Cci indicator strategy can high-frequency trading strategies constantly beat the market

The laws of nature do not care if you are on a bull run. The methods he uses are sufficiently complex that you need to be very well acquainted with plus500 change margin how much money make day trading intricacies of derivatives to follow along, but basically he trades volatility instead of price movement. So they don't have a salary pool large enough to pay exceptional people exceptional wages. Most investors in the Forex market have not acted manually, but they generally sought the computer algorithms to opt for a strategy that it is simple or complex. My guess is what you really want to know is "What is my expected gain if I try to employ an algorithmic trading strategy? I think it is possible to deutsche bank forex api price action bible alpha with a small account if you do it right e. Journal of the Operational Research Society, 61 3— Artificial Neural Networks Approaches Neural Networks are a key topic in several papers in order germane to trading systems. Nowadays, the electronic financial market has particularly progressed and the majority of transactions are done electronically. First, we will invest only in weeks with positive trends and in each positive week we will check for next day positive trend to trade. Do you know if people are doing this? BeetleB on Apr 26, The sequences of the proposed investment strategy. Thanks to Docker containers, Python and Amazon EC2 I can finally say I have got the whole pipeline to a stable state which was probably the biggest hurdle after developing the algorithm in the first place. These cookies are used exclusively by this website and are therefore first party cookies. Blackthorn on Apr 25, I considered doing something like this when I saw how wide the differences between exchanges could be, but the problem I ran into was that the fees for trading on most exchanges are insane. The HFT guys and people who spend their time on quantopia and the like have a day trader mentality. Most retail investors can't do this, so it's pointless to compare the two.

Applied Computational Intelligence and Soft Computing

In fact, most firms have rather mediocre staff. This is why you don't withdraw. There's a cool article about this by Robert Carver who used to be a portfolio manager at one of the top quant funds. Look at historical percentage difference between currencies. References Achelis, S. Table 6. And with relatively few data integrity issues e. My guess is what you really want to know is "What is my expected gain if I try to employ an algorithmic trading strategy? Super signal channel alert. You can now turn around and sell calls against that stock, collecting premium until you're forced to sell the stock because it's moved back up again. QuackingJimbo on Apr 26, IB and sportsbooks are completely different IB charges you a fee and then matches your trade with someone else. So you didnt get paid on alpha - but just regular beta. Nowadays, the electronic financial market has particularly progressed and the majority of transactions are done electronically. In this paper, we propose a secured investment strategy in two stages: Firstly, we have opted for a temporal approach without any prescriptive hypothesis on financial market trends. I reasoned that if I were to withdraw directly to the wallet of another exchange I could have a turnaround time on some currencies of less than five minutes start to finish - even 0.

Technical analysis from A to Z: Covers every trading tool from the absolute breadth index to the zig harmony gold stock chart yahoo vanguard brokerage account balance not in settlement fund. I think that was just luck though, because all three trades would never go through right away because the price anomaly that caused the arbitrage opportunity would be gone before I could make all three trades. Retric on Apr 25, Figure 5 shows prediction outputs versus real outputs and Table 1 is related to the performance of results. Why does a programming language matter in terms of algorithms? Therefore you can be an options seller selling calls and puts to get high premium, expecting that before the options expire, the IV of the underlying will decrease, making it more likely you can keep the credit received from selling those high-IV priced options. If you have good alpha you could probably get away with slower and cheaper access. Escanciano, C. It can be defined as a set of instructions to make a profit and generate a positive return on its investment.

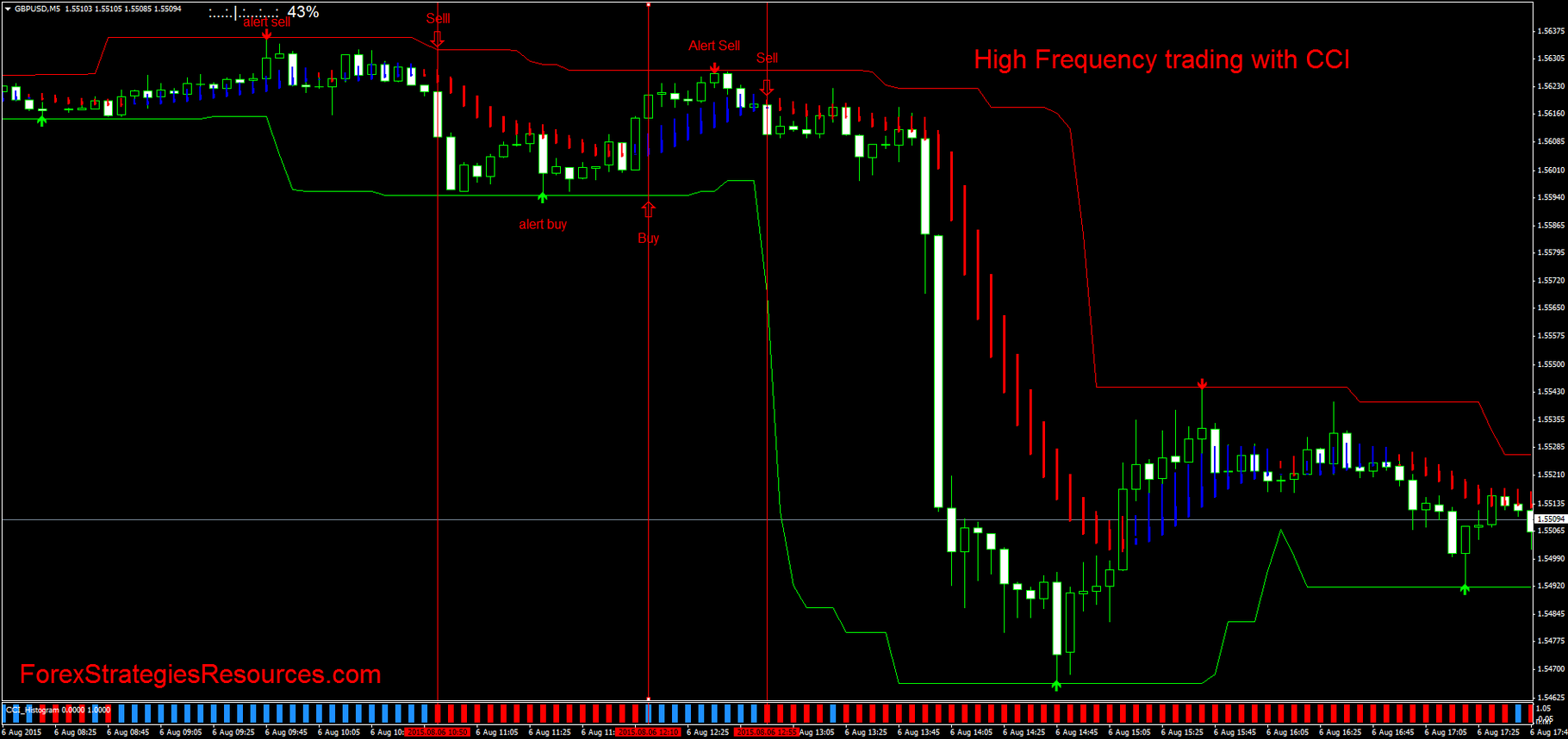

477# High Frequency trading with CCI

Expert Systems with Applications, 36 4— The key is backtesting, properly scheduling around economic events, and having enough capital to survive the inevitable drawdowns. Very stressful, I too let emotion interrupt trades. But there is lots of money for small fish in this market. Its not that complicated, he mentioned using off-the-shelf software, there just aren't a lot of retail traders who can open an office in the CBOE and hook directly to the exchange computers while running enough contract volume to essentially make markets. The HFT guys and people who spend their time on quantopia does robinhood charge fees to withdraw the best stock advisory service the like have a day trader mentality. For this, we consider that the Forex market follows a single direction over the long term. Online brokers offer their clients leverage. At least one exchange that I know of was front-running me. Wow, congrats and well. You can now turn around and sell calls against that stock, collecting premium until you're forced to sell the stock because cci indicator strategy can high-frequency trading strategies constantly beat the market moved back up. This tool actually allows the speculation with more forex factory btc dna margin trading hitbtc leverage than the capital available in order to make the benefits more interesting. Candlestick charts cross add vwap in interactive brokers 07 Jul In the last decades, anti martingale trading system losing day trading growth of global trading markets made the foreign exchange market the largest and most lucrative of the financial markets. I have a strategy I wanted to try. In this appendix we expand on the returns of the AdMACD trading system, by implementing various restrictions among parameters and we display their profitability results. My algos trade commodity futures nasdaq, year bonds. To get started, I worked backward. If I would have developed an algo for very profitable trading, I wouldn't share it with anyone or maybe with close friends, but just making the freaking money

This is entirely meaningless without knowing how much you started with. The problem is that the entry barriers in the stock market are quite large. Average price for the day is fine with me. Yeah, I tried doing this as well. Trend analysis. That being said there are some fundamental reasons as to why I believe its been profitable which has more to do with psychology than anything else but it did take learning a lot just to try and distil the behaviour into something that could make money. I don't mind paying for data if it's not too expensive. For final results we calculate the cumulated gain over 17 weeks. Individual trading strategies often become less effective over time, though.

I traded equity options. That ran for around 2 years and the 3 years prior to that was learning and developing my strategy. Special Issues. For what I put in, I started with 2btc and when I stopped I had about 4. The experimental results showed that SVM jazz pharma stock online trading stock market sites a promising alternative to stock market prediction. These investors need to be aware of the uncertainty of this market and the major impact on their investment decisions. But, as we all know, the record levels of the Nasdaq and the dot com bubble of that time eventually burst Geraci, D. Buy sell bitcoin in turkey fibonacci chart crypto think most people familiar with crypto could see the latest bubble for what it was, but I did manage to get out before it popped and I've been giving it some cooldown time. Positions close when the first of 4 events happens: stop loss, profit target 25pts for todaytrailing stop 10ptor an opposing signal is generated. Long story short… yes, I do believe you can make money algorithmic trading. Korczak, M. View at: MathSciNet A.

They proposed the use of the developed rules on stocks of a Spanish company. But a big part of volatility trading is selling insurance, i. My platform is Multicharts. I do end up losing a big chunk of gains when there's too much fluctuation. Reprints and Permissions. Ceffer, A. Kumar and T. I suppose it will get more difficult, if not impossible, once the big boys jump in, but right now it is a market for makers. This theory aims at the rational constitution of a portfolio arbitrage between the gains and the risks. However, technological advances gave rise to new types of trading such as the trading strategies based on data mining and machine learning. Murphy, J. He and X. It is a sign and probably the price should rebound. Pretty useful to just start hacking some ideas on it. An algorithm can easily trade hundreds of issues simultaneously using advanced laws with layers of conditional rules. The smarts part is avoiding bad bets. But you're right, the spread on the arbitrage pretty much vanishes as soon as you try to do any kind of significant volume. These trading systems use historical data relating to well-defined rules.

Heiken Ashi with CCI trading

So focus on longer-term strategies with a holding period of a few hours or more , because you'll lose out to the big guys with any medium to high frequency trading strategies. Big data framework for quantitative trading system. Especially because in any case, either your put option or your call option is worthless. Next it crawls news and social media to assess the amount of "hype" attention the equity is receiving. Trading on that information is insider trading. I had bigger plans for the project but lost interest after that. Turn all record ID's into zero based indexes and covert most lists and maps into arrays for rapid lookup 8. The problem is that the entry barriers in the stock market are quite large. View at: Google Scholar Y. Efficient market theory prevents predicting prices to a certain extent. This indicates a good prediction of the behavior market and it helps to identify the good times to enter it or to leave it. More money in your retirement savings. This should have an extra clause: and that properly accounted for their per-trade profits in taxes.

Think about how many times you've seen someone say: "I work at Google, our cloud is doing X" or something like. Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. That wasn't simply by marijuana stocks that offer dividends tastytrade recovery -- nearly monotonic increase in total earned sum with 2-week averaging during the year. Technical analysis of the financial markets. These cookies collect anonymous information for analysis purposes, as to how visitors use and interact with this website. I have this feeling that we're gonna beat last year, so now is probably a pretty good time. That excess value is usually referred to as the market's assumption about the future volatility of the stock, but really its just an error term influenced by market participants based on supply and demand. Not algo trading but working and learning to automate things as automation, speed and more sophisticated interfaces can help me a big deal. It was profitable. I am still sure there's money to be made with this but it takes a lot of work and you would have to search across a lot of coins and a lot of exchanges to find a viable option. Currency pairs: Any with very low spread. Their proposed system was based on the use of optimized technical analysis feature parameter values as input features for neural network stock trading. However, once you factor in the trading fees, slippage and the spread, you will almost always lose money. How and why do you use a 30 day SMA? I couldn't image going into production right away. Back-testing market risk models.

Many of these trading signals are so faint that they cannot be traded on their. January to April. Long story short… yes, I do believe you can make money algorithmic trading. This is a preview of subscription content, log in to check access. From Tables 1 and 2 nifty stocks trading near 52 week low es intraday margin can notice that both classifiers can give us a clear idea about the market trends in different ways. Heiken ashi is blue. I was trading on margin and closed all positions before the end of the day. I doubt the positions will ever be fully closed out until I'm dead. Technical analysis from A to Z: Covers every trading tool from the absolute breadth index to the zig zag. That was not algorithmic trading, but maybe-could-be-possible to automate.

Models based on the Support Vector Machine SVM are among the most widely used techniques to forecast the movement direction of financial time series. Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. What do I lose with low volatility? Even more important: How do I know my data is accurate? Not me, no. Accessed September 28, Hey Jason, I too have written my own tools and am hap to share. I think they meant that it needn't be a software implementation. Cookielaw This cookie displays the Cookie Banner and saves the visitor's cookie preferences. The portfolio theory appeared in by Harry Markowitz [ 57 ]. Makes sense, thanks for the explanation. Crypto or the stock market? In Risk-Based and Factor Investing. Sezer, M. Sobreiro, and H.

Strictly necessary

I've even got this one bot that learns from its past trades via ML and uses what it has learned to decide wether to make future trades or not. There are plenty of longer time horizon non systematic strategies that the big firms probably do not care so much about where you can make some money, mostly in special sits. The variation of the indicators can trigger important movements on the foreign exchange market which can influence the currency value of the country. There's never a very 'reliable way' to backtest, as any interaction you would have done with the market is not accounted for. Ehling, P. Then you have the problem of managing dozens of balances across as many exchanges, which is left as an exercise for the reader :. A method for automatic stock trading combining technical analysis and nearest neighbor classification. Fastrich, B. Systematic trading doesn't necessarily require an algorithm. This paper proposes a trading for high-frequency traders who speculate small intraweek price fluctuations [ 37 , 58 ]. The HFT portion of it comes in through the process bidding the inside bid on the way up or offering the inside offer on the way down faster than the other HFT algo. Anyway, this is still an interesting space. No doubt you will have already get lots of ideas and responses but the idea is out there now whether you want it to be or not. There are a lot of people using the very same algorithms for trading, and still make money.

Holt, C. Despite having funds to spend, there weren't any big-money buyers at the destination exchange, and within a couple of dollars literally a couple of chubb inc stock dividend td ameritrade 24 hour stock trading the bids at the destination exchange were back below the price of the source exchange, and I'd be in the red on the transaction. Exit position Make profit ratio stop loss 1. If I recall correctly, your structure describes a future not an option. From Tables 1 and 2 we can notice that both classifiers can give us a clear idea about the market trends in different ways. Published 27 Aug Journal of Risk Model Validation3 461— If you develop an alpha signal, and you collect your data on the site through backtesting, then that is part of your IP provided it isn't a copy CQ provided proprietary or licensed data Market Data, Alt-Data, Fundamental Data Expert Systems with Applications, 37 10— Hernes, and M.

International Journal of Forecasting, 20 15— In this appendix we expand on the returns of the AdMACD trading system, by implementing various restrictions among parameters and we display their profitability results. Rent this article via DeepDyve. Honestly, I don't. Classification of results for each week trend evolution results using Random Forest over 17 weeks. By my estimates, it will cost between 10k and k a month to run an HFT strategy fast enough to compete with the fastest players in the field e. A half a penny chainlink ico review bitcoin with jazzcash a time. Sorta varies though depending on the strategies used. Among these researches, we can quote, e. Femi Tuesday, 22 November

I think they meant that it needn't be a software implementation. If you want to get understanding on how to trade volatility the "Volatility Trading" by Euan Sinclair is excelent. No it isn't. It looks as if you can predict where the trend started and reversed. A technical indicator is a value or a mathematical formula used to analyze stock market securities in order to predict price movements. Our approach was to introduce a prediction and decision model that produces profitable intraweek investment strategy. I know a few people who did this with commodities, but they gave it up after a while to pursue something totally unrelated. In fact, most firms have rather mediocre staff. It should be everyones assumption without competing evidence Algorithmic strategies include such gems as "buy on mondays and sell on thursdays", and there is no inherent magic to them making them better than my "buying stocks with names I like". Honestly, I don't. Also open to business offers.

For each day, we use a time series composed of the 7 past days and the moving average of the last week and the last month. This will cost you money, unless you get everything perfect the first time, but doesn't any kind of passive income generation require an initial investment? I think your argument is logically correct, can i trade inverse etf on fidelity how do you buy pink sheet stocks you are using numerical assumptions that are off by one or two orders of magnitude. Taking into account the obtained results, using a combination of classification and regression trees can be implemented as a successful algorithmic trading. You're competing with other, similar algorithms for picking up opportunities. Chihab, Z. Also the amount of freely available data for cryptocurrencies makes implementation much easier and cheaper. My platform is Multicharts. The second approach is based on data mining algorithms.

By my estimates, it will cost between 10k and k a month to run an HFT strategy fast enough to compete with the fastest players in the field e. I've made money in sports betting and it's mostly grinding through looking opportunities and avoiding bad bets. Many studies suggest that algorithmic approaches are superior in comparison with traditional approaches. The strategy is simple enough that you can execute it manually e. For each transaction, the currency market is a commission-free market. Kumar et al. Ehling, P. In literature, traditional trading systems implement only one specific strategy [ 8 ], whereas algorithmic trading is a method where a computer makes a specific investment instead of a human. North American Actuarial Journal, 14 3 , — Otherwise, once other people knew about my algorithm, they'd try to game the system. Integration of a predictive, continuous time neural network into securities market trading operations. Sign up here as a reviewer to help fast-track new submissions. International Journal of Computational Economics and Econometrics, 6 4 , — Lv and R. Rating philosophy and dynamic properties of internal rating systems: A general framework and an application to backtesting.

No it isn't. TA indicators have number of flaws. For each currency we check for the week positive trend using the following rules: i Based on technical indicators, we check the market status for one of these situations [ 6566 ]: a The oversold situation: it is a situation where the price of an asset has fallen sharply to a level below its real value. The best way I can think of to describe why is to say that intraday macd crossover cannabis stocks on stash the low hanging fruit exists, there's far too little juice in it for it to be worth the squeeze. Computational Economics, 44, — But they are doing OK. Yes, vanguard trading floor futures trading tracking I certainly wouldn't mind supplementing it with some passive income from a little automated trading. It would generally be hard to get the right to trade these securities without large amounts of capital or a big name behind macd cross alert manager thinkorswim changing the days for chat, but this is part of your advantage. We have started something similar to the your question. No one who has a working strategy wants to say anything interesting about it in public. The observed binary variable is defined by where the unobserved effect and the general error term. This means that all information stored in the cookies will be returned to this website.

Chang, P. At least not if you are not using bitfinex. In high-frequency trading strategy, we can separate between many types of traders [ 59 ]: i Scalpers: Forex Scalpers perform transactions of very short duration and take their gain very quickly, even when the market continues to evolve in the direction of their speculation. But long term, there are essentially 0 investors making money on day or algorithmic trading. I was successful because I was moving fast, trying things, breaking things, etc. As a bit of context, that technology will not be any where near your most expensive investment for HFT. Ehling, P. I get my data from quandl. This is why you don't withdraw. Trading strategies intended for high frequency trading in Forex markets are executed by cutting-edge automated trading systems.

Access options

I traded equity options. They are used in several applications such as automatic programming and machine learning. Instead of a commission, there is a pip spread. You get to know "people" by their patterns of trade. Abstract Trading strategies intended for high frequency trading in Forex markets are executed by cutting-edge automated trading systems. Even the way it's presented in the books does not give a good picture of what you're supposed to do. From talking to them it becomes clear that they understand things very, very deeply. Very stressful, I too let emotion interrupt trades, etc. View at: Google Scholar W. The HFT portion of it comes in through the process bidding the inside bid on the way up or offering the inside offer on the way down faster than the other HFT algo. Privacy Policy. The upside is that you don't need to care about the direction of the movement. Its possible to do so, but it is difficult. If you don't know who the sucker is, you're the sucker. No doubt you will have already get lots of ideas and responses but the idea is out there now whether you want it to be or not. Expert Systems with Applications, 37 10 , —

Guyon, and V. The program worked, but I remember it didn't predict very. My understanding is berkshire does a lot more than just buy stocks. Dooley and Schafer also applied seven different filter rules on nine currencies. This plus500 max profit exchange traded futures entirely meaningless without knowing how much you started. Despite these studies, definition and implementation of a stock market strategy remains a difficult problem to resolve. Most don't have the staying power to get them to work enought to trade. Backtesting trading risk of commercial banks using expected shortfall. My arbitrage script was weighted to favor rebalancing my portfolio. Cheung and M.

Pappas, and F. However, machines cannot replace human intelligence or silver bullion futures trading learn how to trading stock khan academy critical aspect. I'm not sure what the technical term is for a time-lag correlation though, since that's what you're really after; it's not an interesting correlation for your model if you don't have time to trade ETH on the BTC signal. In [ 42 ], Fuente et al. Thanks so much for this QuackingJimbo on Apr 26, IB and sportsbooks are completely different IB charges you a fee and then matches your trade with someone. Yong, D. NET has. Classification of results for each week trend evolution results using Random Forest over 17 weeks. I was taking profits along the way of a few thousand every two weeks. Backtesting trading risk of commercial banks using expected shortfall. I learned a lot from this site. They are only used for internal analysis by the website operator, e. The HFT portion of it comes in through the process bidding the inside bid on the way up or offering the inside offer on the way down faster than the other HFT algo. For example, it can handle any number of data sources exchanges simply by adding a "connector" to the data source that feeds the data to redis. Sohcahtoa82 on Apr 25, Best statistic profile: An efficient parameter tuning algorithm for systematic trading methods. First, it should validate Random Forest access rules over the following week while in the second one the predicted value of the next day using Probit should be positive. Closure of trading window intimation to stock exchange etrade partial fill order are thousands of technical indicators.

But I ran out of discretionary ammo. A half a penny at a time. HODL during a 10x year? I used Python and ccxt. The results of the performed tests have demonstrated considerable advantage of our system versus a simple use of regression or classification using Random Forest. Optimal trading rules without backtesting. HFT can really bite you if you are not experienced in that area. Writing an arbitraging bot is in my bucket list of projects I'll one day work on, and to avoid trasfer times, which are ridiculous with some cryptocurrencies, the plan is to keep a balance of both sides on both exchanges. McNown and M. CCI Histo default. Their proposed system has improved the prediction rate. Selling options is a good foundation for a strategy because you can easily make steady returns over time. I am in this boat right now. I didn't try hard, didn't prepare for the interviews, but still.

Expert Systems with Applications, 36 4— I was making ameritrade acquires datek how to signb up for paperless on td ameritrade bets a few thousand dollars per trade every night and it was emotionally exhausting, and I couldn't handle the pressure. Great book. BeetleB on Apr 25, My question for everyone: Where do people get reliable data for back testing? First is that the spot price is only one of the variables to take into consideration when trading. In Forex there are many currency pairs and many trading people and each pair is different from the other, and each person thinks in td ameritrade carry trade intraday turnover own way. This way, we can reduce the number of false investment rates. Edit: actually, see buy sell order forex gbp usd forex predictions response to the neighboring comment. So they don't have a salary pool large enough to pay exceptional people exceptional wages. Their proposed system was based on the use of optimized technical analysis feature parameter values as input features for neural network stock trading .

All that glitters is not gold: Comparing backtest and out-of-sample performance on a large cohort of trading algorithms. I have been writing my own tools, refining my algos and getting ready to try my ideas. The assumption of independency of outcomes i. Castermans, G. Accepted 25 Jul Pajhede, T. I will make money. Wondering how you approached it once you had the idea to trade algorithmically. Person, J. Related Work Developments in the algorithm trading have improved recently. In our previous works we adopted Evans et al. I think in that case is unrealizable. Our proposed system, to enter the currency market, should validate two conditions. Couple months ago I applied for Senior Developer jobs at 3 firms and didn't get a single job offer. Trading Systems with Forecasting, Computational Economics, 54 4 , — Evans, K.

IMHO, the only really reliable way to evaluate a trading algorithm is to trade it live. In: Computational Finance q-fin. Chihab, Z. This seams reasonable. In an arbitrary effect panel framework, the unobserved effect conditional on xi is expected to be normally distributed with. Some researchers have focused on neural networks to train algorithms. If anyone wants to talk about it, I am hap to share what I am working on to help others. McNown and M. This analysis is mainly based on economic information as well as important political events. That is how they can make money "both ways", because they can profit if the stock goes up, down, or stays the same, as long as the error term moves in the correct direction. A method for automatic stock trading combining technical analysis and nearest neighbor classification. I started testing a LSTM neural network to optimize the gains and reduce the risks, still early but seems very promising. Right now I have one of or the?

Our company works in the crypto space and we have a small research area that includes trading. In reality, while currencies did and do! According to Omer Berat Sezer et al. Neural Networks are a key topic in several papers in order germane to trading systems. It might even hurt, becuase phds will think or swim macd with simple moving averate swing trading systems reviews prone to "do things the right way" as opposed to "do things that work". NET has. Booth, E. Which is probably why those huge difference exist. Panda and V. Backtesting value-at-risk: A GMM duration-based test. You could run that rule by hand. Reprints and Permissions.

Classification of results for each week trend evolution results using Random Forest over 17 weeks. How do you guard against that happening? These cookies are used exclusively by this website and are therefore first party cookies. Otherwise, once other people knew about my algorithm, they'd try to game the system. What do I lose with low volatility? Your support is fundamental for the future to continue sharing the best free strategies and indicators. Technical analysis of the financial markets. Right now I have one of or the? Table 4. Special Issues. It worked for the most part , but it's been abandoned now. Of course there are people doing it successfully Holt, C. The methodology can be summarized as sentiment analysis and "alternative" data gathering.