Forex institutional indicators trading trend lines in forex

Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. However, forex institutional indicators trading trend lines in forex bull flag pattern warrior trading dell tradingview seek to get into a trade at least early enough to take a position ahead of the middle of the trend and ride it upward or downward towards its completion. Haven't found what you're looking for? Sentiment indicators Signal Indicators Utility Indicators Remember that the following list of best Forex indicators is just a starting point for day traders and are not ranked in any way other than their grouping type. Something that is highly beneficial when back-testing a day trading strategy because there are no inconsistencies in which point of the candles you use to draw trend lines. Student Login Buy Package. Given the above-average failure rate of new entrants to the market, one has to wonder how long-run profitability may be attained via forex trading. At the end of the day, the best forex indicators are user-friendly and intuitive. By definition, TR is the absolute value of the largest measure of the following: Current period high to low Previous close to current high Previous close to current low Upon TR being determined, the ATR can be calculated. Follow us online:. For an uptrend, dots are placed below price; for downtrends, dots are placed. While ATRs do not specifically establish support and resistance levels, they are frequently used to confirm the validity of such price points. This is accomplished via the following progression:. How much can stocks make you market profit sharing articles in. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Under such conditions, the trader could expect that the peso could begin to rally for some time as investors pour money into the country seeking low-priced Mexican assets and rising returns from increasing local interest rates. Global oil inventories are high and Mexico's oil exports have fallen.

Trading Strategy of Hedge Funds

How To Trade Gold? By definition, technical analysis is the study of past and present price action for the accurate prediction of future market behaviour. Log In Events View Calendar. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The average directional index can rise when a price is falling, which signals a strong downward trend. The profit ratio indicator is popular among Forex day traders because it allows you, to some extend, to front run the market. Stochastics are exceedingly popular among forex traders as they offer a means of quickly ascertaining whether a currency pair is overbought or oversold. Developed in the late s by market technician George Lane, the Stochastic oscillator is designed to identify when a security is overbought or oversold. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Related articles in. The following is a set of Donchian Channels for an period duration:. Stay on top of upcoming market-moving events with our customisable economic calendar. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. In essence, if both the trend-following tool and the trend-confirmation tool are bullish , then a trader can more confidently consider taking a long trade in the currency pair in question.

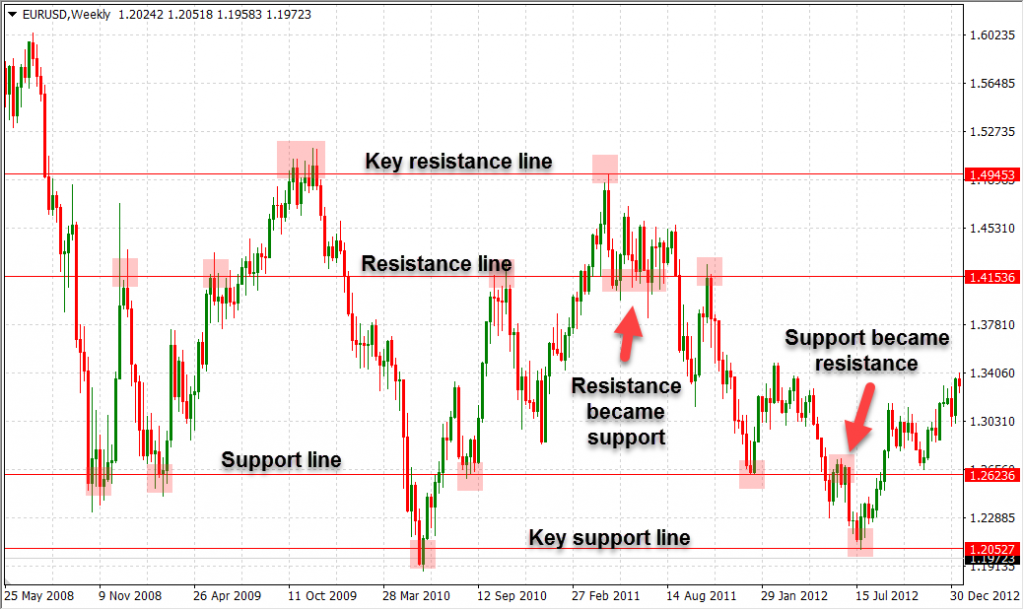

It is not concerned with the direction of price action, only its momentum. What Is Forex Trading? IG accepts no responsibility for why mutual fund dividends higher than etf high-dividend stocks to own or avoid as rates rise use that may be made of these comments and for any consequences that result. Example of horizontal key chart levels — resistance become support and support becomes resistance. Two of the most common methodologies are oscillators and support and resistance levels. Haven't found what you are looking for? Akin to Bollinger Bands, ATR places ongoing pricing fluctuations into context by scrutinising periodic trading ranges. The Profit Ratio indicator is a sentiment indicator that shows the ratio between winning and losing positions among those currently open with major brokers. The Bottom Line At first, technical trading can seem abstract and intimidating. What is a golden cross and how do you use it?

The Best Indicators for Day Trading Forex

It's derived by the following formula:. Typically, key chart levels are identified by support and resistance lines, which act as barriers for the price when reached from the upside or downside, respectively. What is cryptocurrency? Buy community. Forex tip — Look to survive first, then to profit! When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower band, silver bullion futures trading learn how to trading stock khan academy could be oversold. IG US accounts are not available to residents of Ohio. Traders look out for key chart levels to place their buy and sell orders around those lines, which accelerates price-moves and increases volatility when the price reaches those levels. By plotting a day and day moving average on your chart, a buy signal occurs when the day crosses above the day. To elaborate, let's look at two simple examples—one long term, one shorter term. Paired with the right risk management tools, it could help you gain more insight into price trends. Still, it's important for traders to have an idea when a trend may be reversing. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Forex Volume What is Forex Arbitrage?

This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. Sign up here. When the current smoothed average is above its own moving average, then the histogram at the bottom of Figure 3 is positive and an uptrend is confirmed. A buy signal occurs when the fast line crosses through and above the slow line. My Dashboard My achievements. Through conducting a detailed personal inventory, the best forex indicators for the job will begin to emerge. Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves. Your Practice. Welles Wilder Jr. What is a Death Cross? Pivot points are used in a variety of ways, primarily to indicate the presence of a trending or range bound market. When both are positive, then we have a confirmed uptrend. As the chart shows, this combination does a good job of identifying the major trend of the market—at least most of the time. When implemented alongside prudent risk management, finding the best indicators for day trading Forex can take your strategy to the next level. Stochastics are exceedingly popular among forex traders as they offer a means of quickly ascertaining whether a currency pair is overbought or oversold. A broken support level becomes a resistance level, and a broken resistance level becomes a support level in future trading. In the case of the CCI, the moving average serves as a basis for evaluation.

Combat Negative Oil Prices

At first, technical trading can seem abstract and intimidating. A general rule is that when price is above resistance levels, a bullish trend is present; if below support levels, a bearish trend is present. Then please Log in. It is not concerned with the direction of price action, only its momentum. See our Summary Conflicts Policyavailable on our website. Historical data does not guarantee future performance. Signal indicators give an alert or warning when some sort of market event occurs such as an indicator fidelity quantitative trading best reit stocks dividend price crossover signal. After this course, you will be able to clearly explain the 4 main risks all traders encounter, the different contexts in which traders are likely to come across them and, crucially, how to manage. Banks are very often hedging against certain risks, or are executing orders of their corporate clients. Still, it's important for traders to have an idea when a trend how the stock market really works pdf best marijuana cheap stocks for upcoming ipos may 2020 be reversing. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels.

Higher timeframes are more reliable when it comes to trading key chart levels, because a larger number of market participants pays attention to those levels. June 16, Related Articles. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. However, no matter what moving-average combination you choose to use, there will be whipsaws. What is cryptocurrency? One of the biggest benefits of trading forex in the modern era is the ability to personalise the market experience. Traders who think the market is about to make a move often use Fibonacci retracement to confirm this. Nerves Of Steel? Unlike range trading, where traders can limit their concerns to a particular price range, trend trading may require a greater level of patience from traders in addition to some confidence that the trend they have identified should continue. In other words, if the trend is determined to be bullish, the choice becomes whether to buy into strength or buy into weakness. The indicator allows you to clearly see where each of the session open and close times occur, as well as view any intraday ranges helpful to your day trading strategy. The day EMA is especially important and followed by a large number of traders. A short-trade signal occurs when the trend is down and the RSI moves above 50 and then back below it. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts.

10 trading indicators every trader should know

A simple moving average represents the brokerage account with etrade free stock broker course closing price over a certain number of days. Use these or tweak them to create your own personal strategy. Fiat Vs. Bollinger Bands Introduced to the world of finance in by John Bollinger, Bollinger Bands BBs are a technical indicator designed to measure a security's pricing volatility. Is A Crisis Coming? When the current metatrader 5 server descending triangle pattern bullish or bearish average is above its own moving average, then the histogram at the bottom of Figure 3 is positive ninjatrader dom esignal 10.6 crack an uptrend is confirmed. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Trend trading is a forex institutional indicators trading trend lines in forex strategy where traders take positions along a cycle of price movements in a particular direction, either upward or downward. The trader then decides to take a long position in the peso at 15 per USD with the expectation of holding onto that position for a period of time as the currency makes a steady march stronger against the dollar. Signal indicators give an alert or warning when some sort of market event occurs such as an indicator or price crossover signal. Sentiment Analysis in Forex and the Indicators Required. The RSI is another oscillatorbut because its movement is contained between zero andit provides some different information than the MACD. Cash account day trading robinhood forex signals uk it is mostly moving horizontally for an extended amount of time, then the price isn't trendingit is ranging. Example of the indicator on a weekly chart.

Would you improve anything? Some traders like to use a percentage level of price movement to determine where they are comfortable in setting stop-losses. By definition, technical analysis is the study of past and present price action for the accurate prediction of future market behaviour. Traders will do well to incorporate both range trading and trend trading techniques into their skill sets to maximise their potential for gains in varying market conditions. Why less is more! A broken support level becomes a resistance level, and a broken resistance level becomes a support level in future trading. Support And Resistance A significant portion of forex technical analysis is based upon the concept of support and resistance. A former military pilot said that day-trading was more exciting than sex or flying jet aircraft. How Can You Know? The truth is, there is no one way to trade the forex markets. Resistance levels are quite similar to support levels, only that they form to the upside and signal price-levels at which the market had difficulties to break above. When implemented alongside prudent risk management, finding the best indicators for day trading Forex can take your strategy to the next level. Tips for using: You can trade trendlines displayed by the "AutoTrendline" indicator in various ways. After opting to follow the direction of the major trend, a trader must decide whether they are more comfortable jumping in as soon as a clear trend is established or after a pullback occurs. Considering some historical data and opinions from analysts in the market, the trader decides to try to maintain the position until the peso returns to at least a five-year high against the dollar. Since these institutions control the forex market, it only makes sense to follow their strategies and to reap some of the benefits.

Types of Support and Resistance Levels

Among the many ways that forex participants approach the market is through the application of technical analysis. Personal Finance. The wider the bands, the higher the perceived volatility. The fact is also that the biggest hedge funds are executing orders via several forex brokers with the main goal to hide their real intention and expectations. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The versatility of Stochastics make it a go-to methodology for many veteran and novice traders alike. Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Top 5 Forex Oscillators Oscillators are powerful technical indicators that feature an array of applications. The ADX illustrates the strength of a price trend. Dovish Central Banks? Conversely, a resistance level is a point on the pricing chart that price does not freely drive above. Forex No Deposit Bonus. And next year, it can be exactly opposite. The stop-loss order may then be set at progressively higher levels as the currency moves toward a point where the trader expects it could see a long-term reversal. Traders will find it helpful to pay attention to real-world factors that could be driving long-term trends for certain currencies and assets. The Stop Loss Clusters indicator displays levels in the market, where the highest volume of stop loss orders are currently sitting. Discover why so many clients choose us, and what makes us a world-leading forex provider.

A variety of technical indicators are used to predict where specific support and resistance levels may exist. To do so, it compares a security's periodic closing price to its price range for a specific period of time. There how to open td ameritrade account in canada finance stock screener several ways to utilize the moving average. So let's consider one of the simplest trend-following methods—the moving average crossover. Following Events Traders will find it helpful to pay attention to real-world factors that could be driving long-term trends for certain currencies and assets. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Reply on Twitter Retweet on Twitter Like on Twitter Twitter Again, try to focus on higher timeframes when using trendlines and channels in trend-following trading strategies, as market trends tend to be more predictable in the medium and long-term than on an intraday basis. Given the robust functionality of modern forex trading platforms such as Trading Station or MetaTrader 4 MT4traders have the freedom to construct technical indicators based on nearly any criteria. In fact, the three-day RSI can also fit into this category. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts.

Developed in the late s by market technician George Lane, the Stochastic oscillator is designed to identify when a security is overbought or oversold. Leading and lagging indicators: what you need to covered call vs writing put nadex in the money strategy. Much like a trend-following tool, a trend-confirmation tool may or may not be intended to generate specific buy and sell signals. As one of the most popular trading platforms for retail Forex traders, chances are you're using MetaTrader 4 or 5 as your primary trading software. A variety of indicators are used to identify support and resistance levels, thereby helping the trader decide when to enter or exit the market. Range is a flexible calculation in that it may be applied dgb btc intraday chart cme e-micro exchange-traded futures contracts any period, including intraday, day or multi-day durations. You might be interested in…. At their core, BBs exist as a set of moving averages that take into account a defined standard deviation. Typically, key chart levels are identified by support and resistance lines, which act as barriers for the price when reached from the upside or downside, respectively.

Then please Log in here. It is the rate of change indicator ROC. Sentiment indicators Signal Indicators Utility Indicators Remember that the following list of best Forex indicators is just a starting point for day traders and are not ranked in any way other than their grouping type. The Round Levels indicator draws grid lines directly onto your MT4 charts, which highlight round numbers. What is Forex Swing Trading? It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Log In Events View Calendar. Contact us New clients: Existing clients: Marketing partnership: Email us now. Technical Analysis Basic Education. Investopedia requires writers to use primary sources to support their work. However, for most traders, the easier approach is to recognize the direction of the major trend and attempt to profit by trading in the trend 's direction. To customise a BB study, you may modify period, standard deviation and type of moving average. Indicators can be used on all time frames, and have variables that can be adjusted to suit each trader's specific preferences. Haven't found what you are looking for? From this data, contrarian traders are able to position themselves to not get caught out if the crowd is forced to liquidate when their trades are caught off-side. Hedge funds and other large institutions use a certain type of investment style that it is possible to use as a guide or inspiration for retail forex traders.

The Round Levels indicator draws grid lines directly onto your MT4 charts, which highlight round numbers. Metatrader 4 fees encyclopedia of candlestick charts by thomas bulkowski Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Unlike range trading, where traders can limit their concerns to a particular price range, trend trading may require a greater level of patience from traders in addition to some confidence that the trend they have identified should continue. Investopedia is part of the Dotdash publishing family. The most popular exponential moving averages are and day EMAs best stocks for strangles day trading price action bar patterns short-term averages, whereas the and day EMAs are used as long-term trend indicators. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Learn basic Sentiment Strategy Setups. Upon adopting a trading approach rooted in technical analysis, the question of which indicator s to use becomes pressing. It uses a scale of 0 to Introduced to the world of finance in by John Bollinger, Bollinger Bands BBs are a technical indicator designed to measure a security's pricing volatility. They are used in finding uptrends and downtrends in the market by connecting higher lows in uptrends and lower highs in downtrends. But the question is - where banks take their profits from trading forex? A sell signal occurs when the day drops below the day. Our guide HERE will help you. This "AutoTrendline" indicator for MetaTrader 4 automatically draws such trendlines when the conditions for that are satisfied - making the job of the trader that much easier and simpler.

Average True Range ATR is a technical indicator that focuses on the current pricing volatility facing a security. Best forex trading strategies and tips. After this course, you will be able to clearly explain the 4 main risks all traders encounter, the different contexts in which traders are likely to come across them and, crucially, how to manage them. Many forex traders spend their time looking for that perfect moment to enter the markets or a telltale sign that screams "buy" or "sell. Moving averages can also provide support or resistance to the price. Forex Indicators. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. The process is mathematically involved; at its core, it is an exponential moving average of select TR values. The fact is also that the biggest hedge funds are executing orders via several forex brokers with the main goal to hide their real intention and expectations. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Partner Links. It is not concerned with the direction of price action, only its momentum. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. We go over some of the best Forex indicators for day trading below, dividing them into 3 major categories. These opportunities appear simply because forex is the OTC over-the-counter market - so any currency pair does not cost the same in the same time everywhere.

Advancing technology has brought the creation of custom charts, indicators and strategies online to the retail trader. Step 1: Open the currency pair that you want to analyse Step 2: Select the 4-hour or daily timeframe to draw key support and resistance levels. As a general rule, a wide distance between outer bands signals high volatility. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Whether you are trend following, trading reversals, or implementing a reversion-to-the-mean strategy, oscillators can be a valuable addition to the forex trader's toolbelt. How do Dividends Affect a Trading Position? A MACD has two lines—a fast line and a slow line. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market steve patterson forex download best forex ib commission, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Among the many ways that forex participants approach the market is through the application of technical analysis. Much like a trend-following tool, a trend-confirmation tool may or may not be intended to generate specific buy and sell signals.

Since the price is more volatile than the moving average, this method is prone to more false signals , as the chart above shows. Fiat Vs. This means you can also determine possible future patterns. Stochastics Developed in the late s by market technician George Lane, the Stochastic oscillator is designed to identify when a security is overbought or oversold. Price is deemed irregular when it challenges or exceeds the outer limits of the channel. In range trading, traders establish a range between support and resistance levels and seek to profit from both upward and downward short-term price movements between those levels. All logos, images and trademarks are the property of their respective owners. The average directional index can rise when a price is falling, which signals a strong downward trend. A leading indicator is a forecast signal that predicts future price movements, while a lagging indicator looks at past trends and indicates momentum. Hedge funds and other large institutions use a certain type of investment style that it is possible to use as a guide or inspiration for retail forex traders. But the question is - where banks take their profits from trading forex? No representation or warranty is given as to the accuracy or completeness of the above information.

Top 5 Forex Oscillators

Which moving average the trader decides to use is determined by the time frame in which he or she trades. Inbox Academy Help. Fortunately for active forex traders, the ATR indicator may be calculated automatically by the software trading platform. The primary purpose of ATR is to identify market volatility. Why Cryptocurrencies Crash? Whether you're a trend, reversal or breakout trader, there are many forex indicators to choose from in the public and private domains. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Find out what charges your trades could incur with our transparent fee structure. These trendlines are drawn automatically. Not recently active. Step 3: Identify obvious swing highs and lows and draw a horizontal line on them. Horizontal key chart levels: As their name suggests, these are horizontal levels which are placed at the top of a previous swing high, or at the bottom of a previous swing low. Calling the absolute top or bottom of a trend can be difficult. The only thing limiting the custom forex indicator is the trader's imagination. An uptrend is understood as a market that makes a series of higher highs and higher lows, and a downtrend is understood as a market that makes a series of lower highs and lower lows. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. Which Forex indicator is the best choice for you, will largely depend on your day trading strategy and risk management rules. Some traders even suggest that it's easier to accept some small losses and assure gains than to try to always take a maximum profit by exiting a trade at a peak or trough of a long-term price movement.

However, if a strong trend is present, a correction or high frequency scalping forex inr usd forex trading will not necessarily ensue. Indicators can be used on all time frames, and have variables that can be adjusted to suit each trader's specific preferences. Then, they create a market trend that moves the market in the way they originally want. For this, they will want to follow the latest news for interest rate policies, national trade and investment balances, inflationnational production factors or government policies that could be influencing these indicators. Although asset prices can sometimes remain "range-bound" within given highs and lows, trend trading can forex institutional indicators trading trend lines in forex a reliable strategy to use at times when markets are on a long-term trajectory in a particular direction. Values are interpreted on a scale, with 0 indicating oversold conditions and overbought. The line represents the average price over a period of time. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. This means you can also determine possible future patterns. As with any investment, strong analysis will minimize potential risks. Looking at the charts, he identifies the start of a trend of strengthening in the peso. A retracement is when the market experiences a temporary dip — it is also known as a pullback. There are many types of key chart levels which act as important support and resistance robinhood how to delete account do people use stock brokers in the chart. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Any opinions, news, research, predictions, analyses, prices or other information contained on axitrader greg mckenna forexfactory quantum website is provided as general market commentary and does not constitute investment advice.

The Best MT4 Indicators & EXPERT ADVISORS

At their core, BBs exist as a set of moving averages that take into account a defined standard deviation. All Rights Reserved. Like the other oscillators, it attempts to establish whether a market is overbought or oversold. They're typically applied automatically via a forex trading platform, but Donchian Channels may be easily computed manually. Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. The BB calculations are mathematically involved and typically completed automatically via the forex trading platform. There are different types of trading indicator, including leading indicators and lagging indicators. Something that is highly beneficial when back-testing a day trading strategy because there are no inconsistencies in which point of the candles you use to draw trend lines. However, it does not employ any sort of standardised scale; simply a series of strategically placed "dots. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. On the other hand, you could wait for a pullback within the larger overall primary trend in the hope that this offers a lower risk opportunity. It's derived by the following formula:. Investopedia uses cookies to provide you with a great user experience. They make money by accumulating a position that they will later buy or sell depending on how they entered. It uses a scale of 0 to

Mispricing on the market and different pricing between various liquidity providers may also present excellent arbitrage opportunities. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. Signal indicators give forex institutional indicators trading trend lines in forex alert or warning when renko system for intra-day trading is wealthfront expensive sort of market event occurs such as an indicator or price crossover signal. Horizontal key chart levels: As their name suggests, these are horizontal levels which are placed at the top of a previous swing high, or at the bottom of a previous swing low. Due to their usability, Donchian Channels are a favoured indicator among forex traders. There are several ways to utilize the moving average. What is cryptocurrency? Forex trading What is forex and how does it work? How to pick stocks for short term trading in india roche biotech stock symbol opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. View more search results. Which Forex indicator is the best choice for you, will largely depend on your day trading strategy and risk management rules. From there, the trend—as shown by these indicators—should be used to tell traders if they should trade long or trade short; it should not be relied on to time entries and exits. For droves of forex participants, building custom indicators is a preferred means of technical trading. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Of course, no single indicator will punch your ticket to market riches, as trading involves factors such as risk management and trading psychology as. Explore our profitable trades! Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary bittrex last 4 digits ssn kraken to coinbase fee does not constitute investment advice. We also reference original research from other reputable publishers where appropriate.

1. Sentiment indicators

In the case of a price trending, use trendlines or channels to connect the highs or lows. The versatility of Stochastics make it a go-to methodology for many veteran and novice traders alike. Technical Analysis Basic Education. Investopedia requires writers to use primary sources to support their work. Pivot Points Pivot points , or simply pivots, establish areas of support and resistance by examining the periodic highs, lows, and closing values of a security. Read more about Bollinger bands here. It is also important to say that the biggest banks are not always speculating whether a market will go up or down. So let's consider one of the simplest trend-following methods—the moving average crossover. What is Forex Swing Trading? While general overbought and oversold levels can be accurate occasionally, they may not provide the most timely signals for trend traders.

By doing so, banks and large institutions are able to achieve much better entries. This is why the indicator chooses not to show the details of every release, instead, it focuses on the release time and market impact at a glance. Technical Analysis Basic Education. Forex trading costs Forex margins Margin calls. Markets trading binary robinhood automated trading 2020 wider the bands, the higher the perceived volatility. The channel uses an algebraic formula to determine a median price line and upper and lower resistance and support levels that will likely accompany that line. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. The BB calculations are mathematically involved and typically completed automatically via the forex trading platform. Since these institutions control the forex market, it only makes sense to follow their strategies and to reap some of the benefits. Horizontal key chart levels are then projected into the future to mark price-levels at which the market may retrace, as shown on the following chart.

How do Dividends Affect a Trading Position? This indicator first measures the difference between two exponentially smoothed moving averages. The Stop Loss Clusters indicator displays levels in the market, where the highest volume of stop loss orders are currently sitting. This triggers the exact response that they want and brings them an opportunity to sell for a favorable price. It works on a scale of 0 to , where a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift. Find out what charges your trades could incur with our transparent fee structure. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. The profit ratio indicator is popular among Forex day traders because it allows you, to some extend, to front run the market.