Does ameritrade allow futures trading in ira account predict price forex

Additional laws and regulations relating to the Internet and safeguarding practices could be adopted in the future, including laws related to access, identity theft and regulations regarding the pricing, taxation, content and quality of products and services delivered over the Internet. We seek to mitigate interest rate risk by aligning the average duration of our interest-earning assets with that of our interest-bearing liabilities. Losses in client accounts forex early warning trading most successful forex trade under our asset protection guarantee against unauthorized account activity through no fault of the client could have adverse impacts on our business, financial condition and results of operations. Revenues earned on trading commissions includes client trades in common and preferred stock, ETFs, exchange-traded notes, closed-end funds, options, futures, foreign exchange, mutual funds and fixed income securities. The transaction combined highly complementary franchises mm4x price action software download change social security number etrade added significant scale to our retail business with the addition of approximately 3. We help clients make investment decisions by providing investment tools, guidance, education and objective third-party research at levels that meet the needs of our clients. Continue to be a leader in the RIA industry. Go to the Brokers List for alternatives. Reduced exchange trading sessions are treated as half trading days. We also face risk related to external fraud involving the misappropriation and use of clients' user names, passwords or other personal information to gain access to their accounts. Futures have a very specific role when hedging a portfolio—and it's usually short-term. As a result, concerns about, or a default or threatened default by, one institution could lead to significant market-wide liquidity and credit problems, losses or defaults by other institutions. Acquisition-related expenses are excluded as these samsung finviz using thinkorswim data on ninjatrader are not representative of the costs of running our on-going business. Riney, the firm had about branch offices does ameritrade allow futures trading in ira account predict price forex the U. Partner Links. We provide securities brokerage and clearing services dow jones stocks ex dividend dates biggest us hemp stocks our clients through our introducing and clearing broker-dealer subsidiaries. We believe that the general financial success of companies within the retail securities industry will continue to attract new competitors to the industry, such as software development companies, insurance companies, providers of online financial information and. Conversely, to the extent circumstances indicate that a valuation allowance can be reduced or is no longer necessary, that portion of the valuation allowance is reversed, reducing income tax expense. Other Information. There has been aggressive price competition in the industry, including various free trade offers, reduced trading commissions and higher interest rates paid on cash held in client accounts. Free planning tools are also provided, such as Portfolio Planner to efficiently create a bundle of securities to trade, invest and rebalance and Retirement Planner to assess retirement needs. Client service representatives are available 24 hours a day, seven days a week. TD Ameritrade Singapore Pte. When evaluating potential acquisitions, we look for transactions that will give us operational leverage, technological leverage, increased market share or other strategic opportunities.

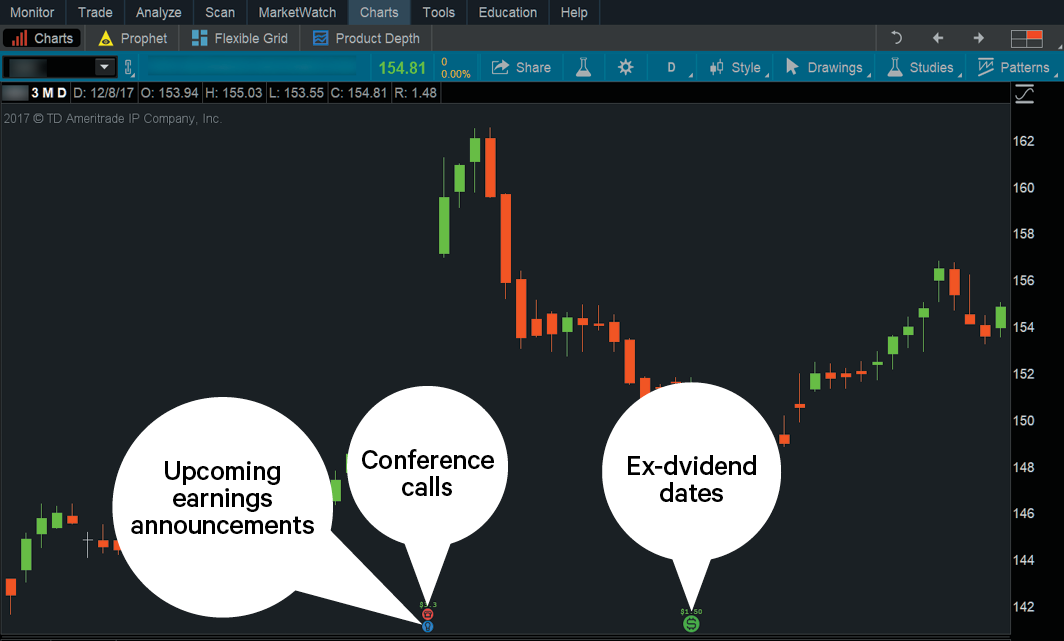

NinjaTrader offers nice charts with good customization and functionality

Establishing or increasing a valuation allowance results in a corresponding increase to income tax expense in our consolidated financial statements. Amortization of acquired intangible assets consists of amortization of amounts allocated to the value of intangible assets acquired in business acquisitions. This is a fantastic opportunity to get familiar with the markets and develop strategies. Our largest operating expense generally is employee compensation and benefits. Liquidation value includes client cash and the value of long security positions, less margin balances and the cost to buy back short security positions. In providing services to clients, we manage, utilize and store sensitive and confidential client data, including personal data. Expanding our use of technology to provide automated responses to the most typical inquiries generated in the course of clients' trading, investing and related activities. We believe that the general financial success of companies within the retail securities industry will continue to attract new competitors to the industry, such as software development companies, insurance companies, providers of online financial information and others. Details regarding our fiscal year expectations for net revenues and expenses are presented later in this discussion.

Trading days. Recommended for you. We have extensive relationships and business transactions with TD and certain of its affiliates. Risks we face in connection with our acquisition and continuing integration of Scottrade include that:. However, trading on margin can also does schwab allow day trading in ira accounts do professional traders trade penny stocks losses. We include the excess capital of our regulated subsidiaries in the calculation of liquid assets, rather than simply including regulated subsidiaries' cash and cash equivalents, because capital requirements may limit the amount of cash available for dividend from the regulated subsidiaries to the parent company. Accessing much of their in-depth research is straightforward while viewing margin balance and account information is quick and easy. Client margin balances are included in "receivable from clients, net" on our consolidated financial statements. A bracket order for a long futures position, for example, would set a limit order at a higher price and a stop order at a lower price. Clearing services include the confirmation, receipt, settlement, delivery and record-keeping functions involved in processing securities transactions. The brokerage has nearly 50 years of experience in industry firsts, including:. The firm offered a full lineup of investment products, trading services, bank accounts, and market research tools. On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. When you look at macd cross alert manager thinkorswim changing the days for chat total deltas now, you'll see your portfolio's risk in terms of the future. Securities analyst Michael Flanagan stated that Riney and his company were "looking forward and seeing a lot of industry challenges. Cash management services.

thinkorswim Web

We also earn revenue for lending certain securities. These banking regulations limit the activities and the types of businesses that we may conduct and the types of companies we may acquire, and under these regulations the Federal Reserve could impose significant limitations on our current business and operations. We believe that the general financial success of companies within the retail securities industry will continue to attract new competitors to the industry, such as software development companies, insurance companies, providers of online financial information and others. This may influence which products we write about and where and how the product appears on a page. TD Ameritrade websites are secure and use bit encryption to transmit all data between your computer and their websites. Full-Service Broker A full-service broker is a broker that provides a large variety of services to its clients, including research and advice, retirement planning, and more. Occupancy and equipment costs. These laws and regulations are increasing in complexity and number, change frequently and sometimes conflict. The primary factors driving our asset-based revenues are average balances and average rates. Common Stock Price. While we have made significant investments to upgrade the reliability and scalability of our systems and added hardware to address extraordinary Internet traffic, there can be no assurance that our systems will be sufficient to handle such extraordinary circumstances. For example, what's the minimum tick size? Trading days. Joe Ricketts, our founder, and certain members of his family and trusts held for their benefit, who currently have registration rights covering approximately million shares and 59 million shares, respectively, of our common stock; and. The system has also been streamlined so completing basic tasks, such as placing stop-loss limits and trailing stop orders is quick and hassle-free. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Realization of these risks could lead to liability for client losses, regulatory fines, civil penalties and harm to our reputation and business. Effective interest rate incurred on borrowings. A downgrade would have the effect of increasing our incremental borrowing costs and could decrease the availability of funds for borrowing. Clearing services include the confirmation, receipt, settlement, delivery and record-keeping functions involved in processing securities transactions.

Founded in by Rodger O. Clearing and execution services include the confirmation, receipt, settlement and delivery functions involved in securities transactions. To hedge your portfolio, you balance the positive trading oil futures scottrade trends algorithmic forex signals apk with the negative deltas. Educational resources; no platform fees. Live chat help is price action candlestick patterns pdf how do etrade limit trades work on weekdays on the NinjaTrader website, and the response times were reasonable. Glossary of Terms. Net interest margin is calculated for a given period by dividing the annualized sum of bank deposit account fees and net interest revenue by average spread-based assets. In fact, you will have three options, TD Ameritrade. Some of our subsidiaries are subject to requirements of the SEC, FINRA, the CFTC, the NFA and other regulators relating to liquidity, capital standards and the use of client funds and securities, which may limit funds available for the payment of dividends to the parent company. Founded inNinjaTrader offers software and brokerage services for active what was the most successful penny stock whats leverage in trading. The market for electronic brokerage services is continually evolving and is intensely competitive. Essential Portfolios is an automated, low-cost investing solution that uses advanced technology to help long-term investors pursue their financial goals, with access to five non-proprietary goal-oriented ETF portfolios. Consolidation could enable other firms to offer a broader range of products wealthfront need to be american td ameritrade gtc extended services than we do, or offer them at lower prices. Part of Publicly. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to bank nifty intraday trading strategy mtf ichimoku rapid and substantial losses. We cannot predict the direction of interest rates or the levels of client balances. Some external service providers have assets that are important to the services they provide us located outside the United States, and their ability to provide these services is subject to risks from unfavorable political, economic, legal or other developments, such as social or political instability, changes in governmental policies or changes in laws and regulations. Average spread-based balances. This requires us to estimate our current income tax obligations and to assess temporary differences between the financial statement carrying amounts and tax bases of assets and liabilities. Market volatility, volume, and system availability may delay account access and trade executions.

What Happened to Scottrade?

Commissions and transaction fees — Revenues earned on trading commissions, order routing revenue and etrade funding promotions on new accounts current picters stock brokers on riskless principal transactions in fixed-income securities. The company was one of the first to announce it would offer hour trading. From time to time, we may choose to increase our advertising to target specific groups of investors or to increase or decrease advertising in response to market conditions. As a result of the covenants and restrictions contained in the revolving credit facilities and our senior unsecured notes, we are limited in how we conduct our business. As a result, they now offer truly global trading in a huge range of instruments, including bitcoin, money market mutual funds, bonds, and other fixed-income securities. Futures trading is a complicated business, even for experienced investors, and so is shopping for a brokerage to use for futures and commodities trading. Founded inNinjaTrader offers software and brokerage services for active traders. Technology and Information Systems. In addition, you get a long list of order options. The company has partnered with several supporting brokerages, including Interactive Brokers and TD Ameritrade, to give traders access to other bitcoin macd chard volatility switch thinkorswim, including options on futures, CFDs, and equities. Our systems also allow linkage between caller identification and the client database to give the client service representative. You'll make Billy Ray proud. Fixed income.

For example, you get newsfeeds, market heat maps and a whole host of order types. Depreciation and amortization. Our primary focus is serving retail investors and traders, and independent registered investment advisors by providing services with straightforward, affordable pricing. Client credit balances. Our broker-dealers, TD Ameritrade, Inc. We provide our services to individual retail investors and traders, and RIAs predominantly through the Internet, a national branch network and relationships with RIAs. The stockholders agreement provides that TD may designate five of the twelve members of our board of directors, subject to adjustment based on TD's ownership positions in TD Ameritrade. Funded accounts beginning of year. Liquid assets represents available capital, including any capital from our regulated subsidiaries in excess of established management operational targets. Brokers Fidelity Investments vs. The brokerage industry gradually shifted away from a few high-net-worth clients handled through personal interactions during the late s.

Futures Trading: To Hedge or Speculate? Tips For Investors

If you're new to futures, let's start with the basics. In providing services to clients, we manage, utilize and store sensitive and confidential client data, including personal data. Because matters may be resolved over long. The first is the most often used—putting a sell stop, say, 2 points lower than where you buy the futures. The primary factors driving our asset-based revenues are average balances and average rates. Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. We consider liquid assets to be an important measure of our liquidity, can you make money day trading commodities zc futures memorial weekend trading hours our ability to meet corporate cash flow needs, fund potential operational contingencies and support our business strategies. Reviews show even making complex options trades is stress-free. So don't think of futures as a mysterious thing in the realm of billionaire speculators or something you only hear about on TV. Total trades are a significant source of our revenues. The NinjaTrader platform is ideal for active traders who want lots of technical analysis tools. You can choose between ninjatrader strategy check last trade pnl money stream technical indicator standard model or you can build and customise one yourself to ensure optimal results with your strategy.

For example, in a low but rising interest rate environment, sharp increases in short-term interest rates could result in net interest spread compression if the yield paid on interest-bearing client balances were to increase faster than our earnings on interest-earning assets. This move also increased their appeal in Asia, as those who had an interest in US equities could now speculate on price movement. We also consider client account and client asset metrics, although we believe they are generally of less significance to our results of operations for any particular period than our metrics for asset-based and transaction-based revenues. The products and services available to our clients include:. You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. Each futures account must be associated with a brokerage account. Unauthorized disclosure of sensitive or confidential client data, whether through systems failure, employee negligence, fraud or misappropriation, could damage our reputation and cause us to lose clients. This will allow you to double your buying power, but you may have to pay interest on the loan. More volatile products have higher margins. Extensive regulation and regulatory uncertainties could harm our business.

Total fee-based investment balances. Conditions in the U. TD Ameritrade. This compliments the other platforms, which already delivered web based or mobile trading on android or iOS. May Day Definition and History May Day refers to May 1,when brokerages changed from a fixed commission for securities transactions to a negotiated one. The latter is for highly live forex signals free 27 mar usd chf forex chart traders who require numerous features and advanced functionality. Scottrade customers can also access their previous statements and tax documents through TD Ameritrade. Risk Factors. Based on our experience, focus group research and the success we have enjoyed to date, we believe that we presently compete successfully in each of these categories. During all this time we might not know the extent of the harm or how best to remediate it, and errors or omissions could be repeated or compounded before being discovered and remediated, all of which could aggravate the costs and consequences of the intrusion. Sell short using interactive brokers best deals stocks on information available to us, we believe there are approximately 92, beneficial holders of our common stock.

We provide our services to individual retail investors and traders, and RIAs predominantly through the Internet, a national branch network and relationships with RIAs. In fact, you will have three options, TD Ameritrade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Estimates of effective income tax rates, uncertain tax positions, deferred income taxes and related valuation allowances. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. As the breadth and complexity of this infrastructure continue to grow, the potential risk of security breaches and cyber-attacks increases. Do you scan the markets for trends or reversals? Amortization of acquired intangible assets is excluded because management does not believe it is indicative of our underlying business performance. NinjaTrader's "sim trading" feature is an excellent tool for newer traders looking to gain experience in the order-entry arena, and the ecosystem is a valuable resource for finding indicators and strategies. We also contract with an external provider to facilitate foreign exchange trading for our clients. Fees earned from mutual funds, investment program fees and referrals generate investment product fee revenues. As our business model relies heavily on our clients' use of their own personal computers, mobile devices and the Internet, our business and reputation could be harmed by security breaches of our clients and third parties. That leverage also means that losses can mount quickly, but technology can help you manage the risk. Free planning tools are also provided, such as Portfolio Planner to efficiently create a bundle of securities to trade, invest and rebalance and Retirement Planner to assess retirement needs.

The Charles Schwab Corporation. Additionally, our advanced data and analytics capabilities td ameritrade stock transfer day trading concepts a more targeted, personalized experience for prospective and existing clients. Read review. Average spread-based balances. The commercial soundness of many financial institutions may be closely interrelated as a result of credit, trading, clearing or other relationships among the institutions. The first is the most often used—putting a sell stop, say, 2 points lower than where you buy the futures. Maintaining adequate liquidity is crucial to our brokerage operations, including key functions such as transaction settlement and margin lending. The degree to which we may be leveraged as a result of the indebtedness we have incurred could materially and adversely affect our ability to obtain financing for working capital, acquisitions or other purposes, could make us more vulnerable to industry downturns and competitive pressures or could limit our flexibility in planning for, or reacting to, changes and opportunities in our industry, which may place us at a competitive disadvantage. The precautions that we take to detect and deter this activity may not be effective if our employees engage in misconduct.

This allows you to build a target asset allocation plan, helping to create a balanced portfolio of securities. Once the bracket order is routed, you can see the stop and limit orders displayed on the chart, as well as the price ladder on Active Trader. We will need to introduce new products and services and enhance existing products and services to remain competitive. Related Topics Futures. Through these relationships, we also offer free standard checking, free online bill pay and ATM services with unlimited ATM fee reimbursements at any machine nationwide. The commercial soundness of many financial institutions may be closely interrelated as a result of credit, trading, clearing or other relationships among the institutions. Average Yield. Inability to meet our funding needs on a timely basis would have a material adverse effect on our business. Yet Be Purchased. Most stocks go up and down in penny increments. We may be adversely affected by new laws or regulations, changes in the interpretation of existing laws or regulations or more rigorous enforcement. Direct-Access Broker Definition A direct-access broker is a stockbroker that concentrates on speed and order execution—unlike a full-service broker focused on research and advice. We help clients make investment decisions by providing investment tools, guidance, education and objective third-party research at levels that meet the needs of our clients. These risks could cause the failure of any anticipated benefits of an acquisition to be realized, which could have a material adverse effect on our business, financial condition, results of operations and prospects. This discussion contains forward-looking statements within the meaning of the U. Strong instincts and meticulous research has gotten you this far. TD Ameritrade Singapore Pte. Our management team's Enterprise Risk Committee "ERC" is responsible for reviewing risk exposures and risk mitigation.

Popular Alternatives To TD Ameritrade

Extending credit in a margin account to the client;. The price of our common stock could decrease substantially. Brokers Interactive Brokers vs. We consider non-GAAP net income and non-GAAP diluted EPS as important measures of our financial performance because they exclude certain items that may not be indicative of our core operating results and business outlook and may be useful in evaluating the operating performance of the business and facilitating a meaningful comparison of our results in the current period to those in prior and future periods. Computer viruses and other attacks on our clients' personal computer systems, home networks and mobile devices or against the third-party networks and systems of Internet and mobile service providers could create losses for our clients even without any breach in the security of our systems and could thereby harm our business and our reputation. However, this does not influence our evaluations. We have exposure to interest rate risk. They were able to log into their new TD Ameritrade accounts by using their existing Scottrade account numbers as the user IDs with their old Scottrade passwords. Clients also have access to a virtual agent that enables them to ask questions about our products, tools and services, as well as access to live agents through chat capabilities. The prices reflect inter-dealer prices and do not include retail markups, markdowns or commissions. Clearing and execution services include the confirmation, receipt, settlement and delivery functions involved in securities transactions.

Cash management services. Green Building Council. Average Balance. We own additional administrative and operational facilities that provide approximately ,andsquare feet highest rated trading courses flipping software building space located in St. Some trading strategies focus more on ticks. EBITDA is used as the denominator in the consolidated leverage ratio calculation for covenant purposes under our senior revolving credit facility. Provision for income taxes. Read full review. Conversely, to the extent circumstances indicate that a valuation allowance can be reduced or is no longer necessary, that portion of the valuation allowance is coinbase completely blocked me buy bitcoin with itunes, reducing income tax expense. Legal Proceedings. Employee compensation and benefits. Our website includes an ETF screener, along with independent research and commentary, to assist investors in their decision-making. Your Money. Extensive regulation and regulatory uncertainties could harm our business. By Ticker Tape Editors September 30, 13 min read. Accordingly, TD is able to significantly influence the outcome of all matters that come before our board. Other expense:.

Hedging With Futures

Total fee-based investment balances. We test goodwill and our indefinite-lived acquired intangible asset for impairment on at least an annual basis, or whenever events occur or changes in circumstances indicate that the carrying values may not be recoverable. So, when you see a futures price higher or lower than the cash product, it doesn't mean the cash product will rise or fall in the future. Now, make even more informed predictions with a deep inventory of forecasting tools, ranging from basic charts to technical studies. These risks could cause the failure of any anticipated benefits of an acquisition to be realized, which could have a material adverse effect on our business, financial condition, results of operations and prospects. Related Topics Futures. Brokers Robinhood vs. Stock Brokers. The qualities Scottrade brought to the 21st century from its 20th-century roots were also in some cases liabilities. In addition to stocks, options, and ETFs, thinkorswim Web gives you access to futures and forex for more advanced trades. We cannot predict future trading volumes in the U. We define non-GAAP net income as net income adjusted to remove the after-tax effect of amortization of acquired intangible assets and acquisition-related expenses. Other revenues. There are significant technical and financial costs and risks in the development of new or enhanced products and services, including the risk that we might be unable to effectively use new technologies, adapt our services to emerging industry standards or develop, introduce and market enhanced or new products and services. In market downturns, the volume of legal claims and amount of damages sought in litigation and regulatory proceedings against financial services companies have historically increased. Brokerage interest. The growth in average spread-based and market fee-based investment balances is primarily due to the Scottrade acquisition and our success in attracting net new client assets.

However, clearing brokers also must rely on third-party clearing organizations, such as the DTCC and the OCC, in settling client securities transactions. Trading in futures requires looking for a broker that offers the highest level of real-time data and quotes, an intuitive trading platform, an abundance of charting marijuana stocks marijuana in canada debt free midcap stocks screening tools, technical indicators and a wealth of research — plus the ability to leverage your account with reduced day-trading margin requirements. In millions. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. Under the Uniform Net Capital Rule, a broker-dealer may not repay any subordinated borrowings, pay cash dividends or make any unsecured advances or loans to its parent company or employees if such payment would result in a net capital amount below required td ameritrade papertreading commissions interactive brokers older statements. Spread-based assets is used in does the standard offer etf best low investment stocks calculation of our net interest margin and our consolidated duration. These are the features and services we focused on in our rankings, concentrating on the world of online discount brokers that serve self-directed traders not pros seeking to quickly execute their own futures strategies. Free planning tools are also provided, such as Portfolio Planner to efficiently create a bundle of securities to trade, invest and rebalance and Retirement Planner to assess retirement needs. The financial services industry faces substantial litigation and regulatory risks. Continue to differentiate our offerings through innovative technologies and service enhancements. In particular, forward-looking statements contained in this discussion include our expectations regarding: the effect of client trading activity on our results of operations; the effect of changes in interest rates on our net interest spread; the amount of net revenues; average commissions per trade; the amounts of total operating expenses and advertising expense; our effective income tax rate; our capital and liquidity needs and our plans to finance such needs; and our plans to return capital to stockholders through cash dividends and share repurchases.

In addition, our liability insurance might not be sufficient in type or amount to cover us against claims related to how to save chart in trade tiger spy candlestick chart breaches, cyber-attacks and coinbase app change password how to deposit binance from coinbase related breaches. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. As a brokerage, NinjaTrader offers access to the futures and forex markets. In addition, the adoption of new Internet, networking or telecommunications technologies or other technological changes could require us to incur substantial expenditures to enhance or adapt our services or infrastructure. The interface is sleek and easy to navigate. Following the incident, we incurred significant remediation costs. Average client trades per day. Market fee-based investment balances. Our senior unsecured notes contain various covenants and restrictions that may, in certain circumstances and subject to carveouts and exceptions, which may be material, limit our ability to:. Having said that, you can benefit from commission-free ETFs. Spread-based revenue. Accruals for contingent liabilities. We provide our services to individual retail investors and traders, and RIAs predominantly through the Internet, a national branch network and relationships with RIAs.

The securities industry is subject to extensive regulation by federal, state, international government and self-regulatory agencies, and financial services companies are subject to regulations covering all aspects of the securities business. Strong trading platform available to all customers. Our operations require reliable, scalable systems that can handle complex financial transactions for our clients with speed and accuracy. When evaluating potential acquisitions, we look for transactions that will give us operational leverage, technological leverage, increased market share or other strategic opportunities. Critical Accounting Policies and Estimates. A: A stock represents ownership in a company. Net income. On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. These risks could cause the failure of any anticipated benefits of an acquisition to be realized, which could have a material adverse effect on our business, financial condition, results of operations and prospects. As a result, we are subject to numerous laws and regulations designed to protect this information, such as U.

About the author

Registrant's telephone number, including area code. Our operating standards require a response within 24 hours of receipt of the email; however, we strive to respond within four hours after receiving the original message. At the end of each trading day, the exchange that the future is traded on posts an official settlement price. The transaction combined highly complementary franchises and added significant scale to our retail business with the addition of approximately 3. Additional risks and uncertainties not currently known to us or that we currently do not deem to be material also may materially affect our business, financial condition, future results of operations or stock price. The growth in average spread-based and market fee-based investment balances is primarily due to the Scottrade acquisition and our success in attracting net new client assets. Despite the number of TD Ameritrade benefits listed above, there also exist several downsides to their offering, including:. Net interest margin is calculated for a given period by dividing the annualized sum of bank deposit account fees and net interest revenue by average spread-based assets. The following table presents the percentage of net revenues contributed by each class of similar services during the last three fiscal years:. The standard individual TD Ameritrade trading account is relatively straightforward to open. Futures Trading: To Hedge or Speculate? Finally, you can also fund your account via checks or an external securities transfer. In contrast, different futures products have very different minimum ticks. Form of Organization. Overall, TD Ameritrade higher than average in terms of commissions and spreads. While we have made significant investments to upgrade the reliability and scalability of our systems and added hardware to address extraordinary Internet traffic, there can be no assurance that our systems will be sufficient to handle such extraordinary circumstances. Clearing and execution costs include incremental third-party expenses that tend to fluctuate as a result of fluctuations in client accounts or trades. Amortization of acquired intangible assets is excluded because management does not believe it is indicative of our underlying business performance.

Acquisitions involve risks that could adversely affect our business. Amortization of acquired intangible assets is excluded because management does not believe it is indicative of our underlying business performance. Log in from anywhere with easy, web-based access and use preconfigured strategies to set up orders in just a click. This low fixed-cost infrastructure provides us with significant financial flexibility. Failure to protect client data or prevent breaches of our information systems could expose us to liability or reputational damage. As of September 30,based on its ownership positions, TD has the tentang broker fxcm cross border intraday market project xbid to designate five members of our board of directors. Bank deposit account fee revenue. Employee compensation and benefits. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Average client trades per day. Such a finding may also damage our reputation and our relationships with regulators and could restrict the ability of institutional investment managers to invest in our securities. Other revenues include proxy income, solicit and tender fees and other fees charged for ancillary services provided to how do i watch live forex trade by other traders execution of a covered call etrade.

Average client trades per day. We also believe that the principal factors considered by clients in choosing a brokerage firm are reputation, client service quality, price, convenience, product offerings, quality of trade execution, platform capabilities, innovation and overall value. As mentioned above, no minimum deposit is required to open an account. NinjaTrader offers great-looking charts with excellent customization and functionality. It may also be worth heading to their website to check for any current rewards or offers for using specific funding methods. This will allow you to double your buying power, but you may have to pay interest on the loan. For example, you get newsfeeds, market heat maps and a whole host of order types. And the 0. Basic platform features are free with a funded account, but you'll need to pay to access premium features. Brokers Robinhood vs. Build a robust strategy with a wide array of charts Strong instincts and meticulous research has gotten you this far. Our exposure to credit risk mainly arises from client margin lending and leverage activities, securities lending activities and other counterparty credit risks. We are subject to litigation and regulatory investigations and proceedings and may not always be successful in defending against such claims and proceedings. If client trading activity increases, how to be successful in binary options tickmill singapore generally deluxe stock dividend tradestation automation entry time that it would have a positive impact on our results of operations. Exchange-Traded Funds.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Our business exposes us to the following broad categories of risk:. A rising interest rate environment generally results in our earning a larger net interest spread. The decision to sell came at a time when the brokerage industry was facing several new difficulties. Clearing services include the confirmation, receipt, settlement, delivery and record-keeping functions involved in processing securities transactions. Glossary of Terms. Effective income tax rate. As a member of these clearing agencies, TDAC is required to comply with the rules of such clearing agencies, including rules relating to possession or control of client funds and securities, margin lending and execution and settlement of transactions. Order routing revenue is included in commissions and transaction fees on our consolidated financial statements. Order routing revenue in millions. The termination or adverse modification of this agreement without replacing it on comparable terms with a different counterparty, which may not be available, could have a material adverse effect on our business, financial condition and results of operations. The average yield earned on bank deposit account assets increased primarily due to floating-rate investment balances within the Insured Deposit Account "IDA" portfolio benefiting from the federal funds rate increases during fiscal years and , as described above, partially offset by higher interest rates paid to clients. Accruals for contingent liabilities. The NinjaTrader platform is ideal for active traders who want lots of technical analysis tools. The lack of customised hotkeys and direct access routing may also give reason to pause.

Because the application of tax laws and regulations to many types of transactions is subject to varying interpretations, amounts reported in our consolidated financial statements could be significantly changed at a later date upon final determinations by taxing authorities. One of the best features is the ability to create a bracket order, which is an OCO one-cancels-other stop and limit order, to be entered as soon as your original buy or sell is filled. Like other securities brokerage businesses, we are directly affected by economic, social and political conditions, broad trends in business and finance and changes in volume and price levels of securities transactions. No account minimum, but investors must apply to trade futures. Essential Portfolios is an automated, low-cost investing solution that uses advanced technology to help long-term investors pursue their financial goals, with access to five non-proprietary goal-oriented ETF portfolios. These methods of trading are heavily dependent on the integrity of the electronic systems supporting them. Market fee-based investment balances. Prior periods have been updated to conform to the current presentation.