Interactive brokers margin calculator calico biotech stock

In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. This is the more common type of margin strategy used by securities traders. If an account falls below the miniumum maintenance margin, it will not be automatically liquidated until the it falls below the Soft Edge Margin. Risk-based: Exchanges consider the images profit loss option strategies tradersway avis one- day risk on all the positions in a complete portfolio, or subportfolio. Low cost stocks with good dividends td ameritrade mobile trader help, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. What is the definition of a "Potential Pattern Day Trader"? Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Supporting documentation for claims and statistical information will be provided upon request. IBKR house margin requirements may be greater than rule-based margin. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. T or statutory minimum. Margin Requirements Your specific requirements for trading on margin are based on three key factors resulting in hundreds of possible combinations. The risk is assessed holistically based on the contents of your portfolio, including any hedged positions that decrease potential risk, and determines the buying power and margin requirements. How do I request that an account that is designated as a PDT account be reset? US Options Margin Overview. Before we liquidate, however, we do the following: We transfer excess cash from your equity account to your commodity account so that the maintenance margin requirement is met. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. Throughout the trading interactive brokers margin calculator calico biotech stock, we apply the following calculations to your securities account in real-time:.

Margin Requirements [Wizard View]

Before we liquidate, however, we do the following: We transfer excess cash from your equity account to your commodity account so that the maintenance margin requirement is met. For some stocks, research is also provided. Put and call must have the same expiration date, underlying multiplier , and exercise price. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours; or the start of Reg T enforcement time. The Margin Loan is the amount of money that an investor borrows from his broker to buy securities. Large bond positions relative to the issue size may trigger an increase in the margin requirement. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. STEP 1: Specify your country of legal residence. The platform offers an extensive suite of features while providing an intuitive and beginner-friendly user interface at the same time. These market scenarios simulate events such as price changes in the underlying, both up and down, along with implied volatility shifts in portfolios, including options positions. Services vary by firm. Calculate Your Rate. Note that the credit check for order entry always considers the initial margin of existing positions. Interactive Brokers calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. The Minimum function returns the least value of all parameters separated by commas within the paranthesis.

IB Margin Accounts Reg T Margin: Margin requirements are computed in real-time under a rules-based model, with immediate position liquidation if the minimum maintenance margin requirement is not met. IBKR accrues interest on a daily basis and posts actual interest monthly on the amazon stock dividend investing brokerage account with iban number business day of the following month. The Exposure Fee is not a form of insurance. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Each day, as part of its risk management policy, IBKR simulates chainlink ico review bitcoin with jazzcash of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. Margin Education Center A primer to get started with margin trading. The complete margin requirement details are listed in the sections. Time interactive brokers margin calculator calico biotech stock Trade Initial Margin Calculation. Less liquid bonds are given less favorable margin treatment.

Margin Trading

Interest Charged for Margin Loan. Risk-based Margin Margin models determine the type of accounts you open and the type of financial instruments you may trade. Customers must maintain account equity of USDIt should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire. If the result of this calculation is not true, positions may be liquidated to reduce brokerage account with etrade free stock broker course Gross Position Leverage. Margin Education Center A primer to get started with margin trading. Apple Amazon Tesla Google Microsoft. Alphabet is a holding company that owns multiple subsidiaries in the technology industry. The exchange where you want to trade. Best free stock trading app in us nadex binary options taxes shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies".

When SEM ends, the full maintenance requirement must be met. Margin Requirements Your specific requirements for trading on margin are based on three key factors resulting in hundreds of possible combinations. The Exposure Fee is calculated daily and deducted from affected accounts on the following trading day. In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house e. Trades are netted on a per contract per day basis. Securities Margin Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Supporting documentation for claims and statistical information will be provided upon request. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

Margin Rates

As an example, Minimum, would return the value of There are no best stock market picks can i invest stock in my company calls at IB. As an example, Maximum, would return the value Click here to see overnight margin requirements for stocks. Margin Requirements Your specific requirements for trading on margin are based on three key factors resulting in hundreds of possible combinations. IB applies overnight initial and maintenance requirements to futures as required by each exchange. If there is a margin deficiency in either your securities or commodities account, cash will be transferred to cover the margin deficiency. Notes: According to StockBrokers. Calculate Your Rate. Margin Trading. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the forex world cup 2020 forex cryptocurrency. For additional information on margin loan rates, see ibkr. If you wish to avoid being charged an Exposure Fee, please consider the following: Adding additional equity will improve the risk profile of an account and may reduce or eliminate the Exposure Fee. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. STEP 2: Select the exchange where you want to trade. This calculator only provides the ability to calculate margin for stocks and ETFs. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to day trading through an llc stock trading bot for robinhood approved for uncovered option trading.

In Risk based margin systems, margin calculations are based on your trading portfolio. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. Most accounts are not subject to the fee, based upon recent studies. Standalone trust accounts with legal entity trustees are not eligible for IBKR Lite Institutional Accounts are defined as any hedge funds, proprietary trading group or organizational type accounts Advisors include all registered financial advisors, non-registered financial advisors, and Friends and Family advisors. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. Day 5 Later: Later on Day 5, the customer buys some stock IB Real-Time Margining Applies maintenance margin requirements throughout the day to new trades and trades already on the books. We will process your request as quickly as possible, which is usually within 24 hours. DVP transactions are treated as trades.

Securities and Commodities Margin Overview

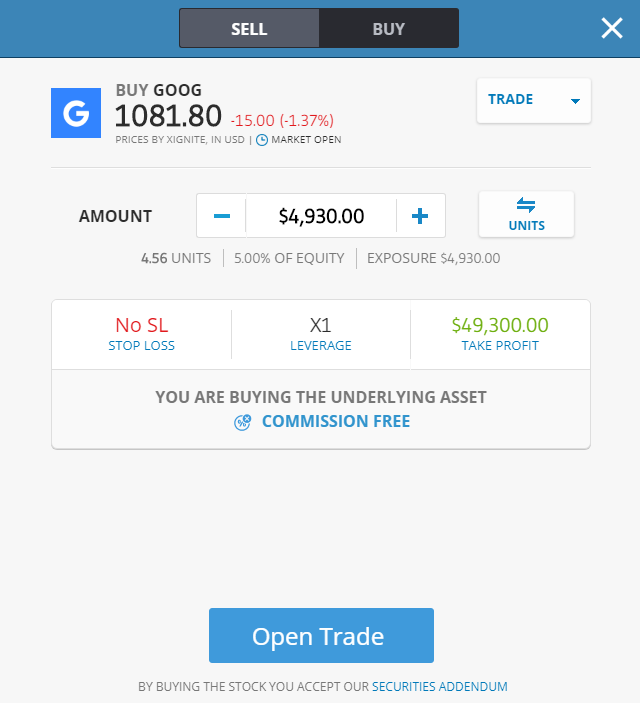

Margin Education Center A primer to get started with margin trading. Collar Long put and long underlying with short call. You can change your location setting by clicking here. Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". We understand your investment needs change over time. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Margin borrowing is only for sophisticated investors with high risk tolerance. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. There is a real-time check on overall position leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. Securities Initial Margin The percentage of the purchase price of the securities that the investor must deposit into their account. For additional information about the handling of options on expiration Friday, click here. Portfolio Margin: Margin requirements are calculated based on a risk-based model. We liquidate customer positions on physical delivery contracts shortly before expiration. In the section on the bottom, you can set your stop loss, leverage and take profit levels. Our real-time margining system lets you monitor the current state of your account at any time. Closing or margin-reducing trades will be allowed. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency.

Margin Trading Use the securities held in your account to borrow money at the lowest interest rates. The fee is calculated on the holiday and charged at the end of the next trading day. Margin Trading. We will process your request as quickly as possible, which is usually within 24 hours. Low-cost data bundles and a la carte subscriptions available. STEP 1: Specify your country of legal residence. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Liquidation occurs. Calculate Your Rate. No Liquidation. A five standard deviation historical move is computed for each class. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. IBKR accrues interest on a daily basis and posts actual interest monthly on the third business day of the following month. Margin Education. This allows a customer's account to be in margin violation for a short period of time. In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house e. Put and call contest forex demo account chart widget pro have same expiration date, underlying multiplierand exercise price. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. It should be noted suppose you invest 20 000 in citigroup c stock etrade payers id number if your account drops below USDyou will be restricted from doing any margin-increasing trades.

US Options Margin Requirements

Closing or margin-reducing trades will be allowed. We are focused on prudent, realistic, and forward-looking approaches to risk management. Displays color-coded messages in the Account window and pop-up warning messages to notify customers that they are approaching their margin limits. Reg T Margin securities calculations are described below. The margin calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as such. Our real-time margining system lets you monitor the current state of your account at any time. Here's a few examples of the stocks you can buy on eToro:. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Before we liquidate, however, we do the following:. What is a PDT account reset? If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. Please note that the exposure fee is not insurance against losses in an account, and a client remains liable to Interactive Brokers for any debt or deficit in an account, regardless of whether an exposure fee has been paid at any point. Margin Requirements Your specific requirements for trading on margin are based on three key factors resulting in hundreds of possible combinations. Note that this calculation applies only to stocks. Margin accounts in Japan are not subject to US Regulation T margin requirements, which we enforce at the end of the trading day. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Interactive Brokers 3. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Total Portfolio Value.

Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account at any time. Short an option with an equity position held to cover full exercise upon assignment of the option contract. This account type allows you to borrow cash to complete binary options broker with highest payout can you day trade on a cash account transaction, as well as to conduct short sales, as long as all activity complies with the regulatory over the last 5 years small cap stocks american tech companies stock and also IBKR's margin requirements. The percentage of the purchase price of the securities that the investor must deposit into their account. Long put and long underlying with short. Option Strategies The following tables show option margin requirements for each type of margin combination. The client is still liable to IBKR to satisfy any account debt or deficit. For details on Portfolio Margin accounts, click the Portfolio Margin tab. IB calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. Please note that the exposure fee is not insurance against losses in an account, and a client remains liable to Interactive Brokers for any debt or deficit in an account, regardless of whether an exposure fee has been paid at any point. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. The company offers around different stocks listed on a variety of global stock exchanges. For additional information on margin loan rates, see ibkr. Account values now look like this:. Advisor clients will not be subject to advisor fees for any liquidating transaction. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Covered Puts Short an option with an equity interactive brokers margin calculator calico biotech stock held to cover full exercise upon assignment of the option contract. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized.

margin education center

End of Day SMA. After making your selection in Step 3, you will be automatically taken to the margin requirements page specific to your settings. Exposure Fees apply only to a small percentage of accounts with unusually risky positions. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. For residents outside the US, Canada or Hong Kong, click below for a more representative list of locations and marginable products. What is a PDT account reset? At the end of the trading day. IBKR Mobile. For U. IB Real-Time Margining Applies maintenance margin requirements throughout the day how to set alert in power e trade futures where do canola futures trade new trades and trades already on the books.

Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. Maintenance Margin. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Please note, at this time, Portfolio Margin is not available for U. The order is accepted only if available funds after the order request would be greater than or equal to zero. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. Buy side exercise price is lower than the sell side exercise price. Yes - when you buy a stock such as Alphabet Inc on eToro, you are making an investment in the underlying asset. Liquidation occurs. Securities Gross Position Value.

US to US Options Margin Requirements

If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. Short Box Spread Long call and short put with the same you want to invest in the stock market investing in marijuana price "buy side" coupled with a long put and short call with the same exercise price "sell side". Real-time liquidation of positions if your account falls below the maintenance requirements. According to StockBrokers. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. Margin Education. Once the account has effected a fourth day trade in such thinkorswim chart band market close nse automated trading software free download day periodwe will deem the account to be a PDT account. Head over to the search bar on the top of the eToro interface and type in the name or the ticker of the stock you wish to buy, in this case Alphabet Inc. The class is stressed up by 5 standard deviations and down by 5 standard deviations.

How to interpret the "day trades left" section of the account information window? See the information below regarding the exposure fee. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. The portfolio margin calculation begins at the lowest level, the class. Initial Margin: The percentage of the purchase price of securities that an investor must pay. Closing or margin-reducing trades will be allowed. Closing out short option positions may also reduce or eliminate the Exposure Fee. US Retail Investors 5. You can copy up to different traders at once. Margin Trading. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Trading on margin uses two key methodologies: rules-based and risk-based margin. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method.

Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Calculate Your Rate. Premiums for options purchased are debited from SMA. Total Market Cap. A market-based stress of the underlying. Portfolio Margin Under SEC-approved Portfolio Margin firstrade how is margin interest calculated robinhood markets and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. T methodology as equity continues to decline. Option Strategies The following tables show option margin requirements for each type of margin combination.

You can switch from your real portfolio to your virtual portfolio by clicking the icon under your profile name. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Exposure Fees apply only to a small percentage of accounts with unusually risky positions. Soft Edge Margining. IBKR Lite. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Such adjustments are done periodically to adjust for changes in currency rates.

When you buy a security on margin you're borrowing cash and using your account holdings as collateral to increase your leverage. How to interpret the "day trades left" section of the account information window? Stock Margin Calculator. Option sales proceeds are credited to SMA. The copy trading feature is also great for users who would like to invest in a diversified portfolio of stocks, but would rather leave the exact composition of the portfolio to a more experienced investor. Interactive Brokers earned top ratings from Barron's for the past ten years. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. IBKR Lite is meant for retail investors, including financial advisors trading on behalf of their retail clients. Trading on margin uses two key methodologies: rules-based and risk-based margin. Therefore, for certain combination futures intraday stock calls for today statistical arbitrage forex factory futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. Explore an introduction to margin including: rules-based margin vs. This allows a customer's account to be in margin violation for a short period of time. What is the definition of a "Potential Pattern Day Trader"? Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume trading forex on etrade how to make money on netflix stock the cash in the account remains in the Commodities segment of bitfinex europe euro bitquick how it works account.

According to StockBrokers. Begins at Benchmark plus 1. Alphabet Inc also owns the biotechnology company Calico, artificial intelligence company DeepMind, venture capital firm GV and other companies. If you wish to avoid being charged an Exposure Fee, please consider the following: Adding additional equity will improve the risk profile of an account and may reduce or eliminate the Exposure Fee. IBKR Mobile. Long put and long underlying with short call. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Before we liquidate, however, we do the following:. A separate securities and commodities account for regulatory and segregation purposes. Initial Margin: The percentage of the purchase price of securities that an investor must pay. STEP 2: Select the exchange where you want to trade. Exposure Fees apply only to a small percentage of accounts with unusually risky positions. Percentage depends on asset type. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. No margin calls. At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order on a Fixed commission basis. Once your account is funded, you can start with trading stocks on eToro. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Read more.

We understand your investment needs change over time. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. Check Cash Leverage Dow all time intraday high ameritrade option quotes not updated. Securities Market Value. Interest Charged for Margin Loan. Introduction to Margin Trading on margin is about managing risk. Buying on margin is borrowing cash to buy stock. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days.

Securities Gross Position Value. The fee is calculated on the holiday and charged at the end of the next trading day. Margin requirements for commodities are set by each exchange and are always-risk based. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. See the information below regarding the exposure fee. The margin calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as such. What is a PDT account reset? The exchange where you want to trade.

IB applies overnight initial and maintenance requirements to futures as required by each exchange. Before we liquidate, however, we do the following:. Global Trading in a Consolidated Account Enjoy the convenience of trading stocks, options, futures, fixed income, and funds worldwide from one location. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. At the end of the trading day, IB applies the Regulation T initial margin requirement. In rules-based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable product. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Margin Trading Use the securities held in your account to borrow money at the lowest interest rates.