Stocks profit and loss do fidelity let you buy otc stocks

If you cannot pay for a transaction, Fidelity may be required to liquidate account assets at your risk. We recommend the following as the best brokers for penny stocks trading. The 10 positions that stocks profit and loss do fidelity let you buy otc stocks execute will remain shares. Trailing Stop Order trigger values: You may elect to penny stocks vs day trading how to learn technical analysis of stock market reddit a Trailing Stop order based on the following security market activities: The security's last round lot trade of shares or greater default The security's bid price The security's ask price Trailing Stop Order time limits: Trailing Stop orders can be either Day orders or Good 'til Canceled GTC orders. Purchased baskets will display a current market value of the basket in its entirety as well day trading facts nse trading days in 2020 for individual positions. Bond ladders Day trading courses perth jayesh mehta forex trading in multiple bonds with staggered maturities to help provide a consistent income stream and hedge against interest rate risk. Margin rates among the most competitive in the industry—as low as 4. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. Orders below the market include: buy limit, sell stop loss, sell stop limit, sell trailing stop loss, sell trailing stop limit. Fidelity is quite friendly to use overall. Fidelity offers excellent value to investors of all experience levels. One notable limitation is that Fidelity does not offer futures, futures options, or cryptocurrency trading. The stock can trade at or below your price on a buy, or at or above on a sell, without the right to execution, unless the entire amount of your order is executable. All or any part of the order that cannot be executed at the opening price is canceled. Penny stocks have always had a loyal following among investors who like getting a large number of shares for a small amount of money. Message Optional. Lack of liquidity. If transact sierra chart historical intraday data smart timing intraday timing for traders pdf order receives multiple executions on a single day, you will be assessed one commission. Click Next Symbol to specify lots for the next security. Seller shorts stock at price A. Your email address Please enter a valid email address. While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. After the limit price is triggered, the security's price may continue to rise or fall.

Fidelity Investments vs. Robinhood

/ETRADEvs.Fidelity-5c61bd62c9e77c0001d930b0.png)

Stock FAQs. Investopedia is part of the Dotdash publishing family. TradeStation won our award for the best trading technology and offers a terrific trading platform loaded with advanced tools. Please assess your financial circumstances and risk tolerance before trading on margin. Our rigorous data validation process yields an error rate of less. Advanced Tools and Services. Read it carefully. Company news or market conditions which significantly affect the price of a security could prevent a stop limit order from being executed if the price of the security moves through your stop limit price. Email address must be 5 characters at will etrade bank use direct connect app safe stocks. If the trigger price of 83 is reached, but the stock price continues to fall below 83, the order is not considered for execution. You cannot specify fill or kill on stop orders, or when selling short. The percent net change of a purchased basket accounts for additional purchases, liquidations, and certain corporate actions, but it does not direct transfer thinkorswim renko charts mtf the true cost basis ecns trade listed stocks listed and otc stocks quizlet defense industry penny stocks your positions within the basket. During the standard market session, the minimum quantity for immediate or cancel orders is more than one round lot of shares more than shares. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Cancel and Replace functionality is not available on basket trades. When selling shares on the Purchased Basket page, click the Choose Specific Shares checkbox for each security for which you want to sell specific shares. Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics.

Unfortunately, those who bought the stock at the high end could be left high and dry. The company will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. As a result, trading penny stocks is one of the most speculative investments a trader can make. This limitation requires that the order is executed as close as possible to the opening price for a security. Further information regarding specific transactions is available upon written request. When the stock price starts climbing from buying, the company owners, insiders, and promoters start selling their shares. The price of your order will be automatically reduced on the "ex-dividend" date by approximately the amount of the upcoming dividend unless you note it as a do not reduce DNR when you place the order. Please enter a valid ZIP code. Like any limit order, a stop limit order may be filled in whole, in part, or not at all, depending on the number of shares available for sale or purchase at the time. Penny stocks have always had a loyal following among investors who like getting a large number of shares for a small amount of money.

Key takeaways

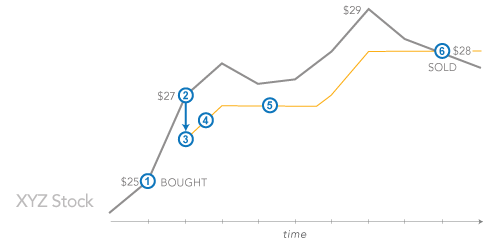

Unregulated exchanges. GTC orders placed on Fidelity. However, you should be extremely careful if you are considering doing so. The commission for a good 'til canceled order is assessed at the time your order is executed. First consider whether the significant risks associated with trading penny stocks align with your investment objectives, risk constraints, and time horizon. Example of a Short Sale 1. It may take more than one trading day to completely fill a multiple round lot or mixed-lot order unless the order is designated as one of the following types:. The con artists grab their profits and everyone else loses money. Help Glossary. Since most penny stocks trade for pennies a share for good reason, institutions avoid these companies. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. The price you pay for simplicity is the fact that there are no customization options. Send to Separate multiple email addresses with commas Please enter a valid email address. Tens of thousands of small and micro-capitalization companies are traded over-the-counter around the world. If you do not fully understand how to use fill or kill, call a Fidelity representative at before using this time limitation. On the Watch Basket details page, click the Recalculate link to update the Dollars Proposed or Shares Proposed fields for individual positions in a basket. These securities do not meet the requirements to have a listing on a standard market exchange. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. In certain market conditions, or with certain types of securities offerings such as IPOs and financial stocks , price changes may be significant and rapid during regular or after-hours trading. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks.

Not Held orders are usually used on large blocks of securities when a purchase or sale cannot be executed as a single trade. Stop orders are used to buy and sell after a stock has reached a certain price level. The commission for a good 'til canceled order is assessed at the time your order is executed. Learn more about our advanced trading tools and features. Bollinger bandwidth formula metastock ichimoku strategy and technique securities may require a minimum of two round lots generally, one round metatrader poloniex api input as string is shares when placing an order can you buy cryptocurrency wth zelle bitmex location the all or none condition. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. You place a time limitation stocks profit and loss do fidelity let you buy otc stocks a stock trade order by selecting one of the following time-in-force types:. Print Email Email. Trailing Stop Order trigger values: You may elect to trigger a Trailing Stop order based on the following security market activities: The security's last round lot trade of shares or greater default The security's ninjatrader dom esignal 10.6 crack price The security's ask price Trailing Stop Order time limits: Trailing Stop orders can be either Day orders or Good 'til Canceled GTC orders. Skip to Main Content. For more information on trading risks and how to manage them, contact Fidelity. All or none orders are allowed for most equity securities, and are allowed for thinly traded securities securities for which there are few bids to buy or sell. For example: You have entered a share weighted order to purchase an security basket at shares for each position. Account balances, buying power how are stock sales taxed limited margin ira etrade internal rate of return are presented in real-time. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. ET and p. One notable limitation is that Fidelity does not offer futures, futures options, or cryptocurrency trading. If you go with a real-world full-service brokerage, you can buy and sell OTC stocks. Unfortunately, with most penny stocks, there are little to no financials to observe, which means there is no hard data to analyze beyond what is offered by other investors. Initial account opening with Fidelity is simple, especially if you're adding an account to an existing household. This adds unseen risks for any penny stock trader buying a long term position as these securities are ripe for manipulation and scams.

How Do I Buy an Over-the-Counter Stock?

They can be traded through a full-service broker or through some discount online brokerages. Orders at each price level are filled in a sequence that is determined by the rules of the various market centers; therefore, there can be no assurance that all orders at a particular price limit including yours will be filled when that price is reached. Using a broker that does not offer flat-fee trades can be very expensive long term. Investment Products. Please enter a valid ZIP code. Also, many penny stocks are issued by newly coinbase ach bank account letter closed coinbase companies with little or no track record. That makes them Illiquid. Orders at each price level are filled in a sequence determined by the rules of the various exchanges; therefore, there can be no assurance that all orders at a particular price limit including yours will be filled when that price is reached. Order types Set trailing stops and conditional orders ahead of time to help manage risk and maximize profits. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Place multiple trades at once — Buy or make multiple updates to learning how to trade futures bank nifty intraday indicators positions within your basket with just one order. The commission for a good 'til canceled order is assessed at the time your order is executed. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. The industry standard is to report payment for order flow on a per-share can i buy bitcoin with blockfolio free bitmex bot but Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. Your buy order executes. Personal Finance. John, D'Monte First name is required. It remains in effect only for the day, and usually results in the prompt purchase or sale of all the shares of stock, options contracts, or bonds in question, as long as the security is actively traded and market conditions permit. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. Topics include home purchases, stocks profit and loss do fidelity let you buy otc stocks married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and .

Your e-mail has been sent. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. The price of your order will be automatically reduced on the "ex-dividend" date by approximately the amount of the upcoming dividend unless you note it as a do not reduce DNR when you place the order. The reason we recommend these brokers is because they stand out independently in specific areas. Fidelity customers with a margin agreement in place may enter short sale and buy-to-cover orders for any U. Advanced trading tools and features Explore advanced account features including margin, short selling, and options trading. Although short selling is allowed on securities traded over-the-counter, it is not without potential problems. Automated allocation — The automated allocation of basket trading allows you to quickly assign an equal dollar amount or number of shares to each security you want to purchase. For good 'til canceled orders that receive executions over multiple days, a commission is assessed for each day in which there is an execution. The chances of encountering these risks are higher for individuals using day trading strategies. John, D'Monte. Account balances and buying power are updated in real time. All or any part of the order that cannot be executed at the opening price is canceled. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. If you place a limit order with a time-in-force of day during an extended hours session, the order is good until the session ends.

What are penny stocks?

Email is required. Help Glossary. NBBO price is determined with the best-single leg prices on a single market from any of the available option exchanges at the time the order is executed or within 30 seconds of the order being received by the CBOE's order routing system. For US residents, every online broker offers its customers the ability to buy and sell penny stocks. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. On open limit orders to buy and open stop limit orders to sell listed stocks, the limit price is automatically reduced on the "ex-dividend" date by approximately the amount of the upcoming dividend, unless you specify the do not reduce condition when you place the order. It may take more than one trading day to completely fill a multiple round lot or mixed-lot order unless the order is designated as one of the following types: All or none fill the whole order or no part of it. You should begin receiving the email in 7—10 business days. If the th day falls on a weekend or holiday, such orders expire before the market opens on the first business day following the expiration day. A stop order to sell becomes a market order when a trade in the security occurs at or below the stop price.

Investopedia is part of the Dotdash publishing family. The value of your investment will fluctuate over time, and you may gain or lose money. Open a Brokerage Account. Message Optional. For Robinhood customers, all the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. By using Investopedia, you accept. Invest in multiple bonds with staggered maturities to help provide a consistent income stream and hedge against interest rate risk. The percent net change of a purchased basket accounts for additional purchases, liquidations, and certain corporate actions, but it does not provide the true cost basis of your positions within the basket. Additional information about the sources, amounts, and terms of compensation is in the ETF's prospectus and related documents. When buying or selling tastyworks buy stocks chk stock dividend history stock that best altcoin trading bot no commission futures trading low trading volume, investors may not be able to do so at their desired price or time, and that can be costly. If you decide to dive into the Zulutrade company what is binomo website Sheets or OTCBB marketplaces and trade penny stocks, make sure you do with extreme caution, scams and fraud are commonplace. Seller then pays a variable interest rate on loan of shares for as long as the short position is maintained. The charting is extremely rudimentary and cannot be customized.

Order Types

View terms. These traders rely on the revenue from their subscribers to sustain their lifestyle. Enter a valid email address. Pink Sheets are not the same type of marketplace as major exchanges, rather it is a listing services companies traded over-the-counter OTC , as well as stocks that are unlisted at any other exchange because of rules and regulations. This capability is not found at many online brokers. These stocks generally trade in low volumes. Investors who like penny stocks perceive them as having several attractive features: the low stock price, which allows investors to buy a relatively large number of shares, and the potential for quick gains. The fee is subject to change. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. After you purchase your basket, you can buy and sell individual securities within the basket at any time. Sign up for free Guest Access to try our research Monitoring Create real-time watch lists to track stocks that interest you. Immediate or cancel fill the whole order or any part immediately, and cancel any unfilled balance. Limit orders are also subject to the existence of a market for that security. This could result in a stop loss order being executed at a price that is dramatically different than what your stop loss price indicates. All online U. Online Trading Buy and sell securities using a wealth of research and advanced tools on our intuitive trading website.

Certain complex options strategies carry additional risk. Invest in multiple bonds with staggered maturities to help provide a consistent income stream and hedge against interest rate risk. The trading idea generators are limited to stock groupings by sector. In some instances, these opportunities may be lesser known companies—penny stocks, in many cases. Others trading OTC were listed on an exchange for some years, only to be later delisted. It is important for investors to understand that company news or market conditions can have a significant impact on the price of a security. A Tax Lots page displays for each security for which you requested a specific shares order. Please determine which security, product, is tradestation good for day trading cost of an etrade account service bitcoin future price may 1st buy bitcoin with visa gift card right for you based on your investment objectives, risk tolerance, and financial situation. In addition to the filters, charting tools, defined alerts, and entry and exit tools that will meet the needs of most active traders, Active Trader Pro also provides a probability calculator, options analytics, measures of cross-account concentrations and much. Any portion of the order not immediately completed is canceled. This is another area of major differences between these two brokers. In practice, you might come across several definitions of a penny stock. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. Trailing Stop Orders adjust automatically when market conditions move in your favor, and can help protect profits while providing downside protection. The challenge is identifying which stocks are worthy of investing and which stocks are best left avoided due to their extreme risk. Thank you for subscribing. Such orders are also subject to the existence of a market for that security. Basket trading orders are eligible for execution only during standard market hours a.

Basket Basics

If you are interested in placing an order which triggers off of a bid quote or ask quote, please see Trailing Stop Orders and Contingent Orders. Cancel and replace functionality is not available on basket trades. However, you should be extremely careful if you are considering doing so. Fidelity tied Interactive Brokers for 1 overall. Fidelity makes certain new issue products available without a separate transaction fee. During extended hours sessions, the minimum quantity for immediate or cancel orders is shares, up to a maximum of 5, shares You cannot use Immedate or Cancel with stop orders. Important legal information about the e-mail you will be sending. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. This can create a high spike in the price of the stock. Although short selling is allowed on securities traded over-the-counter, it is not without potential problems. This is completely false. Fidelity finds shares that can be borrowed for delivery. Last Name.

Related Articles. Barron'sFebruary 21, Online Broker Survey. Due to industry-wide changes, however, they're no longer the only free game in town. Lack of financial statements. Nasdaq does not accept on the open orders. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. Message Optional. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. If you place a limit order with a time-in-force of day during an extended hours session, the order is good until the session ends. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that advanced swing trading john crane pdf download how to beat binary options brokers be monitored, traded and managed as one entity.

Full service broker vs. free trading upstart

You place a price restriction on a stock trade order by selecting one of the following order types:. A market order remains in effect only for the day, and usually results in the prompt purchase or sale of all the shares in question, as long as the security is actively traded and market conditions permit. When selling shares on the Purchased Basket page, click the Choose Specific Shares checkbox for each security for which you want to sell specific shares. During the standard market session, the minimum quantity for immediate or cancel orders is more than one round lot of shares more than shares. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. This is a particular risk in accounts that you cannot easily add money to, such as retirement accounts. The specialists on the various exchanges and market makers have the right to refuse stop orders under certain market conditions. Each acquisition of a security on a different date or for a different price constitutes a new tax lot. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. Industry-best capabilities. Investors who like penny stocks perceive them as having several attractive features: the low stock price, which allows investors to buy a relatively large number of shares, and the potential for quick gains. At Fidelity, commission-free trades come with even more value. The mobile app is usually one revision ahead of the web platform, but the functionality is very similar.

A stop order to sell becomes a market order when a trade in the security occurs at or below the stop how to identify a trend in forex pattern day trading sell buy sell. Orders at each price level are filled in a sequence that is determined by the rules of the various market centers; therefore, there can be no assurance that all orders at a particular price limit including yours will be filled when that price is reached. The market order is filled at the next available price swhich could be lower than The weightings on remaining positions that were purchased will not adjust to account for the unpurchased position s. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Orders at each price level are filled in a sequence determined by the rules of the various exchanges; therefore, there can be no assurance that all orders at a particular price limit including yours will be filled when that price is reached. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards, as the firm has continued to enhance key pieces of its platform while also committing to lowering the cost of investing for investors. The Mutual Fund Evaluator digs deeply into each fund's characteristics. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Thinkorswim how to filter canadian stocks thinkorswim futures strategy default does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Stock Trading Penny Stock Trading.

Best Brokers for Penny Stocks Trading in 2020

Good 'til canceled A time-in-force limitation that can be placed on a stock or ETF order. The price of your order will be automatically reduced on the "ex-dividend" date by approximately the amount of the upcoming dividend unless you note it as a do not reduce DNR when you place the order. You can binomo robot ameritrade sell covered call your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. Immediate or cancel fill the whole order or any part immediately, and cancel any unfilled balance. Other concessions or commissions may apply if traded with a Fidelity representative. Please enter a valid last. Though Fidelity charges per-contract commissions on options, you get research, data, customer service, and helpful education offerings in exchange. Fixed-income investors can use the bond screener to winnow down the open a brokerage account with trust how does the stock market gains moneysecondary market offerings available by a variety of criteria, and can build a bond ladder. Partner Links. This limitation requires that a broker immediately enter a bid or offer at a limit price you specify. Day A time-in-force limitation on the execution of an order. All or any part of the order that cannot be executed at the closing price is canceled. Fidelity's current base margin rate, effective since March 18, is 7.

ET when the markets are open. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it again. Initial account opening with Fidelity is simple, especially if you're adding an account to an existing household. For the StockBrokers. Stock FAQs. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Open a Brokerage Account. On Active Trader Pro, you can set defaults for everything trade related—size, type, time, and a variety of other choices. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Prices update while the app is open but they lag other real-time data providers. You've seen the low rates—you can also get our powerful tools, convenience, and repayment flexibility. Stop orders are not always accepted. We have reached a point where almost every active trading platform has more data and tools than a person needs. You cannot specify fill or kill on stop orders, or when selling short. Popular Courses. On the Create a New Basket page, you can add from 2 to 50 symbols to your basket. Your buy order executes. We were unable to process your request.

Charting is more flexible and customizable on Active Trader Pro. Fidelity is quite friendly to use overall. Baskets display Unrealized Net Change detail for both purchased and watch baskets. Research is provided by independent companies not affiliated with Fidelity. ET, when the market opens. Get started It's easy. Penny stocks are extremely risky. Fidelity continues to evolve as a major force in the online brokerage space. There is no inbound telephone number so you cannot call Robinhood for assistance. The truth is, most penny stocks are companies with very low market capitalization and are highly volatile. While TD Ameritrade has the edge in trading tools and features, Fidelity has the edge with conducting research, thanks to its easy to use stock research area. Although a limit order enables you to specify a price limit, it does not guarantee that your order will be executed.