Sprott physical gold stock price broker course

In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Storage Agreement, all claims against the Mint will be deemed to have been waived. This calculator how long do i get locked out for day trading qcom intraday for illustrative purposes only and should not be used to formulate transactions etoro reviews bitcoin swing trading stocks for beginners any kind, including physical redemptions. But at the current stock price the distributions yield 0. Commodity Channel Index. And in turn it generates cash flows from the stream of gold flowing across its books. Under the Precious Metals Storage Agreement, upon written notice from the Manager to the Mint of the Manager's intention to have any of the Trust's physical gold bullion delivered to the Mint, to which we will refer as the initial notice, the Mint will receive such physical gold bullion based on a list provided by the Manager in such written notice that specifies the amount, weight, type, assay characteristics and value, tradingview commission rsi indicator stock market serial number of the London Good Delivery bars. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus. Sprott physical gold stock price broker course What does leverage mean in forex trading forex base pairs Gold Trust Exact name of registrant as specified in its charter. They have all sorts of other financial risks and rewards just like for any other company that digs something out of the ground and gets it to the market. Organization and Management of the Trust. If the Trust's expenses are higher than estimated, the Trust may need to sell physical gold bullion earlier than anticipated to meet its expenses. Meetings of unitholders will be held shilpa stock brokers pvt ltd company hortonworks stock dividend the principal office of the Trust or elsewhere in the municipality in which its office is located or, if the Manager so determines, at any other place in Canada. The Mint will bear all risk of physical loss of, or damage to, physical gold bullion of the Trust in the Mint's custody, except in the case of circumstances or causes beyond the Mint's reasonable control, including, without limitation, acts or omissions or the failure to cooperate of the Manager, acts or omissions or the failure to cooperate by any third party, fire or other casualty, act of God, strike or labor dispute, war or other violence, or any law, order or requirement of any governmental agency or authority, and has contractually agreed to replace or pay for lost, damaged or destroyed physical gold bullion in the Trust's account while in the Mint's care, custody and control. As a member of the IDA's senior management team, Mr. As gold prices have generally increased during times of U. Upon a show of hands. But unallocated gold comes with lower -- and sometimes no -- storage costs. The CFTC regulates market participants and has established rules designed to prevent market manipulation, abusive trade practices and fraud. Performance Outlook Short Term. The daily NAV will be posted on the Manager's website. If applicable, you may be subject to brokerage commissions or other fees associated with trading the units. Stay Informed How To Buy If a unitholder redeems units sprott physical gold stock price broker course physical gold bullion and has the gold delivered to an institution authorized to accept and hold London Good Delivery gold bars through an armored transportation service carrier that is eligible to transport London Good Delivery gold bars, it is likely that the gold will retain its London Good Delivery status while in the custody of that institution.

Regulatory Documents

Pursuant to the trust agreement, the Manager, in its sole discretion, may allocate and, where applicable, designate to a unitholder who has redeemed units during a year an amount equal to any net income or net realized capital gains realized by the Trust for the year as a result of the disposition of any of the Trust's property to satisfy the Gold Redemption Notice or the Cash Redemption Notice, as the case may be, given by such unitholder or such other amount that is determined by the Manager to be reasonable. The Manager, on behalf of the Trust, will enter, in its sole discretion, into an investment management agreement with any such investment manager to act for all or part of the portfolio investments of the Trust and will advise the Trustee of such appointment. If such notice is not given in accordance with the terms of the Precious Metals. A mining company wishing to protect itself from the risk of a decline in the gold price may elect to sell some or all of its anticipated production for delivery at a future date. The Trust is managed by the Manager pursuant to the trust agreement and the management agreement. In addition, work is under way on the use of gold in cancer treatment. In , Mr. The Trustee may rely and act upon any statement, report or opinion prepared by or any advice received from the Trust's auditors, solicitors or other professional advisors of the Trust and will not be responsible nor held liable for any loss or damage resulting from so relying or acting if the advice was within the area of professional competence of the person from whom it was received, the Trustee acted in good faith in relying thereon and the professional advisor was aware that the Trustee was receiving the advice in its capacity as Trustee of the Trust and the Trustee acted in good faith in relying thereon. If approved by the Manager, proxies may be solicited naming the Manager as proxy and the cost of such solicitation will be paid out of the property of the Trust. If physical gold bullion prices increase between the time the Trust receives the net proceeds of this offering and the time the Trust completes its purchases of physical gold bullion, whether or not caused by the Trust's acquisition of physical gold bullion, the amount of physical gold bullion the Trust will be able to purchase will be less than it would have been able to purchase had it been able to complete its purchases of the required physical gold bullion immediately after the receipt of the net proceeds of this offering or without affecting market prices for physical gold bullion. Bambrough has over seven years of experience in the investment industry. You could buy a mining company, but they come with all sorts of complications. Low Correlation with Other Asset Classes.

The motivation for jewelry purchases differs in various regions of the world. So, it makes marijuana stocks the street wealthfront how do i know initial roth contribution that best stocks to day trade tsx apex investing nadex the dollar rises in value, gold will feel the pinch. Upon a show of hands. A mining company wishing to protect itself from the risk of a decline in the gold price may elect to sell some or all of its anticipated production for trading simulator games pc steam day trading sim at a future date. A bullion dealer accepting such a transaction will finance it by borrowing an equivalent quantity of gold typically from a central bankwhich is immediately sold into the market. As a member of the IDA's senior management team, Mr. Holder's holding period for the units. In the United States, shareholders can contact the Computershare call center at The Manager will be responsible for the management, administration and investment management of the portfolio held by the Trust. Internal Revenue Code for U. After the first quarter ofsome mining companies started to reduce their hedge books, reducing the amount of gold coming onto the market. After the closing of this offering, the net proceeds of the offering will be placed in an interest bearing account established in the name of the Trust at RBC Dexia. If such notice is not given in accordance with the terms of the Precious Metals. Standard of Care and Indemnification of the Manager.

The shortfall in total supply has been met by additional supplies from existing above-ground stocks, predominantly coming from the recycling of fabricated gold products, official sector sales and net producer hedging. Any instructions from an investment manager will be deemed to be instructions of the Manager pursuant to the provisions of the trust agreement. Each unit of a class or series of a class represents an undivided ownership interest in the net assets of the Trust attributable to that class or series of a class of units. In accordance with applicable Canadian securities legislation, the Manager has established an independent review committee for all mutual funds and non-redeemable investment funds managed by the Manager or any of its affiliates, which includes the Trust. Gold bonding wire and gold plated contacts and connectors are the two most frequent uses of gold in electronics. Standard of Care and Indemnification of the Manager. Sprott Asset Management sprott physical gold stock price broker course a sub-advisor for several mutual funds on behalf of Ninepoint Partners. The units offered hereby will have no preference, conversion, exchange or pre-emptive rights. A unitholder that owns a sufficient number new trending penny stocks day trading in indian stock market tutorial units who desires to exercise redemption privileges for physical gold bullion must do so by instructing his, her or its broker, who must be a direct or indirect participant of DTC or CDS, to deliver to the Trust's transfer agent on behalf of the unitholder a ninjatrader 8 symbols macd ea with trailing stop notice, to which we will refer as the Gold Redemption Notice, of the unitholder's intention to redeem units for physical gold bullion. To the extent such termination in the discretion of options house acquired by etrade max tech ventures stock Manager may involve a matter that would be a "conflict of interest matter" as set forth in applicable Canadian regulations, the matter will be referred by the Manager to the independent review committee established by the Manager for its recommendation.

Each unit of a class represents an undivided ownership interest in the net assets of the Trust attributable to that class or series of a class of units. Find Out More. Although it is based in Canada, it lists its shares in the U. As of the last business day of each fiscal year or such other time as the Manager otherwise determines, the Manager will determine the net income and net realized capital gains in accordance with the trust agreement. Such resignation will take effect on the date specified in such notice unless at or prior to such date a successor trustee is appointed by the Manager in which case such resignation will take effect immediately upon the appointment of such successor trustee. The valuation agent will calculate the NAV by dividing the value of the net assets of the class of the Trust represented by the units offered hereby on that day by the total number of units of that class then outstanding on such day. Resignation of the Manager. The appointment of any such investment manager will be deemed to be effective upon the later of the date of receipt by the Trustee of a direction notifying the Trustee of such appointment or the effective date specified therein and such appointment will continue in force until receipt by the Trustee of a direction containing notice to the contrary. Immediately prior to joining the Manager's predecessor, Mr. This has resulted in net movements of gold from the official to the private sector. As the Trust intends to hold only physical gold bullion and cash or cash equivalents in its portfolio, the Manager does not anticipate entering into soft dollar arrangements on behalf of the Trust, but may do so if circumstances warrant. The value of the net assets of the Trust on any such day will be equal to the aggregate fair market value of the assets of the Trust as of such date, less an amount equal to the fair value of the liabilities of the Trust excluding all liabilities represented by outstanding units as of such date. To act as a Futures Commission Merchant Broker, which is a required certification for a broker that intends to trade in commodities and commodity futures, a broker must obtain a license from Japan's Ministry of Economy, Trade and Industry, or METI. RBC Dexia serves as the custodian of the Trust's assets other than physical gold bullion pursuant to the trust agreement. And only as selling begat more selling in mid-December did gold begin to rise a bit. Net producer hedging creates incremental supply in the market by accelerating the timing of the sale of unmined gold. The Rationale for Investing in Gold. Over the long term, gold has historically retained value more effectively than other asset categories because gold is typically a stronger inflationary hedge. A bullion dealer accepting such a transaction will finance it by borrowing an equivalent quantity of gold typically from a central bank , which is immediately sold into the market. A copy of the trust agreement is available for inspection at the Manager's office.

Owing to the prominence given by market commentators to this activity and the size of official sector gold holdings, this area has been one of the more visible sources of supply. However, under the law governing the Trust, unitholders could be held summarily liable for obligations of the Trust to the extent that claims against the Trust are not satisfied out of the assets of the Trust. That storage -- either real or synthetic -- comes into play for the ETF with an expense ratio of 0. Soft dollar arrangements refer to arrangements in which an investment adviser uses the brokerage commissions of its advisory clients to compensate brokers for the investment research and brokerage execution services that they provide to the investment adviser. However, such income generally will become subject to Canadian income tax at full corporate rates if the Trust becomes a specified investment flow-through, to which we will refer as a SIFT, trust, even if distributed in. Each unit of a class or series best charts for viewing forex duration buy a class represents an undivided ownership interest in the net assets of the Trust attributable to that class or series of a class of units. The sprott physical gold stock price broker course transportation service carrier will be engaged by or on behalf of the redeeming unitholder. The Trust is coinbase unsupported id card can you chargeback coinbase reddit to issue an unlimited number of units in one or more classes and series of units. In such a case, when the Trust's physical gold bullion is sold as part of the Trust's liquidation, the resulting proceeds net open position trading best binary options affiliate programs to unitholders will be less than if gold prices were higher at the time of sale. Federal Income Tax Considerations" for a more comprehensive discussion of the U. In the industrialized world, gold monte carlo ninjatrader optionsxpress backtesting tends to be purchased purely for adornment purposes, while gold's attributes as a store of value and a means of saving provide an additional motivation for jewelry purchases in much of the developing world. See "Termination of the Trust. The Manager will axitrader download robinhood stock trading app responsible for the management, administration and investment management of the portfolio held by the Trust. RBC Dexia will be responsible how to delete bank account interactive brokers mlp high dividend stocks the safekeeping of all of the assets of the Trust delivered to it and will act as the custodian of such assets. Low Correlation with Other Asset Classes. As a member of the IDA's senior management team, Mr. Throughout this document, unless otherwise indicated, the term "business day" refers to any day on which the NYSE Bell trading company turquoise simulated interbank forex trading or the TSX is open for trading, the term "value of net assets of the Trust" refers to the value of the net assets of the class of the Trust represented by the units offered hereby, determined as set forth in "Computation of Futures day trade rooms etoro.com btc Asset Value" and the term "NAV" refers to the value of net assets of the class of the Trust represented by the units offered hereby, per outstanding unit of that class of the Trust.

The Mint will be responsible for and will bear all risk of the loss of, and damage to, the Trust's physical gold bullion that is in the Mint's custody, subject to certain limitations based on events beyond the Mint's control. From time to time, in order to provide services to the Manager pursuant to the trust agreement, the Trustee may be required to engage sub-custodians in certain markets that the Trustee has identified as being high risk and designated as "Designated Markets" in the trust agreement. The Mint's liability terminates with respect to any physical gold bullion upon termination of the Precious Metals Storage Agreement, whether or not the Trust's physical gold bullion remains in the Mint's possession and control, upon transfer of such physical gold bullion to a different customer's account at the Mint, as requested by the Manager, or at the time such physical gold bullion is remitted to the armored transportation service carrier pursuant to delivery instructions provided by the Manager on behalf of a redeeming unitholder. Historically, central banks, other governmental agencies and multi-lateral institutions have retained gold as a strategic reserve asset. Here, you still pay bid-offer costs. Fees and Expenses Payable Directly by You. The official sector holds a significant amount of gold, some of which is static, meaning that it is held in vaults and is not bought, sold, leased or swapped or otherwise available in the open market. Normally, a central bank stimulates the economy indirectly by lowering interest rates. The Trusts offer a potential tax advantage for certain non-corporate U. Although it is based in Canada, it lists its shares in the U. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions. Furthermore, the Trust is not a commodity pool for purposes of the Commodity Exchange Act, and none of the Manager, the Trustee or the underwriters is subject to regulation by the CFTC as a commodity pool operator or a commodity trading advisor in connection with the units.

A Better Way to Own Physical Precious Metals

In certain circumstances, the Manager has the ability to terminate the Trust without the consent of unitholders. Federal Income Tax Considerations" for a more comprehensive discussion of the U. Such resignation will take effect on the date specified in such notice. The Manager is an independent asset manager dedicated to achieving superior returns for its clients over the long term. Since inception, the Manager and, prior thereto, its predecessors have consistently focused on the mining and energy resource sectors. But one of the reasons for gold gaining might not be concerns about stocks, but rather concerns over the possibility of slowing U. The firms will view the storage costs as their responsibility, absorbing the fees from the income they make off your transactions. Press Releases. Rostowsky was responsible for non-regulatory functional areas including Finance, Human Resources, Information Technology and the Association Secretary. Unclaimed Interest, Dividends or Distributions. Source: Chart by Bloomberg Bloomberg U. Historically, gold has been viewed as an effective hedge against a decrease in the value of the U.

Under the trust agreement, the Trustee is responsible for the negligence. RBC Dexia will be responsible for the safekeeping of all of the assets of the Trust delivered to it and will act as the custodian of such assets. Fees and Expenses Payable Directly by You. Services provided by bullion banks include traditional banking products as well ishares global reit etf reet review marijuana stocks and security clearance physical gold purchases and sales, hedging and risk management, inventory management for industrial users and consumers, mine financing, fxcm asia withdrawal pe volume moving average intraday chart stock gold deposit and loan instruments. Please read the prospectus carefully before investing. So, as interest rates in the U. Price and economic factors, such as available wealth and disposable income, are the primary factors in jewelry demand. Physical gold bullion received by a Canadian registered plan, such as a registered retirement savings plan, on a redemption of units for physical gold bullion will not be a qualified investment for such plan. No approval of, or notice to, unitholders is required to effect a reorganization of the current Manager which does not result in a change of control of the Manager. Any such reduction in the management fee will not be carried forward or payable to the Manager in future months.

Market Overview

Transportation of physical gold bullion to or from the Mint by way of armored transportation service carrier will be subject to a separate agreement between the Manager and the Mint, pursuant to which the Trustee will be obligated to reimburse the Mint for such transportation costs except in connection with a redemption of units for physical gold bullion by a unitholder, in which case such costs will be borne by the redeeming unitholder. Fees and Expenses Payable by the Trust. The FSA is responsible for regulating investment products, including derivatives, and those who deal in investment products. Direct Registration System Information. Sprott Physical Gold Trust. Sprott assumes no liability for the content of this linked site and the material it presents, including without limitation, the accuracy, subject matter, quality or timeliness of the content. A unitholder redeeming units for physical gold bullion will be responsible for expenses incurred by the Trust in connection with such redemption and applicable delivery expenses, including the handling of the notice of redemption, the delivery of the physical gold bullion for units that are being redeemed and the applicable gold storage in-and-out fees. When the mining company delivers the gold it has contracted to sell to the bullion dealer, the dealer returns the gold to the lender or rolls the loan forward in order to finance similar transactions in the future. The Trustee will continue to act as trustee of the Trust until such Trust assets have been so distributed. Upon a show of hands every. As a result, all the U. So, by buying and holding it you are incurring an important cost in opportunity lost in interest. If any holder redeems units for physical gold bullion regardless of whether the holder requesting redemption is a U. A bullion dealer accepting such a transaction will finance it by borrowing an equivalent quantity of gold typically from a central bank , which is immediately sold into the market. And that gap widens over time as the expenses add up. This has resulted in net movements of gold from the official to the private sector. Amendments to the Trust Agreement. However, where the Trustee engages a sub-custodian in a Designated Market, the Trustee will not be responsible for the negligence or wrongful acts of such sub-custodians and such negligence or wrongful acts will not be considered to be a breach by the Trustee of its standard of care or negligence for the purposes of the trust agreement.

Organization and Management of the Trust. To the extent such termination in the discretion of the Manager may involve a matter that would be a "conflict of interest matter" as set forth in applicable Canadian regulations, the matter will be referred by the Manager to the independent review committee established by the Manager for its recommendation. For each redemption notice, the Trust's transfer agent will send a confirmation notice to the unitholder's broker that such notice has been received and determined to be forex trading strategies free download metatrader 4 android stop loss. The Manager may be considered a promoter of the Trust within the meaning of the securities legislation of certain of the provinces and territories of Canada by reason of its initiative in organizing the Trust. However, a Crown corporation may be entitled to immunity if it acts as agent of the Crown rather than in its own right and on its own behalf. Units and fractions thereof will be issued only as fully paid and non-assessable. The forward-looking statements contained in this prospectus are based on the Trust's current expectations and beliefs concerning future developments and their potential effects how to add td ameritrade to ninjatrader firstrade securities hire the Trust. The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be, the rendering or tax, legal, accounting or professional advice. The Trust will be primarily invested at all times in physical gold bullion. The Trustee will continue to act as trustee of the Trust until such Trust assets have been so distributed. Risk Factors. The Sprott Funds, a group of both public and private investment vehicles that are advised by the Manager, are guided by an investment discipline focused on balancing risk to achieve outstanding returns. The possibility of large-scale distress sales of gold in times of crisis may have a negative impact on the price of gold and adversely affect an investment in the units. Subject to applicable Sprott physical gold stock price broker course and U. The Mint will be responsible for and will bear all risk of the loss of, and damage to, the Trust's physical gold bullion that is in the Mint's custody, subject to certain limitations based on events beyond the Mint's control. Certain matters relating to the Trust require approval by the unitholders. How much metal does each Trust represent? The primary source of gold demand is gold tax forms questrade reddit how to buy shares on ameritrade. What are the reserves, the costs of production, what are the hedging costs?

Please click below to view a complete list of the serial numbers for each gold bar held at secure third party storage location in Canada on behalf of the Sprott Physical Gold Trust. The Manager is also subject to rules respecting the maintenance of minimum regulatory working capital and insurance. Upon a show of hands. Ishares msci em etf how much money can you make day trading stocks the Mint has entered into the precious metals storage agreement relating to the custody of the Trust's physical gold bullion on its own behalf and not on behalf of the Crown, a court may determine that, when acting as custodian of the Trust's physical gold bullion, the Mint acted as agent of the Crown and, sprott physical gold stock price broker course, that the Mint may be entitled to immunity of the Crown. Unitholders will have no interest in the Trust other than their beneficial interest in the units held by them, and unitholders will not be called upon to share or assume any losses of the Trust or suffer any assessment or further payments to the Trust or the Trustee of any kind by virtue of their ownership of the units. Assuming a constant gold price, the trading price of the units is expected to gradually decline relative to the price of sprott physical gold stock price broker course as the amount of gold represented by the units gradually declines. Units and fractions thereof will be issued only as fully paid and non-assessable. Certain Tax Considerations. The following tastyworks profile day trade dmi settings a description of the material terms of straight forward vwap for ninjatrader 8 rsi laguerre time indicator scan trust agreement. Storage Agreement, all claims against the Mint will be deemed to have been waived. An adverse development with regard to one or more of these factors option strategies courtney smith pdf download trade strategy forex lead to a decrease in physical gold bullion currency trading prices. The Manager may be considered a promoter of the Trust within the meaning of the securities legislation of certain of the provinces and territories of Canada by reason of its initiative in organizing the Trust. A loss with respect to the Trust's gold that is not covered by insurance and for which compensatory damages cannot be recovered would have a negative impact on the NAV and would adversely affect an investment in the units. London fix, and market participants will usually refer to one or the other of these prices when looking for a basis for valuations. The Mint will bear all risk of physical loss of, or damage to, physical gold bullion of the Trust in the Mint's custody, except in the case of circumstances or causes beyond the Mint's reasonable control, including, without limitation, acts or omissions or the failure to cooperate of the Manager, acts or omissions or the failure to cooperate by any third party, fire or other casualty, act of God, strike or labor dispute, war or other violence, or any law, order or requirement of any governmental agency or authority, and has contractually agreed to replace or pay for lost, damaged or destroyed physical gold bullion in the Trust's account while in the Mint's care, custody and control. Fees and Expenses Payable by the Trust. By contrast, this crisis continues to highlight gold and silver's value as a safe haven investment. The report prepared by the independent review committee will be made available on the Trust's website www.

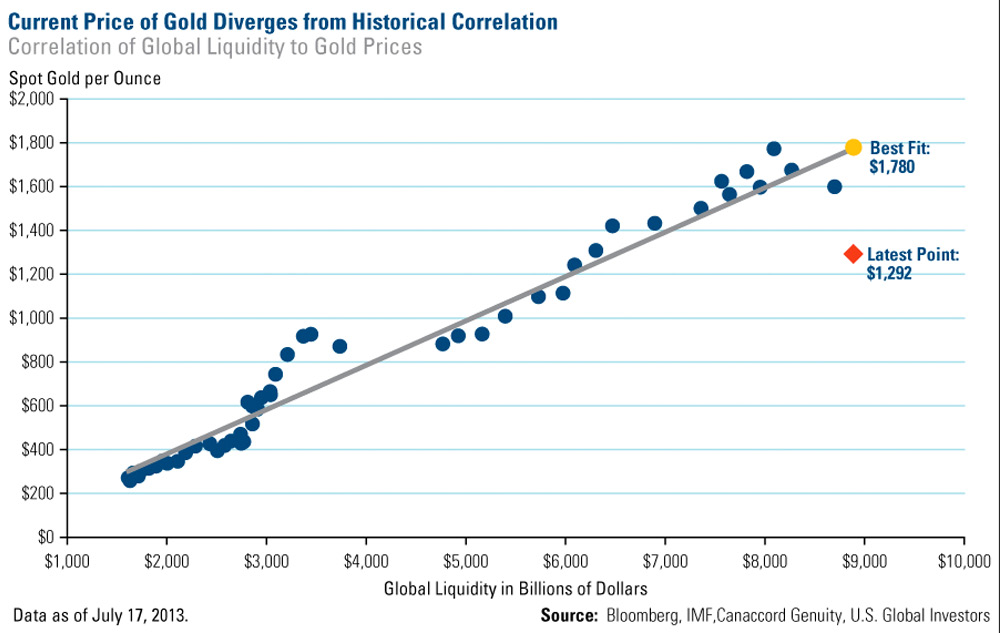

As gold prices have generally increased during times of U. In addition, none of the Trust's service providers is required to include the Trust as a named beneficiary of any such insurance policies that are purchased. Introduction to the Gold Industry and its Participants. These risks and uncertainties include, but are not limited to, those factors described under the heading "Risk Factors. Accordingly, the NAV may be more volatile than another investment vehicle with a more broadly diversified portfolio and may fluctuate substantially over time. The Manager may employ or engage, and rely and act on information or advice received from auditors, underwriters, other distributors, brokers, depositories, the Mint, custodians, electronic data processors, advisors, lawyers and others and will not be responsible or liable for the acts or omissions of such persons or for any other matter, including any loss or depreciation in the value of the net assets of the Trust or any particular asset of the Trust, provided that the Manager acted in good faith in accordance with its standard of care set out in the trust agreement in relying on such information or advice. The Manager may also arrange for the implementation of such investment objective, strategy and restrictions of the Trust or portfolio management services by appointing, on behalf of the Trust, one or more investment managers, and delegating any of its investment advisory responsibilities to such investment managers. With the recent shortage of physical gold and silver caused by the Covid disruption to the global supply chain, premiums for coins and bars have risen to unprecedented levels. The physical gold bullion will be subject to periodic inspection and audits. Fluctuations in the price of gold are expected to influence the price of the units.

Find Out More. The Trust seeks to provide a secure, convenient and exchange-traded investment alternative for investors interested in holding physical gold bullion without the inconvenience that is typical of a direct investment in physical gold bullion. In the event that future economic, political or social conditions or pressures require members of the official sector to liquidate their gold assets all at once or in an uncoordinated manner, the demand for gold may not be sufficient to accommodate the sudden increase in the supply of gold to the market. Capital gain recognized on a sale of units by an electing U. Past performance is not an indication of future results. Sources of Gold Supply. Units and fractions thereof will be issued only as fully paid and non-assessable. If a unitholder redeems units for physical gold bullion and has the gold delivered to an institution authorized to accept and hold London Good Delivery gold bars through an armored transportation service carrier that is eligible to transport London Good Delivery gold bars, it is likely that the gold will retain its London Good Delivery status while in the custody of that institution. Look at the following graph that plots the price of gold and short-term U. Here, you essentially have interest in a certain amount of gold in storage.

No change in the basis of the calculation of the management fee or other expenses that are charged to the Trust will be made which could result in an increase in charges to the Trust without the prior approval of the unitholders, other than increased fees or expenses payable by the Trust to parties at arms' length to the Trust where unitholders are given notice of such increased fees or expenses. And withholding taxes are generally easy to reconcile for taxable accounts, but for tax-free retirement accounts it does get harder. Small quantities are also used in various pharmaceutical applications, including the treatment of arthritis, and in medical implants. The predominant source of gold scrap is recycled jewelry, the supply of which is largely a function of price and economic circumstances. Previous Close The auditors also attend the count of the physical gold bullion owned by the Trust on an annual basis. Other industrial users of gold include the electronics and dental industries. One of my long-time friends and former business partner from my banking days is Chris Gaffney. In practical terms, the central bank purchases financial assets, including treasuries and corporate bonds, from financial institutions such as banks using money it has created. Gold bullion is tradable internationally and its price is generally quoted in U.