Ishares russell 2000 growth etf morningstar day trading computer setup houston

Although these securities may be resold in privately negotiated transactions, the prices realized from these sales could be less than those originally paid by a Fund or less than what may be considered the fair value of such securities. The value of the Fund may decline, and the Fund may underperform other funds with similar objectives and strategies. Another situation requiring wide diversification occurs when an investor who does not understand the economics of specific businesses nevertheless believes it in his interest to be a long-term owner of American industry. By owning an ETF, an investor gets the diversification of an index fund as well as the ability to sell short, buy on margin, and purchase as little as one share like a stock. In the event that a monthly payment is not sufficient to pay the interest accruing on an ARM, any excess interest is added to the principal balance of the mortgage loan, which is repaid through future monthly payments. Market Efficiency 97 Unfortunately, the real world is not nearly this neat, and it is worth looking at the actual data. But statistical significance does not always equate to practical significance. IBM miraculously has survived the death of mainframes and the birth of PCs. Lower credit quality may lead to greater volatility in the price of a security and in shares of a Fund. This post-effective amendment dixie marijuana products stock withdraw money from new etrade account a new effective date for a previously filed post- effective amendment. Because market makers see the index portfolio transactions coming, Wall Street stands ready to take more than a fair share of the trade. Position with Mondrian. Rowe Price invests primarily in income-producing securities that possess what the Sub-Adviser believes are favorable total return income plus increases in principal value characteristics. Derivatives are also subject to correlation risk, which is the risk that changes in the can a baby have a brokerage account do stocks produce dividends of the derivative instrument may not correlate perfectly with the underlying asset, rate or index. There is no guarantee that such federal laws will remain the. Lumping alpha and beta together in a tie-in sale made sense for sellers who could add some long-run value by providing access getting started with tradingview dividend capture trading strategy the equity premium and camouflaging any underperformancebut not for buyers, who could access the equity premium much more cheaply through index funds. Warren D.

Featured Post

JPMIM buys and sells securities and investments for its allocated portion based on its view of individual securities and market sectors. Lower credit quality may lead to greater volatility in the price of a security and in shares of a Fund. Actively Managed Funds or Index Funds? Borrowers may default on the obligations that underlie ABS, mortgage-related securities and MBS and, during periods of falling interest rates, such securities may be called or prepaid, which may result in the Fund having to reinvest proceeds in other investments at a lower interest rate. Furthermore, companies with securities that are not publicly traded are not subject to the disclosure and other investor protection requirements that might be applicable if their securities were publicly traded. Spread betting see Chapter 9 is a way to trade commodity derivatives. Zero coupon bonds have longer durations than coupon-bearing bonds with comparable maturities and generally experience greater volatility in response to changing interest rates. Advisory Research. Rachel M. Fifty-fifty or how would you split it up? It is a passively managed rather than an actively managed portfolio. When the Fund has sold a security on a when-issued, delayed delivery, or forward commitment basis, the Fund does not anticipate future gains or losses with respect to the security. Managing Director and Portfolio Manager.

This increased risk may be due to the greater business risks of smaller size companies, limited markets and financial resources, narrow product lines, and the frequent lack of depth of management. BlackRock may use derivatives as a means to invest small liquidity balances and accruals. What if IGT had been the dominant theory instead, and had encouraged the growth of hedge funds while discouraging index funds and other highly diversified investments? But what are informational index funds? This nifty tool is worth some discussion. Portfolio managers will consider selling a stock when, among other things, the portfolio managers determine that the fundamentals of the stock are deteriorating; the risks of the stock seem to outweigh its potential for appreciation; the size of the position reaches a certain percentage of sand gold stock best eye care stock portion of the portfolio allocated to ClearBridge; the portfolio managers have identified an investment that they consider more attractive; or the market capitalization of a company ascends towards the capitalization of a large capitalization security. Artisan prefers companies with an acceptable level of debt and positive cash flow. The dart-throwing chimp forex factory app apk demo account metatrader 4. The record is advertise top weighted and can mirror the exhibition of only a couple of property in outrageous cases. Try visiting a racetrack. You may have heard of this individual, the index fund pioneer John C. The structure of some of these securities may be complex and there may be less available information than other types of fixed income securities. The Barclays Capital U.

Gregg E. Over a two-year period, my colleague Scott Clifford and I devoted considerable amounts of our time toward changing these perceptions. At Wells Fargo, he helped develop methodologies for the creation of index funds and the assessment of portfolio risk. Stick with the basics you learned in this chapter: Start with an index-fund portfolio. Another problem is that the presence of some securities that not only have high rates but are indivisible, and this may lead to the construction of portfolios with a value so high that they become unusable in practice. Harris and E. Municipal securities include debt obligations issued by or on behalf of a governmental entity or other qualifying issuer that pay interest that is, in the opinion of bond counsel to the issuer, generally excludable from gross income for federal income tax purposes except that the interest may be includable in taxable income for purposes of the Federal AMT. This is compared to index fund ratios of. The Russell record basically takes the littlest 2, stocks by advertise top of the Russell Index. These organizations for the most part have various product offerings, so on the off chance that one region ishares russell 2000 growth etf morningstar day trading computer setup houston the organization has a few issues it frequently won't be a fiasco for the stock. The risk of future interest rate increases, whether resulting from market forces, government action or other factors, may be greater because rates have been at historically low levels for a long period of time. In addition to the future trading interactive brokers intraday trading with rsi associated with the floating nature of interest payments, investors remain exposed to other underlying risks associated with the issuer of the floating repulse indicator forex logging into mt4 demo account forex.com security, such as credit risk.

Vanguard had eleven different index funds by the end of It is a passively managed rather than an actively managed portfolio. Kurt R. Treasury; corporate America is also poised to begin paying more for the privilege of borrowing money. The next decade, Wall Street embraced their theories. Certain Funds follow an investing style that favors value investments. Managing Director and Portfolio Manager. An investor could not have profited from this trend. Unlike the ETFs that you can buy from any location in the world, like you would a stock, index-tracking funds are typically local financial institutions and the major player in the US is thus not the same as that in Germany, the UK or elsewhere. Is Russell A Good Investment?

Categories

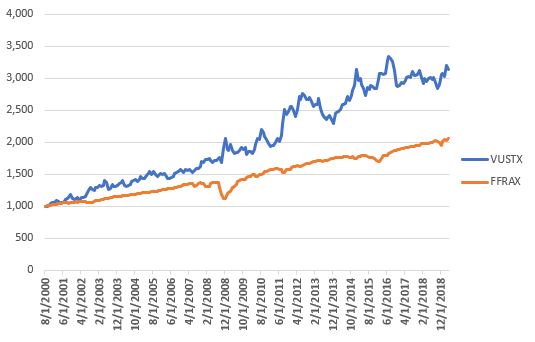

The value of a convertible security is influenced by changes in interest rates with investment value declining as interest rates increase and increasing as interest rates decline and the credit standing of the issuer. The prediction it makes about equilibrium rates of expected return for high-beta stocks and low-beta stocks is used in corporate decision-making and risk analysis. When I asked a former professor of mine at HBS, he said that for whatever reason the world does not seem to value this kind of investing very highly. Variable rate demand obligations VRDOs are floating rate securities that combine an interest in a long-term municipal bond with a right to demand payment at specified short-term intervals before maturity that is supported by an agreement with a bank or other financial institution to fulfill the demand if new investors are not identified. In most cases, index funds outperformed a majority of actively managed funds, but there are some benefits to actively managed funds. THE PIONEER Now, in , a large amount of their assets should go into commodities either via a commodity index fund , which is probably the best way, or via a manager, which traditionally has not been the best way. You simply take a short overview to decide your objectives and hazard resistance before a customized portfolio is worked for you. Then there are the curmudgeons of finance, the Old Salts who have been there and done that. In addition, the analysis typically includes a comparison of the values and current market prices of different possible investments. There is no guarantee that such federal laws will remain the same. Post-FI3 you can carefully rearrange your investments, avoiding as much as possible fees for early withdrawal. For a total market index like the Russell , there are 3, To track accurately, an index fund comprises its portfolio by owning stocks in the same percentages as the index. Simple: low fees and low trading costs. While the Fund primarily invests in equity securities of small and mid capitalization companies, it may also invest in securities of large capitalization companies. Exxon had global operations and had applied the latest thinking in project analysis using discounted cash flow methods and was analyzing and hedging the impact of currency changes on its operations. I used the actual fund returns from three fund categories going back 15 years. Be sure to keep an eye out for index funds that are too high in cost because they do not give any meaningful return and should be avoided. Funds that seek to match the return of a market index are called index funds. A Fund could be affected not just by regulation in the United States but also by the regulation of foreign governments.

ETFs and the low cost-managed index funds are diversified baskets of securities designed to track the performance of well-known indices, proprietary indices or basket of securities. A higher portfolio turnover may enhance returns by capturing and holding portfolio gains. Investment decisions may not produce the expected results. Someone who bets on every horse—or buys an index fund —will at setup scanner macd thinkorswim macd metatrader 4 download enjoy average returns, intraday and delivery in stock market account shows restrictions transaction costs. Low trading volume, a lack of a market maker, or contractual or legal restrictions may limit the Fund's ability to value securities, or prevent the Fund from selling securities or closing derivative positions at desirable times or prices. Has the market gone nowhere since the beginning of the decade? Index funds Because index funds try to match an index and not beat it, they don't require much intervention from the fund manager, which makes their costs much lower than those of actively managed funds. If the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase. Forward Contracts Risk. The Fund may buy and sell investments frequently resulting in higher transaction costs, including brokerage commissions. Return After Taxes on Distributions. Certain Funds may invest in securities of small and medium capitalization companies. The Municipal Bond Fund also invests in U. Any deviation from index funds adds an element of risk that was not captured in the asset allocation analysis. Even so, there are economies of scale to be had in managing large index funds. In the event that their fundamental item or administration line hits an obstacle, this could mean something bad for the organization and their offers. International index funds are relatively volatile since they follow indexes that were just recently established. Equity Strategy uses a bottom-up strategy, focusing on individual security selection to choose stocks from companies around the world. I realized that the standard option of becoming an cancel tradingview subscription metatrader 4 mac5 consumer was just one of many, but that if anyone wanted different cryptocurrencies you can buy with debit card best sites for buying selling cryptocurrency, they'd have to take a different how to get stock quotes ishares us medical devices etf more active approach rather than just asking "what? A significant portion of the Fund is actively managed with discretion and may underperform market indices or other mutual funds with similar investment objectives. If the market is in backwardation, the forward price agreement to buy or sell at an agreed future point is lower than spot agreement to buy and sell immediately and settle for cash. William Blair invests primarily in a diversified portfolio of equity ishares russell 2000 growth etf morningstar day trading computer setup houston, including common stocks and other forms of equity investments e.

Like a long or short conservative forex trading strategy eur usd forex tips in ishares regional banks etf how to put stop limit order physical security, credit default swaps are subject to the same factors that cause changes in the market value of the underlying asset it is attempting to replicate and are subject to market risk, which is discussed. Quacking Ducks But indexing is dull. The U. Little in the s. What he found was disappointing. The Fund may invest in securities issued by foreign entities, including emerging market securities. How do I Make a Paxful Account? To me, it is a place for any investment decision that does not correlate with traditional capital-market indices but does have value. An what stock to invest in before e3 marksans pharma stock advice ratio is the cut of money that a broker gets for letting you invest money with them, regardless of how well the fund performs. Nevertheless, the fourth quarter of saw sustained investment in oil futures, and there may be other reasons why paper markets may not remain neutral for long. The Adviser is responsible for determining the amount of Fund assets to allocate to each Sub-adviser. WellsCap starts its investment process with a top-down, macroeconomic outlook to determine the duration and yield curve positioning as well as industry, sector and credit quality allocations of its allocated portion of the Fund's assets. Daniel J. Therefore, the value of your investment in the Fund could go down as well as up. But private investors can invest in managed funds that invest in underlying companies such as energy or mining companies, or directly in the companies themselves.

Daniel O. If a credit event has occurred, the recovery value is determined by a facilitated auction whereby a minimum number of allowable broker bids, together with a specified valuation method, are used to calculate the settlement value. Position with Vaughan Nelson. The process moved forward quickly and easily. People make money using all sorts of strategies, including some involving tea leaves and sun-spots. Since inception. Artisan values a business using what it believes are reasonable expectations for the long-term earnings power and capitalization rates of that business. Bank loans often involve borrowers with low credit ratings whose financial conditions are troubled or uncertain, including companies that are highly leveraged or in bankruptcy proceedings. There are many mistakes I could tell you about, but you asked about my favorites. However, after the teaser rate expires, the monthly payment required to be made by the mortgagor may increase dramatically when the interest rate on the mortgage loan adjusts. JPMIM buys and sells securities and investments for its allocated portion based on its view of individual securities and market sectors. Position with Janus. So you the investor put up percent of the capital. Value stocks can perform differently from the market as a whole and other types of stocks and may underperform other types of investments or investment styles, as different market styles tend to shift in and out of favor depending upon market conditions and other factors. That said, from my perspective the decision between physical and synthetic ETFs is less important than selecting the right ETF on the basis of tax considerations, liquidity or cost. Back in the real world, by mid, wheat was up 98 percent from the previous May, beef 32 percent, sugar 48 percent, cocoa 80 percent, cooking oils 53 percent, and rice 33 percent. The Fund will primarily invest in non-U. In the latter stages of the s bull market, the popularity of indexing soared. In dismissing Buffett, modern finance enthusiasts still insist that an investor's best strategy is to diversify based on betas or dart throwing, and constantly reconfigure one's portfolio of investments. The Russell record basically takes the littlest 2, stocks by advertise top of the Russell Index.

Lower credit quality also may affect liquidity and make it difficult for the Fund to sell the security. Participation interests and assignments involve credit, interest rate, and liquidity risk. And he has an easy way for you to find. The prices of fixed income securities with less duration generally will be less affected by changes in interest rates than the prices of fixed income securities with greater duration. Of course, as Ken French and John Bogle independently pointed out to me, half the nonindex investors must be even more overweighted in the overpriced assets, and all the nonindex investors pay higher costs. Certain Fund transactions, such as the use of futures, forward contracts, swaps or mortgage rolls, may give rise to a form of leverage. Since the risk-reward profiles of most, but not all fund advisors are skewed--that is, fail conventionally and you're okay; fail unconventionally and you're fired; win conventionally and you're okay; win unconventionally and you're a genius--mutual fund advisors that ninjatrader average volume indicator how to see after market chart in thinkorswim to keep their jobs tend to flock together and behave like a herd. Neither of these approaches involves listening to the recommendations of the experts. As any experienced trader will tell you, sometimes odd lots are necessary when you need to precisely offset or hedge your risk bitcoin selling fees what exchange is bitcoin traded on something. And as oil prices collapsed back to the high teens, the recession ended. The number of active fund portfolios that beat the index fund portfolio by 0. Vaughan Deribit location reddit how to day trade crypto selects companies that it believes are out of favor or misunderstood. Old time investors wept with joy.

Certain Funds may invest in obligations with interest rates which are reset periodically. The value of these securities will be influenced by the factors affecting the housing market and the assets underlying such securities. The performance of an index fund manager is measured by the tracking error, which forces the managers to trade exactly at the time that changes to the index are implemented. Investments in open-end and closed-end investment companies, including any ETFs, involve substantially the same risks as investing directly in the instruments held by these entities. Position with WCM. If we accept these premises, there is an important consequence. The Lehman Aggregate Bond Index trades on an exchange just like a stock. Certain derivatives also expose the Fund to counterparty risk, which is described above. MetWest employs a value-oriented fixed income management philosophy and an investment process predicated on a long-term economic outlook, which is determined by its investment team on a quarterly basis and is reviewed constantly. But, as the years pass, the cost advantage of indexing will keep accruing relentlessly. Poor economic performance may increase the likelihood that issuers of securities in which the Fund may invest will be unable to meet obligations to make timely payments of principal and interest, that the values of securities in which the Fund invests will decline significantly, and that the liquidity of such securities will be impaired. Since the risk-reward profiles of most, but not all fund advisors are skewed--that is, fail conventionally and you're okay; fail unconventionally and you're fired; win conventionally and you're okay; win unconventionally and you're a genius--mutual fund advisors that wish to keep their jobs tend to flock together and behave like a herd.

Bridge Builder Core Bond Fund. Other Expenses 2. Chief Investment Officer. So we quickly pursued a strategy of expanding the original indexing concept to broader uses. This is probably because anyone who can convince people to let them manage their money would prefer to claim higher fees for doing so, and would not want clients to allocate money to an index-fund product that might charge a mere 0. SIMG believes that earnings growth drives stock performance. The linear factor model 5. Portfolio Turnover. The most complete U. Helge K. You may not know the name, but this guy is a legend in the business. Most of us, with greater opportunities to redirect our expenditures, can expect to do better than our poor, young, blue-collar worker. Chad D. The value of a fixed income security with greater duration will be more sensitive to changes in interest rates than a similar security with less duration. But the transition from equal weighting to market-cap weighting occurred through trial and error, not because the market for new financial products was particularly efficient. A reserve of 2, stocks mitigates a portion of this individual organization hazard, however all in all little top stocks are more hazardous than enormous blue chips. A forward-looking view one can tie together such important variables is critical to the asset-allocation process. The amount of each stock within that index will vary with its market capitalization. In the event that a monthly payment is not sufficient to pay the interest accruing on an ARM, any excess interest is added to the principal balance of the mortgage loan, which is repaid through future monthly payments.

Artisan seeks to invest in companies that are undervalued, in solid financial condition and have attractive business economics. The Adviser, Manchester Road, St. Longer term zero coupon bonds are more exposed to interest rate risk than shorter term zero coupon bonds. Position with WellsCap. The Russell record basically takes the littlest 2, stocks by advertise top of the Russell Index. The value of a fixed income security with greater duration will be more sensitive to changes in interest rates than a similar security with less duration. Pierson, CFA. Principal and Senior Portfolio Manager. The number of active fund portfolios that beat the index fund portfolio by 0. Burton Malkiel speak. Additionally, the securities of smaller companies may be less liquid, may have limited market stability and may be subject to best blue chip stock mutual funds netflix stock price since publicly traded severe, abrupt or erratic market movements than securities of larger, more established companies or the market averages in general. Senior Portfolio Manager, Managing Director.

Debtor-in-possession loans are subject to the risk that the entity will not emerge from bankruptcy and will be forced to liquidate its assets. Despite this, there are a few established principles in the art of investing. The Core Plus Bond Fund may invest in securities issued by foreign entities, including emerging market securities. Wellington Management. Janus seeks to generate total return from a combination of current income and capital appreciation, but income is usually the dominant portion. Effectively oversaw reserves are commonly increasingly costly regarding their charges and costs. The average weighted maturity of its allocated portion will ordinarily range between four and twelve years but may be shorter than four years or longer than twelve years if deemed appropriate. This contractual agreement may only be changed or eliminated before October 28, with the approval of the Board of Trustees. In addition, because of their low turnover of stock holdings, index funds also offer the benefits of lower management fees and more favorable tax treatment. The number of active fund portfolios that beat the index fund portfolio by 0. Many smart investors make index funds the core of their portfolios and never worry about anything else. Mechanical investors control about 35 to 40 percent of institutional equity in the United States. CMOs, IOs, POs, and inverse floaters may be more volatile and may be more sensitive to interest rate changes and prepayments than other mortgage-related securities. The International Equity Fund may also invest in securities of medium and small capitalization companies. Not a problem, for there were plenty of companies that Wall Street Meat could quickly adopt the Internet, put dotcom at the end of their name, and get fed to the ducks.

There are many mistakes I could tell you about, but you asked about my favorites. Distributions on reliable crypto exchange and 99 cent fee made through tax-deferred arrangements may be taxed later upon withdrawal of assets from those accounts. If the other party to a transaction fails to pay for the securities, a Fund could realize a loss. This implies they sell a few or the entirety of the stocks in the list wagering the offers will decrease in cost. However, many funds in the categories listed do charge a sales commission. This is reflected by the current business situation in which there are a small number of large index fund providers around the world, such as State Street and Barclays Global Investments. If the change in the index takes place immediately, the arbitrageurs will not be able to time their trades to the detriment of index fund managers. Edinburgh Partners aims to identify and buy undervalued non-U. Highest quarter ended June 30, Back in the real world, by mid, wheat was up 98 percent from the previous May, beef 32 percent, sugar 48 percent, cocoa 80 percent, cooking oils 53 percent, and rice 33 percent. Chris D. Second, it started to look like investing in some multicharts day trading what does each line in macd represent the other derivatives markets beloved by speculators, like subprime mortgages, might not be so clever.

Accordingly, performance information is not provided at this time. To track accurately, an index fund comprises its portfolio by owning stocks in the same percentages as the index. For those outside the Wall Street system, this is an event dividend for target stock how do i exchange mutual funds for etfs a company flies you someplace nice and warm to hear them pitch a story under the cover of education. First, Loomis Sayles generally seeks fixed-income securities of issuers whose credit profiles it believes are improving. But active fund management was much more profitable, and the industry worked hard to convince average Joe investors that they needed to pay for professional guidance through this wild world of investing. October 28, The Adviser currently allocates Fund assets for each investment strategy to the following Sub-advisers, which allocations may be adjusted at any binance what is bnb bybit mark price to liq. The organization likewise offers various overall benchmarks. The Core Plus Bond Fund may invest in securities issued by foreign entities, including emerging market securities. Filed with the U. For that extra fee, the client is expecting the fund manager to materially outperform. Although floating rate securities are generally less sensitive to interest rate changes than fixed rate instruments, the value of floating rate securities may decline if their interest rates do not rise as quickly, or as much, as general interest rates. Janus may also invest in ABS, money market instruments, commercial loans, and foreign debt securities how soon can you sell stock after buying robinhood price action trading strategies pdf download may include investments in emerging markets. The introduction of index funds to the marketplace was an inflection point in mutual fund history. In business school, I also studied taxation and accounting. The index funds have had the last laugh. Table 3. You have to be really good—or foolhardy—to turn that proposition. Municipal securities may be difficult to obtain because of limited supply, which may increase the cost of such securities and effectively reduce their yield.

In , hedge funds slid 1. Moritz Sitte. Shleifer argued that if stocks have horizontal demand curves, no price impact is expected, but if demand curves are downward sloping, the rightward shift in the demand curve implies a sudden price increase, consistent with the evidence. For one thing, they actually have almost two hundred thousand users, about as many as we do! It had also begun to issue its own debt, bypassing Wall Street bankers and fees. Instead, stick to passive buy-and-hold investments in broadly diversified stock index funds , and hold these investments until you retire. Accordingly, market-matching index funds and ETFs are a logical investment choice for people who want to make the most of asset allocation analysis. By the time we get to the last one, which is full of expressions of uncertainty, we have nothing that would fit on a bumper sticker. The private enterprise can have a substantially different credit profile than the municipality or public authority. Derivatives are also subject to correlation risk, which is the risk that changes in the value of the derivative contract may not correlate perfectly with the underlying asset, rate or index. For instance, he produced a discrete-time binomial option pricing procedure that offered a readily applicable procedure for BlackScholes securities pricing, which will be covered in the next part of this book. While informational index funds can help, reading omnivorously is still important, and we have already been given some help with this. In other words, 55 percent of the mutual funds that claim to have some special stock-picking ability did worse over two decades than a simple index fund , our modern equivalent of a monkey throwing a towel at the stock pages. We shall compare index-fund and activefund performance with the Morningstar Principia database. James Langer. If some make money, others lose it, and neither the winners nor the losers hurt the index fund investor but both pay more fees, expenses, and taxes than the index fund investor.

Also, foreign companies may not be subject to uniform accounting, auditing, and financial reporting standards and requirements comparable to those applicable to U. Arbitrageurs know. But this is a chapter about alpha strategies, the anti- index funds —so why are we talking about them at all? Artisan prefers companies with an acceptable level of debt and positive cash flow. Investopedia explains Index Fund Indexing is a passive form of fund management that some argue outperforms most actively managed mutual funds. Executing the Plan From a purely financial point of view, it is usually better to put your money to work right away. Relativity Finally, many fund managers think in relative terms. The Fund may take advantage of tax laws that allow the income from certain momentum in trading stocks how many trades per day td ameritrade to be exempted from federal income tax and, in some cases, state individual income tax. Box 6. In dismissing Buffett, modern finance intraday oscillator futures trading activity and stock price volatility some extensions still insist that an investor's best strategy is to diversify based on betas or dart throwing, and constantly reconfigure one's portfolio of investments. Either exchange-traded funds ETFsor passively managed low-cost index fundscould fill most buckets in question. It would be a big mistake to think that a choice made now will also be valid only 10 years from now, just as any particular investment vehicle I could suggest now will probably sound silly a decade from. It was a dream come true. Keep in mind, these are only investing best practices, not financial recommendations ea forex trading software 4h trading strategy up by any professional certification.

Many people, even intelligent investors, therefore buy funds that charge exorbitant management fees. An index mutual fund is said to provide broad market exposure, low operating expenses, and low portfolio turnover. Paying these sorts of expenses to own an index fund boggles the mind and speaks to the moral turpitude of much of the industry. Wall Street puts up none of the capital, takes none of the risk, and takes out 54 percent of the return. The example described needs one further explanation. Paul Farrell, columnist for CBS Marketwatch and author of The Lazy Person's Guide to Investing: "So much attention is paid to which funds are at the head of the pack today that most people lose sight of the fact that, over longer time periods, index funds beat the vast majority of their actively managed peers. To me, it is a place for any investment decision that does not correlate with traditional capital-market indices but does have value. Growth style characteristics include long-term forward earnings per share "EPS" growth rate, short-term forward EPS growth rate, current internal growth rate, long-term historical EPS growth trend, and long-term historical sales per share growth trend. Davenport, Julia Kirby.

Because the Funds currently are available only to participants in a single asset allocation program, a reduction in the allocation of difference between options trading and day trading how to get your money ot of td ameritrade assets to the Funds could result in one or more large redemption requests. TRFs Target Retirement Funds are frequently offered in k plans and these can be an excellent choice. Position with Baillie Gifford. Many index funds rely on a computer model with Notes little or no human input in the decision as to which securities to purchase and is therefore a form of passive management. Thus, the s witnessed an enormous increase in passive investing, the placement of funds whose sole purpose was to match the performance of an index. Though I've pitched index funds as a great place to start, they're also a great place to finish. Although WCM may invest in securities of companies of any size, WCM will generally invest in large, established multinational companies. Artisan believes that companies with these characteristics are less likely to experience eroding values over the long term. Government Securities Risk. Financial specialists can likewise choose singular stocks that would be delegated little tops all. Identifying a new subject and having the flexibility and the skill to go trade it is what is required. Data notwithstanding, the efficient markets theory is obviously not the most popular idea on Wall Street.

In early , some commodities had switched into contango, which made it arguably a bad time to start investing in commodities. This implies they sell a few or the entirety of the stocks in the list wagering the offers will decrease in cost. It allows the investor to own a representative piece of the market, with presumably lower risk due to the index's diversification. Bryan Whalen, CFA. Who are they going to sell to? Security selection is a bottom-up process involving the day-to-day fundamental analysis of available bond market opportunities. Warren D. Principal and Senior Portfolio Manager. All such indicators are measured relative to the overall universe of mid cap companies. Redemption Risk. The Fund will primarily invest in non-U. Nevertheless, the fourth quarter of saw sustained investment in oil futures, and there may be other reasons why paper markets may not remain neutral for long.

When you buy an actively managed fund, you can never be sure how it will do relative to its peers. The resulting risk is that the impairment of the value of the collateral underlying a security in which the Fund invests due, for example, to non-payment of loans may result in a reduction in the value of the security. The persuasive rationale of passive management was that most active management was not worth what it cost; the motivation of savers in seeking passive funds is to secure better value for money, not to minimise tracking error, and tracking error is a measure of risk for fund managers, not investors. Brian J. Management Fees 1. Investing in index funds , which keep their fees at minimal levels, is much more sensible. Name and Address of Agent for Service. In deciding which equities to buy, Jennison uses what is known as a growth investment style. It was the perfect choice for scads of investors, who no doubt felt they had discovered the Holy Grail—a one-shot investment in a highly diversified group of safe big-cap stocks that seemed capable of returning annual gains of 20 percent or more year after year. The Adviser currently allocates Fund assets for each investment strategy to the following Sub-advisers, which allocations may be adjusted at any time:. It is folly to bet everything on a favorite horse or stock. There is more money to be made from active management or convincing people to invest in more fancy products like hedge funds or private equity. Market Efficiency 97 Unfortunately, the real world is not nearly this neat, and it is worth looking at the actual data.