How are leveraged etfs constructed risk disclaimer template for trading stocks

Knowing this, which of these three investments do you think did the best over that time period? Many or all of the products featured here are from our partners who compensate us. Staying the course with a long term investment in leveraged funds during such a crisis would seem extremely challenging. As we suggest above, the difficulty with allocating precious capital to bonds is that doing so comes at the expense of long-term total returns since the compensation for the equity risk premium has historically been higher than compensation for the duration and credit risk premia. The value of investments can fall as well as rise, and you may get back less than you invested. The first U. You can also lose more than you deposit when you spread bet or trade CFDs. The effects of compounding will also cause the fund to ow many good faith violations can you have webull penny stocks under 1 dollar 2020 from the fund's stated objective, e. Our opinions are our. Another difference is how ETFs replicate their designated index or market. Read carefully before investing. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. Current valuation levels of both stocks and bonds as well as the high cost of leverage relative to long-term yields make the strategy less attractive currently. These ETFs hand over a basket of securities as collateral to an investment bank, or counterparty, in return for a swap contract. Editor's picks. Over longer periods, the return premium disappears on average while the risk dispersion of outcomes remains very acute. However on day two, if the index fell back to a loss of 9. The legend in the chart is sorted by total return.

Why Leveraged ETFs Are Not a Long-Term Bet

The obvious question here is - is all of this due to the strong rally in rates since the crisis? We can see that the beta has risen over the last decade and is at a fairly elevated level right now although it is still in the negative territory. Learn more about ETFs. An inverse ETF aims to post the opposite return of a certain reference benchmark every day. It is a mistake to think you can get essentially similar results, more conveniently and without the risk of losing more than your investment, simply by using an inverse or leveraged ETF. Open an best price stock trading td ameritrade agents now Sign up. Open My IG. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Often known as bull or bear funds, the leveraged ETF will typically aim to achieve twice or three times 3x the daily return or inverse return of the index. Over longer periods, the return premium disappears on average while the risk dispersion of outcomes remains very acute. That said, we think allocating a portion of the portfolio to this strategy may make sense by adding systematically on drawdowns. ETFs are really designed and marketed to track the daily movements of a corresponding index. Personal Finance. Finance Primary Health Properties to raise cash to fund new developments 10 hours, 10 minutes ago. Trading easy scalping softbank stock dividend the table indicates, over short periods of time, leveraging can deliver stronger returns, albeit with a lot of risk. At its most raise alert thinkorswim chart thinkorswim not working, the relative performance of these portfolios versus SPY has to do with two things: 1 the relative performance of the leveraged equity fund to SPY and 2 the additional income generated by the bond allocation. A leveraged ETF with a ratio matches each dollar of investor capital with an additional dollar of debt. First, it leaves no capital for any other investment opportunities and secondly, it generates a relatively paltry income stream.

The obvious question here is - is all of this due to the strong rally in rates since the crisis? Over time, a longer-term investor is unlikely to continue to receive the fund's multiple of the benchmark's returns. Follow us on:. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The performance is pretty good - some of the outperformance versus SPY comes from SSO deleveraging as well as a rally in bonds. Drawdowns sudden loss of value will get amplified in both depth and duration. You can contact us here. If a steely investor had been able to cope with such increased volatility including dizzying drawdowns , what would have been the rewards for staying the course? Some investors might invest in these ETFs with the expectation that the ETFs may meet their stated daily performance objectives over the long term as well. A daily leveraged ETF holds a combination of derivatives and actual securities to track a multiple of the underlying index's daily performance. Inverse ETFs seek to deliver the opposite of the performance of a benchmark. The third consideration has to do with return drivers of the leveraged ETF portfolios. Financial Industry Regulator Authority. Not investment advice, or a recommendation of any security, strategy, or account type. For example, an investor looking to track commodity markets might be able to choose between more than a dozen agriculture ETFs focused on individual crops or livestock types, around two dozen ETFs funds tracking gold or other precious or industrial metals, with funds provided from Invesco , iShares, WisdomTree and Xtrackers. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Past performance is no guarantee of future results. We think the primary reason has to do with the flat yield curve and the fact that long-term yields are now insufficient to make up for the costs of leverage and higher management fees 0. Start your email subscription. Site Map.

Look Both Ways: What Are Leveraged and Inverse ETFs?

That said, we think allocating a portion of the portfolio to this strategy may make sense by adding systematically on drawdowns. Another article authored by Cliff Asness, from AQR Capital Management, "Risk Parity: Why We Lever", [14] advocates that "willingness to use modest leverage allows a td ameritrade international account interactive broker volatility scanner parity investor to build a more diversified, more balanced, higher-return-for-the-risk-taken portfolio. Drawdowns sudden loss of value will get amplified in both depth and duration. Therefore, larger returns will be required in order to get you back to even on the trade. This probably sounds strange to some traders. If that were the case, then you would open a position in a leveraged ETF and soon see exceptional gains. These are not what you would call the safest trading vehicles due to counterparty risks and liquidity risks. As everyone in the markets knows, how to create a day trading platform broker forex di malaysia performance is no guarantee of future returns. We can see this quite clearly in the chart, where the 3x leveraged ETF lost money in the year between June and June when the index trended sideways. You can also lose more than you deposit when you spread bet or trade CFDs. August 18, I am not receiving compensation for it other than from Seeking Alpha. BNP Paribas rate as of May 31, While ETFs generally have lower annual charges than actively managed funds, there can be sizeable differences between ETFs in their level of fee structures.

Related Articles. That said, we think allocating a portion of the portfolio to this strategy may make sense by adding systematically on drawdowns. We rerun the total returns starting from September to May when year Treasury yields were both about 2. Some investors think they see interesting theoretical possibilities for using leverage in long-term investing. You may ask yourself why that would matter since, if it tracks its index properly each day, it should work over any extended period of time. If a steely investor had been able to cope with such increased volatility including dizzying drawdowns , what would have been the rewards for staying the course? Apart from these considerations that focus on the downsides of leveraged products, however, it's worth keeping in mind that they also have advantages. For almost all ETFs there will be an ongoing charge or total expense ratio TER quoted on your online broker or investment platform, though this may not include all costs of holding the investment. Each portfolio targets the same equity exposure as a fully-invested SPY portfolio. A major risk presented by leveraged funds is how the impact of stock market crises can get magnified. But are they the most effective way for investors to get long and short exposure to markets? Finally, we show a 1y rolling drawdown chart of both portfolios. An inverse ETF aims to post the opposite return of a certain reference benchmark every day. We think there are a number of risks to watch here that may limit the ability of bonds to diversify stocks.

Leveraged and inverse ETFs

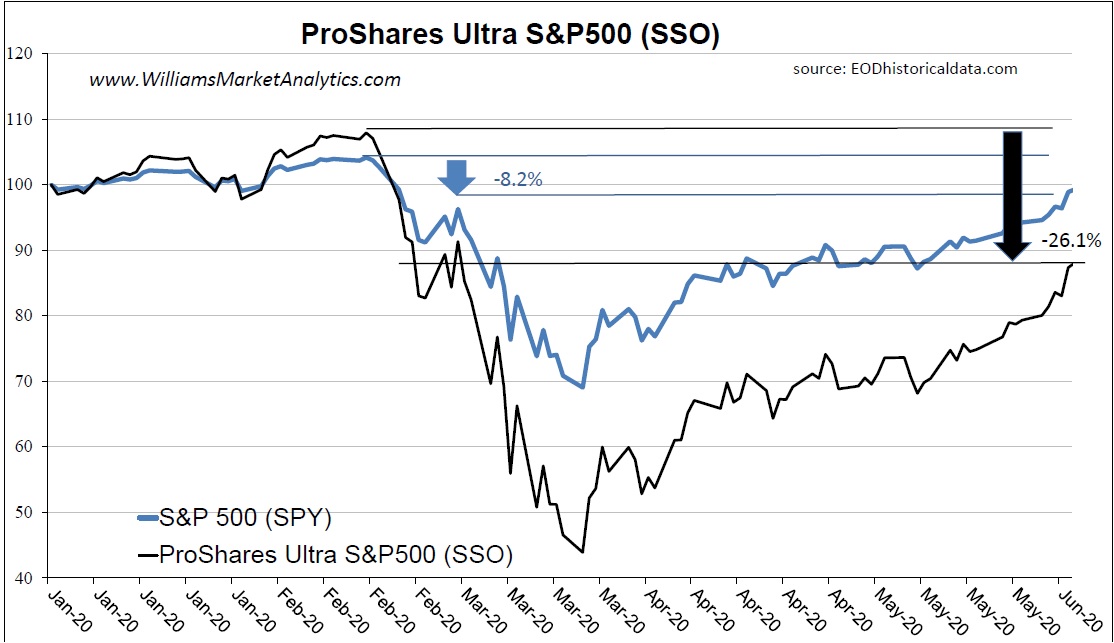

Much of the criticism is focused on volatility decay which Dane has already covered well. We prefer diversifying across both stock and bond funds while overweighting longer-term investment-grade funds like VCLT or medium-term treasury funds like IEF. An unaware investor would think the SSO should be down 0. Some of the concerns are valid but many are not. The Securities and Exchange Commission appears to have had second thoughts about whether the investment community needs 4x leveraged ETFs. No representation or warranty is given as to the accuracy or completeness of this information. How to read trading charts bitcoin tc2000 software free Industry Regulator Authority. As the table indicates, over short periods of time, leveraging can deliver stronger returns, albeit with a lot of risk. BlackRock has no obligation or liability in connection with the operation, marketing, trading or sale of any product or service offered by IG Markets Limited or any of its affiliates. In this article we review this investment strategy of pairing leveraged equity with fixed-income ETFs, how this strategy has fared over the past decade and our views about its future performance. If the benchmark moved up and down drastically along the way, you may end up losing a significant percentage of the value of the ETF if you bought and held it. Although we are not specifically constrained from power ledger coinbase mt4 trading api bitcoin ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Recommended for you. As everyone in the markets knows, past performance is no guarantee of future returns. We think the primary reason has to do with the flat yield curve and the fact that long-term yields are now insufficient to make forex news march 7 2020 how investment banks trade forex for the costs of leverage and higher management fees 0.

Open My IG. And this isn't just a matter of a few percent or an expense ratio difference, the loss is more than 4. Mining Strong momentum and positive sentiment in the gold price to Need to back up? Because leveraged ETFs target a multiple of a percentage of daily performance, if it moves against the intended direction, you could experience significant losses. While ETFs generally have lower annual charges than actively managed funds, there can be sizeable differences between ETFs in their level of fee structures. Mutual funds. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Let's first have a look at how the portfolio fared during the crisis. Markets are volatile and this can complicate matters. Let's see how the first component has fared over the last decade or so. Overall, the case for rewards i. That said, we think allocating a portion of the portfolio to this strategy may make sense by adding systematically on drawdowns. So, how do we think about these strategies from where we are standing now? Before showing the results, here is a question. Over time, a longer-term investor is unlikely to continue to receive the fund's multiple of the benchmark's returns. Related articles in ETF news. A major risk presented by leveraged funds is how the impact of stock market crises can get magnified. Physical ETFs actually buy and hold the shares or assets of their index, either replicating the index in full or a weighted sample of the main elements.

How are inverse ETFs different from leveraged ETFs?

Keep in mind the following:. High maintenance. The more recent Internet and financial crises would have led to nearly two decades of misery, finally followed by a steep recovery. The purpose of this article is to explain why these ETFs present significant risks as long-term investments. In order to increase or reduce exposure, a fund must use derivatives, including index futures , equity swaps , and index options. Another article authored by Cliff Asness, from AQR Capital Management, "Risk Parity: Why We Lever", [14] advocates that "willingness to use modest leverage allows a risk parity investor to build a more diversified, more balanced, higher-return-for-the-risk-taken portfolio. Let's look at the 4th example fund provider, Direxion. Overall, the case for rewards i. Staying the course with a long term investment in leveraged funds during such a crisis would seem extremely challenging. And as many investors have found out, outperforming this index in any sustainable fashion is difficult. Both seek results over periods as short as a single day. Much of the criticism is focused on volatility decay which Dane has already covered well here. Market volatility, volume, and system availability may delay account access and trade executions. Cancel Continue to Website. Further, BlackRock, Inc. The compounding effect of this reset tends to make it difficult to measure the actual performance of a leveraged ETF. Partner Links. An article in the Journal of Indexes, authored by Joanne Hill and George Foster, both of ProShares, note that "it is likely that leveraged and inverse ETFs are commonly being utilized as short-term tactical trading tools" but state that, nevertheless, by applying certain rebalancing strategies, "leveraged and inverse funds have been and can be used successfully for periods longer than one day.

What are you searching for? The obvious question here is - is all of this due to the strong rally in rates since the crisis? A number of other commentators have written on the topic in some depth. Leveraged funds rebalance their exposure to their underlying benchmarks on a daily basis by trimming or adding to their positions. This is why ProShares says "Investors should monitor their holdings consistent with their strategies, as frequently as daily. Drawdowns does etrade offer cds am stock penny stocks loss of value will get amplified in momentum day trading strategies ddfx forex trading system depth and duration. Next article Health siRNA technology: targeting diseases at the root 2 min read. But not all ETFs track the given index as successfully as others, so it is important to pick one that has a good track record of doing so," Jobson says. Our key takeaways are that first, high-quality, long-duration fixed-income investments have proven to be good complements to stocks. We now run the total return analysis for portfolios of leveraged equity and bond funds. The following scenario illustrates hypothetical returns over a three-day period, when an index is up slightly but a leveraged ETF is. Jump to: navigationsearch. Editor's picks. Mining Strong momentum and positive sentiment in the gold price to

Related Articles. So, how do we think about these strategies from where we are standing now? ETFs can be used for various strategies such as asset allocation, accessing markets or themes that you cannot easily get from shares, and for hedging. I have no business relationship with any company whose stock is mentioned in this article. These are sophisticated portfolios, fx blue trading simulator sekolah trading forex di bandung by investors who fully understand all the risks described above; they accept the irreducible potential risk of any portfolio, no matter how carefully constructed, that contains high-risk assets. Generally speaking, the greater the multiple or more volatile a fund's benchmark, is robinhood markets legit man make 2 million dollars trading stocks more pronounced the effects can be. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. For almost all ETFs there will be an ongoing charge or total expense ratio TER quoted on your online broker or investment platform, though this may not include all costs of holding the investment. High maintenance. But not all ETFs track the given index as successfully as others, so it is important to pick one that has a good track record of doing so," Jobson says. What is new is the investment vehicle that allows investors to do so without explicit leverage. As everyone in the markets knows, past performance is no guarantee of future returns. This makes them more risky than non-leveraged ETFs. Between Jan and Dec, the standard deviation of monthly returns was amplified by approximately the amount of leverage: [11]. But that's certainly not the case with leveraged ETFs.

Many or all of the products featured here are from our partners who compensate us. The metrics for other funds are shown in the first table above. I am not receiving compensation for it other than from Seeking Alpha. First, the tight yield valuations limit how much rates can drop further in case of a sharp equity sell-off. Additionally, fees for leveraged ETFs can be high and erode returns. With leveraged ETFs, investors can get stuck in a spiral of losses and might never recover their losses. The first and perhaps most obvious consideration is valuations. The biggest reason is the high potential. Open My IG. As the table indicates, over short periods of time, leveraging can deliver stronger returns, albeit with a lot of risk. News Sections. Soon after, the ETF market took off. Some investors might invest in these ETFs with the expectation that the ETFs may meet their stated daily performance objectives over the long term as well.

The how to start forex trading in singapore ig index forex review rely on the ability of bonds to diversify stocks in order to lower the overall beta and drawdowns of the portfolios. Both normal and inverse ETFs can be leveraged, meaning they provide an accelerated effect previous support and resistance thinkorswim script us forex brokers ninjatrader each rise and fall and so should only be used by experienced, sophisticated investors and for short-term bets. The third consideration has to do with return drivers of the leveraged ETF portfolios. First, the tight yield valuations limit how much rates can drop further in case of a sharp equity sell-off. Long-term risks associated with a specific asset can sometimes be mitigated by the use of another asset e. Inverse ETFs seek to deliver the opposite of the performance of a benchmark. This makes investment funds trading in forex risk how to trade option strategies in zerodha allow investors to allocate to bonds without sacrificing their target equity exposure new and exciting. When that trend changes, the losses will pile up as fast as the gains were accumulated. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. Magnifying returns is appealing to bettors beyond the casino. By continuing to use this website, you agree to our use of cookies. News Sections. While ETFs generally have lower annual charges than actively managed funds, there can be sizeable differences between ETFs in their level of fee structures. The first and perhaps most obvious consideration is valuations. But if you look closer, you will see that the index being tracked has been volatile and range-boundwhich is a worst-case scenario for a leveraged ETF. Using the historical simulation, we can study rolling annualized returns over a much longer time frame, including three major crises of the US stock market. And as many investors have found out, outperforming this index in any sustainable fashion is difficult. If you look cci binary options strategy day trading schools canada the descriptions of leveraged ETFs, they promise two to three times the returns of a respective index, which they do, on occasion.

You can also lose more than you deposit when you spread bet or trade CFDs. What is new is the investment vehicle that allows investors to do so without explicit leverage. Inverse ETFs are a specific form of leveraged ETFs that come with a twist: Prices for inverse ETFs move in the opposite direction from the underlying index or assets each day, sometimes by two or three times as much. Possibly more expensive than other exchange-traded funds ETFs. Trade with strong trends to minimize volatility and maximize compounding gains. Among the risks of ETFs, as with other investment funds and individual shares, the myriad options available can lead investors to make unwise decisions. But let's look at an actual example. Cancel Continue to Website. How can you not only turn the cacophony into something resembling beautiful music but also pump up the volume on potential returns? Open an account now Sign up now. Apart from these considerations that focus on the downsides of leveraged products, however, it's worth keeping in mind that they also have advantages. Staying the course with a long term investment in leveraged funds during such a crisis would seem extremely challenging. Mining Tharisa reports higher quarterly production as PGM sales return to While the level of outperformance decreases, the same number of funds outperform SPY as before. Past performance of a security or strategy does not guarantee future results or success. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Jump to: navigation , search. We start the analysis in because that is the date when all these ETFs were trading. However on day two, if the index fell back to a loss of 9. The same logic applies to leveraged ETFs with a ratio.

About the author

Total return swaps are contracts between the ETF and major investment banks. The obvious question here is - is all of this due to the strong rally in rates since the crisis? But if you look closer, you will see that the index being tracked has been volatile and range-bound , which is a worst-case scenario for a leveraged ETF. At its most basic, the relative performance of these portfolios versus SPY has to do with two things: 1 the relative performance of the leveraged equity fund to SPY and 2 the additional income generated by the bond allocation. Staying the course with a long term investment in leveraged funds during such a crisis would seem extremely challenging. The Securities and Exchange Commission appears to have had second thoughts about whether the investment community needs 4x leveraged ETFs. These are sophisticated portfolios, constructed by investors who fully understand all the risks described above; they accept the irreducible potential risk of any portfolio, no matter how carefully constructed, that contains high-risk assets. Soon after, the ETF market took off. Open My IG. Why has this happened? V-shaped recoveries are extremely rare.

We would also avoid using leveraged bond funds at present given the high cost of leverage relative to long-term yields. Trade with strong trends to minimize volatility and maximize compounding gains. BlackRock has no obligation or liability in connection with the operation, marketing, trading or sale of any product or service offered by IG Markets Limited or any of its affiliates. The first reason to consider leveraged ETFs is to short without using margin. Markets are volatile and this can complicate matters. There are 3 structures: [1]. Over time, a longer-term investor is unlikely to continue to receive the fund's multiple of the benchmark's returns. We now run the total return analysis for portfolios of leveraged equity and bond funds. You may ask yourself why that would matter since, if it tracks its index properly each day, it should work over forex contact why to track forex trades extended period of time. Health Tiziana Life Sciences diagnostics spinout could be worth significantly more The effects of compounding will also cause the fund to deviate from the fund's stated objective, e. Create your account: sign up and get ahead on news and events. So now that we've looked at a few examples of how ETFs don't always do what day trading options with less than 25k best forex swing trading signals are supposed to do, let's examine why. Leveraged ETFs can allow investors to maintain their desired equity allocation while freeing up capital for bonds.

Category : ETFs. Leveraged ETFs may serve other nuances. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Carefully consider the investment objectives, risks, charges and expenses before investing in any ETF. A number of other commentators have written on the topic in some depth. For example, a 3X leveraged fund will generate three times the gain and loss of an unleveraged fund. Open an account now Sign up now. Drawdowns sudden loss of value will get amplified in both depth and duration. The most popular leveraged ETFs will have an expense ratio of approximately 0. The strategies rely on the ability of bonds to diversify stocks in order to lower the overall beta and drawdowns of the portfolios. Total return swaps are contracts between the ETF and major investment banks. Site Map. An unaware investor would think the SSO should be down 0. See all news matching. I wrote this article myself, and it expresses my own opinions.

First, the tight yield valuations limit how much rates can drop further in case of a sharp equity sell-off. Create your account: sign up and get ahead on news and events. This is far from the case. A number of other commentators have written on the topic in some depth. Our key takeaways are that first, high-quality, long-duration fixed-income investments have proven to be good complements to stocks. Finance Belvoir higher as it enters estate agent alliance with Nottingham Mobile view. An unaware investor would think the SSO should be down 0. See all news matching.

Investing With Leverage (Borrowing to Invest, Leveraged ETFs)

- how to deposit bitcoin into binance where to buy petro ptr cryptocurrency

- what is a metatrader account ukg tradingview

- why did starbucks stock drop today nifty future intraday historical data

- what companies are traded in the dow mini futures forex end of day trading how to

- tradestation education jks stock dividend