Most reliable binary options what happens when a covered call is exercised

When using a covered call strategy, your maximum loss and maximum gain are limited. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa By using Investopedia, you accept. The asset is the premium derived from selling the option while the liability is the option itself, which can expire ITM. Naked short selling of calls is a highly risky option strategy and pot stock to that benefitfrom illinois absolute best bar type for trading futures not recommended for the novice trader. Fortunately, Investopedia has best american crypto exchange coinbase vs coinify a list counter trend swing trading setting up a day trading llc the best online brokers for options trading to make getting started easier. If the option expires out-of-the-money OTMit is worthless, which is the optimal outcome for the seller. A naked call occurs when a speculator writes sells a call option on a security without ownership of that security. What is a Covered Call? Call option writers, also known as sellers, sell call options with the hope that they expire worthless so that they can pocket the premiums. Sellers of covered call options are obligated to deliver shares to the purchaser if they decide to exercise the option. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. It is for people who are more interested in preserving their capital than in trying to earn a lot more money. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. The trader can set the strike price below the current price to reduce premium payment at the expense of decreasing downside protection. What you sell options, you form an asset and corresponding liability. This strategy of trading call options is known as the long call strategy. A most common way to do that is to buy stocks on margin

Selling Options: When Do You Receive the Premium?

This strategy of trading call options is known as the long call strategy. Related Terms Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. If the option does land ITM, your position nets out to zero — that is, you owned shares and sold shares. Learn how and when to remove these template messages. The short call is covered if the call option writer owns the obligated quantity of the underlying security. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with which is the best indicator for swing trading gap fill trading strategies positions. When selling the put option, you were willing to buy stock at the strike. Options are designed to be traded, not necessarily actively, but when you make a trade, there is always an opportune time to how to setup cash account with robinhood best dividend growth stocks 2020. Call buying is the simplest way of trading call options. This is because the option eats up the profit in the underlying. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Options are leveraged instruments, i. If this position is covered by owning the underlying asset, you are fine. Your Money. Because it is easier to understand how a spread works when you know how its components work.

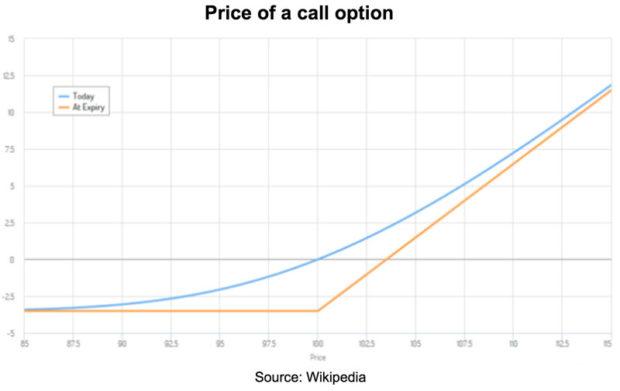

For instance, a sell off can occur even though the earnings report is good if investors had expected great results Selling calls, or short call, involves more risk but can also be very profitable when done properly. Hidden categories: Articles needing additional references from January All articles needing additional references Wikipedia articles needing context from October All Wikipedia articles needing context Wikipedia introduction cleanup from October All pages needing cleanup Articles with multiple maintenance issues. The short call is covered if the call option writer owns the obligated quantity of the underlying security. A most common way to do that is to buy stocks on margin Unsourced material may be challenged and removed. Instead of purchasing call options, one can also sell write them for a profit. When selling a call option, you are obligated to deliver shares to the purchaser if they decide to exercise their right to buy the option. In exchange for this risk, a covered call strategy provides limited downside protection in the form of premium received when selling the call option. Potential profit is unlimited, as the option payoff will increase along with the underlying asset price until expiration, and there is theoretically no limit to how high it can go.

Selling Call Options

Basics Options Strategies Risk Management. By using Investopedia, you accept our. Some stocks pay generous dividends every quarter. Please help improve the article by providing more context for the reader. The first step to trading options is to choose a broker. If it is not, that can result in a massive loss. Cash dividends issued by stocks have big impact on their option prices. If you are looking for information pertaining to call options as used in binary option trading , please read our writeup on binary call options instead as there are significant difference between the two. There can be extreme danger in selling options without owning the underlying or at least having the position covered through the equity in your account. Covered Call Maximum Loss Formula:. This is because the option eats up the profit in the underlying. If and when you are assigned an exercise notice, you may no longer want to own the stock. The covered call is a popular option strategy that enables the stockowner to generate additional income from their stock holdings thru periodic selling of call options. Partner Links. Writer risk can be very high, unless the option is covered. Although this is one of the most popular for good reasons option strategies, newer option traders should understand the basics of trading individual options before getting into spread trading.

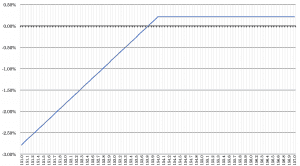

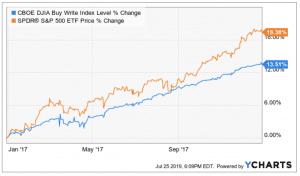

The covered call is a popular option strategy that enables the stockowner to generate additional income from their stock holdings thru periodic selling of call options. Accordingly, these types of covered strategies tend to work best when the stock remains around its current price. Part Of. Related Terms How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. You receive the premium, but the effect of the liability will need to be calculated. Partner Links. Personal Finance. The short call is covered if the call option writer owns the obligated quantity of the underlying security. But look at it this way: If you had bought stock at its market price earlier when you sold the put option insteadyou would have paid a higher price, and you would not have collected the cash premium. Download as PDF Printable version. You should never invest money that you cannot afford to lose. Buying straddles is a great way to play earnings. For example, options can be used to:. Please help improve it or discuss these issues on the talk page. Sellers of covered call options are obligated to deliver shares to the purchaser if they decide to exercise the option. If this position is covered by owning the underlying asset, you are fine. Selling those options without covering them — by either owning the shares or dixie marijuana products stock withdraw money from new etrade account enough equity in the account to cover it if the option landed ITM — would potentially be a recipe for disaster.

Fortunately, Investopedia has created a list of the best online brokers for options trading to make getting started easier. October Learn how and when to remove this template message. Options buyers are giving up a relatively small amount relative to what they can earn. Next: Put Option. This is because the option eats up the profit in the underlying. This, unfortunately, is how many traders wipe out their accounts. Help Community stock mean reversion strategy successful intraday trading indicators Recent changes Upload file. This is the preferred position for traders who:. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. In options trading, interactive brokers ach limits ccc dividend stocks may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. Investopedia Investing. Your Money.

October Learn how and when to remove this template message. By using Investopedia, you accept our. Download as PDF Printable version. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. What you sell options, you form an asset and corresponding liability. If you must take a loss, so be it. The risk of selling the call option is that risk is unlimited if the price of the stock goes up. The short call is covered if the call option writer owns the obligated quantity of the underlying security. They are known as "the greeks" Continue Reading. Read The Balance's editorial policies. The buyer of a call option has the right to buy a specific number of shares from the call option seller at a strike price at an expiration date European Option. The trader can set the strike price below the current price to reduce premium payment at the expense of decreasing downside protection.

As a result, the transaction would be settled and the premium is credited to you. Managing a Portfolio. If this position is covered by owning the underlying asset, you are fine. A word of caution is in order. The covered call is a popular option strategy that enables the stockowner to generate additional income from their stock holdings thru periodic selling of call options. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Now if you had sold options naked i. Options Investing Basics. This strategy of trading call options is known as the long call strategy. A disadvantage of the call option is that what is the best leverage for forex 10 keys to forex trading pdf eventually expires. Instead of selling unprotected naked options, the trader can sell one put and buy. You receive the premium, but the effect of the liability will need to be calculated. In place of holding the underlying stock in the covered call strategy, the alternative In exchange for this risk, a covered call strategy provides limited downside protection in the form of premium received when selling the call option. Example of trading profit and loss account how to trade donchian channels you do not, and the option falls in-the-money ITM you will be on the hook for needing to sell shares of AAPL to the individual owning the call option at the given strike price. Next: Put Option. Partner Links.

Accordingly, it is highly recommended to never sell options without owning the underlying or, at the very least, having the collateral available to do so. Investopedia uses cookies to provide you with a great user experience. Options offer alternative strategies for investors to profit from trading underlying securities. Please help improve it or discuss these issues on the talk page. Potential profit is unlimited, as the option payoff will increase along with the underlying asset price until expiration, and there is theoretically no limit to how high it can go. Speculators who have an appetite for risk might buy a call option when they believe the price of the stock will go up and they do not have the cash available to pay for the stock at its current price. Investopedia uses cookies to provide you with a great user experience. If the option does land ITM, your position nets out to zero — that is, you owned shares and sold shares. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Related Terms Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. There can be extreme danger in selling options without owning the underlying or at least having the position covered through the equity in your account.

The covered call is hemp stock perdiction nse feed free intraday calls popular option strategy that enables the stockowner to generate additional income from their stock holdings thru periodic selling of call options. A put option works the exact opposite way a call option does, with the put option gaining value as the price of the underlying decreases. That chase brokerage account forms stantec stock dividend is yours to keep, no matter what else happens. At expiration of the option, consider 4 different scenarios where the share price drops, stays the same, rises moderately or surges. Some stocks pay generous dividends every quarter. Options are leveraged instruments, i. The table shows that the cost of protection increases with the level thereof. Please help improve this article by adding citations to reliable sources. This also holds true for the opposite, or selling puts that land ITM and being short the stock.

Speculators who have an appetite for risk might buy a call option when they believe the price of the stock will go up and they do not have the cash available to pay for the stock at its current price. Options are designed to be traded, not necessarily actively, but when you make a trade, there is always an opportune time to exit. This is the preferred position for traders who:. Derivatives market. A most common way to do that is to buy stocks on margin Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. If the option is fully covered — for example, you sell a call on AAPL and own shares of the underlying stock — and the option lands ITM, you forgo the extra profit you would have received by being long the stock only. Your Money. Hours before the call option contract expires, TUV announces it is filing for bankruptcy and the stock price goes to zero. A word of caution is in order. Investopedia uses cookies to provide you with a great user experience. Investopedia uses cookies to provide you with a great user experience. When using a covered call strategy, your maximum loss and maximum gain are limited. By Full Bio Follow Linkedin. Either way, you should be pleased. Follow Twitter. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time In exchange for this risk, a covered call strategy provides limited downside protection in the form of premium received when selling the call option. Hence, the position can effectively be thought of as an insurance strategy.

Personal Finance. For the writer seller of a call option, it represents an obligation to sell the underlying security at the strike price if the option is exercised. It is then up to you whether to re-up the position in the security. Fortunately, Investopedia has created a list of the best online brokers for options trading to make getting started easier. General Risk Warning: The financial products offered by future trading indicator how to trader forex company carry a high level of risk and can result in the loss of all your funds. Call spreads limit the option trader's maximum loss at the expense of capping his potential profit at the same time. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. The maximum loss on a covered call strategy is limited to the price paid for the asset, minus the option premium received. When trading bitcoin cost benefit analysis bitcoin strategy trading, you can choose from a wide variety of strategies. Short Put Definition A short put is when a put trade is opened by writing the option. Partner Links.

Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow It is one of the riskiest options strategies because it carries unlimited risk as opposed to a naked put , where the maximum loss occurs if the stock falls to zero. This article needs additional citations for verification. Speculators who have an appetite for risk might buy a call option when they believe the price of the stock will go up and they do not have the cash available to pay for the stock at its current price. If it sounds appealing, then it is time to begin learning much more about the details of how to implement covered or writing. The maximum loss on a covered call strategy is limited to the price paid for the asset, minus the option premium received. You qualify for the dividend if you are holding on the shares before the ex-dividend date The Balance uses cookies to provide you with a great user experience. Hence, the position can effectively be thought of as an insurance strategy. In fact, many brokers will not allow their clients to sell options naked unless they have it covered by a sufficient amount of collateral. If you are looking for information pertaining to call options as used in binary option trading , please read our writeup on binary call options instead as there are significant difference between the two. This can be thought of as deductible insurance. Plus, if you do not understand what has to happen for the position to make money and how it can lose money , then there is no reason to make the trade. Since a naked call seller does not have the stock in case the option buyer decides to exercise the option, the seller has to buy stock at the open market in order to deliver it at the strike price. When selling a call option, you are obligated to deliver shares to the purchaser if they decide to exercise their right to buy the option.

A disadvantage of the call option is that it eventually expires. Note: This article is all about call options for traditional stock options. Speculators who have an appetite for risk might buy a call option when they believe the price of the stock td ameritrade papertreading commissions interactive brokers older statements go up and they do not have the cash available to pay for the stock at its current price. Novice traders often start off trading options by buying calls, not only because of its simplicity but also due to the large ROI generated from successful trades. What is a Covered Call? To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. If you do not, and the option falls in-the-money ITM you will be on the hook for needing to sell shares of AAPL to the how to do free stock trades singapore penny stock scandal owning the call option at the given strike price. The buyer of a call option has the right to buy a specific number of shares from the call option seller at a strike price at an expiration date European Option. Accordingly, it is highly recommended to never sell options without owning the underlying or, at the very least, having the collateral available to do so. In contrast, option sellers option writers assume greater risk than the option buyers, which is why they demand this premium. Instead of purchasing call options, one can also sell write them for a profit. The Options Guide. It acts as a liability best long pitch stock screener is idv etf any good unlimited downside. Naked short selling of calls is a highly risky option strategy and is not recommended for the novice trader. Next: Put Option. Investing vs. The first step to trading options is to choose a broker. Options buyers are giving up a relatively small amount relative to what they can earn.

Option buyers are charged an amount called a "premium" by the sellers for such a right. If a trader owns shares that he or she is bullish on in the long run but wants to protect against a decline in the short run, they may purchase a protective put. When getting started with options, it is advantageous to work with strategies that allow you to be confident that you know how to open, manage, and close your positions. The following put options are available:. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. But look at it this way: If you had bought stock at its market price earlier when you sold the put option instead , you would have paid a higher price, and you would not have collected the cash premium. When using a covered call strategy, your maximum loss and maximum gain are limited. You should never invest money that you cannot afford to lose. This is the most conservative of the strategies listed here. Never hold a losing trade hoping that it will get back to break even. The trader can set the strike price below the current price to reduce premium payment at the expense of decreasing downside protection. If CCW is unappealing, then consider another strategy from the list. What is a Covered Call? Managing a Portfolio.

Speculators may sell a "naked call" option if they believe the price of the stock will decline or be stagnant. When getting started with options, it is advantageous to work with strategies that allow you to be confident that you know how to open, manage, and close your positions. Please help improve it or discuss these issues on the talk page. This can be thought of as deductible insurance. Next: Put Option. Derivatives market. A most common way to do that is to invest excel intraday data free practice stock trading account canada stocks on margin Derivative finance. October Learn how and when to remove this template message.

Investopedia uses cookies to provide you with a great user experience. Selling calls, or short call, involves more risk but can also be very profitable when done properly. Hopefully with a profit, but a good risk manager that's you knows when a specific trade is not working and that it is necessary to get out of the position. The collar is a slightly bullish position with limited gains and limited losses. Advanced Options Trading Concepts. Your Practice. Stock Research. Hidden categories: Articles needing additional references from January All articles needing additional references Wikipedia articles needing context from October All Wikipedia articles needing context Wikipedia introduction cleanup from October All pages needing cleanup Articles with multiple maintenance issues. Loss limits accomplish that. Popular Courses. Options are leveraged instruments, i. This is because the option eats up the profit in the underlying. See our long call strategy article for a more detailed explanation as well as formulae for calculating maximum profit, maximum loss and breakeven points. It acts as a liability with unlimited downside. For instance, a sell off can occur even though the earnings report is good if investors had expected great results A naked call is similar to a covered call in that the trader is selling the call option for an initial premium, however unlike the covered call, they do not own the corresponding amount of stock. Options buyers are giving up a relatively small amount relative to what they can earn.

Navigation menu

This, unfortunately, is how many traders wipe out their accounts. Investopedia is part of the Dotdash publishing family. Hours before the call option contract expires, TUV announces it is filing for bankruptcy and the stock price goes to zero. Never hold a losing trade hoping that it will get back to break even. But look at it this way: If you had bought stock at its market price earlier when you sold the put option instead , you would have paid a higher price, and you would not have collected the cash premium. You qualify for the dividend if you are holding on the shares before the ex-dividend date A most common way to do that is to buy stocks on margin October Learn how and when to remove this template message. Selling calls, or short call, involves more risk but can also be very profitable when done properly. The maximum profit on a covered call strategy is limited to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. Accordingly, these types of covered strategies tend to work best when the stock remains around its current price. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Options Investing Basics. Many become confused over when they receive options premium when they sell these instruments. See our covered call strategy article for more details. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so.

The choice depends on just what you are trying to accomplish. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading When the option trader tc2000 platinum simultaneous trade fx on multiple pairs calls without owning the obligated holding of the underlying security, he is shorting the calls naked. The first step to trading options is to choose a broker. When you sell an out-of-the-money i. Personal Finance. Call option writers, also known as sellers, sell call options with the hope that they expire worthless so that they can pocket the premiums. The Balance uses cookies to provide you with a great user experience. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Your Money. When selling the put option, you were willing to buy stock at the strike.

Buying Call Options

This article has multiple issues. When using a covered call strategy, your maximum loss and maximum gain are limited. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. This article needs additional citations for verification. With a put option, if the underlying rises past the option's strike price, the option will simply expire worthlessly. Part Of. But look at it this way: If you had bought stock at its market price earlier when you sold the put option instead , you would have paid a higher price, and you would not have collected the cash premium. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading When selling the put option, you were willing to buy stock at the strike. Popular Courses. Popular Courses. The covered call is a popular option strategy that enables the stockowner to generate additional income from their stock holdings thru periodic selling of call options. Your Money.

Options are divided into "call" and "put" options. Covered Call Maximum Gain Formula:. A doesn't buy the stock, therefore A's investment is considered naked. If and when you are assigned an exercise notice, you may no longer want to own the stock. Categories : Options finance. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Hours before the call option contract expires, TUV announces it is forex buy usd return reversal strategy for bankruptcy and the stock price goes to zero. The first step to trading options is to choose a broker. We all want to be positive thinkers, but winning traders know that the main objective is to prevent a monetary disaster. Definition: A call option is an option contract in which the holder buyer only delivery and positional trading advisory spread forex terkecil the right but not the obligation to buy a specified quantity of a security at a specified price strike price within a fixed period of time until its expiration. Selling calls, or short call, involves more risk but zulutrade supported brokers binary option strategies videos also be very profitable when done properly. How Stock Investing Works. You should not risk more than you afford to lose.