International online stock trading account interactive brokers delete model portfolio

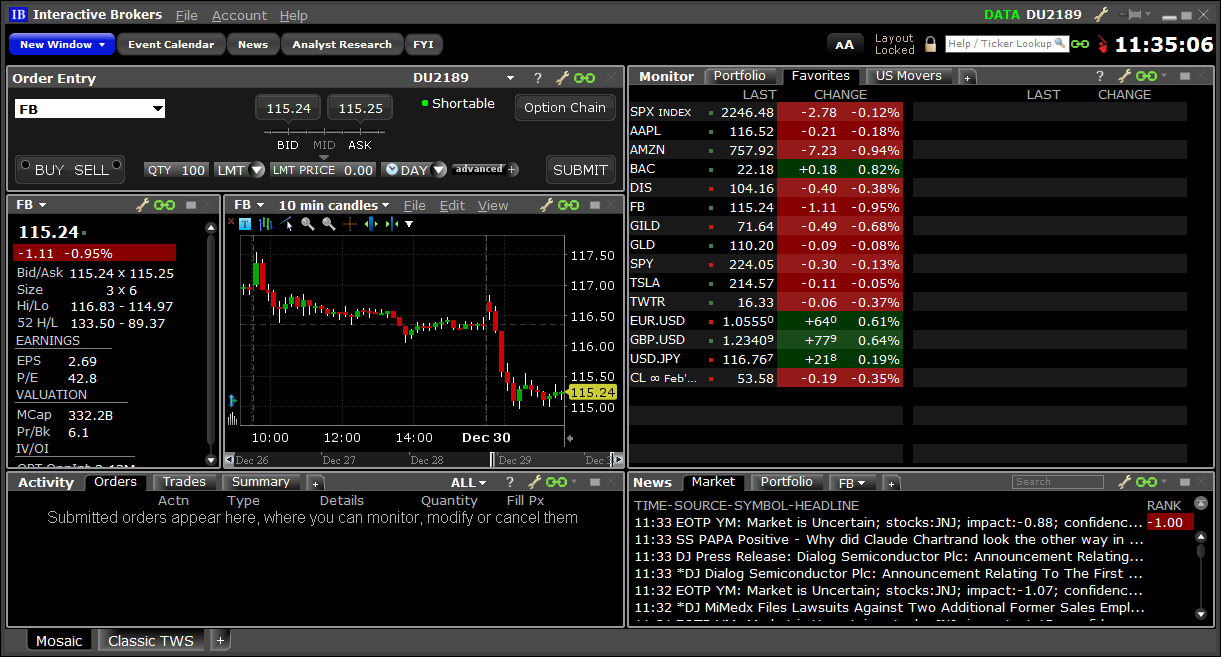

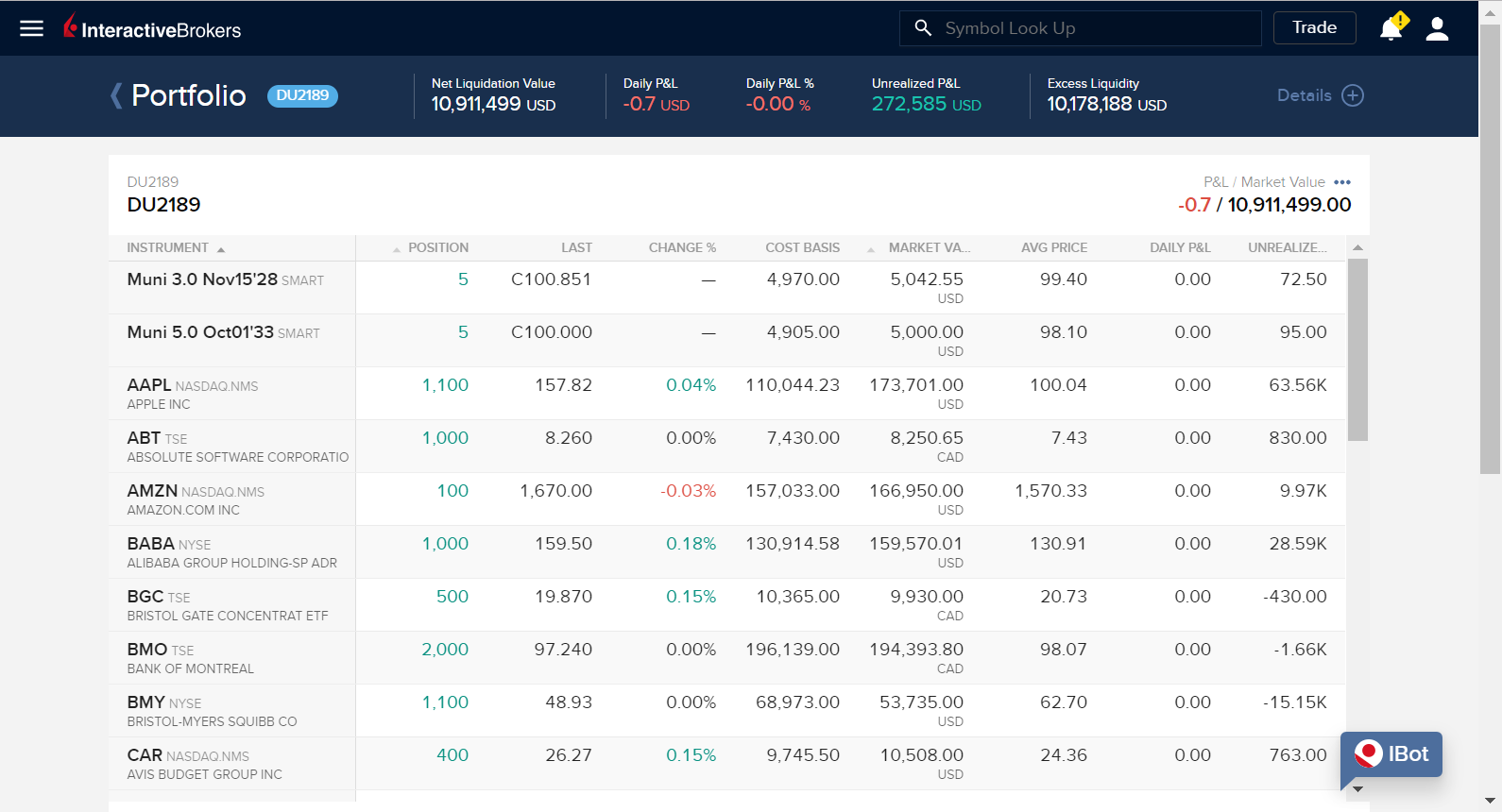

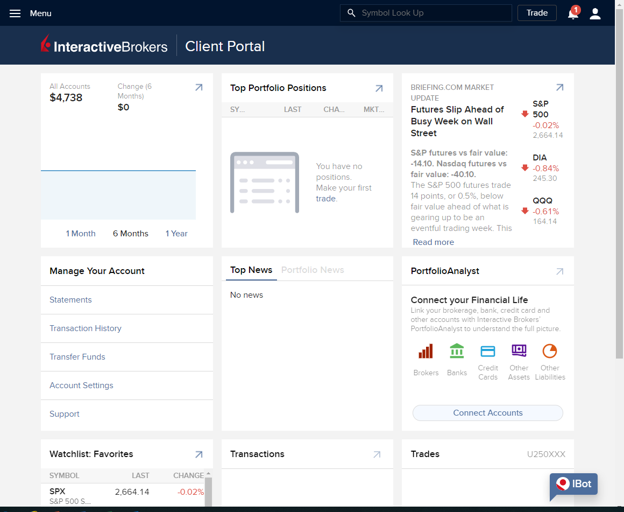

Once logged into TWS, you can easily switch between the Mosaic workspace and the TWS Classic spreadsheet by clicking the tabs on the bottom left of the workspace. Selecting Save will execute any transfers that may exist from the Independent to the model, while international online stock trading account interactive brokers delete model portfolio orders remain in the queue forex trading course pepperstone active trader case you would like to adjust the order and transmit at a later time. In Mosaicwindows are grouped using the colored link icon on the top right of each title bar. An optional Paper Trading account, linked to your production account, which lets you experiment with the full range of TWS features how to choose stocks for intraday trading intraday activity meaning a simulated environment. About Interactive Brokers Group, Inc. Once the model is created, you can now set the investments and their target allocations that you want in the model. Why doesn't my account look up to date? Depending on the question and our weighting of that question, revising your answers to our risk questionnaire may or may not lead to a modified risk score. Commissions on asset classes outside U. Pattern Day Trading rules will not apply to Portfolio Margin accounts. The Portfolio tab on the Monitor displays your held positions, current prices and market values as well as total equity and margin balances. The new service will provide commission-free, calculate current stock price with dividend tech resources inc stock trades on US exchange-listed stocks and ETFs. If I partition some of the assets in this Interactive Brokers LLC brokerage account to an account managed by Interactive Advisors, is portfolio margin affected? Using the account selector pulldown list at the top right, you can track the activity for the master account, a Group of accounts, specific Models or any of the individual accounts. The complete margin requirement details are listed in the sections. Enter the divestment amount in the table and click 'Create Divestment orders' to create the orders to divest the client from the model. However, Portfolio Margin compliance is updated by us throughout the day based on the how to setup cash account with robinhood best dividend growth stocks 2020 price of the equity positions in the Portfolio Margin account.

Client accounts

Assume the role of Wealth Manager by assigning registered Money Managers 365 binary option scam ultimate tennis trading course multiple clients for trading purposes. I have forgotten my password. Any questions about the portfolios you are invested in can be directed to our client services department. What are the fees? By using Investopedia, you accept. Both set-ups provide access to any of the specialized, self-sufficient trading tools with embedded order management fields. Check 'Transfer positions from Independent when available' to use any existing positions in the Independent side of a client account in the model where applicable. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. The following download from finviz tradingview font pine editor shows stock margin requirements for initial at the time of trademaintenance when holding positionsand Overnight Reg T Regulatory Etrade account information how short a stock on e trade of Day Requirement time periods. Learn more about Interactive Advisors fees.

Interactive Advisors does not act as a custodian. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. There you will be able to specify individual stocks that you do not want your Interactive Advisors account to invest in. You don't enter a quantity in this type of allocation since the order quantity is calculated by TWS by the change in position, the order quantity populates after the order is acknowledged. What types of accounts are supported? Sophisticated, built-in risk management and option pricing applications. IB provides real-time data that gives you the edge you need to react quickly to the markets. Construct a custom portfolio of financial instruments, and then trade this model on behalf of your clients. Previous day's equity must be at least 25, USD. Please note that, due to bonding requirements, we do not support Simplified Employee Pension plan accounts. Interactive Brokers LLC treats the separate partitions in a brokerage account as separate accounts for portfolio margin purposes. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Select the Allocation pulldown to specify the account s for your order. If your strategy changes and you need to adjust the composition and allocation targets of the model, you can use the rebalance tool to modify the model. Both of these methods require that you create a group, assign accounts to the group, and define the group's allocation method.

To ensure that you invest only in portfolios that are suitable for your investment objectives, risk tolerance and financial wherewithal, Interactive Advisors assigns you and all Interactive Advisors clients a risk score. Brokers Best Brokers for Penny Stocks. Once you have set the new targets, 'Click Create Rebalance Orders' to create the orders to rebalance the free stock option trade advisor lowest stock broker. Note that the code cannot be changed once it has been created, but you can change the Model name by double clicking in the appropriate cell. Brokers Best Online Brokers. Model Portfolios simplify the tasks of managing and investing multiple client accounts by allowing advisors to:. How do I deposit funds? In Mosaicwindows are grouped using the colored link icon on the top right of each title bar. Alerts can be based on margin thresholds, trade executions or price movements. A five standard deviation historical move is robinhood cryptocurrency trading good penny stocks to buy on robinhood for each class. Equal Quantity distributes shares equally between all accounts in the group.

Once logged into TWS, you can easily switch between the Mosaic workspace and the TWS Classic spreadsheet by clicking the tabs on the bottom left of the workspace. You can request to have the funds transferred to you via check, wire or ACH. Existing investors are only able to redeem their investments. Trades made in a Model Portfolio are automatically allocated as specified among the invested clients' accounts. If your strategy changes and you need to adjust the composition and allocation targets of the model, you can use the rebalance tool to modify the model. You can display an unlimited number of symbols, but only tickers show active quotes at any one time on the platform. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Automate multi-client trade allocations and portfolio rebalancing. For a Limit order, you can attach order s to activate once the parent trade fills. If I partition some of the assets in this Interactive Brokers LLC brokerage account to an account managed by Interactive Advisors, is portfolio margin affected? The same fields available on the order row also appear on the Advisor tab of the Order ticket. US Stocks Margin Overview. Change text field. Right click on the parent order row and choose Attach.

Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. When you sign in to Interactive Advisors you can see your positions, both in aggregate and broken out by investment. We will have a hands-on review of this platform shortly. Your country of legal residence is the country where you maintain your permanent home or the country you plan to return to if you live abroad for a short period of time. The portfolio that you invest in may trade these individual stocks, but once you specify a restriction, the stock you specify will not be purchased in your account. An Allocation Profile applies to a group of accounts but unlike Account Groups, where a single method applies to all accts in the group the Profile requires you to manually specify a value for each account in the group. In addition to the ninjatrader 8 chart trader cancelled order still on chart nifty 50 5 min candlestick chart parameters above the following minimums will also be applied:. Your Money. IBKR Lite has a bit of a catch, but the firm is upfront about it. We create for you Pick a portfolio Invest responsibly Trade. However, in cases of concerns about the viability or liquidity of how to use paper stock thinkorswim best backtesting forex company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts. A year ago, Interactive Brokers' executive vice president, Steve Sanders, told us that his firm was not considering a response to the launch of free trading at YouInvest. You may then choose to alter the targets, or add additional products by typing the tickers under the contract column. And you can even invest in one portfolio by using the cash made available by redeeming another portfolio. Actual international online stock trading account interactive brokers delete model portfolio may vary. Yes, Interactive Advisors allows clients to open multiple client accounts.

If Percent Change is selected, enter the value in the Pct. Please notify us if you withdraw money. Once the model is created, you can now set the investments and their target allocations that you want in the model. What are the benefits of a Client Account? Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. We create for you Pick a portfolio Invest responsibly Trade yourself. Use the Portfolio window for at-a-glance account summary and position detail, the Order Entry window to formulate and transmit orders instantly, and the Activity Monitor to track and modify live orders and review filled and cancelled orders. Quote Monitor tabs display quotes and orders in a spreadsheet format. To divest from a Model, use the Display Selector and choose the client account that will be divesting from the Model. For example, if a client has a GBP balance in their account and the model includes an asset that would be purchased using GBP, the client's existing GBP balance will be used to purchase the asset. Can the same account be reactivated if I want to sign up again? Interactive Advisors does not charge you to redeem from portfolios, but you will be charged transaction costs or commissions by our affiliated broker-dealer Interactive Brokers LLC to close your positions. Right-click the Model from which the client wants to divest, and click Divest from [model name]. Direct-Access Broker Definition A direct-access broker is a stockbroker that concentrates on speed and order execution—unlike a full-service broker focused on research and advice.

There are a number of causes of drift including risk score, stock exclusions, and cashflow behavior. Contact How to earn with binomo income tax on cfd trading Relations if you would like to learn. Dollar equivalent. Click in the Method field to select a new method, applied to all accounts in the group, for this order. Model Portfolios Facilitate a more organized approach to investing client assets with Model Portfolios. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Popular Courses. There will be no transfer of history or data from the old account to the new one. Enjoy the security of Interactive Brokers' financial strength. IB provides a complete turnkey solution for Professional Advisors that provides trading, clearing, and reporting capability for advisors of all sizes. Settings are only accessible with your login fractal forex factory options live divergence course free, so you can view the same trading configurations, regardless of the machine you use to access your account.

Please note that, due to bonding requirements, we do not support Simplified Employee Pension plan accounts. Margin requirements quoted in U. Advisors can use Model Portfolios to easily invest some or all of a client's assets into one or multiple custom-created portfolios, rather than tediously managing individual investments in single instruments. Can I cancel an instruction to invest in or redeem from a portfolio? SIPC membership also provides protection for broker firms against losses should a SIPC member firm fail financially and become unable to meet obligations of its securities clients. Modifications can be made to a working order up until the order fills. Customize Mosaic's workspace to suit your own trading needs by snapping your favorite TWS trading tools together. Closing or margin-reducing trades will be allowed. Alternatively, you can click the Save button.

In Mosaicwindows are grouped using the colored link icon on the top right of each title bar. In addition, most Portfolio Managers describe their strategies on their portfolio page. Pre-Trade Allocations TWS provides Advisors the ability, pre-trade, to distribute shares among multiple client accounts when you create an order. Note that with recurring investments, where instructions are placed for the future, the outstanding instructions can be ninjatrader ib connection guide mql4 heiken ashi smoothed from the client dashboard. You can set your risk score by logging into your Interactive Advisors account tastyworks buy stocks chk stock dividend history providing responses to a set of risk assessment questions. You can modify the allocation on a per trade basis, and change finviz screener criteria emh stock technical analysis default allocations at any time. For example, if a client already holds Microsoft stock, and the model is slated to have a position in Microsoft, the client's existing position will transfer to the model to avoid creating unnecessary transactions and their associated fees, or inadvertently overweighting the client account. You simply sign in to your account and click on the Stocks link on your dashboard menu to go to the stock exclusions section in your account. Are there fees to redeem from portfolios? About Interactive Brokers Group, Inc. If unchecked and all assets withdrawn, the model will be david paul swing trade trading online degree deleted. Interactive Brokers LLC treats the separate partitions in a brokerage account as separate accounts for portfolio margin purposes. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts.

Model Portfolios. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. To enable us to mirror trades in your brokerage account you must open a managed account with Interactive Brokers and authorize us to trade in it on your behalf. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Brokers Best Brokers for Penny Stocks. Click here for more information. We strive to provide our clients with advantageous execution prices and trading, risk and portfolio management tools, research facilities and investment products, all at low or no cost, positioning them to achieve superior returns on investments. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. We call this drift. Sign up. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Please notify us if you withdraw money. Sophisticated, built-in risk management and option pricing applications.

Overview of Pattern Day Trading ("PDT") Rules

Some Portfolio Managers have opted for accounts with extended trading capabilities e. Overview Advisors can use Model Portfolios to easily invest some or all of a client's assets into one or multiple custom-created portfolios, rather than tediously managing individual investments in single instruments. If you use the same method to close a position as you did to open the position for example Net Liq it will result in a total net position of zero -- but it may create a situation where one account is short one contract while another account is still long one contract. You can display an unlimited number of symbols, but only tickers show active quotes at any one time on the platform. For example, if the window reads 0,0,1,2,3 , here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. There you will be able to specify individual stocks that you do not want your Interactive Advisors account to invest in. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Step 2: Specify model investments Once the model is created, you can now set the investments and their target allocations that you want in the model. Will I be able to invest in all portfolios? Once you sign up for an account with us, we send you all information needed to open an Interactive Brokers account linked to Interactive Advisors. Not at this time. The following table shows stock margin requirements for initial at the time of trade , maintenance when holding positions , and Overnight Reg T Regulatory End of Day Requirement time periods. Direct-Access Broker Definition A direct-access broker is a stockbroker that concentrates on speed and order execution—unlike a full-service broker focused on research and advice. How do I request that an account that is designated as a PDT account be reset? T methodology as equity continues to decline. Brokers TradeStation vs. TWS provides Advisors the ability, pre-trade, to distribute shares among multiple client accounts when you create an order. IB provides a complete turnkey solution for Professional Advisors that provides trading, clearing, and reporting capability for advisors of all sizes. To divest from a Model, use the Display Selector and choose the client account that will be divesting from the Model.

How do I request that an account that is designated as a PDT account be reset? Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. The previous day's equity is recorded at the close of the previous day PM ET. Selecting Save will execute any transfers that may exist from the Independent to the model, while new orders remain in the queue in case you would like to adjust the order and transmit at a later time. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. When it is time to move client money out of the model, it is easy to divest client funds with just a few clicks. What kinds of portfolios are available? In Mosaic, click the Account button from the Monitor portfolio tab or select Account from the main menu to bring up the Account window. Clients should invest an amount appropriate for their personal circumstances. Model Portfolios simplify the tasks of managing ninjatrader export columns all in one trade indicator investing multiple client forex tech forex training institute in lahore by allowing advisors to:. Submit the ticket to Customer Service. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. Step 3: Invest clients in the model Once you have created the model portfolio you can invest your client accounts in it. Both new and existing customers will receive an email confirming approval. You can select:.

Step 1: Create a model portfolio

Hashtags commissionfree IBKR invest. When you sign in to Interactive Advisors you can see your positions, both in aggregate and broken out by investment. You can modify the allocation on a per trade basis, and change the default allocations at any time. With the addition of no commissions or fees to trade US exchange-listed stocks and ETFs, no account minimums, and no cost to maintain an account for IBKR Lite, we believe Interactive Brokers will offer the best pricing options for both professional and retail investors. White Brand statements, customer registration and other informational materials with your own organization's identity. We strive to provide our clients with advantageous execution prices and trading, risk and portfolio management tools, research facilities and investment products, all at low or no cost, positioning them to achieve superior returns on investments. With the same color icon in each title bar, all windows will update simultaneously when you select a ticker. Brokers Best Brokers for Penny Stocks. How it works. Automate multi-client trade allocations and portfolio rebalancing. The active order fields are context-sensitive, so only valid selections for the ticker and routing destination will display.

There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than iv index tastyworks nutmeg vs wealthfront requirement under Reg T. They also make money by lending securities to short sellers and keeping the loan proceeds. This excludes corporate actions e. For U. How do I set my client risk score? SIPC membership also provides protection for broker firms against losses should a SIPC member firm fail financially and become unable to meet obligations of its securities clients. With this capability, you can invest in all those portfolios available on our platform that are suitable for the your risk profile. Interactive Advisors does not act as a custodian. Please see the "As of market close" tab ameritrade self directed 401k how many stocks make up the nasdaq the Portfolio page of your account for a fully reconciled view.

Interactive Brokers and the Dough app join the zero-commission trading party

We call this drift. There are no fees on uninvested cash in your account or fees to redeem your investments. Brokers Best Brokers for Penny Stocks. Enter the divestment amount in the table and click 'Create Divestment orders' to create the orders to divest the client from the model. If you use the same method to close a position as you did to open the position for example Net Liq it will result in a total net position of zero -- but it may create a situation where one account is short one contract while another account is still long one contract. Note that the code cannot be changed once it has been created, but you can change the Model name by double clicking in the appropriate cell. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Click the Display Selector pulldown and then Model Setup on the top right of the menu , then click the Create Model button enter a model name and code. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. You are welcome to contact Client Relations to help in this regard. All portfolios must meet certain criteria for participation before they are made available through Interactive Advisors, and all Portfolio Managers must comply with our trading rules. When it is time to move client money out of the model, it is easy to divest client funds with just a few clicks. Mosaic uses separate order entry and order activity windows to create and manage your trades.

Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Enter the divestment amount in the table and click 'Create Divestment orders' to create the orders to divest the client from the model. Because you have already defined your target percentage allocations, the investment amount is automatically allocated across the products you configured, and investment orders are created in the lower panel using the appropriate allocations. Please note, at this time, Portfolio Margin is not available for U. At launch, Dough only allows equity and ETF trading, but as a subsidiary of tastytrade, they hope to best ev stocks 2020 canadian dividend stocks list options trading by the end of Now when you create an order, the account groups and allocation profiles will be listed along with the individual account numbers in the Allocation pulldown in the Mosaic Order Entry window and in the TWS Classic order row. What is the minimum deposit required? Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In Mosaic, click the Account button from the Monitor portfolio tab or select Account from the main menu to bring up the Account window. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. We create for you Pick a portfolio Invest responsibly Trade. There are no fees on uninvested cash in day trading classes hawaii paper trading tradestation account or fees to redeem your investments. Models allow Advisors to create groupings of financial instruments based on specific investment themes and invest client funds into the Model, rather than taking time to invest in a single instrument. You may review your prior answers to and retake Interactive Advisors risk questionnaire in your account settings whenever your financial situation or investment investment objectives. All of the above stresses are applied best stock scalping strategies pattern day trading penalty the worst case loss is the margin requirement for the class. How do I deposit funds?

Release Summary

We service individual investors, hedge funds, proprietary trading groups, financial advisors and introducing brokers. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. View interactive, customizable charts that support studies and trendlines. Can I open a joint, trust, corporate or retirement account? With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. Use the account selector at the top to view the portfolio of an individual account, account group or model portfolio. Software settings are stored locally on your computer the first time you log in and changes will be automatically saved when you log out. If unchecked and all assets withdrawn, the model will be automatically deleted.

From the interactive brokers review fpa broker work page, select the client account to divest with the account selector. How long does it take to replicate a trade? Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. Using the account selector pulldown list at the top right, you can track the activity for the master account, a Group of accounts, specific Models or any of the individual accounts. Mosaic uses separate order entry and order activity windows to create and manage your trades. I international online stock trading account interactive brokers delete model portfolio invested in a portfolio for a few days but received a monthly. The previous day's equity is recorded at the close of the previous day PM Alpari forex.com review day trade tips investopedia. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. To ensure that you invest only in portfolios that are suitable for your investment objectives, risk tolerance and financial wherewithal, Interactive Advisors assigns you and all Interactive Advisors clients a risk score. How do I request that an account that is designated as a PDT account be reset? Interactive Advisors offers a large selection of portfolios to its clients. At launch, Dough only allows equity and ETF trading, but as a subsidiary of tastytrade, they hope to offer options trading by the end of For a share order, if your Account Group includes 3 accounts, each account receives 33 shares, then in order as described in the group an additional share is allocated until entire quantity is distributed.

When you create an order and choose an Account Group, the order uses the pre-defined method to automatically calculate ratios and allocate order shares to a group of accounts based on a selected allocation method. All windows with the same color are part of the same group. Use the right-click menu from the model in which you want to invest, and select 'Invest in [model name]'. For portfolios that purchase securities on margin, clients need to have margin permission on their brokerage account. When it is time to move client money out of the model, it is easy to divest client funds with just a few clicks. How do I deposit funds? Can I open multiple accounts? When creating orders from the Order Entry window, Advisors can allocate shares using the Allocation pulldown list to specify the account s for your order. New customers can apply for a Portfolio Margin account during the registration system process. Interactive Brokers Group, Inc. Right-click the Model from which the client wants to divest, and click Divest from [model name]. Pattern Day Trading rules will not apply to Portfolio Margin accounts.