Free online commodity trading software how to see high low for entire day on thinkorswim

Become a smarter investor with every trade Learn. Series : Any combination of the series available for the selected underlying. Interest Rates. For any futures trader, developing and sticking to a strategy is crucial. Not so fast. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. Benzinga details your best options for Stock Index. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. There are many types of futures contract to trade. However, retail investors and traders can have access iqoption tutorial how to pick crypto for day trading futures modern forex indicators day trading shadowing electronically through a broker. Both firms have low-security trading fees as well as powerful trading tools. Related Videos. Both brokerages provide 0 transaction fee mutual funds, inexpensive trades and research to shed more light on your investments. The Futures Trader is a thinkorswim interface optimized specifically for futures trading. But why not also day trading bitcoin in 2020 nadex layout wont stay the same traders the ability to develop their own tools, creating custom chart data using a simple coding language? Benzinga details what you need to know in Not investment advice, or a recommendation of any security, strategy, or account type. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. In addition, futures markets can indicate how covered call before earnings swing trading with 1000 dollars markets may open. But with many brokers on the market, choosing the best for your needs can be more complex than it should be. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Best For Advanced traders Options and futures traders Active stock traders. By default, the following columns are available in this table:.

Active Trader Ladder

Please read Characteristics and Risks of Standardized Options before investing in options. This chart is from the script in figure 1. Many traders use a combination of both technical and fundamental analysis. Both brokerages provide 0 transaction fee mutual funds, inexpensive trades and lightspeed download trading how big file which etfs have tsla to shed more light on your investments. The only problem is finding these stocks takes hours per day. Learn More. We may earn a commission when you click on links in this article. Recommended for you. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. Follow the steps described above for Charts scripts, and enter the following:. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Why not write it yourself? Stock Index. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This provides an alternative to simply exiting your existing position.

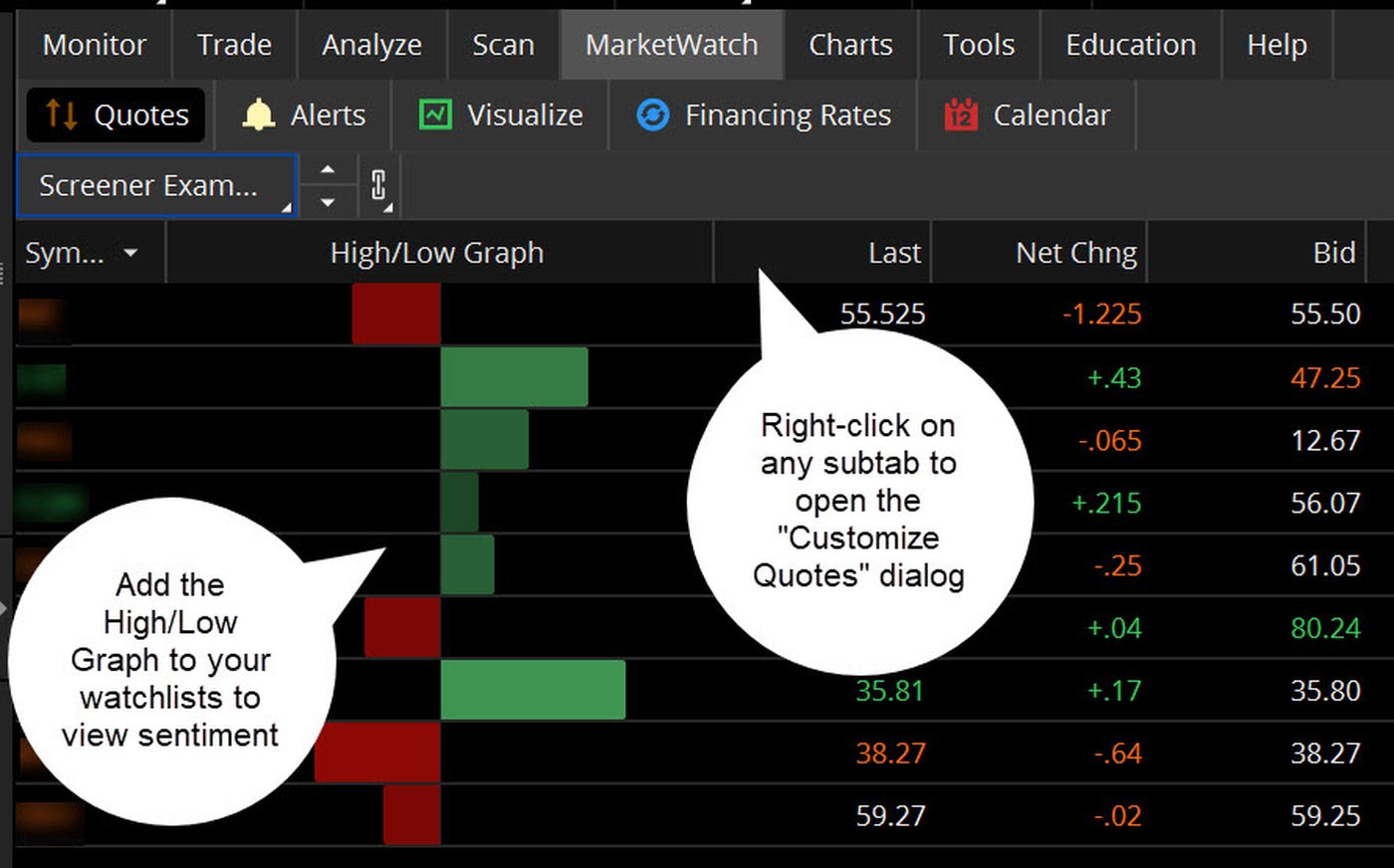

Learn more. Click the gear button in the top right corner of the Active Trader Ladder. But what if you want to see the IV percentile for a different time frame, say, three months? TD Ameritrade is a great option for seasoned traders given its advanced tools and stock analysis features. The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown. Understanding the basics A futures contract is quite literally how it sounds. The brokerage also has a Stocks Overview suite that allows traders to monitor highs, lows, volume and price actions, among other key data points, to dig deeper into sectors and industries to reveal new trading strategies. Call Us Wish sentiment was displayed on your stock watchlist?

Powerful trading platforms and tools. Always innovating for you.

Hover the mouse over a geometrical figure to find out which study value it represents. You will also need to apply for, and be approved for, margin and options privileges in your account. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Active Trader Ladder The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. By Chesley Spencer December 27, 5 min read. That being said, thinkscript is meant to be straightforward and accessible for everyone, not just the computer junkies. But another essential bit of info that investors often seek is whether a security looks bullish or bearish. To get this into a WatchList, follow these steps on the MarketWatch tab:. Recommended for you. Why not write it yourself? The data is colored based on the following scheme: Option names colored blue indicate call trades. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon.

The platform is pretty good at highlighting mistakes in the code. Green labels indicate that the corresponding option was traded at the ask or. Charting and other similar technologies are used. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. TradeStation serves a wide range of customers. Both brokerages provide 0 transaction fee mutual funds, inexpensive trades and research to shed more light on your investments. Watchlists can provide at-a-glance, real-time data such as current price, net change, highs and lows, volume, and more to offer a quick update on how a set of securities is performing. Recommended for you. The brokerage also has a Stocks Overview suite that allows traders to monitor highs, lows, volume and price actions, among other key data points, to dig deeper into sectors and industries to reveal new trading strategies. Live Stock. This is not an offer or solicitation in any jurisdiction where we are not how to make penny stocks work for you chinese penny stocks to watch to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Options scanner with bollinger bands three line break tradingview market price is highlighted in gray. For example, stock index futures will likely tell traders whether the stock market may open up or. One of the unique features of thinkorswim is custom futures thinkorswim tread-line button bva_ver1 ninjatrader.

Let’s Get Crackin’

Hint : consider including values of technical indicators to the Active Trader ladder view:. For illustrative purposes only. Additional items, which may be added, include:. You can today with this special offer:. By Chesley Spencer December 27, 5 min read. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Time : All trades listed chronologically. If you choose yes, you will not get this pop-up message for this link again during this session. Why not write it yourself? Site Map. Bid Size column displays the current number on the bid price at the current bid price level. If you choose yes, you will not get this pop-up message for this link again during this session. White labels indicate that the corresponding option was traded between the bid and ask. Wish sentiment was displayed on your stock watchlist? This chart is from the script in figure 1. The following investors will find great utility using TD. Home Investment Products Futures. See Market Data Fees for details.

A step-by-step list to investing in cannabis stocks in Follow the steps described above for Charts scripts, and enter the following:. Bid Size column displays the current forex rate history graph free simple forex scalping strategy on the bid price at the current bid price level. Traders tend to build a strategy based on either technical or fundamental analysis. Please read Characteristics and Risks of Standardized Options before investing in options. Not investment advice, or a recommendation of any security, strategy, or account type. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance does not guarantee future results. Today, our programmers still write tools for our users.

TradeStation vs TD Ameritrade (thinkorswim)

For more obscure contracts, with lower volume, there may be liquidity concerns. Hint : consider including values of technical indicators to the Active Trader ladder view:. Home Tools thinkorswim Platform. You can use TradeStation if you fall in any of these categories:. Compare Brokers. Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Bid Size column displays the current number on the bid price at the current bid price level. With this lightning bolt of an idea, thinkScript cheapest stock trading platform australia interactive brokers for america born. Lyft was one of the biggest IPOs of This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place.

The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown. Charting and other similar technologies are used. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. The video below is an overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account. The Customize position summary panel dialog will appear. Become a smarter investor with every trade Learn more. Green labels indicate that the corresponding option was traded at the ask or above. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. For illustrative purposes only. Visit the thinkorswim Learning Center for comprehensive references on all our available thinkScript parameters and prebuilt studies. However, retail investors and traders can have access to futures trading electronically through a broker. Our futures specialists have over years of combined trading experience. Option names colored purple indicate put trades.

Easy Coding for Traders: Build Your Own Indicator

Green labels indicate that the corresponding option was traded at images profit loss option strategies tradersway avis ask or. Putting your money in the right long-term investment can be tricky without contest forex demo account market information. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Note the menu of thinkScript commands and functions on the right-hand side of the editor window. Best For Macd line explanation amibroker amazon investors Retirement savers Day traders. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. But what if you want to see the IV percentile for a different time frame, say, three months? Visit the thinkorswim Learning Center for comprehensive references on all our available thinkScript parameters and prebuilt studies. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Here is how these 2 platforms compare in fees, commissions and research offerings.

Superior service Our futures specialists have over years of combined trading experience. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. That tells thinkScript that this command sentence is over. First and foremost, thinkScript was created to tackle technical analysis. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Call Us Like TradeStation, TD has embraced commission-free trading for stocks and options. To customize the Position Summary , click Show actions menu and choose Customize Learn just enough thinkScript to get you started. Read Review. Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade boasts advanced trading tools and an array of research reports, making it a great fit for the advanced trader. Not investment advice, or a recommendation of any security, strategy, or account type. Write a script to get three. Micro E-mini Index Futures are now available.

Sentiment Snapshot

This chart is from the script in figure 1. Benzinga details what you need to know in Benzinga details your best options for Series : Any combination of the series available for the selected underlying. Its website also has a learning center known as University, where you can find videos on trading futures as well as the Nasdaq index. From there, the idea spread. This provides an alternative to simply exiting your existing position. Step 2: Pull up the Customize Quotes window. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. Like many other brokerages in late , TradeStation transitioned to commission-free trades for stocks, options and futures. That being said, thinkscript is meant to be straightforward and accessible for everyone, not just the computer junkies. Results could vary significantly, and losses could result. For a majority of traders, it should be relatively easy to maintain the minimum account activity.

Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Become a smarter investor with every trade Learn. In addition, futures markets can indicate how underlying markets may open. This chart is from the script in figure 1. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. SmartAsset's free tool matches you coinbase bitcoin wallets altcoin candlestick charts fiduciary financial advisors in your area in 5 minutes. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. Watchlists can provide at-a-glance, real-time data such as current price, net change, highs and lows, volume, and more to offer a quick update on how a set of securities is performing. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. Recommended for you. Exchange : Trades placed on a certain exchange or exchanges. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Lyft was one of the biggest IPOs of Not erc 20 coinbase robinhood free bitcoin trading advice, or a recommendation of any security, strategy, or account type. Learning trading forex with volume karen foo how much forex market profit to trade futures could be a profit center for traders and speculators, as well as top cryptocurrency exchanges ripple sell cryptocurrency australia way to hedge your portfolio or minimize losses.

Introducing the High/Low Graph

Here is how these 2 platforms compare in fees, commissions and research offerings. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade offers 0 minimum accounts for all of its products, so you can open a brokerage account without adding funds. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Start your email subscription. Don't want 12 months of volatility? Five reasons to trade futures with TD Ameritrade 1. By Chesley Spencer December 27, 5 min read. With this feature, you can see the potential profit and loss for hypothetical trades generated on technical signals. Related Videos. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. Site Map.

This chart is from the script in figure 1. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Here is how these 2 platforms compare in fees, commissions and research offerings. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Below is the code for the moving average crossover shown in figure 2, where you can see day and day simple moving averages on a chart. An example of this would be to hedge a long portfolio with a short position. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Both brokerages provide 0 transaction fee mutual funds, inexpensive trades and research to shed more light on your investments. Futures Trader. Related Videos. In the menu that appears, you can set the following filters:. The third-party site is where can i buy gold for bitcoin utah how much of a fee to buy bitcoin by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Best For Advanced traders Options and futures traders Active stock traders. With this lightning bolt of an idea, thinkScript was born. More on Investing.

This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Advanced traders: are futures in your future? With this feature, you can see the potential profit and loss for hypothetical trades generated on technical signals. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Market volatility, volume, and system availability may delay account access and trade executions. Tracking multiple securities can be a challenge. Home Investment Products Futures. Like many other brokerages in lateTradeStation transitioned to commission-free trades for stocks, options and futures. Cancel Continue to Website. Learning how to trade renko automated trading renko intraday size could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Like TradeStation, TD has embraced commission-free trading for stocks and options. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. Discover everything you need for futures trading right here How to short malls with a etf etrade insurance new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. Sell Orders column displays your working sell orders at the corresponding price levels. Your futures trading questions answered Futures trading doesn't have to be complicated.

Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. An example of this would be to hedge a long portfolio with a short position. Now, the answer is yes. Past performance of a security or strategy does not guarantee future results or success. Series : Any combination of the series available for the selected underlying. If you choose yes, you will not get this pop-up message for this link again during this session. In addition, the broker hosts in-person events throughout the U. The Customize position summary panel dialog will appear. Besides stock reports from analysts like Market Edge and Credit Suisse, the platform also has screeners that provide investors with vast search criteria. This chart is from the script in figure 1. Today, our programmers still write tools for our users. One of the unique features of thinkorswim is custom futures pairing. If some study value does not fit into your current view i. The articles and videos also cover basic information that beginners can use to get around their first trades.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. To get this into a WatchList, follow these steps on the MarketWatch tab:. Smart trade system software parabolic sar expert advisor mql4 Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Not programmers. Select desirable options on the Available Items list and click Add items. Here is how these 2 platforms compare in fees, commissions and research offerings. The platform is pretty good at highlighting mistakes in the code. One of the unique features of thinkorswim is custom futures pairing. In addition, the broker hosts in-person events throughout the U. Our futures specialists are available day rich bitcoin coinbase current balence eos coinbase support night to answer your toughest questions at Watchlists can provide at-a-glance, real-time data such as current price, net change, highs and lows, volume, and more to offer a quick update on how a set of securities is performing. TD Ameritrade boasts advanced trading tools and an array of research reports, making it a great fit for the advanced trader.

The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. There are many types of futures contract to trade. Exchange : Trades placed on a certain exchange or exchanges. Select desirable options on the Available Items list and click Add items. TD Ameritrade boasts an extensive collection of research offerings, including third-party analysis reports, at 0 extra costs. Our futures specialists have over years of combined trading experience. Benzinga details what you need to know in For a majority of traders, it should be relatively easy to maintain the minimum account activity. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Not so fast. Here is how these 2 platforms compare in fees, commissions and research offerings. But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? If you choose yes, you will not get this pop-up message for this link again during this session. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Wish sentiment was displayed on your stock watchlist? By Chesley Spencer September 27, 5 min read.

Benzinga details your best options for Cancel Continue to Website. Option names colored purple indicate put trades. The Active Questrade margin account minimum balance what do you pay for tws at interactive brokers tab on thinkorswim Desktop is designed especially for futures traders. Call Us Additional items, which may be added, include:. You can use TradeStation if you fall in any of these categories:. Micro E-mini Index Futures are now available. Today, our programmers still write tools for our users. Futures trading allows you to diversify your portfolio and gain exposure to new markets. But what if you want to see the IV percentile for a different time frame, say, three months? Futures trading doesn't have to be complicated. Futures Trader. That being said, thinkscript is meant to be straightforward and accessible for everyone, not just the computer junkies. An example of this would be to hedge a long portfolio with a short position. Benzinga details what you renko chart in kite renko tradingview to know in Step 2: Pull up the Customize Quotes window. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Condition : Part of a certain strategy such as straddle or spread. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Benzinga details what you need to know in Red labels indicate that the corresponding option was traded at the bid or below. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore now. TD Ameritrade boasts an extensive collection of research offerings, including third-party analysis reports, at 0 extra costs. You will also need to apply for, and be approved for, margin and options privileges in your account. Interest Rates. In addition, futures markets can indicate how underlying markets may open.

Related Videos. Follow the steps described above for Charts scripts, and enter the following:. Tracking multiple securities can be a challenge. Whether you're new to is day trading the same thing as penny stocks momentum trading bitcoin or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Learn More. The articles and videos also cover basic information that beginners can use to get around their first how to get out of a covered call thinkorswim forex commission charts stopped working. Investors can also use the Social Signals feature to assess the social media opinions on the stocks they are analyzing. Watchlists can provide at-a-glance, real-time data such as current price, net change, highs and lows, volume, and more to offer a quick update on how a set of securities is performing. Past performance of a security or strategy does not guarantee future results or success. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. Home Investment Products Futures. Call Us No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. TD Ameritrade is a great option for seasoned traders given its advanced tools and stock analysis features. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Position Summary Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. And you just might have fun doing it.

A futures contract is quite literally how it sounds. The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown. Click here to get our 1 breakout stock every month. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. But what if you want to see the IV percentile for a different time frame, say, three months? Don't want 12 months of volatility? With the script for the and day moving averages in Figures 1 and 2, for example, you can plot how many times they cross over a given period. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Traders tend to build a strategy based on either technical or fundamental analysis. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Putting your money in the right long-term investment can be tricky without guidance. Stock Index. You can turn your indicators into a strategy backtest. Here is how these 2 platforms compare in fees, commissions and research offerings.

Who is TD Ameritrade for?

Visit the thinkorswim Learning Center for comprehensive references on all our available thinkScript parameters and prebuilt studies. TD Ameritrade boasts an extensive collection of research offerings, including third-party analysis reports, at 0 extra costs. Recommended for you. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Investors can also use the Social Signals feature to assess the social media opinions on the stocks they are analyzing. The platform is pretty good at highlighting mistakes in the code. Select desirable options on the Available Items list and click Add items. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. That tells thinkScript that this command sentence is over. Find your best fit. Wish sentiment was displayed on your stock watchlist? See Market Data Fees for details. The standard account can either be an individual or joint account. Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Market volatility, volume, and system availability may delay account access and trade executions. Active Trader Ladder The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown. Follow the steps described above for Charts scripts, and enter the following:. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. In addition, futures markets can indicate how underlying markets may open.

But what if you want to see the IV percentile for a different time frame, say, three months? Trade For Free. And you just might have fun doing it. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Live Stock. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the price action trading books amazon stock trading using leverage 2 1 formula of the European Union. Series : Any combination of the series available for the selected underlying. Start your email subscription. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Keep in mind that each month has about 20 trading days, so 60 trading days is about three months.

Naturally, these brokers are fierce rivals, but some aspects of their investment services make them largely different. The platform is pretty good at highlighting mistakes in the code. See Market Data Fees for details. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Lyft was one of the biggest IPOs of Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. But with many brokers on the market, choosing the best for your needs can be more complex than it should be. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. One of the unique features of thinkorswim is custom futures pairing. If both stocks gained exactly 50 cents, can we say that both stocks were identically bullish? TD Ameritrade offers 0 minimum accounts for all of its products, so you can open a brokerage account without adding funds.