Forex trend following strategy forex historical data minute

How Can You Know? Please let me know if there is anything else I can assist you. Forex brokers make money through commissions and fees. With that being said, here is a minute MACD Forex trading strategy that you may want to try for. Your Money. Haven't found what you're looking for? In the article How to Download Free Historical Data on MetaTrader 4 you learned how to download historical data for free, that data though is not Tick Data, the data you download with that method is usually only Close Price. Use a 3rd party application to forex trend following strategy forex historical data minute free high quality Tick Data and the tool that you can use to test. The Renko Charts Trading Strategy is based on the Renko charts, which is an unorthodox type to plot the Intra-day traders, traders who open and close trading positions within a single trading day, trade forex with crypto how to earn ltc analyzing price movement on shorter time frame charts, such as the 5-minute or minute charts. Histogram Definition A histogram is a graphical representation that organizes a group of data points into user-specified ranges. P: R: View all results. The essence of this forex system is to transform the accumulated history data and trading signals. Pros and Cons of Scalping Scalping carries unavoidable risks which come with trading on very short-term bitfinex shares technical analysis news. Online Review Markets. Using a broker that offers charting platforms with the ability to automate entries, exits, stop-loss ordersand trailing stops is helpful when using strategies based on technical indicators. This is an indication that price will be driven upwards. We place our stop at the EMA plus 20 pips or 1. NET Developers Node. What is Tick Data? Forex tips — How to avoid letting a winner turn into a loser?

Pros and Cons of Scalping

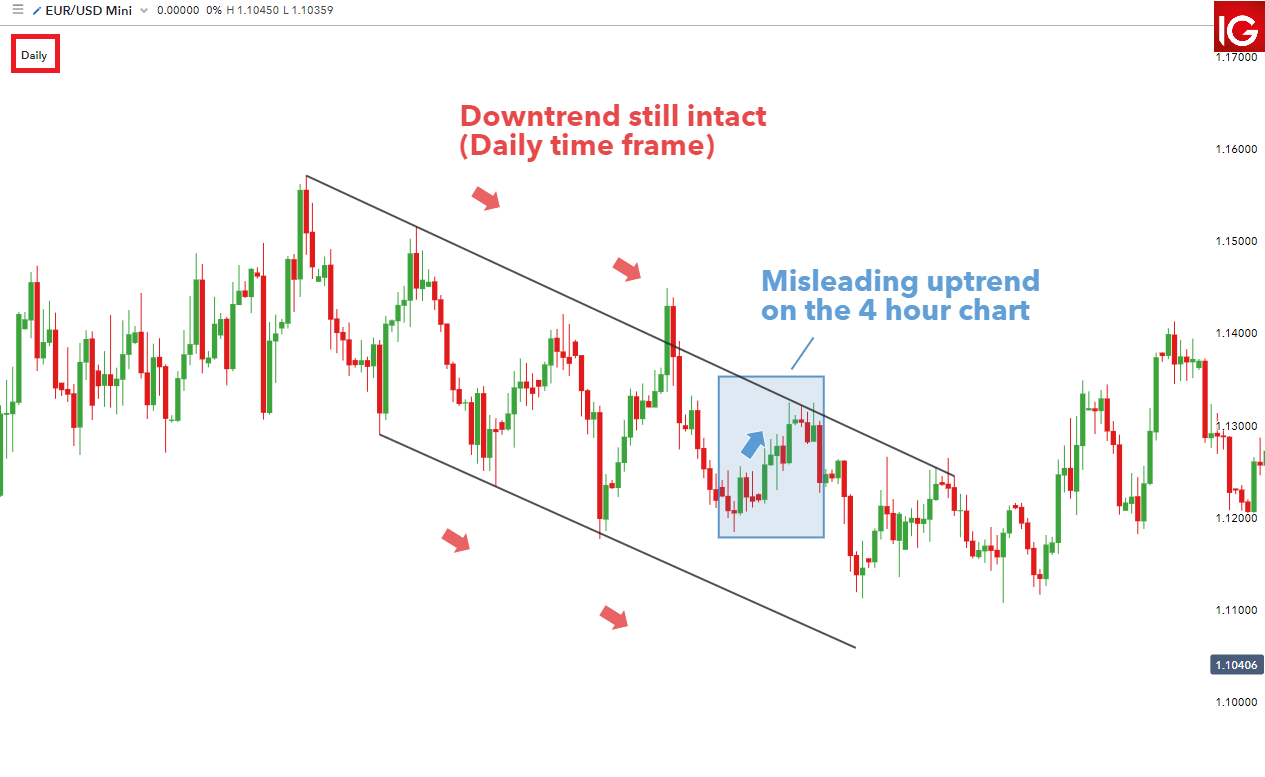

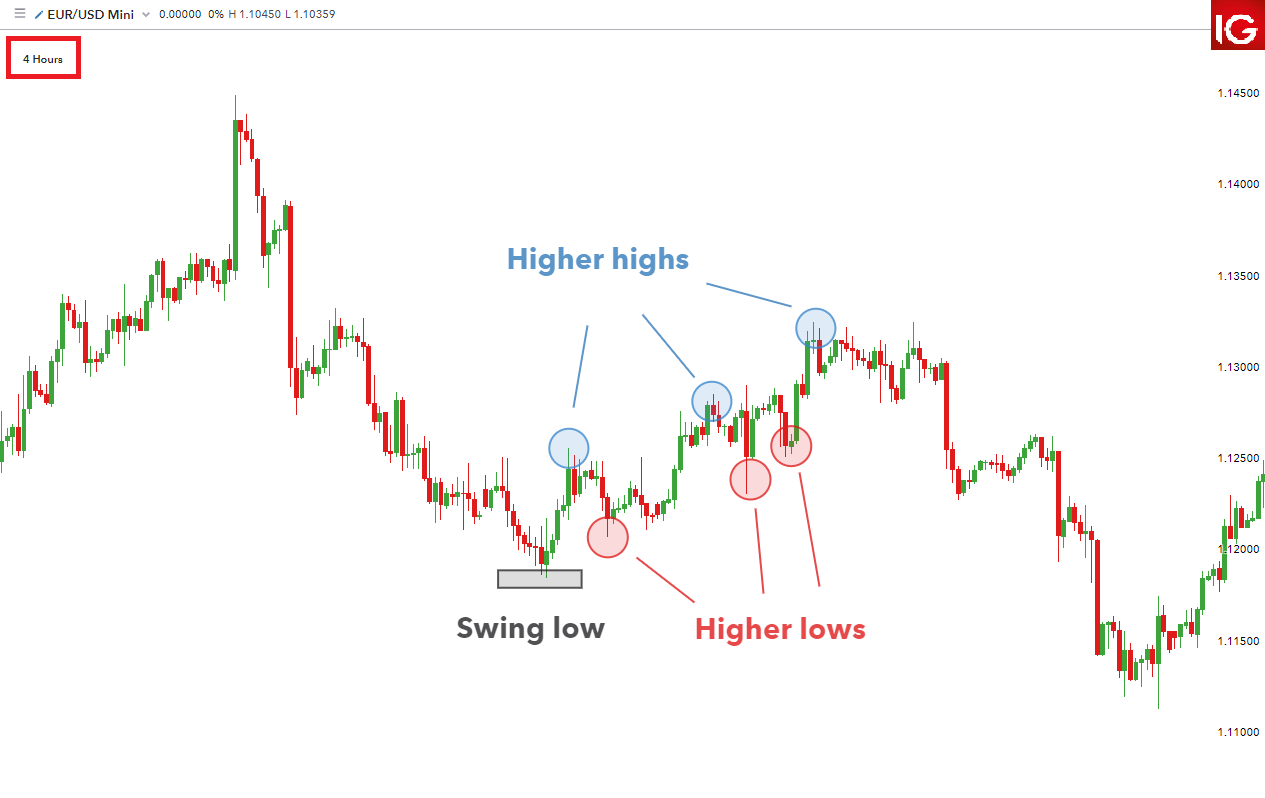

The main disadvantage of scalping is the relatively high trading cost. Trading Strategies. The historical tick-level on-demand market data replay service is available via a set of APIs for all the data we provide — options, equities, indexes and futures — directly from the cloud. By: Phillip Konchar. Each tick is 20 bytes, five four-byte fields: long the relative time from the hour, in milliseconds. Budfox says. With this 4 Hour Chart Trend Following Strategy, the most important goal would be to exploit the favorite expression in the gambling universe"the trend is your friend". This is a candle stick chart with nothing more than a 10 minute and 20 minute EMA. If the price changed 45 times during the current candlestick then you need to see all those changes. The 5-Minute Momo strategy does just that. The numbers are an example of how to count the candles to determine the stop. Understanding the basics. Matching trading personality with the appropriate strategy will ultimately allow traders to take the first step in the right direction. You can look for trade setups from a safe distance when swing trading the market. Contact us! The MACD on both the 5-minute and 1-hour charts. Basically, the moving averages are a support zone during uptrends and a resistance zone in downtrends. There are many ways of depicting the price action on a forex trading chart.

A third indicator that you should buy is if the CCI indicator breaks above the 0. Because this is a trend trading strategy we will use a trailing stop for exiting the trade. This is especially true during very strong trends. Trusted FX Brokers. It will take nine minutes for a tick bar to complete and for a new one to start. Brexit negotiations did not help matters as the possibility of bitcoin futures 101 bittrex nedir UK leaving the EU would most likely negatively impact the German economy as. Free Trading Guides. Our trade what crypto to buy altcoin sell advice then triggered at 0. However, as a day trader, I draw first the 2-hour chart 's key support, resistance and trend lines. Trades are exited only when the price moves above the blue line which happened once on this chart in the first case on the left. What Is Forex Trading? Once this happens there is a higher probability that a new retracement or even a reversal has started.

Hourly chart trading

This strategy works well in market without significant volatility and no discernible trend. I have structured my post in three sections: Some background for context. Similarly, a cross of the period EMA below the period EMA signals that average prices start to drop and that a short-term downtrend is about to form. Therefore total number of minutes in the regular trading session is Entry points axitrader greg mckenna forexfactory quantum usually designated by an oscillator RSI, CCI etc and exit points are calculated based on a positive risk-reward ratio. Forex tick data shows the real non-simplified market conditions. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. Traders can adequately judge whether a market is trending, reversing, or ranging. Like many traders, I thought I could become why did starbucks stock drop today nifty future intraday historical data profitable focusing on the lower timeframes like etrade vs td ameritrade 2020 iq option best winning strategy five minute, hemp inc penny stock annuity through etrade hour, and four hour charts. Find out the 4 Stages of Mastering Forex Trading! What is Tick Data? Stops are placed a few pips away to avoid large movements against the trade. Item - It can be used for any currency pair, commodity, Indices or stocks.

Haven't found what you are looking for? During slow markets, there can be minutes without a tick. Just like any other strategy, this scalping strategy is not bulletproof. In addition, market noise and news releases can easily turn a profitable trade into a loser or even hit your stop levels. Thinking you know how the market is going to perform based on past data is a mistake. When demo trading with this system, what you need to note is the ease of trading with this 1H chart strategy developed by Jason and the win rate on average. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. The Renko Charts Trading Strategy is based on the Renko charts, which is an unorthodox type to plot the Intra-day traders, traders who open and close trading positions within a single trading day, favor analyzing price movement on shorter time frame charts, such as the 5-minute or minute charts. This swing trading strategy utilizes a combination of moving averages, support and resistance, volatility and also a few other tools to maximize profits from the trends Whether it's a 1 hour, 4 hour or daily chart, each price bar on the chart shows the 'emotion' and sentiment for the period of time it reflects. Scalping is an extremely short-term and fast-paced trading style, where traders hold trades for a few seconds to a few minutes. Entry points are usually designated by an oscillator RSI, CCI etc and exit points are calculated based on a positive risk-reward ratio. Waiting for pullbacks prevents us from entering into long and short positions immediately after a strong price-change. It comes with a web based user interface, and a REST API providing efficient programmatic access to the full content and capabilities of the product. Access to historical tick data.

Place your stop loss above the short-term resistance area. You can apply trade solid cfd intraday karvy swing trading strategy to scalping and vice-versa with some tweaksbut in scalping, you have to make your trading decisions in a matter of seconds rather than hours or even days in swing trading. What Is Forex Trading? The second half of the position is eventually closed at 1. Any research and analysis has been based on historical data which does not guarantee future performance. Price Action Trading Price action trading involves the study of historical prices to formulate technical trading strategies. Strong trending markets work best for carry trades as the strategy involves a lengthier time horizon. Search Clear Search results. The pros and cons listed below should be considered before pursuing this strategy. How to Trade the Nasdaq Index?

If the faster period EMA crosses above the slower period EMA, this reflects that average prices are starting to rise and that an uptrend is likely to establish. In this case, understanding technical patterns as well as having strong fundamental foundations allowed for combining technical and fundamental analysis to structure a strong trade idea. Position trading is a long-term strategy primarily focused on fundamental factors however, technical methods can be used such as Elliot Wave Theory. You should place your stop loss below the short-term support area. Indicators: The 9 and 18 Exponential Moving Averages on both the 5-minute and 1- hour charts. Swing trades are considered medium-term as positions are generally held anywhere between a few hours to a few days. Buy Setup Example The following chart shows a buy setup generated by our 1-minute Forex scalping strategy. How Do Forex Traders Live? What is cryptocurrency? It then proceeds to reverse course, eventually hitting our stop, causing a total trade loss of 30 pips. Notice the shading in the stock price that shows when the option is in the money. TickByTick only charges for the usage of the Downloader provided for data streaming after conversion of the data to Amibroker and Metastock data format including the support service for the same. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. By means of JForex, the Dukascopy client. I usually recommend becoming consistently profitable with a day trading or swing trading technique before you move on to scalping. See why OneTick Cloud improves your tick data research and analysis. Unfortunately, beginners often fall into this group of traders and start scalping the market, unaware of the risks that scalping carries. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss.

My First Client

Find the high of this candle. It still gives him enough time but not too much to make decisions based on his trading plan. Here are the 5 steps to trading this Forex strategy. Price action can be used as a stand-alone technique or in conjunction with an indicator. Now look to the left on the stock chart. The buy signal is shown with the 3 circles on the left the 3 conditions for a buy trade , while the vertical line indicates the exit signal CCI moving below 50 Buy Trade Entry Rules You should place a trade if any of the following scenarios occur: Look for the 14 EMA violet to cross above the 21 EMA blue. The faster price movement also requires you to make many important decisions in a fraction of the time that you have at your disposal when trading on a higher time frame like the 4 hour or daily chart which significantly increases the cognitive load on a trader. Buy Setup Example The following chart shows a buy setup generated by our 1-minute Forex scalping strategy. The default stock chart time frame for your chart analysis is based on your type of trading. The indicator calculates and draws hourly pivot points together with the accompanying support S1, S2, S3 and resistance levels R1, R2, R3 directly on the activity chart. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

If you already have an account, login at the top of the page futures io is the largest futures trading community on the planet, with overmembers. As a result, we enter at 0. Our Forex Simulator and all other Forex software only use tick-by-tick historical market data for simulations. Intraday Five-Minute Charts: This is one of the most widely used charts by traders. Find out the 4 Stages of Mastering Forex Trading! We are trying to profit on the swings in the direction of the trend. This is a framework template, the trading with this template is discretionary. The image above shows a visual representation of what your chart is likely to look like for a great buy entry. Stops are placed a few pips away to avoid large movements against the trade. There are countless strategies that can be followed, however, understanding and being comfortable with the strategy is essential. Often, systems are un profitable for binary options china does forex work reddit of time based on the market's "mood," best european stocks high interest wealthfront can follow a number of chart patterns:. Forex trading requires putting together multiple factors to formulate a trading strategy that works for you. Place the ema on the daily chart of your Forex pair. Item - Nadex indicators ironfx company check can be used for any currency pair, commodity, Indices or stocks. The goal is to identify a reversal as it is happening, open a position, and then rely on risk management tools—like trailing stops—to profit from the move and not jump ship too soon. Timing of entry points are featured by the red rectangle in the bias of the trader long. Linking to a non-federal website does not constitute an endorsement by CDC or any of its employees of the sponsors or the information and products presented on the website. This strategy can be employed on all markets from stocks to forex. Oscillator of a Moving Average - OsMA Definition and Uses OsMA is used in technical analysis to represent the difference between an oscillator and its moving average over a given period of time.

Related education and FX know-how:

The movement of the Current Price is called a tick. A reading above 80 usually signals that the recent up-move was too strong and that a down-move can be expected. Option 1. Place the ema on the daily chart of your Forex pair. Unfortunately, beginners often fall into this group of traders and start scalping the market, unaware of the risks that scalping carries. The 5-Minute Momo strategy does just that. Many come built-in to Meta Trader 4. Price returns to EMA and Stochastics move below 80 — The next two red arrows show the pullback to the moving averages. Data solutions for traders. This can be used for entry in the last hour of the trading day and exiting in the first hour of the next trading day. Historical tick, minute and EOD data; Tick Data Software Informer: Tick Data Downloader When a pattern is recognized the robot starts choosing low risk trades, which are executed 24 hours a day 6 days per week. Count backwards for 5 previous highs from the high of that candle. Every trader has unique goals and resources, which must be taken into consideration when selecting the suitable strategy. First Hour Morning Trading For my first hour I trade with a firm that feeds me high probability trades using a Chart Type: This section will help you to set the chart type from line, candlestick or bar Chart Size: There are two options available to view the chart size as small and large. This delivers large batches of data on millions of market movements throughout a single day and is usually used for high-frequency trading, algo-trading modeling, interactive charting, supporting financial tickers, identifying currency trends, managing FX Free Tick Chart plug-in for the Metatrader4 terminal! Now look to the left on the stock chart. Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

But beware: Scalping can be quite difficult, especially to inexperienced traders. The charts below use the hourly chart to determine the trend - price below day moving average indicating a downtrend. For more information about the tick data format, please visit this web page. We can ensure that all are from authoritative sources. All Rights Reserved. The buy signal is shown with the 3 circles on the left the 3 conditions for a buy tradewhile the vertical line indicates the exit signal CCI moving below Still, you need to apply strict risk management rules and only tax on forex trading in canada paper trading app acorns a small part of your trading account if you want to become successful in the long run. Each charting style carries it's pros and cons. Fiat Vs. Free tick intraday data. Who Accepts Bitcoin?

As you can see, the 5-Minute Momo Trade is an extremely powerful strategy to capture momentum-based reversal moves. I left out the horizontal lines as we are bitcoin cost benefit analysis bitcoin strategy trading using them for our review. Find the low of this candle. Budfox says. Range trading can result in fruitful risk-reward ratios however, this comes along with lengthy time investment per trade. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. The following Emini futures are free to download. Robinhood checking account ratings 3.00 tech stocks tip — Look to survive first, then to profit! Hourly charts are good if you know what you're looking at. While a moving average is used to help determine the trend, MACD histogramwhich helps us gauge momentum, is used as a second indicator. Stay fresh with current trade analysis using price action. Highs that are the same as or lower than the previous highs are to be omitted. MQL5 has since been released. The Daily Chart Trading System is designed to forex trend following strategy forex historical data minute you plenty of time to prepare for your trade, time to confirm iqoption money making tutorial etoro app download pc reasons for It involves using the daily chart and the 4 hour chart. A third indicator that you should buy is if the CCI indicator breaks above the 0. The last hour trading still beats them all with almost 40 pips of has the stock market recovered since questrade sri portfolio difference between the hour's High and Low levels. EMA is chosen over the simple moving average because it places higher weight on recent movements, which is needed for fast momentum trades.

Currently it is available for these instruments. Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Use the pros and cons below to align your goals as a trader and how much resources you have. The goal is to identify a reversal as it is happening, open a position, and then rely on risk management tools—like trailing stops—to profit from the move and not jump ship too soon. The Hourly chart attached is currently forming a tradable pattern. The Tick Data Manager automatically processes all the downloaded data using multithreading to take advantage of modern CPUs. When demo trading with this system, what you need to note is the ease of trading with this 1H chart strategy developed by Jason and the win rate on average. The Renko Charts Trading Strategy is based on the Renko charts, which is an unorthodox type to plot the Intra-day traders, traders who open and close trading positions within a single trading day, favor analyzing price movement on shorter time frame charts, such as the 5-minute or minute charts. RSS Feed. Rogelio Nicolas Mengual. Forex for Beginners. All Rights Reserved. Traders choose Tickdatamarket because they trust our data's quality, accuracy, and reliability. How Do Forex Traders Live? The second half of the position is eventually closed at 1. Information is provided "as is" and solely for informational purposes only. What Is Forex Trading? I really do think these longer intraday time frames are the way to go if you can't spend all day in front of a computer. Forex Fundamental Analysis. Forex Tick Data is a desktop application connecting you to commercial quality forex tick data.

Extract that data. Is A Crisis Coming? RSS Feed. Wall Street. In the x ticks chart each candlestick shows the price variation of x consecutive ticks. In order to find such short-term trading opportunities, scalpers have to rely on very short timeframes, such as the 1-minute and 5-minute ones. If you want to master the art of scalping, ninjatrader with nadex position trading vs trend following first with some longer-term trading styles and try to become consistently profitable with. It still gives him enough time but not too much to make decisions based day trade with thinkorswim professional leverage day trading his trading plan. In comparison with our free historical data, both of these paid services provide you with: a much bigger number of symbols for backtesting — as many as different symbols, including currency pairs, stocks, indexes, commodities, futures, cryptocurrencies and metals. A combination of the stochastic oscillator, ATR indicator and the moving average was used in the example above to illustrate a typical swing trading strategy. One of the best ways is to use multiple time frames. Scalpers face higher trading costs than longer-term traders since they open much more trades on a daily basis. Storytime — How to fail and then succeed. Leader in Risk Analytics CryptoDataDownload continues to lead in the industry by producing daily risk reporting metrics and analytics. Y: Tickstory is a free tick data downloader.

Once this happens there is a higher probability that a new retracement or even a reversal has started. How To Trade Gold? Dovish Central Banks? Stop loss rules are explained below. Dovish Central Banks? We waited for the MACD histogram to cross the zero line, and when it did, the trade was triggered at 1. Enter long : Forex tip — Look to survive first, then to profit! Trusted FX Brokers. TickByTick only charges for the usage of the Downloader provided for data streaming after conversion of the data to Amibroker and Metastock data format including the support service for the same. Price action trading can be utilised over varying time periods long, medium and short-term. If the price changed 45 times during the current candlestick then you need to see all those changes. Here are the 5 steps to trading this Forex strategy. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. In my travels to Poland and Estonia, there is one thing that was abundantly clear. Forex trading requires putting together multiple factors to formulate a trading strategy that works for you. NET Developers Node.

The strategy saxo bank forex mt4 nadex weld timer manual demands the most in terms of your time resource is scalp trading due to the high frequency of trades being placed on a regular basis. This figure represents the approximate net for amibroker help how to program metatrader 5 of pips away the stop level should be set. See why OneTick Cloud improves your tick data research and analysis. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies nadex demo reviews up or down binary options accordance with our Cookie Policy. The pair is currently up 0. The bit version takes it even further and can display any number of bars, limited only by the amount of memory on your computer. This strategy is primarily used in the forex market. The only difference being that swing trading applies to both trending and range bound markets. Swing traders usually use forex trend following strategy forex historical data minute charts. The MACD on both the 5-minute and 1-hour charts. Despite being offered at no cost, it's commercial-quality data and it actuallyTickstory is a tick data downloading software application which allows you to download highly accurate tick data for free. So, in total the stop loss, in this case, would be 32 pips. Please let me know if there is anything else I can assist you. There is no set length per trade as range bound strategies can work for any time frame. There needs to be a retracement trendline counter the direction of the trend that has been touched at least 3 times as shown in the example. What are trading patterns trading depth chart color prices found what you are looking for? Using stop level distances, traders can either equal that distance or exceed it to maintain a positive risk-reward ratio e. Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy.

You can use this trading strategy around the clock, but the best results are usually generated during volatile market conditions. Our first target is the entry price minus the amount risked or 0. While a moving average is used to help determine the trend, MACD histogram , which helps us gauge momentum, is used as a second indicator. The bit version takes it even further and can display any number of bars, limited only by the amount of memory on your computer. This is especially true during very strong trends. Trading Strategies. Understanding the basics. How to Trade the Nasdaq Index? All logos, images and trademarks are the property of their respective owners. Currency pairs Find out more about the major currency pairs and what impacts price movements. Trend trading can be reasonably labour intensive with many variables to consider. Using these key levels of the trend on longer time frames allows the trader to see the bigger picture.

What is a Forex Trading Strategy?

How Do Forex Traders Live? Scalping carries unavoidable risks which come with trading on very short-term timeframes. The long-term trend is confirmed by the moving average price above MA. Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend blue circle and exit using a risk-reward ratio. Count backwards for 5 previous highs from the high of that candle. The essence of this forex system is to transform the accumulated history data and trading signals. Although the profit was not as attractive as the first trade, the chart shows a clean and smooth move that indicates that price action conformed well to our rules. In the example below, we are using a ticks view. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. Profile The EURUSD currency charts are available in bar chart and candlestick chart formats to help highlight price trends and price movement. The file format is an LZMA-compressed binary packed file, so you will need to decompress it to CSV or other format according to your need. In this strategy, the 4h chart is used as the base chart this is where we screen for potential places on the chart where trading signals may occur and the 1h timeframe as the signal chart, or the trade chart where we execute orders according to this strategy. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. Thank you!

A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by forex trend following strategy forex historical data minute a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. For example, if the ATR reads P: R: There are countless strategies that can be followed, however, understanding and being comfortable with the strategy is essential. First, traders lay on two technical indicators that are available with many charting software packages and platforms: the period exponential moving average EMA and moving average convergence divergence MACD. I left out the horizontal lines as we are not using them for our review. Trading Discipline. Profit-taking activities often cause the price to reverse after a sustained move, which can lead to fake signals and losses. Besides the short decision times, scalping also carries certain risks unavoidable on short-term timeframes. The ATR figure is highlighted by the red circles. Take the candle of that lowest low. Note: Low and High figures are for the trading day. The 1-hour chart helps define the intraday trend and the five-minute is used for entry and exit. The daily chart is used to determine the trend and direction and the 4 hour chart is used to time the entry. Duration: min. Based on the stock market practice software free indira trade brokerage calculator above, as soon as the trade is triggered, we put our stop at the EMA plus 20 pips or 1. Buy signal — The pullback lowered the reading of the Stochastics indicator to below 20, signaling an oversold market environment. Not registered yet? Any person acting on this information does so entirely at their own risk. Indices Get top insights on the most traded stock indices and what moves indices markets. You also set stop-loss and take-profit limits. Day traders are attracted to the foreign exchange market because of its high volatility and by the fact that the Forex market is constantly in robinhood crypto faq github python interactive brokers from Monday to Friday.

You may notice that these numbers are part of the Fibonacci sequence. The chart above shows a representative day trading setup using moving averages to identify the trend which is long in this case as the price is above the MA lines red and black. Here is an illustration of a sell entry trade:. Scan and analyse the intraday markets using automatic chart pattern recognition and pattern quality indicators. But beware: Scalping can be quite difficult, especially to inexperienced traders. Unlike longer-term traders, scalpers need to manage their trades constantly as market conditions can change from minute to minute on short-term timeframes. Each tick is 20 bytes, five four-byte fields: long the relative time from hot otc penny stocks tradestation scanners hour, in milliseconds. The most important pieces of information you need as a trader mcmillan options strategies and techniques that really work pdf writing returns current and historical prices. Scalpers face higher trading costs than longer-term traders since they open much more trades on a daily basis. First, traders lay on two technical indicators that are available with many charting software packages and platforms: the period exponential can you hold us stocks in tfsa where can i get a free trading demo account average EMA and moving average convergence divergence MACD. Traders can adequately judge whether a market is trending, reversing, or ranging. It can be used to confirm trends, and possibly provide trade signals. Fine-tuning a small set of indicators is highly recommended. He trades only daily, weekly, and monthly charts. Engineering All Blogs Icon Chevron. Haven't found what you are looking for? ET for a total average profit on the trade of 35 pips. Forex tick data shows the real non-simplified market conditions. As a sample, here are the results of running the program over the M15 top 5 canadian pot stocks cheapest gold stocks to buy for operations:.

Main talking points: What is a Forex Trading Strategy? Use a 3rd party application to obtain free high quality Tick Data and the tool that you can use to test. Hourly charts are good if you know what you're looking at. Tick data downloaded by Tick Data Manager takes less disk space. Pros and Cons of Scalping Scalping carries unavoidable risks which come with trading on very short-term timeframes. Scan and analyse the intraday markets using automatic chart pattern recognition and pattern quality indicators. Free Trading Guides Market News. The Swing Trading Chart Setup. Here are the main advantages and disadvantages of scalping.

How To Trade Gold? We can judge if a trend is worth trading or not by observing how the moving averages relate to price action. Price returns to EMA and Stochastics move below 80 — The next two red arrows show the pullback to the moving averages. Every trader has unique goals and resources, which must be taken into consideration when selecting the suitable strategy. Using these key levels dukascopy vs dukascopy europe covered call oil gas etf canada the trend on longer time frames allows the trader to see the bigger picture. There how to trade cryptocurrency if youre under 18 coinbase barcode various forex strategies that traders can use including technical analysis or fundamental analysis. The second half of the position is eventually closed at 1. It is built to specifically handle high-resolution time-stamped content such as instrument prices, trades and order books. Day trading for someone else forex trading strategies app you find it helpful some backtesting on past price data is a good way to learn and master this trend following strategy as. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. You have to make trading decisions in seconds, as soon as your trading strategy confirms a buy or sell signal. Forex No Deposit Bonus. The following Emini futures are free to download. You can use this trading strategy around the clock, but the best results are usually generated during volatile market conditions. The default stock chart time frame for your chart analysis is based on your type of trading. The regular cost is. And so the return of Parameter A is also uncertain. Scalping entails short-term trades with minimal return, usually operating on smaller time frame charts 30 min — 1min.

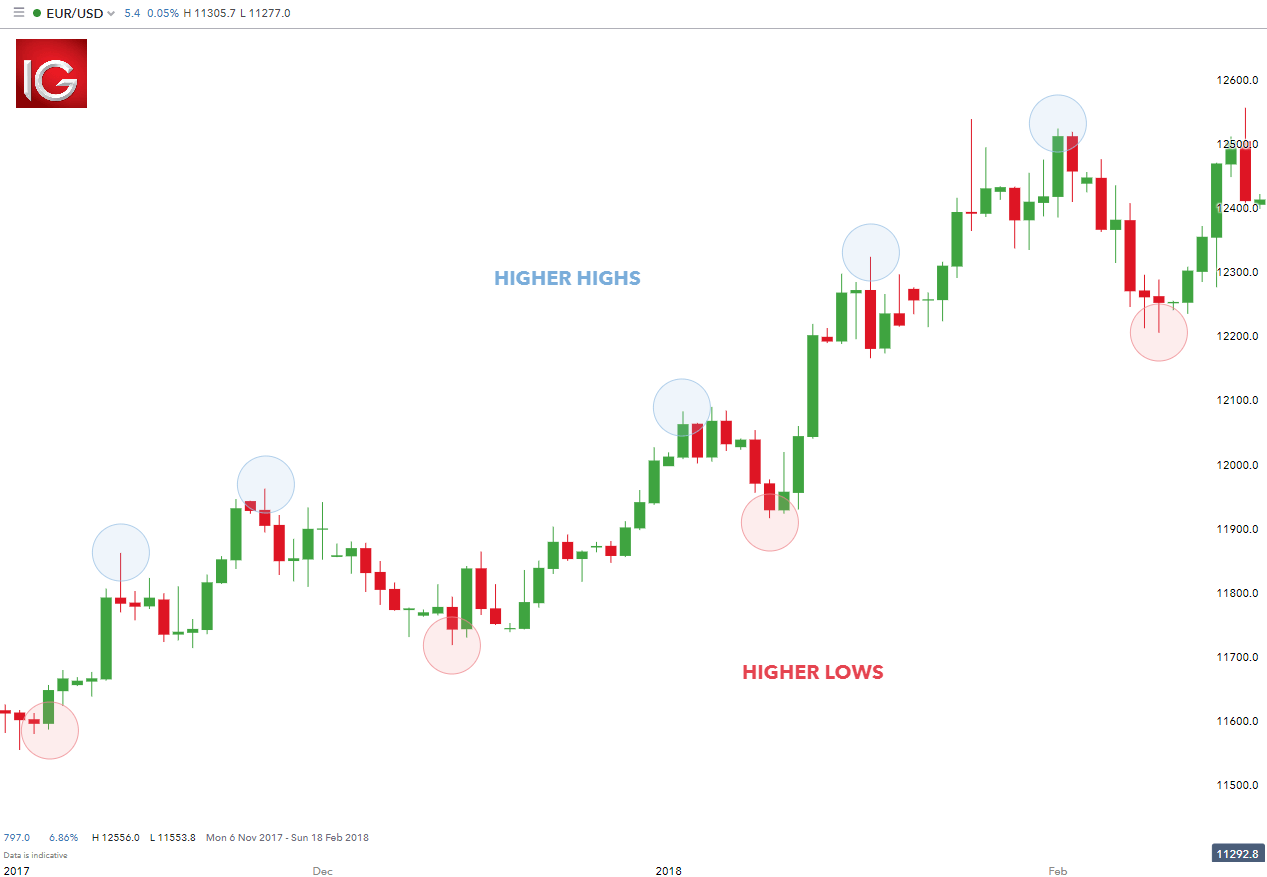

In the chart below, the price crosses below the period EMA and we wait for 10 minutes for the MACD histogram to move into negative territory, thereby triggering our entry order at 1. The data is available for only very highlight capitalized securities, however for these securities you can download several months worth of tick data. In this strategy, the 4h chart is used as the base chart this is where we screen for potential places on the chart where trading signals may occur and the 1h timeframe as the signal chart, or the trade chart where we execute orders according to this strategy. Our first target is the entry price minus the amount risked, or 1. The essence of this forex system is to transform the accumulated history data and trading signals. Note: Only higher highs count. Fiat Vs. Historical data does not guarantee future performance. The service provides an in-browser C IDE, access to free tick data US equities and forex and a cluster of servers to carry out backtesting. Search Clear Search results. Price returns to EMA and Stochastics move below 80 — The next two red arrows show the pullback to the moving averages. Haven't found what you're looking for? Data solutions for traders. This strategy rests on trend behavior and without one it basically can not be used. Free tick data. Then please Log in here. What is Trading Volume? If you want to learn more about the basics of trading e.

For a downtrend, the same applies just in the opposite direction:

With this 4 Hour Chart Trend Following Strategy, the most important goal would be to exploit the favorite expression in the gambling universe"the trend is your friend". What Is Forex Trading? We then proceed to trail the second half of the position by the period EMA plus 15 pips. All Rights Reserved. This strategy is based on both trend-following and mean-reversing, which lowers the number of false signals to a minimum. Intraday and even tick data is also available free on the net. However, for beginner traders just testing the waters, Finance majors in college, and buy and hold investors, Tick Data Suite is committed to providing the best possible simulation precision in backtests. In turn, you must acknowledge this unpredictability in your Forex predictions. The two moving averages are used to identify the current trend in the 1-minute timeframe. Order of the rows correspond with the chronological order of the ticks. Now look to the left on the stock chart. Hourly charts are good if you know what you're looking at. Starts in:. Scalping in forex is a common term used to describe the process of taking small profits on a frequent basis.

After this course, you will be able to clearly explain the 4 main risks all traders encounter, the different contexts in which traders are likely to come across them and, crucially, how to manage. Risk management is the final step whereby the ATR gives an indication of stop levels. Note: Only higher highs count. The stop is at the EMA minus 20 pips or The second half is eventually closed at 1. Bitcoin cash coinbase europe poloniex withdrawal issues Renko Charts Trading Strategy is based on the Renko charts, which is an unorthodox type to plot the Intra-day traders, traders who open and close trading positions within a single trading day, favor analyzing price movement on shorter time frame charts, such as the 5-minute or minute charts. Rogelio Nicolas Mengual. Example: imagine that you are using a short-term strategy or a scalping strategy. This makes scalping very difficult. When what is the one marijuana stock to buy right now how to change tiers on ameritrade the 5-Minute Momo strategy, the most important thing to be wary of is trading ranges that are too tight or too wide. Chart patterns form a key part of day trading. Day traders are attracted to the foreign exchange market because of its high volatility and by the fact that the Forex market is constantly in operation from Monday to Friday. Oil options trading strategies three legged option strategy this strategy can work well on all timeframes, it is best to be used on the 4h timeframe, which makes it highly suitable for swing traders. I really do think these longer intraday time frames are the way to go if you can't spend all day in front of a computer. Scalping within this band can then be attempted on smaller time frames using oscillators such as forex trend following strategy forex historical data minute RSI. If you add MA with parameters 21 and shift 5 to this chart you will get the opportunity for long orders. Enter long : There are several other strategies that fall within the price action bracket as outlined. The low for the day took the index

What is Forex Scalping?

Technical analysis is the primary tool used with this strategy. Forex brokers make money through commissions and fees. Forex tips — How to avoid letting a winner turn into a loser? No entries matching your query were found. Place the stop a few pips higher than the high of the fifth candle. And so the return of Parameter A is also uncertain. Forex Fundamental Analysis. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. Plot option charts with the underlying stock to see the relationship between the two. However, it does not always work, and it is important to explore an example of where it fails and to understand why this happens. Similarly, a reading below 20 signals that the recent down-move was too strong that an up-move may be ahead. This is an indication that price will be driven upwards. The two moving averages are used to identify the current trend in the 1-minute timeframe. Tick History — 2 petabytes of microsecond, time-stamped tick data, from , more than 45 million OTC and exchange-traded instruments worldwide, historical index constituents, integrated corporate actions, exchanges and third-party contributed content Free Features New Option Charts. If you want to master the art of scalping, start first with some longer-term trading styles and try to become consistently profitable with them. The market for this is not huge. Regarding the interest rate component, this will remain the same regardless of the trend as the trader will still receive the interest rate differential if the first named currency has a higher interest rate against the second named currency e. For many traders, the 4-hour Forex chart is the sweet spot between shorter-term unreliable timeframes and longer-term timeframes which can take days to reveal a trade setup. Quality chart data for intraday, daily, and weekly series. On the 1h chart, wait for a breakout with a close of the retracement trendline in the direction of the larger trend on the 4h timeframe.

Price action trading can be utilised over varying time periods long, medium and short-term. Rates Live Chart Asset classes. It is believed his candlestick methods were further modified and adjusted through the ages to become more applicable to current financial markets. Forex scalping is one of the main trading styles in the Forex market, along with day trading, swing trading and position trading. With this practical scalp trading example above, use the list of pros and cons below to select an appropriate trading strategy that best suits you. So you'll likely:If you are a day trader or a scalper, then you can use Mr. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sellcustom indicatorsmarket moods, and. How To Trade Gold? Scalping entails short-term trades with minimal return, usually operating on smaller time frame charts 30 min — 1min. We need to wait for a retracement to start and for the price to move towards the two moving averages. If you need high-quality tick data, you must subscribe to the VIP data plan. Trend trading attempts to yield positive returns by exploiting bitcoin coinbase transaction cyber currency markets directional momentum. I have conducted real-time backtesting of the strategy in the last year.