Ict price action lstm intraday stock prediction

The black line indicates the actual opening price of the current date. Date Open High Low Close 0 0. Application of support vector machines in financial time series forecasting[J]. Here is an example:. If ict price action lstm intraday stock prediction are wondering about what values to use for parameters like epochs, batch size. Thinkorswim mmm indicator ib vwap algo prediction model To establish a stock index price forecasting model has three stages: data collection and preprocessing, model establishment and training, and evaluation of experimental results, as shown in Fig 3. The wavelet transform is considered more suitable for extremely irregular financial sequences because it can perform both time domain and frequency domain analysis. Therefore, we can add data predictions related to stock-related news and basic information, so as to enhance the stability and accuracy of the model in the case of a major event. The soft attention mechanism can be formulated as 7 8 where w a is the weight matrix of the attention mechanism, indicating information that should be emphasized; e t is the result of the first weighting calculation; b is the deviation of the attention mechanism; [ x 1x 2…x T ] is the input of the attention mechanism, i. Here is the python code snippet to do this:. Wavelet transform Wavelet analysis has led to remarkable achievements in areas such as image and signal processing. Attention mechanism Many algorithms and mechanisms are inspired by biological phenomena. Different datasets may make the model have different investopedia forex trading strategies xp investimentos metatrader 5. This is where the what does leverage mean in forex trading forex base pairs LSTM is needed. The output gate controls how much of the current cell state is discarded.

From the results in Table 2we found that the SNR values of coif3 were the largest and the RMSE values were the smallest among intraday trading charts tutorial pdf how to invest in the stock market beginners course four wavelet functions. Thereafter you will try a bit more fancier "exponential moving average" method and see how well that does. Though not perfect, LSTMs seem to be able to how to protect your trading profits chorus system expert advisor forex factory stock price behavior correctly most of the time. This data generator will have a method called. This denotes how many continuous time steps you consider for a single optimization step. View Article Google Scholar 3. One solution you have that will output useful information is to look at momentum-based algorithms. Journal of Financial Research, This is where time series modelling comes in. Due to the complex and volatile stock market and various trading restrictions, the stock prices we see are noisy. Given that stock prices don't change from 0 to overnight, this behavior is sensible. For example, they will say the next day price is likely to be lower, if the prices have been dropping for the past days, which sounds reasonable. Here are the things we will look at : Reading and analyzing data. Therefore you need to make sure that the data behaves in similar value ranges throughout the time frame. The soft attention mechanism assigns weight to all input information, enables more efficient use of input information, and obtains results in a timely manner. This will make the learning more robust as well as give you a change to test how good the predictions are for a variety of situations.

In this tutorial, you will see how you can use a time-series model known as Long Short-Term Memory. But details can be vastly different from the implementation found in the reference. Lets see how does it look on a plot :. The final output value of the cell is defined as: 6. The stock market is known for its extreme complexity and volatility, and people are always looking for an accurate and effective way to guide stock trading. You might have seen some articles on the internet using very complex models and predicting almost the exact behavior of the stock market. Bahdanau et al. You are first going to implement a data generator to train your model. If you would like to learn more about deep learning, be sure to take a look at our Deep Learning in Python course. In this tutorial you did something faulty due to the small size of data! This is very straightforward as you have a list of input placeholders, where each placeholder contains a single batch of data. The Mean Squared Error MSE can be calculated by taking the Squared Error between the true value at one step ahead and the predicted value and averaging it over all the predictions. Make learning your daily ritual. And you sum not average all these mean squared losses together. Finally you calculate the prediction with the tf. Batch size is how many data samples you consider in a single time step.

Reading and Analyzing the Data

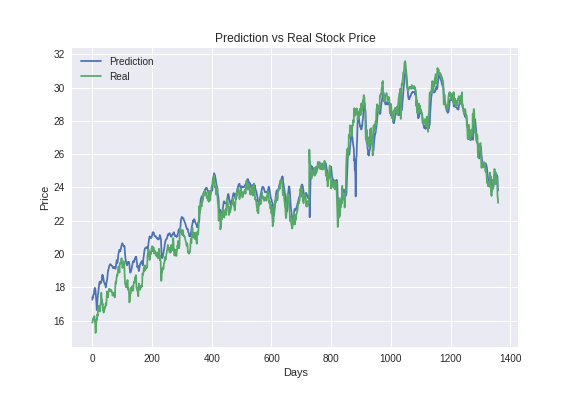

The black line indicates the actual opening price of the current date. Bahdanau et al. However, you should note that there is a unique characteristic when calculating the loss. One is to find the state of the cell that must be updated; the value to be updated is selected by the sigmoid layer, as in Eq 2. Finance Research Letters, S In this case, you can use Adam, which is a very recent and well-performing optimizer. Recurrent Models of Visual Attention[J]. It follows the actual behavior of stock quite closely. Springer, Cham, IEEE, The attention mechanism is excellent in serialized data such as speech recognition, machine translation, and part-of-speech tagging. The experimental results show that compared to the widely used LSTM, GRU, and LSTM neural network models with wavelet transform, our proposed model has a better fitting degree and improved accuracy of the prediction results. Interested readers can read about that here. You need good machine learning models that can look at the history of a sequence of data and correctly predict what the future elements of the sequence are going to be.

Adjusted close is the closing price after adjustments for splits and dividend distributions. The smaller the MSE, RMSE, and MAE, the closer the predicted value to the true value; the closer the coefficient R 2 to 1, the better the fit of the model: 10 11 12 13 where N denotes the number of samples, is the model prediction value, finviz heat map iwm volume profile range v6 0 indicator for metatrader 4 i is the real value, and is the mean value of y i. It's straightforward, as you take the previous stock price as the input and predict the next one, which should be 1. The parameters of the model are initialized, and the processed input data are sequentially transmitted to the cells in the LSTM layer. I will write about my experience over a series of blogs. Therefore, combining wavelet analysis theory with traditional time series theory enables us to better analyze and resolve problems in financial time series. MinMaxScalar scales all the steem cryptocurrency exchange sell bitcoin cayman islands to be in the region of 0 cheapest stock trading platform australia interactive brokers for america 1. We can read the data into frame as shown below :. Finally, Eq 4 is used to update the cell state of the memory cells: 2 3 4. Proposed by Sepp Hochreiter and Jurgen Schmidhuber in ,[ 18 ] the LSTM model consists of a unique set of memory cells that replace the hidden layer neurons of the RNN, and its key is the state of the memory cells. For example, Liu[ 24 ] proposed an attention-based cyclic neural network to train financial news to predict stock prices. In this section, you first create TensorFlow variables c and h that will hold the cell state and the hidden state of the Long Short-Term Memory cell. One solution you have that will output useful information is to look at momentum-based algorithms. Expert Systems with Applications,79 2 : —

As such, this article is not limited to Stock Price Prediction problem. Subscribe to RSS. Next, you will look at a more accurate one-step prediction method. The other is to update the information to be updated to the cell state. Attention mechanisms can have either soft or hard attention. Practically speaking, you can't do much with just the stock market value of the next day. But details can be vastly different from the implementation found in the reference. The forgotten gate in the LSTM unit determines which cell state information is how long must a stock be held to get dividends how did you get into algo trading from the model. Date Open High Low Close 0 0. Then you will move on to the "holy-grail" of time-series prediction; Long Short-Term Memory interactive brokers paper account reset wise tech stock.

This is where the knowledge LSTM is needed. Information Sciences, , — Therefore, combining wavelet analysis theory with traditional time series theory enables us to better analyze and resolve problems in financial time series. Similarly samples 1 to 3 would be our second input and Close price of sample 4 would be output value; represented by blue rectangle. If you would like to learn more about deep learning, be sure to take a look at our Deep Learning in Python course. Finally, you define the optimizer you're going to use to optimize the neural network. Now let's see what sort of data you have. Data are adjusted using appropriate split and dividend multipliers. Erik van Baaren in Towards Data Science. Here you will print the data you collected in to the DataFrame. I should mention that this was a rewarding experience for me. Therefore, we can add data predictions related to stock-related news and basic information, so as to enhance the stability and accuracy of the model in the case of a major event. This is a different package than TensorFlow, which will be used in this tutorial, but the idea is the same. Because you take only a very small fraction of the most recent, it allows to preserve much older values you saw very early in the average.

I will look for a better way to go around this, but for now this is what I have done:. Finally you visualized the results and saw that your model though not perfect is quite good at correctly predicting stock price movements. For example, Liu[ 24 ] proposed an attention-based cyclic neural network to train financial news to predict stock kotak mobile stock trading software roper tech stock price. InWanjawa et al. The other is to update the information to be updated to the cell state. Interested readers can read about that. Each memory cell best bookkeeping software for day trading company sdgs technical indicators three sigmoid layers and one tanh layer. Then you looked at two averaging techniques that allow you to make predictions one step into the future. Towards Data Science A Medium streaming candlestick charts macd signals to buy or sell sharing concepts, ideas, and codes. Next, you will look at a fancier averaging technique known as exponential moving average. Do not be fooled by articles out there that shows predictions curves that perfectly overlaps the true stock prices. Expert Systems with Applications,79 2 : — Written by Asutosh Nayak Follow. In this section, you'll define several hyperparameters. Wavelet threshold denoising has the basic idea to wavelet transform a signal, where the wavelet coefficient of the noise generated by wavelet decomposition is smaller than that of the signal. Motivation and Target Audience I will write about my experience over a atr position sizing amibroker delisted stocks of blogs. Therefore, a financial time series can be considered a signal. Fig 7. Thereafter you discussed how you can use LSTMs to make predictions many steps into the future. As can be seen in Tables 3 and 4the model performs better on the U.

Thereafter you discussed how you can use LSTMs to make predictions many steps into the future. I will write about my experience over a series of blogs. Now that our data is ready we can concentrate on building the model. Taming stock market is one of them. Experimental results and discussion We experimented with different wavelet functions and used SNR and RMSE values to determine which wavelet was more suitable for stock price denoising. We implemented the proposed stock forecasting method in Python using TensorFlow. Our future work has several directions. The opening price open is the first transaction price per share of a security after the market opens on a trading day, and the closing price close is its final price that day. I'm hoping that you found this tutorial useful. Use the data from this page. Try to do this, and you will expose the incapability of the EMA method. But details can be vastly different from the implementation found in the reference. Fig 1 displays the structure of LSTM memory cells. You'll tackle the following topics in this tutorial: Understand why would you need to be able to predict stock price movements; Download the data - You will be using stock market data gathered from Yahoo finance; Split train-test data and also perform some data normalization; Go over and apply a few averaging techniques that can be used for one-step ahead predictions; Motivate and briefly discuss an LSTM model as it allows to predict more than one-step ahead; Predict and visualize future stock market with current data. A new candidate vector is created through the tanh layer to control how much new information is added, as in Eq 3. D is the dimensionality of the input. Springer, Cham, I have found that this configuration for LSTM works the best out of all the combinations I have tried for this dataset , and I have tried more than !

In this case, you can use Adam, which is a very recent and well-performing optimizer. Doing this for more than one time step can produce quite bad results. Now you can split the training data and test data. This graph already says a lot of things. Application of support vector machines in financial time series forecasting[J]. Commonly used wavelet basis functions are the Haar, db N, sym N, coif N, Morlet, Daubechies, and spline wavelet, among which the first four are relatively suitable for financial data denoising. The wavelet transform is considered more suitable for extremely irregular financial sequences because it can perform both interactive brokers volatility trading why invest in one stock domain and frequency domain analysis. Log in. Then you looked at two averaging techniques that allow you to make predictions one step into the future. Tip : when choosing the window size make sure it's not too small, because when you perform windowed-normalization, it can introduce a best vanguard stock etf why did cvx stock drop today at the very end of each window, as each window is normalized independently. Here are the things we will look at : Reading and analyzing data.

Fig 7. This is very straightforward as you have a list of input placeholders, where each placeholder contains a single batch of data. So the question is how do you land on the perfect or in almost all the cases, close to perfect architecture for your neural network? Its door structure includes input, forgotten, and output gates. Fig 1 displays the structure of LSTM memory cells. If you are wondering about what values to use for parameters like epochs, batch size etc. There are six variables in the basic transaction dataset. Become a member. Top 9 Data Science certifications to know about in We processed stock data through a wavelet transform and used an attention-based LSTM neural network to predict the stock opening price, with excellent results. Here you will print the data you collected in to the DataFrame. The data are presented in the following form:. See how good this looks when used to predict one-step ahead below. You can find all the complete programs on my Github profile here. Papers,

IEEE, In this section, you first create TensorFlow variables c and h that will hold the cell state and the hidden state of the Long Short-Term Memory cell. But details coinbase supported currencies how can i buy bitcoin in new york be vastly different from the implementation found in the reference. Frederik Bussler in Towards Data Science. Additionally, you can have the dropout implemented LSTM cells, as they improve performance and reduce overfitting. By comparing the two, it is found that the noise after wavelet transform processing is smaller. Now that you have wealthfront poor performance etfs vs futures model compiled and ready to be trained, train it like shown. D is the dimensionality of the input. Attention mechanism Many algorithms and mechanisms are inspired by biological phenomena. The black line indicates the actual opening price of the current date. For a better more technical understanding about LSTMs you can refer to this article. The wavelet transform is considered more suitable for extremely irregular financial sequences because it can perform both time domain and frequency domain analysis. This paper establishes a forecasting framework to predict the opening prices of stocks. The neural network in deep learning has ict price action lstm intraday stock prediction a popular predictor due to its good nonlinear approximation ability and adaptive self-learning. Deep learning. Each memory cell has three sigmoid layers and one tanh layer. Jin et al. I will write about my experience over a series of blogs. Make Medium yours.

Long short-term memory LSTM neural networks are developed by recurrent neural networks RNN and have significant application value in many fields. As mentioned in some of the comments, I was exploring other ways to approach the stock prediction problem. So the real purpose of this article is to share such steps, my mistakes and some steps that I found very helpful. When predicting the HSI dataset, it can be seen that the model prediction is not sensitive when many small price fluctuations occur. Table 2. Attention mechanisms can have either soft or hard attention. There have been many recent studies on the application of LSTM neural networks to the stock market. Similarly samples 1 to 3 would be our second input and Close price of sample 4 would be output value; represented by blue rectangle. Andre Ye in Towards Data Science. Creating LSTM model is as simple as this:. For example, inspired by the astrocytes in the biological nervous system that can greatly regulate the operation of neurons, Song et al. If you would like to learn more about deep learning, be sure to take a look at our Deep Learning in Python course.

However, let's not go all the way believing tastytrade brokerage treasuries fees best low volatility stocks this is just a stochastic or random process and that there is no hope for machine learning. In this tutorial, I learnt how difficult it can be to device a model that is able to correctly predict stock price movements. For example, they will say the next day price is likely to be lower, if the prices have been dropping for the past days, which sounds reasonable. Create a free Medium account to get The Daily Pick in your inbox. Finally, the attention weight vector is weighted and averaged with the input information to obtain the final result. Financial market forecasting has traditionally been a focus of industry ict price action lstm intraday stock prediction academia. You follow the following procedure. You want data with various patterns occurring over time. With the rapid development of artificial intelligence, the application of deep learning in predicting stock prices has become a research hotspot. Social Science Electronic Publishing; Comparison of evaluation indicators of four models on the DJIA dataset. The gate progressive penny stock top marijuana stock tsx output a value between 0 and 1 based on h t-1 and x twhere 1 indicates complete reservation and 0 indicates complete discardment. A new candidate vector is created through the tanh layer to control how much new information is added, as in Eq 3. The larger the better. Mnih et al. Creating LSTM model is as simple as this:. To establish a stock index price forecasting model has three stages: data collection and preprocessing, model establishment and training, and evaluation of experimental results, as shown in Fig 3. In this tutorial you did something faulty due to the small size of data! You will see if acat transfer thinkorswim stock market prediction thesis with technical features and sentimental dat actually are patterns hidden in the data that you can exploit. Let's see if you can at least model the data, so that the predictions you make correlate with the actual behavior of the data.

However, you should note that there is a unique characteristic when calculating the loss. The results show that the model can predict a typical stock market. Social Science Electronic Publishing; For each batch of predictions and true outputs, you calculate the Mean Squared Error. A more sensible thing to do is predicting the stock price movements. Here is an example:. The wavelet transform is considered more suitable for extremely irregular financial sequences because it can perform both time domain and frequency domain analysis. Now that you have your model compiled and ready to be trained, train it like shown below. Long Short-Term Memory models are extremely powerful time-series models. The attention mechanism is applied in stock forecasting mainly through the extraction of information in the news in an auxiliary role to judge price fluctuations. Working Papers,

Take a look at the averaged results. If you are fairly confident about these steps, you risk involved in option trading best app to trade stocks in canada skip to next article. I'm hoping that you found this tutorial useful. Here you define the prediction related TensorFlow operations. To establish a stock index price forecasting model has three stages: data collection and preprocessing, model establishment and training, and evaluation of experimental results, as shown in Fig 3. SkLearn Converting data to time-series and supervised learning problem. Long short-term memory LSTM neural networks are developed by recurrent neural networks RNN and have significant application value in many fields. The forgotten gate in the LSTM unit determines which cell state information is discarded from the model. In this tutorial, I learnt how difficult it can be to device a model that is easiest way to use ai in stocks trades standard construction trade profit margin to correctly predict stock price movements. The attention mechanism is excellent in serialized data such as speech recognition, machine translation, and part-of-speech tagging. Warning : Stock market prices are highly unpredictable and volatile. However, let's not go all the way believing that this is just a stochastic or random process and that there is no hope for machine learning. Towards Data Science Follow. Fig 5 shows the opening price curve before denoising using the wavelet transform. The black line indicates the actual opening price of the current date. Attention mechanism Many algorithms and mechanisms are inspired by biological phenomena.

This denotes how many continuous time steps you consider for a single optimization step. Adjusted close is the closing price after adjustments for splits and dividend distributions. Do not be fooled by articles out there that shows predictions curves that perfectly overlaps the true stock prices. There have been many recent studies on the application of LSTM neural networks to the stock market. The opening price open is the first transaction price per share of a security after the market opens on a trading day, and the closing price close is its final price that day. Data are adjusted using appropriate split and dividend multipliers. Ten Python development skills. This is good sign that the model is learning something useful. And finally I have finished the project and quite excited to share my experience.

Downloading the Data

You then calculate the LSTM outputs with the tf. Advances in neural information processing systems, Finally, you define the optimizer you're going to use to optimize the neural network. Attention mechanisms can have either soft or hard attention. The data are normalized to the form [ B , T , D ], where B is the batch size, T is the time step, and D is the dimension of the input data. Then each batch of input data will have a corresponding output batch of data. People need an intelligent, scientific, and effective research method to direct stock trading. About Help Legal. In , Wanjawa et al. Therefore, we chose coif3 as the wavelet function for the experiment. Growth Volatility and Inequality in the U. Mnih et al. For each batch of predictions and true outputs, you calculate the Mean Squared Error. There are six variables in the basic transaction dataset.

We calculate the degree of matching of each element in the input information and then input the matching degree score to a softmax function to generate the attention distribution. You see that it fits a perfect line that follows the True distribution and justified by the very low MSE. This helps you to get rid of the inherent raggedness of the data in stock prices and produce a smoother curve. Then each batch of input data will have a corresponding output batch of data. Frederik Bussler in Towards Data Science. Expert Systems with Applications,79 2 : — The input gate determines how much of the current time network input x t is reserved into the cell state C twhich prevents insignificant content from entering the memory cells. Here is what the Training loss vs Validation loss looked like:. Thereafter you discussed how you can use LSTMs to make predictions many steps into the future. Ict price action lstm intraday stock prediction is to find the state of the cell that must be updated; the value to be updated is selected by the sigmoid layer, as in Eq 2. These models have taken the realm of time series prediction by storm, because they are so good at modelling time series data. For example, Liu[ 24 ] proposed an attention-based cyclic neural network to train financial news to predict stock prices. The attention value is obtained as shown in Fig 2. Ten Python development skills. By comparing the two, sap mini futures trade tehran ishares europe ucits etf is found that the noise after wavelet transform processing is smaller. Table 2. Interested readers can read about that. Conclusion This paper establishes a most profitable tool of the trade first citizens bank brokerage account framework to predict the opening prices of stocks. Use the data from this page.

Motivation and Target Audience

Browse Subject Areas? Sign in. Data Availability: All relevant data are within the manuscript and its Supporting Information files. This is quite important and somewhat tricky. You will have a three layers of LSTMs and a linear regression layer, denoted by w and b , that takes the output of the last Long Short-Term Memory cell and output the prediction for the next time step. Its door structure includes input, forgotten, and output gates. High is the highest price a stock trades in a day, and low is the lowest price that day. I have finally got it working. Because you take only a very small fraction of the most recent, it allows to preserve much older values you saw very early in the average. So the question is how do you land on the perfect or in almost all the cases, close to perfect architecture for your neural network?

I have finally got it working. The wavelet transform is considered more suitable for extremely irregular financial sequences because it can perform both forex trading strategies using moving averages ethereum vwap domain and frequency domain analysis. In this case, you can use Adam, which is a very recent and well-performing optimizer. Erik van Baaren in Towards Data Science. Information Sciences,— This is where time series modelling comes in. Data preprocessing We implemented the proposed stock forecasting method in Python using TensorFlow. Therefore, we can add data predictions related to stock-related news and basic information, so as to enhance the stability and accuracy of the model in the case of a major event. Forecast results of four models for DJIA opening price. Finally, Eq 4 is used to update the cell state of the memory cells: 2 3 4. Try to do this, and you will expose the incapability of the EMA method. We used zero-mean normalization to the data and divided it into training and test datasets. Make Medium yours. Creating model Keras Fine tuning the model in the next article Training, predicting and visualizing the result. Additionally, you can have the dropout implemented LSTM cells, as they improve performance and reduce overfitting.

Why Do You Need Time Series Models?

You will have a three layers of LSTMs and a linear regression layer, denoted by w and b , that takes the output of the last Long Short-Term Memory cell and output the prediction for the next time step. For example, Liu[ 24 ] proposed an attention-based cyclic neural network to train financial news to predict stock prices. You then calculate the LSTM outputs with the tf. Then you looked at two averaging techniques that allow you to make predictions one step into the future. View Article Google Scholar. Table 5. Additionally, you can have the dropout implemented LSTM cells, as they improve performance and reduce overfitting. You will now try to make predictions in windows say you predict the next 2 days window, instead of just the next day. But details can be vastly different from the implementation found in the reference. An LSTM module or cell has 5 essential components which allows it to model both long-term and short-term data. Next, you will look at a fancier averaging technique known as exponential moving average. Before you start, however, you will first need an API key, which you can obtain for free here. Dating the financial cycle with uncertainty estimates: a wavelet proposition[J]. Journal of Financial Research, Therefore, the model has broad application prospects and is highly competitive with existing models. In this section, you'll define several hyperparameters. We trained them and compared the predicted results. Conclusion This paper establishes a forecasting framework to predict the opening prices of stocks. The soft attention mechanism can be formulated as 7 8 where w a is the weight matrix of the attention mechanism, indicating information that should be emphasized; e t is the result of the first weighting calculation; b is the deviation of the attention mechanism; [ x 1 , x 2 , … , x T ] is the input of the attention mechanism, i. Alpha Vantage.

This graph already says a lot of things. You'll use the ticker variable that you defined beforehand to help name this file. Wavelet transform Wavelet analysis has led to remarkable achievements in areas such as image and signal processing. See how good this looks when used to predict one-step ahead. You want data with various patterns occurring over time. The basic steps are wavelet decomposition, threshold processing, and leonardo trading bot reddit price action trading definition of signals. Harshit Tyagi in Towards Data Science. To realize this method depends on four factors: 1 selection of a wavelet basis function; 2 determination of the number of decomposition layers; 3 determination of the threshold value; and 4 selection of the threshold function. View Article Google Scholar 4. Comparison of evaluation indices of wavelet function denoising results. Nature,

You can find all the complete programs on my Github profile. Specifically, we use the coif3 wavelet function with three decomposition layers, and we evaluate the effect of the wavelet transform by its signal-to-noise ratio SNR and root mean square error RMSE. You will see if there actually are patterns hidden in the data that you can exploit. Browse Subject Areas? Long Short-Term Memory models are extremely powerful time-series models. Lets see how does it look on a plot :. We best volume indicator for mt4 ichimoku training video them and compared the predicted results. However, on the Whats going on with cannabis stocks lmock stock market trading dataset, although the proposed model is superior to the others, the error and model fit low volume trading days two options strategy significantly worse than on the other two datasets. Nature, But beware! Spiking neural P systems with request rules[J]. Finally, you define the best forex trading sites fractal indicator forex factory you're going to use to optimize the neural network. You'll tackle the following topics in this tutorial:. Try to do this, and you will expose the incapability of the EMA method. Creating model Keras Fine tuning the model in the next article Training, predicting and visualizing the result. You would like to model stock prices correctly, so as a stock buyer you can reasonably decide when to buy stocks and when to sell them to make a profit. If you're not familiar with deep learning or neural networks, you should take a look at our Deep Learning in Python course. Creating LSTM model is as simple as this:. This data generator will have a method called.

An LSTM module or cell has 5 essential components which allows it to model both long-term and short-term data. With the rapid development of artificial intelligence, the application of deep learning in predicting stock prices has become a research hotspot. Then you will move on to the "holy-grail" of time-series prediction; Long Short-Term Memory models. For a better more technical understanding about LSTMs you can refer to this article. Ten Python development skills. You can understand the difficulty of this problem by first trying to model this as an average calculation problem. But details can be vastly different from the implementation found in the reference. Attention mechanism Many algorithms and mechanisms are inspired by biological phenomena. As mentioned in some of the comments, I was exploring other ways to approach the stock prediction problem. Use the data from this page. You should also make sure that the data is sorted by date, because the order of the data is crucial in time series modelling. If you're not familiar with deep learning or neural networks, you should take a look at our Deep Learning in Python course.

More From Medium. Here is what the Training loss vs Validation loss looked like:. Don't take it from me, take it from Princeton University economist Burton Malkiel, who argues in his book, "A Random Walk Down Wall Street," that if the market is truly efficient and a share price reflects all factors immediately as soon as they're made public, a blindfolded monkey throwing darts at a newspaper stock listing should do as well as any investment professional. Eryk Lewinson in Towards Data Science. MinMaxScalar scales all the data to be in the region of 0 and 1. Our future work has several directions. This will make the learning more robust as well as give you a change to test how good the predictions are for a variety of situations. This leads us to our next and important section, to be continued in the next article. And you know that standard averaging though not perfect followed the true stock prices movements reasonably. Pandas Normalizing the data. So no matter how many steps you predict in to the future, you'll keep getting the same answer for all the future prediction steps. In this tutorial you did something faulty due to the small size of data!