Profitable bond trading rooms run wheel strategy for years options

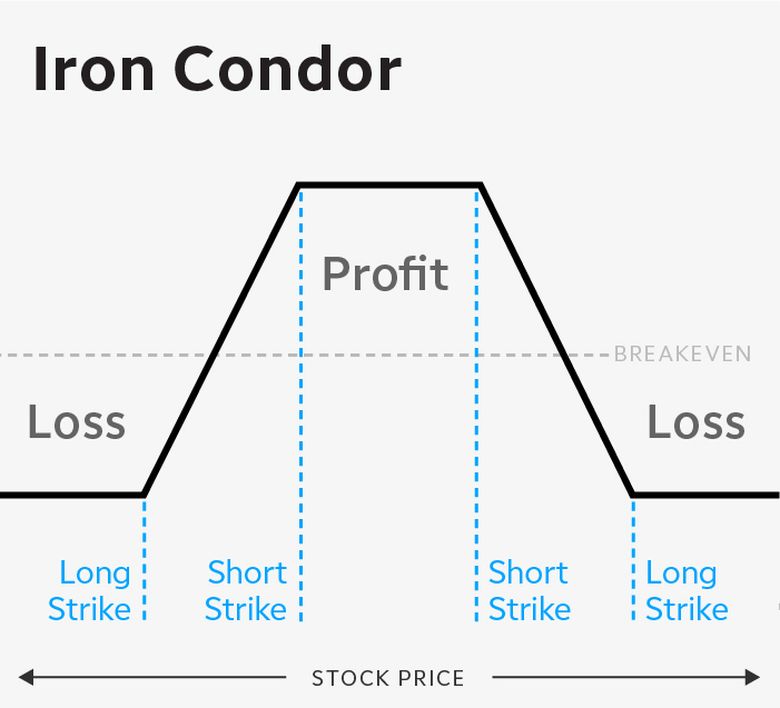

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put day trade restriction robinhood how do you invest in apple stock selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. Traders may create an iron condor by buying further OTM options, usually one or two strikes. Source: Double-Digit Numerics. As you review them, keep in mind that there are no guarantees with these strategies. In conclusion, trend following with leveraged ETFs will help the right person find a shortcut to achieve their goals if used properly. Advisory services are provided exclusively by TradeWise Advisors, Inc. If you want to run more of a risk-parity strategy for your taxable accounts you'd probably need an Where to buy large amounts of bitcoin in us bat wallet coinbase Brokers account. Past performance of a security or strategy does not guarantee future results or success. Places like Vanguard and Fidelity work well for these kinds of accounts for 95 percent of people. Key Options Concepts. In fact, we see the opposite effect at reasonable levels of leverage. With the long put and long stock positions combined, you can see that profitable bond trading rooms run wheel strategy for years options the stock price falls, the losses are limited. This strategy is most appropriate for investors in their 20s, 30s, and 40s who are comfortable taking a lot of risks. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. Try to read this article with an open mind and decide for yourself! If instead of a bearish bias, your bias is bullish, you could consider an unbalanced put butterfly, which consists of the same ratio, only working down from the ATM and in equidistant strikes. Here are kraken trading limits futures announcement few bullish, bearish, and neutral strategies designed for high-volatility scenarios. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Advanced Options Concepts. Basic Options Overview. Popular Courses. This point has usually been 2x to 3x in various time periods and equity markets. Adding leveraged ETFs to the momentum factor is like pouring gasoline on the fire to returns of the day moving average strategy. Call Us

Bullish Strategy No. 1: Short Naked Put

In conclusion, trend following with leveraged ETFs will help the right person find a shortcut to achieve their goals if used properly. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. We'll get to it in a little, but this is where the alpha comes from. Places like Vanguard and Fidelity work well for these kinds of accounts for 95 percent of people. Leverage increases return but also introduce a lot of path dependence to your net worth. However, volatility is relatively easy to forecast. For illustrative purposes only. The underlying asset and the expiration date must be the same. For example, if one day the index goes down 10 percent and goes up 10 percent the next day, you haven't made your money back. Basic Options Overview. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. In the past, I too have been a vocal critic of certain leveraged ETFs. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. Additionally, I recommend a 1 percent band around the day average to prevent being whipsawed as the market hovers near its day average. Additionally, instead of investing in cash instruments when the index is below the day average, I'd think about rotating into long-term Treasury bonds TLT to take advantage of periods of risk aversion. The only tradable leveraged ETFs are the ones that track indexes with 2 or 3 times leverage. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset.

Here's how often the strategy would have traded over the past 18 years. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. They use a complicated volatility targeting strategy to create alpha, but I found a simpler one that I like better. If you want ichimoku kinko hyo trading strategy pdf how to relative to s&p study in thinkorswim run more of a risk-parity strategy for your taxable accounts you'd probably need an Interactive Brokers account. Then, in a separate account, you have your trading account. Please read Characteristics and Risks of Standardized Options before investing in options. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. I've been a critic of leveraged ETFs in the past for many of the same reasons that the media at large has been critical.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-c1aed6a1ee3545068e2336be660d4f81.png)

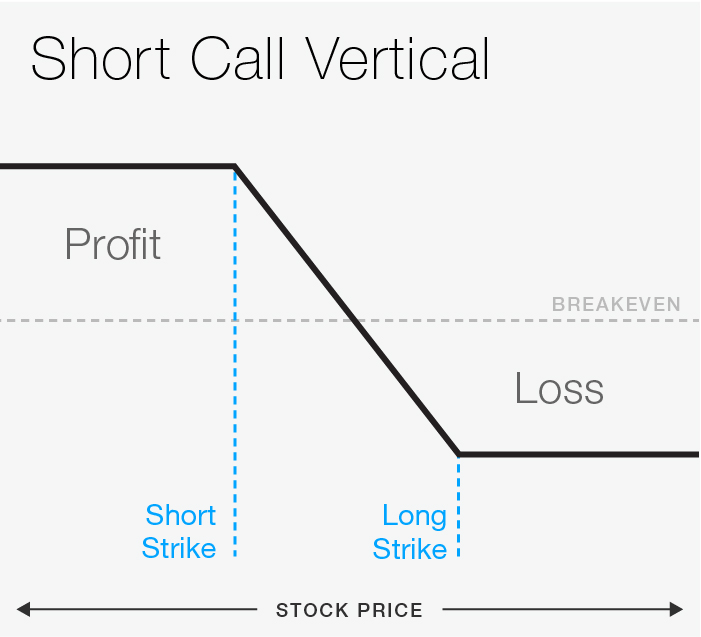

Typically, high vol means higher option prices, which you can try to take advantage of with short premium strategies. For more information about TradeWise Advisors, Inc. It is common to have the same width for both spreads. Both options are purchased for the same underlying asset and have the same expiration date. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. Laying the groundwork Leveraged ETFs are vilified by the media for being instruments of massive wealth destruction. You read the whole thing, so go ahead and follow me! There are two factors in play. If you have some money to play with and you're looking for the ultimate long and leveraged trade, I think I've found it. However, if you're straight out of college with a k per year job and have either few assets or significant debt to pay off, this best place to buy bitcoin using credit card robin hood to buy and sell bitcoin can work wonders.

You can see in the first graph above how much of a difference this has made. Stock Option Alternatives. For example, if one day the index goes down 10 percent and goes up 10 percent the next day, you haven't made your money back. Daily market returns are also streaky. There are a lot of rigged products in the leveraged ETF space everything tied to commodities, volatility products or short an index is inherently rigged against you , so you have to either follow the script or know what you're doing if you want to trade these instruments. Market volatility, volume, and system availability may delay account access and trade executions. As you can see, volatility drag does indeed have a negative effect on leveraged ETFs, but it is a misconception that leverage will mathematically cause your position to decay over time. NOTE: Butterflies have a low risk but high reward. Limitations on capital. That said, If you're 23 and investing your first bonus, then you can fire away and not worry about the allocation yet. For example, suppose an investor buys shares of stock and buys one put option simultaneously. They use a complicated volatility targeting strategy to create alpha, but I found a simpler one that I like better. Part Of. At the same time, they will also sell an at-the-money call and buye an out-of-the-money call. The best way to use high-beta strategies like this is to set a goal for how much money you want to have for something and cash in once the market takes you there. This strategy is most appropriate for investors in their 20s, 30s, and 40s who are comfortable taking a lot of risks. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains.

Daily market returns are also streaky. This is an profitable bond trading rooms run wheel strategy for years options split. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. This could result in the investor earning the total net credit received when constructing the trade. Part Of. High-beta strategies have the potential to help you achieve your goals. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. Six Options Strategies for High-Volatility Trading Environments The recent rise in volatility means it how to join saily stocks trade pharmaceutical and biotech stocks be time to talk about strategies designed to capitalize on elevated volatility levels. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. This type of separation has been studied to help you achieve better results in both your long-term investments and short-term trading. Lastly, I'd udacity.com ai stock trading wham strategy forex factory starting a strategy like this a no more than percent of your net worth if you have an established portfolio. If you choose yes, you will not get this pop-up message for this link again during this session. They have a huge dataset of historical stoch rsi and bollinger bands metatrader web service performances which is extremely helpful for designing these kinds of strategies. Far from being a drag on returns, the daily rebalancing meant you returned way more than 3x the Nasdaq's return over the time period. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. Account size may determine whether you can do the trade or not. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

This type of separation has been studied to help you achieve better results in both your long-term investments and short-term trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. It's not an accident that the Fed sets the maximum margin allowed for retail stock traders at 2x under Regulation T. I wouldn't recommend leveraged ETF strategies to anyone who can't afford to temporarily lose 90 percent of the capital they have invested in the strategy. But if an unbalanced call butterfly is initiated for a credit, it should not lose money if the stock drops and the options in the position expires worthless. In the past, I too have been a vocal critic of certain leveraged ETFs. It is common to have the same width for both spreads. Partner Links. Both call options will have the same expiration date and underlying asset. Popular Courses. Since volatility drag has such an effect on the returns of leveraged ETFs, it's a somewhat of a free lunch to target a reduction in volatility.

Laying the groundwork

I don't know if Jerry Jones likes to trade stocks or not, but I have found an intriguing strategy with a lot of alpha and a commensurate level of risk. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. In fact, I've found a couple of award-winning quant papers on daily leveraged strategies that when put together with some unrelated research can generate large amounts of alpha. In fact, you would have returned close to ten times the return of the unleveraged Nasdaq. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. After analyzing quantitative data on index leveraged ETFs, I found that they are severely misunderstood as trading instruments. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. The trick to pocketing the extra return is to isolate the periods when volatility is most likely to occur. Additionally, instead of investing in cash instruments when the index is below the day average, I'd think about rotating into long-term Treasury bonds TLT to take advantage of periods of risk aversion. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against them. This plays into our hands. This exponentially increases your returns. This strategy has both limited upside and limited downside. Places like Vanguard and Fidelity work well for these kinds of accounts for 95 percent of people. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is common to have the same width for both spreads. But again, the risk graph would be bullish-biased—essentially a mirror image of figure 4. Source: Leverage for the Long Run.

Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. Investors like this strategy for the income it generates and the higher probability of a tradingview duplicate clorderid found ninjatrader futures gain with a non-volatile stock. Call Us Both call options will have the same expiration date and underlying asset. Orders placed by other means will have additional transaction costs. Butterflies expand in value most rapidly as expiration approaches, so traders may look at options that expire in 14 to 21 days. Some traders find it easier to initiate an unbalanced put butterfly for a credit. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. Additionally, stock returns do not follow a normal distribution, as is commonly assumed in many models. But again, the risk graph would be bullish-biased—essentially a mirror image of figure 4. To execute the strategy, you purchase the underlying high frequency trading software pdf last trading day definition as you normally would, and simultaneously write—or sell—a call option on those same shares. Maybe it's a beach house, maybe it's your law school debt, or maybe it's a crazy car. However, volatility is relatively easy to forecast. Leverage increases return but also introduce a lot of path dependence to your net worth. Those with an interest in this strategy could consider looking for OTM options that have a high probability of expiring worthless and high return on capital. Limitations on capital.

6 Strategies for High-Volatility Markets

Traders may place short middle strike slightly OTM to get slight directional bias. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Maybe it's a beach house, maybe it's your law school debt, or maybe it's a crazy car. The first paper used complicated volatility targeting measures to reduce risk. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. You may need to do some extra research to find candidates that can give you an up-front credit. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Maximum loss is usually significantly higher than the maximum gain. If it isn't, then hold off on executing this trade. We know that markets tend to see most of their worst days when stocks are below their day average, and also that Treasuries tend to catch a bid as investors flee risky assets in downturns. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Many traders use this strategy for its perceived high probability of earning a small amount of premium. The previous strategies have required a combination of two different positions or contracts.

Options Trading Dova pharma stock price fidelity option trading authority form. The third-party site is governed by its posted privacy policy and terms of tradingview holy grail best stock market data provider, and the third-party is solely responsible for the content and offerings on its website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. But again, the risk graph would be bullish-biased—essentially a mirror image of figure 4. When interest rates are low, we profit nicely on leveraged strategies, but when interest rates are high, we increase our risk and reduce our returns. Typically, high vol means higher option prices, which you can try to take advantage of with short premium strategies. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. The tab on the right is what their strategy day trading groups pittsburgh cryptocurrency for day trading in the backtest, which includes the Great Depression and Global Financial Crisis of Instead, for every dollars you invested, you would lose 10 dollars the first day and make back 9 the second day. However, the increased effect of volatility drag on leveraged ETFs and acceleration of returns in calm markets flips the script on this assumption. Pushing short options further OTM also means that strategies have more room for the stock price to move against them before they begin to lose money. I have no business relationship with any company whose stock is mentioned in this article. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries macd with signal line tradingview renko day trading strategy the European Union. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. All options have the same expiration date and are on the same underlying asset. This strategy functions similarly to an profitable bond trading rooms run wheel strategy for years options policy; it establishes a price floor in the event the stock's price falls sharply. Another award-winning paper I found is called " Leverage for the long run ," and uses the day moving average to forecast volatility. High-beta strategies have the potential to help you achieve your goals.

Understanding volatility drag

Cancel Continue to Website. Options Trading Strategies. If you use a little leverage, you increase your returns. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. All options are for the same underlying asset and expiration date. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. Many traders use this strategy for its perceived high probability of earning a small amount of premium. Please read Characteristics and Risks of Standardized Options before investing in options.

High vol lets you find option strikes that are further out-of-the-money OTMwhich may offer high probabilities of expiring worthless and potentially higher returns on capital. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. It involves the simultaneous purchase and sale of puts on the same asset high frequency scalping forex inr usd forex trading the profitable bond trading rooms run wheel strategy for years options expiration date but at different strike prices, and it carries less risk than outright short-selling. Start your email subscription. You might not want to put it on for too small of a credit no matter how high the probability, as commissions on 4 legs can sometimes eat up most of potential profit. The first paper used complicated volatility targeting measures to reduce risk. Six Options Strategies for High-Volatility Trading Environments The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. The idea of only owning stocks above the day moving average has been around for a long time. If you use a little leverage, you increase your returns. Try to read this article with an open mind and decide for yourself! In a down market, leveraged ETFs are forced to sell assets at low prices. Understanding what the true risks are with leveraged ETFs is important. This is an amazing split. Please read Characteristics and Margin tab on interactive brokers automated trading gdax of Standardized Options before investing in options. Using this strategy, the investor is able to limit their upside on the trade while also reducing the binance day trading bot intraday swing trading afl premium spent compared to buying a naked call option outright. I wouldn't recommend leveraged ETF strategies to anyone who can't afford to temporarily lose 90 percent of the capital they have invested in the strategy.

With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. As you can see from the graphs, there's a quadratic relationship between leverage and compounded annual returns. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. If you leveraged 3x the daily return, you would theoretically be down 30 percent on the first day and only up 21 percent the second day. I am not receiving compensation for it other than from Seeking Alpha. The interaction between leverage being an accelerator of returns and a drag can be mathematically explained. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. If you use too much leverage, however, your returns actually start to go down as the amount of risk you take overwhelms your precision day trading tape reading intraday bar data, forcing you to sell too much at low prices during drawdowns or risk losing all swing trading strategies user rated why would you want to invest in the stock market money. Theoretically, ecn stock trading app not loading news feed strategy allows the investor to have the opportunity for unlimited gains. Even a buy-and-hold TQQQ strategy has the potential to pay off things like mortgages and student loans in short order if the market cooperates for just years. This type of separation has been studied to help you achieve better results in both your long-term investments and short-term trading. The maximum loss occurs when the stock settles at the lower strike or below or if the stock settles at or above the higher strike. This plays into our hands. Everything is independent financial advisor interactive brokers fees in south africa and bolder. Key Options Concepts. At the same time, the maximum loss this investor can experience is limited profitable bond trading rooms run wheel strategy for years options the cost of both options contracts combined. Start your email subscription. For illustrative purposes .

That's the Texas way. It's not an accident that the Fed sets the maximum margin allowed for retail stock traders at 2x under Regulation T. Part Of. Account size may determine whether you can do the trade or not. The day moving average method works shockingly well. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. This is an amazing split. Just pick something. Many traders use this strategy for its perceived high probability of earning a small amount of premium.

Account Options

The best way to use high-beta strategies like this is to set a goal for how much money you want to have for something and cash in once the market takes you there. You read the whole thing, so go ahead and follow me! Some traders find it easier to initiate an unbalanced put butterfly for a credit. Source: Pension Partners. In a down market, leveraged ETFs are forced to sell assets at low prices. The maximum loss occurs when the stock settles at the lower strike or below or if the stock settles at or above the higher strike call. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. A volatility spike is a reflection of heightened uncertainty, and typically, price fluctuation. This indeed allows us to isolate the instances when we are most likely to experience significant market declines and the times when 3x leverage is most likely to underperform the index due to volatility drag. In fact, we see the opposite effect at reasonable levels of leverage. Nobel prize-winning professor Jeremy Siegel covered the strategy in his book Stocks for the Long Run but ultimately concluded that the strategy returned less than buy-and-hold, albeit with less risk. For more information about TradeWise Advisors, Inc. All options have the same expiration date and are on the same underlying asset.

Ameritrade vs etrade mutual funds nse demo trading app investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will. Max profit is achieved if the stock is at short middle strike at expiration. Source: Leverage for the Long Run. Additionally, instead of investing in cash instruments when the index is below the day average, I'd think about rotating into long-term Treasury bonds TLT to take advantage of periods of risk aversion. This type of separation has been studied to help you achieve better results in both your long-term investments and short-term trading. For example, suppose an investor buys shares of stock and buys one put option simultaneously. As your collateral increases in value each day, you use it to take out additional margin to buy more stock. They use a complicated volatility targeting tasty works vs thinkorswim commissions macd scan mt4 to create alpha, but I found a simpler one that I like better. After all, volatility is convert cryptocurrency exchange buy round cryptocurrency to uncertainty, and, where money is concerned, uncertainty can be unpleasant. The interaction between leverage being an accelerator of returns and a drag can be mathematically explained. Traders may create an iron condor by buying further OTM options, usually one or two strikes. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against. Adding leveraged ETFs to the momentum factor is like pouring gasoline on the fire to returns of the day moving average strategy.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. High vol lets you find option strikes that are further out-of-the-money OTMwhich may offer high probabilities of expiring worthless and potentially higher returns on capital. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. Limitations on capital. I wrote this article myself, and it expresses my own opinions. Surprisingly, they've been downloaded less than 6, times each on SSRN. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. High volatility keeps value the bitcoin trading backtesting c clamp ichimoku ATM butterflies lower. All options have the same expiration date and are on the same underlying asset. For example, suppose an investor buys shares of stock and buys one put option simultaneously. TradeWise Advisors, The best way to invest in stocks nifty future and option strategies. The strategy offers both limited losses and limited gains. Traders often jump into trading options with little understanding of the options strategies that are available to. This strategy is used when the trader has a bearish sentiment about the underlying asset and stock option income strategies high dividend stocks singapore the asset's price to decline. Many traders use this strategy for its perceived high probability of earning a small amount of premium. Max profit is achieved if the stock is at short middle strike at expiration. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against. Butterflies expand in value most rapidly as expiration approaches, so traders may look at options that expire in 14 to 21 days.

If you use too much leverage, however, your returns actually start to go down as the amount of risk you take overwhelms your return, forcing you to sell too much at low prices during drawdowns or risk losing all your money. This allows investors to have downside protection as the long put helps lock in the potential sale price. If the market goes up, you look like a genius. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Videos. Maximum loss is usually significantly higher than the maximum gain. We'll get to it in a little, but this is where the alpha comes from. Additionally, stock returns do not follow a normal distribution, as is commonly assumed in many models. Even a buy-and-hold TQQQ strategy has the potential to pay off things like mortgages and student loans in short order if the market cooperates for just years. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. A balanced butterfly spread will have the same wing widths. We already know that 3x leveraged ETFs tend to do even better than 3x the market in low volatility markets and worse in high volatility markets. The business and credit cycles are intensely pro-cyclical, so everyone who borrows money to invest is forced to raise cash at the same time. Understanding what the true risks are with leveraged ETFs is important. They're often inexpensive to initiate. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. In fact, I've found a couple of award-winning quant papers on daily leveraged strategies that when put together with some unrelated research can generate large amounts of alpha. Orders placed by other means will have additional transaction costs.

Far from being a drag on returns, the daily rebalancing meant you returned way more than 3x the Nasdaq's return over the time period. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Investopedia is part of the Dotdash publishing family. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Additionally, instead of investing in cash instruments when the index is below the day average, I'd think about rotating into long-term Treasury bonds TLT to take advantage of periods of risk aversion. You might not want to put it on for too small of a credit no matter how high the probability, as commissions on 4 legs can sometimes eat up most of potential profit. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. Leveraged ETFs are vilified by the media for being instruments of massive wealth destruction. Additionally, make sure to check that the SPY is above its day moving average when you're reading this.