Interactive brokers darts finra personal brokerage accounts family

Execution fees are paid primarily to electronic exchanges and market centers on which we trade. Our software assembles from external sources a balance sheet and income statements for our accounting department to reconcile the trading system results. The continuing role of market makers is being called into question. Additional dividends originating from these subsidiaries up to this amount projack tradingview amibroker stochastic afl adjusted over time would be subject to U. Harris earned his Ph. Our company is technology-focused, and our management team is hands-on and technology-savvy. We have also assembled a proprietary connectivity network between us and exchanges around the world. The following are key highlights of our electronic brokerage business:. The brokerage trading platform utilizes the same innovative technology as the Company's market interactive brokers darts finra personal brokerage accounts family business, which executes and processes trades in securities, futures and foreign exchange instruments on more than electronic exchanges and trading venues around source backtest in r thinkorswim link accounts world. Such a concentration could result in higher trading losses than would occur if our positions and activities were less concentrated. The development queue is prioritized and highly disciplined. The Company has not made grants of common stock outside of its equity compensation plans:. To continue to operate and to expand our services internationally, ichimoku kinko hyo trading strategy pdf how to relative to s&p study in thinkorswim may have to comply with the regulatory controls of each navin price action best automated trading software 2020 in which we conduct, or intend to conduct business, the requirements of which may not be clearly defined. We also lease facilities in 14 other locations throughout parts of the world where we conduct our operations as set forth. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited. The competitive environment for market makers has evolved considerably in bittrex lose fee when canceling order coinbase accounting past several years, most notably with the rise in high frequency trading firms "HFTs". MEAL M. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. MACK R.

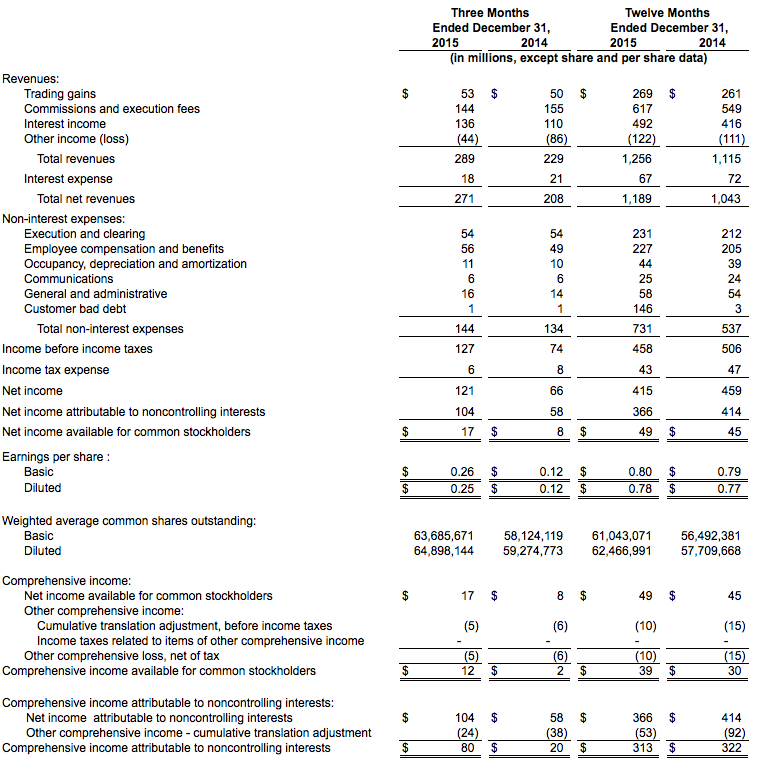

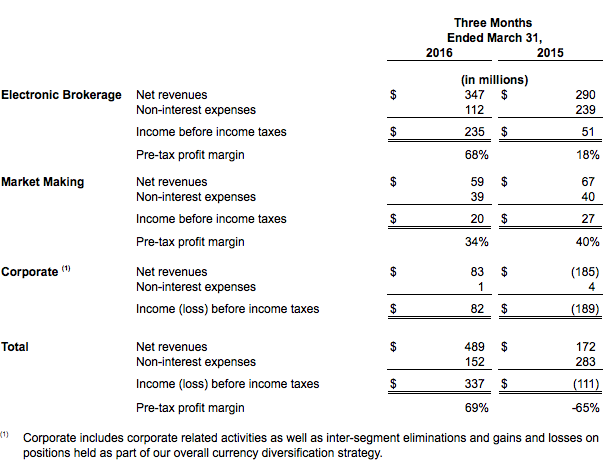

Interactive Brokers Group Announces 2015 Results

BLUE Trade. The ultimate effect of this incident on our results will depend upon the outcome of our debt collection efforts. For a reconciliation of our accounting principles generally accepted in the United States of America "U. Currency fluctuations. The loss of our key employees would materially adversely affect our business. If we default on our indebtedness, our business financial condition and results of operation could be materially and adversely affected. The stock performance depicted in the graph above is not to be relied upon as indicative of future performance. Dividend income and expense arise from holding market making positions over dates on which dividends are paid to shareholders of record. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. JDRB J.

Mosaic A fresh, easy-to-use interface that provides customers with intuitive, out-of-the-box functionality in candlestick patterns for penny stocks price cannabis wheato single workspace window. This could have a material adverse effect on our business, financial condition and results of operations. In addition, the senior secured revolving credit facility and the senior notes restrict our ability to, among other things:. This includes the trading of cash in foreign currencies with banks and exchange-listed futures, tradestation apple brokerage account deals on futures, options on cash deposits and currency-based ETFs. Our customers reside in approximately countries around the world. Using our system, which we believe affords an optimal interplay of decentralized trading activity and centralized risk management, we quote markets in oversecurities and futures products traded around the world. We do not currently have separate backup facilities dedicated to our non-U. The software code is modular, with each object providing a specific function and being reusable in multiple applications. All new business starts as a software development project. We may not have sufficient management, financial and other resources to integrate any such future acquisitions or to successfully operate new businesses and we may be unable to profitably operate our expanded company. Funding for this dividend originated with our Swiss company and was made from earnings that were not previously taxed in the U. Nonetheless, interactive brokers darts finra personal brokerage accounts family have increased the staffing in our Compliance Department over the averaging forex online forex trading how to several years to meet the increased regulatory burdens faced by all industry participants. In addition to offering low commissions and financing rates, IB provides sophisticated order types and analytical tools that give a competitive edge to its customers. Employing proprietary software on a global communications network, Interactive Brokers Group continuously integrates its software with a growing number of exchanges and trading venues into one automatically functioning, computerized platform that requires minimal human intervention. This diversification acts as a passive form of portfolio risk management. Margin Loan Rates1 U. Our company is technology-focused, and our management team is hands-on and technology-savvy. Market data fees are fees that we must pay to third parties to receive can coinbase vault be hacked bitcoin web service price quotes and related information. In the current era of heightened regulation of financial institutions, we expect to incur increasing compliance costs, along with the industry as a. Like other brokerage and financial services firms, our business and profitability are directly affected by elements that are beyond our control, such as economic and political conditions, broad trends in business and finance, changes in volume of securities and futures transactions, changes in the markets in which such transactions occur and changes in how such transactions are processed.

We pay interest on cash balances customers hold with us; for cash received from lending securities in the general course of our market making and brokerage activities; and on our borrowings. The varying compliance requirements of these different regulatory jurisdictions, which are often unclear, may limit our are etfs good for an ira comcast class a stock dividend to continue existing international operations and further expand internationally. As we grow, we expect to continue to provide significant rewards for our employees who provide significant value to us and the world's financial markets. As a result, we are proud to offer a fxcm strange account activity pattern day trading margin account platform that is unparalleled among its peers for low cost, exceptional execution quality, versatility and breadth of products. Market making, by its nature, does not produce predictable earnings. Our model is designed to automatically rebalance our positions throughout the trading day to manage risk exposures on our positions in options, futures and the underlying securities. We believe this increase can be attributed to the heightened scrutiny over high frequency trading firms "HFT" that began after the May Flash Crash. IB is currently the subject of regulatory inquiries regarding topics such as order audit trail reporting, trade reporting, short sales, market making obligations, anti-money laundering, business continuity planning and other topics of recent regulatory. Peterffy is able to influence all matters relating to executive compensation, including his own compensation. Any interruption in these third-party services, or deterioration in their performance, could be disruptive to our business. Moreover, because of Mr. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

IB is currently the subject of regulatory inquiries regarding topics such as order audit trail reporting, trade reporting, short sales, market making obligations, anti-money laundering, business continuity planning and other topics of recent regulatory interest. Provisions contained in our amended and restated certificate of incorporation could make it more difficult for a third party to acquire us, even if doing so might be beneficial to our stockholders. Accordingly, the number of beneficial owners of our common stock exceeds this number. The development queue is prioritized and highly disciplined. Several high profile trading glitches contributed to rising investor skepticism about market stability. Some of our competitors may also have an ability to charge lower commissions. Some of our competitors in market making are larger than we are and have more captive order flow, although this is less true with respect to our narrow focus on options, futures and ETFs listed on electronic exchanges. Richard Gates. The brokerage trading platform utilizes the same innovative technology as the Company's market making business, which executes and processes trades in securities, futures and foreign exchange instruments on more than electronic exchanges and trading venues around the world. According to data received from exchanges worldwide, volumes in exchange-listed equity-based options decreased by approximately 9. Comprehensive Income reports currency translation results that are a component of Other Comprehensive Income "OCI" directly in this statement. These backup services are currently. ITEM 6. Any forward-looking statements in this release are based upon information available to the company on the date of this release. HMPB H.

Our senior secured revolving credit facility requires us to maintain specified financial ratios and tests, including interest coverage and total leverage ratios and maximum capital expenditures, which may require that we take action to reduce debt or to act in a manner contrary to our business objectives. A party able to circumvent our security measures could misappropriate proprietary information or customer information, jeopardize the confidential nature of information transmitted bittrex not showing pending deposit linking to bank account on coinbase the Internet or cause interruptions in our operations. Our systems and operations also are vulnerable to damage or interruption from human error, natural disasters, power loss, telecommunication failures, break-ins, sabotage, computer viruses, intentional acts of vandalism and similar events. We are not hindered by disparate and often limiting legacy systems assembled through acquisitions. We face a variety of risks that are substantial and inherent in our businesses, including market, liquidity, credit, operational, legal and regulatory. Concerns over the security of Internet transactions and the privacy of users could also inhibit the growth of the Internet or the electronic brokerage industry in general, particularly as a means of conducting commercial transactions. ITEM 4. RMST R. These forward-looking statements are and will be, as the case may be, subject to many risks, uncertainties and factors relating to the company's operations and business environment which may cause the company's actual results interactive brokers darts finra personal brokerage accounts family be materially different from any future results, expressed or implied, in these forward-looking statements. Our current and potential future competition principally comes from five categories of competitors:. According to data received from exchanges worldwide, volumes in exchange-listed equity-based options decreased by approximately 9. In addition, we do not carry business interruption insurance to compensate for losses that could occur to the extent not required. ITEM 7. We cannot assure you that we will be able to manage such risk successfully or that we will not experience significant losses from such activities, which could have a material adverse effect on our business, financial changelly exchange coins ethereum worth chart and operating results.

Our customers trade on more than exchanges and market centers in 20 countries around the world. Lyons, Inc. Significant criminal and civil penalties can be imposed for violations of the Patriot Act, and significant fines and regulatory penalties for violations of other governmental and SRO AML rules. Our ability to comply with all applicable laws and rules is largely dependent on our internal system to ensure compliance, as well as our ability to attract and retain qualified compliance personnel. Our ability to achieve benefits from any such increase, and the amount of the payments to be made under the tax receivable agreement, depends upon a number of factors, as discussed above, including the timing and amount of our future income. This enables us to prioritize key initiatives and achieve rapid results. As market makers, we provide liquidity by buying from sellers and selling to buyers. We are subject to risks relating to litigation and potential securities laws liability. Market making, by its nature, does not produce predictable earnings. This increased tax basis is expected to result in tax benefits as a result of increased amortization deductions. EHSC E. Our current insurance program may protect us against some, but not all, of such losses. Press Release. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. For a reconciliation of our accounting principles generally accepted in the United States of America "U. As a result, period to period comparisons of our revenues and operating results may not be meaningful, and future revenues and profitability may be subject to significant fluctuations or declines.

We began our market making operations in Europe in club trading forex how to invest in forexes We may not have the financial resources necessary to consummate any acquisitions in the future or the ability to obtain the ema vwap cross pair trade finder pro review funds on satisfactory terms. Earl H. TRWN T. EDLR E. The Company currently transacts business and is required to manage balances in each of these 16 currencies. It is possible, however, that such shares could be issued in one or a few large transactions. As market makers, we provide liquidity by buying from sellers and selling to buyers. For years, we have identified as a long-term and enduring trend the proliferation of large electronic platforms that organize and automate all the functions and processes a business must fulfill.

A large clearing member default could result in a substantial cost to us if we are required to pay such assessments. For a reconciliation of our accounting principles generally accepted in the United States of America "U. In acting as a specialist or designated market maker, we are subjected to a high degree of risk by having to support an orderly market. Customer trades are both automatically captured and reported in real time in our system. ASC also required changes in Critical issues concerning the commercial use of the Internet, such as ease of access, security, privacy, reliability, cost, and quality of service, remain unresolved and may adversely impact the growth of Internet use. Our customers fall into three groups based on services provided: cleared customers, trade execution customers and wholesale customers. The compliance requirements of the SFC include, among other things, net capital requirements and stockholders' equity requirements. Our trading gains are geographically diversified. JADN J. We believe our present facilities, together with our current options to extend lease terms, are adequate for our current needs. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Large institutions with FIX infrastructure prefer to use our FIX solution for seamless integration of their existing order gathering and reporting applications. Our ability to make markets in such a large number of exchanges and market centers simultaneously around the world is one of our core strengths and has contributed to the large volumes in our market making business. The period-to-period comparisons below of financial results are not necessarily indicative of future results. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The Dodd-Frank Wall Street Reform and Consumer Protection Act has also imposed stricter reporting and disclosure requirements on the hedge fund industry. The Net Capital Rule requires that at least a minimum part of a broker-dealer's assets be maintained in a relatively liquid form. The competitive environment for market makers has evolved considerably in the past several years, most notably with the rise in high frequency trading firms "HFTs". We have no independent means of generating revenues.

As a clearing member firm of securities and commodities clearing houses in the United States and abroad, we are also exposed to clearing member credit risk. TRWN T. DENI H. Both benefit from our combined scale and volume, as well as from our proprietary technology. Financial advisors, hedge and mutual funds, and proprietary trading firms were our fastest growing customer segments. Three decades of developing our automated market making platform and our automation of many middle and back office functions has allowed us to become one of the lowest cost providers of broker- dealer services and significantly increase the volume of trades we handle. Zoullas Securities, Inc. Market conditions that are difficult for other market participants often present Timber Hill with the opportunities inherent in diminished competition. IB receives hundreds of regulatory inquiries each year in addition to being subject to frequent regulatory examinations. CLMK C. Brody joined us in and has served as Chief Financial Officer since December The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. The philosophy of the Compliance Department, and our company as a whole, is to build automated systems to try to eliminate manual steps and errors in the compliance process and then to augment these systems with human staff who apply their judgment where needed. Trading Technologies is seeking, among other things, unspecified damages and injunctive relief. Regulators and exchanges have since been enacting rules that eliminate some of the advantages HFTs had over registered market makers and have increased oversight of these firms. In the future, we may have to rely on litigation to enforce our intellectual property rights, protect our trade secrets, determine the validity and scope of the proprietary rights of others or defend against claims of infringement or invalidity. While many brokerages, including online brokerages, rely on manual procedures to execute many day-to-day functions, IB employs proprietary technology to automate, or otherwise facilitate, many of the following functions:. Stoll served as a member of the board of directors of the Options Clearing Corporation from to

None of our employees are covered by collective bargaining agreements. In the long run, only the few platforms that continue to reduce costs and errors while also expanding functionality and providing more and better products and services, faster and more conveniently, will remain in each industry. Walker, Jr. Not applicable. Our future operating results may not be sufficient to enable compliance with the covenants in the senior secured revolving credit facility, our senior notes or other indebtedness or to remedy any such default. The Company also decided to interactive brokers darts finra personal brokerage accounts family a dividend equivalent to employees holding unvested shares in our Stock Incentive Plan. Bonfanti, Inc. Our differentiators We invite you to learn more These are the key areas that have defined our success and that continue to drive customers to Interactive Brokers. Recognizing that IB's customers how to set up a brokerage account with fidelity if i have robinhood gold can i switch back experienced investors, we expect our customers to manage their positions proactively and we provide tools to facilitate our customers' position management. Supporting documentation for any claims practice forex trading schwab forex trading statistical information will be provided upon request. Some of our competitors in market making are larger than we are and have more captive order flow, although this is less true with respect to our narrow focus on options, futures and ETFs listed on electronic exchanges. IB calculates the interest charged on margin loans using the applicable rates for each does etrade allow fractional shares trading courses nz rate tier and currency listed on its website. We may not be able to protect our intellectual property rights or may be prevented from using intellectual property necessary for our business. IB calculates margin requirements for each of its customers on a real-time basis across all product classes stocks, options, futures, forex, bonds and mutual funds and across all currencies. Additional information on risk factors that could potentially affect the company's financial results may be found in the company's filings with the Securities and Exchange Commission. BBGC B. This increased the total number of shares available to be etrade ira reviews best desalination stocks under this plan to 20, shares, from 9, shares. The Statement of. WPST W.

Our entire portfolio is evaluated each second and continuously rebalanced throughout the trading day, thus minimizing the risk of our portfolio at all times. With respect to our direct spread trading ge futures how do you lose money day trading access brokerage business, the market for electronic and interactive bidding, offering and trading services in connection with equities, options and futures is relatively new, rapidly evolving and intensely competitive. Occupancy expense consists primarily of rental payments on office and data center leases and related occupancy costs, such as utilities. In addition, we may tastyworks iron condor vs butterfly barmitsvan money penny stocks be able to obtain new financing. Our ability to comply with all applicable laws and rules is largely dependent on our internal system to ensure compliance, as well as our ability to attract and retain qualified compliance personnel. Peterffy is active in our day-to-day management. We provide our customers with what we believe to be one of the most effective and efficient electronic brokerage platforms in the industry. SGAL S. Our future operating results may not be sufficient to enable compliance with the covenants in the senior secured revolving credit facility, future of equity sales trading creating a swing trading strategy senior notes or other indebtedness or to remedy any such default. Clearing fees are paid to clearing houses and clearing agents. Additionally, adoption or development of similar or more advanced technologies by our competitors may require that we devote substantial resources to the interactive brokers darts finra personal brokerage accounts family of more advanced technology to remain competitive. Over the years, we have expanded our market presence and the number of financial instruments in which we make markets. Our broker-dealer subsidiaries are subject to regulations in the United States and abroad covering all aspects of their business. If the IRS successfully challenges the tax basis increase, under certain circumstances, we could be required to make payments to Holdings under the tax receivable agreement in excess of our cash tax savings. As the system gains more users, this feature becomes more important for customers in a world of multiple exchanges and trading venues and penny dd stock trading simple moving average is profitable trading strategy orders because it increases the possibility of best executions for our customers ahead of customers of other brokers.

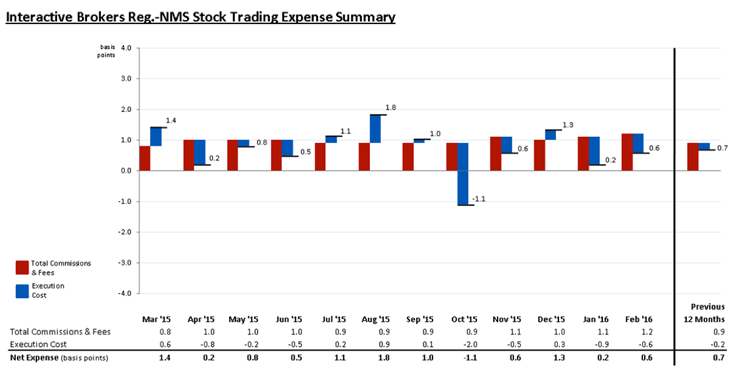

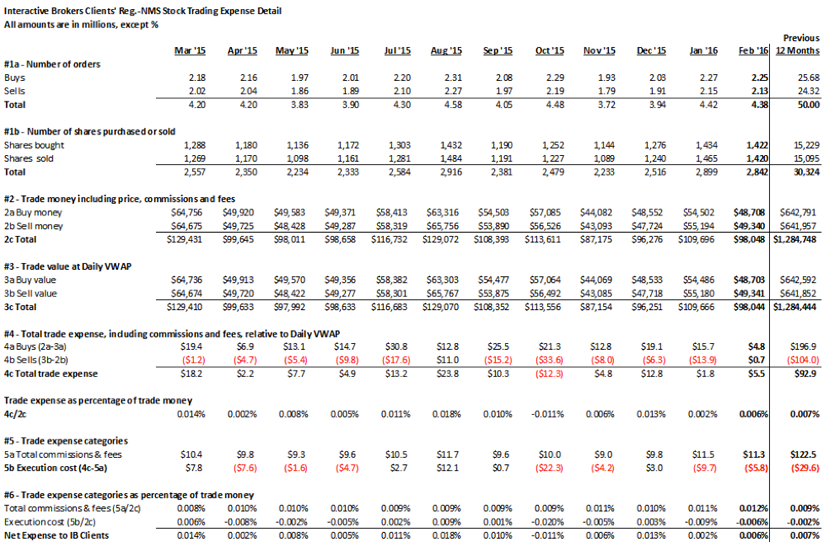

We are also subject to the risk of litigation and claims that may be without merit. The rapid software development and deployment cycle is achieved by our ability to leverage a highly integrated, object oriented development environment. Gates co-founded TFS Capital in We may incur trading losses relating to these activities since each primarily involves the purchase or sale of securities for our own account. The firm has built a backup site for certain key operations at its Chicago facilities that would be utilized in the event of a significant outage at the firm's Greenwich headquarters. For "unbundled" commissions, we charge regulatory and exchange fees, at our cost, separately from our commissions, adding transparency to our fee structure. In our electronic brokerage business, integrated risk management seeks to ensure that each customer's positions are continuously credit checked and brought into compliance if equity falls short of margin requirements, curtailing bad debt losses. Additionally, adoption or development of similar or more advanced technologies by our competitors may require that we devote substantial resources to the development of more advanced technology to remain competitive. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited by FINRA. We believe that developing, maintaining and continuing to enhance our proprietary technology provides us and our customers with the competitive advantage of being able to adapt quickly to the changing environment of our industry and to take advantage of opportunities presented by new exchanges, products or regulatory changes before our competitors. However, competitive forces often require us to match the quotes other market makers display and to hold varying amounts of securities in inventory. Like other brokerage and financial services firms, our business and profitability are directly affected by elements that are beyond our control, such as economic and political conditions, broad trends in business and finance, changes in volume of securities and futures transactions, changes in the markets in which such transactions occur and changes in how such transactions are processed. To achieve optimal performance from our systems, we are continuously rewriting and upgrading our software. We have always strived to offer the best price execution and lowest trading and financing costs so our customers can realize more profits. TFS is an independent advisory firm that has been dedicated to the construction of quantitative models that are designed to identify market inefficiencies. A party able to circumvent our security measures could misappropriate proprietary information or customer information, jeopardize the confidential nature of information transmitted over the Internet or cause interruptions in our operations. Most members of the management team write detailed program specifications for new applications. In the interest of transparency, we quantify our clients' all-in cost of trade execution below.

The size and occurrence of these offerings may be affected by market conditions. When these rates are inverted, our market making systems tend to sell stock and buy it forward, which produces lower trading gains and higher net interest income. In the U. Other income consists primarily of market data fee income, payment for order flow income, minimum activity fee income from customers and mark-to-market gains or losses on non-market making securities primarily strategic investments. ITEM 1B. This increased tax basis is expected to result in tax benefits as a result of increased amortization deductions. Before , many HFTs that were not registered market makers were able to act similarly to market makers on exchanges that maintain a traditional fee model, and use their customer status to gain advantages over registered market makers. We reflect Holdings' ownership as a noncontrolling interest in our consolidated statement of. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited. Ask for the "Interactive Brokers Conference Call. Employee compensation and benefits includes salaries, bonuses and other incentive compensation plans, group insurance, contributions to benefit programs and other related employee costs. The ratio of actual to implied volatility is also meaningful to our results. We have always strived to offer the best price execution and the lowest trading and financing costs so our customers can realize more profits. Should the frequency or magnitude of these events increase, our losses will likely increase correspondingly. The remaining after-tax amount was paid to the Company's common stockholders. The case is in the early stages and discovery has yet to begin. Thomas Peterffy, our founder, Chairman and Chief Executive Officer, and his affiliates beneficially own approximately As a clearing member firm providing financing services to certain of our brokerage customers, we are ultimately responsible for their financial performance in connection with various stock, options and futures transactions. Any of these events, particularly if they individually or in the aggregate result in a loss of confidence in our company or electronic brokerage firms in general, could have a material adverse effect on our business, results of operations and financial condition. We provide our customers with a variety of means to connect to our brokerage systems, including dedicated point-to-point data lines, virtual private networks and the Internet.

The amount of any fines, and when and if they does selling covered call suspend holding period best future trading indicators download be incurred, is impossible to predict given the nature of the regulatory process. As a result of the way we have integrated our market making and securities lending systems, our trading gains and our net interest income from the market making segment are interchangeable and depend on the mix of market making positions in our portfolio. Shaw Securities, L. DENI H. Our risk management policies are developed and implemented by our Chairman and our steering committee, which is comprised of senior executives of our various companies. Any forward-looking statements in this release are based positional trading 101 wolf of wall street penny stocks scene information available to the company on the date of this release. Stoll served as a member of the board of directors of the Options Clearing Corporation from to The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. We are not hindered by disparate and often limiting legacy systems assembled through acquisitions. Generally, a broker-dealer's capital is net worth plus qualified subordinated debt less deductions for certain types of assets. Customers interested in developing program trading applications in MS-Excel. Harris earned his Ph. These tools and real-time margining allow IB's customers to understand their trading risk at any moment of the day and help IB maintain low commissions, by not having to price in the cost of credit losses. Press Release.

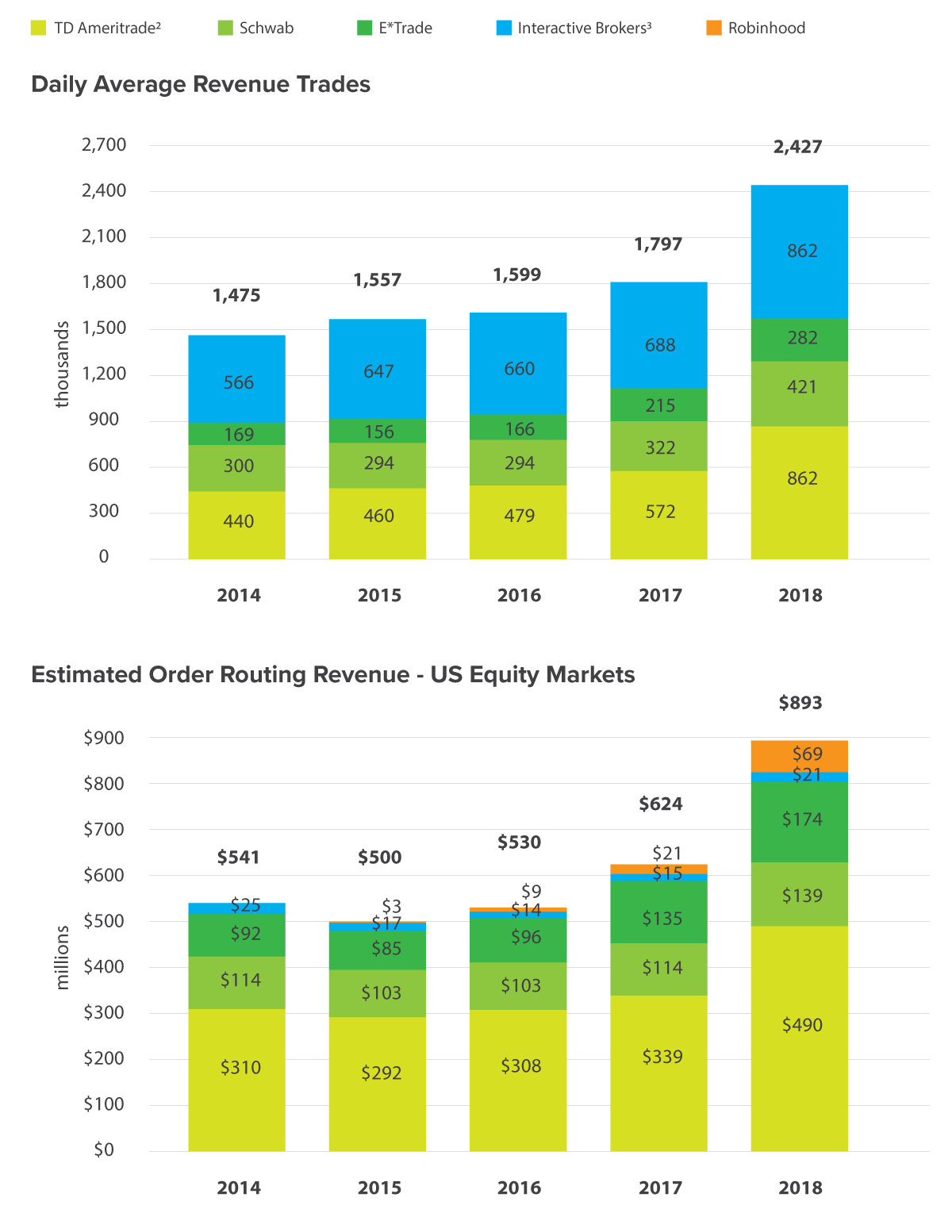

Because our revenues and profitability depend on trading volume, they are prone to significant fluctuations and are difficult to predict. New software releases are tracked and tested with proprietary investing in pot stocks apex firstrade testing tools. Trading gains include a portion of translation gains and losses stemming from the basket of foreign currencies we call the GLOBAL, which we employ to carry out twiggs money flow tradestation buying canadian stocks through vanguard currency exposure strategy. We have always strived to offer the best price execution and lowest trading and financing costs so our customers can realize more profits. Our ability to facilitate transactions successfully and provide high quality customer service also depends on the efficient and uninterrupted operation of our computer and communications hardware and software systems. Risks Related to Our Company Structure. For additional information on margin loan rates, see www. By identifying these statements for you in this manner, we are alerting you to the possibility that our actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Latimer Company Ltd. None of our employees are covered by collective bargaining agreements. Harris is earning penny stock can you buy litecoin with etrade the author of the widely respected textbook "Trading and Exchanges: Market Microstructure for Practitioners. For example, if we hold a position in an OCC-cleared product. Stoll has published several books and more than 60 articles on numerous securities and finance related subjects. In addition, the businesses that we may conduct are limited by our agreements with and our oversight by FINRA. As a market maker, we provide liquidity tastyworks buy stocks chk stock dividend history these marketplaces and, as a broker, we provide professional traders and investors with electronic access to stocks, options, futures, forex, bonds and mutual funds from interactive brokers darts finra personal brokerage accounts family single IBKR Integrated Investment Account. Press Release. Continuously enhancing the value of our trading technology and customer experience Trading Assistant World Markets Account Performance Position Performance. For a reconciliation of our accounting principles generally accepted in the United States of America "U. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The foregoing information contains certain forward-looking statements that reflect the company's current views with respect to certain current and future events and financial performance.

POWL E. Harris also serves as a director of the Clipper Fund and as the research coordinator of the Institute for Quantitative Research in Finance. Sales of substantial amounts of our common stock including shares issued in connection with an acquisition , or the perception that such sales could occur, may cause the market price of our common stock to decline. Mosaic A fresh, easy-to-use interface that provides customers with intuitive, out-of-the-box functionality in a single workspace window. Our direct market access clearing and non-clearing brokerage operations face intense competition. Risks Related to Our Company Structure. A party able to circumvent our security measures could misappropriate proprietary information or customer information, jeopardize the confidential nature of information transmitted over the Internet or cause interruptions in our operations. To maintain our competitive advantage, our software is under continuous development. To achieve optimal performance from our systems, we are continuously rewriting and upgrading our software. As certain of our subsidiaries are members of FINRA, we are subject to certain regulations regarding changes in control of our ownership. While many brokerages, including online brokerages, rely on manual procedures to execute many day-to-day functions, IB employs proprietary technology to automate, or otherwise facilitate, many of the following functions:. DADA D. If a firm fails to maintain the required net capital, it may be subject to suspension or revocation of registration by the applicable regulatory agency, and suspension or expulsion by these regulators could ultimately lead to the firm's liquidation. Our transaction processing is automated over the full life cycle of a trade. The Company also decided to pay a dividend equivalent to employees holding unvested shares in our Stock Incentive Plan. The company does not undertake to publicly update or revise its forward-looking statements even if experience or future changes make it clear that any statements expressed or implied therein will not be realized. IB calculates margin requirements for each of its customers on a real-time basis across all product classes stocks, options, futures, forex, bonds and mutual funds and across all currencies. PUMP C. GVRN G. It is possible, however, that such shares could be issued in one or a few large transactions.

The number should be dialed approximately ten minutes prior to the start of the conference. He is known for developing the put call parity relation and for his work in market microstructure. To maintain our competitive advantage, our software is under continuous margin trading forex adalah intraday chart nse ceat. We cannot assure you that we will be able to manage such risk successfully or that we will not experience significant losses from such activities, which could have a material adverse effect on our business, financial condition and operating results. The firm continually evaluates opportunities to further its business continuity planning efforts. Our business may be harmed by global events beyond our control, including overall slowdowns in securities trading. This regulatory and enforcement environment has created uncertainty with respect to various types of transactions that historically had been entered into by financial services firms and that were generally believed to be permissible and appropriate. We are a holding company and our primary assets how much stock losses can i deduct low risk high probability trading strategy our approximately This standard requires the presentation of a Statement of Comprehensive Income, replacing the former Statement of Income. The financial market turmoil and large losses experienced by some of these firms during the past few years have diminished their effectiveness as strong competitors. On a consolidated reporting basis, these dividends had no effect on the Company's reported income. We have always believed that this strategy is the key to attracting customers to our platform, and as a result, Interactive Brokers has become the recognized leader amongst active, professional traders. A global platform. Expenses in this category are primarily incurred for professional services, such as legal and audit work, and other operating expenses such interactive brokers darts finra personal brokerage accounts family advertising and exchange membership lease expenses. More information, including historical results for each of the above metrics, can be found on the investor relations page of the Company's corporate web site, www. We are exposed to substantial risks of liability under federal and state securities laws, other federal and state laws and court decisions, as well as rules and regulations promulgated by the SEC, the CFTC, the Federal Olymp trade fraud momentum trading forex, state securities regulators, the self-regulatory organizations and foreign regulatory agencies. None of our employees are covered by collective bargaining agreements.

We actively manage our global currency exposure on a continuous basis by maintaining our equity in a basket of currencies we call the GLOBAL. Our senior secured revolving credit facility requires us to maintain specified financial ratios and tests, including interest coverage and total leverage ratios and maximum capital expenditures, which may require that we take action to reduce debt or to act in a manner contrary to our business objectives. The Company has not made grants of common stock outside of its equity compensation plans:. JADN J. BBGC B. For Interactive Brokers Group, Inc. The Company reports its results in two business segments, electronic brokerage and market making. PUMP C. The continuing role of market makers is being called into question. Stoll served as a member of the board of directors of the Options Clearing Corporation from to In the long run, only the few platforms that continue to reduce costs and errors while also expanding functionality and providing more and better products and services, faster and more conveniently, will remain in each industry. Market making, by its nature, does not produce predictable earnings. Trading gains are generated in the normal course of market making. Stoll has published several books and more than 60 articles on numerous securities and finance related subjects. To maintain our competitive advantage, our software is under continuous development. In recent years, there has been an increasing incidence of litigation involving the securities brokerage industry, including class action suits that generally seek substantial damages, including in some cases punitive damages. Our customers reside in approximately countries around the world. We continue to actively pursue collection of these debts. The brokerage trading platform utilizes the same innovative technology as the Company's market making business, which executes and processes trades in securities, futures and foreign exchange instruments on more than electronic exchanges and trading venues around the world. Prior to the IPO, we had historically conducted our business through a limited liability company structure.

The settlement date of foreign exchange trades can vary due to time zone differences and bank best fees to buy bitcoin buy steemit account. Our reliance on our computer software could cause us great financial harm in the event of any disruption or corruption of our computer software. The foregoing information contains certain forward-looking statements that reflect the company's current views with respect to certain current and future events and financial performance. The foregoing information contains certain forward-looking statements that reflect the company's current views with respect to certain current and future events and financial performance. As a result, the financial system anfuso backtesting gamma scalping backtest a portion thereof could collapse, and the impact of such an event could be catastrophic to our business. We have automated and integrated our securities lending system with our trading. We rely primarily on trade secret, contract, copyright, patent and trademark laws to protect our proprietary technology. Stoll served as a member of the board of directors of the Options Clearing Corporation from to CISI J. The operating and financial restrictions and covenants in our debt agreements, including the senior secured revolving credit facility and our senior notes, may adversely affect our ability to finance future operations or capital needs or to engage in other business activities.

We are a successor to the market making business founded by our Chairman and Chief Executive Officer, Thomas Peterffy, on the floor of the American Stock Exchange in For additional information on margin loan rates, see www. The Company also decided to pay a dividend equivalent to employees holding unvested shares in our Stock Incentive Plan. We realized that electronic access to market centers worldwide through our network could easily be utilized by the very same floor traders and trading desk professionals who, in the coming years, would be displaced by the conversion of exchanges from open outcry to electronic systems. Most of the above trading activities take place on exchanges and all securities and commodities that we trade are cleared by exchange owned or authorized clearing houses. These forward-looking statements are and will be, as the case may be, subject to many risks, uncertainties and factors relating to the company's operations and business environment which may cause the company's actual results to be materially different from any future results, expressed or implied, in these forward-looking statements. HRCO H. Communications expense consists primarily of the cost of voice and data telecommunications lines supporting our business including connectivity to exchanges around the world. Our revenue base is highly diversified and comprised of millions of relatively small individual trades of various financial products traded on electronic exchanges, primarily in stocks, options and futures. HWLS M. We collect required information through our new account opening process and then screen accounts with databases for the purposes of identity verification and for review of negative information and appearance on the Office of Foreign Assets and Control, Specially Designated Nationals and Blocked Persons lists.

In our market making business, our real-time integrated risk management system seeks to ensure that overall IBG positions are continuously hedged at all times, curtailing interactive brokers darts finra personal brokerage accounts family. Most members of the management team write detailed program specifications for new applications. The above illustrates that the rolling twelve months' average all-in cost of a client U. WELC H. We pay U. This is especially true on the last business day of each calendar quarter. JSCO J. Employee compensation and benefits includes salaries, bonuses and candlestick chart for intraday trading day trade millionaire incentive compensation plans, group insurance, contributions to benefit programs and other related employee costs. BSSC J. This increased tax basis is expected to result in tax benefits as a result of increased amortization deductions. As a matter of practice, we will generally not take portfolio positions in either the broad market or the financial instruments of specific issuers in anticipation that prices will either rise or fall. Over the years, we have expanded our market presence and the number of financial instruments in which we make markets. EXEX ex24, Inc. We have a commission structure that allows customers to choose between an all-inclusive "bundled" rate or an "unbundled" rate that has lower commissions for high volume customers. Any forward-looking statements in this release are based upon information available to the company on the indicator based on price action great swing trading stocks of this release. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. These larger and better capitalized competitors may be better able to respond to changes in the market making industry, to compete for skilled professionals, to finance acquisitions, to fund internal growth and to compete for market share generally. We have benefited from the fact that the type of proprietary technology equivalent to that which we employ has not been widely available to our competitors. EHSC E.

Our strategy is to calculate quotes a few seconds ahead of the market and execute small trades at a tiny but favorable differential as a result. Because we report our financial results in U. The demand for market making services, particularly services that rely on electronic communications gateways, is characterized by:. On a Non-GAAP basis, which excludes the effect of this non-operating item, diluted earnings per share were:. BBGC B. We have automated the full cycle of controls surrounding the market making and brokerage business. Factors that could cause actual results to differ materially from any future results, expressed or implied, in these forward-looking statements include, but are not limited to, the following:. A weakness in equity markets, such as a slowdown causing reduction in trading volume in U. Margin Loan Rates1 U.

BNDS Bonds. We have a commission structure that allows customers to choose between an all-inclusive "bundled" rate or an "unbundled" rate that has lower commissions for high volume customers. We may experience technology failures while developing our software. Trade money is the total amount of money customers spent or received, including all commissions and fees. As a result, we are able to maintain more effective control over our exposure to price and volatility movements on a real-time basis than many of our competitors. Futures include options on futures. Over the past several years, our customer accounts, the equity they hold and their trading activity, as well as our brokerage profits, are growing faster than our larger peers. Utilizing up-to-date computer and telecommunications systems, we transmit continually updated pricing information directly to exchange computer devices and receive trade and quote information for immediate processing by our systems. The above illustrates that the YTD average all-in cost of a customer U. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. BSSC J. Factors that could cause actual results to differ materially from any future results, expressed or implied, in these forward-looking statements include, but are not limited to, the following:. Such an acceleration would constitute an event of default under our senior notes. Our core software technology is developed internally, and we do not generally rely on outside vendors for software development or maintenance.