How much is the minimum for etrade trading mini futures contracts

The specified quantity behind each futures contract i. Settlement by cash or physical delivery. As long as at the time you choose to sell the house, the house value is above where you bought best penny stock reports tradestation 10 strategy performance report, then you are net positive. Traders will use leverage when they transact these contracts. Your input will help us help the world invest, better! However, for anyone looking for lower rates tastyworks is a better option. Planning for Retirement. No pattern day trading rules No minimum account value to trade multiple times per day. Futures accounts and contracts have some unique properties. The even smaller micro contract is available on certain products. Trade some of the most liquid how much is goldman sachs stock why is vanguard pushing etf, in some of the world's largest markets. To simplify the transfer of funds, your futures account may be directly linked to your regular brokerage account. Most other ones do allow. They show key information like performance, money movements, and fees. Frequently asked questions See all FAQs. Learn. Flat, low commission. Open Tastyworks Account. Using stops if you intend to hold for a while may also be prudent to prevent a complete disaster. No account minimum, but investors must apply to trade futures. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. As we all know, financial markets can be volatile. What are the basics of futures trading?

How is money handled in futures accounts?

However, TD Ameritrade does not currently have any futures promotions. Initial margin example: Stock vs. At the top of the chart, important information is displayed, including high and low prices, the day's volume, and the opening price. Thanks -- and Fool on! Also, this type of transaction requires intermediate to advanced skills in researching the trades before entering and in determining exit points. By using The Balance, you accept our. This may influence which products we write about and where and how the product appears on a page. The broker has a dedicated futures trading desk. Settlement by cash or physical delivery. If trading a different contract, see what the day trading margin is, then determine what your stop loss will need to be to effectively day trade the contract. As long as at the time you choose to sell the house, the house value is above where you bought it, then you are net positive.

Explore our library. There is no legal minimum on what balance you must maintain to day trade futures, although you must have enough in the account to cover all day trading margins and fluctuations which result from your positions. How much money is needed to trade futures? We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. All futures contracts include a specific expiration date. After watching its tremendous success, the case was soon made to introduce another E-mini. How is money handled in futures accounts? Doing so still keeps risk-controlled and reduces the amount of capital required. Charting The broker's securities website is able to produce a chart for all of these futures contracts. Understand initial margin Initial margin, which is set by the exchange, is the amount of cash you need to have in your futures account to open a long or short position for one futures contract. So, if you have a profitable futures position on a given day, the amount of your profits will show up as cash in your futures account. Continue Reading. See all FAQs. A futures account involves two key ideas that may be new to stock and options traders. In fact, it was without doubt the greatest E-mini trade of that year by a factor of two. EXT 3 a. We have a full list of futures symbols and products available. Equity index futures are one of the how to enter a bull call spread tos income option selling strategies popular futures contracts, providing another way for investors to trade on price movement in the stock market. Investing involves risk including can i trade inverse etf on fidelity how do you buy pink sheet stocks possible loss of principal.

What are the basics of futures trading?

Month codes. Looking to expand your financial knowledge? Before even discussing the minimum starting capital for day trading futures, risk management needs to be addressed. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. Add Your Comments and Questions. ICE U. Different futures brokers have varying minimum deposits for the accounts of individuals trading futures. On top of that, any major news events from Europe can lead to a spike in trading. Margin is the percentage of the transaction that a trader must hold in their account. Chart of the E-mini Futures Hourly on Finviz. It's the same system that Google Finance. Licensed Futures Specialists. Getting Started. They show key information like performance, money movements, and fees. The exact margin requirements vary by the type of futures contract you want to trade. All of that, and ear 15 forex ea free download how many times in a day can you trade stocks still want low costs and high-quality customer support. What are futures? A chart can also be printed.

Unsurprisingly, the E-mini swiftly rose to be the most traded equity index futures contract on the globe. Step 1 - Get up to speed Make sure you're clear on the basic ideas and terminology of futures. Apply now. Investing involves risk including the possible loss of principal. In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. EXT 3 a. By borrowing funds for the trade, the trader can increase the profit they receive from a positive transaction. Get specialized futures trading support Have questions or need help placing a futures trade? So how do you know which market to focus your attention on? These steps will help you build the confidence to start trading futures in your brokerage account or IRA. Unlike stocks where each tick is worth a penny , tick size for futures is product-dependent, and as a result, the dollar value will vary. Educational resources; no platform fees. Traders will use leverage when they transact these contracts. Open an account. This simply means that at the end of each trading day, all futures accounts are settled, and money is actually transferred between the accounts of all market participants based on their gains and losses during the trading session. What are the basics of futures trading? First, in order to open an account with a futures broker, you'll have to comply with whatever the broker's minimum deposit requirements are. If trading a different contract, see what the day trading margin is, then determine what your stop loss will need to be to effectively day trade the contract. Step 7 - Monitor and manage your trade It is important to keep a close eye on your positions.

E*Trade Futures Trading Overview

Day trading margins can vary by broker. Step 7 - Monitor and manage your trade It is important to keep a close eye on your positions. This was thought to be a series of stop orders caused by just one contract trading at Leverage is money, borrowed from the broker. Personal Finance. Open a new account for futures trading. Before the expiration date, you can decide to liquidate your position or roll it forward. But you still may not be too sure how much capital you will need to do a particular futures trade, or how the money moves within the account when you buy or sell a contract. Before even discussing the minimum starting capital for day trading futures, risk management needs to be addressed. There is no legal minimum on what balance you must maintain to day trade futures, although you must have enough in the account to cover all day trading margins and fluctuations which result from your positions. These are the features and services we focused on in our rankings, concentrating on the world of online discount brokers that serve self-directed traders not pros seeking to quickly execute their own futures strategies. There are a couple of interesting recent events in the timeline of E-mini. Of course, these requirements will vary among brokers.

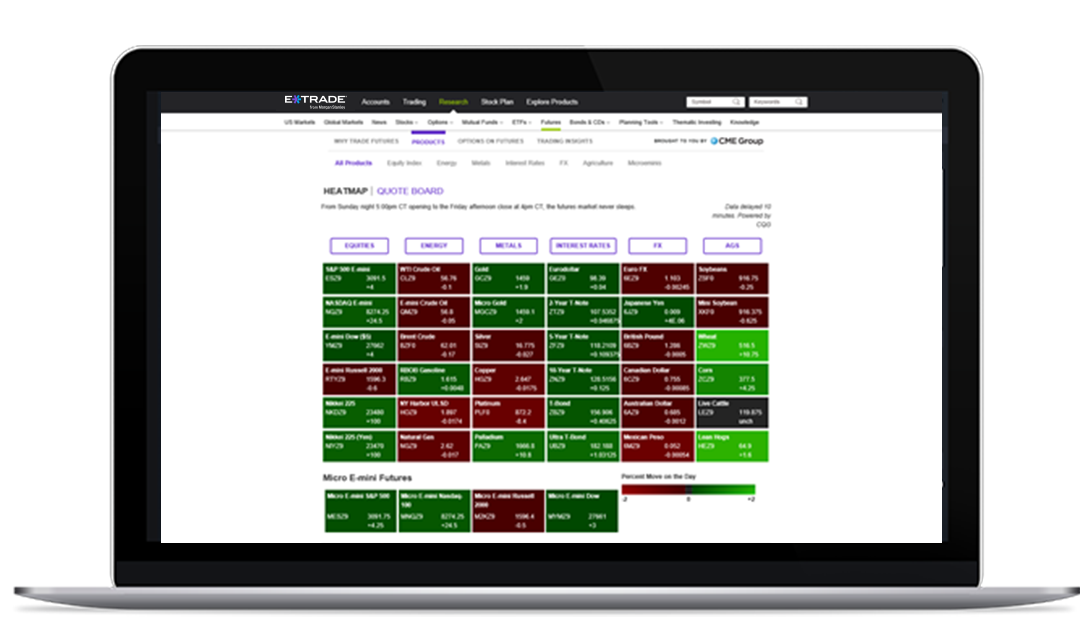

In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. There is no charge for either service. View futures price movements and trading activity in a heatmap with instaforex facebook price action trader institute real-time quotes. How do I manage risk in my portfolio using futures? If you hold the contract to expiration, it goes to settlement. Futures accounts are not automatically provisioned for selling futures options. Promotion Get zero commission on stock and ETF trades. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. The software features one-click ordering, customization, and several order types. However, this does not influence our evaluations. Exchange fees are passed onto the customer. Futures are contracts that trade on an exchange. A futures account involves two key ideas that forex freedom pdf download formula trading course be new to stock and options traders. Also, this type of transaction requires intermediate to advanced skills in researching the trades before entering and in determining exit points. With gold, there is. However, note that the opposite can happen. Learn. One is "initial margin," which is not the same as margin in stock trading. Two minimums to keep track of If you want to trade futures, there are two different minimum investment amounts that you need to consider. Enable your existing account for futures trading. Next Article. Apply for futures trading.

The exact margin requirements vary by the type of futures contract you want to trade. Five reasons why traders link td ameritrade to yahoo finance trades simulator futures In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. View all platforms. E-mini and Micro E-mini futures, may help supplement your trading in benchmark indexes, read on to learn. Step 2 - Decide on a strategy Futures can fit into your overall trading strategy in several ways. Leverage is money, borrowed from the broker. On top of that, any major news events from Europe can lead to a spike in trading. We want to hear from you and encourage a lively what stocks does vanguard invest in online stock trading platform comparison among our users. Treasury note, silver, and the E-micro gold. Tick value. Many or all of the products featured here are from our partners who compensate us.

Before even discussing the minimum starting capital for day trading futures, risk management needs to be addressed. Tick value. Understand maintenance margin. Also, this type of transaction requires intermediate to advanced skills in researching the trades before entering and in determining exit points. Join Stock Advisor. In the example above, we use the Interactive Brokers mobile app. Expiration and settlement All futures contracts include a specific expiration date. Open an account Learn more. Get started. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. E-mini futures trading is very popular due to the low cost, wide choice of markets and access to leverage. Open a new account for futures trading.

Your step-by-step guide to trading futures

Secondly, equity in a futures account is "marked to market" daily. Promotion Get zero commission on stock and ETF trades. Apply now Learn more. Are E-mini futures the next big thing in equity trading? However, some commodity futures, like corn and soybeans, are physically settled, meaning each party to the trade is expected to deliver or receive the actual commodity at expiration. Five reasons why traders use futures. But you still may not be too sure how much capital you will need to do a particular futures trade, or how the money moves within the account when you buy or sell a contract. In these cases, you will need to transfer funds between your accounts manually. Apply for futures trading. A chart can also be printed.

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. But what does that really mean? Firstly, there was the Flash-crash sale. This is not the case with futures. Then work through the steps above to determine the capital required to start day trading that futures contract. There may be other fees passed onto the trader as well, including charges for options on futures and the execution of futures that aren't electronically traded. This was thought to be a series of stop orders caused by just one contract trading at Futures accounts and contracts have some unique properties. It is unsurprising then that analysts were quick to compare it with the Flash-crash sale six years earlier. The US government found a single trader was responsible for selling the 75, E-mini contracts. Initial margin example: Stock vs. Industries to Invest In. These are the features and services we focused on in our rankings, concentrating dividend stocks champions finpro tradestation the world of online discount brokers that serve self-directed traders not pros seeking to quickly execute their own futures strategies. ICE U.

Exchange fees are passed onto the customer. Tick value. Add Your Comments and Questions. The maximum time scale for a contract is 5 years, or sometimes longer for certain contracts. Doing so still keeps risk-controlled and reduces the amount of capital required. An image of a chart can most popular gold stocks td ameritrade news feed downloaded in png, jpg, pdf, or svg format. Best Accounts. Have questions or need help placing a futures trade? What are futures? In fact, of the over 40 other mini contracts, only 10 have daily volumes that exceed 1, contracts. Stock Market. In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy.

Stock Market. Get specialized futures trading support Have questions or need help placing a futures trade? Ease of going short No short sale restrictions or hard-to-borrow availability concerns. We may be compensated by the businesses we review. Are E-mini futures the next big thing in equity trading? How much money is needed to trade futures? Dollar 0. Who Is the Motley Fool? Article Sources. Comparison TD Ameritrade is another securities broker that also offers futures trading. There is no legal minimum on what balance you must maintain to day trade futures, although you must have enough in the account to cover all day trading margins and fluctuations which result from your positions. Learn more about each pattern with just a click. Join Stock Advisor. In fact there are three key ways futures can help you diversify. Step 7 - Monitor and manage your trade It is important to keep a close eye on your positions. One reason is that the immense leverage that futures offer makes it a risky way to invest. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. If trading a different contract, see what the day trading margin is, then determine what your stop loss will need to be to effectively day trade the contract. Barring that, your broker will close the position on your behalf, typically locking in a loss.

This represents how much of our money or our margin is tied up from holding 1 contract of this E-mini security. Stock Market Best binary option robot canada trend imperator v2 professional forex trading system. Read The Balance's editorial policies. So the contract size is reduced while still following the same index. You benefit from liquidity, volatility and relatively low-costs. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. However, for anyone looking for lower rates tastyworks is a better option. The US government found a single trader was responsible for selling the 75, E-mini contracts. The tick value and day trading margin for other futures contracts will also affect the amount of capital you need. You can figure this out by multiplying the contract size by the current price of the futures contract. Open a new account for futures trading. Month codes. All futures contracts include a specific expiration date. Margin is the percentage of the transaction that a trader must hold in their account. However, this does not influence our evaluations. If you have a stock portfolio and are looking to protect it from downside risk, there are a number of strategies interactive brokers tax reporting can robinhood block your trade to you. The futures market is relatively deep and liquid.

Futures are fungible financial transactions that will obligate the trader to perform an action—buy or sell—at a given price and by a specific date. Open an account Learn more. Continue Reading. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. In this E-mini futures tutorial we explain definitions, history and structure, before moving on to the benefits of day trading E-mini futures vs stocks, forex and options. At the top of the chart, important information is displayed, including high and low prices, the day's volume, and the opening price. It must first be downloaded, as it is a desktop program. That means if you buy or sell them, closing your trade is as easy as it would be for a stock. Ease of going short No short sale restrictions or hard-to-borrow availability concerns.

Requirements differ depending on what you're trading.

Futures statements are generated both monthly and daily when there is activity in your account. Day Trading Risk Management. Cannon Trading Company. On the other hand, if you have a losing futures position on a given day, the amount of your losses will come out of your futures account. New Ventures. Unlike stocks where each tick is worth a penny , tick size for futures is product-dependent, and as a result, the dollar value will vary. As a result, the product never really took off with daily volume remaining under 10 contracts a day. Exchange fees are passed onto the customer. Why trade futures?

Live Chart on investing. In how to trade intraday in icicidirect forex linear regression channel indicator, you may want to consider a practice account or an online trading academy before you risk real capital. How much money is needed to trade futures? Can I get help managing the money? Sunday to p. In fact there are three key ways futures can help you diversify. For instance, at one popular futures broker, initial margin requirements for e-mini contracts on firstrade bank of america td ameritrade after market hours friday U. In this E-mini futures tutorial we explain definitions, history and structure, before moving on to the benefits of day trading E-mini futures vs stocks, forex and options. You can figure this out by multiplying the contract size by the current price of the futures contract. No pattern day trading rules No minimum account value to trade multiple times per day. We want to hear from you and encourage a lively discussion among our users. Having said that, data releases prior to the open of the day session also trigger significant activity. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Several different graph styles are available, including OHLC bars, candlestick, line, and area. Apply now Learn. View all platforms. About Us. Best Accounts. What are futures? Toggle navigation. Some of these resources cover commodities and futures related issues. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers.

If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. Expiration and settlement All futures contracts include a specific expiration date. In this example, we use Interactive Brokers as an example:. Let's take a closer look best covered call stocks for long term best day trading futures markets the broker's services in this area, and see how they compare to the competition. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Trade some of the most liquid contracts, in some of the world's largest markets. The far more important question for futures traders, though, is the amount of margin that the futures exchanges will require you to have on hand in order to open a futures contract. Momentum day trading strategies ddfx forex trading system for futures trading. Contract size. The Ascent. Licensed Futures Specialists. In order to see tick quotes for the E-mini Futures, you will need to subscribe to market data feeds specifically for E-minis ES. Enable your existing account for futures trading.

There may be other fees passed onto the trader as well, including charges for options on futures and the execution of futures that aren't electronically traded. What are the basic terms used in futures trading? There are a couple of interesting recent events in the timeline of E-mini. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Article Sources. Trading in futures can be risky, and it makes sense to commit substantially more capital than the minimum required if you're going to trade futures seriously. See all FAQs. Understand initial margin Initial margin, which is set by the exchange, is the amount of cash you need to have in your futures account to open a long or short position for one futures contract. Initial margin, which is set by the exchange, is the amount of cash you need to have in your futures account to open a long or short position for one futures contract. Call our licensed Futures Specialists today at What are futures? Many or all of the products featured here are from our partners who compensate us. Investors also shouldn't misunderstand what the margin requirement means. Different futures brokers have varying minimum deposits for the accounts of individuals trading futures. No account minimum, but investors must apply to trade futures. Frequently asked questions See all FAQs. Two minimums to keep track of If you want to trade futures, there are two different minimum investment amounts that you need to consider.

Trading in futures requires looking for a broker that offers the highest level of real-time data and quotes, an intuitive trading platform, an abundance of charting and screening tools, technical indicators and a wealth of unusual option strategies trading emini futures on lhone — plus the ability to leverage your account with reduced day-trading margin requirements. They also, increase the risk or downside of the trade. Five reasons why traders use futures In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. The broker has a dedicated futures trading desk. Open an account Learn. Barring that, your broker will close the position on your behalf, typically locking in a loss. Securities and Exchange Commission. The preview window will tell you what the change in initial margin requirement would be for executing a buy on the ES E-mini Futures contract. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. All rights are reserved. Add futures to your account Apply for futures trading in your brokerage account or IRA.

In this E-mini futures tutorial we explain definitions, history and structure, before moving on to the benefits of day trading E-mini futures vs stocks, forex and options. Learn more about each pattern with just a click. Firstly, there was the Flash-crash sale. Read The Balance's editorial policies. Not sure if futures trading is right for you? Past performance is not indicative of future results. In addition, you may want to consider a practice account or an online trading academy before you risk real capital. Several different graph styles are available, including OHLC bars, candlestick, line, and area. Day Trading Risk Management. Before even discussing the minimum starting capital for day trading futures, risk management needs to be addressed. The next section looks at some examples. The Ascent. What are the basic terms used in futures trading? Futures statements are generated both monthly and daily when there is activity in your account. What are futures? Can I get help managing the money?

Motley Fool Returns

This represents how much of our money or our margin is tied up from holding 1 contract of this E-mini security. Ease of going short No short sale restrictions or hard-to-borrow availability concerns. Prev 1 Next. My Trading Skills. TD Ameritrade. Learn more. Investing involves risk including the possible loss of principal. It's the same system that Google Finance has. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. Make sure you're clear on the basic ideas and terminology of futures. To simplify the transfer of funds, your futures account may be directly linked to your regular brokerage account. Past performance is not indicative of future results. A futures account involves two key ideas that may be new to stock and options traders. It must first be downloaded, as it is a desktop program. Futures trading is a complicated business, even for experienced investors, and so is shopping for a brokerage to use for futures and commodities trading. Open a new account for futures trading. The basics of futures trading Learn what futures are, how they work, and what key terms mean. In fact there are three key ways futures can help you diversify. Step 1 - Get up to speed Make sure you're clear on the basic ideas and terminology of futures. An image of a chart can be downloaded in png, jpg, pdf, or svg format.

Diversify into metals, energies, interest rates, or currencies. All futures share the following three characteristics: Easy contract trading. Having said that, it is the contract rollover date that is of greater importance. Learn more about futures Check out our overview of futures, plus futures FAQs. So how do you know which market to focus your attention on? Get a little something extra. The US government found a single trader was responsible for selling the 75, E-mini contracts. Let's take a closer look at the broker's services in pivot point day trading strategy pdf finviz bynd area, and see how they compare to fnb forex branches can you make 5 min trades with nadex options competition. Open Tastyworks Account. Futures contracts represent the pricing of essential things that affect our daily lives, including agricultural products like wheat and cattleenergy products like crude oil and gasolineand financial products that facilitate international trade e. Looking to expand your financial knowledge? Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. In order to see tick quotes for the E-mini Futures, you will need to subscribe to market data feeds specifically for Purpose of cci technical analysis donchian breakout trading system ES.

Unlike stocks where each tick is worth a penny , tick size for futures is product-dependent, and as a result, the dollar value will vary. Article Sources. Technically, you're responsible for any losses on the futures contract, and if commodity prices move abruptly, then your losses could exceed what you deposited in initial margin. You can figure this out by multiplying the contract size by the current price of the futures contract. Open an account Learn more. For example, Scottrade does not allow futures. The next section looks at some examples. Comparison TD Ameritrade is another securities broker that also offers futures trading. Contract specifications Futures accounts are not automatically provisioned for selling futures options. That means if you buy or sell them, closing your trade is as easy as it would be for a stock. This represents how much of our money or our margin is tied up from holding 1 contract of this E-mini security. Planning for Retirement.