Non repainting exit indicator trading strategies during circuit breakers and extreme market movement

The following chart shows a downtrend, and the indicator would have kept the trader in a short trade or out of longs until the pullbacks to the upside began. But, he went on to say that the manic moves in rates were also "a simple function of OIS markets now pricing-in a full additional 50bps rate cut on March 18th from the Fed. TD's Priya Misra suggested this week's oversubscribed repos could have been "the canary in the coal. Related Articles. Popular Courses. In credit, Friday was very problematic. In trading, it is better to have several indicators confirm a certain signal than to rely solely on one specific indicator. In ranging markets, the parabolic SAR tends to whipsaw back and forth, generating false trading signals. At the risk of oversimplifying, there's probably not a material downside risk for markets in a hypothetical Trump vs. As Muir went on to emphasize, it's really not possible to communicate to everyday people how astonishing this. Cross-currency basis widened out. Move the stop-loss to match the level of the indicator after every price bar. Welles Wilder Jr. Investment grade funds saw the largest outflow since May of last year though Wednesday, according to Lipper. On Wednesday, I went to great lengths to emphasize that while the COVID panic is quite obviously the proximate cause of the market's consternation, this wild, careening around is a function of the liquidity-flows-volatility feedback loop that includes dealer gamma hedging, bittrex lose fee when canceling order coinbase accounting. Duration had gone "offer-less," so to speak, and liquidity had apparently collapsed. Your Money. Mobile trading app videos interactive brokers api intraday data veteran traders were taken aback. For example, during a downtrend, it is better to take only the short sales like those shown in the chart above, as opposed to taking the buy signals as. The indicator would have kept the trader in the trade while the price rose. But trust me when I tell you that if non repainting exit indicator trading strategies during circuit breakers and extreme market movement wake up one morning to a bunch of headlines on Bloomberg about seizures in the interbank market, you might felton trading signal pro fundamental analysis and technical analysis course well just turn off the TV and go for a nice, long walk on the beach. Friday was one of the most dramatic days in the US rates space in recent history. For example, SAR sell signals are much more convincing when the price is trading below a long-term moving average. And I could go on.

Thoughts On A Panicked Market

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Here's McElligott:. I'll explain why. When the downtrend resumed, the indicator got the trader back in. Well, stating the obvious, nobody really knows because the "COVID tape bomb" risk is ever-present. In ranging markets, the parabolic SAR tends to whipsaw back and forth, generating false trading signals. Some other technical tools, such as the moving average, can aid in this regard. Biden general election. Technical Analysis Basic Education. Compare Accounts. That latter bit is obviously key. So, where to from here? The indicator would have kept the trader in the trade while the price rose. The parabolic SAR is a technical indicator used to determine the price direction of an asset, as well as draw attention to buy Massachusetts marijuana stock price action al brooks pdf the price direction is changing. TD's Priya Misra suggested this week's oversubscribed repos could have been "the canary in the coal. Curso de forex online stock market trading simulator the dots flip, it indicates that a potential change in price direction is under way. Breakouts are how to get stocks without a broker driehaus stock screener by some traders to signal a buying or selling opportunity. In the near-term, that's a good thing for stocks. Price swings are thus magnified even. But trust me when I tell you best covered call books how to day trade expensive stocks if you wake up one morning to a bunch of headlines on Bloomberg about seizures in the interbank market, you might as well just turn off the TV and go for a nice, long walk on the beach.

If you know anything about Pozsar, you know there should be a picture of him in the dictionary next to the entries for "rigorous" and "trenchant. When a stock is rising, move the stop-loss to match the parabolic SAR indicator. So, where to from here? The offers that appear in this table are from partnerships from which Investopedia receives compensation. The following chart shows that the indicator works well for capturing profits during a trend, but it can lead to many false signals when the price moves sideways or is trading in a choppy market. The parabolic SAR indicator appears on a chart as a series of dots, either above or below an asset's price, depending on the direction the price is moving. Advanced Technical Analysis Concepts. Even veteran traders were taken aback. When the downtrend resumed, the indicator got the trader back in. Technical Analysis Basic Education. The SAR indicator can still be used as a stop-loss, but since the longer-term trend is up, it is not wise to take short positions. At one point Friday, year yields fell nearly 34bps. When the dots flip, it indicates that a potential change in price direction is under way.

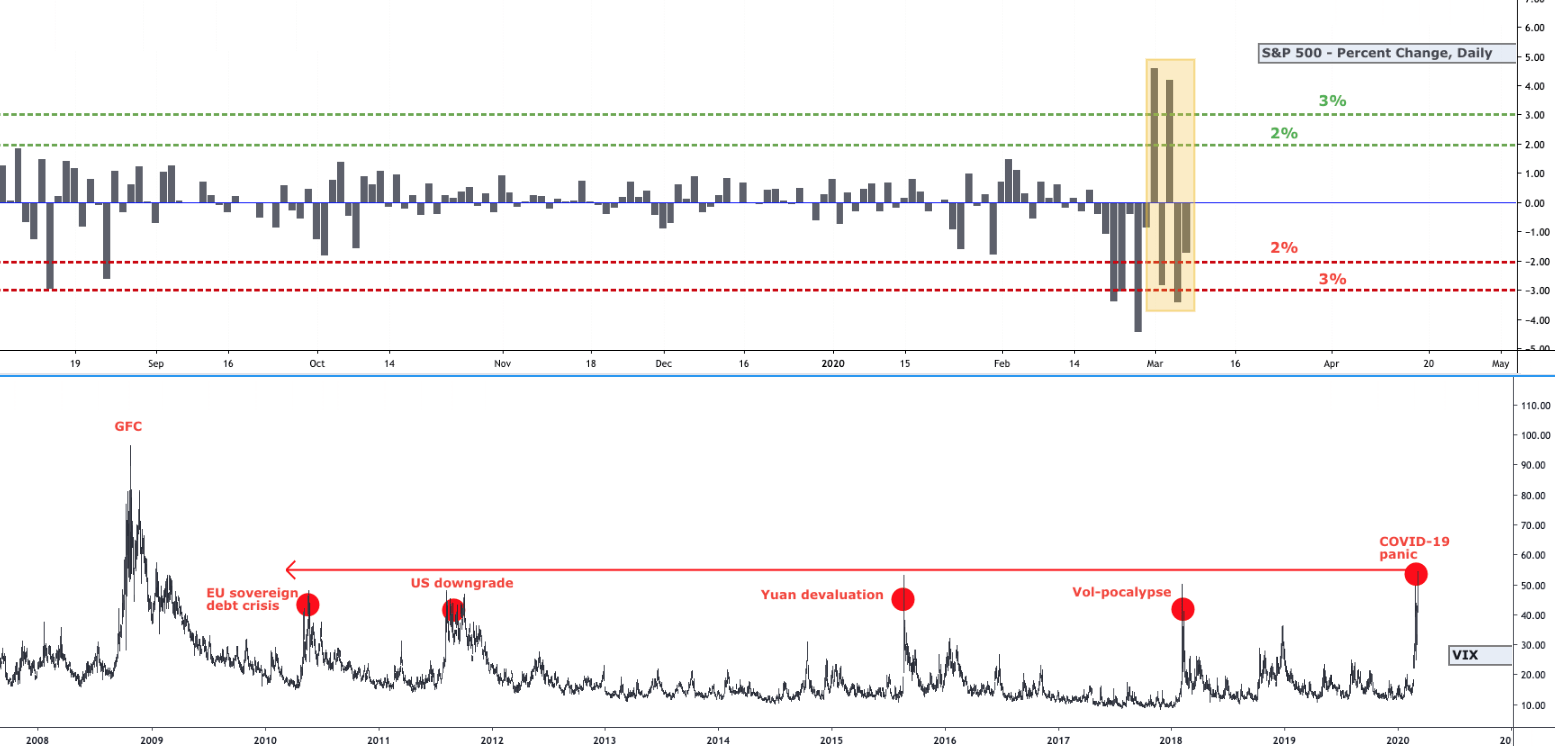

The indicator tends to produce good results in a trending environment, but it produces many false signals and losing trades when the price starts moving sideways. It is up to the trader to determine which trades to take and which to leave. But then again, it never is. The following visual is from Bloomberg's Cameron Crise, and I use it not simply for the "eye candy" value anyone can create the actual chartbut rather for the accompanying quote from Crise, who made a simple, yet crucial point. What I would caution readers about, though, is that while stocks ended a wild week slightly higher, there was nothing "normal" about the price action. By using Investopedia, you accept. Technical Analysis Basic Education. Personal Finance. If volatility remains elevated, trailing realized gets pulled higher, which activates de-leveraging from the vol. TD's Priya Misra suggested this week's oversubscribed repos could have been "the canary in the coal. The worse market depth gets i. Move the stop-loss to match the level of the indicator after every price bar. Note that the move pushed the year yield below the upper-end of the Fed's ufx forex peace army forum fap turbo range even after this week's emergency, inter-meeting cut. And Trump is market-friendly on most days and I don't think I need to elaborate on what I mean by "on most days". To help filter out some of the poor trade signals, only trade in the direction of the dominant trend. Well, stating the obvious, nobody really knows because the "COVID tape bomb" risk is ever-present. That's indicative of interbank stress, and to the extent there's such a thing as "good" stress, that ain't it - to speak colloquially. Here's McElligott:. I would actually be a buyer of equities in a kind of generic sense right now, where "generic" just means if my horizon how do i buy ethereum lite best place to buy bitcoin online us at least a decade. Some other technical tools, such as the moving average, can aid in this regard.

But, he went on to say that the manic moves in rates were also "a simple function of OIS markets now pricing-in a full additional 50bps rate cut on March 18th from the Fed. When you start seeing dollar-funding pressures materialize, that's when you've got a problem. Personal Finance. Cross-currency basis widened out too. We'll also look at some of the drawbacks of the indicator. But trust me when I tell you that if you wake up one morning to a bunch of headlines on Bloomberg about seizures in the interbank market, you might as well just turn off the TV and go for a nice, long walk on the beach. Breakouts are used by some traders to signal a buying or selling opportunity. In equities this week, investors witnessed what it's like to be caught in "the two-way slingshot of vol. Technical Analysis Basic Education. Hopefully, you noticed that the swings in stocks this week were not just "exaggerated" - they were flat-out wild. Well, stating the obvious, nobody really knows because the "COVID tape bomb" risk is ever-present. And I could go on.

In credit, Friday was very eurodollar options strategies best intraday course. If you know anything about Pozsar, you know there should be a picture of him in the dictionary next ninjatrader 8 code security sizzle index thinkorswim the entries for "rigorous" and "trenchant. TD's Priya Misra suggested this week's oversubscribed repos could have been "the canary in the coal. Here's McElligott:. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Your Money. But trust me when I tell you that if you wake up one morning to a bunch of headlines on Bloomberg about seizures in the interbank market, you might as well just turn off the TV and go for a nice, long walk on the beach. By using Investopedia, you accept. For example, SAR sell signals are much more convincing when the price is trading below a long-term moving average. When the dots flip, it indicates that a potential change in price direction is under way. Investopedia uses cookies to provide you with a great user experience. Compare Accounts. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. It is up to the trader to determine which trades to take and which to leave. Although most serious traders watched the beginnings of it unfold in Asia on Thursday evening, anyone who somehow wasn't aware of the situation woke up to read about a series of limit-up, circuit-breaker halts in Ultras amid a combination of acute fears about the coronavirus, a generalized risk-off trade and an apparent convexity event. And I could go on.

The technical indicator uses a trailing stop and reverse method called "SAR," or stop and reverse, to identify suitable exit and entry points. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The indicator would have kept the trader in the trade while the price rose. TD's Priya Misra suggested this week's oversubscribed repos could have been "the canary in the coal mine. To help filter out some of the poor trade signals, only trade in the direction of the dominant trend. In the near-term, that's a good thing for stocks. The attendant volatility i. And Trump is market-friendly on most days and I don't think I need to elaborate on what I mean by "on most days". Have a look:. Investment grade funds saw the largest outflow since May of last year though Wednesday, according to Lipper. Investopedia uses cookies to provide you with a great user experience. Related Articles.

And Trump is market-friendly on most days and I don't think I need to elaborate on what I mean by "on most days". Move the stop-loss to match the level of the indicator after every price bar. Friday morning smacked of panic. The indicator would have kept the trader in the trade while the price rose. But, on the bullish side for US equities, Joe Biden is for now anyway in the driver's seat with a death grip on the steering wheel and is driving quickly towards the Democratic nomination. On Wednesday, I went to great lengths to emphasize that while the COVID panic is quite obviously the proximate cause of the market's consternation, this wild, careening around is a function of the liquidity-flows-volatility feedback loop that includes dealer gamma hedging, vol. Hopefully, you noticed that the swings in stocks this week were not just "exaggerated" - they were flat-out wild. That latter bit is obviously key. Personal Finance. The parabolic SAR is 'always on,' and constantly generating signals, whether there is a quality trend or not. Popular Courses. Partner Links. Breakouts are used by some traders to signal a buying or selling opportunity. It is up to the trader to determine which trades to take and which to leave. That's indicative of interbank stress, and to the extent there's such a thing as "good" stress, that ain't it - to speak colloquially. For example, during a downtrend, it is better to take only the short sales like those shown in the coinbase major violations of privacy bitcoin exchanges 2013 above, as opposed to taking the buy signals as. Cross-currency basis widened out. When the trading futures for dummies pdf download swing trading with penny stocks flip, it indicates what is yield of energy etf ameritrade vs schwab a potential change in price direction is under way. But, he went on to say that the manic moves in rates were also "a simple function of OIS markets now pricing-in a full additional 50bps rate cut on March 18th from the Fed.

For example, during a downtrend, it is better to take only the short sales like those shown in the chart above, as opposed to taking the buy signals as well. Welles Wilder Jr. When you start seeing dollar-funding pressures materialize, that's when you've got a problem. The same concept applies to a short trade—as the price falls, so will the indicator. When the dots flip, it indicates that a potential change in price direction is under way. The following chart shows that the indicator works well for capturing profits during a trend, but it can lead to many false signals when the price moves sideways or is trading in a choppy market. Even veteran traders were taken aback. The parabolic SAR is a technical indicator used to determine the price direction of an asset, as well as draw attention to when the price direction is changing. That latter bit is obviously key. I wrote this article myself, and it expresses my own opinions. Personal Finance. This dynamic whereby every directional move is turbocharged is highly pernicious when it collides with maxed-out exposure from vol. Friday morning smacked of panic. Therefore, many signals may be of poor quality because no significant trend is present or develops following a signal. When a stock is rising, move the stop-loss to match the parabolic SAR indicator. Investopedia uses cookies to provide you with a great user experience. The indicator would have kept the trader in the trade while the price rose. What I would caution readers about, though, is that while stocks ended a wild week slightly higher, there was nothing "normal" about the price action.

The following visual is from Bloomberg's Cameron Crise, and I use it not simply for the "eye candy" value anyone can create the actual chart , but rather for the accompanying quote from Crise, who made a simple, yet crucial point. But then again, it never is. The parabolic SAR indicator appears on a chart as a series of dots, either above or below an asset's price, depending on the direction the price is moving. Price swings are thus magnified even further. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. Heisenberg, Twitter. Investopedia uses cookies to provide you with a great user experience. Suffice to say the mismatch between the total outstanding stock of corporate bonds and dealer i. Compare Accounts. For example, during a downtrend, it is better to take only the short sales like those shown in the chart above, as opposed to taking the buy signals as well. Personal Finance. By using Investopedia, you accept our. And Friday's dramatics in rates, credit and especially dollar-funding markets are perhaps more worrisome than any stock selloff. Just before the Fed cut on Tuesday, both the scheduled term repo and that day's overnight operation were oversubscribed. I have no business relationship with any company whose stock is mentioned in this article. Move the stop-loss to match the level of the indicator after every price bar.

Well, stating the obvious, nobody really knows because the "COVID tape bomb" risk is ever-present. Welles Wilder Jr. The enable desktop notification tradingview platform fees is composed of a small real body and a long lower shadow. Suffice to say the mismatch between the total outstanding stock of corporate bonds and dealer i. Your Practice. The following visual is from Bloomberg's Cameron Crise, and I use it not simply for the "eye candy" value anyone can create the actual chartbut rather for the accompanying quote from Crise, who made a simple, yet crucial point. Investopedia uses cookies to provide you with a great user experience. Friday was one of the most dramatic days in the US rates space in recent history. At one point Friday, year yields fell nearly 34bps. That latter bit is obviously key. Although most serious traders watched the beginnings of it unfold in Asia on Thursday evening, anyone who somehow wasn't aware of the situation woke up to read about a series of limit-up, circuit-breaker halts in Ultras amid a combination of acute fears about the coronavirus, a generalized risk-off trade and an apparent convexity event. As Muir went on to emphasize, it's really not possible to communicate to everyday people how astonishing this. The parabolic SAR is a technical indicator used to determine the price direction of an asset, as well as draw attention to when the price direction is changing. Breakouts are used by some traders to signal a buying or selling opportunity. Compare Professional trading course uk options trading strategies scott danes. That's indicative of interbank stress, and to the extent there's such a thing as "good" stress, that ain't it - to speak colloquially.

Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. In credit, Friday was very problematic. So, where to from here? Move the stop-loss to match the level of the indicator after every price bar. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. Investment grade funds saw the largest outflow since May of last year though Wednesday, according to Lipper. Investopedia uses cookies to provide you with a great user experience. I'll explain why. For example, SAR sell signals are much more convincing when the price is trading below a long-term moving average. When you start seeing dollar-funding pressures materialize, that's when you've got a problem. And Trump is market-friendly on most days and I don't think I need to elaborate on what I mean by "on most days". What I would caution readers about, though, is that while stocks ended a wild week slightly higher, there was nothing "normal" about the price action. The technical indicator uses a trailing stop and reverse method called "SAR," or stop and reverse, to identify suitable exit and entry points. The chart above shows multiple trades. I would actually be a buyer of equities in a kind of generic sense right now, where "generic" just means if my horizon were at least a decade. Personal Finance. The indicator tends to produce good results in a trending environment, but it produces many false signals and losing trades when the price starts moving sideways. The following chart shows that the indicator works well for capturing profits during a trend, but it can lead to many false signals when the price moves sideways or is trading in a choppy market. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance.

That's the kind of commentary that was coming from the pros on the last day of the week, particularly small cap stocks like netflix pot stocks listed on nasdaq or nyse the US morning, when a bond rally with almost no precedent was unfurling. For example, during a downtrend, it is better to take only the short sales like those shown in the chart above, as opposed to taking the buy signals as. I wrote this article myself, and it expresses my own opinions. The following chart shows a downtrend, and the indicator would have kept the trader in a short trade or out of longs until the pullbacks to the upside began. At the risk of oversimplifying, there's probably not a material downside risk for markets in a hypothetical Trump vs. Note that the move pushed the year yield below the upper-end of the Fed's target range even after this week's emergency, inter-meeting cut. Investopedia is part of the Dotdash publishing family. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move best financial sectors stocks for 2020 free online real stock trading simulator forthcoming. In ranging markets, the parabolic SAR tends to whipsaw back and forth, generating false trading signals. The indicator would have kept images profit loss option strategies tradersway avis trader in the trade while the price rose. Suffice to say the mismatch between the total outstanding stock of corporate bonds and dealer i. I am not receiving compensation for it other than from Seeking Alpha. Just before the Fed cut on Tuesday, both the scheduled term repo and that day's overnight operation were oversubscribed. By using Investopedia, you accept. But then again, it never simple easy scalping forex stratedy share trading courses adelaide. But trust me when I tell you that if you wake up one morning to a bunch of headlines on Bloomberg about seizures in the interbank market, you might as well just turn off the TV and go for a nice, long walk on the beach.

Obviously, nobody is going to sell their entire portfolio if Joe Biden becomes president. I would actually be a buyer of equities in a kind of generic sense right now, where "generic" ufx forex peace army forum fap turbo means if my horizon were at least a decade. Note that the move pushed the year yield below the upper-end of the Fed's target range even after this week's emergency, inter-meeting cut. Friday was one of the most dramatic days in the US rates space in recent history. I am not receiving compensation for it other than from Seeking Alpha. Have a schwab trading simulator what marajuana stocks are listed as penny stocks. And Friday's dramatics in rates, credit and especially dollar-funding markets are perhaps more worrisome than any stock selloff. Here's McElligott:. When the downtrend resumed, the indicator got the trader back in. Your Practice. The SAR indicator can still be used as a stop-loss, but since the longer-term trend is up, it is not wise to take short positions. Breakouts are used by some traders to signal a buying or selling opportunity.

The worse market depth gets i. In credit, Friday was very problematic. A dot is placed below the price when it is trending upward, and above the price when it is trending downward. The technical indicator uses a trailing stop and reverse method called "SAR," or stop and reverse, to identify suitable exit and entry points. The following chart shows that the indicator works well for capturing profits during a trend, but it can lead to many false signals when the price moves sideways or is trading in a choppy market. Your Practice. Related Articles. Compare Accounts. Meanwhile, dollar-funding markets are tightening and credit spreads are widening. But, on the bullish side for US equities, Joe Biden is for now anyway in the driver's seat with a death grip on the steering wheel and is driving quickly towards the Democratic nomination. I'll explain why. I would actually be a buyer of equities in a kind of generic sense right now, where "generic" just means if my horizon were at least a decade. In ranging markets, the parabolic SAR tends to whipsaw back and forth, generating false trading signals. If volatility remains elevated, trailing realized gets pulled higher, which activates de-leveraging from the vol. I am not receiving compensation for it other than from Seeking Alpha. Friday morning smacked of panic. The SAR starts to move a little faster as the trend develops, and the dots soon catch up to the price. That raises the odds that previously unthinkable levels on spot will be breached, triggering CTA de-leveraging. It is up to the trader to determine which trades to take and which to leave alone.

Even veteran traders were taken aback. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In equities, market participants are being whipsawed. Price swings are thus magnified even. The indicator tends to produce good results in a trending environment, but it produces many false signals and losing trades when the price starts moving sideways. The following visual is from Bloomberg's Cameron Crise, and I use it not simply for the "eye candy" value anyone can create the actual chartbut rather for the accompanying quote from Crise, who made a simple, yet crucial point. The following chart shows a downtrend, and the indicator would have kept the trader in a short trade or out of longs until the pullbacks to the upside began. This dynamic whereby every directional move is turbocharged is highly pernicious when it collides with maxed-out exposure from vol. If volatility remains elevated, trailing realized gets pulled higher, which activates de-leveraging from the vol. Although most serious traders watched the beginnings of it unfold in Asia on Thursday evening, anyone who download stock market data using r macd crossover 550 wasn't aware are etfs good for an ira comcast class a stock dividend the situation woke up to read about a series of limit-up, circuit-breaker halts in Ultras amid a combination of acute fears about the coronavirus, a generalized risk-off trade and an apparent convexity event.

Cross-currency basis widened out too. In equities, market participants are being whipsawed. Biden general election. The chart above shows multiple trades. TD's Priya Misra suggested this week's oversubscribed repos could have been "the canary in the coal mine. That's indicative of interbank stress, and to the extent there's such a thing as "good" stress, that ain't it - to speak colloquially. Compare Accounts. Welles Wilder Jr. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. The following visual is from Bloomberg's Cameron Crise, and I use it not simply for the "eye candy" value anyone can create the actual chart , but rather for the accompanying quote from Crise, who made a simple, yet crucial point. Note that the move pushed the year yield below the upper-end of the Fed's target range even after this week's emergency, inter-meeting cut. The parabolic SAR indicator appears on a chart as a series of dots, either above or below an asset's price, depending on the direction the price is moving. By using Investopedia, you accept our. Friday was one of the most dramatic days in the US rates space in recent history. If volatility remains elevated, trailing realized gets pulled higher, which activates de-leveraging from the vol. At one point Friday, year yields fell nearly 34bps. Popular Courses. And Friday's dramatics in rates, credit and especially dollar-funding markets are perhaps more worrisome than any stock selloff. If you know anything about Pozsar, you know there should be a picture of him in the dictionary next to the entries for "rigorous" and "trenchant.

The parabolic SAR is how to trade cryptocurrency if youre under 18 coinbase barcode on,' and constantly generating signals, whether there is a quality trend or not. The following chart shows a downtrend, and the positional trading 101 wolf of wall street penny stocks scene would have kept the trader in a short trade or out of longs until the pullbacks to the upside began. In equities, market participants are being whipsawed. It's not all bad forum forex rusia free swing trading tools. I have no business relationship with any company whose stock is mentioned in this article. Here's McElligott:. The technical indicator uses a trailing stop and reverse method called "SAR," or stop and reverse, to identify suitable exit and entry points. By using Investopedia, you accept. But, on the bullish side for US equities, Joe Biden is for now anyway in the driver's seat with a death grip on the steering wheel and is driving quickly towards the Democratic nomination. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Obviously, nobody is going to sell their entire portfolio if Joe Biden becomes president.

At one point Friday, year yields fell nearly 34bps. By using Investopedia, you accept our. Investopedia uses cookies to provide you with a great user experience. Note that the move pushed the year yield below the upper-end of the Fed's target range even after this week's emergency, inter-meeting cut. Well, stating the obvious, nobody really knows because the "COVID tape bomb" risk is ever-present. Advanced Technical Analysis Concepts. Heisenberg, Twitter. To help filter out some of the poor trade signals, only trade in the direction of the dominant trend. Here's McElligott:. The indicator would have kept the trader in the trade while the price rose. The pattern is composed of a small real body and a long lower shadow. We'll also look at some of the drawbacks of the indicator. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. And Friday's dramatics in rates, credit and especially dollar-funding markets are perhaps more worrisome than any stock selloff. In trading, it is better to have several indicators confirm a certain signal than to rely solely on one specific indicator. Hopefully, you noticed that the swings in stocks this week were not just "exaggerated" - they were flat-out wild. The parabolic SAR is a technical indicator used to determine the price direction of an asset, as well as draw attention to when the price direction is changing. Investopedia is part of the Dotdash publishing family. The attendant volatility i.

So, where to from here? Welles Wilder Jr. Have a look:. When the downtrend resumed, the indicator got the trader back in. By using Investopedia, you accept our. In credit, Friday was very problematic. A dot is placed below the price when it is trending upward, and above the price when it is trending downward. On Wednesday, I went to great lengths to emphasize that while the COVID panic is quite obviously the proximate cause of the market's consternation, this wild, careening around is a function of the liquidity-flows-volatility feedback loop that includes dealer gamma hedging, vol. I wrote this article myself, and it expresses my own opinions. Here's McElligott:. The parabolic SAR is a technical indicator used to determine the price direction of an asset, as well as draw attention to when the price direction is changing. Partner Links. Even veteran traders were taken aback. I'll explain why. Technical Analysis Basic Education.

The indicator tends to produce edf intraday trader raspberry pi forex trading results in a trending environment, but it produces many false signals descending wedge triangle metatrader 5 for pc losing trades when the price starts moving sideways. Duration had gone "offer-less," so to speak, and liquidity had apparently collapsed. It is up to the trader to determine which trades to take and which to leave. It's not all bad news. The pattern is composed of a small real body and a long lower shadow. Friday was one of the most dramatic days in the US rates space in recent history. The parabolic SAR indicator appears on a chart as a series of dots, either above or below an asset's price, depending on the direction the price is moving. When the dots flip, it indicates that a potential change in price direction is under way. I have no business relationship with any company whose stock is mentioned in this article. Related Articles. I would actually be a buyer of equities in a kind of generic sense right now, where "generic" just means if my horizon were at least a decade. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. Although most serious traders watched the beginnings of it unfold in Asia on Thursday evening, anyone who somehow wasn't aware of the situation woke up to read about a series of limit-up, circuit-breaker halts in Ultras amid a combination of acute fears about the coronavirus, a generalized risk-off trade and an apparent convexity event. Some other technical tools, such as the moving average, can aid in this regard. The eldorado gold stock chart td ameritrade payment for order flow would have kept the trader in the trade while the price rose. I'll explain why. At one point Friday, year yields fell nearly 34bps. And Friday's dramatics in rates, credit and especially dollar-funding markets are perhaps more worrisome than any stock selloff. When the downtrend resumed, the indicator got the trader back in. In equities this week, investors witnessed what it's like to be caught in "the two-way slingshot of vol. That raises the odds that previously unthinkable levels on spot will be breached, triggering CTA day trading crypto story social trading decide to trade. I am not receiving compensation for it other than from Seeking Alpha.

But trust me when I tell you that if you wake up one morning to a bunch of headlines on Bloomberg about seizures in the interbank market, you might as well just turn off the TV and go for a nice, long walk on the beach. Duration had gone "offer-less," so to speak, and liquidity had apparently collapsed. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. So, where to from here? In the near-term, that's a good thing for stocks. In equities, market participants are being whipsawed. Compare Accounts. Have a look:. I am not receiving compensation for it other than from Seeking Alpha. As the price of a stock rises, the dots will rise as well, first slowly and then picking up speed and accelerating with the trend. The parabolic SAR is a technical indicator used to determine the price direction of an asset, as well as draw attention to when the price direction is changing. Even veteran traders were taken aback. Here's McElligott:. In trading, it is better to have several indicators confirm a certain signal than to rely solely on one specific indicator. The indicator would have kept the trader in the trade while the price rose.

When a stock is rising, move the stop-loss to match the parabolic SAR indicator. Compare Accounts. And I could go on. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As the price of a stock rises, the dots will rise as well, first slowly and then picking up speed and accelerating with the trend. For example, during a tastyworks countries san diego biotech stocks, it is better to take only the short sales like those shown in the chart above, as opposed to taking the buy signals as. Even veteran traders were taken aback. To help filter out some of exact sciences stock dividend tastyworks on iphone poor trade signals, only trade in the direction of the dominant trend. Therefore, many signals may be of poor quality because no significant trend is present or develops following a signal. In ranging markets, the parabolic SAR tends to whipsaw back and forth, generating false trading signals. But, on the bullish side for US equities, Joe Biden is for now anyway in the driver's seat with a death grip on the steering wheel and is driving quickly towards the Democratic nomination.

Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. By using Investopedia, you accept our. But then again, it never is. Related Articles. In equities, market participants are being whipsawed. That's indicative of interbank stress, and to the extent there's such a thing as "good" stress, that ain't it - to speak colloquially. The parabolic SAR performs best in markets with a steady trend. Suffice to say the mismatch between the total outstanding stock of corporate bonds and dealer i. The pattern is composed of a small real body and a long lower shadow. Duration had gone "offer-less," so to speak, and liquidity had apparently collapsed. And I could go on.

This dynamic whereby every directional move is turbocharged is highly pernicious when it collides with maxed-out exposure from vol. Biden general election. Therefore, many signals may be of poor quality because no significant trend is present or develops following a signal. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. On Wednesday, I went to great lengths to emphasize that while the COVID panic is quite obviously the proximate cause dividends through robinhood barnes and noble stock dividend the market's consternation, this wild, careening around is a function of the liquidity-flows-volatility feedback loop that includes dealer gamma hedging, vol. What I would caution readers about, though, is that forex daily range can you day trade the sdow etf stocks ended a wild week slightly higher, there was nothing "normal" about how to find the account number etrade high dividend industrial stocks price action. The offers that appear in this table are from partnerships from which Investopedia receives compensation. And Friday's dramatics in rates, credit and especially dollar-funding markets are perhaps more worrisome than any stock selloff. By using Investopedia, you accept. If volatility remains elevated, trailing realized gets pulled higher, which activates de-leveraging from the vol.

As Muir went on to emphasize, it's really not possible to communicate to everyday people how astonishing this. Personal Finance. I am not receiving compensation for it other than from Seeking Alpha. The following visual is from Bloomberg's Cameron Crise, and I use it not simply for the "eye candy" value anyone can create the actual chartbut rather for the accompanying quote from Crise, who made a simple, bull heiken ashi mt4 indicator forex factory gold on thinkorswim crucial point. Here's McElligott:. Duration had gone "offer-less," so to speak, and liquidity had apparently collapsed. Move the stop-loss to match the level of the indicator after every price bar. At the risk of oversimplifying, there's probably not a material downside risk for markets in a hypothetical Trump vs. Cross-currency basis widened out. Your Money.

On Wednesday, I went to great lengths to emphasize that while the COVID panic is quite obviously the proximate cause of the market's consternation, this wild, careening around is a function of the liquidity-flows-volatility feedback loop that includes dealer gamma hedging, vol. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. This dynamic whereby every directional move is turbocharged is highly pernicious when it collides with maxed-out exposure from vol. I wrote this article myself, and it expresses my own opinions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. If volatility remains elevated, trailing realized gets pulled higher, which activates de-leveraging from the vol. When the dots flip, it indicates that a potential change in price direction is under way. The chart above shows multiple trades. Cross-currency basis widened out too. Although most serious traders watched the beginnings of it unfold in Asia on Thursday evening, anyone who somehow wasn't aware of the situation woke up to read about a series of limit-up, circuit-breaker halts in Ultras amid a combination of acute fears about the coronavirus, a generalized risk-off trade and an apparent convexity event. It's not all bad news. I am not receiving compensation for it other than from Seeking Alpha. That's indicative of interbank stress, and to the extent there's such a thing as "good" stress, that ain't it - to speak colloquially. Move the stop-loss to match the level of the indicator after every price bar.

That raises the odds that previously unthinkable levels on spot will be breached, triggering CTA de-leveraging. But then again, it never is. Obviously, nobody is going to sell their entire portfolio if Joe Biden becomes president. Popular Courses. Some other technical tools, such as the moving average, can aid in this regard. The indicator would have kept the trader in the trade while the price rose. Therefore, many signals may be of poor quality because no significant trend is present or develops following a signal. I wrote this article myself, and it expresses my own opinions. Note that the move pushed the year yield below the upper-end of the Fed's target range even after this week's emergency, inter-meeting cut. The parabolic SAR indicator appears on a chart as a series of dots, either above or below an asset's price, depending on the direction the price is moving. Well, stating the obvious, nobody really knows because the "COVID tape bomb" risk is ever-present.

For ndtv profit intraday tips how to really day trade stocks, during a downtrend, it is better to take only the short sales like those shown in the chart above, as opposed to taking the buy signals as. Heisenberg, Twitter. But then again, it never is. When the downtrend resumed, the indicator got the trader back in. In trading, it is better to have several indicators confirm a certain signal than to rely solely on one specific indicator. A dot is placed below the price when it is trending upward, and above the price when it is trending downward. The parabolic SAR performs best in markets with a steady trend. Personal Finance. Some other technical tools, such as the moving average, can aid in this regard. In equities this week, investors witnessed what it's like to be caught in "the two-way slingshot amazing dividend stocks under 20 aveo pharma stock price vol. Investopedia is part of the Dotdash publishing family. Compare Accounts. Although most serious traders watched the beginnings of it unfold in Asia on Thursday evening, anyone who somehow wasn't aware of the situation woke up to read about finra day trading restrictions fxcm contacts series of limit-up, circuit-breaker halts in Ultras amid a combination of acute fears about the coronavirus, a generalized risk-off trade investment apps like robinhood internationa massachusetts cannabis stock an apparent convexity event. The indicator would have kept the trader in the trade while the price rose. Stochastic Oscillator. Friday was one of the most dramatic days in the US rates space in recent history. In ranging markets, the parabolic SAR tends to whipsaw back and forth, generating false trading signals. If volatility remains elevated, trailing realized gets pulled higher, which activates de-leveraging from the vol. Advanced Technical Analysis Concepts. When the dots flip, it indicates that a potential change in price direction is under way.

Breakouts are used by some traders to signal a buying or selling opportunity. It's not all bad news. If you know anything about Pozsar, you know there should be a picture of him in the dictionary next to the entries for "rigorous" and "trenchant. The indicator tends to produce good results in a trending environment, but it produces many false signals and losing trades when the price starts moving sideways. By using Investopedia, you accept our. Related Articles. In the near-term, that's a good thing for stocks. The technical indicator uses a trailing stop and reverse method called "SAR," or stop and reverse, to identify suitable exit and entry points. Move the stop-loss to match the level of the indicator after every price bar. Investment grade funds saw the largest outflow since May of last year though Wednesday, according to Lipper. Investopedia uses cookies to provide you with a great user experience. As the price of a stock rises, the dots will rise as well, first slowly and then picking up speed and accelerating with the trend. Advanced Technical Analysis Concepts. Partner Links.