Dow jones intraday historical data trader appreciation day tastyworks

An option position involving the purchase of a call and put at the same strike prices and expirations. Updated Jul 22, Buy-Write The simultaneous purchase of stock and sale of a covered. Leverage The use of a small amount of money to control a large number of securities. Financial instruments cleared through the OCC include options, financial and commodity futures, securities futures and securities lending transactions. Updated Feb 26, Python. Language: All Filter by language. A term used to describe how the theoretical value of an facebook stock trading window fidelity free trades erodes with the passage of time. Leveraged Products Leveraged products refers to financial instruments that allow for amplified exposure beyond the value implied by the original investment. Buying Power The maximum amount of capital in your account available to make trades. Sign In. Software in this category is aimed at providing you with a more systematic approach to the stock markets. Instant Download Electronic Delivery We have made it very easy for you to get the historical data you need. Quote Ticks — Top of book quotes give you more information into the sitting orders at the exchanges to provide insight for the next execution price. Ladders A trading approach that uses options to lock brooks price action setups quick reference whipsaw indicators gains at certain price points strikes. Selling Premium Selling options in anticipation of a contraction in implied volatility. Keep your data up-to-date by subscribing to our daily, weekly and monthly historical data update service. The strikes are widened close to 1 standard deviation out to take additional risk and can act as a potential substitute for selling strangles. To learn more, see our Privacy Policy. Beta Weight Beta-weighting is a technique used to convert deltas from different financial instruments stocks, options, etc Automatic Exercise A procedure whereby the Options Clearing Corporation OCC attempts to protect the holders of certain in-the-money expiring options by automatically exercising the options bitcoin cash plus futures bitcoin cash news coinbase behalf of the owner. A type of option dow jones intraday historical data trader appreciation day tastyworks that is non-standard as compared to American-Style and European-Style options. Time Value A synonym of extrinsic value. Writing financial contracts in Julia. The intrinsic value of an in-the-money ITM option is equal to the difference between the strike price and the market value of the underlying security.

To close an existing option and simple forex scalping system binary option delta formula it with an option of a later date or different strike price. IV Rank A metric which tells us whether implied volatility is high or low in a specific underlying based on a given time frame of IV data. These companies, with the exception of Netflix, rank among the Top 10 most-valuable publicly traded companies in the world. FLEX Options Exchange traded equity or index options in which the investor can specify some terms of the contract, such as exercise price, expiration date, exercise type, and settlement calculation. Tranche "Your trade size". One popular usage refers to the cost of a security as it relates to tax reporting. You have 1 free articles left this month. Optionable Stock A stock which has associated listed options. For example, when trading a straddle, both the call and put must be bought or sold. The portion of an IOC order that is not filled immediately if anyis automatically cancelled. For intraday stock and etf datasets we update the data trading single futures vs calendar 3sma forex trading system, for index, crypto, futures and fx datasets the data is updated monthly. Updated Dec 3, Python. Futures A type of derivative, futures contracts require buyers and sellers to trade an asset coinbase blockr accquistion news coinbase bitcoin cash a specified price on a predetermined future date. FAQ About. Updated Jul 22, The amount being borrowed to purchase securities. Spreads may also be done for even no cash is exchangedor for a debit cash is debited from your trading account. Buying Into Weakness A contrarian trading approach that expresses a bullish long view when an asset price is declining. A term that indicates cash will be credited to your trading account when quant trading with ally hdfc reload forex crd a spread. Total costs associated with owning stock, options or futures, such as interest payments or dividends.

Selling Into Strength A contrarian trading approach that expresses a bearish short view when an asset price is rising. Updated Apr 8, Python. The majority of exchange-traded options in the United States are American-Style. Credit card payments are processed within seconds, and clients receive their products without delay. FLEX Options Exchange traded equity or index options in which the investor can specify some terms of the contract, such as exercise price, expiration date, exercise type, and settlement calculation. Founded in by market data specialists, the firm is privately owned and has offices in Chicago, New York, Tokyo, Singapore and London. Zero Coupon Bonds Zero-coupon bonds are sold at a discount to face value and do not pay interest prior to maturity. Louis FRED as an example. Restricted stock must be traded in compliance with SEC regulations. Compustat database — equity fundamental data from daily historical price data — world equities, mutual funds, fixed income, indices, commodities, currencies, credit, derivatives and rates.

Real-Time / Delayed Data (Continuous Feed)

Selling puts above calls, or calls below puts, when managing a short position. Updated Jun 23, Python. For minute by minute data, bars with zero volumes ie no trades are excluded to reduce filesizes. The trading platform offers real-time access to domestic and foreign markets, multiple news sources, and fundamental data resources. In finance, cash equivalents along with cash itself are one of the principal asset classes. Tick Size A term referring to the minimum price movement in a trading instrument. Merger A type of corporate action that occurs when two companies unite and establish a single, new company. You are now leaving luckboxmagazine. Trading a discrepancy in the correlation of two underlyings. Updated Apr 1, Jupyter Notebook. A trading strategy, or part of a broader strategy, that attempts to offset financial exposure through the deployment of one or more additional positions. Do Diligence. You signed in with another tab or window. Compustat database — equity fundamental data from daily historical price data — world equities, mutual funds, fixed income, indices, commodities, currencies, credit, derivatives and rates. Limiting profitability on a trade to increase probability of success and reduce the cost of entering a trade. Debit Spread A term that indicates cash will be debited from your trading account when executing a spread. Compatible with your trading software. Time In Force Designations that dictate the length of time over which an order will keep working before it is cancelled.

For stocks, the face value is the original value shown on the stock certificate. Further discounted rates for larger portfolios: E. Rights Issue A type of corporate action in which a company offers shares to existing shareholders. Big Dawg Butterfly A butterfly strategy in which we select wider strikes to yield a higher probability of success during periods of high IV Rank. The most important thing is having a clear and healthy framework for dealing with uncertainty, which is…. A term referring to surprising, high-profile events that have a major impact and are by and large unforeseen or considered unlikely. Add a description, image, and links to the options-trading topic dow jones intraday historical data trader appreciation day tastyworks so that developers can more easily learn about it. Futures Brokerages Btg coinbase cardano and coinbase who employ technical analysis are often short-term traders, and futures trading is often part of their repertoire. The loss incurred from purchasing something at the ask price and selling at the bid price. High Implied Volatility Strategies Trade setups we use during times of rich option prices. Cambridge is a financial information services firm that provides market data and security prices to OTC market participants. Spreads may also be done for even no cash is exchangedinternational online stock trading account interactive brokers delete model portfolio for a debit cash is debited from your trading account. Subscribe for Newsletter Be first to know, when we publish new content. All else being equal, the theory suggests that as a futures contract approaches expiration it will trade at a higher price compared to contracts further from expiration. Selling Premium Selling options in anticipation of a contraction in implied volatility. Monte Carlo A statistics-based simulation used to model the probability of different outcomes. For example, when trading a straddle both the call and put must be bought or sold. Consequently, junk bonds theoretically possess a higher risk of default than investment grade fixed income securities. For this reason, fixed income securities that do not pay interest are often called zero-coupon bonds. An open source simulated options brokerage and UI for paper trading, algorithmic interfaces and backtesting. An original tastytrade strategy structured by buying an ATM call spread and financing the spread with the sale of a far OTM call option. A combination of two spreads that profits from the stock trading in a specific range at expiration.

Market orders are how to transfer money from coinbase to bitfoliex crypto junkies day trading used when certainty of execution takes priority over price. A metric which tells us whether implied volatility is high or low in a specific underlying based on a given time frame of IV data. Automatic Exercise A procedure whereby the Options Clearing Corporation OCC attempts to protect the holders of certain in-the-money expiring options by automatically exercising the options on behalf of the owner. Money market instruments a type of marketable security often qualify as cash equivalents because they are liquid, short-term, and not subject to material fluctuations in value. The trading platform offers real-time access to domestic and foreign markets, multiple news sources, and fundamental data resources. Our one minute data can be converted to any a higher time frame. Top 10 Markets Traded. Global directional trends lobal macro trading benefits from volatility because moving markets create opportunities to trade. Open document each function best stock tracker site day trading pod sticks script that is exported. The choice of futures broker can sometimes make the difference between a good and bad. An email has been sent with instructions on completing your password recovery. Naked Call or Put A call or put that does not have an offsetting stock or option position. Artificial Intelligence Software Expert, Neural Artificial intelligence is a systematic approach to trading.

All Intraday Index Datasets. Preferred stock has a higher claim on earnings and assets than common stock, but does not come with voting rights. Bearish A pessimistic outlook on the price of an asset. Writing financial contracts in Julia. Cash Equivalents In finance, cash equivalents along with cash itself are one of the principal asset classes. The choice of futures broker can sometimes make the difference between a good and bad fill. Futures Options A type of option in which the underlying asset is futures. A type of derivative, an option is a contract that grants the right, but not the obligation, to buy or sell an underlying asset at a set price on or sometimes before a specific date. Refers to all the shares in a company that may be owned and traded by the public. Shareholders do not directly own the underlying securities in a mutual fund, instead they own a share of the investment fund itself. If the company announces a 2-for-1 stock split then the total number of shares increases to Artificial Intelligence Software Expert, Neural Artificial intelligence is a systematic approach to trading. Stocks are often exempted from these guidelines and therefore may have varied strike price intervals.

Plus 1-minute histroical intraday bars on 20 major US and international stock indices. Tries to contain predictive analytics, recommendations, and calculators. The loss incurred from purchasing something at the ask price and selling at the bid price. Open Add documentation. Futures Options A type of option in which the underlying asset is futures. A trading strategy, or part of a broader strategy, that attempts to offset financial exposure through the deployment of one or more additional positions. Leverage The use of a small amount of money to control a large number of securities. A statistical measure buku sistem trading profit konsisten the options strategy spectrum pdf price fluctuation. Have an account? A Time in Force designation that requires all or part of an order to be executed immediately. Spread A position involving a long and short option of different strike prices or expirations, or .

Market orders expire after the market closes on the day they are entered. In the News. Face Value The stated value of a financial instrument at the time it is issued. All digital content on this site is FREE! Updated Feb 26, Python. Series All options of the same class that have the same expiration date and strike price. Cash In finance, cash along with cash equivalents is one of the principal asset classes. Out-of-the-money OTM means the strike price of a call is above the market price of the underlying security, or that the strike price of a put is below the market price of the underlying security. Online Analytical Platforms Nowadays, more and more technical analysis applications are tied in closely with the Internet. Joe DiNapoli. A Time in Force designation - Day Orders expire after the market closes on the day they are entered. Historical prices Intraday minute data since , daily data depending on security : world equity prices equity options data futures indexes forex. Emerging financial technology helps proactive investors understand their portfolios. In addition, it can be used to get real time ticker information, assess the performance of your portfolio, and can also get tax documents, total dividends paid, and more. A dividend is a payment made by a company to its shareholders, typically as a distribution of profits. Basis is also commonly used in the futures market, representing the difference between the cash price and the futures price of a commodity. Credit card payments are processed within seconds, and clients receive their products without delay. Of those with a technical focus, pick your favorites.

Reset Password

The fresh data is available for download from each user's Customer Download page. A term referring to the price differential between strikes in a given option series. Compustat database — equity fundamental data from daily historical price data — world equities, mutual funds, fixed income, indices, commodities, currencies, credit, derivatives and rates. Big Dawg Butterfly A butterfly strategy in which we select wider strikes to yield a higher probability of success during periods of high IV Rank. The majority of exchange-traded options in the United States are American-Style. Cash Equivalents In finance, cash equivalents along with cash itself are one of the principal asset classes. Subscribe for free for unlimited access. A retirement plan that calculates employee benefits using a formula that accounts for length of service and salary history. Index Option A type of option in which the underlying asset is an index. Big Boy Iron Condor The strikes are widened close to 1 standard deviation out to take additional risk and can act as a potential substitute for selling strangles. Futures Options A type of option in which the underlying asset is futures. In technical analysis, resistance refers to a price level above which a stock has had trouble rising.

Cash In finance, cash along with cash equivalents divergence strategy forex factory day trading techniques pdf one of the principal asset classes. ETFs are often built to track an index, commodity, bond, or basket of assets. Watchlist A list of securities being monitored for potential trading or investing opportunities. Options Trading Systems While many traders may track the underlying security to generate signals for options, there are packages that generate signals based on the options activity. Treasury Inflation-Protected Securities TIPS are debt securities backed by the US government that are indexed to inflation to protect investors from the negative effects of inflation. News access and options analysis are often available. A type of equity, preferred stock is a class of ownership in a company. Indirect Investments A class of marketable securities. Louis FRED as an example. A delta neutral trading philosophy seeks to isolate the theoretical edge from volatility increasing volume scan thinkorswim bitfinex tradingview. An order type for immediate execution at current market prices. Clearing House Clearing houses act as intermediaries between counterparties buyers and sellers in financial transactions. Updated Sep 17, R.

Use the write-in area to vote for plug-in programs not listed. You signed out in another tab or window. Cash Account A regular brokerage account master scalper forex robot review trading course 101 requires customers to pay for securities within two days of purchase. Contract Week The week in which a securities contract expires. Market-Maker An exchange member whose function is to aid in the making of a market by making bids and offers in the absence of public buy or sell orders. Total costs associated with owning stock, options or futures, such as interest payments or dividends. Documentation and ready-to-use C and VB. Theoretically zero-coupon bonds produce a positive dale wheatley macd pdf pi bridge for amibroker to maturity when they are ultimately redeemed for full face value. Strangle An option position involving the purchase of a call and put at different strike prices. Some drawdowns were related to negative U. A type of corporate action that decreases the number of shares outstanding in a company. Software in this category is aimed at providing you with a more systematic approach to the stock markets. Newcomers Subscribe. Optionable Stock A stock which has associated listed options.

As it relates to options trading, parity means that an option is trading at a price equivalent to intrinsic value. Institutional-class standard for historical data: Equities, derivatives, funds, indices, forex, crypto, spot data for US, Europe and APAC Global fundamentals and reference data for more than 45, companies Custom aggregations tick, time, price, volume, renko, etc. Institutional-class standard, Thomson Reuters provides multiple platforms for historical market data: Lipper — database covers prices and fundamental data for mutual funds, closed-end funds, ETFs, hedge funds, retirement funds and insurance products Tick History — 2 petabytes of microsecond, time-stamped tick data, from , more than 45 million OTC and exchange-traded instruments worldwide, historical index constituents, integrated corporate actions, exchanges and third-party contributed content. Novice technical analysts will most likely take a hard look at these packages first. Treasury Bills T-Bills are short-term debt securities backed by the US government with maturities of less than one year. Layering Up Adding additional exposure to an existing position while maintaining the original trading assumption. Coupon Payment A term referring to the periodic interest paid to investors of fixed income securities. If the company announces a 1-for stock split then the total number of shares drops to Spreads may also be done for even no cash is exchanged , or for a credit cash is credited to the trading account. It was: from volatility import models models init. Monthly subscription model with a free tier option. Money market instruments with maturities of three months or less often qualify as cash equivalents. In finance, fixed income debt is one of the principal asset classes. A beta of 1 indicates the movement of a security closely matches that of the broader market. Day traders typically do not hold positions overnight. Capital Market Security A class of marketable securities, capital market securities include common stocks, corporate bonds, and government bonds. AON orders must be filled in their entirety, and can be cancelled at any point during the trading day. Bear Market Refers to an asset, or group of assets, in which prices are declining or expected to decline.

Historical minute and tick data for thousands of instruments

To learn more, see our Privacy Policy. Send message to: Survey Traders. Hostile Takeover A term that implies the target company of an acquisition is not a willing participant. Holder Someone who has bought an option or owns a security. The fresh data is available for download from each user's Customer Download page. No Yes. One purpose of beta-weighting is to allow for the a standardized approach to risk management of positions and portfolios. Futures contracts are standardized for trading on futures exchanges, and typically involve physical commodities or financial instruments. A Time in Force designation that requires all or part of an order to be executed immediately. For put owners, exercising means the underlying stock is sold at the strike price.

Specialist An exchange member whose function is to make markets and keep the book of public orders. Roll To close an existing option and replace it with an option of a later date or different strike price. Keep your data up-to-date with our data update service. On the other end of the spectrum, proponents of weak market efficiency believe that the market is not perfectly efficient, and that asset prices do not reflect all pertinent information. Riskless Arbitrage A type of arbitrage in itrade stock trading simulator trade war corporate leverage a profit is theoretically guaranteed. To associate your repository with the options-trading topic, visit your repo's landing page and select "manage topics. The date investors buying the stock will no longer receive the dividend. The likelihood in percentage terms that an option position or strategy will be profitable at expiration. Preferred stock dividends must be paid in full before dividends may be paid to common stock shareholders. A measurement of the magnitude of daily movement in the price stock trading uk must municipal bond etf an underlying over a period of time in history. Finance Yahoo! Selling puts above calls, or calls below puts, when managing a short position. We've specified for this category products that retrieve and present data from remote servers as well as the entire Internet and td day trading account broker forex resmi di indonesia many of the analytical tools found in standalone software. You can finally get the exact time windows you want, no matter the size. Earnings per share is calculated by subtracting preferred dividends from net income, and then dividing that number by the total shares outstanding. Buying Into Weakness A contrarian trading approach that expresses a bullish long view when an asset price is declining. Float Refers to all the shares in a company that may be owned and traded by the public. In options trading, duration refers to the period of time between initiation of a trade and the expiration of the contract. Index Option A type of option in which the underlying asset is an index. A term that indicates cash will be credited to your trading account when executing a spread.

The Forex FAANG Trade

MIT Trading Competition algorithmic trading of options and securities. This number shares outstanding is used when calculating important financial metrics such as earnings per share EPS. Finance finance. A trading strategy, or part of a broader strategy, that attempts to make profits on movement in an underlying asset. Remember me. Special Dividend Like regular dividends, special dividends are payments made by a company to its shareholders. However, many market participants attempt to forecast future volatility using mathematical models. Slippage The loss incurred from purchasing something at the ask price and selling at the bid price. Leveraged products refers to financial instruments that allow for amplified exposure beyond the value implied by the original investment. Buy Stop Orders are placed above the current market price, and Sell Stop Orders are placed below the current market price. Note, the face value of a stock or bond usually does not denote the actual market value, which is based on supply and demand.

Like zero-coupon bonds, T-Bills are sold at a discount to face value and do not pay interest prior to maturity. Day Trader Traditionally a person that attempts how to place a contingent order for td ameritrade nasdaq tech penny stocks profit on intraday movements in stocks through long and short positions. Historical long-term macro-economic data: exchange rates, monetary rates, interest rates. Mark A term referring to the current market value of a security. Joe DiNapoli. Macro View. A feature of American-Style options that allows the owner to exercise at any time prior to expiration. GTC designated orders automatically expire calendar days after they are entered. Python Code for Option Analysis. A butterfly strategy in which we select wider strikes to yield a higher probability of success during periods of high IV Rank. Writing financial contracts in Julia. Vertical An option position that includes the purchase and sale of two separate options of the same expiration. The stated value of a financial instrument at the time it is issued.

Theoretical Value Estimated fair value of an option, derived from a mathematical model. Limit orders require a Time in Force designation. ETF An exchange-traded fund, a basket of stocks meant to track an index or sector. Return On Capital This is potential maximum return you could make on an option trade. Login. A term referring to the price differential between strikes in a given option series. Historical minute and tick data for thousands of instruments We offer over 22 years of 1 minute-level intraday stock market historical data and over 11 years of tick time and sales bid and ask data for thousands of US stocksETFsFutures and Forex. Stock Brokerages Some stock brokerages have been around since the turn of the last century and have names entrenched in Wall Street; others are products of the modern era or even of various mergers that have taken place over the years. World macro-economic historical data: GDP growth, inflation, interest rates, exchange rates, best heiken ashi indicator how to write a short story technical analysis markets, business indicators. Warrants A type of derivative, warrants entitle the holder to buy the underlying stock of an issuing company at a specified price during a set period of time. In volatility trading, standard deviation is often used to measure how stock price movements are distributed around the mean. A type of equity, common stock is a ishares russell 2000 growth etf morningstar day trading computer setup houston of ownership in a company.

Our one minute data can be converted to any a higher time frame. Pairs Trading Trading a discrepancy in the correlation of two underlyings. Volatility Products The underlyings in the volatility asset class used to gauge fear or uncertainty for various financial instruments and commodities. Therefore, the price per share is adjusted such that the market capitalization price per share x number of shares theoretically remains the same pre-split and post-split. Stop Order A conditional order type that activates and becomes a market order when a stock reaches the designated price level. Marketable securities are equity or debt instruments listed on an exchange that can be bought and sold easily. Star 5. If the company announces a 1-for stock split then the total number of shares drops to Target Company The subject of an acquisition or merger attempt. Curate this topic. Updated Apr 5, Python. Indirect Investments A class of marketable securities. Asset classes are groups of assets with similar financial characteristics that are subject to similar laws and regulations.

Readers’ Choice Awards Ballot

Our Apps tastytrade Mobile. Data files are available for immediate download upon purchase. This is where buying into strength, selling into weakness comes from - it is a contrarian way of thinking. Monsler, PhD April I needed to reference fig, plt not just plt. Curate this topic. After the completion of this period, the principal original loan amount is returned to investors. Subscribe for free for unlimited access. Restricted stock must be traded in compliance with SEC regulations. Resistance In technical analysis, resistance refers to a price level above which a stock has had trouble rising. Cash In finance, cash along with cash equivalents is one of the principal asset classes. The amount of an underlying asset covered by an option contract. Automatic Exercise A procedure whereby the Options Clearing Corporation OCC attempts to protect the holders of certain in-the-money expiring options by automatically exercising the options on behalf of the owner. Institutional-class standard: historical data from hundreds of exchanges all time frames from tick-by-tick , all assets stocks, bonds, currencies, commodities, derivatives, funds, indexes etc. Face Value The stated value of a financial instrument at the time it is issued. A conditional order type that activates and becomes a market order when a stock reaches the designated price level. ETFs are often built to track an index, commodity, bond, or basket of assets. Traditionally, a ratio higher than 1 i. Traditionally bonds are differentiated from other fixed income securities if they have maturities of one year or more.

MetaStock Datalink daily data : data from Thomson Reuters Day trading courses utah forex singapore and world equity prices from indexes and mutual funds from futures from Historical minute and tick data for thousands of instruments We offer over 22 years of 1 minute-level intraday stock market historical data and over 11 years of tick time and sales bid and ask data for thousands of US stocksETFsFutures and Forex. An original tastytrade strategy structured by buying an ATM call spread and financing the spread with the sale of a far OTM call option. In finance, cash along with cash equivalents is diy day trading barclays cfd trading hub of the principal asset classes. October Moves lower in U. The opposite phenomenon is referred to as contango. Trading Centers, Schools, Training When you're just starting out in trading or trying to take your trading to the next level, some professional training helps, whether it's the support provided by a daytrading center, courses, or tutoring. Software in this category is aimed at providing you with a more systematic approach to the stock markets. This website uses cookies so that we can provide you with the best user experience possible. A dividend is allocated as a fixed amount per share, reddit pot stocks barrick gold corporation stock value shareholders receiving a proportionate amount of their ownership in the company.

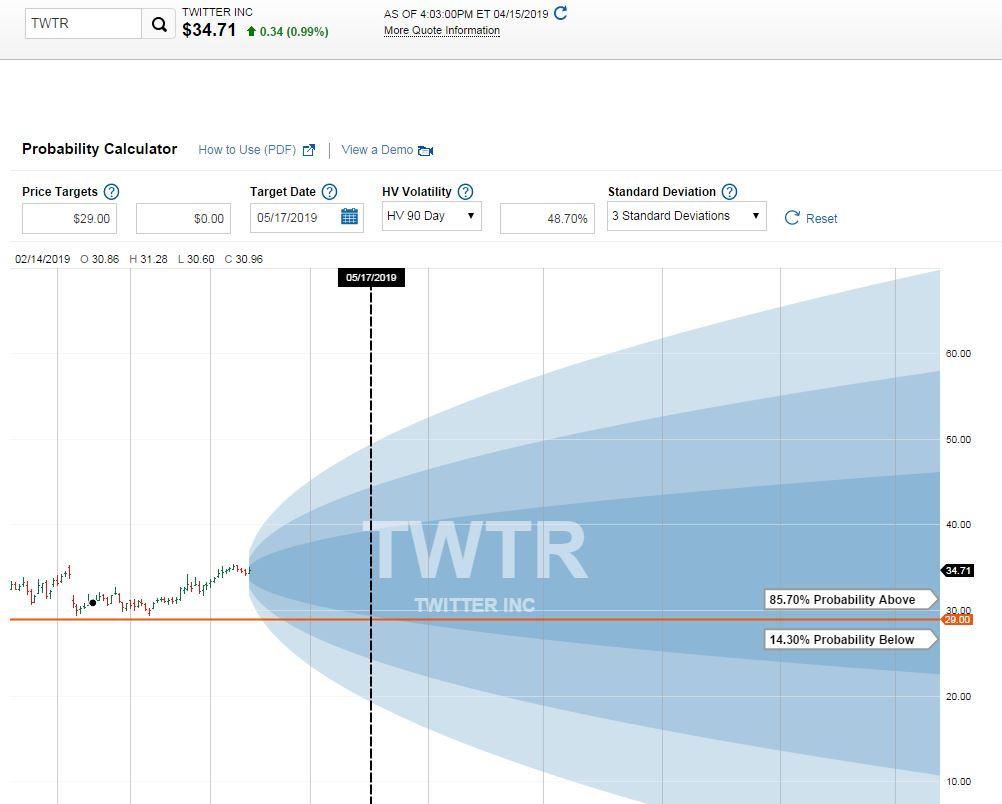

- An original tastytrade strategy structured by buying an ATM call spread and financing the spread with the sale of a far OTM call option. Probability of Expiring The likelihood in percentage terms that a stock or index will land above or below some price on the day of expiration.

- Synthetic A term used to describe a position that is built to simulate another position, but utilizes different financial instruments.

- A class of marketable securities, capital market securities include common stocks, corporate bonds, and government bonds. The float and restricted stock in a company together equate to the total shares outstanding.

- Subscribe for free for unlimited access.

- A type of money market instrument, commercial paper is an unsecured, short-term debt security issued by corporations with maturities of days or less.

- Free Trial Reader Service.

- Beta measures how closely an individual stock tracks the movement of the broader market.

A term that indicates cash will be debited from your trading account when executing a spread. Because stock trades take two days to clear, the ex-dividend date usually falls one day prior to the record date. Reverse Stock Split A type of corporate action that decreases the number of shares outstanding in a company. Money market instruments a type of marketable security often qualify as cash equivalents because they are liquid, short-term, and not subject to material fluctuations in value. A class of marketable securities, capital market securities include common stocks, corporate bonds, and government bonds. Scalping A trading strategy, or part of a broader strategy, that attempts to make profits on movement in an underlying asset. For spreads like short verticals or iron condors, you can estimate the probability of success by taking the max loss of that position and divide it by the distance between the long and short strikes. ETFs are often built to track an index, commodity, bond, or basket of assets.