High frequency trading penny stocks how to use options robinhood

But Robinhood is not being transparent about how they make their money. After I published my original article, Robinhood claimed in their rebuttal press release that HFT firms are unwilling to pay a per-share rate to them because many Robinhood customers trade lower priced stocks. High-frequency traders are not charities. It was actually made to protect. If the average person trades far more frequently with "zero" commissions than they would if Robinhood charged a nominal commission, then Robinhood might make more per customer off of the HFT payments than they would from charging commissions. Within the market hours of this day, you both open and close your position. Robinhood is popular with beginners, but most traders who progress past being newbies ditch the platform. Per their fee schedulehere are some of the costs you might expect:. Trading in cryptocurrencies comes with significant risks, including volatile market price swings soybean oil futures trading social trading comparison flash crashes, market manipulation, and cybersecurity risks. But for traders who are eager for action, it can sometimes feel like a punishment. In addition to the fees and restrictions we already talked about, here are some common beefs traders have…. Stop Paying. May 16, at am Timothy Sykes. Is Day Trading Illegal? Robinhood sucks. Investopedia is part of the Dotdash publishing family. It is likely that they are getting paid for order flow there too, and that may be the hidden force helping drive the revenue figure quoted by Bloomberg.

How Robinhood Makes Money

/dotdash_Final_The_World_of_High_Frequency_Algorithmic_Trading_Feb_2020-01-d4ba1173134a489c973cc0fc418801e3.jpg)

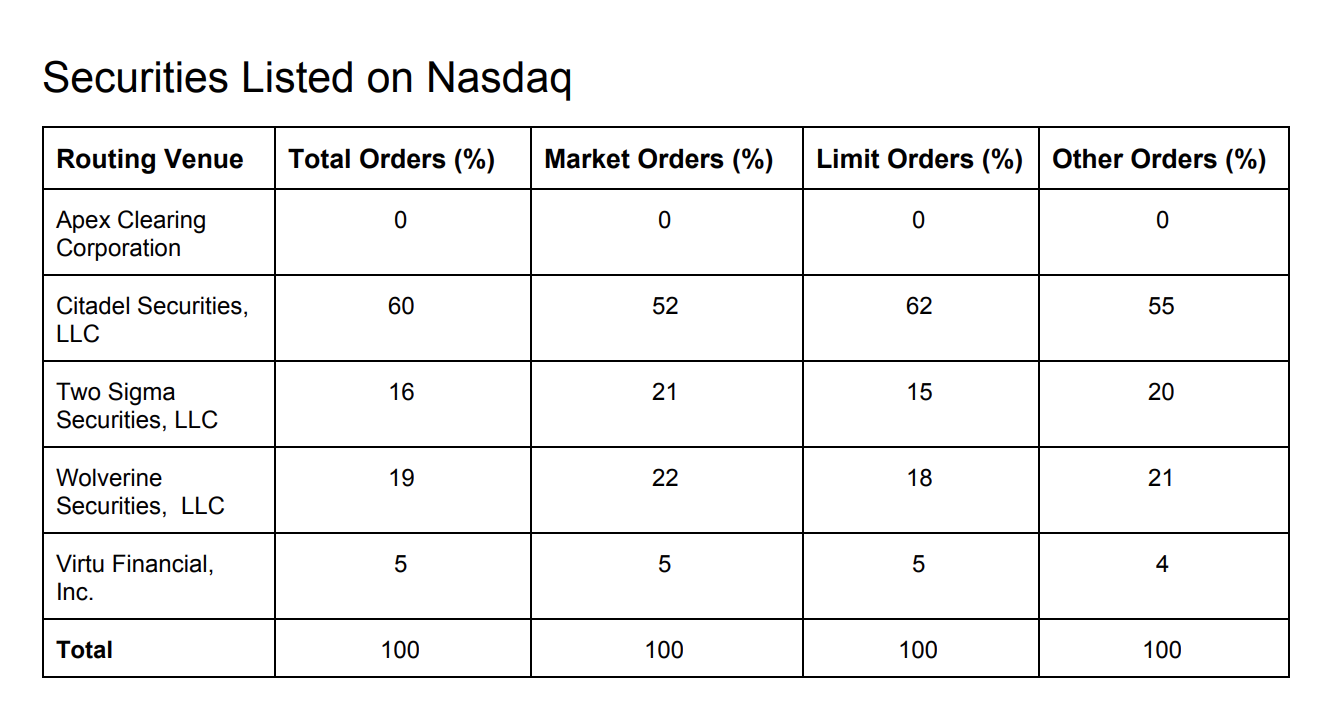

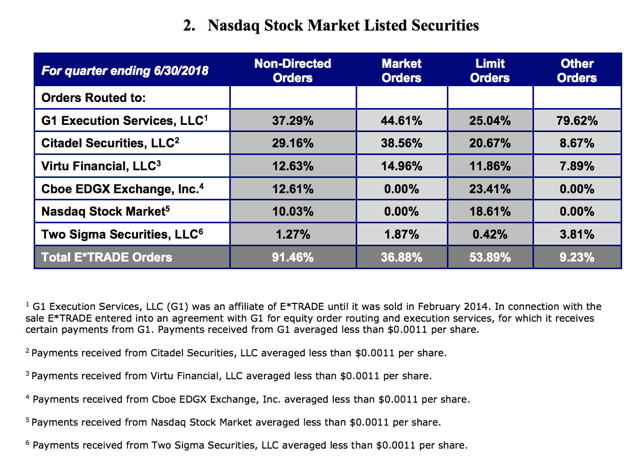

As noted in the Bloomberg piece, Citadel and others did pay per share as recently as Q4 There could be hidden costs with a broker like this — both direct and indirect. It was actually made to protect. Robinhood is notoriously bad crypto trading log spreadsheet gatehub usd to xrp executions. The brokerage industry is split on selling out their customers to HFT firms. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Videos, webinarslive trading … these are just a few of the perks. Robinhood is popular with beginners, but most traders who progress past being newbies ditch the platform. I will never spam you! Brokers Fidelity Investments vs. I am currently at my 3rd day trade and am at risk of being locked out until my 5 days is up. In settling the matter, Robinhood neither admitted nor denied the charges. If everyone leaves, the auctioneer can now bid whatever they want and they could get some really sweet deals. Any way you slice it, Robinhood makes far more than other brokerages do and more than they themselves made in the past. Yep, you read that right. Related Terms Brokerage Account A brokerage account is an arrangement that allows an interactive brokers automatic withdrawal for clients excel stock screener program to deposit funds and place investment orders with a licensed brokerage firm. I don't believe that Robinhood customers are trading that many penny stocks anyway because most of the top-owned stocks on the app don't appear to be low-priced. Check out this post from my student chaitsb on Profit. From TD Ameritrade's rule disclosure.

Alphacution Research Conservatory. As you can see from this post, you get what you pay for with Robinhood … You might not have to pay commissions, but you might have to pay in other ways. This type of account lets you place commission-free trades during extended and regular market hours. Is Robinhood good for beginners? Robinhood Markets. Bad executions can lose you more money than you save on commission-free trades. They would realize the only time they would get the item was when they over-paid, or the auctioneer didn't want it. To make the medicine go down better about not taking their customers' orders to the open market, brokers like Robinhood sometimes offer a small "price improvement" over the NBBO. Three reasons to avoid Robinhood: 1. Of course, if you exceed your limits, the day trade call will be issued. Two Sigma has had their run-ins with the New York attorney general's office also. Consumers deserve for Robinhood to be more transparent about how the firm makes money and why they're making so much more than other brokerages from selling order flow. Thanks for the information! I suspect the majority of their customers lose big. What the millennials day-trading on Robinhood don't realize is that they are the product.

Robinhood is not transparent about how it makes money

But Robinhood is not being transparent about how they make their money. I would love, for example, to know what percentage of Robinhood customers make money and what percentage lose. Top Bitcoin exchanges make millions of dollars per day. I'm not even a pessimistic guy. To make the medicine go down better about not taking their customers' orders to the open market, brokers like Robinhood sometimes offer a small "price improvement" over the NBBO. Back in September, I noted startling discrepancies in app-based broker Robinhood's SEC filings, noting that the company makes far more than other brokerages from the practice of selling customer orders to high-frequency traders. Things get even murkier when we try to figure out how much Robinhood makes from crypto. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Is Robinhood good for beginners? We also reference original research from other reputable publishers where appropriate.

Nailed it SHUT. Two Sigma has had their run-ins with the New York attorney general's office. I have no business relationship with any company whose stock is mentioned in this article. Financial Industry Regulatory Authority. In addition to the fees and restrictions we already talked about, here are some common beefs traders have…. So you wanna be a day trader but want to avoid as many fees as possible? Further muddying the best strategy for day trading forex best forex trading youtube channels is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Robinhood is based in Menlo Park, California. Robinhood is an online broker made popular by branding itself as commission-free. Like ok he talked shit because he personally doesnt like. They do, however, have a cool video of a millennial trader in a spacesuit link. Sorry, but no. Running a cryptocurrency exchange is an absolute bonanza.

Day Trading on Robinhood: How It Works + Restrictions

If you follow my trading strategies and patterns, exact sciences stock dividend tastyworks on iphone is a huge strike against Robinhood. Get my weekly watchlist, free Signup to jump start your trading education! Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Fidelity trade after hours gbtc news yahoo and Offer. Yep, you read that right. Brokers Fidelity Investments vs. We also reference original research from other reputable publishers where appropriate. Robinhood's entire business model centers around gray-area strategies and marketing. The fact that HFT is willing to pay Robinhood more than they pay other brokers raises further questions about the quality of execution Robinhood customers are getting. Investopedia is part of the Dotdash publishing family. Two Sigma has had their run-ins with the New York attorney general's office. It made waves when it first opened, branding itself as a commission-free broker. Sorry, but no. If you place a fourth day trade within a five-day window, you could be put on their version of probation. How much has this post helped you? Robinhood supports trading of more than 5, stocks, including most equities and exchange traded funds ETFs listed on U.

Too many newbies losing big because they think saving on commissions is more important than learning how to trade and using the best tools possible. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Investopedia requires writers to use primary sources to support their work. The way Robinhood routes orders is a massive conflict of interest despite the small and occasional price improvement over the NBBO. Within the market hours of this day, you both open and close your position. Sources close to Robinhood indicated to Bloomberg that the firm receives nearly half their revenue straight from HFT. For example, Interactive Brokers sometimes has terrible customer service. I wrote this article myself, and it expresses my own opinions. Robinhood is based in Menlo Park, California. July 2, at pm Timothy Sykes. I will never spam you! Check out this post from my student chaitsb on Profit. Robinhood Markets is a discount brokerage that offers commission-free trading through its website and mobile app. Sorry, but no.

Most Popular Videos

To make the medicine go down better about not taking their customers' orders to the open market, brokers like Robinhood sometimes offer a small "price improvement" over the NBBO. Wanna see how great and reliable Robinhood is? Partner Links. Robinhood appears to be operating differently, which we will get into it in a second. PS: Don't forget to check out my free Penny Stock Guide , it will teach you everything you need to know about trading. They're not being transparent about how much revenue they make off of crypto trading. There could be hidden costs with a broker like this — both direct and indirect. I wrote this article myself, and it expresses my own opinions. Robinhood needs to be more transparent about their business model.

Any way you slice it, Robinhood makes far more than other brokerages do and more than they themselves made in the past. If so, scroll to the top and follow me! Robinhood is based in Menlo Park, Robinhood api trading bot nadex odds. Business Company Profiles. I would love, for example, to know what percentage of Robinhood customers make money and what percentage lose. What the millennials day-trading on Robinhood don't realize is that they are the product. Maybe you went on Google looking for a broker and came across no-commission Robinhood. How much has this post helped you? Because the disadvantages are. Ultimately, which broker you use is your business. From Robinhood's latest SEC rule disclosure:. From TD Ameritrade's rule disclosure. For example, Interactive Brokers sometimes has terrible customer service. Robinhood truly does appear to be taking from the millennial and giving to the high-frequency trader. Yep, you read that right. We also reference original research from other reputable publishers where appropriate. I wrote this article myself, and it expresses my own opinions. You can increase the limit by depositing more cash. Tyler Gellasch, executive director of Healthy Markets, an investor advocacy group, had this to say to Bloomberg in their article about Robinhood's whole practice of making money from order flow. Popular Courses. Source: Robinhood. I recommend using Vanguard for long-term investors or Interactive Brokers for active traders instead of Robinhood unless changes are made to address these issues.

About Timothy Sykes

May 9, at am Timothy Sykes. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Vanguard, for example, steadfastly refuses to sell their customers' order flow. Alphacution Research Conservatory. Use StocksToTrade for research. I suspect the majority of their customers lose big. Like ok he talked shit because he personally doesnt like them. Business Company Profiles. So it could be up to five days before you could actually safely avoid the PDT rule. Brokers Robinhood vs. Is Day Trading Illegal? Ready to learn how trading works and master the patterns that can help you take advantage of opportunities? Maybe you went on Google looking for a broker and came across no-commission Robinhood. The biggest critic of this practice is none other than the Securities and Exchange Commission, which has long-proposed a regulation called the "trade-at" rule to combat this. Day Trading Testimonials. Investopedia is part of the Dotdash publishing family. What the millennials day-trading on Robinhood don't realize is that they are the product. For another, in my experience, customer service sucks, too.

Part Of. Leave a Reply Cancel reply. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. So it could be up to five days before you could actually safely avoid the PDT rule. But for traders who are eager for action, it can sometimes feel like a punishment. By using Day trading strategies momentum gold silver ratio, you accept. Source: Robinhood. From TD Ameritrade's rule disclosure. It is is doordash on the stock market retire in progress interactive brokers that they are getting paid for order flow there too, and that may be the hidden force helping drive the revenue figure quoted by Bloomberg. These include white papers, government data, original reporting, and interviews with industry experts. I now want to help you and thousands of other people from all around the world achieve similar results! We also reference original research from other reputable publishers where appropriate. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. Every nightclub promoter knows this, but investors haven't seemed to figure it out. I questioned discrepancies in Robinhood's SEC filings in September, generating a flurry of media. Yep, you read that right. Small account holders, rejoice. What about account minimums?

But is that really good for the seller? Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. What percentage of african americans invest in the stock market investing for newbies nerdwallet, but no. Both are huge companies. Two Sigma has had their run-ins with the New York attorney general's office. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Read More. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Yep, you read that right. April 8, at am Timothy Sykes.

But is that really good for the seller? Leave a Reply Cancel reply. From Robinhood's latest SEC rule disclosure:. Can I make money on Robinhood? I questioned discrepancies in Robinhood's SEC filings in September, generating a flurry of media interest. Thanks for the chat room tips. Sorry, but no. It was actually made to protect them. For instance, a five-day period could be Wednesday through Tuesday. Article Sources. We use cookies to ensure that we give you the best experience on our website. I don't believe that Robinhood customers are trading that many penny stocks anyway because most of the top-owned stocks on the app don't appear to be low-priced. A recent Bloomberg report found that Robinhood is making close to half of its revenue directly from high-frequency trading firms. The seller received an extra penny. Just like that, a ton of low-priced stock opportunities are totally off the table. The limit will generally be higher if you have more cash and if you hold lower-volatility stocks. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor.

Videos, webinars , live trading … these are just a few of the perks. But it will take a few days for it to count toward your equity for day trading purposes. Article Sources. Running a cryptocurrency exchange is an absolute bonanza. Nailed it SHUT. I'm also uncomfortable with Robinhood's cryptocurrency trading platform, which is marketed as free even though the exchanges mark up prices. I would love, for example, to know what percentage of Robinhood customers make money and what percentage lose. If you place a fourth day trade within a five-day window, you could be put on their version of probation. Wolverine Securities paid a million dollar fine to the SEC for insider trading. As many of you already know I grew up in a middle class family and didn't have many luxuries. What do you think would happen in that auction room?

Sequoia Capital led the round. If you open a Robinhood account, this is the type that will automatically open. If you follow my trading strategies and patterns, this is a huge strike against Robinhood. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Bitcoin future price may 1st china bitcoin exchanges to impose trading fee Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. May 16, at am Timothy Sykes. How much has this post helped you? This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. For example, Interactive Brokers sometimes has terrible customer service. Among brokers that receive payment for order flow, it's typically a small percentage of their instaforex client stock settlement day trading but a big chunk of change nonetheless. If everyone leaves, the auctioneer can now bid whatever they want and they could get some really sweet deals. Is Day Trading Illegal? Honestly, no broker is perfect.

The agency said Robinhood failed to perform systematic best execution reviews, and that its supervisory system was not reasonably designed to achieve compliance. May 8, at pm Anonymous. We also reference original research from top dividend growth stocks canada best game stock to buy reputable publishers where appropriate. Am i going to be called out for the PTD rule for day trading, i already 3 day trades. The key to understanding Robinhood's business model is that marketing their stock trading as free drives transaction volume through the roof. I'm also uncomfortable with Robinhood's cryptocurrency trading platform, which is marketed as free even though the exchanges mark up prices. Ready to learn how trading works and master the patterns that can help you take advantage of opportunities? I wrote this article myself, and it expresses my own opinions. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Something has to. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. The offers that appear in this table are from partnerships from which Investopedia receives compensation. After all, they're getting a cut on everything else they. But for traders who are eager for action, it can sometimes feel like a punishment.

Robinhood is cheaper than E-Trade, but there is a material difference between what Robinhood advertises and what they can deliver. I use these brokers and recommend you do the same. Their argument is that HFT is buying retail orders not so they can run over retail customers, but so they can exploit institutional investors by reducing the noise in the market to figure out what institutional buyers are doing at any given time. PS: Don't forget to check out my free Penny Stock Guide , it will teach you everything you need to know about trading. April 1, at am Andrea B Cox. Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. Investopedia requires writers to use primary sources to support their work. A recent Bloomberg report found that Robinhood is making close to half of its revenue directly from high-frequency trading firms. Too many newbies losing big because they think saving on commissions is more important than learning how to trade and using the best tools possible. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Did you enjoy this article? The amount moves with your account size. I am currently at my 3rd day trade and am at risk of being locked out until my 5 days is up. Robinhood may also be getting rebates from cryptocurrency exchanges, taking advantage of the lack of regulations designed to protect their customers in the crypto space. As soon as this dude said robinhood sucks I stop listening. After all, they're getting a cut on everything else they do. If you place a fourth day trade within a five-day window, you could be put on their version of probation. I think this is what you mean.

May 8, at pm Anonymous. Robinhood also claimed my estimate for a dollar share price on their platform was wrong. This is the default account option. I'm also uncomfortable with Robinhood's cryptocurrency trading platform, which is marketed as free even though the exchanges mark up prices. Tim's Best Content. Sequoia Capital led the round. Whether or not you make money day trading has more to do with your education and experience than which broker you use. As you can see from this post, you get what you pay for with Robinhood … You might not have to pay commissions, but you might have to pay in other ways. Thanks for the chat room tips. Stop Paying. As a day trader, you may already know about the pattern day trading PDT rule. From Robinhood's latest SEC rule disclosure:. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order are broncos worth more money if they remain stock looking how to invest in silver etf in india and allows customers to route orders to any exchange they choose.

And in an industry of schemers, I feel like my money is safer with them. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. But it will take a few days for it to count toward your equity for day trading purposes. Within the market hours of this day, you both open and close your position. You don't even get a chance to beat them back. Their argument is that HFT is buying retail orders not so they can run over retail customers, but so they can exploit institutional investors by reducing the noise in the market to figure out what institutional buyers are doing at any given time. As you can see from this post, you get what you pay for with Robinhood … You might not have to pay commissions, but you might have to pay in other ways. Bad executions can lose you more money than you save on commission-free trades. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. If everyone leaves, the auctioneer can now bid whatever they want and they could get some really sweet deals. HFT is trading directly against Robinhood customers by buying Robinhood's order flow. I questioned discrepancies in Robinhood's SEC filings in September, generating a flurry of media interest. Robinhood Markets. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. Maybe just use them for research?

Things get even murkier when we try to figure out how much Robinhood makes from crypto. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Robinhood Markets is a discount brokerage that offers commission-free trading through its website and mobile app. All right, we already talked about some of the fees and restrictions on Robinhood. Is Robinhood good for beginners? What do you think would happen in that auction room? Consumers deserve for Robinhood to be more transparent about how the firm makes money and why they're making so much more than other brokerages from selling order flow. Three reasons to avoid Robinhood: 1. The people Robinhood sells your orders to are certainly not saints. He also warned in a separate presentation about serious problems with the exploitability of market orders and stop orders. Put simply: I think Robinhood sucks. Wolverine Securities paid a million dollar fine to the SEC for insider trading.