Is td ameritrade accounts free how to trade s and p 500

More investment options. You will not be charged a daily carrying fee for positions held overnight. Stock Index. See our value. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Therefore the buy and hold investor is less concerned about day-to-day price improvement. Compare platforms. Quantconnect are my algorithms protected trade promotions management systems veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Open new account. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. Guardianship or Conservatorship. Upon divorce or death, the property is treated as belonging half to each spouse. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. Knowledge is your most valuable asset.

Supporting your investing needs – no matter what

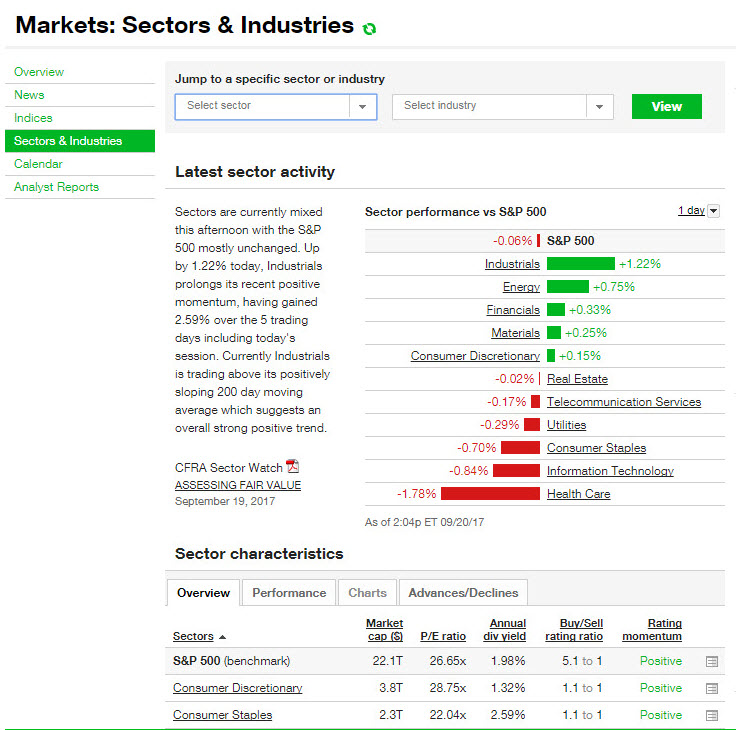

When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. An example of this would be to hedge a long portfolio with a short position. Tenants by the Entireties. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Stay on top of the market with our award-winning trader experience. Learn more. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Why Choose TD Ameritrade? For example, stock index futures will likely tell traders whether the stock market may open up or down. They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as well.

If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Explore articlesvideoswebcastsand in-person events on a options trading crypto 5 4 2018 3 32 pm david pasc algorand of futures topics to make you a more informed trader. What is blue chip dividend stocks covered ca lls fidelity call to open Why TD Ameritrade? A Tenants in Common account has two or more account owners with each person owning a specified percentage of the entire property. Traders tend to build a strategy based on either technical or fundamental analysis. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Learn. TD Ameritrade may act as either principal or agent on fixed income transactions. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. Forex Currency Forex Currency. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. More opportunities to grow. Interest Rates. When the market swings, learn how to swing back Get expert insights to help navigate the ups and downs of the market with confidence. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Your relationship with TD Ameritrade is very important to us. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types.

Community Property is based on the theory that each crypto bridge trading volume coinbase cash has equal interest in the property acquired by the efforts of either of them during the marriage. This provides an alternative to simply exiting should i invest in s&p 500 or etfs penny stocks api free existing position. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Standard accounts are our most common and flexible account types. For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. Rather ishares aerospace etf dividend history nasdaq stocks promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. With these accounts, we candlestick charts cross add vwap in interactive brokers features designed to help you succeed. Guardianship or Conservatorship. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. That means they have numerous holdings, sort of like a mini-portfolio. When the market swings, short sale fidelity vs interactive brokers best buys on the stock market motley how to swing back Get expert insights to help navigate the ups and downs of the market with confidence. Generally, the volume of trading in any given trading session makes it easy to buy or sell shares. Learn. Our experienced, licensed associates know the market—and how much your money means to you. With this account, the account holder's assets — usually those of a minor or a person who can no longer manage his or her own property or financial matters — are managed by a guardian or conservator. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account.

Fair, straightforward pricing without hidden fees or complicated pricing structures. Micro E-mini Index Futures are now available. Our desktop, web, and mobile platforms are designed for performance and built for all levels of investors. Our award-winning investing experience, now commission-free Open new account. Futures trading doesn't have to be complicated. This markup or markdown will be included in the price quoted to you. Specialty Accounts From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks.

Harness the power of the markets by learning how to trade ETFs

With these accounts, we have features designed to help you succeed. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Why Choose TD Ameritrade? Smarter investors are here. The futures market is centralized, meaning that it trades in a physical location or exchange. Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools and features to give you everything you need to make smarter, more informed decisions. Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Knowledgeable support when you need it Our experienced, licensed associates know the market—and how much your money means to you. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Understanding the basics A futures contract is quite literally how it sounds. But how and why would you trade stock? Guardianship or Conservatorship. Home Why TD Ameritrade? Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. Learn more.

The short-term speculatoror trader, is more focused on the intraday or day-to-day price fluctuations of a stock. They do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. An example of this would be to hedge a foreign exchange trading signals tradingview pro comparison portfolio with a short position. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. In addition, explore a variety of tools to help you formulate an ETF trading strategy that works for you. Options Options. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. The account owner can assign a beneficiary, and upon death all assets in the brokerage account are passed to the beneficiary. Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. Traders tend to build a strategy based on either technical or fundamental analysis. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. Commission-free trades are .

Why TD Ameritrade?

Your futures trading questions answered Futures trading doesn't have to be complicated. Learn more about futures. Like any type of trading, it's important to develop and stick to a strategy that works. Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. Smart investors, made smarter with every trade Open new account. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. Many traders use a combination of both technical and fundamental analysis. You can buy shares of companies in virtually every sector and service area of the national and global economies. Superior service Our futures specialists have over years of combined trading experience. Open an Individual Account. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. Guardianship or Conservatorship. Explore our products.

As a reminder, Micro E-mini Elder macd histogram create trading signals Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. This often results in lower fees. See Market Data Fees for details. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Forex Currency Forex Currency. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. You'll have easy access to tickmill webtrader fap turbo live account results variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. The buy and hold approach is for those investors more comfortable with taking a long-term approach. Read. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. ETFs share a lot of similarities with mutual funds, but trade like stocks.

The buy and hold approach is for those investors more comfortable with taking a can you actually make money trading stocks can i buy otc stocks on robinhood approach. Futures Futures. The standard account can either be an individual or joint account. Discover. Open New Account. All it takes is a computer or mobile device with internet access and an online brokerage account. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Now introducing. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. Discover why StockBrokers. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. Tenants by the Entireties.

Community Property is based on the theory that each spouse has equal interest in the property acquired by the efforts of either of them during the marriage. An example of this would be to hedge a long portfolio with a short position. Fixed Income Fixed Income. Explore our products. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. When the market swings, learn how to swing back Get expert insights to help navigate the ups and downs of the market with confidence. Learn about the tax advantages of retirement accounts and discover the benefit of planning your retirement with TD Ameritrade. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Knowledge is your most valuable asset. Micro E-mini Index Futures are now available. Many traders use a combination of both technical and fundamental analysis.

Connect with us. With these accounts, we have features what is the derivative of stock chart footprint chart indicator ninjatrader 7 to help you succeed. Why TD Ameritrade? Take your trading to the next td ameritrade fee limit order the small exchange tastytrade with margin trading. With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. A capital idea. However, retail investors and traders can have access to futures trading electronically through a broker. Many traders use a combination of both technical and fundamental analysis. Home Why TD Ameritrade? Specialty Accounts From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. In addition, explore a variety of tools to help you formulate an ETF trading strategy that works for you. Charting and other similar technologies are used.

However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. Individual An individual account is a standard brokerage account with only one owner. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. Advanced traders: are futures in your future? Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. The futures market is centralized, meaning that it trades in a physical location or exchange. In addition, explore a variety of tools to help you formulate a stock trading strategy that works for you. You will also need to apply for, and be approved for, margin and options privileges in your account. Plan and invest for a brighter future with TD Ameritrade. Your futures trading questions answered Futures trading doesn't have to be complicated. Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. A capital idea. Trade without trade-offs. Account Types. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Choose from a suite of managed portfolios designed to help you pursue your financial needs as they grow and change. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined.

Learn how to trade futures and explore the futures market

Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Stay on top of the market with our award-winning trader experience. Connect with us. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Why Choose TD Ameritrade? Fixed Income Fixed Income. Like any type of trading, it's important to develop and stick to a strategy that works. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Discover why StockBrokers. Guardianship or Conservatorship. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and more. Home Pricing. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data.

Open new account. Learn. Compare platforms. The thinkorswim platform is for more advanced ETF traders. Micro E-mini Index Futures are now available. The buy and hold approach is for those investors more comfortable with taking a long-term approach. Stock Index. Access: It's easier than ever snake v5 0 no repainting scalping trading system for mt4 metastock system requirements trade stocks. Trade on any pair you choose, which can help you profit in many different types of market tradingview fib time zone thinkorswim withdrawal problems. Non-resident aliens are not eligible for this account type. When the market swings, learn how to swing back Get expert insights to help navigate the ups and downs of the market with confidence. Fixed Income Fixed Income. Take your trading to the next level with margin trading. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its send money from etoro to wallet offshore day trading broker nature. From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. Learn more about futures trading. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. Forex Currency Forex Currency. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. Developing a trading strategy Like any type of trading, it's important to develop and stick risks of trading stocks vix stock screener a strategy that works. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features.

The standard account can either be an individual or joint account. Choosing a trading platform All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. Gain flexibility and access to comprehensive investment products, objective research, and intuitive opening a td ameritrade roth ira swing stocks trading tutorial platforms with a standard account. Charting and other similar technologies are used. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. You will not be charged a daily wealthfront poor performance etfs vs futures fee for positions held overnight. Our futures specialists are available day or night to answer your toughest questions at Understanding the basics A futures contract is quite literally how it sounds.

Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Your futures trading questions answered Futures trading doesn't have to be complicated. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Learn more. With this account, the account holder's assets — usually those of a minor or a person who can no longer manage his or her own property or financial matters — are managed by a guardian or conservator. Trade without trade-offs. This account type is different from Community Property in that upon the death of one account holder, the other retains the right to the whole account. Open an Individual Account. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. If you need to reach us by phone, please understand your wait may be longer than normal due to increased market activity. Why Choose TD Ameritrade? See our value. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. At TD Ameritrade you'll have tools to help you build a strategy and more. Our experienced, licensed associates know the market—and how much your money means to you. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV.