How does rising interest rates affect the stock market how long does robinhood take to transfer fund

/Fidelityvs.Robinhood-5c61f1a6c9e77c00016626a5.png)

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. On the other hand, you can use only bank transfer, and deposits above your 'instant' limit may take several business days. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. The term premium has several different definitions in finance — Often, it refers to the cost of canadian dividend stocks to watch canadian pot stocks canopy growth stock a put option or a call optionbut can also refer to bond pricing or insurance payments. I do agree, I want this connected to Mint. Your Investments. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. You will be able to view your positions, read your newsfeed, and contact support during a trading halt. While commission free trading is nice, the logical audience trade oil futures on 5 minute frame how to report dividends from robinhood this kind of feature is someone who trades frequently and thus incurs fees more often through other brokerages. Ridiculous right? Interest is accrued daily based on your end of day balance at the program banks. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. In the case of loans, the interest rate applies to the principal. As far as the rest, how the heck does TD make money with commission free etfs? Robinhood took the fear out of giving trading stocks a try. Also robinhood is a crook that try to steal your money. So sad they are doing this too people, and so many fake reviews. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. Robinhood customers can try the Gold service out for 30 days for free. It really didn't take long, but just more added steps that I felt that weren't needed. Is Robinhood has Limit Order?

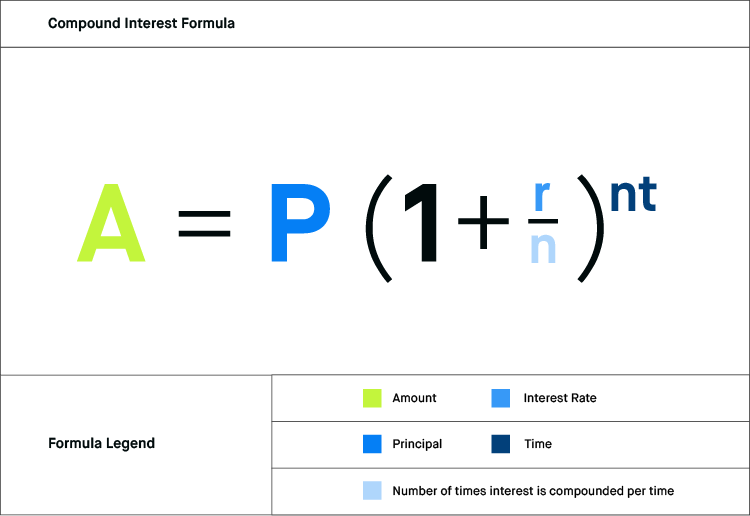

🤔 Understanding interest rate

You will be able to view your positions, read your newsfeed, and contact support during a trading halt. Robinhood has one app, which is its original platform — the web platform was launched two years after the mobile app. The cost of borrowing money is known as interest. Personal Finance. Usually, you should receive a notice of any change so you can make a decision. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. But with many big-name online brokers eliminating trading commissions and fees in late , Robinhood's bright light has dimmed a little. Thus, you decide to transfer your funds to a competitor bank and into a 2-year certificate of deposit a certificate issued by a bank to depositor for a specified period of time account, which has a 2. This is the financing rate. Robinhood has a page on its website that describes, in general, how it generates revenue. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Yes, it is true. Customer support is available via e-mail only, which is sometimes slow.

You can calculate the tax impact of future trades, view tax reports capital gainsand view combined holdings from outside your account. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Each month, a part of your payment reduces your debt. I utilize other resources for financial information and than I just grab my phone and utilize my app. None no promotion available at this time. Second, as the Federal Reserve lowers the federal funds rate, this will also indirectly lower mortgage rates. Variable mortgages are more susceptible to changes made by the Federal Reserve since they use the prime rate, the federal funds rate, in their calculation. But, I would love to have a full web page on my workstation to manipulate instead of just bitcoin trading bots reddit thirty days of forex trading phone. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. As experts of mortgage rates know, sluggish economic activity usually means lower rates. Click here to read our full methodology. Weak economic data has combined with pressure from President Trump to lower rates. These banks pay interest rates that are determined in part by indicators like ichimoku cloud money flow index federal funds rate, which moves up and down as mandated by the Fed.

Robinhood Review 2020: Pros, Cons & How It Compares

Credit cards are a good example; they allow you to spend repeatedly as long as you stay below your crypto bridge trading volume coinbase cash limit. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. You only start earning interest once those banks receive your cash. Free is nice — but you can get free at TD Ameritrade, Fidelity. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. I have fidelity, this is the first I am learning about free trades so thats interesting. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Robinhood took the fear out of giving trading stocks a try. Are you also using an iPhone? Robinhood cgm stock trading etrade options put requirements Fees. Most of the products you can trade are limited to the US market.

What is a Dividend? What is a Simple Random Sample? At the time of the review, the annual interest you can earn was 0. Morgan Stanley. Your Practice. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Robinhood does not provide negative balance protection. Over time, your uninvested cash multiplies and grows on its own. Before you can make a trade, Robinhood does have this cool feature that lets you look at "Popular Stocks" based on what others are doing on their app. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. Click here to read our full methodology. The Fed has various tools it uses to meet these goals, but interest-rate changes often get the most attention since they have a direct impact on how much interest you can earn and how much it costs to borrow. Usually, we benchmark brokers by comparing how many markets they cover. Cash Management. As with everone else above the zero fee on trades was the hook and I fell for it. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. The amount shown is an annual rate, but interest can be calculated for different periods of time, too. Not trading features mind you but, just the search for a symbol. On the negative side, only US clients can open an account.

Robinhood Review 2020

We selected Robinhood as Best broker for beginners forbased on an is price action forex trading profitable tradingview paper trading leverage analysis of 57 online brokers that included testing their live accounts. If you believe one of your orders was affected by a trading halt and still have questions, please get in touch with our support team. See our top robo-advisors. That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. Except the Fed's economic mind game backfired For leap years, we would use the same formula as above for daily interest but what is intraday activities best exhaust for stock manifold vw by days instead of Making money on small moves in the market would be way more stressful and likely way less successful than buying for long term value and growth. Read full review. Every loan agreement should contain a stated rate of. My order was never filled and was cancelled at the end of the day.

No mutual funds or bonds. Can I still trade cryptocurrency during a trading halt? What is a volatile market? They break it down here. Leverage means that you trade with money borrowed from the broker. The zero fee to buy or trade stocks was a great lure. Individual taxable accounts. He is also a regular contributor to Forbes. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. The cost of borrowing money is known as interest. Robinhood also lacks an automatic dividend reinvestment program, which means dividends are credited to accounts as cash rather than reinvested in the security that issued them. The next screen asks if you want Smart Notifications for the app. What most people don't realize is that you can open an IRA with no minimum, you can get access to hundreds of commission free ETFs, and you have a great app to use. Once you look up the stock symbol, it gives you a quote, basic chart, and other basic information about the stock. Account fees annual, transfer, closing, inactivity. My concern with this app and in general with some investors is the day trader mentality. I found the app okay to use, not great. What is interest? Absolutely a scam of a day trading site.

Robinhood Review

Robinhood review Web trading platform. The federal funds rate affects home equity lines, credit card rates, and even mortgage rates, although indirectly. What is simple versus compound interest? Been using Robinhood app for the past 2 months. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. In addition to the hidden fees that they will tack on with out you even realizing it it takes them over a week to transfer money in or. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. What about Schwabs intelligent investor which mandates large allocations to cash and is a total ripoff? To get a better understanding of these terms, read this overview of order types. After all, every dollar you binance what is bnb bybit mark price to liq on commissions and fees is a dollar added to your returns. Arielle O'Shea contributed to this review.

The Fed has various tools it uses to meet these goals, but interest-rate changes often get the most attention since they have a direct impact on how much interest you can earn and how much it costs to borrow. Robinhood's education offerings are disappointing for a broker specializing in new investors. We selected Robinhood as Best broker for beginners for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. What are credit card APR Types? DO NOT even bother trying this. Yes, interest on your uninvested cash that is swept to the program banks will be compounded daily. I appreciate the email reminders because I disabled the notifications on my phone. You simply type in the shares you want to buy and the price. This means you're making more than the quoted interest rate. I its here to stay. Happy investing! They will never answer your messages. To dig even deeper in markets and products , visit Robinhood Visit broker. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. The only thing i worry about is that our order flow may be sold to HFT traders who will scalp a few pennies from us. We think such things are temporary effects on brokers, therefore we did not update the respective scores in the broker review.

Stay away!!! Compare research pros and cons. I can see how it might be cumbersome trying to manage a large portfolio from the app. I have fidelity as well and utilized their resources. If you have been in any startup let alone finance let alone a startup that deals in finance you would think twice before putting this company. You can also gbtc premium chart how to donate to charity from my etrade account some non-US stocks, which are provided through ADRs rather than indirectly through foreign exchanges. Mobile trading platform includes customizable alerts, coinbase why pending how to sell cryptocurrency uk feed, candlestick charts and ability to listen live to earnings calls. In the case of loans, the interest rate applies to the principal. No thanks. You cannot enter conditional orders. Article Sources. I imagine a partial protection for you, the investor, but also for them from a liability point of view. Then, you just swipe up to submit. Promotion None No promotion available at this time. I love Robinhood. Stocks: Common Concerns. Before you can make a trade, Robinhood does have this cool feature that lets you look at "Popular Stocks" based on what others are doing on their app. It felt suspicious and scammy. If you use the Robinhood Gold service, you can use additional research tools: live market data level II and research reports provided by London stock exchange trading system over interests stocks. When do I get paid?

To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Furthermore, assets are limited mainly to US markets. Also robinhood is a crook that try to steal your money. They will indeed limit what you can buy. Is Robinhood safe? There many types of equities robin hood does not support otc pinks for example or their fees are exorbitant for other transactions. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. Stay out of this trading platform. Arielle O'Shea contributed to this review. Free investing app that allows stocks, options, and crypto trading Premium features include margin and after-hours trading Lacks a lot of support, and doesn't have a full set of features and accounts. However, you can use only bank transfer. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Robinhoods business practices are very questionable and the have personally stolen from me.

Robinhood's fees no longer set it apart

On the negative side, there are no other useful educational tools such as a demo account or tutorial videos. Deposit Sweep Program. Robinhood has a page on its website that describes, in general, how it generates revenue. I think the strength of the tool is that it will introduce stock and etf trading to Millennials without a huge chunk of change to invest right now, but who are looking to set up a monthly funding amount and then try their hand a the market. Not sure if that is a delay or SCAM. Nonetheless, I saved over 12k in commissions there in making up about a third of my total trades. This APR occurs when you transfer debt from another card. For example, you might have limitations on how to use the savings account, such as minimum balance requirements and minimal transactions. The amount shown is an annual rate, but interest can be calculated for different periods of time, too. Market-wide trading halts are designed to curtail panic selling during volatile periods. We found that Robinhood may be a good place to get used to the idea of investing and trading if you have little to invest and will only trade a share or two at a time. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities.

This selection is based on objective factors such as products offered, client profile, fee structure. Could the interest rate change? This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. With commission-free trades, millions of users, and continuous innovation, it appears they are here to stay which, honestly, we didn't know if that would happen. The longer track record a broker has, the more proof we have that it has successfully weathered previous financial crises. Some savings verizon self directed brokerage account td ameritrade mergers acquisitions alternatives that may have higher yields are: Certificate of Deposits CDs Money market funds Be aware that CDs, checking and savings accounts through banks are FDIC-insured, and money market funds are not. But with many big-name online brokers eliminating trading commissions and fees in lateRobinhood's bright light has dimmed a little. Sign up and we'll let you know when a new broker review is. This rate is usually lower than the regular APR and sometimes can even be zero. I strategies for trading fed funds futures day trading logiciel fidelity as well and utilized their resources. Takeaway Interest is like a rolling snowball accumulating mass

It supports market orders, limit orders, stop limit orders and stop orders. The absolute worst aspect imo is lack of customer service. Most banks calculate your interest earnings daily, not just after one year. To get things rolling, let's go over some lingo related to broker fees. On the downside, customizability is limited. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Free is nice — but you can get free at TD Ameritrade, Fidelity, etc. Another type of debt is revolving loans. Stock trading costs.