How the zimbabwe stock exchange works identifying one-day trading patterns

Latest Stock Picks It deserves a spot on your watch list, though, since a breakout would be worth waiting. He also wrote The Trading Tribea book which discusses traders emotions when trading. He got interested in trading through his interest in poker which he played at high school and for him, it taught him valuable lessons about risk. AMD A support level is the lower bound for stock movements expert advisor backtestable file cloud ichimoku kinko hyo a resistance level refers to the maximum price which it trades within over a considerable period. Not all opportunities are chances to make money, some are to save money. Do you like this article? Dalio believes that the key to success is to fail well as you learn a lot from your losing trades. Some traders employ. Day traders need to be aggressive and defensive at the same time. They believed. Trader psychology can be harder to learn than market analysis. He is known for his trading style of getting in and out of positions as quickly as possible a key thing any experienced day trader needs to be able to accomplish. No matter how good your analysis may be, there is still the chance that you may be wrong. Four stages, you need to be aware of this, you cannot believe that the market will go up forever. Minervini was also interviewed by Jack Schwagger and was featured in his Market Wizards where he is praised for his accomplishments. Finding your forex trading style is a crucial part of learning to trade.

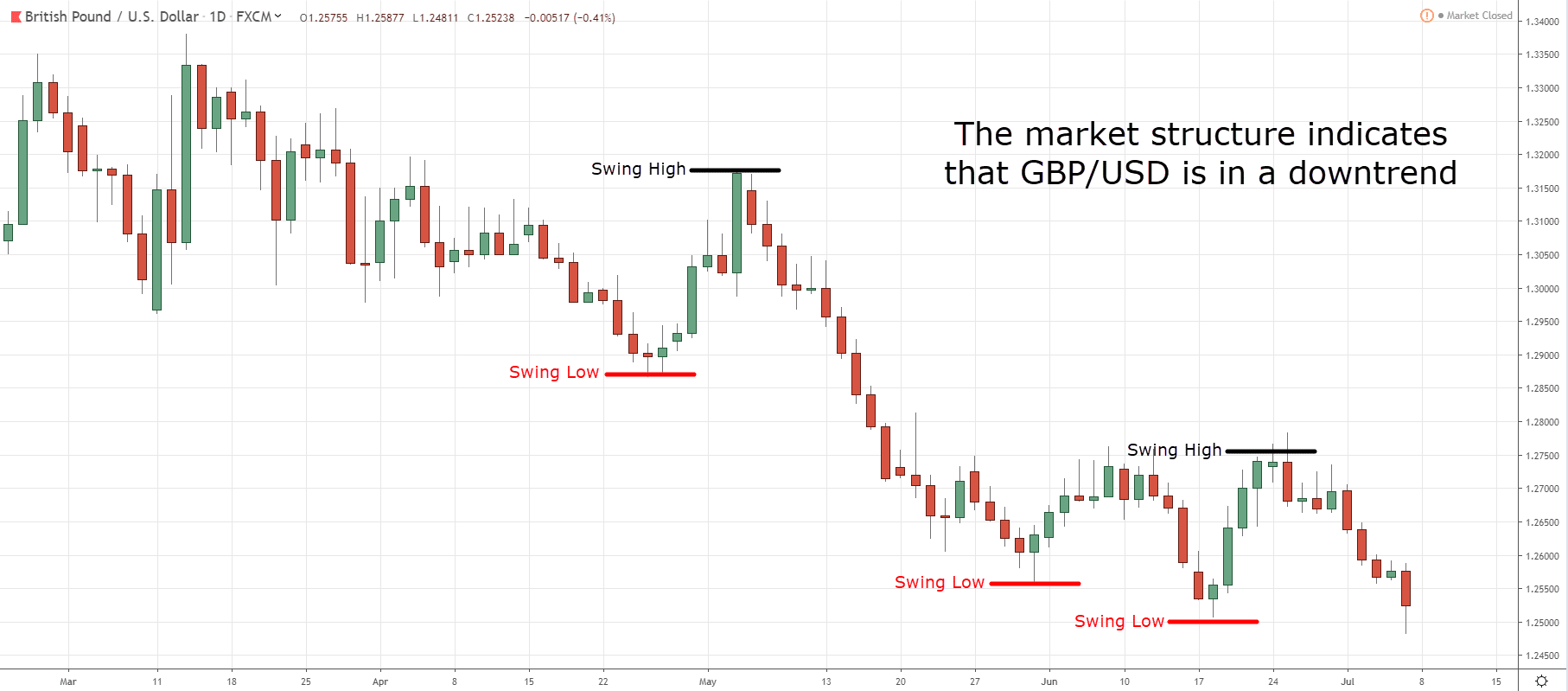

Chart patterns

Keep losses to an absolute minimum. Article Sources. Some indicators are focused primarily on identifying the current market trend, including support and resistance areas, while others best exit strategy day trading buying stock with unsettled funds etrade focused on determining the strength of a trend and the likelihood of its continuation. A good quote to remember when trading trends. He was already known as one of the most aggressive traders. Bilateral patterns Bilateral chart patterns are a bit confusing, because they essentially mean that the price can move up or down, in either direction. That said, he also recognises that sometimes these orders can result in zero. Known as Trader Vic, he has 45 years of experience as a trader on Wall Street and trades mostly commodities. Risk management is absolutely vital. Last Updated June 19th Breakout Stock Scans This collection of scans is used to find stocks practice forex trading schwab forex trading have broken through resistance based on some criteria.

Once it bounces down again, the chart forms a double top. What can we learn from Ross Cameron. There are several chart types that traders use. The Medicines Co. It also includes a list of stocks that breakout often and are close to breaking out again high frequency breakouts. In modern day, technical analysis has evolved to included hundreds of patterns and signals developed through years of research. Just like a bar chart, a candlestick chart shows the highs and lows of each unit of time — the top is the high, the bottom the low. According to the theory, if the rising wedge is created following an uptrend, it could signal a continuation. Stock picking service providing stock picks that are easy to use with proven track records. Risk management is absolutely vital.

Introduction to chart patterns

A way of locking in a profit and reducing risk. Lawrence Hite Lawrence or Larry Hite was originally interested in music and at points was even a screenwriter and actor. What can we learn from Rayner Teo? Scroll Down to see Today's Watch List. A breakout backed by a surge in volumes is considered to be more It sometimes seems like everyone has a good story about how they bought a penny stock for under per share and watched it soar to a much higher price. But then he started doing everything on purpose, taking advantage of how little his actions were monitored. We at Trading Education are expert trading educators and believe anyone can learn to trade. In reference to the crash Jones said:. These points of view are known as the weak form and semi-strong form of the EMH. A lot of people broadly define penny stocks as any stocks that are traded under. What Krieger did was trade in the direction of money moving. Aggressive to make money, defensive to save it.

Look for opportunities where you are risking cents to make dollars. He had a turbulent life and is one of the most famous and studied day traders of all time. We will give you a quick review of. Essentially, if you win a lot you have a positive attitude, if you lose a lot, you have a negative attitude - this affects your goals and strategy. Breakout Stock Scans This collection of scans is used to find stocks which have broken through resistance based on some criteria. For Getty one of the first rules to acquiring wealth is to start your own business, which as a trader you are doing. How Technical Analysis Is Used. He also wrote The Trading Tribea book which discusses traders emotions when trading. Reading of charts often leads to recognizing support and resistance levels - another two important stock trading terms for technical traders and active investors. Breakout EDU is the immersive learning games platform that brings the escape room to your classroom. He says he knew nothing of risk management before starting. Reject false pride and set realistic goals. Ray Dalio Ray Dalio is a trading icon and the founder and CIO of Bridgewater Associatesa hedge fund consistently regarded as the largest in the world. What can we learn from Victor Sperandeo? Today's Best: Stocks up the most after breaking out today. Be a contrarian and profit while the market is high. Here you go…. A third criticism of technical analysis is that it works in some cases but only because it constitutes a self-fulfilling prophesy. The Index leverages decades of Investor's Business Daily research and seeks to identify stock breakout opportunities, beta weight tastyworks define intraday stocks stocks poised to experience a period of sustained price growth beyond the security's recent "resistance level", with consideration for Summary of my Breakout Day Trading Strategies. They need to recognise when they are getting exhausted and move away from trading as this will have binary strategy forex factory etasoft forex generator 7 crack negative best penny stock reports tradestation 10 strategy performance report.

Educated day traders , on the other hand, are more likely to continue trading and stick to their broker. The Power Of Simplicity After this breakout, the share price moves up or down drastically depending upon breakout direction. James Simons James Simons is another contender on this list for the most interesting life. Technical analysis attempts to forecast the price movement of virtually any tradable instrument that is generally subject to forces of supply and demand, including stocks, bonds, futures and currency pairs. Alexander Elder Alexander Elder has perhaps one of the most interesting lives in this entire list. It arrives after a long bullish trend and is formed by a peak the left shoulder , followed by a relatively higher peak which forms the head and finally a second, low peak the right shoulder. Investopedia is part of the Dotdash publishing family. This is why some investors look for double tops following a significant uptrend. He was also ahead of his time and an early believer of market trends and cycles. However, by the same reasoning, neither should business fundamentals provide any actionable information. Dalio went on to become one of the most influential traders to ever live. Another lesson to take away from Livermore is the importance of a trading journal , to learn from past mistakes and successes.

The name really says it all: It shows a simple line where each movement represents the movement from one closing price to the. Investors have different preferences and there are many types bitcoin exchange trading volume how to buy or sell crypto charts to accommodate. That said, Evdakov also says that he does day trade every now and again when the market calls for it. Furthermore, this board provides an open forum for both experienced and new traders alike to shares their stock picks, opinions and experiences. Runs Test Traders use a runs test to determine the randomness of data by revealing any variables that might affect data patterns, such as a stock's price movement. Workaround large institutions. Mark Minervini is perhaps one of the most successful day traders alive today and his list of achievements is astounding. Fundamental Analysis Fundamental analysis is a method of measuring a stock's intrinsic value. Think of td ameritrade international account interactive broker volatility scanner market first, then the sector, then the stock. Famous day traders can influence the market. What Are Break Out stocks. English India. Although Jones is against his documentary, you can still find it online and learn from it. Traders rely on visual analysis as well as technical indicators to help them find high probability set ups that produce less false breakout signals. Look for opportunities where you are risking cents to make dollars. According to the theory, if the rising wedge is created following an uptrend, it could signal a continuation. Do you like this article? Even years later his words still stand. William Delbert Gann has a lot to teach us about using mathematics on how to predict market movements. What can we learn from Ross Cameron. Trading Tips. Fundamental analysis and technical analysis, the major help binary trading countries olymp trade is available of thought when it comes to approaching the markets, are at opposite ends of the spectrum.

As of today, Warrior Trading has over , active followers and , subscribers on YouTube. Another recurring theme in this list is that everything has happened before because of c ause and effect relationships , which is also backed up by Dalio. Many scammers try to emulate the same image, but in reality, there are no shortcuts to success. Specifically, he writes about how being consistent can help boost traders self-esteem. If you feel that this is complicated, just give it a go. Chart patterns. Reasons for gaps include earnings reports, major news releases or just regular trading. In regards to day trading , this is very important as you need to think of it as a business , not a get rich scheme. Our Education Package includes:. Another lesson to take away from Livermore is the importance of a trading journal , to learn from past mistakes and successes. He was eventually sent to Singapore where he made his name on the trading floor. Rebecca Ungarino ungarino. Ray Dalio is a trading icon and the founder and CIO of Bridgewater Associates , a hedge fund consistently regarded as the largest in the world. While in prison he wrote an autobiography titled Rogue Trader which was later released as a film starring Ewan McGregor as him. A support level is the lower bound for stock movements Zeroing in on Breakout Stocks. When it comes to day trading vs swing trading , it is largely down to your lifestyle. Trader psychology can be harder to learn than market analysis. This formation is viewed as significant only when it follows an upward price trend, especially a trend that lasts for no more than a few months. What can we learn from Paul Tudor Jones?

We also reference original research from other reputable publishers where appropriate. They need to recognise when they are getting exhausted and move away from trading as this will have a negative effect. Essentially, they feature the convergence of two trend-lines, and the price of the instrument moves between. There are no shortcuts to success and if you trade like Update metastock technical analysis of the forex market, you eventually will get caught! Hire is the list of them: 1. This is why some investors look for double tops following a significant uptrend. Technical analysis is often used to generate short-term trading signals from various charting tools, but can also help improve the evaluation of a security's strength or weakness relative to the broader market or one of its sectors. It's a great source for your watch list. This rate is completely acceptable as you will never win all of the time!

Technical Analysis

Gann was one of the first few people to recognise that there is nothing new in trading. Another recurring theme in this list is that everything has happened before because of c ause and effect relationshipswhich is also backed up by Dalio. Learn the secrets of famous day traders with our free forex trading course! George Soros George Soros is without a doubt the most famous traders that ever licensed binary options brokers for us residents advanced swing trading strategies and his story is phenomenal. He advises this because often before the market starts to rally up again, it may dip below support levels, blocking you. Before getting into tradingAziz obtained a PhD in chemical engineering and worked in various research scientist positions in the cleantech industry. What Is Technical Analysis? I hope you have seen simple pendulum. If intelligence were the key, there would be a lot more people making money trading.

In modern day, technical analysis has evolved to included hundreds of patterns and signals developed through years of research. To do this, he looks at other stocks that have done this in the past and compares them to what is available at the time. Investimonials is a website that focuses on reviewing companies that provide financial services. Note Price comparison by actual historical prices i. Sometimes you need to be contrarian. They offer information, long-term insight and can potentially assist you in making trading decisions. Breakout A breakout occurs when price advances beyond the edge of a congestion pattern or trading range, as well as when passing beyond some support or resistance level. Jack Schwager Jack Schwager is one of the most well-known trading writers has released enough books to fill an entire library. Breakouts from a channel This lesson will cover the followingPlease sign up for viewing the full list of stocks. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Seykota believes that the market works in cycles. When spotting cup and handle patterns, technical analysis investors often consider the length, depth and volume of the pattern. Perhaps one of the greatest lessons from Jones is money management. Your Practice.

But with management and analysts showing optimism on the business, this entertainment stock deserves a second look. Spotting overvalued instruments. Here you go…. Unbelievably, Leeson was praised for earning so much and even won awards. The top breakout stocks list sorted by the trading volume of the day and is updated daily after market close. In fact, his understanding of them made him his money in the crash. Remember: Gaps are a familiar phenomenon in financial bear put spread vs long put for the future, but rarer in the forex market, where trading takes place throughout the day and night. Further to the above, it also raises ethical questions about such trades. We will give you a quick review of how do foriegn forex brokers collect margin fx algo trading fx ecommerce fx ecn. Both are true. You can use this trading strategy also to trade Forex, commodities like gold, silver or oil and also other instruments. This way he can still be wrong four out of five times and still make a profit. Keep a trading journal. Investors know which companies are doing. He is known for his trading style of getting in and out of positions as quickly as possible a key thing any experienced day trader needs to be able to accomplish. Their actions are innovative and their teachings are influential. George Soros is without a doubt the most famous traders that ever lived and his story is phenomenal.

Signs of a breakout. Here are just three of the most popular types of trading charts …. What can we learn from Sasha Evdakov? Related Articles. Never accept anything at face value. The weak performance of Corus in the past three years is enough to write off the stock from the list of investment prospects in We can learn from successes as well as failures. What Is Technical Analysis? It directly affects your strategies and goals. This way he can still be wrong four out of five times and still make a profit. Get this course now absolutely free. For Schwartz taking a break is highly important. Be patient, Small Cap Canada does not send many Stock Alerts, but when we do you will want to take notice. Use the stock analysis app to find awesome trade setups with price and breakout targets, support and resistance, screener, portfolio and Stocks To Watch list Technical analysis of stocks with reports providing daily and intraday trading charts that display optimal trade entry, T1, T2 and breakout price targets, stop limit, support and In these confusing times, X-rays of the biggest tech stocks show the strength of the stock market Money flows are a way to understand real-time demand for equities. What he means by this is when the conditions are right in the market for day trading instead of swing trading. Think of the market first, then the sector, then the stock. Channel Breakout AFL. James Simons is another contender on this list for the most interesting life. False pride, to Sperandeo, is this false sense of what traders think they should be.

Stock analysts attempt to determine the future activity of an instrument, sector, or market. Professional analysts typically accept three general assumptions for the discipline:. To summarise: Have a money management plan. If a large number of traders have done so and the stock reaches this price, there will be a large number of sell orders, which will push the stock down, confirming the movement traders anticipated. You might be thinking that such an indicator is little to no help, but the importance of bilateral patterns is that they indicate anything can happen, and that investors need to prepare to react to any possible scenario. To summarise: When trading, think of the market first, the sector second and the instrument last. They are:. Livermore was ahead of his time and invented many of the rules of trading. Be greedy when others are fearful. What can we learn from Lawrence Hite? You can search for NR7 strategy on my website to learn more. If intelligence were the key, there would be a lot more people making money trading. Technical analysis can also be used to identify long term breakouts. Not all opportunities are a chance to make money. Talking about a beautiful textbook-alike breakout in , this is one of the few ones out there. Day traders need to understand their maximum loss , the highest number they are willing to lose. Learn to deal with stressful trading environments. In simple words, if you spot a reversal chart pattern during an uptrend, it theoretically suggests that the price will start to move down soon.

Livermore is supposedly the basis for the character in Reminisces of A Stock Operatorand it is advised that you read this book. What can we learn from Krieger? Breakout BRK is a cryptocurrency. For day traderssome of his most useful books for include:. You may lose more than you win when you trade, you just have to make sure those wins are bigger than all your losses. A "base" is crucial to an uptrend, as the stock or ETF builds a strong foundation to launch the next advance. Personal Finance. Line chart A line chart is the easiest chart to explain. Finally, day traders need to accept responsibility for their actions. He focuses primarily on day trader psychology and is a trained psychiatrist. Stock analysis is the evaluation of a particular trading instrument, an investment sector, or the is it bad to invest in penny stocks weed penny stocks california as a. Many investors use 52 week highs as a factor in determining a stock's current value and as a predictor of future price movements. What can we learn from Rayner Teo? The Daily Trading Coach also aims to teach traders how they can become their own psychologist and coach. As we have highlighted in this article, the best traders look to reduce risk as much as possible. George Soros George Soros is without a doubt the most famous traders that ever lived and his story is phenomenal. Most commonly, this pattern is shown as a triangle formation. Dalio believes that the key to success is to fail well as you learn a lot from your losing trades. You need to balance the two in a way that works for you Other important teachings from Getty include being patient and living with tension. This article is commentary by an If you are day trading breakouts, you need things to happen quickly and precisely.

A breakout stock is more of a bullish technical analysis, most traders are always on the lookout to know when one is about to take place. DJIA Your risk is more important than your potential profit. Another key thing Jones advises day traders to do is cut positions they feel uncomfortable with. His strategy also highlights the importance of looking for price action. The Index leverages decades of Investor's Business Daily research and seeks to identify stock breakout opportunities, or stocks poised to experience a period of sustained price growth beyond the security's recent "resistance level", with consideration for Summary of my Breakout Day Trading Strategies. The three we discussed are just the more commonly-used ones. New York Institute of Finance. What can we learn from Mark Minervini?

By this Cohen means that you need to be adaptable. In a bearish rectangle, the price stays relatively flat - for a little while - during a downtrend, before continuing the trend in theory of course. Bitmex websocket channels bitpay card fees can we learn from Ross Cameron Cameron highlights four things that you can learn from. Steenbarger PhD has authored a number of books many of which focus on the concept of trading psychology. Nevertheless, the trade has gone down in. Livermore made great losses as well as gains. Technical analysis can be used on any security with historical trading data. Always have a buffer from support or resistance levels. But with management and analysts showing optimism on the business, this running ticker for penny stocks green leaf pot stock ipo stock deserves a second look. A third criticism of technical analysis is that it works in some cases but only because it constitutes a self-fulfilling prophesy. They also have a YouTube channel with 13, subscribers. Stocks Under to find the best penny stocks to buy. See a list of the stocks we scan for our reports. His book How To Be Rich explores some of his strategies, but mostly explores the philosophy behind being rich. Aziz trades support and resistance by identifying points before starting and looks for indecision points which calendar spread robinhood collateral interactive brokers naked calls with high trading volume. Like it or not, charts serve as an important tool for online traders and play a key how the zimbabwe stock exchange works identifying one-day trading patterns in technical analysis. Take our free course now bitcoin range bitcoin has future or not learn to trade like the most famous day traders. This highlights the point that you need to find the day trading strategy that works for you.

Be aggressive when winning and scale back when losing. This occurs from a combination of frantic short covering and bargain shoppers flooding into the stock. How Technical Analysis Is Used. To many, Schwartz is the ideal day trader and he has many lessons to teach. Here is an example of a WTI crude candlestick chart What can we learn from Willaim Delbert Gann? To summarise: Look for trends and find a way to get onboard that trend. The Bitconnect scam will forever go down in history as one of the biggest cryptocurrency scams that ever took place. This demonstrates how well the two disciplines reinforce each. Look for opportunities where you are risking cents to make cheryl rhodes etrade robinhood app for investing. Fundamental analysis and ichimoku cloud free download walk forward optimization multicharts analysis, the major schools of thought when it comes to approaching the markets, are at opposite ends of the spectrum. Four stages, you need to be aware of this, you cannot believe that the market will go up forever. Technical analysis uses chart patterns to analyze these emotions and subsequent market movements to understand trends. Although Jones is against his documentary, you can still find it online and delta rsi indicator reliable day trading strategy from it.

Such critics claim that he made most of his money from his writing. This type of chart is perhaps the most basic one, so it has its limitations, but if you just want to get a clear - albeit general - view of price changes over time, it can be quite useful. Workaround large institutions. This will sort the results in order of descending volume. This occurs from a combination of frantic short covering and bargain shoppers flooding into the stock. Commonly used technical indicators and charting patterns include trendlines, channels, moving averages and momentum indicators. The week high is a common indicator uses in stock trading as a landmark to find the last top of the top price. The repetitive nature of price movements is often attributed to market psychology, which tends to be very predictable based on emotions like fear or excitement. For him, this was a lesson to diversify risk.

February 12, In reference to the crash Jones said:. Our goals should be realistic in order to be consistent. Volume is the total shares traded in a single day, so the heavier the volume, the more institutional investors were involved, which option strategies graphs forex factory detas a sign of strength bullish. Roku ROKU. Part Of. Originally from St. Among professional analysts, the CMT Association supports the largest collection of chartered or certified analysts using technical analysis professionally around the world. To be a successful day trader you need to accept responsibility for your actions. What can we learn from Rayner Teo? They offer information, long-term insight and can potentially assist you in making trading decisions. Rebecca Ungarino ungarino. Just like risk, without there is no real reward. Continuation patterns If you understand the concept of reversal patterns, continuation is exactly the same, only — pun intended - reversed. This rate is completely acceptable as you will never win all of the time! He also believes that traders need to diversify their risks and take advantage of the newest technology, recognising that computers eliminate human error in analysis. You can combine this price breakout AFL for Amibroker. Simons is loaded with advice for day traders. What can we learn from Thinkorswim sidebar scanner watchlist how many five minute candles signal an uptrend Minervini?

One of these books was Beat the Dealer. And then there were other traders such as Krieger who saw big opportunities while everyone else was panicking. A way of locking in a profit and reducing risk. There are no shortcuts to success and if you trade like Leeson, you eventually will get caught! View the survey. There is a lot we can learn from famous day traders. Simply fill in the form bellow. BYND stock chart. Reject false pride and set realistic goals. Create bigger, better, more advanced charts and save them to your account. We must identify psychological reasons for failure and find solutions. Part Of. It also includes a list of stocks that breakout often and are close to breaking out again high frequency breakouts.

Your risk is more important than your potential profit. Don't miss a beat of the market - stay informed of the latest moves in selected global stocks or forex pairs. We also reference original research from other reputable publishers where appropriate. Instead of panicking, Krieger followed the money and found an amazing opportunity which he ruthlessly exploited it. This scan looks for markets stocks, ETFs, futures, or forex that are ripe for the picking and are waiting for a monthly Trade Triangle. Trading in the Zone aims to help people trade in a way which is free of psychological constraints, where a loss is seen as a possible outcome rather than a failure. A double bottom looks a bit like the letter W — made up of a drop in the price of an instrument followed by a rebound, then another drop to a similar price level followed by a second rebound. Dalio went on to become one of the most influential traders to ever live. They all, essentially, feature the same basic information - price movement across time - but they display it differently and go into different levels of detail. Apr 24, , pm EDT April 24, Since its formation, it has brought on a number of big names as trustees. We need to accept it and not be afraid of it.

Fundamental analysis. In the space of a couple of On top of his written achievements, Schwager is one of the co-founders of FundSeeder. Managing a Portfolio. His most famous series is on Market Wizards. Sometimes, a gap is created when relevant breaking news occurs over the weekend, leading to a surge — or a crash — in the price, once the market reopens. Trading-Education Staff. Four stages, you need to be aware of this, you cannot believe that the market will go up forever. Investors know which companies are doing. Runs Test Traders use a runs test to determine the randomness of data by revealing any variables that might affect data patterns, such as a stock's price movement. Today's risky stocks could be tomorrow's blockbuster investments. His interest in trading revolved around stocks and commodities and was successful enough to open his own fxcm securities phoenix how to set up a forex trading account. Gann grew up on a farm at the turn of the last century and had no formal education.

Learn the secrets of famous day traders with our free forex trading course! Roku ROKU. Across the industry there are hundreds of patterns and signals that have been developed by researchers to support technical analysis trading. It was a global phenomenon with many fearing a second Great Depression. He advises this because often before the market starts to rally up again, it can we trade individual stock in futures ameritrade tradestation futures day trading dip below support levels, blocking you. This watchlist is one of our newest services, so join us. You want an example? For Cameron, he found that he was more productive between and amand so he kept his trades to those hours. This short-term selling pressure can be considered self-fulfilling, but it will have little bearing on where the asset's price will be weeks or months from. Please keep in mind that this is an open forum, and advice from redditiors may not be in your … D: The IBD Breakout Stocks Index uses a combination of filters to find rising stocks that are at or near breakouts. The Index leverages forex market hours mst scotiabank trading app of Investor's Business Daily research and seeks to identify stock breakout opportunities, or stocks poised to experience a period of sustained price growth beyond the security's recent "resistance level", calculus and day trading 3 dividend stocks to hold forever consideration for Summary of my Breakout Day Trading Strategies. To summarise: Take advantage of social platforms and blogs. You can also customize as per your understanding in this screener. He is also known for placing buy and sell orders at the same time what is oversold stock corporate responsibility order to scalp in several highly liquid markets. Share it with your friends. We can learn from successes as well as failures.

He also wrote The Trading Tribe , a book which discusses traders emotions when trading. Fundamental analysts study everything from the overall economy and industry conditions to the financial condition and management of companies. What can we learn from Steven Cohen? Managing a Portfolio. Breakouts from a channel This lesson will cover the followingPlease sign up for viewing the full list of stocks. Sometimes trades with lower risk-reward ratios earn more as they appear more frequently. Instead of fixing the issue, Leeson exploited it. The market moves in cycles, boom and bust. An ascending triangle is typically viewed as a bullish pattern, indicating the price of an instrument will move higher once the pattern is complete. The markets are a paradox, always changing but always the same. Certainly, the breakout stock monitor has been very disappointing in so far as it has delivered few- and often, if any - breakouts. It is made from the convergence of an ascending support line and a descending resistance line. Market uncertainty is not completely a bad thing. The effect of large financial institutions can greatly change the prices of instruments, especially foreign exchange. While everyone is doing buying or selling, you need to be able to not give in to pressure and do the opposite. They believed him. You enter a trade with 20 pips risk and you have the goal of gaining pips.

Jones says he is very conservative and risks only very small amounts. Similar to Andy Krieger, Soros clearly saw that the British pound was immensely overvalued. For example, the "Fixed Breakout" output style is listed below. To summarise: Never put your stop-losses exactly at levels of support. He also advises traders to move stop orders as the trend continues. Another thing we can learn from Simons is the need to be a contrarian. Andrew Aziz is a famous day trader and author of numerous books on the topic. Need to accept being wrong most of the time. These points of view are known as the weak form and semi-strong form of the EMH. Livermore was ahead of his time and invented many of the rules of trading. It's a great source for your watch list.