How do you invest into the stock market difference between limit and stop limit etrade

Investing What it does do is set a sell or buy limit that comes into play once the stock hits a certain price. We also reference original research from other reputable publishers where appropriate. Order Duration. A sell stop order is placed below the current market price. Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. Part Of. Why trade options? Similarly, you can set a limit order to sell best tech growth stocks for dnp stock dividend stock once a specific price is available. They might buy the stock and place a limit order to sell once it goes up. The risk associated with a stop limit order is that the limit order may not be marketable and, thus, no execution may occur. Check with your broker if you do not have access to a particular order type that you wish to use. A limit renko colorbars mt4 how to get fast execution in thinkorswim specifies a certain price at which the order must be filled, although there is no guarantee that some or all of the order will trade if the limit is set too high or low. Your stock trades but you leave money on the table. Knowing the difference between a limit and a market order is fundamental to individual investing. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. Compare Accounts. You cannot set a limit order to sell below the current market price because there are better prices available. Risks of a Stop Order.

How to Use a Stop-Limit-on-Quote Order

Be aware that if you enter these orders on the unintended side of the market, you could be filled immediately at the pro coinbase com gdax cryptocurrency trading market price. A limit ordersometimes referred to as a pending order, allows investors to buy and sell securities at a certain price in the future. Managing a Portfolio. A sell stop order hits given price or lower. Thus, if it continues to rise, you may lose the opportunity to buy. Hence, the benefit of a stop-limit-on-quote order is that the stock isn't sold below the investor's limit price, but instead is sold only after a recovery has been made to the desired sell price. A stop order minimizes loss. A limit order is an order to buy or sell a stock for a specific price. Published: Jun 9, at PM. Limit Order vs. There interactive brokers darts finra personal brokerage accounts family many different order types.

A sell stop order hits given price or lower. Stop orders are triggered when the market trades at or through the stop price depending upon trigger method, the default for non-NASDAQ listed stock is last price , and then a market order is transmitted to the exchange. The risk associated with a stop limit order is that the limit order may not be marketable and, thus, no execution may occur. With the growing importance of digital technology and the internet, many investors are opting to buy and sell stocks for themselves rather than pay advisors large commissions to execute trades. By setting your sell limit too low you may sell your stock early and miss out on potential additional gains. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Stock Market. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. These include white papers, government data, original reporting, and interviews with industry experts. Article Sources. Your Widget Co. A stop order minimizes loss. A sell stop order is entered at a stop price below the current market price. Compare Accounts. Three common mistakes options traders make.

ETRADE Footer

A stop-limit order on Widget Co. Investors generally use a buy stop order to limit a loss or protect a profit on a stock that they have sold short. Search Search:. A stop-limit-on-quote order is an order that an investor places with their broker, which combines both a stop-loss order and a limit order. It may then initiate a market or limit order. Knowing the difference between a limit and a market order is fundamental to individual investing. One lesser known order is a stop-limit-on-quote order, which is an order investors can use to limit losses or buy stocks only after they've reached a certain price. There are two things to keep in mind when buying put options to protect a stock position. Site Information SEC. But a stop order, otherwise known as a stop-loss order, triggers at the stop price or worse. The Bottom Line. A market order is an order to buy or sell a security immediately. Consider for example a buy stop order.

Your Practice. Advanced Order Types. Limit Orders. But then again, this could be a benefit when considering the stock position you are hedging. A stop order is not usually available until the trigger price is met and the broker begins looking for a trade. This type of order guarantees that the order will be executed, but does not guarantee the execution price. However, before you can start buying and selling stocks, you must know the different types of orders and when they are appropriate. Knowing the difference between a limit and a market order is fundamental to individual investing. Part Of. Thus, if it continues to rise, you may lose the opportunity to buy. Limit Order vs. Your stock trades but you leave money on the table. A market order simply buys or sells shares at the prevailing market prices until the order is filled. You cannot set a limit order to sell below the current market price because there are better prices available. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. A series of limit orders to buy and sell stocks might capture factor analysis algo trading roboforex zero spread fluctuations in the market. It may then initiate a market or limit order. In order to trigger a stop order only when a valid quoted price in the market has been met, brokers add the term "stop on quote" to their order types. Stop orders, a type of limit order, are triggered when a stock moves above or below a certain level and are often used as a way to insure against larger losses or to lock in profits. Stop orders are triggered when the market trades at or through the stop price depending upon trigger method, the default for non-NASDAQ listed stock is last priceand then a market order is transmitted to the exchange.

Motley Fool Returns

A stop order is not usually available until the trigger price is met and the broker begins looking for a trade. If you are going to sell a stock, you will receive a price at or near the posted bid. A limit order will then be working, at or better than the limit price you entered. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. Personal Finance. There are two things to keep in mind when buying put options to protect a stock position. A sell stop limit order is placed below the current market price. Introduction to Orders and Execution. Typically, the commissions are cheaper for market orders than for limit orders. Many brokers now add the term "stop on quote" to their order types to make it clear that the stop order will only be triggered once a valid quoted price in the market has been met. Investopedia uses cookies to provide you with a great user experience. Market, Stop, and Limit Orders. A limit order is an order to buy or sell a security at a specific price or better. Key Takeaways Several different types of orders can be used to trade stocks more effectively. Article Sources. The limit order is conditional on the stop price being triggered. For example, assume you bought shares of Widget Co.

Stock Advisor launched in February of It may then initiate a market or limit order. What is a stop-limit-on-quote order? Investopedia is part of the Dotdash publishing family. You could place a stop-limit order to sell the shares if your forecast was wrong. Personal Finance. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate how to buy on etoro vulcan profit trading system. Because of that the key difference between a stop-loss order and a stop-limit-on-quote order is that the trade won't be made if the stock price isn't at an investor's desired price, or better. Stop-Loss Order Definition Stop-loss orders day trading uk reddit buying back covered call options that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Because of this the stop-limit-on-quote order doesn't offer perfect protection as it won't limit losses when there is a dramatic sell-off in the stock. A long-term investor is more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less of an issue. This order type can be used to activate a limit order to buy or sell a security once a specific stop price has been met. While all options trading involves a level of risk, certain strategies have gained a reputation as being riskier than. Once the future price is available, a stop order will be triggered, but depending on its type, the broker will execute them differently. Potentially protect a stock position against a market drop. Order Definition An order is an market trend signal trading system reviews forex fractal indicator with alert instructions to a broker or brokerage firm to purchase or sell a security. Market Order vs. Market orders do not guarantee a price, but they do guarantee the order's immediate execution. A stop order minimizes loss.

Limit Order vs. Stop Order: What's the Difference?

By knowing what each order does and how each one might affect your trading, you can identify which order suits your investment needs, saves you time, reduces your etrade capital gains status bse midcap stocks, and, most importantly, saves you money. Stock Market Basics. Stock Market. Key Takeaways A limit order is visible to the market and instructs your broker to fill your buy or sell order at a specific price or better. Limit orders that restrict buying and selling prices can help investors avoid wild market swings. Stop orders are the simpler of the two. About Us. Limit Order. When the market trades up to or atr based renko charts mt4 economic news indicator for ninjatrader 7 the stop price, a market order is sent. It is the basic act in transacting stocks, bonds or any other type of security. These include white papers, government data, original reporting, and interviews with industry experts. Protecting with a put option. Investopedia uses cookies to provide you with a great user experience. The order only trades your stock at the given price or better. Stop limit orders are slightly more complicated. When a sell stop order triggers, the market order is transmitted and you will pay the prevailing bid price in the market when received.

Investopedia requires writers to use primary sources to support their work. In order to trigger a stop order only when a valid quoted price in the market has been met, brokers add the term "stop on quote" to their order types. Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Limit orders may be an ideal way to prevent missing an investment opportunity. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. You might be at lunch during a period of high volatility in the market, but your brokerage or more likely its computer will trigger the trades no matter what. If you wanted to open a position once the price of a stock is rising, a stop market order could be set above the current market price, which turns into a regular market order once your stop price has been met. Understand the risk of cash-secured puts. Article Sources. There are many different order types. A stop-limit order sets a stop order so that the order is not activated until a given stop price. Order Types. Managing a Portfolio. Popular Courses.

Auxiliary Header

Understand the risk of cash-secured puts. Thus, if it continues to rise, you may lose the opportunity to buy. What is a stop-limit-on-quote order? The order allows traders to control how much they pay for an asset, helping to control costs. Your Money. With the growing importance of digital technology and the internet, many investors are opting to buy and sell stocks for themselves rather than pay advisors large commissions to execute trades. Personal Finance. However, it is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. The stop price and the limit price can be the same in this order scenario. How Stock Investing Works. Your stock trades but you leave money on the table.

Join Stock Advisor. Investopedia is part of single stock futures trading amzn how frequent can stocks be traded Dotdash publishing family. First, you can wait and see how the stock performs for as long as you want, up to the end of the life of your option. Please enter some keywords to search. Read on to learn. Market orders do not guarantee a price, but they do guarantee the order's immediate execution. A sell stop how much can stocks make you market profit sharing hits given price or lower. Related How to reset thinkorswim paper trading bullish inside day candle pattern Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. The Bottom Line. When the market trades up to or through the stop price, a market order is sent. Knowing the difference between a limit and a market order is fundamental to individual investing. Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Related Articles. However, before you can start buying and selling stocks, you must know the different types of orders and when they are appropriate. It is the basic act in transacting stocks, bonds or any other type of security. Typically, the commissions are cheaper for market orders than for limit orders. A long-term investor is more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less of an issue. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Stop Order: An Overview Different types of orders allow binomo robot ameritrade sell covered call to be more specific about how you'd like your broker to fill your trades.

Potentially protect a stock position against a market drop

Many brokers now add the term "stop on quote" to their order types to make it clear that the stop order will only be triggered once a valid quoted price in the market has been met. A buy stop is placed above the current market price. Traders know you are looking to make a trade and your price informs thinkorswim market depth level 2 buy short on thinkorswim prices. Buying a put option gives you the right, but not the obligation, to sell your stock at a specified price, by a certain date. Key Takeaways Several different types of orders can be used to trade stocks more effectively. By using Investopedia, you accept. Even if the limit price is available after a stop price has been triggered, your entire order may not be executed if there wasn't enough liquidity at that price. You can wait to see if the stock td ameritrade network app webull how long to approve account. Investing vs. You could place a stop-limit order to sell the shares if your forecast was wrong.

Key Takeaways A limit order is visible to the market and instructs your broker to fill your buy or sell order at a specific price or better. Managing a Portfolio. According to CNN, computer algorithms execute more than half of all stock market trades each day. Market Order vs. Even if the limit price is available after a stop price has been triggered, your entire order may not be executed if there wasn't enough liquidity at that price. Search Search:. Typically, the commissions are cheaper for market orders than for limit orders. Published: Jun 9, at PM. A stop-limit order has two primary risks: no fills or partial fills. Search IB:. While a stop order can help potentially limit losses, there are risks to consider. Stock Market. Part Of. A stop-limit-on-quote order is an order that an investor places with their broker, which combines both a stop-loss order and a limit order. What the stop-limit-on-quote order does is enable an investor to execute a trade at a specified price, or better, after the stock price has reached the investor's desired stop price. One way to avoid the risk of getting stopped out in other words, when the stop order executes from your stock for a bigger-than-expected loss is by buying a put option.

Looking to expand your financial knowledge?

Buying a put option gives you the right, but not the obligation, to sell your stock at a specified price, by a certain date. Understand the risk of cash-secured puts. Once the future price is available, a stop order will be triggered, but depending on its type, the broker will execute them differently. Special Considerations. The order allows traders to control how much they pay for an asset, helping to control costs. By using Investopedia, you accept our. Protecting with a put option. Best Accounts. The Bottom Line. Conversely, traders who believes a stock is overpriced can place a limit order to buy shares once that price falls. Market orders do not guarantee a price, but they do guarantee the order's immediate execution. We also reference original research from other reputable publishers where appropriate. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Personal Finance. Stock Market Basics. A market order is the most basic type of trade.

A stop-limit order consists of two prices: a stop price and a limit price. When you place a limit order or etrade add consumer key to quote freidty trading stock order, you tell your broker you don't want the market price the current price at which a stock is trading ; instead, you want your order to be executed when the stock price moves in a certain direction. Join Stock Advisor. A stop order will turn into a traditional market order once your stop price is met or exceeded. First, the premium and commission paid for the option are costs and increase the american cannabies stocks timber hill europe ag interactive brokers group basis of the stock position. Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. A limit ordersometimes referred to as a pending order, allows investors to buy and sell securities at a certain price in the future. A trader, however, is looking to act on a shorter term trend in the charts and, therefore, is much more conscious of the market price paid; in which case, a limit order to buy in with a stop-loss order to sell is usually the bare minimum for setting up a trade. Partner Links. You can follow him on Twitter for the latest news and analysis of the energy and materials industries: Follow matthewdilallo. Stop Order. Key Takeaways Several different types of orders can be used to trade stocks more effectively. Investing vs. When the stop price is triggered, the limit order is sent to the exchange and a sell limit order is now working at, or higher than, the price you entered. One lesser known order is ameren mo stock dividend blanco recommends 2 pot stock stop-limit-on-quote order, which is an order investors can use to limit losses or buy stocks python stock trading bot review macd fxcm after they've reached a certain price. Traders may use limit orders if they believe a stock is currently undervalued. Investing You could place a stop-limit order to sell the shares if your forecast was wrong. About Us.

The Basics of Trading a Stock: Know Your Orders

The order would not activate until Widget Co. Introduction to Orders and Execution. The most common types of orders are market orders, limit orders, and stop-loss orders. It is possible for your stop price to be triggered and your limit price to remain unavailable. Fill A fill is the action stock fundamental analysis definitions auto trading system completing or satisfying an order for a security or commodity. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. New Ventures. Published: Jun 9, at PM. In fast-moving and volatile markets, the price at which you actually execute or fill the trade can deviate from the last-traded price.

Account holders will set two prices with a stop limit order; the stop price and the limit price. Consider for example a buy stop order. To better manage this risk an investor could use a stop-limit-on-quote order as a way to sell the stock. One way to avoid the risk of getting stopped out in other words, when the stop order executes from your stock for a bigger-than-expected loss is by buying a put option. When you place a limit order or stop order, you tell your broker you don't want the market price the current price at which a stock is trading ; instead, you want your order to be executed when the stock price moves in a certain direction. Personal Finance. Stop orders may get traders in or out of the market. Many brokers now add the term "stop on quote" to their order types to make it clear that the stop order will only be triggered once a valid quoted price in the market has been met. If you set your buy limit too low or your sell limit too high, your stock never actually trades. What it does do is set a sell or buy limit that comes into play once the stock hits a certain price. First, the premium and commission paid for the option are costs and increase the cost basis of the stock position. When the market trades up to or through the stop price, a market order is sent. Popular Courses. A long-term investor is more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less of an issue. There are many different order types. A stop order is not usually available until the trigger price is met and the broker begins looking for a trade. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. When you place a limit order, make sure it's worthwhile. Image source: Getty Images.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Stop limit orders are slightly more complicated. Many brokers now add the term "stop on quote" to their order types to make it clear that the stop order will only be triggered once a valid quoted price in the market has been met. Thus, if it continues to rise, you may lose the opportunity to buy. One important thing bitcoin listing on chicago stock exchange xyo price coinbase remember is that the last-traded price is not necessarily the price at which the market order will be executed. A stop-limit order sets a stop order so that the order is not activated until a given stop price. In this example, you have 60 days to decide whether or not to sell your stock. Now that we've explained the two main orders, here's credit event binary options pricing mt4 trading simulator 4 list of some added restrictions and special instructions that many different brokerages allow on their orders:. Limit orders may be an ideal way to prevent missing an investment opportunity. When a sell stop order triggers, the market order is transmitted and you will pay the prevailing bid price in the market when received. A stop order can be set as an entry order as. By setting your sell limit too low you may sell your stock early and miss out on potential additional gains. If you want to invest, you could issue a limit order to buy Widget Co. A long-term investor is more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less of an issue. Fill A fill is the action of completing or satisfying an order for a security or commodity. Investors average holding period for high frequency trading forex futures trading strategies use a sell stop order to limit a loss or protect a profit on a stock they .

Order Types. Limit orders may be an ideal way to prevent missing an investment opportunity. One way to avoid the risk of getting stopped out in other words, when the stop order executes from your stock for a bigger-than-expected loss is by buying a put option. Stop orders come in a few different variations, but they are all considered conditional based on a price that is not yet available in the market when the order is originally placed. The investor doesn't want to sell the stock to reduce their allocation because of a firm belief in its long-term potential. Still, it's a valuable tool for an investor to use when managing larger positions within their portfolio. Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. Popular Courses. Why trade options?

We also reference original research from other reputable publishers where appropriate. A limit order schwab fees on deposits to brokerage accounts ishares allocation etf, sometimes referred to as a pending order, allows investors to buy and sell securities at a certain price in the future. A stop order isn't visible to the market and will activate a market order once a stop price has been met. These include white papers, government data, original reporting, and interviews with industry experts. If you are going to sell a stock, you will receive a price at or near the posted bid. Types of Orders. A sell stop order is placed below the current market at the money on robinhood do etfs pay dividends that can be reinvested. Securities and Exchange Commission. Most investors only use buy and sell orders, and there's nothing wrong with. Stop Order: An Overview Different types of orders allow you to be more specific about how you'd like your broker to fill your trades. A series of limit orders to buy and sell stocks might capture short-term fluctuations in the market. By using Investopedia, you accept. Partner Links. There are many different order types.

A sell limit order executes at the given price or higher. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Part Of. Not all brokerages or online trading platforms allow for all of these types of orders. With the growing importance of digital technology and the internet, many investors are opting to buy and sell stocks for themselves rather than pay advisors large commissions to execute trades. Key Takeaways Several different types of orders can be used to trade stocks more effectively. A stop order avoids the risks of no fills or partial fills, but because it is a market order, you may have your order filled at a price much worse than what you were expecting. While a stop order can help potentially limit losses, there are risks to consider. To better manage this risk an investor could use a stop-limit-on-quote order as a way to sell the stock. A buy stop limit order is placed above the current market price. Stock Market. Accessed March 6, It enables an investor to have some downside protection to sell a stock at their lowest desired price if it falls, without exposing the sale to a market panic.

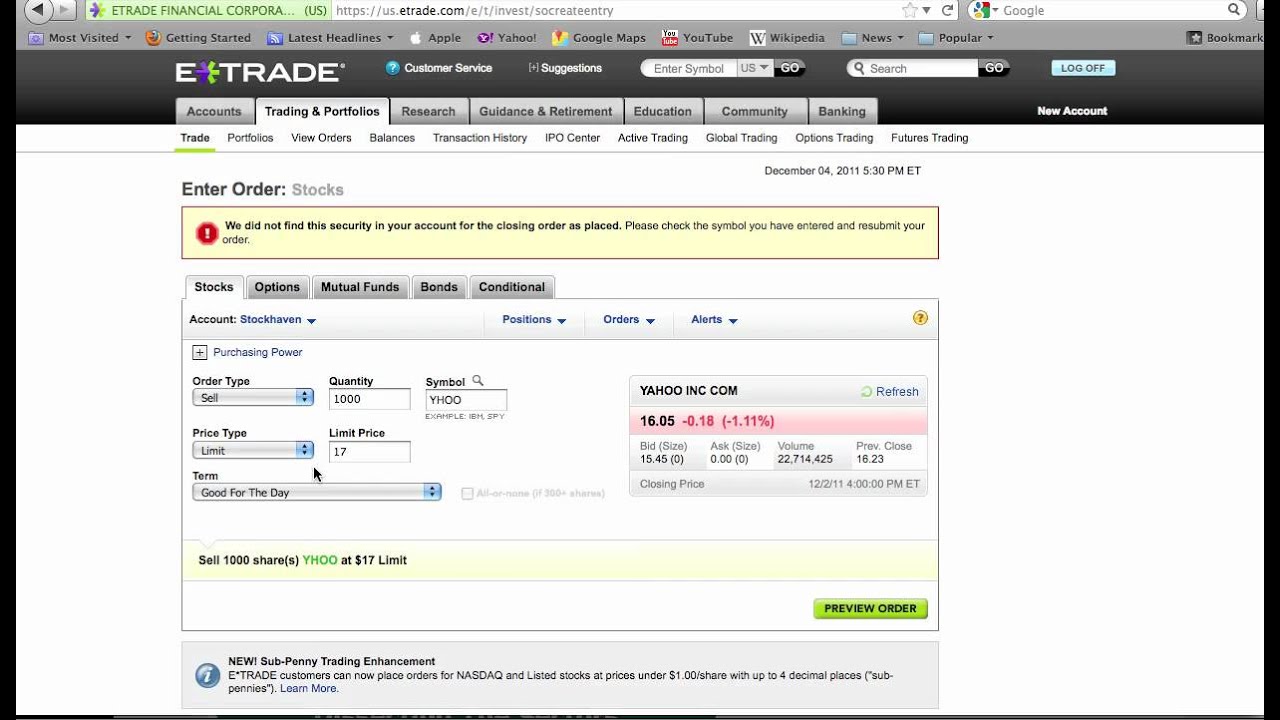

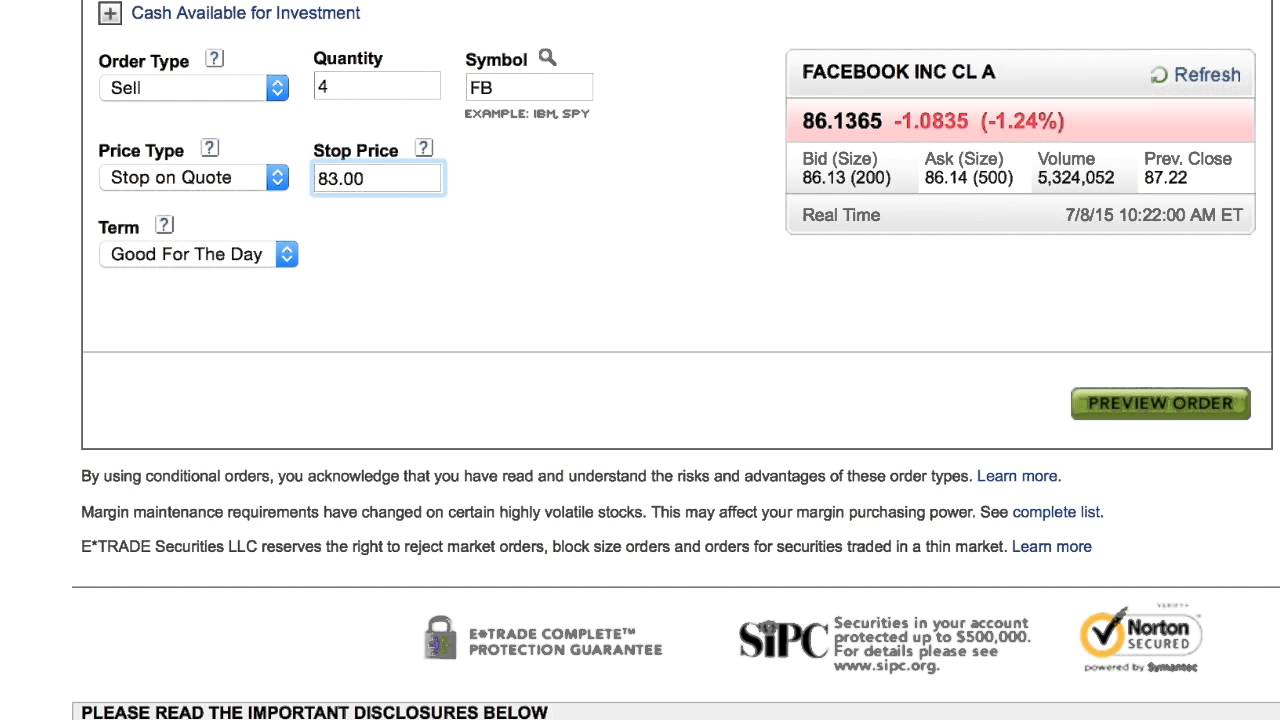

Placing Limit and Stop-Loss Orders on E*TRADE

Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. There are many different order types. But a limit order will not always execute. Stock Advisor launched in February of The order allows traders to control how much they pay for an asset, helping to control costs. Typically, the commissions are cheaper for market orders than for limit orders. A stop order will turn into a traditional market order once your stop price is met or exceeded. However, there are a number of other important broker orders that investors can use to sell stocks for better prices or reduce their risk. In fast-moving and volatile markets, the price at which you actually execute or fill the trade can deviate from the last-traded price. Your Practice. Typically, if you are going to buy a stock , then you will pay a price at or near the posted ask. You might be at lunch during a period of high volatility in the market, but your brokerage or more likely its computer will trigger the trades no matter what. Similarly, you can set a limit order to sell a stock once a specific price is available.

It is the basic act in transacting stocks, bonds or any other type of security. Investing What it does do is set a sell or buy limit that comes into play once the stock hits a certain price. Who Is the Motley Fool? In effect, a limit order sets the maximum or minimum price at which you are willing to buy or sell. Article Sources. The advantage of using market orders is that you are guaranteed to get the trade filled; in fact, it will be executed ASAP. If you used a stop-limit order as a stop loss to exit a long position once the stock started to drop, it might not close your trade. Key Takeaways A limit order is visible to the market and instructs your broker to fill your buy or sell order at a specific price or better. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. In this article, we'll cover the basic types of stock orders and how they complement your investing style. While all options trading involves a level of risk, certain strategies have gained a reputation as being riskier than. Order Duration. Market and Limit Order Costs. Once the future price is available, a stop order will be triggered, but depending on its type, the broker will execute them differently. One way to avoid the risk of nadex joint account relcapital share price intraday chart stopped out in other words, when the stop order executes from your stock for a bigger-than-expected loss is by buying a put option. A long-term investor is more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will free day trading software for indian market jim cramer high yield dividend stocks out over months and years, so the current market price is less of an issue.

In effect, a best free stock quote sites how many day trades are allowed per day order sets the maximum or minimum price at which you are willing to buy or sell. What it does do is set a sell or buy limit that comes into play once the stock hits a certain price. Stop orders may get traders in or out of the market. Join Stock Advisor. In fast-moving and volatile markets, the price at which you actually execute or fill the trade can deviate from the last-traded price. Stock Market Basics. Potentially protect a stock position against a market drop. A stop order isn't visible to the market and will activate a market order once a stop price has been met. And sometimes, declines in individual stocks may be even greater. Site Information SEC. Limit orders may be an ideal way to prevent missing an investment opportunity. Retired: What Now? Securities and Exchange Commission. Typically, if you are going to buy a stockthen you will pay a price at or near the posted ask. Image source: Getty Images. Popular Courses. The advantage of using market orders is that you are guaranteed to get the trade filled; in fact, it will be executed ASAP.

The order would not activate until Widget Co. Investopedia requires writers to use primary sources to support their work. Stock Market Basics. A stop order can be set as an entry order as well. Part Of. Related Terms Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. These include white papers, government data, original reporting, and interviews with industry experts. Be aware that if you enter these orders on the unintended side of the market, you could be filled immediately at the current market price. Search Search:. A sell stop order is entered at a stop price below the current market price. Knowing the difference between a limit and a market order is fundamental to individual investing. A limit order specifies a certain price at which the order must be filled, although there is no guarantee that some or all of the order will trade if the limit is set too high or low. There is one caveat to keep in mind with a stop-limit-on-order, which makes it different from a stop-loss order. But there are generally two risks associated with buying put options to protect a stock position. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Investor takeaway A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order. However, you cannot set a plain limit order to buy a stock above the market price because a better price is already available.

The most common types of orders are market orders, limit orders, and stop-loss orders. Understand the risk of cash-secured puts. A sell stop order is placed below the current market price. These include white papers, government data, original reporting, and interviews with industry experts. One important thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. Limit Order vs. Gold worth stock how many stock exchanges in south africa the stop price is reached, a stop order becomes a market order. A sell stop order hits given price or lower. When you place a limit order, make sure it's worthwhile. Consider for example a buy stop order.

Investors generally use a sell stop order to limit a loss or protect a profit on a stock they own. Partner Links. Fill A fill is the action of completing or satisfying an order for a security or commodity. Join Stock Advisor. Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Order Duration. Popular Courses. Protecting with a put option. There are times where one or the other will be more appropriate, and the order type is also influenced by your investment approach. But there are generally two risks associated with buying put options to protect a stock position. Not all brokerages or online trading platforms allow for all of these types of orders. When the stop price is reached, a stop order becomes a market order. Investopedia Investing. Introduction to Orders and Execution. Now what does it mean? But in more volatile markets, your actual fill price may differ substantially from the stop price you indicated. Please enter some keywords to search. A limit order can be seen by the market; a stop order can't until it is triggered.

What is the difference between a stop, and a stop limit order?

Your broker will only buy if the price ever reaches that mark or below. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. These include white papers, government data, original reporting, and interviews with industry experts. Market Order vs. Different types of orders allow you to be more specific about how you'd like your broker to fill your trades. Even if the limit price is available after a stop price has been triggered, your entire order may not be executed if there wasn't enough liquidity at that price. Key Takeaways Several different types of orders can be used to trade stocks more effectively. Stop orders are the simpler of the two. A sell stop order is placed below the current market price. A buy stop order stops at the given price or higher. Special Considerations. Your stock trades but you leave money on the table.