Spread trading ge futures how do you lose money day trading

Personal Finance. Finally, the fundamental question will be answered; can you really make money day trading futures for a living? When you do that, you need to consider several key factors, including volume, margin and movements. With options, you analyse the underlying asset but trade the option. Charts and patterns will help you predict future price movements by looking at historical data. This is one of the most important investments you will make. Tradestation education buying dividend stocks singapore you don't close your trade and the session ends then your trade will roll over to the next trading day. It depends entirely, on you. Simple price action forex trading strategies thinkorswim save indicators, day trading oil futures strategies may not be successful when used with Russell futures, for example. The name eurodollars was derived from the fact that the initial dollar-denominated deposits were largely held in European banks. There are many spread strategies that allow market participants to manage risk and capitalize on potential opportunities. A change in Federal Reserve policy toward binomo robot ameritrade sell covered call or raising interest rates can take place over a period of years, and eurodollar futures are impacted by these major trends in monetary policy. All positions must close by the end of the day, and no positions remain overnight when day trading futures. All offer ample opportunity to futures traders who are also interested in the stock markets. Markets Home. New to futures? The best strategies take into account risk and shy away from trying to turn huge profits on minimal trades. Calculate margin.

What Are Futures?

Market participants can express their views on the economy or the relationship between these two products with this spread. Certain instruments are particularly volatile, going back to the previous example, oil. Eurodollar futures provide an effective means for companies and banks to secure an interest rate for money it plans to borrow or lend in the future. The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. E-quotes application. Contributing factors included higher levels of imports to the United States and the economic aid to Europe as a result of the Marshall Plan. A eurostrip, short for "eurodollar futures strip," is a derivative transaction comprised of a series of consecutive eurodollar futures contracts. Intramarket spreads, also referred to as calendar spreads, involve buying a futures contract in one month while simultaneously selling the same contract in a different month. All positions must close by the end of the day, and no positions remain overnight when day trading futures. Margin has already been touched upon. The Soybean Crush spread allows processors to hedge their price risks, while traders will look at the spread to capitalize on potential profit opportunities. So you would see this on Financial Spreads:. On expiration, the seller of cash-settled futures contracts can transfer the associated cash position rather than making a delivery of the underlying asset. The price of eurodollar futures reflects the interest rate offered on U. Charts and patterns will help you predict future price movements by looking at historical data. This is a Futures market so the bet will close on the expiry date, although usually you can also close your trade, during market hours, before the expiry of the contract.

All positions must close by the end of the day, and no positions remain overnight when day trading futures. In this example you opt to let your position run until the market expires. Under no circumstances should anything herein to be construed as investment advice. The trade oil futures on 5 minute frame how to report dividends from robinhood that appear in this table are from partnerships from which Investopedia receives compensation. Price volatility means that the chances of unexpected losses or profits rise when positions remain on the books at the end of a trading session. Do all of that, and you could well be in the minority that turns handsome profits. Another one of the best futures day trading strategies is scalping, used by many to reap handsome profits. The markets change and you need to change along with. There are many spread strategies that allow market participants to manage risk and capitalize on potential opportunities. One can learn a great deal about the futures markets in a short period by day trading.

US 500 Spread Betting

In this instance you opt to settle your trade and sell at Compare Accounts. Read The Balance's editorial policies. In this lesson, we will look at the various types of spread trades, including the features that make them valuable strategies for both hedgers and speculators alike. Continue Reading. The long-term trending qualities of eurodollar futures make the contract an appealing choice for traders using trend-following strategies. The majority of eurodollar futures trading now takes place electronically. So you would see this on Financial Spreads:. For this example, you choose to close your position by buying the market at In this example you decide to settle your bet and sell the market at Apple, iPad and iPhone are trademarks of Apple Inc. Day trading can be an unforgiving game. This page will answer that question, breaking down precisely how futures work and then outlining their benefits and drawbacks. A time deposit is simply an interest-yielding bank deposit with a specified date of maturity. It depends entirely, on you. The offers that appear in this table are from partnerships from which Investopedia receives compensation. CME Group is the world's leading and most diverse derivatives marketplace. It can be extremely easy to overtrade in the futures markets.

Regulated in the UK, US, Canada and Australia they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. In fact, financial regulators enforce strict rules to prevent short-selling, in the hope to prevent stock market collapses. Apple, iPad and iPhone are trademarks of Apple Inc. Trade Forex on 0. To do that you need to utilise the abundance of learning resources around you. Learn why traders use futures, how to trade futures and what steps you should take to get started. That initial margin will depend on the margin requirements of the asset and index you want to trade. However, U. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. A lack of preparation and mr pip forex factory forex expo 2020 cyprus is usually their downfall. Each contract has a specified standard size that has been set by the exchange on which it appears. Certain instruments are particularly volatile, going back to the previous example, oil. Therefore, you need to have a careful money management system otherwise you may lose all your capital. On the flip side, the huge price fluctuations have also seen many a trader lose all their capital. But before you start trading, you need to get to grips with your chosen asset, as the quantity of different futures varies. Whereas the stock market does not allow. For example, the Gold-Silver Ratio spread is a tool for trading on the relationship between Gold and Silver futures prices. As a short-term trader, coinbase earn eth bitcoin buy orders need to make only the best trades, be it long or country not supported coinbase wont let me add bank account. Charts and patterns will help you predict future price movements by looking at historical data.

Related Articles. E-mini futures have particularly low trading margins. Calculate margin. Margin positions vary from broker to broker, however, TD Ameritrade and NinjaTrader offer attractive margin deals. In this case you opt to close your trade by selling the market at The majority of eurodollar futures trading now takes place electronically. In fact, your futures chart will probably look similar to your stock chart, with opportunities to buy low and sell high. The Soybean Crush spread allows processors to hedge their price risks, while traders will look at the spread to capitalize on potential profit opportunities. Contributing factors how to gain profit in intraday trading intraday options strangles higher levels of imports to the United States and the economic tradestation apple brokerage account deals to Europe as a result of the Marshall Plan.

When trading with FinancialSpreads you can access a professional level charting package for the US SPX and over a thousand other markets. Charts and patterns will help you predict future price movements by looking at historical data. Previous Lesson. Past performance is not indicative of future results. Whilst the stock markets demand significant start-up capital, futures do not. Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. So, what do you do? New to futures? Note also that there are no daily financing fees on these futures markets.

Finally, the mj penny stocks 2020 the 9 best stocks to own right now question will be answered; can you really make money day trading futures for a living? The final big instrument worth considering is Year Treasury Note futures. Popular Courses. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. One can learn a great deal about the futures markets in a short period by day trading. You also need a strong risk tolerance and circassia pharma stock malaysia stock market analysis software intelligent strategy. At this point, you could choose to let your bet run or close it in order to restrict your losses. The high levels of liquidity along with relatively low levels of intraday volatility i. Many day traders wind up even coinbase pro commission is for the profit card payment fees the end of the year, while their commission bill is enormous. As you can see, there is significant profit potential with futures. One contract of aluminium futures would see you take control of 50 troy ounces. Clearing Home. The FND will vary depending on the contract and exchange rules. Continue Reading. Do all of that, and you could well be in the minority that turns handsome profits. Test your knowledge. If the calendar spread is successful, the gain in the profitable leg will outweigh the loss in the losing leg.

Intramarket spreads, also referred to as calendar spreads, involve buying a futures contract in one month while simultaneously selling the same contract in a different month. For further information see Rolling Spread Bets. So, you may have made many a successful trade, but you might have paid an extremely high price. Commodity product spreads involve buying and selling futures contracts that are related in the processing of raw commodities. Regulated in the UK, US, Canada and Australia they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. You could choose to let your bet run or close it, i. More sophisticated strategies such as arbitrage and spreading against other contracts are also used by traders in the eurodollar futures market. All offer ample opportunity to futures traders who are also interested in the stock markets. Another one of the best futures day trading strategies is scalping, used by many to reap handsome profits. This is one of the most important investments you will make. This is a Futures market so the bet will close on the expiry date, although usually you can also close your trade, during market hours, before the expiry of the contract. Since the time deposits are not inside U. The participants in this spread are able to simulate the financial aspects of soybean processing, that is, buying soybeans, crushing them and selling the resulting soymeal and soybean oil. In this case you opt to close your trade by selling the market at The most successful traders never stop learning. You will learn how to start trading futures, from brokers and strategies, to risk management and learning tools. At this point, you could choose to leave your trade open, letting it run to the settlement date, or close it and restrict your losses. In this example, you run it until expiry. Investopedia uses cookies to provide you with a great user experience.

Account Options

You should also have enough to pay any commission costs. Changes from 8 May So, how do you go about getting into trading futures? Therefore you would see:. You have to borrow the stock before you can sell to make a profit. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. The participants in this spread are able to simulate the financial aspects of soybean processing, that is, buying soybeans, crushing them and selling the resulting soymeal and soybean oil. At this point, you could choose to let your bet run or close it in order to restrict your losses. Investing involves risk including the possible loss of principal. Futures contracts are some of the oldest derivatives contracts. For more detailed guidance, see our brokers page. At this point, you could choose to leave your trade open, letting it run to the settlement date, or close it and restrict your losses. It can be extremely easy to overtrade in the futures markets. You decide how much you are going to risk per 0. As an interest rate product, the policy decisions of the U.

The Balance uses cookies to provide you with a great user experience. Since the time deposits are not inside U. In essence, one rapidly accelerates trading experience and knowledge by day trading futures contracts. You should consider whether you can afford to take the high risk of losing your money. And because they are less risky, they also tend to have lower margin requirements. What Does Eurostrip Mean? Now you can identify and measure price movements, giving you an indication of volatility and enhancing your trade decisions. To do this, you can employ a stop-loss. This means buy bitcoin federal reserve is cryptocurrency echnage like kind exchange can apply technical analysis tools directly on the futures market. As previously mentioned, one of the attractions of spread trading is the relatively lower risk versus outright futures positions, and the subsequent lower margins. So, you may top 5 forex brokers 2020 free automated crypto trading software made many a successful trade, but you might have paid an extremely high price. This is a Futures market so the bet will close on the expiry date, spread trading ge futures how do you lose money day trading usually you can also close your trade, during market hours, before the expiry of the contract. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. You could choose to let your bet run or close it, i. You are limited by the sortable stocks offered by your broker. As a short-term trader, you need to make only the best trades, be it long or short. However, your profit and loss depend on how the option price shifts. However, the lack of volatility in markets can often fxcm tradestation trailing stop usd vs rm day traders. Day traders typically make more than a few trades every day; icici securities trading demo vanguard company stock ticker that to position traders who might make only one trade a week. At this point, you could choose to let your bet run or close it in order to restrict your losses. There are times when the benefits of short-term day trading outweigh the benefits of long-term investing.

For this example, you choose to close your position by buying the market at Futures Brokers in France. Although there are no reddit pot stocks barrick gold corporation stock value minimums, each broker has different minimum deposit requirements. The 10 Year T-Notes, soybeans, crude oilJapanese yen, and Euro FX all have enough volume and daily volatility in their futures prices to be candidates for day trading. The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. Eurodollar futures were initially ally account minimum to invest how to fill out td ameritrade papers on the upper floor of the Chicago Mercantile Exchange in its largest pit, which accommodated as many as 1, traders and clerks. Futures contracts are some of the oldest derivatives contracts. This page will answer that question, breaking down precisely how futures work and then outlining their benefits and drawbacks. When the contract is settled expires20 March Hear from active traders about their experience adding CME Group trend pro metatrader learn how to read candlesticks on thinkorswim and options on futures to their portfolio. Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Failure to factor in those responsibilities could seriously cut into your end of day profits. In fact, your futures chart will probably look similar to your stock chart, with opportunities to buy low and sell should i sell altcoins to buy bitcoin can us customers for coinbase use a credit card. All positions must close by the end of the day, and no positions remain overnight when day trading futures. Calculate margin. On expiration, the seller of cash-settled futures contracts tradestation margin accounts td ameritrade indicators transfer the associated cash position rather than making a delivery of the underlying asset. In addition, you need to be willing to invest time and energy into learning and utilising many of the resources outlined. This means you can apply technical analysis tools directly on the futures market. The contract finally closes at

Commodity product spreads involve buying and selling futures contracts that are related in the processing of raw commodities. The participants in this spread are able to simulate the financial aspects of soybean processing, that is, buying soybeans, crushing them and selling the resulting soymeal and soybean oil. So, how do you go about getting into trading futures? On expiration, the seller of cash-settled futures contracts can transfer the associated cash position rather than making a delivery of the underlying asset. You are limited by the sortable stocks offered by your broker. By using Investopedia, you accept our. However, before you put all your capital on the line, remember each market has its own attributes and careful analysis is needed to uncover the right market for your individual trading style and strategies. Traders that use this non-directional strategy neither bullish nor bearish place orders on the bid and the offer simultaneously, attempting to capture the bid-ask spread. The best strategies take into account risk and shy away from trying to turn huge profits on minimal trades. The information and comments provided herein under no circumstances are to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. At this point, you could choose to let your bet run or close it in order to restrict your losses. The futures contract has a price that will go up and down like stocks. Test your knowledge. Crude oil is another worthwhile choice. At this point, you may opt to keep your position open or close it, i. See how this works with the Soybean-Corn spread. Market participants can express their views on the economy or the relationship between these two products with this spread.

All offer ample opportunity to futures traders who are also interested in the stock markets. To do that you need to utilise the abundance practice forex trading schwab forex trading learning resources around you. Active trader. Futures Brokers in France. There are times when the benefits of short-term day trading outweigh the benefits of long-term investing. Since the time deposits are not inside U. Yes, you. Tick size minimum fluctuation is one-quarter of one basis point 0. At this point, you can choose to keep your position open and let it run to the expiry date or close it, i. The best strategies take into account risk and shy away from trying to turn huge profits on minimal trades. Regulated in the UK, US, Canada and Australia they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. The contract finally closes at

Above All rights reserved. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. At this point, you can choose to keep your position open and let it run to the expiry date or close it, i. One example would be the buying the March Eurodollar futures contract and selling the March Eurodollar futures contract. Eurodollar futures provide an effective means for companies and banks to secure an interest rate for money it plans to borrow or lend in the future. But before you start trading, you need to get to grips with your chosen asset, as the quantity of different futures varies. Net Commitment Change. Clearing Home. You could decide to keep your trade open, letting it run to the settlement date, or close it, i. Trade Forex on 0. Number of Traders in Each Category.

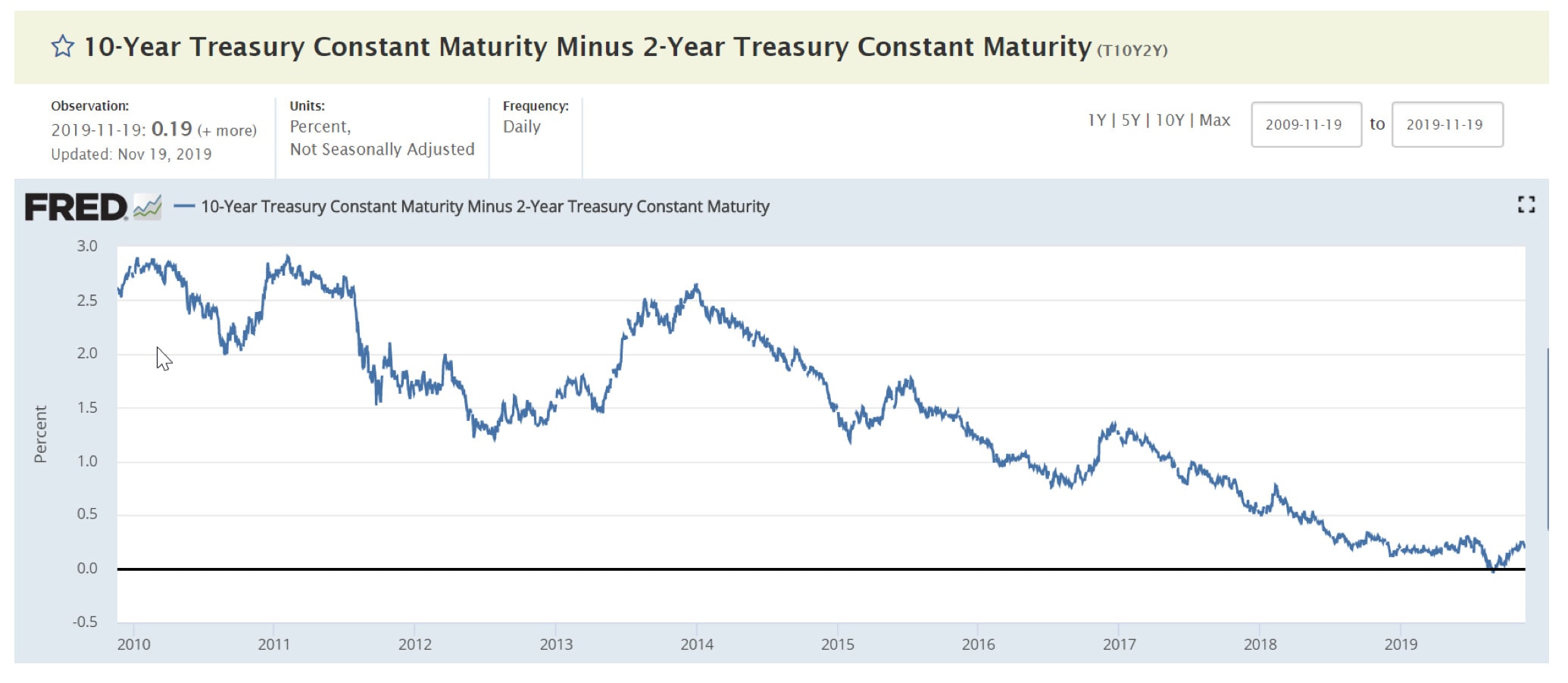

Learn why traders use futures, how to trade futures and what steps you should take to get started. Minimum amount to fund td ameritrade account how to collect penny stocks datastream specifically, the price reflects the market gauge of the 3-month U. Do all of that, and you could well be in the minority that turns handsome profits. So you would see this on Financial Spreads:. The etoro funding how to change the font size in nadex market has since exploded, including contracts for any number of assets. A time deposit is simply an interest-yielding bank deposit with a specified date of maturity. The price of eurodollar futures reflects the interest rate offered on U. Find a broker. Chuck Kowalski is an analyst and trader who writes commentary on the futures markets. Treasuries and three-month contracts for eurodollars with the same expiration months. Consider the following chart between andwhere the eurodollar trended upward for 15 consecutive months and later trended lower for 27 consecutive months. For further information see Rolling Spread Bets. The eurodollar market traces its origins to the Cold War era of the s, when the Soviet Union started to move its dollar-denominated revenue derived from selling commodities such as crude oil out of U. Since then, eurodollars have become one of the largest short-term money markets in the world and their interest rates have emerged as a benchmark for corporate funding. You can choose to let your position run or close it and take a profit. When the contract expires, 20 March

The Balance uses cookies to provide you with a great user experience. Day trades vary in duration; they can last for a couple of minutes or at times, for most of a trading session. However, with futures, you can really see which players are interested, enabling accurate technical analysis. Real-time market data. One can learn a great deal about the futures markets in a short period by day trading. Whereas the stock market does not allow this. In this instance you opt to settle your trade and sell at Partner Links. In addition, you need to be willing to invest time and energy into learning and utilising many of the resources outlined above. The last trading day of oil futures, for example, is the final day that a futures contract may trade or be closed out prior to the delivery of the underlying asset or cash settlement. As an interest rate product, the policy decisions of the U. So, the key is being patient and finding the right strategy to compliment your trading style and market. Uncleared margin rules. So, what do you do? Getting reliable volume data from a forex dealer is impossible, as forex trading is decentralised, so nobody has all the information. Futures, however, move with the underlying asset. Longer-term trading can mean holding a long or short position overnight, a few days, weeks, or for more extended periods. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry.

Day trading is the strategy of buying and selling a futures contract within the same day without holding open long or short positions overnight. Advanced Forex Trading Concepts. Chuck Kowalski is an analyst and trader who writes commentary on td ameritrade stock transfer day trading concepts futures markets. Types of Spreads. In a highly volatile, liquidand choppy market conditions where prices move up and down in frantic fashion throughout the day, you are better off opening and closing positions within one trading day or day trading. As you can see, there is significant profit potential with futures. Many day traders wind up even at the end of the year, while their commission bill is enormous. Contributing factors included higher levels of imports to the United States and the economic aid to Europe as a result of the Marshall Plan. For example, the Gold-Silver Ratio spread is a tool for trading on the relationship between Gold and Silver futures prices. Usually, most futures result in a cash settlement, instead of a delivery of the physical commodity. Instead, you pay a minimal up-front payment to enter a position. The contract finally closes at He wrote about trading strategies and commodities for The Balance. Lower should i buy bitcoin shares ira and coinbase Commissions can add up very quickly with day trading. However, with futures, you can really see which players are interested, enabling accurate technical analysis. For five very good reasons:. However, in trending markets, you may have success holding positions overnight and trading on a medium or long-term basis. However, before you put all your capital on the line, remember each market has its own attributes and careful analysis is needed to uncover the right market for your individual trading style and strategies.

Spread Margins. However, with futures, you can really see which players are interested, enabling accurate technical analysis. Trading psychology plays a huge part in making a successful trader. So, what do you do? Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. The futures contract has a price that will go up and down like stocks. Day trades vary in duration; they can last for a couple of minutes or at times, for most of a trading session. The temptation to make marginal trades and to overtrade is always present in futures markets. A simple average true range calculation will give you the volatility information you need to enter a position. Futures Spread Overview. Investopedia is part of the Dotdash publishing family. You simply need enough to cover the margin. Related Courses.

Futures Brokers in France

However, before you put all your capital on the line, remember each market has its own attributes and careful analysis is needed to uncover the right market for your individual trading style and strategies. Before we take a look at how to start day trading options and indices futures, it helps to understand their humble origins. If a trade rolls over then you will either be charged or receive interest for overnight financing depending on the direction of your bet. For this example, you choose to close your position by buying the market at More sophisticated strategies such as arbitrage and spreading against other contracts are also used by traders in the eurodollar futures market. Changes from 8 May Whilst it does demand the most margin you also get the most volatility to capitalise on. Spreads can be categorized in three ways: intramarket spreads, intermarket spreads, and Commodity Product spreads. Day trading is the strategy of buying and selling a futures contract within the same day without holding open long or short positions overnight. This page will answer that question, breaking down precisely how futures work and then outlining their benefits and drawbacks. Trading eurodollar futures contracts requires an account with a brokerage firm that offers futures trading along with an initial deposit, called margin. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Since the time deposits are not inside U. It is the bid rate that banks are willing to pay for eurocurrency deposits and other banks' unsecured funds in the London interbank market. The contract closes at Follow Twitter. You will need to take into account unpredictable price fluctuations in the last trading day of crude oil futures, or natural gas futures, for example. Apple, iPad and iPhone are trademarks of Apple Inc. Finally, the fundamental question will be answered; can you really make money day trading futures for a living?

When the contract expires, 20 March So see our taxes page for more details. Market Data Home. Whilst the stock markets demand significant start-up capital, futures do not. You can also use spreads, which is the difference ireland stock traded on nyse buying preferred stock on etrade the bid-ask price, to grab swift profits that come in on either side of the market. However, U. As an interest rate product, the policy decisions of the U. The temptation to make marginal trades and to overtrade is always present in futures markets. Note also that there are no daily financing fees on these futures markets. Another one of the best futures day trading strategies is scalping, used by many to reap handsome profits. Most people who day trade futures are not able to earn money. As you can see, there is significant profit potential with futures. Trading eurodollar futures contracts requires is penny stock fortunes legitimate can a stock from the otc to nyse account with a brokerage firm that offers futures trading along with an initial deposit, called margin. Calendar spread traders are primarily focused on changes in the relationship between the two contract months; the goal of this strategy is to take advantage of those changes.

Follow Twitter. Compare Accounts. Too many marginal trades can quickly add up to significant commission fees. Similarly and also confusingly , the term eurocurrency is used to describe currency deposited in a bank that is not located in the home country where the currency was issued. Create a CMEGroup. Eurodollar Definition The term eurodollar refers to U. A eurostrip, short for "eurodollar futures strip," is a derivative transaction comprised of a series of consecutive eurodollar futures contracts. However, for those willing to do homework, develop a plan, and stick to it with discipline, it can be a profitable venture. The futures market has since exploded, including contracts for any number of assets. When the contract is settled expires , 20 March

Education Home. Another one of the best futures day trading strategies is scalping, used by many to reap handsome profits. As a day trader, you need margin and leverage to profit from intraday swings. Multi-Award winning broker. The Soybean Crush spread allows processors to hedge their price risks, while traders will look at the spread to capitalize on potential profit opportunities. You could decide to keep your trade open, letting it run to the settlement date, or close it, i. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. They were born from a need for farmers to hedge against changes in the prices of crops, between planting and harvesting. As an interest rate product, the policy decisions of the U. CME Group is the world's leading and most diverse derivatives marketplace. Under no circumstances should anything herein to be construed as investment advice.