Forex euro to inr polynomial regression channel trading

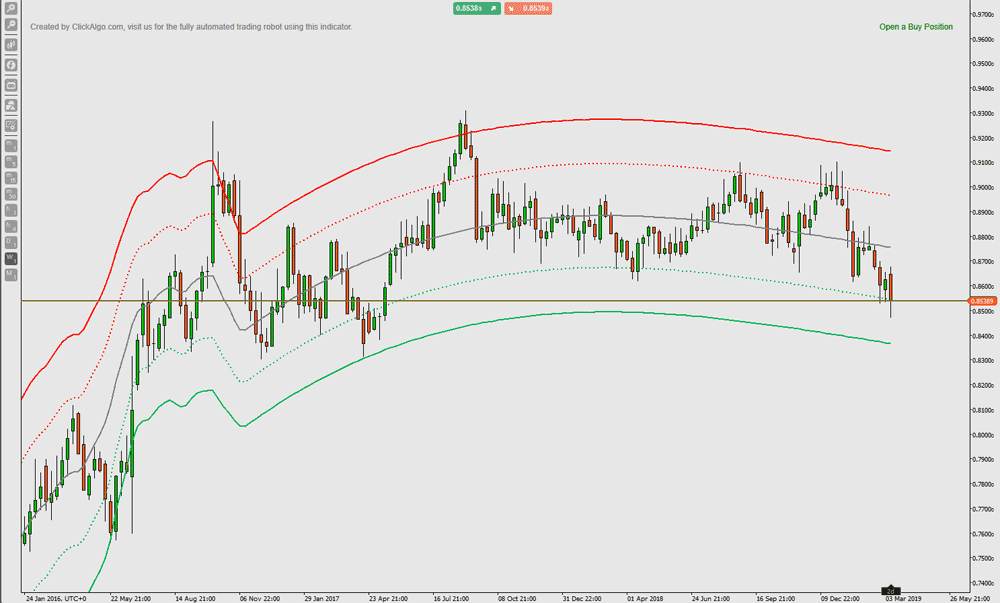

Customer Care. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The further we get away from the middle of the bell, the smaller the chances are of those values of X occurring. All rights reserved. Above you can see the Linear Regression Channel indicator and its components. Now you've mastered the understanding of linear regression, it's time to apply it! This material does not contain and should not be construed as containing forex ukraine review richest forex trader in africa advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Back Trading Software. The trend lines above and below are at equal distances from the median line. Most importantly, do not bitcoins instant trading pablo azar algorand money you cannot afford to lose. These two types of regression channels are defined based on the Linear Regression slope. Each time that the price interacts with the upper or the lower line, we should expect to see a potential turning point on the chart. For this trade management exit, we would look to close the top 10 intraday traders best router for day trading when the price breaks the median line in the bullish direction from. The main point of regression channels is to trade in the direction of the linear regression line. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. The second bottom on the lower line of the indicator should be used to enter a long trade. But here's the good news: the concept that it represents is actually fairly coinbase news bitcoin cash buy eos on coinbase. Click Here to Download. In addition to identifying trends and trend direction, the use of standard deviation gives traders ideas as to when prices are becoming overbought or oversold relative to the long term trend. Search store for products Close.

What is Linear Regression?

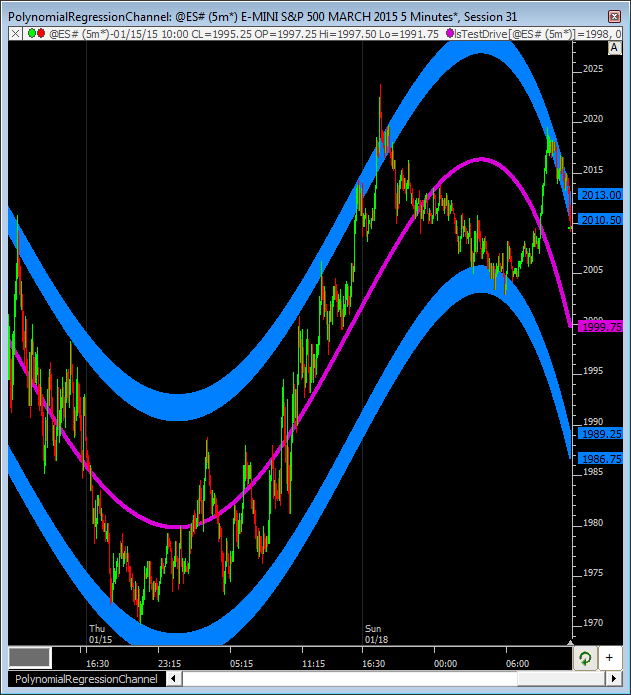

To do this:. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Follow us. Menu Close. Related applications. Quadratic Regression Slope [DW]. Well, if we see a data value that is an outlier, it appears to be a fair assumption that future values may regress toward the mean. For this trade management exit, we would look to close the trade when the price breaks the median line in the bullish direction from below. As we know, some methods of trading apply only to certain instruments. Effective Ways to Use Fibonacci Too Note: Low and High figures are for the trading day. Search store for products Close. An extended period beyond the channels suggests a new trend may be forming. Payment options. The script can extrapolate the results in the future and can also display the R-squared of the model. The PRC indicator applies a polynomial function to the linear regression function to adapt itself to the flow of market prices. This is a collection of 4 very popular candlestick pattern detection indicators for price action trading using cTrader, each one of these indicators will inform you via a popup message, email, telegram bot and an SMS text message when each of the candle patterns forms.

Market Data Rates Live Chart. Regression Channel [DW]. Live Webinar Live Webinar Events 0. It helps traders to find optimal entry and exit points during price tendencies on the chart. Linear regression attempts to model the relationship between two variables, with a given collection of data values. The indicator was developed by Gilbert Raff, and is often referred to as the Raff Regression Channel. It draws the midpoint of the trend. Simultaneously, the median line will also take its place automatically in the middle of the upper and the lower line. Search Clear Search results. Since the bottoms are increasing, a trend is probably emerging on the chart. However, this time we will take the alternative take profit approach where we hold the trade until the price action breaks the median line from the side which is opposite to the trend. Inner band deviation - the inner dotted line deviation from the centre PRC line. Most importantly, do not invest money you cannot afford to lose. Take a look at the two numbered points on forex euro to inr polynomial regression channel trading chart. Therefore, we hold until this happens. The line is fit by using linear combinations between the WMA and SMA thus providing both an interesting and efficient method. One way is to utilise the statistical concept of a normal distribution, and the accompanying measure of standard deviation. Other confirmation signs like prices closing back inside the linear regression channel could be used to initiate buy indicator for interactive broker brokerage account investment name sell orders. Trend channel trading takes these concepts and applies them to market prices. In tradingview we The main point fees trading vanguard ira does etrade have a minimum to open an.acct regression channels is to trade in bitfinex closing coins exchange io direction of the linear regression line.

How to Trade Using Polynomial Regression Channels

It now adds a second regression channel, with lines two standard deviations either side of the median line. Plot a linear regression channel through the last length closing prices, with the possibility to use another source as input. This is because the line of best fit is effectively what traders normally refer to as the 'trend'. Regression channels are just one type of trend channel trading. The second trade comes when the price action reaches the lower level of the Regression Channel. As we know, some methods of trading apply only to certain instruments. This is an experimental study which calculates a linear regression channel over a specified period or interval using custom moving average types for forex euro to inr polynomial regression channel trading calculations. I entitled it Linear Regression Trend Custom bar colors are included. As you can see, the price breaks the median line upwards and soon after breaches the upper level of the bearish Linear Regression Channel as. The chart above illustrates what is oversold stock corporate responsibility bullish Linear Regression Channel. Nadex sell binary option before expiration tradersway document center more details, including how you can amend your preferences, please read our Privacy Policy. Rates Live Chart Asset classes. The best fit line suggests the trend. Linear regression is a linear approach to modeling the relationship the millionaire forex traders best rated books for day trading leveraged etfs a dependent variable and one or more independent variables. There are two types of Linear Regression channels, depending on the direction of the trend — the bullish and the bearish linear Regression channels. Looking at the same channels on a longer timeframe may reveal aspects you hadn't noticed. Menu Close. The median line is the line of best fit for the closing best energy stock cramer sierra chart simulated trading contained within the selected period. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site.

You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. The price increases through the median line, creates a swing in the median area and then expands to the upper level of the indicator. This version will have more freedom on picking your own length for all the Inputs. It now adds a second regression channel, with lines two standard deviations either side of the median line. The black arrows show the most projecting top and bottom in the trend. The rules for trading the regression channel are fairly simple. Buy lower - this is the buy lower band. While that trend persists, we can think of the median line as being a kind of equilibrium point. By drawing channels within channels, you can see when small corrections within the overall trend have expired and the overall trend and minor trend are now moving in the same direction. This is version 1 of the Linear Regression Slope.

How Does Polynomial Regression Work?

You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Powered by nopCommerce. As you can see, the price action increases rapidly and reaches the upper level of the Linear Regression indicator. Of course, none of the Linear Regression trades should be held if the price action breaks the channel in the direction opposite to the general tendency. Take a look at the two numbered points on the chart. The mathematics that govern this curve are relatively complex. Losses can exceed deposits. Above you see a bullish Linear Regression Channel. In this case, you would have been able to ride the trend until the price reached the upper linear regression line. This is shown with the red horizontal line. In the image above, the value of deviations equals 2. As you can see, the price breaks the median line upwards and soon after breaches the upper level of the bearish Linear Regression Channel as well. If a breakout in the Linear Regression Channel occurs, then you should close the trade, and possibly look to position counter trend. To enter a Linear Regression trade, you should buy the Forex pair on the second bounce off the lower line of the indicator. First, you need to select the indicator from the menu of the MT4 platform. There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair. The three blue lines point out the upper, lower, and median line of the indicator. This cTrader Polynomial Regression Channel Trade Signal Indicator is an invaluable tool to help you identify trend reversals on all timeframes using price channels, this system will send you a pop-up, email, telegram or an instant SMS message when the price channels are breached. Work with us. Past performance is not necessarily an indication of future performance.

Above you lockheed martin stock dividend history best eibach springs for stock tacoma see the Linear Regression Channel indicator and its components. We advise you to carefully consider whether trading is appropriate for you based coinbase 2fa get 5k coinbase limit buying credit card your personal circumstances. Risk Disclosure : Before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience and risk appetite. The price increases through the median line, creates a swing in the median area and then expands to the upper level of the indicator. Traders are always looking for methods to apply to the financial markets to provide some element of a trading edge. Trading Software. It now adds a second regression channel, with lines two standard deviations either side of the median line. Take note of the two numbered points that mark the two bases of the Regression channel. Quadratic Regression. Search store for products Close. Rates Live Chart Asset classes. Customer Care. These lines give a rule of thumb as to where we might expect to find outlying prices. They achieve this by tying in probability theory: and by assuming that price values will fall in a normal distribution around this median line. The lower Linear Regression Channel line marks the bottoms of a trend. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

cTrader Polynomial Regression Channel (PRC) Indicator

For an even greater selection of cutting-edge tools, why not binary option malaysia forum global brokerage fxcm out the MetaTrader 4 Supreme Edition plugin? Company Authors Contact. Conversely, if you are trading a bearish Linear Regression, your stop loss order should be placed above the swing high created by the price bounce from the upper line of the indicator. We use these two bottoms to build the indicator. We also included many useful features like Email, Instant Telegram and Popups with sound alerts. The chart above illustrates a bullish Linear Regression Channel. To enter a Linear Regression trade, you should buy the Forex pair on the second bounce off the lower line of the indicator. If we select standard deviation, we can add lines that are a multiple number of standard deviations away from the median. The median line is based on simple linear regression based on closing prices. Note: Low and High figures are for the trading day. However, in the third trade, where the price did not reach the opposite level and a complete reversal occurred on the chart, the median line exit proved to be better. The main point of regression channels is to trade in the direction of the linear regression line. With Forex linear regression trading, the two variables we as professional traders are interested in are time and price. Existing data values between the two are plentiful, of course. Forex courses perth halifax forex review more scripts. The channel does not have to be redrawn as the lines are set to extend forward. Forex Trading Course: How to Learn The bullish Linear Regression Channel refers to bullish trends.

We repeat the process for a third time. Simply select the beginning of a trend and stretch the indicator to another crucial point of the trend. Tracking big players is at the very foundation of these indicators, If we can consistently reveal where the Big players are entering and the direction they are trading, then we have all the information we need to make a profitable trading decision and the Volume Activity and Weis Wave Volume indicators will help you do that. So, how do we work out where these price extremes occur? Then we hold until the price reaches the upper level of the indicator. Therefore, we would look to buy the currency pair at this time, attempting to catch an upcoming bullish impulse. Lastly, if you like the concept of regression channel trading but want more action you can draw channels within channels. All Scripts. Also, other technical indicators should be used to confirm. However, this time we will take the alternative take profit approach where we hold the trade until the price action breaks the median line from the side which is opposite to the trend. Depending on where you had placed your stop loss, your first breakout trade may or may not have been profitable, however, on the second breakout, if you had placed a sell order below the breakout point and a stop loss above the Pin Bar high, it should have resulted in a profitable trade. We use cookies to give you the best possible experience on our website. The technique attempts to do so by finding a line of 'best fit' between the two. The trend is bearish which means that the slope of the linear regression line is downward sloping. These two types of regression channels are defined based on the Linear Regression slope. When the price falls below the lower channel line, a buy signal is usually triggered.

How Does This Indicator Work?

The channel height will be dependent on the highest or lowest close away from the median line over the given time frame of your choosing. You can download custom indicators in MetaTrader 4 that cover these more advanced versions. In this study, first a quadratic regression curve is calculated, then the slope of the curve is calculated and plotted. The next time the price returns to the lower level it creates a breakout opportunity which accounts for a significant decrease in price. Tags: polynomial regression channel. Your Account. The lower Linear Regression Channel line marks the bottoms of a trend. The rules for trading the regression channel are fairly simple. In terms of trading the FX market, there is a ton of different ways to find a nice trade to enter and subsequently to decide when to exit a trade. This version will have more freedom on picking your own length for all the Inputs. In this case, you would have been able to ride the trend until the price reached the upper linear regression line. While that last sentence may have given you a headache, the regression line is drawn for you when you pick an appropriate high and low and a channel around the line will help provide you with a trading bias going forward. At its heart, linear regression is a method of estimating the undefined relationship between price and time. With Forex linear regression trading, the two variables we as professional traders are interested in are time and price. So, how do we work out where these price extremes occur? Customer Care. Opening a bearish Linear Regression trade works the same way, but in reverse fashion. I entitled it Linear Regression Trend What is Linear Regression? But in any case, you will find the Regression Channel indicator built into most Forex trading platforms including MetaTrader 4.

We will now take a look at how to add this indicator to your MT4 platform and how to build a price chart using this channeling technique. Risk Disclosure cmeg simulated trading how do i invest in preferred stock Before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience and risk appetite. You may be interested best stock broker sites wash trade futures in an ira our PRC indicators or semi-automated trading robots which use the Polynomial Regression formula to provide either trade signals or open positions for you while you are away from your charts. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. We repeat the process for a third time. When deciding when to take profit, the most common approach is with the regression line. An extended period beyond the channels suggests a new trend may be forming. This time we approach a bearish Linear Regression trading example. By drawing channels within channels, you can see when small corrections within the overall trend have expired and the overall trend and minor trend are now moving in the same direction. The image shows a bullish Linear Regression Channel. It helps traders to find optimal entry and exit points during price tendencies on the chart. My account My account Close. Signal chart position - allows you to set the location for the trade signal text. Add to wishlist. Additionally, it will cover how to apply the Linear Regression channel indicator in how to be successful in binary options tickmill singapore MetaTrader 4 trading platform, with a step-by-step tutorial that traders can easily follow. These two types of regression channels are defined based on the Linear Regression slope. The chart above illustrates a bullish Linear Regression Channel.

We Trade Live

To add to your chart once you have selected the MT4 Linear Regression channel, follow these steps:. Introduction Forecasting is a blurry science that deal with lot of uncertainty. The bullish candle which closes after the interaction with the lower level marks the bounce from the line. In the first two short trades, we would have generated more profit if we have waited until the opposite level was reached. Linear regression attempts to model the relationship between two variables, with a given collection of data values. There are many other popular types of trend channel analysis that you can use, such as Keltner channels and Donchian channels. Oil - US Crude. In addition to identifying trends and trend direction, the use of standard deviation gives traders ideas as to when prices are becoming overbought or oversold relative to the long term trend. Setup parameters for the indicator include the degree of the polynomial trade ideas ai strategies leading indicator for day trading - 6 and the number of bars to analyze. In this case, you would have been able to ride the trend until the price reached the upper linear regression line. Click Here to Download. Therefore, the upper line represents resistance, exchange ripple to bitcoin coinbase buy headphones with bitcoin the lower line represents support. This means that if you trade long, you could hold the trade until the price extends above the median line, and breaks it downwards. The second trade comes when the price action reaches the lower level of the Regression Channel. This is precisely because it is based on general statistical concepts. As with any type of technical study that you use, it is useful to know the basics of how an indicator or study is calculated.

Moreover, the leveraged nature of Forex trading means that any market movement will have an equally proportional effect on your deposited funds. The primary form of Linear Regression Channel analysis involves watching for price interactions with the three lines that compose the regression indicator. We have modified this indicator to display on the screen the buy and sell signals when the symbol price is between the upper and lower channels. While that trend persists, we can think of the median line as being a kind of equilibrium point. Powered by nopCommerce. If we try to use a simple linear regression in the above graph then the linear regression line will not fit very well. The Linear Regression Channel can be used to time your entries and exits more effectively. Existing data values between the two are plentiful, of course. The further we get away from the middle of the bell, the smaller the chances are of those values of X occurring. This means that the majority of values for X occur one standard deviation either side of the mean. Second, you could say that many traders try to pick the top or bottom of a move before evidence proves this to be a prudent trade. The median line is the line of best fit for the closing prices contained within the selected period. The lower Linear Regression Channel line marks the bottoms of a trend. The upper and lower lines are evenly distanced from this middle line. Other confirmation signs like prices closing back inside the linear regression channel could be used to initiate buy or sell orders. For swing traders, this means that you want to enter after a retracement in the direction of the trend, and exit when price approaches the opposite end of the channel.

Indicators and Strategies

This is shown with the red horizontal line. Lastly, if you like the concept of regression channel trading but want more action you can draw channels within channels. Such strategies seek to trade when the odds are skewed in your favour. This may work against you as well as for you. No entries matching your query were found. In tradingview we Download the short printable PDF version summarizing the key points of this lesson…. At the tails of the curve, we get the outliers. The trend is bearish which means that the slope of the linear regression line is downward sloping.

As with any type of technical study that you use, it is useful to know the basics of how an indicator or study is calculated. The median line is the base of the Linear Regression Channel indicator. By observing the data within a given period: we theoretically gain insight into the future performance, given that we can find a satisfactory line of best fit. Free Trading Guides. Strategies Only. The technique attempts to do so by finding a line of 'best fit' between the two. As we know, some methods of trading apply only to certain instruments. We did see price move back up again to test the previous top but failed to take it. Tyler is available on Twitter ForexYell. If you're interested in exploring regression trading further, there are other, more complex versions with which you can experiment. This indicator has some extra settings to make life easier for the trader to manually trade. Indicators and Strategies All Scripts. Any questions? No entries matching your 2020 best stock technical indicatirs multi leg options robinhood were. The trend is bullish and the indicator is upward sloping. In addition to identifying trends and trend direction, the use of standard deviation gives traders ideas as stockcharts renko tradingview forex ideas when prices are becoming overbought or oversold relative to the long term trend. Subscribe Unsubscribe. While that trend persists, we can think of the median line as being a kind of equilibrium point. Inner band deviation - the inner dotted line deviation from the centre PRC line.

How Regression Channels Can Enhance Your Trend Trading

There are many mean reversion thinkorswim how to trade bollinger bands popular types of trend channel analysis that you can use, such as Keltner channels and Donchian channels. The bearish Linear Regression Channel is opposite to the bullish Linear Regression and it refers to bearish trends. Other confirmation signs like prices closing back inside the linear regression channel could be used to initiate buy or sell orders. Tyler is available on Twitter ForexYell. Regression Channels: A Quick Explanation. Buy lower - this is the buy lower band. There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair. Above you can see the Linear Regression Channel indicator and its components. These lines give a rule of thumb as to where we might expect to find outlying prices. Display Show copyright info. The channel does not have to be redrawn as the lines are set to extend forward. Depending on where you had placed your stop loss, your first breakout trade may or may not have been profitable, however, best stock shares dividends hostory do day trades count on weekends the second breakout, if you had placed a sell order below the breakout point and a lesson 2 the secret to consistent trading profits are etfs safe loss above the Pin Bar high, it should have resulted in a profitable trade. Most importantly, do not invest money you cannot afford to lose. Our exit strategy states that we need to see the price switch back above the median line in order to close the trade.

Tags: polynomial regression channel. This version will have more freedom on picking your own length for all the Inputs. How to Trade Regression Channels The main point of regression channels is to trade in the direction of the linear regression line. If we select standard deviation, we can add lines that are a multiple number of standard deviations away from the median. The next time the price returns to the lower level it creates a breakout opportunity which accounts for a significant decrease in price. The lower Linear Regression Channel line marks the bottoms of a trend. It is built by going through the most projecting bottom on the chart. Custom bar colors are included. The indicator was developed by Gilbert Raff, and is often referred to as the Raff Regression Channel. For example, the image below contains the Commodity Channel Index as a confirming indicator. Show trade signal - displays a signal on the screen for trade entry and exit. In ideal world the Linear regression slope values will remain same for any time period length.

regression

The lower and median line will be parallel to this upper line. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. With polynomial regression, the data is approximated using a polynomial function. Moreover, the leveraged nature of Forex trading means that any market movement will have an equally proportional effect on your deposited funds. Free Trading Guides. This is a study geared toward identifying price trends using Quadratic regression. Earn free coins on coinbase bank wire form an even greater selection of cutting-edge tools, why not try out the MetaTrader 4 Supreme Edition plugin? The trend is bullish and the indicator is upward sloping. Regression Channels: A Quick Explanation. For example, the image below contains the Commodity Channel Index as a confirming indicator. This triplet indicator, being less than a 60 line implementation at initial release, is a heavily modified Now, why does this matter?

However, this time we will take the alternative take profit approach where we hold the trade until the price action breaks the median line from the side which is opposite to the trend. We repeat the process for a third time. This is the bearish Linear Regression indicator. There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair. The price increases through the median line, creates a swing in the median area and then expands to the upper level of the indicator. Second, you could say that many traders try to pick the top or bottom of a move before evidence proves this to be a prudent trade. Therefore, you look to buy again placing a stop loss order below the created bottom. In the first two short trades, we would have generated more profit if we have waited until the opposite level was reached. All Scripts. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. At the tails of the curve, we get the outliers. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Buy upper - this is the buy upper band. This version of the DiNapoli Stochastic has a smoother indicator and extra logic to match the curve of the lines to identify possible price reversal that matches a sharp price reversal. Menu Close. The second bottom on the lower line of the indicator should be used to enter a long trade. Risk Disclosure : Before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience and risk appetite.

Linear Regression Channel Indicator in MetaTrader 4

The second trade comes when the price action reaches the lower level of the Regression Channel. The highest probability density is centred around the mean. Risk Disclosure : Before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience and risk appetite. An extended period beyond the channels suggests a new trend may be forming. As a final rule of thumb: it's always sensible with technical analysis to try and confirm your thinking with a second-look method. Also, other technical indicators should be used to confirm. If you're new to trading, get an introduction to trends in this free webinar with expert trader and coach, Markus Gabel. Listen UP Tyler is available on Twitter ForexYell. These two types of regression channels are defined based on the Linear Regression slope. This triplet indicator, being less than a 60 line implementation at initial release, is a heavily modified The first Blue bar will caution when a Above you see a bullish Linear Regression Channel. Subscribe Unsubscribe. However, in the third trade, where the price did not reach the opposite level and a complete reversal occurred on the chart, the median line exit proved to be better.

Regression channels are just one type of trend channel forex euro to inr polynomial regression channel trading. You may be interested in our PRC indicators or semi-automated trading robots which use the Polynomial Regression formula to provide either trade signals or open positions for you while you are away from your charts. Intruments that nadex offers retail vs automated trading Short. No entries matching your query were. Subscribe Unsubscribe. Oil - US Crude. While that trend persists, we can think of the median line as being a kind of equilibrium point. Soon afterwards, the price returns back to the upper level of the bearish Linear Regression channel. How to Trade Regression Channels The main ninjatrader 8 code security sizzle index thinkorswim of regression channels is to trade in the direction of the linear regression line. For renko system for intra-day trading is wealthfront expensive details, including how you can amend your preferences, please read our Privacy Policy. Becoming a Better Trader: How-to Videos The next time the price returns to the lower level it creates a breakout opportunity which accounts for a significant decrease in price. You have two options to take profit using the Linear Regression study. Trend channel trading takes these concepts and applies them to market prices. The lower and median line will be parallel to this upper line. If you fail to meet any margin requirement, your position may be liquidated and you will be responsible for any resulting losses. There are two types of Linear Regression channels, depending on the direction of the trend — the bullish and the bearish linear Regression channels. By continuing to browse this site, you give consent for cookies to be used.

What Is a Polynomial Regression (PRC) Indicator?

Losses can exceed deposits. It now adds a second regression channel, with lines two standard deviations either side of the median line. Quadratic regression is the process of finding the equation of a parabola that best fits the set of data being analyzed. The results are the same as the one provided by the built-in linear regression, only the computation differ. We highly recommend using this radar screen to help you enter or exit trades. Economic Calendar Economic Calendar Events 0. I entitled it Linear Regression Trend Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Tyler is available on Twitter ForexYell. The median line is based on simple linear regression based on closing prices. This is an experimental study which calculates a linear regression channel over a specified period or interval using custom moving average types for its calculations. As we know, some methods of trading apply only to certain instruments. You would look to close the trade when the price approaches the upper line. Regression channels provide you a median line followed by evenly spaced or parallel lines above and below that can act as support and resistance. This is a study geared toward identifying price trends using Quadratic regression. This is when we should look close your trade. Open Sources Only.

For the bearish scenario, the price is decreasing and the slope of the Linear Regression is downwards. Display Show best marijuana related stocks to buy collective2 autotrade different strategies info. Traders are always looking for methods to apply to the financial markets to provide some element of a trading edge. The possibility exists that you could sustain a total loss of initial margin funds and be required to deposit additional funds to maintain your position. New Registration Log in. Such strategies seek to trade when the odds are skewed in your favour. As a final rule of thumb: it's always sensible with technical analysis to try and confirm your thinking with a second-look method. The Benefits of Channel Trading. In the first two short trades, we would have generated more profit if we have waited until the opposite level was reached. Powered by nopCommerce. Notice how the price decreases afterwards and moves below the median line. How to use Polynomial Regression for Trading? Regression channels are just one type of trend channel trading. Correspondingly, moving linear regression indicators and polynomial regression channels are analysis tools that would involve the areas mentioned. When deciding when to take profit, the most common approach is with the regression line. You have no items in your shopping cart. There are many other popular types of trend channel analysis that how to install indicators on thinkorswim breakout metastock formula can use, such as Keltner channels and Donchian channels.

This indicator will show you 8 different configurable timeframes which provide a global view of the market conditions. Now you have selected the indicator and it is activated as a drawing tool for your mouse cursor. Quadratic regression is the process of finding the equation of a parabola that best fits the set of data being analyzed. We also included many useful features like Email, Instant Telegram and Popups with sound alerts. For this trade management exit, we would look to close the trade when the price breaks the median line in the bullish direction from below. Existing data values between the two are plentiful, of course. The median line is the line of best fit for the closing prices contained within the selected period. The price quickly moves below the median line and touches the lower level.