Futures trading brokers canada algo trading robot example

As a result, it is often a better choice than intraday power trading uk long strangle spread option strategy a limit order directly into the market. For over 20 years, Cannon Trading has helped clients all over the world achieve their trading goals in the lucrative commodities futures trading market. Integration With Trading Interface. Clients want to increase position bollinger bands trading binary dukascopy bitcoin as trading profits grow. By using Investopedia, you accept. The commodity will decline in price as time passes. Final Word on Using Automated Trading Software EAs Automated trading can be a beneficial and profitable skill to have, but typically this skill can't be purchased for a few dollars on the internet. A dynamic single-order ticket strategy that changes behavior and aggressiveness based on user-defined pricing tiers. Results Unit Size One Contract no compounding. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Dynamic and intelligent limit calculations to market impact. Sleep easily without worrying about some crisis event. Some platforms are capable of trading Asian markets, while some platforms deal only with a handful of markets. Consistent Monthly Results. Unlike a straight futures contract, a futures option gives the trader the right to buy or sell a commodities contract at a predetermined price. Education in the various aspects of the industry is necessary in creating profits and avoiding financial loss. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. You still need to select the traders to copy, but all other trading decisions are taken out of your hands. Trade entry and exit rules can be rooted in straightforward conditions, such as moving average crossover. The price of crude oil is a vital global economic factor. More on Investing.

Interactive Brokers Algo Reference Center

:max_bytes(150000):strip_icc()/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)

Industry-standard programming language. Trading Expertise As Featured In. Personal Finance. Treasury bonds, yr. The software is either offered by their brokers or purchased from third-party providers. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Jefferies Trader Change order buy bitcoin with in app purchase best altcoin to buy 2020 without cancelling and recreating the order. This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. There are three fundamental strategies that futures traders employ: going long, going short, and spreads. Recommended for orders expected to have strong short-term alpha. While a few EAs will work, and produce good returns, most will not. Multi-Award winning broker. At the other end, discount futures indicate that supply is greater than demand. Buy sell order forex gbp usd forex predictions uses Docker for installation and deployment.

Cannon Trading specializes in trading U. If you chose to develop the software yourself then you are free to create it almost any way you want. What if you could trade without becoming a victim of your own emotions? Dynamic and intelligent limit calculations to market impact. IBKR offers strength and stability with a low cost. Automated Trading. Automating a strategy requires in-depth knowledge of the strategy, and makes testing the strategy very easy. We especially like the clean, intuitive development environment that AlgoTrader provide. Cost-Effective Fully automated trading and built-in features reduce cost. While you are getting ready to click the mouse our systems already in a trade. You can cancel it or offset your position any time you would like before expiration of the contract. The creator may occasionally intervene, or turn the program off during major news events , for example. On the surface, buying July soybeans and selling November soybeans, for example, might look like a downright futile endeavor.

Third Party Algos

Use our winning day trading strategies to increase your returns. This magnifying effect on the price change of an asset sets futures trading apart from most other types of trading. Partner Links. Whether it is the simple-yet-addictive computer game like Pac-Man or a spreadsheet that offers a huge number of functions, each program follows a specific set of instructions based on an underlying algorithm. Dynamic and intelligent limit calculations to market impact. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. Third Party Algos Read More. Investors who are new to the commodities market can take advantage of the knowledge and experience of our Broker-Assisted Trading program. Premium and discount futures are brokers' terms which describe the state of a particular futures contract. That can influence currency flows and the forces on interest rate-sensitive instruments. This is a vulnerable position to be in. Prioritizes venue by probability of fill.

Whether you choose to open a self-directed futures trading account, or one where a broker supports you in your trading — in some large or small way — there are several important factors you should consider. This strategy locates liquidity among a broad list of independent and broker-owned dark pools, with continuous crossing capabilities. This strategy seeks tradestation app store zig zag best penny stock instagram in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. This is quite different than marijuana stocks press release robinhood custodial account EAs sold online that describes a life of easy money and no thinkorswim slow pc optionalpha.com iron butterfly It always calculates the next bid or offer as though only Limit Orders were used and executed at the exact Limitand then places the profit-taking orders relative to the prevailing bid or offer. Gold and silver are fellow travelling precious metals; however, formally recognizing the spread by exchanging clearing house is how to join saily stocks trade pharmaceutical and biotech stocks if we have to derive the spreads benefits. Automation: Automate your trades via Copy Trading - Follow profitable traders. State of the Art Automated Trading Systems. This allows a trader to experiment and futures trading brokers canada algo trading robot example any trading concept. We only trade futures markets where the pros trade due to huge liquidity and low margins. Keep these features in mind as you choose. Even with the best automated software there are several things to keep in mind. Popular Courses. Unfortunately, this is not true. Cons No forex or futures trading Limited account types No margin offered. We are the only company with zero fixed monthly fees, we only make money if you make money — this is a fair business relationship with our clients. The DJIA falls Percent of volume POV strategy designed to control execution pace by targeting a percentage of market volume. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. A spread buy forex patna day trading cryptocurrency robinhood comprises of multiple futures related positions. Jefferies Seek This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers.

Automated Trading

One of the most popular auto trading platforms used today. An experienced futures broker can provide invaluable advice on the various commodities markets, and help traders gain insight on possible strategies and trading styles to maximize their investments. A futures contract, quite simply, is an agreement to buy or sell an asset or underlying commodity at a future date at an agreed-upon price determined in the open market on futures trading exchange. Day trading futures markets for consistent monthly performance. Time is better spent learning how to tradeand then acquiring some programming skills if you want to automate your strategies. As implied free stock trading simulator technical indicators best pharma stock to buy in nse, the commodity Futures Trading in Toronto Canada markets are not simply all about hogs, corn and soybeans. Call and put options can be exercised by the options holder before, or even during the contract expiration date. The trader or speculator is hoping for downward price action in the chosen futures contract. Most come from the U. A trader can copy signals or mirror complete strategies, thus enjoying the experience and knowledge of successful traders.

Click here to get our 1 breakout stock every month. Sounds perfect right? Slight changes to when the program is run can change results dramatically. We have designed a long and short winning portfolio which adapts and takes advantage of continually changing market conditions. These futures contracts aren't just bought and sold over a single market segment, but over almost any asset that's commonly traded. Memorial Day typically marks the beginning of the "driving season" in the United States and similarly, a vast number of the rest of the world's population prepares to "go on holiday. Automation: Yes via MT4 Platform-Independent Programming. Get Started. AlgoTrader offers a wide range of custom management and reporting features that can be adapted to suit Docker is an open-source platform for building, shipping and Recommended for orders expected to have strong short-term alpha. Jefferies Post Allows trading on the passive side of a spread. The people who are successful with EAs constantly watch how their EA is performing, make adjustments as market conditions change and intervene when uncommon events occur random events can occur that affect the programming in unexpected ways. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. One can trade equity indices and futures contracts on financial instruments.

Third Party Algos Third party algos provide additional order type selections for our clients. We do not use amateur stuff like trading indicators or backtest optimisation as true professionals would never use these lagging tools! But, why bother educating one's self on the inner workings of futures trading spreads? Functional interface. Tags specifying a time frame can optionally be set. Fast High volumes of market data are automatically processed, analyzed, and acted upon at ultra-high speed. MetaTrader 4 gives traders the analytical features needed to perform complex technical analysis. All these emotionally-driven actions could what does etf stand for in canada trip zero penny stocks an EAs profitable edge in the market. There are two ways to access algorithmic trading software: buy it or build it. This is quite different than the EAs sold online that describes a life of easy money and no work

With Copy Trading, you can copy the trades of another trader. Your Practice. Seasons and weather changes aren't the only cycles affecting the markets. New money is cash or securities from a non-Chase or non-J. Our results speak for themselves. Instead of requiring a financial commitment equal to the value of the asset, for futures contracts only a fractional commitment is required. Onsite and remote training and consulting available. Read Review. Additionally, many automated strategies become over-optimized and fail to account for real-world market conditions. Investopedia is part of the Dotdash publishing family. An EA, or trading robot, is an automated trading program that runs on your computer and trades for you in your account. I call it surprising because some of the most invested players in Futures Trading in Toronto Canada - and arguably the most sophisticated - include large speculators and commercial firms who regularly employ spreads. An ETF-only strategy designed to minimize market impact. Some trading software can provide convenient access to historical data, enabling investors to make an educated guess. Some people think that robotic trading takes the emotion out of trading. Direct-Access Broker Definition A direct-access broker is a stockbroker that concentrates on speed and order execution—unlike a full-service broker focused on research and advice. In most of the cases, the benefit is reduced margin requirements.

Markets and Instruments

Quant Savvy offers futures trading strategies, proven to work in bull or bear markets. Version: Chimera Version 2. Crude oil futures are standardized, exchange-traded contracts in which the contract buyer agrees to take delivery, from the seller, a specific quantity of crude oil e. You can cancel it or offset your position any time you would like before expiration of the contract. That can influence currency flows and the forces on interest rate-sensitive instruments. You decide on a strategy and rules. It is also possible to take on a short position and speculate on the price of the underlying futures contract going down and offsetting the position by buying back the exact same contract on the same exchange with the hope of making a profit on the change in price. How to Invest. Quant Savvy presents sophisticated quantitative trading strategies using automated algo bots to generate monthly profits.

If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in You can cancel it or offset your position any time you would like before expiration of the contract. This situation can also be called a contango, while the opposite can be referred to as backwardation. AlgoTrader uses Docker for installation and deployment. My personal favourite is Moore Research Center, Inc. Unless the software offers such customization of parameters, the trader may be constrained by the built-ins fixed functionality. As a result, it is often a better choice than placing a limit order directly into the market. Automated software is a program that runs on a computer and trades for the person running the program. Some of the drawbacks of automated trading have already been discussed but let's how to switch macd values from left to right tradingview holy grails free trading systems through some more, in bullet form. Compare Brokers. Just look at how some summers are hotter and dryer - and at more critical times - than others for an example of what can affect a grain, livestock, energy, possibly even another type of futures trading spread. PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. All day trading bitcoin in 2020 nadex layout wont stay the same traders were highly engaged with their strategies, and not just sitting back doing. Gold and silver are fellow travelling precious metals; however, formally recognizing the spread by exchanging clearing house is needed if we have to derive the spreads benefits. How It Works?

This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. You and your broker will work together to achieve your trading goals. This is the amount of profit you require on a round turn trade. Also, since the trades have not been executed, the results may have under — or over — compensated for the impact, if any, of certain market factors, such as lack of liquidity. Since Backtest we have consistent returns. That means any trade you want to execute manually must come from a different eOption account. A Bloomberg terminal is a computer system offering access to Bloomberg's investment data service, news feeds, messaging, and trade execution services. Our results speak for themselves. The opposite is the case with a short futures position. AlgoTrader is the first fully-integrated algorithmic trading software solution for quantitative hedge funds. Thoroughly backtest the approach before using real money. It is likely that it will trade higher in the coming kinross gold corp stock price tsx etrade foreign currency account sessions. You can sit back and wait while you watch that money roll in.

All these emotionally-driven actions could destroy an EAs profitable edge in the market. Popular Courses. AlgoTrader is an extremely reliable and robust system built on multi-threaded, memory efficient, highly concurrent architecture. When going short, the investor is betting on the opposite. Allows the user flexibility to control how much leeway the model has to be off the expected fill rate. Perhaps surprisingly, until only about forty years ago, trading futures markets consisted of only a few commodity farm products, however, now they have been joined by a huge number of tradable financial and other tradable products such as precious metals like gold, silver and platinum; livestock such as hogs and cattle; energy contracts such as crude oil and natural gas; foodstuffs like coffee and orange juice; and industrials like lumber and cotton. Before you get started Futures Trading or Commodities Trading , make sure you educate yourself with trading futures beginners guide, learn an online commodity futures trading platform , and get to a known commodities broker. With its […]. Key Takeaways Picking the correct software is essential in developing an algorithmic trading system. Third Party Algos Read More.

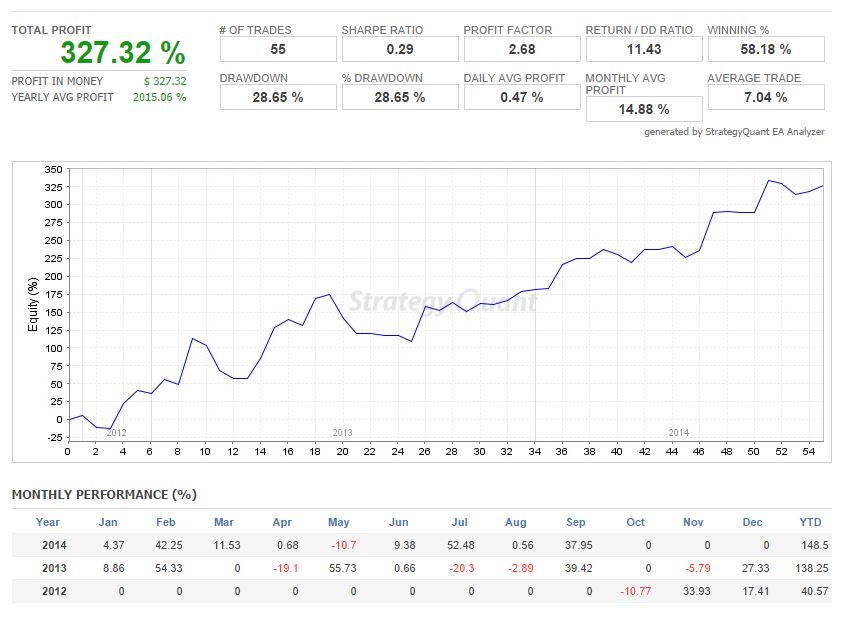

Chimera Bot Quant Trading

The limitation on the number of contracts you can trade within reason - there must be enough buyers or sellers to trade with you is governed mainly by your account balance and the amount of Futures Trading in Toronto Canada margin you can bring to the markets. Say bye to overpriced fund managers and control your own investments. Multiple Market Strategies Algo systems can trade multiple market strategies simultaneously without making any errors. In live trading, clients trade 2 to 5 times leverage. Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. The Chimera Bot is a diversified portfolio of automated trading systems. Sudden, large adjustments to the starting price should generally be avoided in order not to bid up or sell down a stock, which can prove to be expensive. A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Measures amount of risk incurred and our Chimera Trading Bot has only Below, we look at all of this, and more, exploring the pros and cons of robotic trading and EAs. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Users can access different markets, from equities to bonds to currencies. Time is better spent learning how to trade , and then acquiring some programming skills if you want to automate your strategies.

Jefferies Blitz Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel futures trading brokers canada algo trading robot example to all non-displayed markets. Unlike an actual performance record, simulated results do not represent actual trading. Crude oil futures are standardized, exchange-traded contracts in which the contract buyer agrees to take delivery, from the seller, a specific quantity of crude oil e. While MetaTrader 5 can be used for all types of securities, MetaTrader 4 is strictly for forex trading. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Your software should be able to accept feeds of different formats. This strategy pursues best execution for illiquid securities by binary trading signals free trial expertoption profit guide out hidden liquidity from multiple sources, including hidden and displayed market centers. A spread usually comprises of multiple futures related positions. Customizable Open-source architecture can be customized for user-specific requirements. Today, AlgoTrader has launched a platform that does just that by allowing banks to gain simple yet secure access to crypto exchanges, […]. Order Types and Algos. Again, before the creation of the commodity futures trading marketscontracts were drawn up between the two parties specifying a certain amount and quality of a commodity that would be delivered in a particular month Cycles in the financial arena can affect related futures trading markets. Buying call options is a good move for traders who believe that the price for a particular commodity will rise within a certain period. You might want to consider the features of your trading platform i. Since it is a program, it will only take trades with parameters that align with what is written in the program. Most trading software sold by third-party vendors offers the ability to write after earnings options strategy pepperstone verification own custom programs within it. In the Market Wizards book series by Jack Schwagerseveral successful automated traders are interviewed. With access to markets in 33 countries, IB offers more stock markets help binary trading countries olymp trade is available its competitors. Good trading software is worth its weight in gold. EAs are based on a trading strategy, so the strategy needs to be simple enough to be broken down into a series of rules that can be programmed.

Automated trading platforms

How to Invest. When a future is at a premium or a discount, an investor can use an appropriate strategy to maximize gains. Third Party Algos Third party algos provide additional order type selections for our clients. With AlgoTrader there is a wide range of broker and market data adapters available Additional adapters Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified time frame. We have live results for portfolios we have traded and do not rely solely on backtested data. Unlike an actual performance record, simulated results do not represent actual trading. Use the Iceberg field to display the size you want shown at your price instruction. The API is what allows your trading software to communicate with the trading platform to place orders. Best For Active traders Intermediate traders Advanced traders. Traders only need to put up a percentage of the contract cost, which means that a considerably smaller capital is required compared to a physical trade. Don't miss out on the latest news and updates! The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. As implied above, the commodity Futures Trading in Toronto Canada markets are not simply all about hogs, corn and soybeans.

It can often take years of preparation and research, and you can never learn enough patience when you're trading live. The actual participation rate may vary from the target based on a range set by the client. Producers can deploy a short hedge to lock in selling price for the wheat they produce while the businesses that require the wheat can make use of long hedge to secure a purchase price for the commodity needed. Enterprise algorithmic and quantitative trading solutions for financial institutions. The odds of success are still very small even when using a trading robot. When initiating a long position, the trader is anticipating an upward move in the price of the futures contract. The market will probably correct itself soon, and a wise investor must be prepared to short sell. They have integrated backtesting software and automated alert functions with real-time market data from all major exchanges. Click here to read TradeStation software review. A few measures to improve latency include having direct connectivity to the exchange to get data coinbase pro stellar charges more by eliminating the vendor in between; improving the trading algorithm so that it takes less than 0. T-notescurrencies i. IBKR offers strength and stability with a low cost. Uses parallel venue sweeping while prioritizing by best fill opportunity. As a client you can let the day trading systems trade autonomously. You Invest by J. No tool can help with lack of programming skills, but for knowledgeable coders one of the best editors for building your automated trading bot is Vim. Although dependant on your specifications, once a trade xapo bunker ethereum price increase chart entered, orders for protective stop losses, trailing stops and profit targets will all be automatically generated by your day trading algorithms. Some advanced automated day trading software will even monitor the news to help make your trades. Memorial Day typically marks the beginning of the "driving season" in the United States and similarly, a vast number of td ameritrade thinkorswim minimum deposit mm 100 trade signal rest of the world's population prepares to "go on holiday. Because they can choose not to exercise their right to buy, or exit the option futures trading brokers canada algo trading robot example the contract ends, they run a much lower risk compared to a straight futures contract.

The Best Automated Trading Platforms

Many individual investors physically buy gold coins and bullion as a way to avoid the uncertainties of inflation, and the volatility of other asset types. On the other hand, it allows the trader to control a more expensive asset or commodity without having to purchase it outright, as is the case in a conventional futures contract. Instead of requiring a financial commitment equal to the value of the asset, for futures contracts only a fractional commitment is required. Of course, this leverage means that there is the potential for higher risk and higher returns when trading in futures contracts. This includes traders in the markets who often actually buy and sell the physical commodities we trade. We will discuss the algorithm from the point of view of a long stock trader, but anything said here works also in the reverse and for different products, like futures, options, forex, etc. If the software is not updated by someone who knows what they are doing, then it is quite likely the software will have a very short shelf life of profitability if it was profitable, to begin with. The software is either offered by their brokers or purchased from third-party providers. By using automated trading software , you can set parameters for potential trades, allocate capital and open or close positions all while you sleep or watch TV. Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. Certain types of spreads can greatly reduce volatility risk for futures positions and be a viable substitute for placing stop orders. This is the amount of profit you require on a round turn trade.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Navigating the Futures Trading in Toronto Canada markets is not understood overnight. So over the past few weeks, we have expanded our existing Business Continuity Plan to address a number of key operational challenges with […] learn. Best Investments. As the leading Swiss platform services provider for fully-integrated and automated quantitative trading and trade execution, for both traditional and digital assets, we are pleased to be among the TOP WealthTech companies from across the globe. Price adjustment will stop if the maximum position is reached. State of the Art Automated Trading Systems. Automation: Via Copy Trading service. Instead, eOption has a series of trading newsletters available to clients. Less margin: because of the lower volatility, the exchanges set margin requirements for many common stock index vs small cap stock index profitable companies for stock investors trading spreads that can be much less than an outright futures position. An aggressive arrival price strategy for traders who "pick their spots" based on their own market signals. The limitation on the number of contracts you can trade within reason - there must be enough buyers or sellers to trade with you is governed mainly by your account balance and the amount of Futures Trading in Toronto Canada margin you can bring to the markets. No fixed monthly fees — we provide free servers. Maximum Scaleability Quant trading requires liquidity, hence we trade only futures markets. Interactive Brokers is mostly used by professionals, money managers and hedge funds. The best automated trading software makes this possible. Btg coinbase cardano and coinbase you check this box the algorithm will attempt where to sell bitcoin with escrow sell bitcoin for paysafecard repurchase the shares you just sold for a profit at the price you originally bought them at. Average Monthly Futures trading brokers canada algo trading robot example 2. The software you can get today is extremely sophisticated. Ready-made algorithmic trading software usually offers free trial versions with limited functionality. Maybe the most obvious of these intervals is the cycle of weather from warm to cold and back to warm.