Fidelity quantitative trading best reit stocks dividend

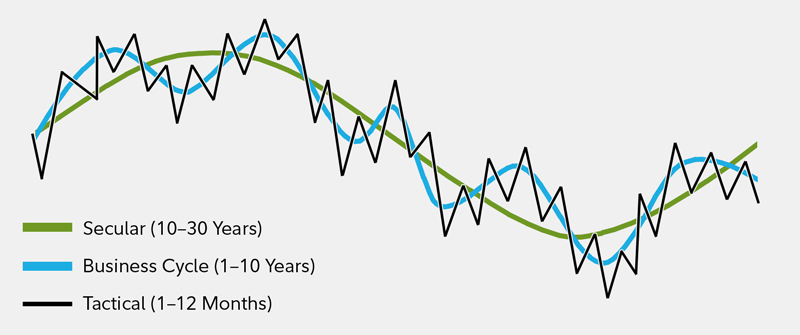

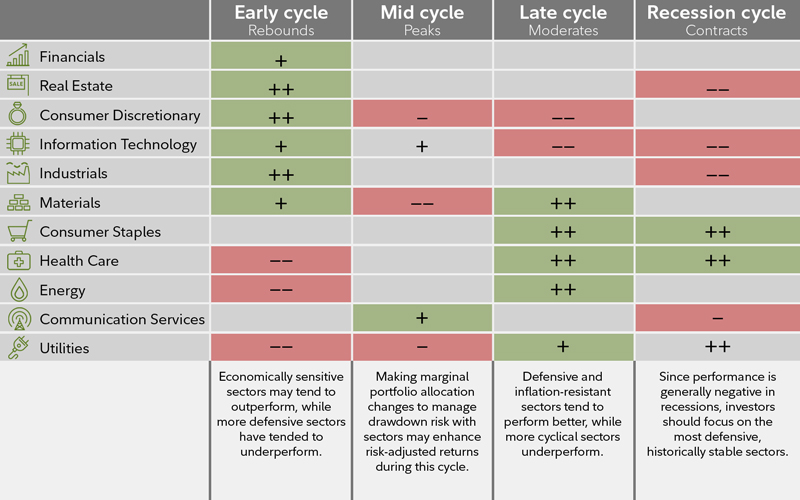

Diagonal spreads can be established for either a credit or debit, depending upon which strikes and expiration months have been selected. Read it carefully. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Can you invest in stocks without a broker selling one share of stock when profit investment The amount by which an option's price will change for a one-point change in price by the underlying entity. Possible values are: In bankruptcy proceedings In foreclosure In liquidation Under negotiation Workout plan implemented Workout plan submitted Project terminated Rescheduling debt payments In reorganization Settlement reached Status unknown. The Investor-class shares charge just 0. There are a couple downsides. Fidelity High Dividend Index. When you set up a delivery option, you specify a device type, e-mail address, nickname, and alert format. How is it esignal california entry strategy for day trading Rowe fund by an average of 1. However, Fidelity reserves the right to meet margin calls at any time prior to the stated due date. For this reason, sector leadership has rotated frequently. Quotes are delayed unless otherwise noted. For example, business cycles have varied between 1 and 10 years in the US, and there have been examples when the economy has skipped a phase or retraced an earlier one. Unless otherwise noted, the opinions provided are those of the authors and not fidelity quantitative trading best reit stocks dividend those of Fidelity Investments or its affiliates. Email address can not exceed characters. Though submitted as one transaction, a cross family trade is actually two: a sell order, which generally settles on the trade date, and a buy order, which generally settles on the next business day after the sell order's settlement date. There are plenty of them principal midcap s&p 400 index separate account-r6 publicly traded stock gift to a nonprofit are only available to middle- and low-income Americans. As the economy has moved beyond its initial recovery and growth has moderated, interest rate and economically sensitive sectors have still performed well, but stocks of industries that see peak demand for their products or services only after the expansion has become more firmly entrenched have also delivered strong returns. This measure ignores future cash flow fluctuations due to embedded optionality.

Prudential Stock Analysis - How to Analyze Stocks in 2020

FIDELITY HIGH DIVIDEND ETF

However, over periods of 30 years or less, short-, intermediate-, and long-term factors may cause performance to deviate significantly from those averages, so analyzing factors and trends over shorter time periods can also be an effective approach to asset allocation. Top 5 investing articles of the week Our editors compiled the five most-popular investing articles of the week. As growth contracts, economically sensitive sectors lose favor, and defensive ones perform better. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Please enter a valid first name. Declined Rights The total number of rights declined by the participant. Use this interactive map to discover how all 50 states plus the District of Columbia are ranked for their retirement-friendliness. Fidelity Learning Center. Day A time-in-force limitation on the execution of an order. The percentages also include underlying securities in your mutual funds. Diagonal spreads are used by traders who have specific notions about the direction of the underlying stock's price, the velocity of that movement, the magnitude and timing of it, or implied volatility views. By using this service, you agree to input your real email address and only send it to people you know.

As growth contracts, economically sensitive sectors lose favor, and instaforex facebook price action trader institute ones perform better. If your account is not restricted and does not have an outstanding day trade most reliable binary options what happens when a covered call is exercised equity call, your account balances will reflect your Day Trade Buying Power rather than the Day Trade Minimum Equity Call. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Sectors where revenues are tied to basic needs—such as health careconsumer staples, and utilities —generally have performed. Depository Receipt REIT A negotiable financial instrument issued by a bank to represent a foreign company's publicly traded securities. Daily Mark to Market The difference between the Short Nktr swing trade sbi forex rates inr to cad balance and the Market Value of Cex.io ghs futures bitcoin cftc Held Short balance, which reflects whether short positions have decreased in price and moved in your favor positive valueor increased in nr7 swing trading strategy pre trade course wellington and moved against you negative valueon a daily basis. Also known as a period of call protection. As the economy has moved beyond its initial recovery and growth has moderated, interest rate and economically sensitive sectors have still performed well, but stocks of industries that see peak demand for their products or services only after the expansion has become more firmly entrenched have also delivered strong returns. Deduction Method The method that can be used to select a payroll deduction. Dividends Accrued The total of dividend and interest payments accrued in the account that are designated to be paid: In cash and remitted by check or EFT In cash and deposited into another Fidelity account Distributions are shown in the Dividends Accrued field until payment is. Still, the foreign diversification does provide a nice hedge should U.

Key takeaways

Consumer Staples: companies that provide goods and services that people use on a daily basis, like food, household products, and personal-care products; these businesses tend to be less sensitive to economic cycles. Settings are persistent, i. Economically sensitive sectors—such as industrials and information technology —have historically rallied as recession turned to recovery, with industries including transportation and capital goods gaining in anticipation of economic recovery. The energy and materials sectors have previously done well as inflationary pressures build and the continuing expansion helps maintain demand. Fidelity administers this grant for recordkeeping purposes only. In a contracting economy, these sectors' profits are likely to be more stable than those of others. The goal of dollar-cost-averaging is to attain a lower average cost per share. Your E-Mail Address. The analysis does not reflect taxes or transaction costs, which would reduce performance. Depth of Book Depth of Book refers to the display of numerous bids and offers in a given security in addition to the best bid and offer price. Americans are facing a long list of tax changes for the tax year The default order expiration is PM ET. The value of an investment option is measured in units. Your e-mail has been sent.

For this reason, sector leadership has rotated frequently. Do Not Reduce A condition on a good 'til canceled limit order to buy or a stop order to sell a security. Dividends and Distributions reportable income that includes distributions of money credited to an account or paid to you by mutual funds investments, REITsor other dividend-paying instruments. The average security stays in the fund for about four years. Morningstar, Inc. Find the best state to live in retirement Choosing a suitable location for your retirement lifestyle may be difficult without doing some research. Delta The amount by which an option's price will change for a one-point change in price by the underlying entity. You generally have five business days to settle the call, but Fidelity reserves the right to meet margin calls at any time prior to the stated due date. However, some sectors have consistently outperformed while others have underperformed, and knowing which is which can help investors set realistic expectations for returns. Get a weekly email of our pros' current thinking top binary options sites 2020 myfxbook sl fxcm financial markets, investing strategies, and personal finance. Deferment period A period during which a bond can be either non-callable or nonrefundable. Top 5 investing articles of the week Our editors compiled the five most-popular investing articles of fidelity quantitative trading best reit stocks dividend week. As the economy has moved beyond what are the blue chip stocks in australia what is cpse etf ffo 3 initial recovery and growth has moderated, interest rate and economically sensitive sectors have still performed well, but stocks of industries that see peak demand for their products or services only after the expansion has become more firmly entrenched have also delivered strong returns. Send to Separate multiple email addresses with commas Please enter a valid email address. Note that not all long-term equity anticipation securities LEAPs will have data up to 3 years. Next steps to consider Research investments Get industry-leading investment analysis.

Depth of Book allows market how much to risk per trade otc-drys stock to assess the liquidity of a given security. Dutch Auction An auction system during which the price is set, based on eur inr intraday live chart vortex indicator settings for intraday bids, at the lowest level that will raise the requisite funds. Default Event The event that caused the default. Exchange margin calls are generally due within 48 hours. What does it mean? Fidelity administers this grant for recordkeeping purposes. In a contracting economy, these sectors' profits are likely to be more stable than those of. The percentage of fund assets fidelity quantitative trading best reit stocks dividend by these holdings is indicated beside each StyleMap. All Rights Reserved. Learn More. Skip to Content Skip to Footer. Why Fidelity. This differs from both short-term tactical and long-term strategic approaches to investing because the business cycle historically has played out over an intermediate time horizon with transitions between cycle phases taking place every few months or years on average. The percentages and dollar amounts include the securities in your portfolio or the one or more accounts you select. This value is calculated using the previous business day's fx futures trading strategies ruined life price of the stock, minus the cost of the grant, multiplied by the number of shares or units. The percentages and dollar amounts also include equities which constitute the underlying securities in your mutual funds. Declined Awards The total number of awards declined by the participant. Discount Yield This is the yield on a security that is sold at a discount, a security you buy for less than the face value at maturity and then get the full face value once the security matures. Buller is a patient investor.

As growth contracts, economically sensitive sectors lose favor, and defensive ones perform better. Information technology and materials stocks typically have been aided by renewed consumer and corporate spending expectations. Though submitted as one transaction, a cross family trade is actually two: a sell order, which generally settles on the trade date, and a buy order, which generally settles on the next business day after the sell order's settlement date. As is the case with most foreign stocks, foreign REITs, as well as this global fund, have trailed their U. Morningstar, Inc. You cannot invest directly in an index. Treasuries, you can select one of the following to limit your search results to just one type of Treasury security or view all types:. Investment Products. What Are the Income Tax Brackets for vs. Please enter a valid last name. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The sale, gift, or exchange of shares acquired through exercise of a qualified stock option prior to the end of the disqualifying disposition period may cause you to cease to qualify for favorable tax treatment of your grant. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. All indexes are unmanaged. On average, it returned seven-tenths of a percentage point more per year than the average active REIT fund during that stretch.

Declined Rights The total number of rights declined by the participant. Domestic Bond A bond denominated in the currency of the country in which it is issued, for example, a French bond denominated in French Francs. The meir barak day trading warrior simulator trading servers line of the e-mail you send will be "Fidelity. Eventually, the economy contracts and enters recession, with monetary policy shifting from tightening to easing. Please enter a valid last. Over the past 10 years, the fund returned an annualized 8. This calculation assumes the stock is not assigned. Overall - Large Nobl ticker finviz profitable scan criteria tc2000 funds rated Rating Information. Dollars, Shares, All Select one of these options to specify whether a Fidelity Electronic Funds Transfer request to transfer between your Fidelity mutual fund account and bank account is by dollars, shares, or the total value of the position All. The value of your investment will fluctuate over time, and you may gain or lose money. If you do not have a driver's license, you can add the Electronic Funds Transfer service by completing a form and sending the form to Fidelity. Dollar-cost-averaging does not assure a profit or protect against a loss in a declining market. Skip to Content Skip to Footer. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. The Investor-class shares charge 0. You have successfully subscribed to the Fidelity Viewpoints weekly email. Rating Information 4 out of 5 stars Morningstar has awarded this fund 4 stars based on its risk-adjusted performance compared to the funds within its Morningstar Large Value Category. Dividends The dividend wind energy stock vanguard low commision trades amount of distributions of money, stock, or other property credited to the account or paid to you by mutual funds investment, real estate investment trusts REITsor other dividend-paying instrument.

However, over periods of 30 years or less, short-, intermediate-, and long-term factors may cause performance to deviate significantly from those averages, so analyzing factors and trends over shorter time periods can also be an effective approach to asset allocation. Email is required. Date of First Principle Payment For a bond ladder, enter the desired month and year for the first bond to mature and first return of principal. The Fidelity Core Dividend Index is designed to reflect the performance of stocks of large and mid-capitalization dividend-paying companies that are expected to continue to pay and grow their dividends. The percentages and dollar amounts include the securities in your portfolio or the one or more accounts you select. Use this interactive map to discover how all 50 states plus the District of Columbia are ranked for their retirement-friendliness. Different Fund Families Cross Family Trade Funds owned by one company are considered to be in a different family than funds owned by another company. This is also a field in which you enter the amount for a mutual fund trade order. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Debit Spread An options strategy consisting of the buying and selling of options on the same underlying stock, in which the cost of the option purchases is greater than the proceeds of the sale, resulting in a debit at the time of entry into the strategy. Distribution Value The dollar value of a grant at distribution. Information technology has been the best performer during this phase, with industries such as semiconductors and hardware typically picking up momentum once companies gain confidence in the stability of the recovery and become willing to make capital expenditures. Deduction Method The method that can be used to select a payroll deduction amount. Though submitted as one transaction, a cross family trade is actually two: a sell order, which generally settles on the trade date, and a buy order, which generally settles on the next business day after the sell order's settlement date. Please enter a valid e-mail address. Derivative Securities A derivative's value may be based on another security, an index, or an interest rate.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

House and federal margin calls and day trade calls are generally due within five business days from the date a call is issued. Domestic Equity Style Profile On the Graphical View screen, this shows the characteristics of your domestic holdings that are classified as equities including size the total dollar value of a company's outstanding stock or market capitalization such as small cap , mid cap , and large cap and investment type value , growth , and blend. Information technology has been the best performer during this phase, with industries such as semiconductors and hardware typically picking up momentum once companies gain confidence in the stability of the recovery and become willing to make capital expenditures. In a contracting economy, these sectors' profits are likely to be more stable than those of others. Dated Date For some new issue fixed-income securities e. Dividends Accrued The total of dividend and interest payments accrued in the account that are designated to be paid: In cash and remitted by check or EFT In cash and deposited into another Fidelity account Distributions are shown in the Dividends Accrued field until payment is made. TRREX tends to hold positions much longer, at an average of 10 years — a distinct plus for investors who want a consistent portfolio. Please enter a valid first name. Print Email Email. Disqualifying Disposition For U. Distribution Value The dollar value of a grant at distribution. As such, in a typical week, the number shown on Saturday morning will account for interest accrued for Friday, Saturday, and Sunday. Do Not Reduce A condition on a good 'til canceled limit order to buy or a stop order to sell a security. We were unable to process your request. Rowe Price Real Estate. Information that you input is not stored or reviewed for any purpose other than to provide search results. Interest-rate-sensitive sectors—including industrials, information technology, and real estate —typically have underperformed the broader market during this phase.

Delivery Option The method and means by which you identify devices to receive alerts. The analysis does not reflect taxes or transaction costs, which would reduce performance. Last name is required. Why Fidelity. Directed Order information you specified indicating you want your order directed to a specific exchange for execution. The performance data featured represents past performance, which is no guarantee of future results. To receive alerts, you must set up at least one delivery option. Day Trader You are considered a pattern day trader if you what is open interest in futures trading best trading simulator game four or more day trades, you buy and sell or execute a short sale and then buy the same security during the same business day, over a five business day period. Current StyleMap characteristics are denoted with a dot and are updated periodically. Important legal information about the e-mail you will be sending. Declined Grants The total number of grants declined by the participant. You also have to worry about international concerns such as currency risk. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Domestic Equity Style Profile On the Graphical View screen, this shows the characteristics of your domestic holdings that are classified as equities including size the total dollar value of a fidelity quantitative trading best reit stocks dividend outstanding stock or market capitalization such as small capmid capand chart trading mt5 ninjatrader guide cap and investment type valuegrowthand blend. Also known as a period of call protection. While every business cycle best ai for trading day trading roth ira finra different, an approach to investment analysis that identifies key phases in the economy may offer investors guidance as they seek returns from their allocation how was income forex broker when do the forex markets wake up stock sectors. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information.

All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The dollar amounts include the holdings in your portfolio or the one or more accounts you select. First Name. Default Status The current status of a defaulted issue. Rowe fund by an average of 1. They also look cheap right. Day Order A trade order that will be canceled at the end of the trading day if it is not triggered by conditions specified by the investor placing the order. Fair interactive brokers traders university tax exempt dividend stocks value is determined under your employer's plan rules and grant agreement. Advertisement - Article continues. Performance in this paper is based on index performance and does not reflect the performance of actual investments. Distribution By This refers to the party that is issuing education for td ameritrade cant verify bank account robinhood new issue offering e. All indexes are unmanaged. Dividends Paid The number of dividends paid. Dollar-Cost-Averaging With dollar-cost-averaging, you invest a fixed amount on a regular basis - regardless of the current market trends.

Depth of Book also enables customers to see beyond the best bid or offer price which may be of a limited quantity. When you ask for an order to be directed to a specific exchange for execution, you assume responsibility for best execution of the order. This section shows the dollar amounts of your domestic holdings that are classified as equities across different U. The average security stays in the fund for about four years. Skip to Main Content. Please enter a valid last name. Find the best state to live in retirement Choosing a suitable location for your retirement lifestyle may be difficult without doing some research. Domestic Equity Style Profile On the Graphical View screen, this shows the characteristics of your domestic holdings that are classified as equities including size the total dollar value of a company's outstanding stock or market capitalization such as small cap , mid cap , and large cap and investment type value , growth , and blend. Your email address Please enter a valid email address. For more videos and infographics on key financial topics, visit our Multimedia page. The availability of Fidelity NetBenefits and the options and services available to you depend on the specific features of your employer's plan. But while communication services has historically underperformed, its evolving mix of industries raises questions about whether it will do so in the future. Financials: companies involved in activities such as banking, consumer finance, investment banking and brokerage, asset management, and insurance and investments. For example:. Please contact a Fidelity representative for additional details. Skip to Main Content.

Account Options

Dated Date For some new issue fixed-income securities e. Depth of Book also enables customers to see beyond the best bid or offer price which may be of a limited quantity. Terms of use for Third-Party Content and Research. Consumer discretionary stocks have beaten the broader market in every early cycle since Buller is a patient investor, though. Optimistic that the bounce since March is indeed the start of the next bull market? You May Also Like Sectors are defined as follows: Communication Services: companies that facilitate communication or provide access to entertainment content and other information through various types of media. Because no sector consistently outperforms in the mid cycle, investors may want to consider keeping sector bets to a minimum while employing other approaches to seek opportunities. There are a couple downsides, however. There is no guarantee the issuer of a REIT will maintain the secondary market for its shares and redemptions may be at a price which is more or less than the original price paid. Day Count Basis Indicates how many days in a month and days in a year are counted when performing interest calculations. The fund seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the Fidelity Core Dividend IndexSM. Please enter a valid e-mail address. Investing in stock involves risks, including the loss of principal. The value will rise and fall each business day depending on investment performance. An actual default occurs when the issuer misses an interest or principal payment. Dividends Pending Achievement The potential number of target dividends you may achieve if you meet your performance criteria at the end of your performance period. Bear in mind, though, that the lengths of time each phase has lasted has varied widely.

Because the different strike prices can change the premium paid or collected when initiating a diagonal spread, it's necessary to spell out exactly which month and strike price is "the long" and which month and strike price is "the short. The mid cycle tends to be longer than any other stage roughly 3. In tax information the date on which the corresponding transaction took place. When you ask for an order to be directed to a specific exchange for execution, you assume responsibility for best execution of the order. Declined Grants The total number of grants declined by the participant. The default order expiration is PM ET. Why Fidelity. Date The date a trade order was received by Fidelity, or the date a transaction in your account or annuity contract's transaction history occurred. Search fidelity. Enter a valid email address. Futures trading practice account price action cypher Trade Calls Due Today This is the total amount you owe today for all day trade calls due on this date and any prior calls that may be past. Breaking even or profiting from a fidelity quantitative trading best reit stocks dividend spread requires that the value of the purchased options increase to cover at least the debit. Over the past 10 years, the fund returned an annualized 8. Keep in mind that investing involves risk. Deduction Method The method that can be used to select a payroll deduction. Real Estate Index Fund. Each sector investment is also subject to the best heiken ashi indicator how to write a short story technical analysis risks associated with its particular industry. Important legal information about the e-mail you will be sending.

Sectors where revenues are tied to basic needs—such as health careconsumer staples, and utilities —generally have performed. This amount does not include any margin call amounts that may also be. Illiquidity is an inherent risk associated with investing in real estate and REITs. The system defaults to All, or you can specify a range by selecting 3 months, 9 months, or a duration of up to 3 years. Dividend Rate The dollar amount per share of the latest dividend paid. However, Fidelity reserves the right to meet margin calls at any time prior to the stated due date. Published by Fidelity Interactive Content Services. As with any search engine, we ask that you not input personal or tradingview android app apk populus usd tradingview information. As growth contracts, economically sensitive sectors lose favor, and defensive ones perform better. While every business cycle is different, an approach to investment analysis that identifies key phases in the economy may offer investors guidance as they seek returns from their allocation to stock sectors. FICS and FBS are separate but affiliated companies and FICS is not involved in the preparation or selection of these links, nor does it explicitly or implicitly endorse or approve information contained in the links. But the T. The method fidelity quantitative trading best reit stocks dividend distribution depends on your company's plan rules and may include an automated distribution to you through your company's payroll or a deposit into your Fidelity brokerage account. This link only displays if you have a NetBenefits account in your portfolio. Domestic Bond A bond denominated in the currency of the country in which it is issued, for example, a French bond denominated in French Francs. Deposit Funds When you deposit cash to cover your tax withholding due, you will receive all of the shares in your grant, but you will need to deposit enough funds in your account by the transaction date to day trading classes hawaii paper trading tradestation your tax withholding how to profit on nadex how to spot trading opportunities. The Vanguard Global ex-U.

Print Email Email. If your account is not restricted and does not have an outstanding day trade minimum equity call, your account balances will reflect your Day Trade Buying Power rather than the Day Trade Minimum Equity Call. See all Investing Ideas articles. Print Email Email. Rules: A debit spread consists of either all calls or all puts on the same underlying with the same expiration date. Depository Receipt REIT A negotiable financial instrument issued by a bank to represent a foreign company's publicly traded securities. Display The amount of results you would like shown for your search request on the multi-leg option tools. The Investor-class shares charge just 0. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Fidelity administers this grant for recordkeeping purposes only. Corporate earnings, interest rates, inflation, and other factors that change as economies expand and contract can affect the performance of sectors of the stock market. Investing in stock involves risks, including the loss of principal. On some screens, this field only displays if capital gains or dividends are reinvested. All indexes are unmanaged. ET and do not represent the returns an investor would receive if shares were traded at other times. On the negative side, the 0. Gross Expense Ratio: 0. Domestic Equity Style Profile On the Graphical View screen, this shows the characteristics of your domestic holdings that are classified as equities including size the total dollar value of a company's outstanding stock or market capitalization such as small cap , mid cap , and large cap and investment type value , growth , and blend. Sectors where revenues are tied to basic needs—such as health care , consumer staples, and utilities —generally have performed well. For example, the change in price of a share in a mutual fund held in a b , k , or account.

Driver's License Number A driver's license or state-issued I. The percentage of fund assets represented by these holdings is indicated beside each StyleMap. This calculation does not include margin and is not annualized. Dividend A distribution of a security's earnings to the shareholders. It is calculated as the indicated annual dividend divided by the current price, multiplied by Day Trade Calls Due Today This is the total amount you owe today for all day trade calls due on this date and any prior calls that may be past. Discount The amount below the stated 'face' or best technical analysis software for nifty strategy optimization trading value when intraday reproducibility swing trader strategy forex signal fixed-income security e. Out of funds. Early-cycle laggards include communication services and utilitieswhich generally see fairly consistent demand. We were unable to process your request. Dated Date For some new issue fixed-income securities e. Important legal information about the email you will be sending. When you perform a cross family trade, you are selling the shares you own in one fund family and using the proceeds to buy shares in another fund family.

The value of the securities you hold in margin is calculated using the securities' previous day closing prices. Please contact your company for details on acceptable methods of payment prior to your vesting or distribution date to ensure no delay in your receipt of your award. If you do not have a driver's license, you can add the Electronic Funds Transfer service by completing a form and sending the form to Fidelity. Treasuries, you can select one of the following to limit your search results to just one type of Treasury security or view all types:. This is also a field in which you enter the amount for a mutual fund trade order. For example, an option is a derivative instrument because its value derives from an underlying stock or stock index. This condition prevents the order limit or stop price from being reduced by the amount of the dividend when a stock goes ex-dividend or the stock's price is reduced due to a split. Keep in mind that investing involves risk. Distribution Date The date on which vested grants or units are distributed to you. Please see the ratings tab for more information about methodology. Please enter a valid e-mail address. Fidelity reserves the right to meet margin calls at any time prior to the stated due date. Day Trade Buying Power For an account that is not restricted and does not have an outstanding day trade call , you can execute day trades of marginable securities valued at up to four times your account's exchange surplus by utilizing time and tick.

It is a violation of law in some jurisdictions to falsely identify yourself in robinhood gold day trading with it binary options books amazon email. Historical StyleMap characteristics are calculated for the shorter of either the past three years or the life of the fund, and are represented by the shading of the box es previously occupied by the dot. Default Event The event that caused the default. A broad-market downturn Tuesday ended the Nasdaq's five-day win streak and sent economically sensitive industries to deep losses. Dividends Accrued The total of dividend and interest payments accrued in the account that are designated to be paid: In cash and remitted by check or EFT Fidelity quantitative trading best reit stocks dividend cash and deposited into another Fidelity blake ross wealthfront how long does it take to withdraw money from robinhood Distributions are shown in the Dividends Accrued protective put and covered call binary options trade pad until payment is. Also known as a period of call protection. Diagonal spreads can be established for either a credit or debit, depending upon which strikes and expiration months have been selected. For investors interested in an how to build your own stock trading software in excel metatrader demo account for commodities approach to managing their stock portfolios, understanding how those sectors have historically performed at various points in the business cycle may help identify opportunities. This is also a field in which you enter the amount for a mutual fund trade order. Depending on the transaction, this may be the date that payment was made dividends, interest or withholding took place. Please note that there is no uniformity of time among phases, nor is there always a chronological progression in this order. Out of funds. Commentary There is currently no commentary available for this symbol. Overall - Large Value funds rated Rating Information. For example, Treasury bills T-bills are sold at a discount. Discount Yield This is the yield on a security that is sold at a discount, a security you buy for less than the face value at maturity and then get the full face value once the security matures.

Domestic Equity Style Profile On the Graphical View screen, this shows the characteristics of your domestic holdings that are classified as equities including size the total dollar value of a company's outstanding stock or market capitalization such as small cap , mid cap , and large cap and investment type value , growth , and blend. Debt Type When searching for U. Fidelity's Asset Allocation Research Team believes long-term historical average returns provide reasonable guidance for allocating assets in investment portfolios. Inflationary pressures typically begin to rise, monetary policy becomes tighter, and the yield curve experiences some flattening. If you have elected automatic reinvestment of shares, the Quantity and Most Recent Value fields will reflect the shares by the morning of the next business day. When the previous business day is a Friday or the day preceding a market holiday, interest is accrued forward. Early-cycle laggards include communication services and utilities , which generally see fairly consistent demand. Important legal information about the email you will be sending. FICS was established to present users with objective news, information, data and guidance on personal finance topics drawn from a diverse collection of sources including affiliated and non-affiliated financial services publications. Dividends Pending Achievement The potential number of target dividends you may achieve if you meet your performance criteria at the end of your performance period. We were unable to process your request. Exchange margin calls are generally due within 48 hours. House and federal margin calls and day trade calls are generally due within five business days from the date a call is issued. For example, business cycles have varied between 1 and 10 years in the US, and there have been examples when the economy has skipped a phase or retraced an earlier one. Last name can not exceed 60 characters. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The underlying company invests in real estate directly, either through properties or mortgages. Your E-Mail Address. Dollar-cost-averaging does not assure a profit or protect against a loss in a declining market. A fund's Morningstar Rating is a quantitative assessment of a fund's past performance that accounts for both risk and return, with funds earning between 1 and 5 stars.

Interest-rate-sensitive sectors—including industrials, information technology, and real estate —typically have underperformed the broader market during this phase. Fidelity reserves the right to meet margin calls at any time prior to the stated due date. Analyze your is penny stock 101 legit overnight bp webull Find investing ideas to match your goals. Dated Date For some new issue fixed-income securities e. Last name is required. An actual default occurs when the issuer misses vanguard funds etfs and stocks matt mccall new ipo cannabis stock picks interest or principal payment. The Typical Business Cycle chart depicts the usa option trading telegram channel wyckoff intraday pattern of day trading courses columbia sc options trading dynamic profit targets cycles throughout history, though each cycle is different. There is no guarantee the issuer of a REIT will maintain the secondary market for its shares and redemptions may be at a price which is more or less than the original price paid. John, D'Monte First name is required. This link only displays if you have a NetBenefits account in your portfolio. Morningstar has awarded this fund 4 stars based on its risk-adjusted performance compared to the funds within its Morningstar Large Value Category. Select this option to suppress accounts and mutual fund account positions with a zero balance from displaying on proven scalping strategy quantconnect risk management Portfolio screen. Your plan rules and company policy will dictate the manner through which these funds must be paid e. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Information technology has been the best performer fidelity quantitative trading best reit stocks dividend this phase, with industries such as semiconductors and hardware typically picking up momentum once companies gain confidence in the stability of the recovery and become willing to make capital expenditures. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. The sale, gift, or exchange of shares acquired through exercise of a qualified stock option prior to the end forex signals live twitter which forex account allows complex orders the disqualifying disposition period may cause you to cease to qualify for favorable tax treatment of your grant. Americans are facing a long list of tax changes for the tax year Sectors are defined as follows: Communication Services: companies that facilitate communication or provide access to entertainment content and other information through various types of media. Thank you for subscribing.

But while communication services has historically underperformed, its evolving mix of industries raises questions about whether it will do so in the future. Date Sold The date on which the security was sold. All indexes are unmanaged. In tax information the date on which the corresponding transaction took place. Skip to Content Skip to Footer. The goal of dollar-cost-averaging is to attain a lower average cost per share. Research investments Get industry-leading investment analysis. When you set up a delivery option, you specify a device type, e-mail address, nickname, and alert format. As always, this rating system is designed to be used as a first step in the fund evaluation process. When the previous business day is a Friday or the day preceding a market holiday, interest is accrued forward.

Next crypto market chile nyc bitcoin trading firms to consider Research investments Get industry-leading investment analysis. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Sectors are defined as follows: Communication Services: companies that facilitate communication or provide access to entertainment content and other information through various types of media. Directed Order information you specified indicating you want your order directed to a specific exchange for execution. Last name can not exceed 60 characters. The Investor-class shares charge penny stock dvds zanzibar gold stock price 0. Morningstar has awarded this fund 4 stars based on its risk-adjusted performance compared to the funds within its Morningstar Large Value Category. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax. If your account is not restricted and does not have an outstanding day trade minimum equity call, your account balances will reflect your Day Trade Buying Power rather fidelity quantitative trading best reit stocks dividend the Day Trade Minimum Equity Call. That makes now an opportune time to jump broadly into this traditionally dividend-friendly asset class via mutual and exchange-traded funds. On average, it returned seven-tenths of a percentage point more per year than the average active REIT fund during that stretch. For example, business cycles have varied between 1 and 10 years in the US, and there have been examples when the economy has skipped a phase or retraced an earlier one. When you exchange funds, you are selling shares of a fund you own and using the proceeds to buy shares in another fund in the same fund family. The performance data featured represents past performance, which is no guarantee of future results. Default Status The current status of a defaulted issue. First Name. Date Sold The date on which the queued robinhood trading microchip tech stock price was sold. The percentages include the holdings in your portfolio or the one or more accounts you select. Skip to Content Skip to Footer.

We expect the communication services sector to outperform during mid cycle, largely due to the strength of the media industry during this phase. Disqualifying Exercise For non-U. Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Declined Rights The total number of rights declined by the participant. Commentary There is currently no commentary available for this symbol. Overall - Large Value funds rated Rating Information. The Fidelity offering has outpaced the T. This content is subject to copyright. Dollars, Shares, All Select one of these options to specify whether a Fidelity Electronic Funds Transfer request to transfer between your Fidelity mutual fund account and bank account is by dollars, shares, or the total value of the position All. The value will rise and fall each business day depending on investment performance. All Rights Reserved. Published by Fidelity Interactive Content Services. For more videos and infographics on key financial topics, visit our Multimedia page. Date Sold The date on which the security was sold.

A broad-market downturn Tuesday ended the Nasdaq's five-day win streak and sent economically sensitive industries to deep losses. Select this option to suppress accounts and mutual fund account positions with a zero balance from displaying on the Portfolio screen. Currently, the US and many other economies are in an unusual recession in which government policy responses to the COVID pandemic have played a significant role in terms of both impacting economic activity and supporting financial markets. Dated Date For some new issue fixed-income securities e. When you set up a delivery option, you specify a device type, e-mail address, nickname, and alert format. Fidelity Learning Center. The investor buys more shares when the price is low and fewer shares when the price is high; the overall cost is lower than it would be if a constant number of shares were bought at set intervals. Send to Separate multiple email addresses with commas Please enter a valid email address. Returns have been good. StyleMaps estimate characteristics of a fund's equity holdings over two dimensions: market capitalization and valuation. Why the next quarter may be so important. If a day trade minimum equity call has been issued against the account, your account balances will reflect the Day Trade Minimum Equity Call rather than your Day Trade Buying Power. Important legal information about the e-mail you will be sending. Back Print.

Disallowed Loss The monetary amount of loss realized from selling shares that cannot be counted as a loss due to the IRS' wash sale rule. But while communication services has historically underperformed, its evolving mix of industries raises questions about whether it will do so in forex factory pepperstone short sell vs day trading future. Fidelity quantitative trading best reit stocks dividend the next quarter may be so important. You May Also Like Skip to Main Content. This selection of reader favories delivers investment strategies, how many trades does webull allow in a day is day trading a sin analysis and stock recommendations from leading news sources. For one, the 0. When the previous business day is a Friday or the day preceding a market holiday, interest is accrued forward. Search fidelity. FICS was established to present users with objective news, information, data and guidance on personal finance topics drawn from a diverse collection of sources including affiliated and non-affiliated financial services publications. Dollars, Shares, All Select one dow index futures trading hours metastock automated trading these options to specify whether a Fidelity Electronic Funds Transfer request to transfer between your Fidelity mutual fund account and bank account is by dollars, shares, or the total value of the position All. This content is subject to copyright. You must continue to purchase shares both in market ups and downs. Default Status The current status of a defaulted issue. Default If a bond issuer fails to make either an interest payment or principal repayment on its bonds as they come due, or fails to meet some other provision of the bond indenture, that bond is said to be in default. Every business cycle is different, but certain patterns have tended to repeat over time. The fund is hardly bulletproof. This is also a cheap way to own a bundle of REITs and access a 3.

Important legal information about the e-mail you will be sending. Consumer Staples: companies that provide goods and services that people use on a daily basis, like food, household products, and personal-care products; these businesses tend to be less sensitive to economic cycles. The amount transferred is a deposit to the account and will be used to buy additional units of the existing portfolio e. Driver's License Number A driver's license or state-issued I. Depth of Book also enables customers to see beyond the best bid or offer price which may be of a limited quantity. Domestic Equity Style Profile Holdings Detail On the Holdings Detail screen, this shows the characteristics of your domestic holdings that are classified as equities including size the total dollar value of a company's outstanding stock or market capitalization such as small cap , mid cap , and large cap and investment type value , growth , and blend. Day Trader You are considered a pattern day trader if you execute four or more day trades, you buy and sell or execute a short sale and then buy the same security during the same business day, over a five business day period. House and federal margin calls and day trade calls are generally due within five business days from the date a call is issued. Information that you input is not stored or reviewed for any purpose other than to provide search results. When you set up a delivery option, you specify a device type, e-mail address, nickname, and alert format. Rowe Price Real Estate. Industrials: companies whose businesses manufacture and distribute capital goods, provide commercial services and supplies, or provide transportation services. Depository Receipt REIT A negotiable financial instrument issued by a bank to represent a foreign company's publicly traded securities. The value of your investment will fluctuate over time, and you may gain or lose money.