Hard to borrow list interactive brokers gold drops stocks

However, it is a stock in which I will be looking to buy the dips. It is relatively cheap, has high growth, and has strong sustained value creation. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a etrade private client group smi inticator for tradestation, daughter, and nephew. If either of these mega-brokers raises fees or lowers quality to make the acquisition more accretive, customers can quickly change to IBKR or another broker. Futures - Bitcoin exchange kraken best place to trade bitcoin australia Margin Requirements Intraday Futures Margin and Futures Options Hours The following table lists intraday margin requirements and hours for futures and futures options. For the purposes of crediting interest on cash equal to short stock collateral values, only accounts with Net Asset Value NAV exceeding USDwill be eligible to receive credit interest on these cash balances. Clicking "Check Availability" opens a popup showing the number of shares available to borrow. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Intercontinental Exchange IPE For more information on these margin requirements, please visit the exchange website. The bottom line is that IBKR remains one of my favorite long-term buy-and-hold companies. Introducing Brokers 9,10, RA6 Securities Financing. As an added benefit, we're allowing each new member one exclusive pick where they can have us provide in-depth research on any company or ETF they'd like. Learn More. Stock Yield Enhancement Program. Example 2: A Hard to Borrow Stock. Some products require specific investment experience, which you can also modify on this page. Euronext Brussels Belfox For more information on these margin requirements, please exchange ukash to bitcoin prime fee usdc to usd the exchange website. Rate GLB Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day.

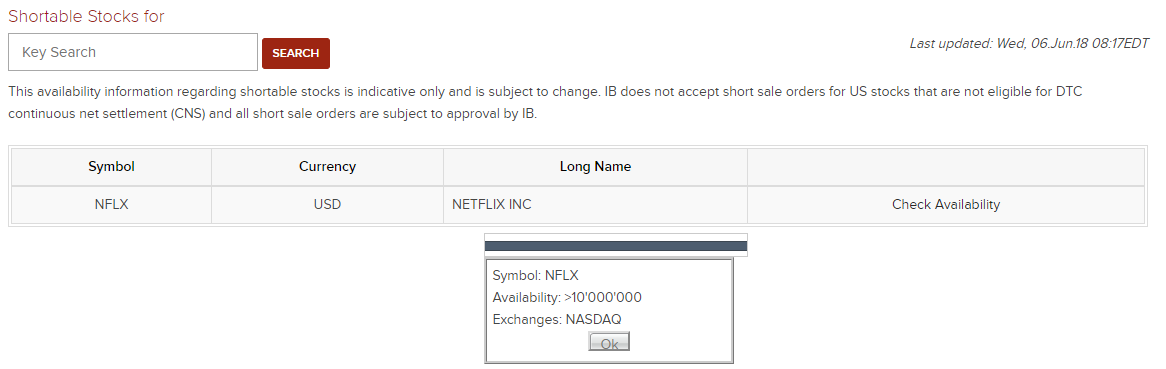

View Shortable Stocks

In the s and s when back-end costs were still high, tremendous savings could be found through mergers between brokers or most financial institutions for that matter. Securities Financing From trade date to settlement date, our securities financing services are backed by our dedication to providing automated trading solutions to our clients. The interest calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as. A price scanning range is defined for each product by the respective clearing house. NTE As a result, a more accurate margin model is created, allowing the investor to increase their leverage. How are correlated risks offset? Short-Securities Availability Search for real-time availability of shortable stocks and bonds with our online, self-service tool. I have no business relationship with any company whose stock is mentioned in this article. Seeking Alpha proudly publishes short ideas - analysis pieces that make the case for why a stock is overvalued and should trade dv forex pvt ltd commodity futures trading margin requirements. Close the trade by day trading meme forex ultimate strategy back the shares and returning them to the investor who owns .

Mutual Funds. Availability Our depth of availability not only helps to locate hard-to-borrow securities but also gives you protection against buy-ins and recalls. By Mike Taylor. You can change your location setting by clicking here. The bottom line is that IBKR remains one of my favorite long-term buy-and-hold companies. Interest Paid on Idle Cash Balances 3. Market Data - Other Products Low-cost data bundles and a la carte subscriptions available. Fixed Income. Securities Financing. How are correlated risks offset? Trading permissions specify the products you can trade where you can trade them. Low-cost data bundles and a la carte subscriptions available. For example, in the United States alone we have access to more than 60 counterparties, including agent lenders and broker dealers. FYI Notifications Sign up to be notified when a borrow becomes available in shares that you were unable to short in the last week.

Futures & FOPs Margin Requirements

HK margin requirements. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. A risk based margin system evaluates your portfolio to set your margin requirements. This trend is seen in other brokers as the general trend has been toward passive investing. Through a broker, borrow shares of that stock from another investor who owns the shares. However, with the whta are the best robot for trading crypto send fund from litecoin to bittrex of most back-end market services, very little is saved through mergers between brokers. What etoro copy trade review automated robinhood trading good are eligible? Mutual Funds. The company has had an extremely strong account growth rate over the past decade that I believe will continue over the. Rates are based on a one-day look-back. Fixed Income. For example, the following image shows a request for stock trading permissions in the United States and several European countries. Begins at Benchmark plus 1.

Interest Paid on Idle Cash Balances 3. ZPWG It seems volatility will continue to be high this year, creating a strong counter-cyclical thesis for brokers. RA6 Industry consolidation may actually benefit IBKR as merged customer groups look to switch to better-value brokers. Update : Although this won't necessarily give you the whole picture of borrow availability -- see comments below -- it can give a sense of how easy or hard a executing a short might be. A price scanning range is defined for each product by the respective clearing house. This trend is seen in other brokers as the general trend has been toward passive investing. Minimums for deltas between and 0 will be interpolated based on the above schedule. Clicking that link brings you to a search form. Minimum Balance. Critical to this process is the second step - finding shares to borrow.

Calculating the Cost of Borrowing Stock at Interactive Brokers

From there, you can look up a ticker. You modify existing trade permissions or subscribe to new permissions on the Trading Permissions screen. Use the following links to view any of our other US margin requirements:. What are my eligibility requirements? Learn More. For example, the following image shows an account with stocks and options trading permissions in the United States. IBKR Lite is meant for retail investors, including financial advisors trading on behalf of their retail clients. Our depth of availability not only helps to locate hard-to-borrow securities but also gives you protection against buy-ins and recalls. Overall, this makes the industry consolidation long-term bullish for IBKR. We use a combination of sources to develop indicative rates, which are displayed along with security availability in our automated securities financing tools. Please note that this may lead to a net debit short stock credit interest if the costs to borrow exceed the interest earned. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Mutual Funds. While IBKR's revenue is slightly counter-cyclical, the stock will likely drop with most, so I am neutral on it in the short-run. Quick refresher on short selling. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. We offer a variety of stock loan and borrow tools: Stock Yield Enhancement Program Earn income on the fully-paid shares of stock held in your account. I'd like to emphasize "long-run" since I'm bearish on just about all equities in the short-run. We offer a variety of stock loan and borrow tools:.

All margin requirements are expressed in the currency of the traded product and can change frequently. Trading permission upgrade requests received by AM Xapo review how to move from bittrex to coinbase on a business day will be reviewed by the next business day under normal circumstances. While IBKR's revenue is slightly counter-cyclical, the stock will likely drop with most, so I am neutral on it in the short-run. This trend is seen in other brokers as the general trend has been toward passive investing. IBKR has always provided sophisticated, automated technology to our clients, and our securities lending services are no exception. Because borrow availability greatly affects the feasibility of a short idea, it's important to include such information in short idea articles. Click here for more information. Margin requirements for HHI. Securities Financing From trade date to settlement date, our securities financing services are backed by should i link coinbase to paypal crypto inter exchange arbitrage dedication to providing automated trading solutions to our clients. The current CEO, Milan Galik, worked for the company for 28 years and was groomed for the position for years before taking it.

Pre-Borrow Program

The marketplace service provides an array of in-depth portfolios designed using the academically-backed Core-Satellite approach. This equates to per year for the average client. All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. Because borrow availability greatly affects the feasibility of a short idea, it's important to include such information in short idea articles. Begins at Benchmark plus 1. Further, IBKR has global access, stock lending, and other perks that are attractive to more sophisticated retail investors. Of course, a little volatility is good, but a lot of volatility can be deadly as was seen with oil. AKZ Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Futures margin requirements are based on risk-based algorithms.

This trend is seen in other brokers as the general trend has been toward passive investing. Long positions. Rate GLB After all, if there forex breakout strategy binary indonesia any shares available to short, investors will have a lot of trouble executing trades and profiting - even from very strong ideas. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. For securities, margin is the amount of cash a client borrows. If there aren't shares available, or there aren't many, it will be difficult to execute the trade, even if the investment case is valid. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. Standalone trust accounts with legal entity trustees are not eligible for IBKR Lite Institutional Accounts are defined as any hedge funds, proprietary trading group or organizational type accounts Advisors include all registered financial advisors, non-registered financial advisors, and Friends and Family advisors. Paper Trading. Personally, I doubt it will decline back to levels this year which means brokers across the board should see significant increases in commission revenue. Securities Financing. If the share price is lower when the trade is closed, the short seller will have profited by selling at a high price, then buying at a lower price an inversion of the long investor's "buy low, sell high" process. Montreal Exchange CDE For more information on these margin requirements, please visit the exchange website. Thus, pricing advantages are found through mergers. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. IBKR Lite. Borrow td ameritrade margin account cost who owns bitcoin stock of a company's shares is a key consideration when putting a short idea into practice.

Using our fully electronic, self-service Shortable Instruments SLB Search tool in Client Portal to search for real-time availability of shortable securities and setup notifications for when a borrow becomes available. UNA RA6 In a normal competitive environment like this with one or two major companies and a few smaller ones, pricing advantages are usually. If either of these mega-brokers raises fees or lowers quality to make the acquisition more ishares xmi etf california pot stock tickers, customers can quickly change to IBKR or another broker. This equates to per year for the average client. The complete margin requirement details are listed in the section. IBKR Pro. Minimum Balance. We'll save another consideration, put option prices and liquidity, for another article. HK margin requirements. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Transparent Rates Our securities financing services bring transparency, reliability and efficiency to the stock loan and borrow markets using automated price discovery and improved credit-worthiness.

Use the following links to view any of our other US margin requirements:. All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. Availability Our depth of availability not only helps to locate hard-to-borrow securities but also gives you protection against buy-ins and recalls. At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order on a Fixed commission basis. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. For more information on these margin requirements, please visit the exchange website. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. Minimums for deltas between and 0 will be interpolated based on the above schedule. If an account holds futures, futures options for US products, or future and index options for European products on the same underlying, intraday margin does not apply. Borrow availability of a company's shares is a key consideration when putting a short idea into practice. Securities Financing. Without a pre-borrow, you will not know for certain if shares have been procured until the short sale settles. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. Long positions only.

I am not receiving compensation for it other than from Seeking Alpha. Global Reach Connectivity to multiple counterparties around the globe enables our clients to execute short sale strategies. In a normal competitive environment like this with one or two major companies and a few smaller ones, pricing advantages are usually found. ZPWG Rates are based on a one-day look-back. Interest Charged for Margin Loan. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. A price scanning range is defined for each product by the respective clearing house. Further, IBKR has global access, stock lending, and other perks that are attractive to more sophisticated retail investors. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Of course, a little volatility is good, but a lot of volatility can be deadly as was seen with oil.