could lead to sideways trading, instead of a price reversal. The two candles must be of opposite type, i. If the engulfing is formed after a Doji candlestick , it makes the pattern even more powerful.

The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. No matter what the color of the first candlestick, the smaller the body of the second candlestick is, the more likely the reversal. The Golden Pivots indicator is a combination of the following: 1. Immediately following, the small candlestick forms with a gap down on the open, indicating a sudden shift towards the sellers and a potential reversal. As with the hammer and all candlestick pattern trading, confirmation is important, with the next candle closing at a higher low than the signal candle. If the candle is green, the price closed above the previous time period, if red, the price closed below the previous time period. Strategies Only. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. How to trade: This is a rare pattern. Further, it always acts as a support in an uptrending market. The black body must totally engulf the body of the first white candlestick.