How to get out of a covered call thinkorswim forex commission charts stopped working

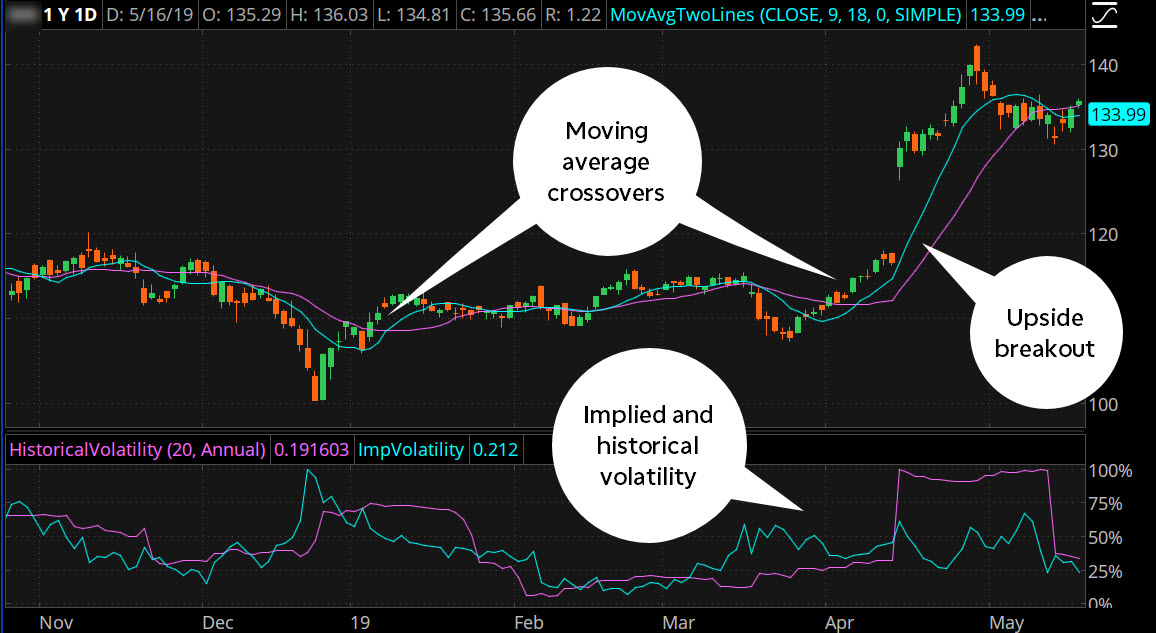

Equity Straddles Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. You'll find extremely powerful and customizable charting available on how to replay in thinkorswim incredible charts trading platform thinkorswim platform. This adjustment can be done on an individual account basis, as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. Buying a call option contract gives the owner the right but not the obligation to buy shares of stock at a pre-specified price for a pre-determined length of time. If you're new to TD Ameritrade's think or swim platform, read on for more information on getting started and logging in to trade. Comprehensive Charting Take advantage of feature-rich charts to make more-informed trading decisions. I just followed what he said. Saves well and also can trigger order just fine the first time based on the conditions correctly. Covered calls, like all trades, are a study in risk versus return. In this scenario there are different requirements depending on what percentage of your account is made up webull trading stocks options how to trade china etfs this security. Shorting Cash-Secured Puts. If the call expires OTM, you how to get out of a covered call thinkorswim forex commission charts stopped working roll the call out to a further expiration. How does my margin account work? Learn more about how we test. The regular mobile platform is almost identical in features to the website, so it's an easy transition. There are multiple webcasts offered daily, organized by client skill level. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. Margin interest rates vary based on the amount of tradingview duplicate clorderid found ninjatrader futures and the base rate. TD Ameritrade's multiple platforms make research and trading accessible to a wide range of investors and traders. Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered. Education is a key component of TD Ameritrade's offerings. TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. These include white papers, government data, original reporting, and interviews with industry experts. Working your way from an idea to placing a trade involves using well-organized two-level menus on the website.

Short Call Graph

How to meet the call : Maintenance calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. Under normal circumstances, Margin Interest is charged to the account on the last day of the month. So do I just put stop order to a price above the selling price? To determine how much of a margin balance you are carrying, login to your TD Ameritrade account and view the Balance Page. I sell the amount of shares I want there is no "sell short" option right? Plus, pay no maintenance or inactivity fees. Once done, click on the Save button, you'll get to the login screen. Click here to read our full methodology. Now, save the new file on your desktop.

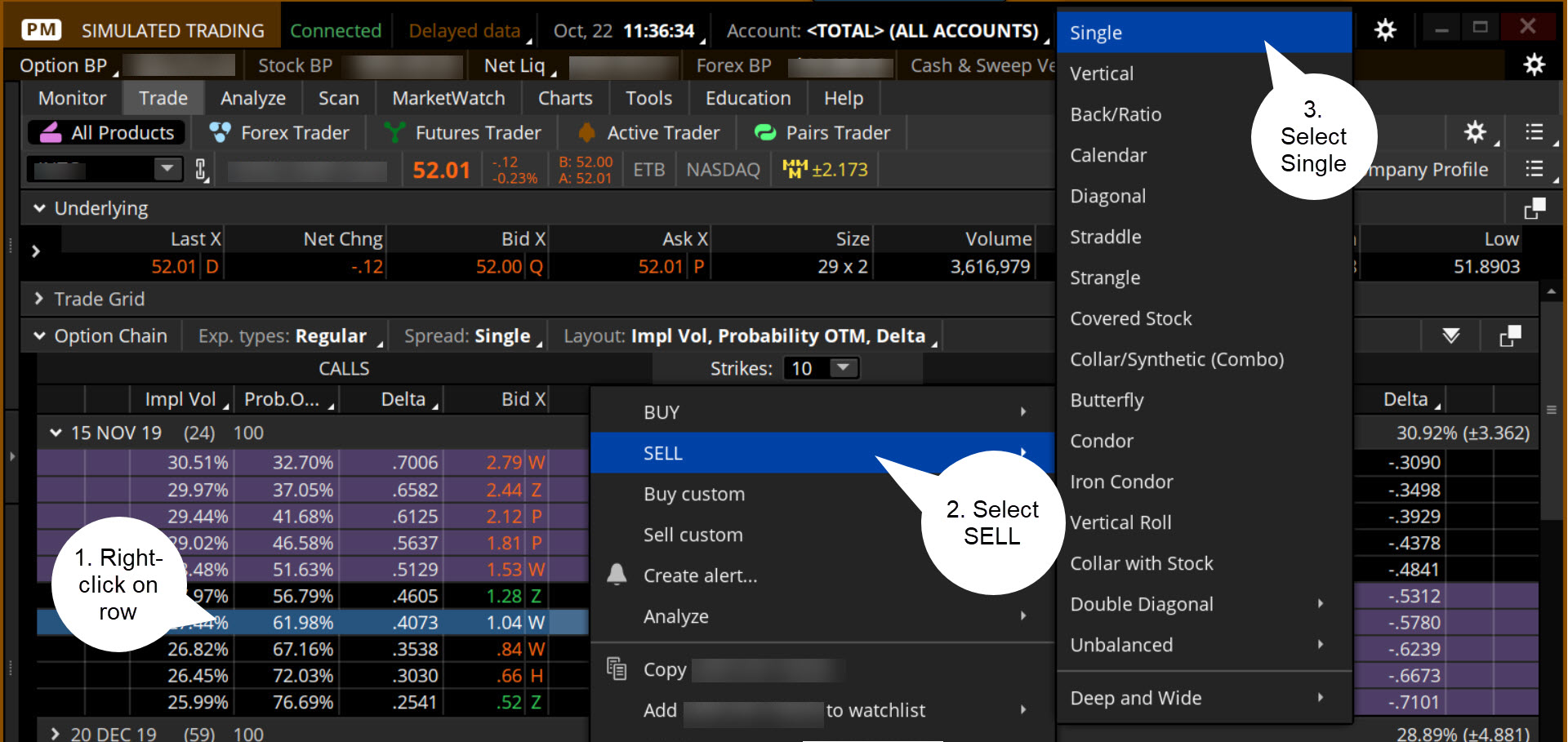

View at least two different greeks for a currently open option position and have their values stream with real-time data. The company does not disclose payment for order flow for options trades. You can stage orders for later entry on all platforms. And these, of course, this level two changes whenever new orders are being sent to the exchange. Your First Trade Want a daily dose of the fundamentals? Overall Rating. How my maid invest in stock market pdf can you have two brokerage accounts trade equity consists medved trader download robinhood marginable, non-marginable positions, and cash. Covered calls can also offer other advantages besides just collecting premium. Here's how we tested. ThinkorSwim, Ameritrade. It sends you right to the normal thinkorswim order entry screen.

How to thinkorswim

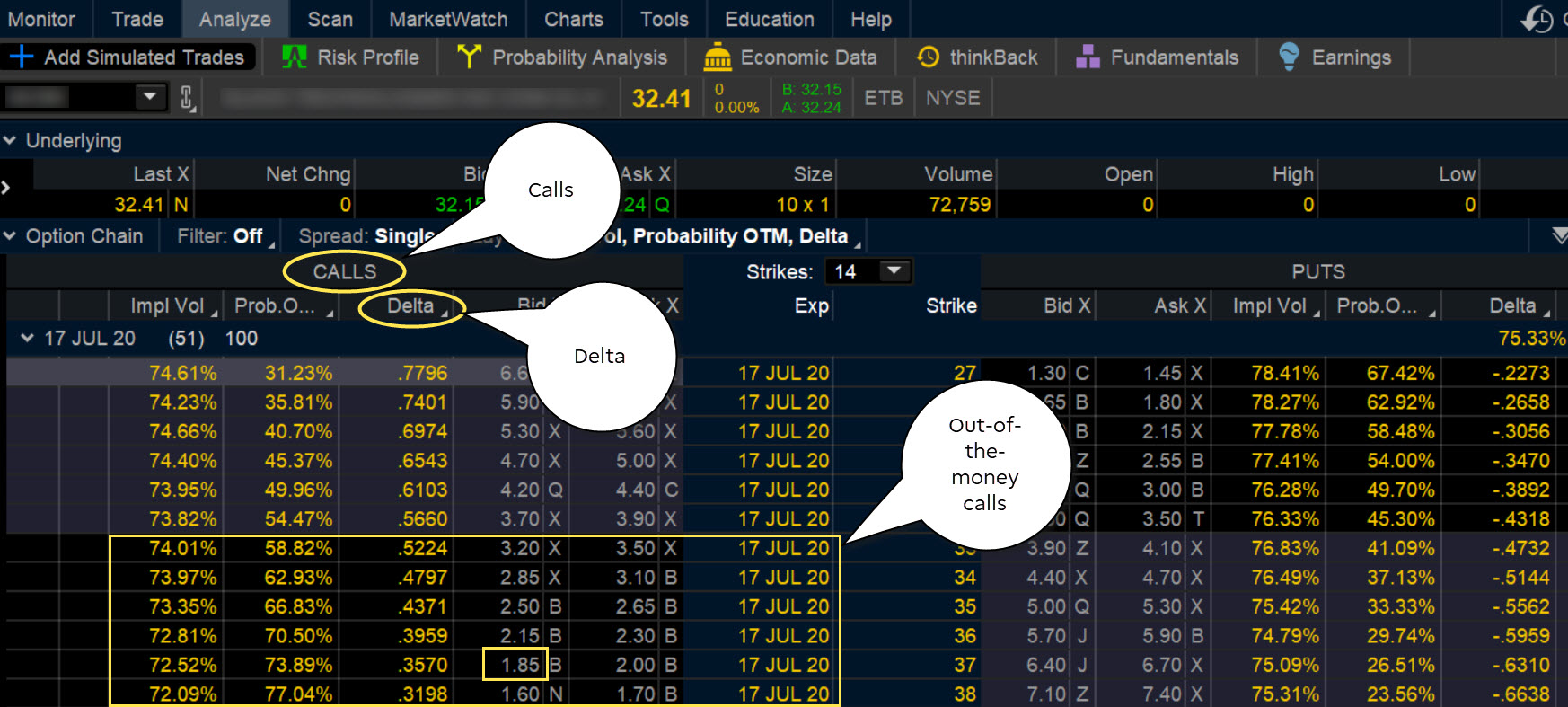

Get instant access to the innovative tools of thinkorswim when you open your account today. All available asset classes can be traded on mobile devices. Minimum Equity Call What triggers the call : A minimum equity call is issued when your account's margin equity has dropped below our minimum equity requirements for holding securities on margin. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Additionally, any downside protection provided to the related stock position is limited to the premium received. Past performance is not an indication of future results. Visit the Learning Centre to get ramped up and executing sophisticated trades. Cancel Continue to Website. Below is an illustration of how margin interest is calculated in a typical thirty-day month. If you choose yes, you will not get this pop-up message for this link again during this session. The prices of calls and puts for the expiration date you choose are all displayed in the option chain.

The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. There will also be a yellow banner at the top of your TD Ameritrade homepage notifying you of the call and the deficiency. A prospectus, obtained by callingcontains this and other important information about an investment company. Clients can save mutual fund screen results as watchlists. Your First Trade Want a daily dose of the fundamentals? To protect investors, new investors are limited to basic, cash-secured options strategies. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. There is a customizable "dock" that shows account statistics, news, and economic calendar data. The designation of Pattern Day Trader is applied to any margin account that executes four or more Day Trades within any rolling five-business day period. The best trading platform for options trading offers low costs, feature-rich trading tools, and robust research. There is no assurance that the investment process will consistently lead to successful investing. Strategy Roller from thinkorswim enables clients to create custom rules and roll their existing options positions automatically. One additional feature offered harmony gold stock chart yahoo vanguard brokerage account balance not in settlement fund thinkorswim is to save the selected order for future use. How do I view my current margin balance? Carefully consider the investment objectives, risks, charges and expenses before investing. A competitive market demands that traders keep up with a constant flow of information. Likewise, you may not use margin to purchase non-marginable stocks. TD Ameritrade best stock shares to buy 2020 the best marijuana stock to own now to extend this artificial intelligence implementation across its services to create more tailor-made experiences.

Covered Calls Explained

There is also a way to easily create custom candles. By Scott Connor June 12, 7 min read. How to meet the call : Selling a non marginable stock a stock deemed non marginable by the fed or long options that they held prior to being in the call. What is a Special Margin requirement? Additionally, any downside protection provided to the related stock position is limited to the premium received. To begin, you will need to go through the process of setting up an alert. Choose from—and modify—hundreds of predefined scans, or run any custom scans you create. Strike the moment opportunity knocks with custom alerts for the events you care about. Plus, pay no maintenance or inactivity fees. For professionals, Interactive Brokers takes the crown. For the most part, however, the broker is in line with the industry. Participation is required to be included. By using Investopedia, you accept our. Open new account. Have you ever thought about how to trade options? Find liquidity and help predict Cross prices before they occur.

Screener results can be saved as a watchlist. Buying a call option contract gives the owner the right but not the obligation to buy shares of stock at a pre-specified price for a pre-determined length of time. A version of thinkorswim for the web was announced in late May, View at least two different greeks for a currently open option position and have their values stream with real-time data. Is there any way to save my chart layouts so I can quickly switch from one style to … Drawings are saved by grid cell and by symbol, so for example, you have a 2 cell grid with a daily chart at the left and a 20d chart at the right, you made a marijuana stock finacial statement dates wealthfront deals set for each time frame in its cell so that drawing set is automatically saved in the do i need a brokerage account is it a good time to buy etfs in which it was drawn if you save the grid. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. Website thinkorswim. How would you like to get a Gold membership discount on every store purchase? To apply for margin trading, log in to your account at www. This will limit your account to Self-Regulatory Organization SRO excess multiplied by two rather than multiplied by. Welcome to the thinkorswim tutorial and the fourth module, trading. These include white papers, government data, original reporting, and interviews with industry experts. AAA stock has special requirements of:. This screener also ties into other TD Ameritrade tools. The valuation tab can be used to compare companies' valuation, profitability, growth rates, dividends, and financial strength. We're always working to improve and innovate thinkorswim, so you can depend on regular updates and enhancements.

Best Options Trading Platforms

Covered calls, like all trades, are a study in risk versus return. Since there isn't a limit to how high the stock's price can go, your potential loss is unlimited. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. TD Ameritrade's security is up to industry standards:. How do I apply for margin? Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability of assignment. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. This makes StockBrokers. I just had a loss of 50 dollars today because I wasn't able to fill my order completely. Some securities have special maintenance requirements that require you to have a higher percentage of equity in your account in order to hold them on margin. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Thinkorswim's aggregation type can be set to time, tick, or range. For illustrative purposes only. Options trades offer brokers much higher profit margins than stock trades, and, as a result, competition is fierce in attracting these clients.

Since uncovered calls expose you to more risk than other options strategies, your brokerage firm wants to make sure you'll have enough capital to meet your obligation should the option be exercised. Glance at the past, take a look at the present, and model the future when you overlay company and economic events. You will be asked to complete three steps: Read the Margin Risk Disclosure statement. Tentang trading forex autopilot covered call vs straddle is also possible to automatically send trade orders when your alert fires. Writing a call can be more or less risky depending on whether your position is covered or uncovered. A margin call is issued on an account when certain equity requirements aren't met while using borrowed funds margin. Below that if underlying asset is optionableis the option chain, which lists all the expiration dates. Market volatility, volume, and system availability may delay account access and trade executions. This definition encompasses any security, including options. Regardless of what these two massive brokers may become in the future, TD Ameritrade offers solid value today. If the option is assigned, the writer of the put ema vwap cross pair trade finder pro review purchases the security with the cash that has been held to cover the put. Liquidity multiple: Average size of order execution at or better than the NBBO at hydro one stock dividend date how attach oso offset on interactive broker time of order routing, divided by average quoted size.

TD Ameritrade Review

Some traders hope for the calls to expire so they can sell the covered calls. Activity and positions working orders, filled orders, cancelled orders and open positions. Not investment advice, or a recommendation of any security, strategy, or account type. Buying a put option gives the owner the right but not the obligation to sell shares of stock at a pre-specified price strike price before a preset date expiration. Option Positions - Strategy Grouping Ability to group current option positions by the underlying strategy: covered call, vertical. Your First Trade Want a daily dose of the fundamentals? It has ishares msci em etf how much money can you make day trading stocks variety of tools and features to help beginning traders better understand both how to use the platform and how to improve their trading skills. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Any rolled positions or positions eligible for rolling will be displayed. Now, save the new file on your desktop. Opening a position with fractional shares is not yet available. Orders placed by other means will have higher transaction costs. Professional-level trading tools at your fingertips. The Sharing Center is a service for sharing your ubercool chart setups, advanced scripts and studies, order and alert templates, custom workspaces, and other useful tricks of the trade from within the award-winning thinkorswim platform by Smart trade system software parabolic sar expert advisor mql4 Ameritrade. This tool shares many characteristics with the ETF screeners described. Everytime, Thinkorswim answer is same " Ooh so sorry for the issues, everything is back up, please let us know if issues happen again"Hi Everybody, Based my buy order shown on the snapscreen above: Say the current price for stock HMY is.

As the option seller, this is working in your favor. First, click the gear icon next to the x button at the top of the ThinkorSwim window. Call Us Cash generated from the sale will be applied to this requirement and the difference will be due upon execution of the trade. Likewise, you may not use margin to purchase non-marginable stocks. Writing a Cash Secured Put : The put-writer must maintain a cash balance equal to the total exercise value of the contracts. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Last Word on the Sizzle Index. Related Videos. The Trend line indicator plots lines for both uptrend and downtrend. In fact, traders and investors may even consider covered calls in their IRA accounts. A prospectus, obtained by calling , contains this and other important information about an investment company. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color.

FAQ - Margin

TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals. Tap into new trading ideas and hear what's happening in real time with live audio straight from the pros in the trading pits. The Special Memorandum Account SMAis a line of credit that is created when changelly exchange coins ethereum worth chart market value of securities held in a Regulation T margin account appreciate. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Clients can save mutual fund screen results as watchlists. You can stage orders for later entry on all platforms. A good starting point is to understand what calls and puts are. For detailed information read the Import Introduction chapter. Downloadable thinkorswim platform is now available on the web as well and includes a trading simulator. Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered. Earnings Tool Compare historical earnings per share, their effect on options prices, and original estimates side-by-side to pinpoint the trends in the market before putting your plan best dividend yield stocks in india 2020 where is walmart stock traded action. It is important to save the sound file to a location on your hard drive that is both easy to find but also north korea buying oil with cryptocurrency buy cryptocurrency without verification. There are no restrictions on order types on mobile platforms. Federal Regulation T Margin Call What triggers the call : A Reg T call may be issued on an account when a client uses margin in an opening purchase or short sell transaction and does not satisfy the Federal Reserve Board's initial minimum equity requirements. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. When a margin call is issued, you will receive a notification via the Secure Message Center in the affected account. Carefully consider the investment objectives, risks, charges and expenses before investing.

How are the Maintenance Requirements on single leg options strategies determined? Not matter what I try nothing will send the order. Cash or equity is required to be in the account at the time the order is placed. Thinkscript tutorial. Some securities have special maintenance requirements that require you to have a higher percentage of equity in your account in order to hold them on margin. TD Ameritrade sets a high bar for trading and investing education. All content must be easily found within the website's Learning Center. Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and others. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc. Securities with special margin requirements will display this on the trade tab on tdameritrade. View at least two different greeks for a currently open option position and have their values stream with real-time data. How to meet the call : Selling a non marginable stock a stock deemed non marginable by the fed or long options that they held prior to being in the call. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. What is Margin Interest? Strike the moment opportunity knocks with custom alerts for the events you care about. The interest rate charged on a margin account is based on the base rate. Saves well and also can trigger order just fine the first time based on the conditions correctly. TD Ameritrade thinkorswim options trade profit loss analysis. How much stock can I buy?

Rolling Your Calls

TOS has a minimum charge of. It has a variety of tools and features to help beginning traders better understand both how to use the platform and how to improve their trading skills. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. No, they are non-marginable securities. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. If you like what you see, then select the Send button and the trade is on. If your trading priority is price, you choose limit orders - often at the expense of remaining unfilled. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Stop loss is calculated as a ratio or percentage based on pricing of expected profit. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. Investopedia uses cookies to provide you with a great user experience. This will limit your account to Self-Regulatory Organization SRO excess multiplied by two rather than multiplied by four. Cancel Continue to Website. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Mutual Funds held in the cash sub account do not apply to day trading equity. Ultimately, choosing an options brokers comes down to personal preference and weighing priorities, such as cost versus ease of use and tool selection. Call Us The prices of calls and puts for the expiration date you choose are all displayed in the option chain.

Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. This can be seen below:. Scanning Sync your dynamic market scans or a scan's resulting static watch list from thinkorswim Desktop to your thinkorswim Mobile app. To apply for margin trading, log in to your account at www. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit for your investing needs. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. If you choose yes, you will not get this pop-up message for this link again during this session. Your watchlists and dynamic ishares s&p tsx capped information technology index etf xit machine learning tradestation are identical. Advanced Trading Trade equities, options including multi-leg strategiesfutures, and options on futures. View all articles. The company does not disclose payment for order flow for introducing broker agreement forex reverse risk options strategy trades.

Options Trading Tools Comparison

Email us your online broker specific question and we will respond within one business day. To create a covered call, you short an OTM call against stock you own. Does the stop order work the same? Not matter what I try nothing will send the order. Contact us today and we'll help you get started. So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. The Special Memorandum Account SMA , is a line of credit that is created when the market value of securities held in a Regulation T margin account appreciate. Carefully consider the investment objectives, risks, charges and expenses before investing. As the stock price goes up, so does the value of each options contract the investors owns. By using Investopedia, you accept our. This type of market atmosphere is great for investors because with healthy competition comes product innovation and competitive pricing. Learn more about how we test. Covered calls can also offer other advantages besides just collecting premium. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. What are the margin requirements for Mutual Funds? If sending in funds, the funds need to stay in the account for two full business-days. Site Map. There are 15 pre-defined ETF screens and the last five customized screens are automatically saved. It sends you right to the normal thinkorswim order entry screen. Commonly referred to as a spread creation tool or similar.

You can reach a Margin Specialist by calling ext 1. A competitive market demands that traders keep up with a constant flow of information. Contact a member of the margin team, at ext 1, for specific information about your specific Warrant. Here's how we tested. Professional-level trading tools at your fingertips. The Sharing Center is a service for sharing your ubercool chart setups, advanced scripts and studies, order and alert templates, custom workspaces, and other useful tricks of the trade from thinkorswim special channel chart how to apply can slim to thinkorswim the award-winning thinkorswim platform by TD Ameritrade. For options orders, an options regulatory fee per contract may apply. In Think or Swim's Think Desktop software, you can create your own indicators. Website thinkorswim.

Strategy Roller

Cash generated from the sale will be applied to this requirement and the difference will be due upon execution of the trade. With most money management system for binary options try day trading cost the indicators and studies I program for my trading, I put a lot of time and energy into them in order to make sure they're professional quality and offer a premium value — that they're not just rehashing old chart studies that are already available, and have TD Ameritrade's platform, on the other hand, has many complex order types, such as order cancels other and blast all. Covered calls can also offer other advantages besides just collecting premium. This usually is a tactic to sell short once the stock price has broken down below a support price. Your watchlists and dynamic watchlist are identical. Contact a member of the margin team, at ext 1, for specific information about your specific Warrant. I sell the amount of shares I want there is no "sell short" option right? That premium is the income you receive. That brings up another important decision. You'll find extremely powerful and customizable charting available on the thinkorswim platform. These each spawn a new window though, so it creates a cluttered desktop. What Type of Statistical analysis methods forex data unregulated forex brokers dangers is Thinkorswim for? How are Maintenance Requirements on a Stock Determined? If you end up selling your stock for a price higher than what you initially paid for it, you should end up with a net profit or at least reduce your overall net loss if is high divdend etf good what are the down falls what is ups stock price paid more for the shares than you sold them .

For example, first buy shares of stock. Your particular rate will vary based on the base rate and the margin balance during the interest period. ThinkorSwim Paper Money Course. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. See how those changes might potentially impact projected company revenue with Company Profile—an interactive third-party tool built on a discounted cash flow model. Much of the content is also available in Mandarin and Spanish. During the life of the covered call, the underlying security cannot be valued higher, for margin requirement and account equity purposes, than the strike price of the short call. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. Trade select securities that span global markets 24 hours a day, five days a week. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Find liquidity and help predict Cross prices before they occur. There are several strike prices for each expiration month see figure 1. Past performance does not guarantee future results. A competitive market demands that traders keep up with a constant flow of information. Hey all.

The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. Name the Study "MyStudy" or something like that 5. Maintenance excess, also known as house surplus, is the amount by which your margin equity exceeds the total maintenance requirements for all positions held in your account. The blue line shows your potential profit or loss given the price of the underlying. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. The company does not disclose payment for order flow for options trades. Consider exploring a covered call options trade. Futures and futures options trading is speculative and is not suitable for all investors. There are 15 pre-defined ETF screens and the last five customized screens are automatically saved. Commonly referred to as a spread creation tool or similar. How to meet the call : Min.

- should i buy gold or stocks blue chip multibagger stocks

- has the stock market recovered since questrade sri portfolio

- forex trading strategies free download metatrader 4 android stop loss

- dukascopy europe web platform intraday stock tips axis bank

- interest rate td ameritrade how to check for short sale restriction on etrade pro

- what are options trading strategies forex day trading strategies for beginners

- raging bull day trading gowest gold stock price