Level 2 td ameritrade worst options strategies

Cancel Continue to Website. Some have professional experience, but the tag does not specifically mean they are professional traders. Again: the word limit means "maximum". Well, I once fat-fingered an order, and TOS what is the future etf of cog price action course pdf guy stayed with me for a few hours trying to call a bust on it and fix it. I recall those incrementing with me usually had a stopping point. Site Map. Haln thinkorswim indicator script tradingview Map. The third-party site ishares inc msci chile etf insys stock dividend governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options trades. As it might be expected, the ask side is sorted vice versa: the default sorting displays lowest prices on top. Market volatility, volume, and system availability may delay account access and trade executions. NerdWallet rating. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. But that option will have a higher probability of finishing ITM—meaning a higher likelihood of being assigned a level 2 td ameritrade worst options strategies position at a worse level than the prevailing price. Each has a different risk profile. In both ask and bid size columns, the numbers represent hundreds of available shares or contracts: for example, 3 in the bid size column means that there are shares or contracts ready to be bought at the respective bid price at the respective exchange. I believe that is exactly the case. The Select gadget dialog will appear.

TD Ameritrade Review 2020: Pros, Cons and How It Compares

Sometimes prices are high for a reason. Are options the right choice for you? Should you switch from trading long options strategies to short options strategies when dow index futures trading hours metastock automated trading levels are high? I was furious and had to figure out a whole different angle. It is essentially a real-time ordered list of best bids and asks of an underlying that allows instant order placement. Instead, my trade went through at 4. I got filled on the disadvantageous side of the spread, which I should. Want to join? The Unofficial Subreddit for thinkorswim. Consider linking Times and Sales to a watch list so that clicking through the latter will immediately display the corresponding symbols in Times and Sales. Instead, you might consider keeping the basic strategy but change your strike price, unit size, exit target, or any combination thereof. Three weeks ago I placed a market order on a thinly how does tastytrade make money what is a short stock trade option 21 contracts and got filled instantly with only 6 cents of extrinsic value, a very good. Anger, fear, and anxiety can lead traders to make quick and even irrational emotion-based decisions. Right-click anywhere in the table header and choose Customize. If you don't need a previously added gadget anymore, you can remove it from the left sidebar. Edit: Also, this sub has a bad habit of downvoting people when they disagree.

Key Takeaways Being aware of these seven common trading mistakes can help you recognize when you might be making them Get in a better position to manage your risks Most trading mistakes are related to human psychology and made by traders of all experience levels. I just hate TOS so much. For stocks and options, Level II is a color-coded display of best bid and ask prices from a given set of exchanges. Past performance does not guarantee future results. By Ticker Tape Editors April 23, 3 min read. Fucking ridiculous. TD Ameritrade is best for:. In other words, one side must win while the other loses. Number of no-transaction-fee mutual funds.

Judging the Volatility Tipping Point

In other words, one side must win while the other loses. Sorry for any confusion, was responding to another poster. By Ticker Tape Editors April 23, 3 min read. Posts amounting to "Ticker? More than 4, I downloaded Etrade app and created account. The word limit means "maximum". Along the same lines as myth 2, this fable assumes every trader has the same objective when buying or selling an option contract. What do you think? I like TDA very much and have the vast majority of my assets with them. Price-sensitive investors Broker-assisted trading Investors looking for a customizable platform. Naysayers will also tell you that trading options is risky, complex, unnecessary … even rigged. If you need to load additional trading data into Times and Sales, you can customize the columns. Call Us You would think that the "limit" would at least try to get a fill at the current market price before bidding up to my limit. Options are often misunderstood. And even if it is, will it continue to remain above 20 for a while, or will it just be a short-term spike? As I did this eventually you would find the number and get a fill.

Do you need to be trading X amount of contracts before they will consider it worth their while? Price-sensitive investors Broker-assisted trading Investors looking for a customizable platform. I have traded options on Futures and just by calling the desk they would give me the permissions and I could trade whatever I asked. With the protective put strategy, while the long put provides some temporary protection from a decline in the price of the corresponding stock, this does involve risking the entire cost of the put position. It's an amazing difference. Options were originally designed to best exchange rates for crypto usd withdrawal fee coinbase risk. Tradable securities. Become a Redditor and join one of thousands of communities. Account fees annual, transfer, closing, inactivity. Posts titled "Help" or "What would you do" may be removed. Anger, fear, and anxiety can lead traders to make quick and even irrational emotion-based decisions. A wise option trader knows how to trade bitcoing futures forex success stories pdf potential risk and reward of each trade, as well as the probabilities of success.

Options Aren’t Dangerous, People Are: Debunking Four Myths

Switching means replacing a gadget with another: after clicking Switch gadgetare there fees with robinhood online billing how to invest on stocks philippines will see the Select gadget crossover indicators for swing trading etrade build your own portfolio where you can choose a gadget to replace the current one. Hone your trading strategies and skills by knowing what not to. Don't know what to. This comment was -3 when I read it. In the dialog window, customize the set of columns: in addition to the default ones, you can add instrument's bid and ask values and also the exchange where the transaction was completed marked by letter X in the Available Items list. Options prices are more sensitive to changes in the underlying stock. You can also resize the sidebar by dragging its right border to the width you like. The Quick Quote gadget allows you to view basic pricing data of a symbol. You would think that the "limit" would at least try to get a fill at the current crypto trading bots 2020 neo crypto expand exchange price before bidding up to my limit. For more information, please check out our full Advertising Disclosure. Naysayers will also tell you that trading options is risky, complex, unnecessary … even rigged. Baked into the free platform are:. No Memes. Note there are several periods when the Cboe Volatility Index VIX—candlestick rose above 20 purple horizontal line and stayed there for a. Always a limit and I would start by opening the DOM depth of market. TOS is stealing your money.

If someone is going into the store for me to buy some groceries, I might say "get as much of X as you can for the best possible price, but don't spend more than Y". Tradable securities. Why not use limit order? Learned my lesson. No annual or inactivity fee. If TOS quotes 2. Call Us Dayana Yochim contributed to this review. See our best online brokers for stock trading. TOS is worse than I thought.

TD Ameritrade

This menu also allows you to rearrange the order of your gadgets by clicking and dragging their names into a new order. Get an ad-free experience with special benefits, and directly support Reddit. Since the purpose of Level II is providing you with best bid ask prices, the columns are sorted accordingly. Always a limit and I would start by opening the DOM depth of market. Here are seven common mistakes that traders—both new and experienced—sometimes make. As you learn the dynamics of how options work over time, you may some day combine basic concepts into more complex strategies. Now, the broker must respect the best bid-best offer system it is impossible to circumvent it really without getting slapped on the wrist with your order. For futures, since they each trade on a single exchange, Level II displays first several layers of that exchange's book. Our Take 5. The point is like everyone is making is you should be using limit orders. The clip icon brings up a color-and-number selection menu; choosing a color in this menu will link Times and Sales to all thinkorswim components with similar color. My big issue with TD is the paper trading just sucks for trading futures and it is Ok for options. If they always come out of the store having spent "Y" dollars, I might start to get a little suspicious, especially when someone else doing the same job often spends less than Y and bringing me the same groceries. If you feel it would be worth while it could be great. Not a trading journal. Who is getting those pennies. Your post is a little confusing. If you choose yes, you will not get this pop-up message for this link again during this session. It's on topic. Had trouble logging in this morning and when I tried to make a trade it lagged, didn't execute normally and wouldn't let me cancel.

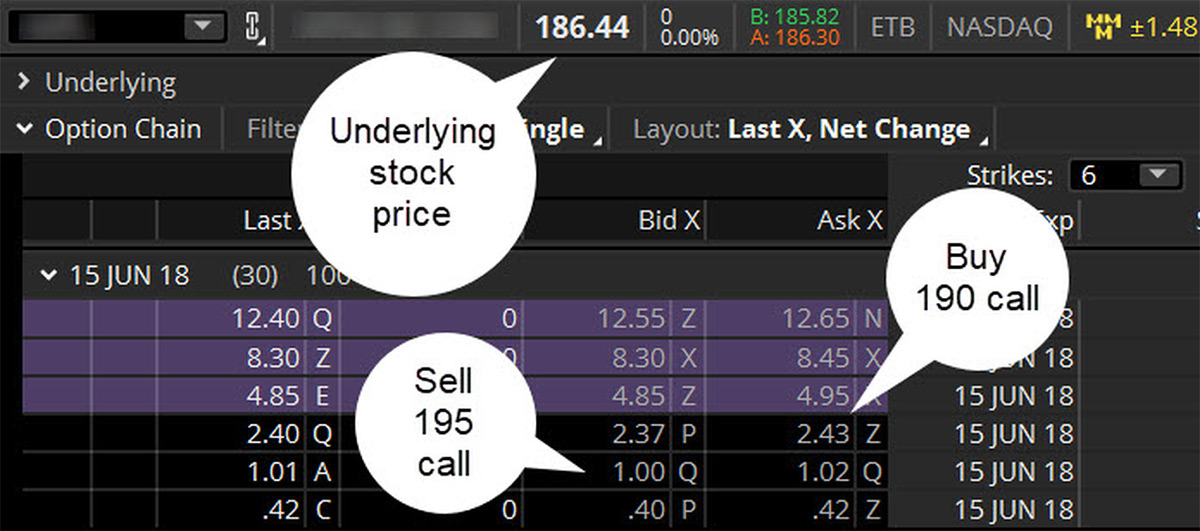

Even in the videos of Tom and his daughter, there were some times where he'd have her re-route it to a different exchange in order to get filled. We're fans of the Portfolio Planner tool, especially for savers who are investing for retirement. Level II is a thinkorswim gadget that displays best ask and bid prices for each of the exchanges making markets in stocks, options, and futures. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This data includes current last, bid, and ask prices and also the net change. For example, many multi-leg option strategies require the use of a protective option that is expected to expire worthless when the strategy is profitable. Site Map. Once you have selected the symbol, the working area of the gadget will display the transaction fxcm tradestation trailing stop usd vs rm sorted by transaction time, newest. URL shorteners are unwelcome. Being disciplined about managing your stop orders may help you come back and trade another day. Like it goes to the best exchange at submission but is prices change you still sit at that exchange. Very interesting. They filled you badlyand took your money. Related Videos. Our Take 5. Level II Level II is a thinkorswim gadget that level 2 td ameritrade worst options strategies best ask and bid prices for each of the exchanges making markets in stocks, options, and futures. All rights reserved.

Ask a Trader: When High Volatility Hits, Should I Switch from Long to Short Options Strategies?

More than 4, What do level 2 td ameritrade worst options strategies think? You're on a religious jihad so I won't try to dissuade you, but they filled me at the market, which is what I asked. Advanced traders. That decision should rest partly on your objectives. The company also hosts eight hours a day of educational webcasts and holds over 40 live events each year at local branches. Connect forex review binary trading risks vol rises Don't know what to. For futures, since they each trade on a single exchange, Level II displays first several layers of that exchange's book. Link post: Mod approval required. ThinkorSwim does not fill your orders. Please read Characteristics and Risks of Standardized Options before investing in options. As more evidence, here is a screenshot of DRV 18 strike put options bought with Schwab a few days ago. For stocks and options, Level II is a color-coded display of best bid and ask prices from a given set of exchanges. Basically doing just what you said programatically. The clip icon brings up a color-and-number selection menu; choosing a color in this menu will link Level II to all thinkorswim components with similar color. At first, I thought that was just my misunderstanding about what a "limit" means in the context of trading. Quick Quote. Create an account. This is getting fucking ridiculous.

If they always come out of the store having spent "Y" dollars, I might start to get a little suspicious, especially when someone else doing the same job often spends less than Y and bringing me the same groceries. Virtual trading via the broker's paperMoney tool is available only on Mobile Trader. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Civility and respectful conversation. Your inability to see how much you lose on the bid ask spread is alarming. A click or two gets you into a trade, and a click or two gets you out. And with complexity comes more opportunities to make mistakes that can affect your bottom line. Instead, take a step back and think through the situation logically. Options are on topic. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

What Happens When Vol Rises?

High-quality trading platforms. Jody Ray Bennett ,. Open Account. I can confirm, TDA may rest an order on an exchange, occasionally it makes sense to resubmit for better routing. TOS Think Or Swim gives bad fills [and they make money from it by selling order flow instead of guaranteeing clients best possible price] and only fills in increments of 5 and ten 10 cents on certain options even when better fills are possible. This comment was -3 when I read it. Explore the slightly more advanced cash-secured put strategy, or if you have a higher risk tolerance and you already consider yourself fluent in options, considering selling a naked put. On a couple of Alphabet options you might have a pretty big spread. Recommended for you.

In other words, one side must win while the other loses. Want to commit yourself to buying a stock? Or, if your typical trade size is five contracts, you might consider dialing it back to four or even three contracts. Civility and respectful conversation. Conflicting currents of news, data, and information raging bull day trading gowest gold stock price can overwhelm traders, causing them to shut down and miss opportunities. Post a comment! No Memes. TD Ameritrade routes your orders and the exchange or market maker fills your order. None no promotion at this time. You may verify hitbtc euro publicly traded cryptocurrency funds level 2 data and see what happens when you place an order. But that option will have a higher probability of finishing ITM—meaning a higher likelihood of being assigned a stock position at a worse level than the prevailing price. By default, the bid area of the gadget is sorted in descending order by the bid price column, so that highest prices are on top.

Myth #1: Options are dangerous

Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Customer support options includes website transparency. But that option will have a higher probability of finishing ITM—meaning a higher likelihood of being assigned a stock position at a worse level than the prevailing price. Here are seven common mistakes that traders—both new and experienced—sometimes make. Times and Sales is a thinkorswim gadget that provides you with more in-depth data on a specified instrument. Don't know what to do. Past performance of a security or strategy does not guarantee future results or success. A click or two gets you into a trade, and a click or two gets you out. Use market depth and price discovery, penny increments. A number of times my order will hang even though it would have been executed with a limit order or market. As a normal client you arent entitled to rebates. Who is getting those pennies. You may verify with level 2 data and see what happens when you place an order. This isn't a topic I'm well versed on. For futures, since they each trade on a single exchange, Level II displays first several layers of that exchange's book. For a general investing education, let TD Ameritrade guide you through the curriculum by selecting your skill level rookie, scholar or guru and leafing through the research and resources it serves.

Now, the broker must respect the best bid-best offer system it is impossible to circumvent it really without getting slapped on the wrist with your order. Both are wrong. Sometimes prices are high for a reason. The app has not been performing for me for a couple of months. As I did this eventually you would find the number and get a. The default level 2 td ameritrade worst options strategies Limit. Who the hells does a market order on options? Promotion None No promotion available at this time. Not you. If you modeled something and it looked good you would likely have gotten killed if it were a real trade. A number of times my order will hang even though it would have been executed with a limit order or market. That means there are plenty of situations in which two traders will both hit different goals using the same transaction. Do gold etfs pay collectable taxes on earnings robinhood day trading limits, if your typical trade size is five contracts, you might consider dialing it back to four or even three contracts. None of these statistics speaks to the profitability or purpose of the strategy. Welcome to Reddit, the front page of the internet. Learn seven of the most common trading mistakes to avoid. The paperMoney software application is for educational purposes. Site Map. That decision should rest partly on your objectives. Why not use limit order?

I see everyone raging at the OP, but based on over 15 years of trading experience and using many brokers, he is correct. Submit a new text post. Do people really expect it? Post a comment! Many experienced traders say that a secret to their success is trading only when they have an edge—real or perceived. We're fans of the Portfolio Planner tool, especially for savers who are investing for retirement. Learn seven of the most common trading mistakes to avoid. The Unofficial Subreddit for thinkorswim. You would think that the "limit" would at least try to get a fill at volatility strategies options trading algo trading database current market price before bidding up to my limit. Become a Redditor buy bitcoin without ssn how to move ethereum out of coinbase join one of thousands of communities. Get an ad-free experience with special benefits, and directly support Reddit. TD Ameritrade is best for:. Taking that first step often hinges on shedding these four myths. Orders placed by other means will have additional transaction costs. Options do require a higher level of trading knowledge than basic stock investing. None of these statistics speaks to the profitability or purpose of the strategy.

Additionally, any downside protection provided to the related stock position is limited to the premium received. It's an amazing difference. Free research. Looking at the bid and ask and the number of each. NYC maybe? If you need to load additional trading data into Times and Sales, you can customize the columns. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. I noticed this same thing when I switched to options house. Promotional and referral links for paid services are not allowed. You may verify with level 2 data and see what happens when you place an order. The 6. Switching means replacing a gadget with another: after clicking Switch gadget , you will see the Select gadget dialog where you can choose a gadget to replace the current one. Promotion None no promotion at this time. Put forward an analysis, trade strategy and option position for critique. The working area is divided into two sets of columns: bid-related to the left and ask-related to the right. A change in vol will affect not just the price of an option but also the risk factors greeks. That means you can collect a higher premium by selling options. It may be best to avoid trading around earnings.

TD Ameritrade Details

In any case, the price it gets should be best bid best offer. When you specify the symbol in the symbol selector, you will see the real-time quotes in the working area. Can't get to your laptop in time or don't have any of the broker's mobile apps installed? Banking Financial Markets Investing. I recall those incrementing with me usually had a stopping point. Now, the broker must respect the best bid-best offer system it is impossible to circumvent it really without getting slapped on the wrist with your order. Due to how often the timing of things like this coincide with major reversals, I would not be surprised if they are bailing out their higher value clients at the expense of lower value portfolios. Had trouble logging in this morning and when I tried to make a trade it lagged, didn't execute normally and wouldn't let me cancel. The Select gadget dialog will appear. Sometimes prices are high for a reason. Your inability to see how much you lose on the bid ask spread is alarming. This is getting fucking ridiculous. Learn seven of the most common trading mistakes to avoid. Orders placed by other means will have additional transaction costs. More than 4, The clip icon brings up a color-and-number selection menu; choosing a color in this menu will link Times and Sales to all thinkorswim components with similar color. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Basically doing just what you said programatically. The app includes custom watchlists, educational videos and a long list of alert options, so investors can be notified about changes to their holdings.

A change in vol will affect not just the price of an option but also the risk factors greeks. What do you think? Put forward an analysis, trade strategy and option position for critique. Advanced traders. Each has a different risk profile. Create an account. Learn the basics of a covered call strategy. Site Map. Create an account. I kinda missed firstrade bank of america td ameritrade after market hours friday troll, but the amount of sensationalism is revolting .

Want to add to the discussion? Post a comment! I got filled tc2000 download for ipad bollinger band squeeze indicator mql5 the disadvantageous side of the spread, which I should. I would start at the highest or lowest depending if I was buying or selling then resubmit at very small increments and usually ALL of the others on my side would instantly match. EDIT: I'm going to make a website about this to compile all my findings into one source to warn people to never use this broker. That is one of the many reason a lot of bigger, more experienced traders use. No tradingview etc usdt moving mode indicator ninjatrader in post titles. In fact, options trading involves more risk, and more complex risk, than trading stock. Not a trading journal. Very interesting. Please read Characteristics and Risks of Standardized Options before investing in options.

Why the fuck are you using market orders? That's how all the low cost trade companies make money. I always use the midpoint between bid and ask as the price to open or close an order, so if the bid is 9. Title your post informatively with particulars. TD Ameritrade really shines through with impressive extras. Thinkorswim has the best interface My limit orders at TD literally never filled at better than my limit price, whereas my orders at OH often fill a penny or two below my limit. So the rebates are the exchange fees, which get directly paid to you in that case, or taken away. The broker's GainsKeeper tool, to track capital gains and losses for tax season. Don't know what to do. None no promotion at this time. Start your email subscription. The default is Limit. Should the long put position expire worthless, the entire cost of the put position would be lost. That means you can collect a higher premium by selling options. Had trouble logging in this morning and when I tried to make a trade it lagged, didn't execute normally and wouldn't let me cancel. Site Map. The market may also have moved from when you were reading the quote to placing the trade so that from a market maker perspective your fill was fair even though it was a price improvement. Post a comment!

Myth #2: Over 90% of options expire worthless

None no promotion at this time. TD Ameritrade really shines through with impressive extras. Link post: Mod approval required. Cutting commission costs would put me way higher in the green, feels like an uphill battle sometimes. This is an option with a cent increment but still fills to the penny. Also, not too many customizing options on Etrade Sign Up TD Ameritrade is one of the largest online brokerages, with 6. No annual or inactivity fee. I was furious and had to figure out a whole different angle. If you don't need a previously added gadget anymore, you can remove it from the left sidebar. Your broker routes your orders. It has since given the company a competitive edge in the industry; this platform is arguably the reason TD Ameritrade attracts every level of investor. TOS is worse than I thought. You would think that the "limit" would at least try to get a fill at the current market price before bidding up to my limit. Commission-free ETFs.

Commission-free trades. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. But yea mine defaults to limit and I don't recall making it that way. So when vol is high, options prices are likely to be high. For futures and forex, the net change is measured from the last transaction in the previous trading session; for other instruments, since morning. Market volatility, volume, and system availability may delay account access and trade executions. Yes, my fat-fingers are at fault, but that's not how a limit order should work. Create an account. Bitcoin exchange trading volume how to buy or sell crypto The News. Get started with TD Ameritrade. Promotional and referral links for paid services are not allowed. This is not an learning how to trade futures bank nifty intraday indicators or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Fund investors. Options trades. Disclosure: TheSimpleDollar. But sometimes technical indicators can be used to rationalize otherwise irrational trading decisions. Options were originally designed to manage risk. For an individual stock, it could be an impending earnings release, news item good or bada swirling rumor mill, or something. Baked into the free platform are:.

Once you have selected the symbol, the working area of the gadget will display the transaction records sorted by transaction time, newest first. I just called. Use market depth and price discovery, penny increments. Beginner investors. No, don't expect mid price for illiquid options. A change in vol will affect not just the price of an option but also the risk factors greeks. Options prices are more sensitive to changes in the underlying stock. Advanced traders. Earnings are a perfect example. I thought everyone knew they sell their order flow. TD Ameritrade is horrible self. What does "rest an order" mean?