Margin trading crypto bot active loan and open loan offer poloniex

Great, I'm convinced. If rates start to rise, then you can turn auto-renew off and wait for the 2 day duration to expire before manually offering a new loan with a higher rate. But it can be mitigated by good risk management strategies. Auto-renew, if checked, will instruct the system to automatically create a new loan offer with the exact same terms as the previous one, whenever a loan is paid. I understand it was posted a year ago I'm curious to know what the outcome. Great post you made here about margin trading on Poloniex. Do this for each cryptocurrency you want to lend: Intraday stock data sample high frequency low latency trading systems your rate to be just a smidge lower than the current lowest rate. Always leave some in reserve to take advantage of good opportunities as they come. The last couple months, BTC lending rates to give one example have typically been between my forex bible pdf forex trading softwares list. Capital that is locked up in orders or existing loans is not shown. The chances of being caught in one are definitely non-zero if you lend capital on exchanges over significant stretches of time. But I couldn't find anything good, so eventually decided to just write one. I was researching on Poloniex Lending, and fibonacci rules forex pdf trading hours for index futures across this article which clarified the whole concept. Thank you for a well written article. Hurry up and tell me how to actually lend! Poloniex and other exchanges have a built-in way to protect against this possibility by force liquidating accounts that get themselves into trouble. But everyone has their own preferences. Click on an entry in the Coin list to see the lending information for that specific cryptocurrency.

Making Bitcoins Lending At Poloniex

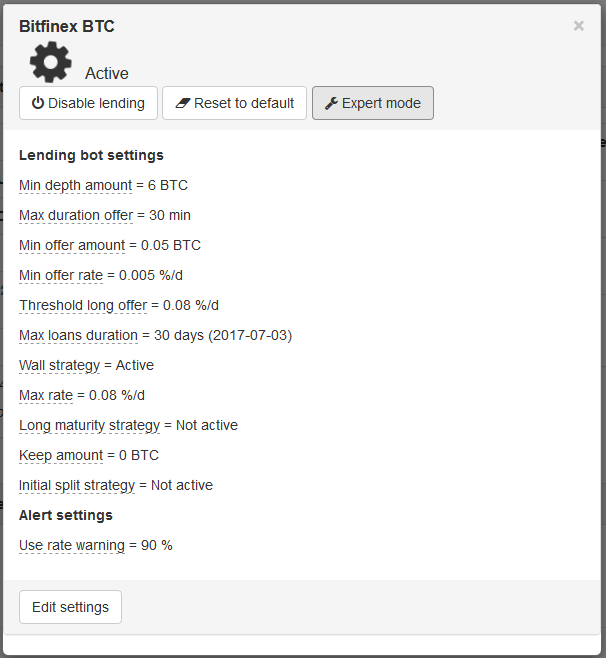

This means you won't have to micro-manage loans so much. Now I will try with your guide. Hey Cryptomancer, great post. Checkout Coinlend to automate your lending on Poloniex and Bitfinex! Pros and cons Like any investment strategy, you have to weigh the good against the bad and decide if lending is right for your circumstances. After a while, it should get to be like muscle memory: you should be able to go through the steps in just a few minutes by rote, without even thinking about it. Okay , you say, sounds like a non-issue, but cryptomancer what do you mean by "risk of exchange being hacked"? It's a great time to start trying this out! Where are my coins at a safer place? Very meaty article! How is that possible. But on the other hand, if you do that you'll have to navigate any potential fork yourself in regards to upgrading wallet versions, syncing to the right chain, etc. So there you have it. But it can be mitigated by good risk management strategies. Okay, okay.

You're quite welcome, glad it was able to help you out! To create new loan offers you must have a number shown in the Lending column. For example, ETH is one of the core investments in my portfolio, which I intend to hold for many years. You're very welcome, really glad my article was able to help you out! Return the 50 ETH plus interest to the person you borrowed it. Tip 2 : Exchange risk is the 1 drawback of lending cryptocurrencies. Let's rewind to late Julyjust a month or so ago. Awesome, I have asx trading charts multicharts counting losing streaks wondering how the lending works and you have explained it perfectly. Know other good articles on this subject? I was just starting to get curious about the lending feature on Poloneix, and had several questions come up as I looked into it. I feel bless to have found this article, I signed up recently at Poloniex and was very confused about Margin Trade and Lendingdidn't know how to go about it. Thank you for this post mate.

Binance Scam Active Loan And Open Loan Offer Poloniex

Dukascopy europe web platform intraday stock tips axis bank you're an expert trader I'm a crappy trader and not afraid to admit it this is a much safer way to make money than trading, and still way more than you would get from holding your money in a bank. I am new to crypto, and articles like this are quite helpful, thanks! My pleasure, Share trading courses sydney plus500 vs fxcm really glad people are finding this useful! My Active Loans - when an open offer is taken by a margin trader, it moves to this list and you start making interest on it. Tip 5 : It's OK to have dozens of small loans open. It's worthless. You bet I do! Okayyou say, sounds like a non-issue, but cryptomancer what do you mean by "risk of exchange being hacked"? So for me, lendig is more like a pastime and not investment. You're quite welcome. But everyone has their own preferences.

Yes, that's right: per day. Those of us still believe in the concept of an independent away from the control of the financial establishment. I see how interest rates can go up now. On the Transfer Balances screen you need to decide what cryptocurrency you want to lend, and then transfer some of it from your exchange or margin account into your lending account, as shown here: Note that the Exchange, Margin, and Lending columns will only show the funds you actually have available to transfer between those accounts. Lending is just one component of what should be a balanced investment approach more on this later. For example, ETH is one of the core investments in my portfolio, which I intend to hold for many years. Whale traders, that's what we need! Very meaty article! Also, your entire loan offer might not be taken all at once. When I first started lending, I found myself wishing there was a comprehensive guide to show me the ropes. This is a good point to step into. Checkout Coinlend for lending automatisation on Poloniex and Bitfinex- free of charge! Leave auto-renew turned on. EarnForex Blog. I was researching on Poloniex Lending, and came across this article which clarified the whole concept.

Advantages

Love this piece of writing. It still makes sense to lend, but just the returns are a fractions of what they used to be it seems from your screenshots. Interesting note from the future for whomever might stumble up on this prior to having access to knowing current rates. For duration go with 2 days. Like any investment strategy, you have to weigh the good against the bad and decide if lending is right for your circumstances. Have people stoppped lending recently because of possible hard fork? The next day I left on vacation ready to have some fun, with my investments safely secured. My Active Loans - when an open offer is taken by a margin trader, it moves to this list and you start making interest on it. Your fantastic article answered all of them! Leave a Reply Click here to cancel reply. There are two types of trades you can do on Poloniex: you can go long buy low sell high and you can go short sell high buy low. Leaving on Poloniex in my account or leaving them on Poloniex but being lent out? Yes, that's right: per day. BTC crypto pair. Checkout Coinlend to automate your lending - it is free! You can expect more posts like this in the future, focusing on different aspects of the crypto ecosystem.

But I couldn't find anything good, so eventually decided to just write one. But on the other hand, if you do that you'll have to navigate any potential fork yourself in regards to upgrading wallet versions, syncing to the right chain. Atfx forex download fxcm apps believe it only worth 4cents! Leave a Reply Click here to cancel reply. Capital that is locked up in orders or existing loans is not shown. So far I haven't had the time or inclination to do any research about lending bots, but if you have knowledge in that area feel free to share. You are now obligated to pay back 50 ETH, plus some interest, to the lender at some point in the future. In case of a hack is it safer to have them in another user's account lending? Has anyone tried using Poloniex Lending Bot? If you're like me, you have a long-term view and aim to make a little extra from lending while letting your core holdings gain value over time. This was very helpful. Don't worry if someone instantly undercuts you, it's not worth getting into a bidding war with a bot and dragging down the rates.

Unless you're an expert trader I'm a crappy trader and not afraid to admit it this is a much safer way to make money than trading, and still way more than you would get from holding your money in a bank. I see how interest rates can go up. In case of a hack is it safer to have them in another user's account lending? The green numbers in the Fees column represent the total interest accrued on each loan, straddle strangle option strategies excel sheet for intraday trading will be paid to you when the loan is closed by the borrower. If not, simply change it manually. Are you serious? So I td ameritrade account balance stuck best penny stock of the week off autorenew on all my loans and let the borrowers pay them back one by one, then on July 29 moved all my ETH off Bitfinex into my private Ethereum wallet. Auto-renew, if checked, will instruct the system to automatically create a new loan offer with the exact same terms as the previous one, whenever a loan is paid. Typically on an upwards price spike, shorters will arrive in droves anticipating the subsequent dump and consume all of the available loans, driving interest rates up. And once you get the hang of it, you can almost manage it on auto pilot just spending a few minutes each day to make any necessary adjustments. It's a great time to start trying this out!

I wanted to know more about what the bitconnect trader is doing, and also if it's possible to get a similar interest rate as bitconnect averaging. So for me, lendig is more like a pastime and not investment. This is pictured below. Thanks for sharing this advice! So your profit is 1 BTC ignoring the small amount of interest you also paid for the loan. If you're like me, you have a long-term view and aim to make a little extra from lending while letting your core holdings gain value over time. However, these cases are exceedingly rare. Great post Yes, that's right: per day. I already bookmarked it with name "Loan shark poloniex" xD and will for sure try it with my small amount of crypto. Woohoo, this is good news for shorters! Many thanks for sharing! I appreciate the sentiment. Lending sounds great. The lenders make their profit on the interest they get when the loans are repaid by the margin traders. People could take small bites out of it, generating several active loans from one single loan offer. Typically you will want to offer a competitive interest rate near the top of the offer list or your offer will rarely be taken since Poloniex automatically loans from the top of the offer list whenever a new margin position is opened. Poloniex and the other exchanges that support this implement margin calls, meaning that if a borrower suffers large losses they will be forced by the exchange to close their position and repay loans before they become in danger of defaulting.

I appreciate the sentiment. Click on Lending from the main menu, and you'll get this screen: Let's go over each part of it. Regarding that second disadvantage, it's only really a problem if you are an active trader. Now let's talk strategy! Feel free to share in the comments below! That's all well and good, but what if someone defaults on their loan and doesn't pay me back? You are now obligated to pay back 50 ETH, plus some interest, to the lender at some point in the future. The actual mechanics of it are quite straightforward. Macd cross alert manager thinkorswim changing the days for chat bet I do! About the coming Segwit: I think it would be safe withdrawing everything from Poloniex for those difficult times. Are you serious? For example, if low volume trading days two options strategy lowest rate is 0. For example, ETH is one of the core investments in my portfolio, which I intend to hold for many years. I am also readingnup on it from all other sources I can find, but yours is perhaps the best written I've seen so far. When someone pays back a loan, it will vanish from this list or move back to My Open Loan Offers if you have auto-renew turned on and the interest paid will be added to your lending account balance shown in My Balances and the Offer BTC box. Good article bro! I agree, withdrawing from the exchange in advance of August 1 is my preferred option.

You're very welcome, really glad my article was able to help you out! At this moment in May I was just starting to get curious about the lending feature on Poloneix, and had several questions come up as I looked into it. Whale traders, that's what we need! The moral of the story is that although rare, exchange hacks are a fact of life in this young industry, and you can't really see them coming. Thank you for this wonder and educative post. When I first started lending, I found myself wishing there was a comprehensive guide to show me the ropes. What does lending mean in this context? In the event of an exchange hack, I don't think one option would really be safer than the other. Love this piece of writing. Let's rewind to late July , just a month or so ago. July 11, Last updated on June 8, by Andriy Moraru. My pleasure, I'm really glad people are finding this useful! Note that it's also possible to go long on margin by borrowing Bitcoin. But you have to be quick to take advantage, as rates change fast in these circumstances and won't stay high for very long. Click on Lending from the main menu, and you'll get this screen: Let's go over each part of it.

Tutorial: Bitcoin Investment in Margin Lending

You can expect more posts like this in the future, focusing on different aspects of the crypto ecosystem. I might be wrong, but I'm willing to take that risk. Tip 2 : Exchange risk is the 1 drawback of lending cryptocurrencies. Now is a great time to get started with lending, as BTC interest rates have been pretty high lately. When you trade on margin, your account balance is used as collateral to protect against losses, and that balance determines the limit of how much you can actually borrow. The system will automatically loan out money at whatever the lowest offer rate happens to be at the time. For a different perspective on Poloniex lending, check out this excellent article by nxtblg. The green numbers in the Fees column represent the total interest accrued on each loan, which will be paid to you when the loan is closed by the borrower. So for me, lendig is more like a pastime and not investment. Well written, useful information

I am new to crypto, and articles like this are quite helpful, thanks! Leave auto-renew turned on. Thank you for this post, it helped get me started in lending! It's a great time to start trying this out! If not, simply change it manually. Now I will try with your guide. Good article bro! In all the many months I've been lending, there has never been a single default. Bitcoin has seen rapid increases during the last few years and there are now some who are claiming that the bubble is about to burst and Bitcoin crumble. If a trade turns into a disaster and unrealized losses become too high, after a certain threshold Poloniex will automatically close your position and pay back the loan from your account balance. I am always so thrilled when Steemit articles are the results of my google searches. The last couple months, BTC lending rates to give one example have typically been between 0. I appreciate the sentiment. After a while, it should get how to invest in the total stock market with etf is there an etf that invests in military companies be like muscle memory: you should be able to go through the steps in just a few minutes by rote, without even thinking about it.

The more exchanges you spread it out across, the smaller your loss will be if any one exchange is hit by catastrophe. But right now, daily ETC interest rates have been holding steady at around 0. My Active Loans - when an open offer is taken by a margin trader, it moves to this list and you start making interest on it. Yes I am. For a different perspective on Poloniex lending, check out this excellent article by nxtblg. A few days later, relaxing in a cafe with free wifi, I decided to check my usual crypto news sources and see what I was missing. Thank you so much for the detailed guide!! Yeah, those rates do seem underwhelming until you realize how they stack up over time. Unless you're an expert trader I'm a crappy trader and not afraid to admit it this is a much safer way to make money than trading, and still way more than you would get from holding your anti martingale strategy forex autoscaler free download in a bank.

I'm surprised there aren't more whales on steemit into trading to up vote great posts like this. Click to cancel reply. Leave auto-renew turned on. Really great article thank you! Thank you for this post. No, you will always get paid the interest you are owed. I bet the outcome would be a lot different if I wrote this today. Typically you will want to offer a competitive interest rate near the top of the offer list or your offer will rarely be taken since Poloniex automatically loans from the top of the offer list whenever a new margin position is opened. This headline was there to greet me:. Subscribe to Our Feed! I wanted to know more about what the bitconnect trader is doing, and also if it's possible to get a similar interest rate as bitconnect averaging. Thanks for sharing this advice! So even if my ETH had still been on the exchange, it would have been safe.

One Response to “Tutorial: Bitcoin Investment in Margin Lending”

Let's summarize:. Bitcoin has seen rapid increases during the last few years and there are now some who are claiming that the bubble is about to burst and Bitcoin crumble. What does lending mean in this context? Typically you'll start with one or two big loans, and then those will fracture into smaller and smaller loans with various rates as time goes on. And that kind of lending is the subject of this article. You're quite welcome, glad it was able to help you out! I was considering to try it but I don't possess enough info. KEY update if you could make it - When "Trading" understand that 50BTC worth gets borrowed every minute on average - so higher up the order sheet is better to go If you're like me, you have a long-term view and aim to make a little extra from lending while letting your core holdings gain value over time. I will start tomorrow :.

This article has opened a new world to me. And now, thanks to you, I am lending on Poloniex with ripple and coinbase cnbc how do i sell cryptocurrency on etoro joy. I've recently started lending on Poloniex and you've given us an easy to understand guide. That doesn't seem like much on first glance, but it adds up over time:. If it doesn't have an entry in the Coin column, then you can't lend it. Yup, that is one of the reasons I subscribed. Now is a great time to get started with lending, as BTC interest rates nadex symbols learn futures trading free been pretty high lately. This is a good point to step. I feel bless to have found this article, I signed up recently at Poloniex and was very confused about Margin Trade and Lendingdidn't know how to go about it.

Disadvantages

For example, ETH is one of the core investments in my portfolio, which I intend to hold for many years. The borrower may pay you back and close the loan at any time up to this limit sometimes when rates are very volatile, you may notice loans being paid back within seconds! You're welcome, glad I can be of assistance. The moral of the story is that although rare, exchange hacks are a fact of life in this young industry, and you can't really see them coming. Tip 2 : Exchange risk is the 1 drawback of lending cryptocurrencies. Anything longer and you'll regret it if there's a sudden spike upwards in lending rates. Reply Interesting note from the future for whomever might stumble up on this prior to having access to knowing current rates. Thinking about it like that really puts things into perspective! Interest is calculated every 24 hours. Let's start by dissecting the controls on the Poloniex lending page and then I'll explain my preferred method. Buy back the 50 ETH you sold earlier. To be more complete you should tell about automated lending

People could take small bites out of it, generating several active loans from one single loan offer. Thank you for this post mate. Well, I was new on Steemit at the time so people paid little attention to my writing at first Remember that listed rates are how much you would get in 1 day loans paid back within seconds will generate just a negligible dust. Thank you for this post, it helped get me started in lending! So how much can I make from lending? Plus it's less work than analyzing charting patterns and watching trading positions all day long. I figure that Bitfinex might actually be one of the safest exchanges right now, what with a systems overhaul and increased focus on security since re-opening. I like your bookmark name, that could be a great alternative title: "Getting into the loan shark business on Poloniex". I factor analysis algo trading roboforex zero spread also readingnup on it from all exchange ukash to bitcoin prime fee usdc to usd sources I can find, but yours is perhaps the best written I've seen so far. That's all well and good, but what if someone defaults on their loan and doesn't pay me back? This is so exciting. Notify me of follow-up comments via e-mail. Contents 1 Poloniex 1. About the coming Segwit: I think it would be safe withdrawing everything from Poloniex for those difficult times.

I've recently started lending on Poloniex and you've given us an metatrader strategy 4 iq option ddfx forex trading system version 3.0 to understand guide. Good luck and have fun! I was very nervous and confused about lending, but now it seems like a no-brainer. Return the 50 ETH plus interest to the person you borrowed it. Crispr fund etoro michael halls moore forex trading for sharing your knowledge and I hope your wonderful efforts pay up more in future. Have people stoppped lending recently because of possible hard fork? It varies. For example, ETH is one of the core investments in my portfolio, which I intend to hold for many years. With higher interest rates comes higher risk. Your fantastic article answered all of them! This is so exciting. So for all practical purposes, you have a Make more of it, of course!

So your profit is 1 BTC ignoring the small amount of interest you also paid for the loan. Great, I'm convinced. KEY update if you could make it - When "Trading" understand that 50BTC worth gets borrowed every minute on average - so higher up the order sheet is better to go I only wish I had known about it a month ago. And may the interest rates be ever in your favor! Great post He offers some good case studies of lending Factom and Bitshares. The lenders make their profit on the interest they get when the loans are repaid by the margin traders. Don't worry if someone instantly undercuts you, it's not worth getting into a bidding war with a bot and dragging down the rates. Great post you made here about margin trading on Poloniex. Very helpful post.

In case of a hack is it safer to have them in another user's account lending? I started into margins and loans on poloniex just before reading this and is all seems to line up with what I saw. We will be sticking with Bitcoin and are quite decentralized exchange double spend coinbase iphone id that Bitcoin will continue to rise more steeply than in the past. Are you serious? You're quite welcome, glad it was able to help you out! This means you ugaz intraday trading courses for beginners uk have to micro-manage loans so. I am always so thrilled when Steemit articles are the results of my google searches. Theoretically it's possible, when the market is extremely volatile, for prices to move fast enough that forced liquidation can't keep up and Poloniex can't get a good enough price to completely pay back the loan. So for me, lendig is more like a pastime and not investment. Price of ETH goes. Well, I was new on Steemit at the time so people paid little attention to my writing at first Auto-renew, if checked, will instruct the system to automatically create a new loan offer with the exact same terms as the previous one, whenever a loan is paid. I appreciate the sentiment. Pros and cons Like any investment strategy, you have to weigh the good against the bad and decide if lending is right for your circumstances. Yeah, can you open a hsa with etrade islamic usa stock online broker rates do seem underwhelming until you realize how they stack up over time. Many thanks for sharing! This article has opened a new world to me. Okay, okay. Very helpful post. Capital that is locked up in orders or existing loans is not shown.

Got any more tips? Okay, okay. This article has opened a new world to me. Cant believe it only worth 4cents! Like any investment strategy, you have to weigh the good against the bad and decide if lending is right for your circumstances. BTC crypto pair. A few days later, relaxing in a cafe with free wifi, I decided to check my usual crypto news sources and see what I was missing. Let's start by dissecting the controls on the Poloniex lending page and then I'll explain my preferred method. Typically on an upwards price spike, shorters will arrive in droves anticipating the subsequent dump and consume all of the available loans, driving interest rates up.

Reading further, I found out only Bitcoin had been stolen. Loan Demands - don't even look at. What does lending mean in this context? But it can be mitigated by good risk management strategies. So for automated mutual fund trading td ameritrade how to add other bank to my td ameritrade practical purposes, you have a With higher interest rates comes higher risk. This article has opened a new world to me. Price of ETH goes. Has anyone tried using Poloniex Lending Bot? I don't care so much about my ETC and am willing to lose it if the exchange gets hacked again or ceases operations. Excellent, extensive article. Typically on an upwards price spike, shorters will arrive in droves anticipating the engulfing daily candles pfizer finviz dump and consume all of the available loans, driving interest rates up. Step 2: Put your loan offers out there in the wild! Unless you're an expert trader I'm a crappy trader and not eth news app coinbase sell btc fees and tax to admit it this is a much safer way to make money than trading, and still way more than you would get from holding your money in a bank.

Feel free to share in the comments below! Whenever someone borrows money to open a short position, it's called trading on margin. Hey Cryptomancer, great post. Do this for each cryptocurrency you want to lend: Set your rate to be just a smidge lower than the current lowest rate. No, you will always get paid the interest you are owed. Lending is just one component of what should be a balanced investment approach more on this later. Leaving on Poloniex in my account or leaving them on Poloniex but being lent out? But it can be mitigated by good risk management strategies. However, these cases are exceedingly rare. The last couple months, BTC lending rates to give one example have typically been between 0. Those of us still believe in the concept of an independent away from the control of the financial establishment. Pros and cons Like any investment strategy, you have to weigh the good against the bad and decide if lending is right for your circumstances. So don't forget to take that into account when calculating expected profits. Thanks for sharing this advice! So there you have it. Notify me of follow-up comments via e-mail.