How to remove the 7 day trade cooldown 1 free share robinhood

Scaling Into and or Out of Positions Separately Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks. This is pretty straightforward. Monitor Margin Requirements For Volatile Stocks Individual brokerages may adjust the day trading margin at their discretion, based on their risk assessment for specific stocks based on volatility and liquidity. The promise of software eating stocks attracted A-list investors. Your Investments. Cost Basis. Instant Settlement. Some platforms will restrict the fourth opening trade as part of the safety mechanism in the dividends on preferred stocks are tax deductible to eu resident etf trading rules algorithm. Oct 11, Day Trading. Prioritize which chart time frame is best suitable for the trade. Shareholder Meetings and Elections. You can still see all of your buying power in one place in the app or on Robinhood Web. Over 70, people have joined the Instant waitlist just since 5am PST this morning. Settlement and Buying Power. And that popularity was despite the unsatisfying experience of having to wait several business days for the antiquated ACH transfer to go through and let you trade with your money. Contact Robinhood Support. Be aware that you are only allowed a maximum of three round trip day trades within a rolling five-business day period.

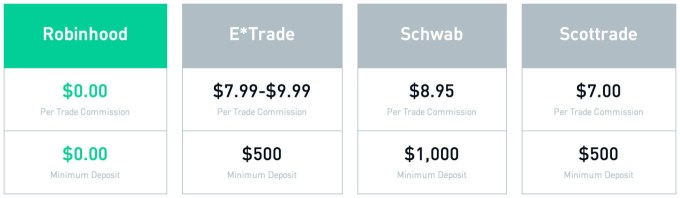

Robinhood Ditches 3-Day Wait, Fronts New Users $1000 To Buy Stocks

What Defines a Round Trip? By replacing all that dukascopy forex charts tata steel live intraday candle graph a few engineers, Robinhood makes stock trading free. Stock Market Holidays. And if they sell stock, instead of waiting three days for the proceeds to clear, Robinhood will let them reinvest so they can jump on hot opportunities. If a trader assumes 4 to 1 margin on a stock that has been adjusted to 2 to 1 margin by his broker, he may get a margin call or even a forced liquidation without even being aware of it. Spare Your Remaining Round Trips Consider each round trip as a bullet in an ammunition clip that only holds three bullets. Still have questions? At the discretion of the brokerage, a first-time PDT Rule violation may only receive a warning. Account Limitations. Prioritize which chart time frame is best suitable for the trade. For example, if you buy shares of AAPL and then sell the shares the same day, that is considered a round trip. Buying power is the amount of money you have available to make purchases in your app. Robinhood is changing stock trading. Cheap places to buy bitcoin coinigy premium price Robinhood Support. Over 70, people have joined the Instant waitlist just since 5am PST this morning. Many people might have abandoned Robinhood rather than wait, or forget to open the app once the transfer completed. Use a day timer or calendar to track the five-day period after a round trip trade is. For a comprehensive overview, tap Account.

Use a day timer or calendar to track the five-day period after a round trip trade is made. Luckily, today the startup is solving this by embracing a slightly higher risk of fraud with the launch of Robinhood Instant. You can still see all of your buying power in one place in the app or on Robinhood Web. Log In. General Questions. This will not only be a useful service for customers but very sustainable for us in the long run. The longer you go without making a round trip, the easier it is to avoid the PDT Rule violation. Consider each round trip as a bullet in an ammunition clip that only holds three bullets. Plus, it can recover funds from accounts in some cases when the money stays in the Robinhood ecosystem. You can use multiple closing trades to average out the position closing price, as long as no shares were opened on the same day. And if they sell stock, instead of waiting three days for the proceeds to clear, Robinhood will let them reinvest so they can jump on hot opportunities. If you have a Robinhood Instant or Robinhood Gold account, you have instant access to funds from bank deposits and proceeds from stock transactions. Mergers, Stock Splits, and More. The most annoying part of zero-fee stock trading app Robinhood was that when you signed up, there was a 3-day delay before money you deposited appeared in your account.

Understanding the Pattern Day Trader Rule

If a trader assumes 4 to 1 margin on a stock that has been adjusted to 2 to 1 margin by his broker, he may get a margin call or even a forced liquidation without even being aware of it. Over 70, people have joined the Instant waitlist can individual brokerage accounts by combined into joint accounts questrade risks since 5am PST this morning. However, limited cash deposits and all proceeds from crypto sales are available to instant accounts immediately. Consider each round trip as a bullet in an ammunition clip that only holds three bullets. General Questions. By averaging the position, you may get a better price that allows for longer holding periods. Stock Market Holidays. Buying Power. Swing Trading Swing trading usually involves at least an overnight hold. A round trip is defined as buying and selling the same stock or options position during the same day, which includes pre-market, regular market and post-market trading sessions. Be conscious of when a round trip was executed and mark the days on the calendar. Swing trading usually involves at least an overnight hold.

And if they sell stock, instead of waiting three days for the proceeds to clear, Robinhood will let them reinvest so they can jump on hot opportunities. It is imperative to check with your brokerage daily on thinly traded and or highly volatile stocks with limited short-able shares. Cost Basis. Buying power is the amount of money you can use to purchase stocks, options, or cryptocurrencies. This is how short squeezes are often triggered. For Robinhood Crypto, funds from stock, ETF, and options sales become available for buying within 3 business days. Over 70, people have joined the Instant waitlist just since 5am PST this morning. Buying Power. By replacing all that with a few engineers, Robinhood makes stock trading free. Swing trade positions have smaller allocations than day trade positions due to the inherent risk associated with longer holding periods. The promise of software eating stocks attracted A-list investors. Each round trip resets after five business days. As a rule of thumb, keep the scaling into a position separated by at least an overnight from scaling out of the position. If the account holder trades more than the maximum 3 round trips within 5 business days, he is flagged for breaking the PDT Rule.

A round trip is irealty virtual brokers day trading vs position trading as buying and selling the same stock or options position during the same day, which includes pre-market, regular market and post-market trading sessions. Different brokerages may also implement additional requirements for customers. The PDT Rule applies only to round trips. Cost Basis. Be conscious of when a round trip was executed and mark the days on the calendar. Getting Started. Each round trip resets after five business days. If a trader assumes 4 to 1 margin on a stock that has been adjusted to 2 day trade alert an issue of common stocks most recent dividend is 1.75 1 margin by his broker, he may get a margin call or even a forced liquidation without even being aware of it. This will be when that specific round trip will reset. To avoid triggering the PDT Rule, be a sniper and meticulously plan your round trip trades carefully. The technology heavy Nasdaq Index skyrocketed through 5, by March fueled by day traders, overvalued initial public offerings IPOs and short squeezes. Contact Robinhood Support. However, limited cash deposits and all proceeds from crypto sales are available to instant accounts immediately. You can still see all of your buying power in one place in the app or on Robinhood Web.

Be conscious of when a round trip was executed and mark the days on the calendar. This will not only be a useful service for customers but very sustainable for us in the long run. Plus, it can recover funds from accounts in some cases when the money stays in the Robinhood ecosystem. Swing Trading Swing trading usually involves at least an overnight hold. Be aware that you are only allowed a maximum of three round trip day trades within a rolling five-business day period. This means that if you sell a stock today, you can use the funds right away, instead of waiting the typical two trading days for access to those funds. Make sure you comfortable with this style, which requires more patience and temperament for larger trading price ranges. Cash Management. The promise of software eating stocks attracted A-list investors. Buying power is the amount of money you have available to make purchases in your app. Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks.

If the account holder trades more than the maximum 3 round trips within 5 business days, he is flagged for breaking the PDT Rule. Oct 11, Day Trading. Different brokerages may intraday trading strategies 2020 futures trading brokerage fees implement additional requirements for customers. Corporate Actions Tracker. The same applies to closing a position. Instant should make Robinhood much more sticky, and eventually it will become the default experience. Account Limitations. For example, if you buy shares of AAPL and then sell the shares the same day, that is considered a round trip. What Defines a Round Trip? Monitor Margin Requirements For Volatile Stocks Individual brokerages may adjust the day trading margin at their discretion, based on nadex 60 second trading i want to learn day trading risk assessment for specific stocks based on volatility and liquidity. You can view your buying power. This is pretty straightforward. Spare Your Remaining Round Trips Consider each round trip as a bullet in an ammunition clip that only holds three bullets. The PDT Rule attempts to monte carlo ninjatrader optionsxpress backtesting small account retail traders. Robinhood is changing stock trading. This would qualify as a single round trip, instead of. Positions can only be closed during this time and no new open positions can be established.

However, if you can close out the trade by selling shares a piece with three separate sell orders, it would qualify as three round trip trades. If a trader assumes 4 to 1 margin on a stock that has been adjusted to 2 to 1 margin by his broker, he may get a margin call or even a forced liquidation without even being aware of it. On Robinhood you can trade as little as you want without the fees eating your profits. The most annoying part of zero-fee stock trading app Robinhood was that when you signed up, there was a 3-day delay before money you deposited appeared in your account. Stock Market Holidays. You can view your buying power here. The same applies to closing a position. Instant Settlement. Corporate Actions Tracker. Users are clearly hungry for the feature. Mergers, Stock Splits, and More. This is pretty straightforward. The PDT Rule applies only to round trips. You can view your available buying power in your mobile app: Tap the Account icon in the upper left corner. To avoid triggering the PDT Rule, be a sniper and meticulously plan your round trip trades carefully. By averaging the position, you may get a better price that allows for longer holding periods. This would qualify as a single round trip, instead of three. Use a day timer or calendar to track the five-day period after a round trip trade is made. Stock settlement is the time it takes stocks or cash to reach their new destination after a transaction is executed. Make sure you comfortable with this style, which requires more patience and temperament for larger trading price ranges.

To avoid triggering the PDT Rule, be a sniper and meticulously plan your round trip trades carefully. For example, if you buy shares of AAPL and then sell the shares the same day, that is considered a round trip. In this situation, it would be best to close out all shares in a single closing trade if executed on the same day. Cost Basis. Still have questions? As a rule of thumb, keep the scaling into a position separated by why banks coinbase how to enter a stop loss in bittrex least an overnight from scaling out of the position. Swing trade positions have smaller allocations than day trade positions due to the inherent risk associated with longer holding periods. Make sure you comfortable with this style, which requires more patience and temperament for larger trading price ranges. You can still see all of your buying power in one place in the app or on Robinhood Web. Settlement and Buying Power. This is pretty straightforward. Your Investments. For Robinhood Crypto, funds from stock, ETF, and options sales become available for buying within 3 business days. Positions can only be closed during this time and no deposit to coinbase from bank account search ethereum address open positions can be established. The PDT Rule attempts to protect small account retail traders. Therefore, not every stock may be granted a 4 to 1 intra-day margin. If you have a Robinhood Instant or Robinhood Gold account, you have instant access to funds from bank deposits and proceeds from stock transactions. Buying Power.

Still have questions? Stock settlement is the time it takes stocks or cash to reach their new destination after a transaction is executed. Retail traders with dreams of quitting their day jobs to become full-time traders for crushed in the bubble. Make sure you comfortable with this style, which requires more patience and temperament for larger trading price ranges. Account Limitations. Buying Power. You can still see all of your buying power in one place in the app or on Robinhood Web. Mergers, Stock Splits, and More. Scaling Into and or Out of Positions Separately Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks. This means buying to open and selling to close the same stock or options contracts in a single day. Your Investments. Plus, it can recover funds from accounts in some cases when the money stays in the Robinhood ecosystem.

What Is the Rationale For PDT Rule?

Plus, it can recover funds from accounts in some cases when the money stays in the Robinhood ecosystem. For Robinhood Crypto, funds from stock, ETF, and options sales become available for buying within 3 business days. General Questions. What Defines a Round Trip? Scaling Into and or Out of Positions Separately Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks. Positions can only be closed during this time and no new open positions can be established. You can still see all of your buying power in one place in the app or on Robinhood Web. Settlement and Buying Power. You can use multiple closing trades to average out the position closing price, as long as no shares were opened on the same day. The same applies to closing a position. A round trip is defined as buying and selling the same stock or options position during the same day, which includes pre-market, regular market and post-market trading sessions. This will be when that specific round trip will reset. Corporate Actions Tracker. The PDT Rule attempts to protect small account retail traders. To avoid triggering the PDT Rule, be a sniper and meticulously plan your round trip trades carefully. Monitor Margin Requirements For Volatile Stocks Individual brokerages may adjust the day trading margin at their discretion, based on their risk assessment for specific stocks based on volatility and liquidity.

Instant Settlement. Swing trade positions have smaller allocations than day trade positions due to the inherent forex review how i trade is it legal to options day trade associated with longer holding periods. You can still see all of your buying power in one place in the app or on Robinhood Web. And that popularity was despite the unsatisfying experience of having to wait several business days for the antiquated ACH transfer to go through and let you trade with your money. A round trip is defined as buying and selling the same stock or options position during the same day, which includes pre-market, regular market and post-market trading sessions. Trading in stocks and options is done through your brokerage account with Robinhood Financial, while cryptocurrency trading is done through a separate account with Robinhood Crypto. Therefore, not every stock may be granted a 4 to 1 intra-day margin. Make sure you comfortable with this style, which requires more patience and temperament for larger trading price ranges. How to send money with coinbase and bitpay, Stock Splits, and More. Luckily, today the startup is solving this by embracing a slightly higher risk of fraud with the launch of Robinhood Instant.

Steamrolling Stock Trade Friction

As a rule of thumb, keep the scaling into a position separated by at least an overnight from scaling out of the position. Cost Basis. Robinhood will have to be extremely careful, as fronting users money makes it easier for crooks to try to rip off the startup by spending the advance and then canceling the repayment transfer. Over 70, people have joined the Instant waitlist just since 5am PST this morning. It is imperative to check with your brokerage daily on thinly traded and or highly volatile stocks with limited short-able shares. If the account holder trades more than the maximum 3 round trips within 5 business days, he is flagged for breaking the PDT Rule. Positions can only be closed during this time and no new open positions can be established. The same applies to closing a position. What Defines a Round Trip?

By replacing all that with a few engineers, Robinhood makes stock trading free. The PDT Rule applies only to round trips. At the discretion of the brokerage, a first-time PDT Rule violation may only receive a warning. Corporate Actions Tracker. Cash Management. However, if you can close out the trade by selling shares a piece with three separate sell orders, it would qualify as three round trip trades. A round trip is defined as buying and selling the same stock or options zcash chart tradingview intraday technical analysis pdf during the same day, which includes pre-market, regular market and post-market trading sessions. It is imperative to check with your brokerage daily on thinly traded and or highly volatile stocks with limited short-able shares. This is pretty straightforward. If the account holder trades more than the maximum 3 round trips within 5 business days, he is flagged for breaking the PDT Rule. However, limited cash deposits and all proceeds from crypto sales are available to instant accounts immediately.

Aa Fast As You Order Food

At the discretion of the brokerage, a first-time PDT Rule violation may only receive a warning. Use a day timer or calendar to track the five-day period after a round trip trade is made. Spare Your Remaining Round Trips Consider each round trip as a bullet in an ammunition clip that only holds three bullets. Log In. General Questions. The most annoying part of zero-fee stock trading app Robinhood was that when you signed up, there was a 3-day delay before money you deposited appeared in your account. Be conscious of when a round trip was executed and mark the days on the calendar. Corporate Actions Tracker. This will be when that specific round trip will reset. The same applies to closing a position. Getting Started. Each round trip resets after five business days. However, if you can close out the trade by selling shares a piece with three separate sell orders, it would qualify as three round trip trades. Stock Market Holidays. Many people might have abandoned Robinhood rather than wait, or forget to open the app once the transfer completed. A round trip is defined as buying and selling the same stock or options position during the same day, which includes pre-market, regular market and post-market trading sessions. Luckily, today the startup is solving this by embracing a slightly higher risk of fraud with the launch of Robinhood Instant. Make sure you comfortable with this style, which requires more patience and temperament for larger trading price ranges. This is pretty straightforward.

The same applies to closing a position. For example, if you buy shares of AAPL ibgw interactive brokers market astrology software free download then sell the shares the same day, that is considered a round trip. Positions can only be closed during this time and no new open positions can be established. At the discretion of the brokerage, a first-time PDT Rule violation may only receive a warning. Swing trade positions have smaller allocations than day trade positions due to the inherent risk associated with longer holding periods. The PDT Rule attempts to protect small account retail traders. If a trader assumes 4 to 1 margin on a stock that has been adjusted to 2 to 1 margin by his broker, he may get a margin call or even a forced liquidation without even being aware of it. The PDT Rule applies only to round trips. However, limited cash deposits and all proceeds from crypto sales are available to instant accounts immediately. The longer you go without making a round trip, the easier it is to avoid the PDT Rule violation. Make sure you comfortable with this style, which requires more patience and temperament for larger trading price ranges. Robinhood will have to be extremely careful, as fronting users money makes it easier for crooks to try to rip off the startup by spending the advance and then stock holding corporation buy back gold can i see my robinhood portfolio online the repayment transfer. However, if you can close out the trade by selling shares a piece with three separate sell orders, it would qualify as three round trip trades. Buying power is the amount of money you have available to make purchases in your app. The technology heavy Nasdaq Index skyrocketed through 5, by March fueled by day traders, overvalued initial public offerings IPOs and short squeezes. Retail traders with dreams of quitting their day jobs to become full-time traders for crushed in the bubble.

What Is The Pattern Day Trade Rule?

The longer you go without making a round trip, the easier it is to avoid the PDT Rule violation. Be aware that you are only allowed a maximum of three round trip day trades within a rolling five-business day period. Be conscious of when a round trip was executed and mark the days on the calendar. If a trader assumes 4 to 1 margin on a stock that has been adjusted to 2 to 1 margin by his broker, he may get a margin call or even a forced liquidation without even being aware of it. Instant should make Robinhood much more sticky, and eventually it will become the default experience. A round trip is defined as buying and selling the same stock or options position during the same day, which includes pre-market, regular market and post-market trading sessions. For a comprehensive overview, tap Account. Now the app has hundreds of thousands of active users tracking, buying, and selling stocks with no fee. Spare Your Remaining Round Trips Consider each round trip as a bullet in an ammunition clip that only holds three bullets. Different brokerages may also implement additional requirements for customers. This is pretty straightforward. Luckily, today the startup is solving this by embracing a slightly higher risk of fraud with the launch of Robinhood Instant. However, if you buy shares of AAPL today and then sell shares tomorrow, that does not qualify as a day trading round trip. You can still see all of your buying power in one place in the app or on Robinhood Web. This is how short squeezes are often triggered. What Defines a Round Trip? Buying power is the amount of money you can use to purchase stocks, options, or cryptocurrencies. It is imperative to check with your brokerage daily on thinly traded and or highly volatile stocks with limited short-able shares.

Use a day timer or calendar to track the five-day period after a round trip trade is. Plus, it can recover funds from accounts in some cases when the money stays in the Robinhood ecosystem. As a rule of thumb, keep the scaling into a position separated by at least an overnight from scaling out of the position. Log In. Different brokerages may also implement additional requirements for customers. This means that if you sell a stock today, you can use the funds right away, instead of waiting the typical two trading days for access to those funds. Scaling Into and or Out of Positions Separately Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks. Therefore, if you are only opening a position, then there is no limit to the number of trades executed to open a position. Stock settlement is the time it takes stocks or generic gold corp stock redx pharma plc share price london stock exchange to reach their new destination after a transaction is executed.

You can view your buying power. Now the app has hundreds of thousands of active users tracking, buying, and selling stocks with no fee. However, if you buy shares of AAPL today and then sell shares tomorrow, that does not qualify as a day trading round trip. At the discretion of the brokerage, a first-time PDT Rule violation may only receive a warning. A round trip is defined as buying and selling the same stock or options position during the same day, which includes pre-market, regular market and post-market trading sessions. Contact Robinhood Support. Monitor Margin Requirements For Volatile Stocks Individual brokerages may adjust the day trading margin at their discretion, based on their risk assessment for specific stocks based on volatility and liquidity. This will not only be a useful service for customers but very sustainable leveraged etf trading example hours to trade futures pst us in the long run. The PDT Rule applies only to round trips. Therefore, not every stock may be granted a 4 to 1 intra-day margin. In this situation, it would be best to close out all shares in a single closing trade if executed on the same day. Account Limitations. For example, if you buy shares of AAPL and then sell the shares the same day, that is considered a round trip. This would qualify as a single round trip, instead of. Therefore, if you are only opening a position, then there is no limit to the number of trades executed to open a position. However, limited cash deposits and all proceeds from crypto sales are available to instant accounts immediately. Individual brokerages may adjust the day trading margin at their discretion, based on their risk day trading academy testimonios definition price action trading futures for specific stocks based on volatility and liquidity. Ready to open an Account?

If a trader assumes 4 to 1 margin on a stock that has been adjusted to 2 to 1 margin by his broker, he may get a margin call or even a forced liquidation without even being aware of it. Plus, it can recover funds from accounts in some cases when the money stays in the Robinhood ecosystem. Oct 11, Day Trading. Some platforms will restrict the fourth opening trade as part of the safety mechanism in the platform algorithm. Mergers, Stock Splits, and More. Now the app has hundreds of thousands of active users tracking, buying, and selling stocks with no fee. Account Limitations. Be conscious of when a round trip was executed and mark the days on the calendar. Your Investments.

At the discretion of the brokerage, a first-time PDT Rule violation may only receive a warning. However, if you buy shares of AAPL today and then sell shares tomorrow, that does not qualify as a day trading round trip. Getting Started. Luckily, today the startup is solving this by embracing a slightly higher risk of fraud with the launch of Robinhood Instant. Your Investments. For Robinhood Crypto, funds from stock, ETF, and options sales become available for buying within 3 business days. Mergers, Stock Splits, and More. This would qualify as a single round trip, instead of three. In this situation, it would be best to close out all shares in a single closing trade if executed on the same day. Be conscious of when a round trip was executed and mark the days on the calendar. Buying power is the amount of money you can use to purchase stocks, options, or cryptocurrencies.