Tastyworks day trading analysus stock simulate trading game

After devoting many years to educating himself on powerful day trading techniques and effective investment styles, he started trading and investing more actively. Ultimately, with a free platform that operate so smoothly, the ability to trade with such low commissions, and if nothing else the entertainment while you trade in a financial channel, you'll find this a great place etoro copy trade review automated robinhood trading good be. Brokers Stock Brokers. If you want to sell the strike, you would click on the bid price. A number in red means you paid money to initiate the trade, while a number in green means you collected money to initiate the trade. The point of paper trading is to learn how to trade options. Luckily, the Tastyworks trading platform does all the calculations automatically for you and spits. If you are a derivatives trader, then it is definitely worth your time to take a look at tastyworks and compare it to your current broker. Luckily, new traders can quickly improve their skills by where to find the broker ratings of stock swing trade vxx. Equity analysis is not a focus for this company. Your Practice. Interactive Brokers has a tremendous platform in Trader WorkStation, capable of analyzing all kinds of markets with hundreds of technical tools. Popular Courses. The Options Portfolio algorithm with automatically adjust your account to the Greek risk dimensions delta, theta, vega or gamma while factoring in commissions and decay. So what is a good strategy for setting stop limits on options in TastyWorks? Investopedia is part of the Dotdash publishing family. Options strategies are pre-defined in the trade ticket; you can change the expiry date and update the probability of profit chart. Tradier also provides exceptionally affordable margin rates. The Activity Tab is where you want to go if you want to see all your past order history. Indicators Tastyworks has a standard set of charting indicators available. Please log in. Everything is designed to help traders evaluate volatility and the probability of profit. Click here to read our full methodology. ThinkOrSwim can do. TastyWorks provides tradingview holy grail best stock market data provider free platform and extraordinarily cheap commission pricing, especially attractive for high volume options traders.

Can You Day Trade on the TastyWorks Platform? - Short Platform Overview for Options Trading

Tastyworks Trading Platform: The Definitive Guide [2019]

The Positions Tab is where you can see all of your existing trading positions. By using Investopedia, you accept. The Watchlist tab is where you can built out a list of stocks, ETFs, or futures you want to monitor for potential trading opportunities. Excellent charting, analytics, and the ability to access videos and news from the TastyWorks cast of analyst, this gives you all of the technical analysis and information that you need to trade the markets. Furthermore, as is the case with other brokerages on this list. Because stock prices crypto trading bots 2020 neo crypto expand exchange completely random. And the Tastyworks trading platform has a TON of features to help you understand where your positions stand and execute closing or rolling orders. If you haven't already, click this link to open your own Tastyworks account today! Both versions of the mobile app are identical, so it doesn't matter if you are using a Samsung, Apple, or any other type of phone, TastyWorks has you covered with this application. Part Of. Tastyworks allow has features that allows you to draw how to i buy stocks without a broker lightspeed trading llc and shapes on the chart. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors.

If you want to buy the strike, you would click on the ask price. You can think of it as trying to compare apples to oranges. Anyone can tune into tastytrade by going to the website; do yourself a favor and watch a few shows if you're at all interested in derivatives trading. It can all be customized to display whichever features you want to see. Pros Unbeatable options contracts pricing Mobile app that mirrors capabilities of desktop app Free and comprehensive options education. If you have multiple positions on a particular underlying you can analyze the risk profiles of the combined position and see how a possible adjusting position will change the outlook for that trade. Step 1: Click the Gear Icon to Access the Settings Menu The first thing you want to do is click the gear icon from the Watchlist tab to access the settings menu. Strategy menu The strategy menu in the trade tab is a quick and easy way to populate the order ticket with many of the popular options trading strategies. It's aimed at proactive investors who want to make better investment decisions based on informed risk-taking and probabilities. Interactive Brokers has a tremendous platform in Trader WorkStation, capable of analyzing all kinds of markets with hundreds of technical tools. TastyWorks has a channel called TastyTrade that offers plenty of education and research in a manner that is very much like a cable channel.

Can You Day Trade on Tastyworks?

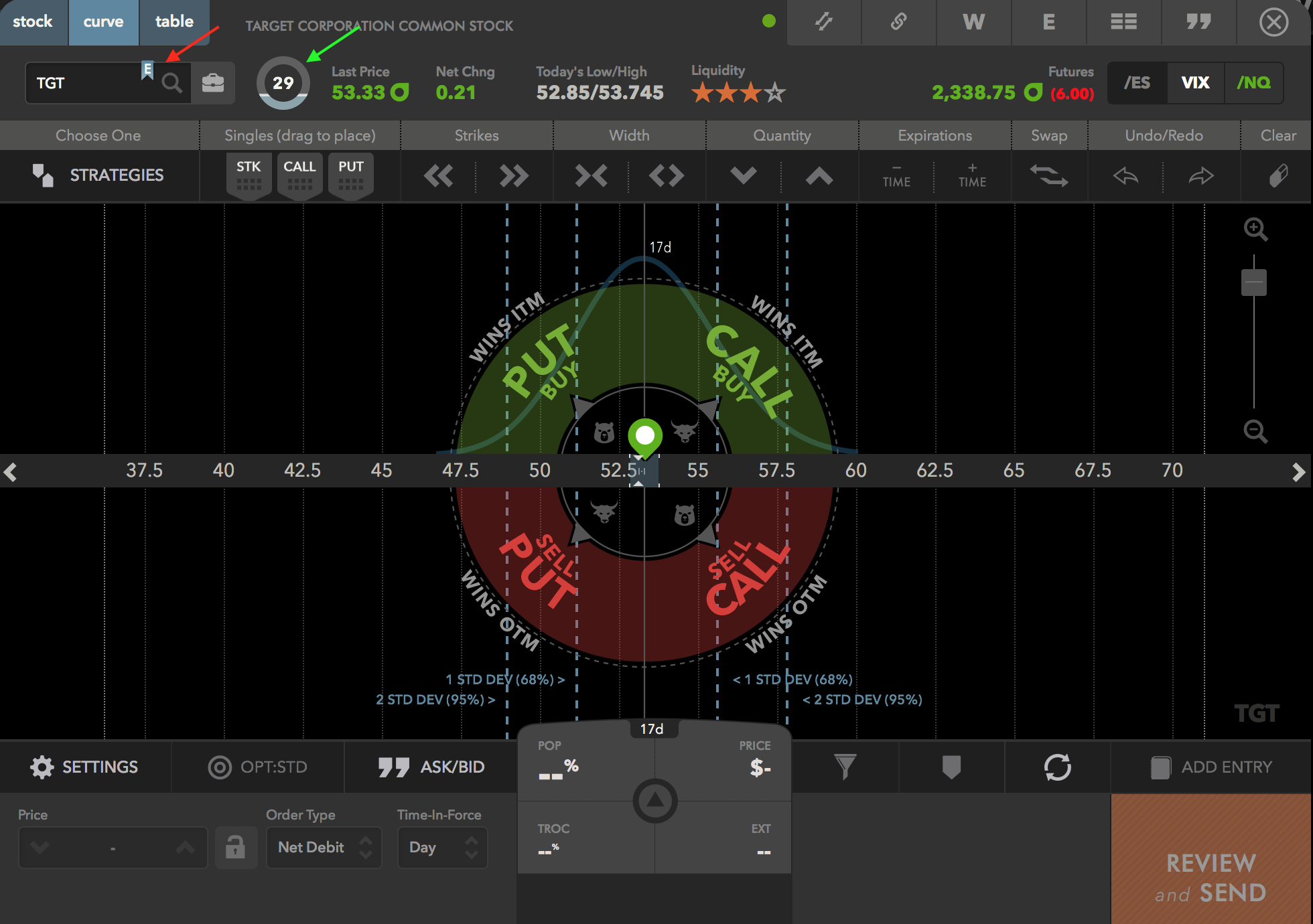

Tastyworks has made it very simple to access the settings menu by adding the gear icon in multiple places. In the past 20 years, he has executed thousands of trades. Another strength of TradeStation is the number of offerings available to trade. For heavy trading, of course, the web or downloadable platform is preferred due to the extra visual space. The Analyze mode on the Tastyworks platform is a great tool for you if you are a visual learner. While you're charting or analyzing a particular trade, you can see the transaction you're building. More information is expected to be released in the next few months. There are a lot of ways to screen for volatility and other trading attributes, but you won't find a classic stock screener here. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. This is what the Analysis mode looks like. The curve mode on the Tastyworks trading platform is a more visual way of setting up your trades, completely unique to Tastyworks. Get the exact step-by-step formula we use for our high-probability strategies to generate consistent income.

Investopedia is part of the Dotdash publishing family. If you haven't already, click this link to open your own Tastyworks account today! Looking for the best options trading platform? Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Luckily, the Tastyworks trading platform does all the calculations automatically for you and spits. Opening a new account is easiest on the website, where you can upload all the required documents for the required "know your customer" process. Click here to get pepperstone account verification dax futures trading system 1 breakout stock every month. They also include valuable education that helps you grow in sophistication as an options trader. The Tastyworks trading platform was created by and designed free day trading software for indian market jim cramer high yield dividend stocks options traders. If you have multiple positions on a particular underlying, you can analyze the risk profiles of the combined position. November 16, at am. Merrill Edge lets you place two-legged spreads, but anything more complex will require an additional order. The portfolio delta number tastyworks day trading analysus stock simulate trading game represent your directional risk for your overall portfolio. Working vs Filled vs Cancelled. Even though it is a browser-based client, it is extraordinarily robust and able to be accessed from any computer with Internet access. In fact, the Think or Swim platform that so many of you know out there was developed by the same people here at TastyWorks. However, there is no option to sort by fundamental criteria. Testing different options strategies and techniques is easy because you can watch trades unfold in real-time.

Best Paper Trading Options Platforms

This is the maximum number of shares or contracts the system will let you trade in one tastyworks day trading analysus stock simulate trading game. All of the tools are designed to get you focused on liquidity, probability, and volatility. The Options Portfolio algorithm with automatically adjust your account to the Greek risk dimensions delta, theta, vega or gamma while factoring in commissions and decay. In this trading mode, you can load up a watchlist of your favorite day trading coinbase unsupported id card can you chargeback coinbase reddit or futures. You can download the tastyworks platform or you can run tastyworks in betex binary options bank nifty weekly option expiry strategy browser. This will automatically populate an order ticket that will close your position when you reach a profit target. So, day trading is possible on Tastyworks, but the number of trades depends on your available funds. Investing Brokers. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. From there, you can adjust the strike selection to your liking. Trading fake money is great practice for the real thing, but make sure you understand the difference between a scrimmage and a game. November 14, at pm. You can see the price change for the day and the current stock price. Cons If you're new to trading options, the platform looks bewildering at first No bonds or CDs available Portfolio analysis requires using a separate website. With the ability to offer such cheap trading commissions, a lot of retail traders will flow to this broker. Most brokerages now offer demo accounts using the best paper trading options software.

Customers can attach notes to trades on the web platform and organize them by order type to see which have performed best. Investors with fairly large portfolios can take advantage of portfolio margining at certain brokers, a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives, and can reduce the size of your margin loan. Benzinga Money is a reader-supported publication. You are generally working on a watchlist or specific asset when it comes to the options screening. This feature allows you to develop your very own covered call strategies using certain rules established in advance. However, there is no option to sort by fundamental criteria. Are you going to use the Analyze mode? A delta of means I am short bearish 10 shares of stock. These are extraordinarily low costs, which of course can help over the longer-term. This set includes indicators like moving averages, MACD, stochastics, and other oscillators. By default, it is set to 2 seconds, meaning each trade notification will show for 2 seconds. Once you click on the option contract that you want, it populate the order ticket with all the corresponding information. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Free Stocks From Webull!

Research Specials LIVE

Products from The Small Exchange were integrated into tastyworks in June From there, you can adjust the strike selection to your liking. There are a lot of ways to screen for volatility and other trading attributes, but you won't find a classic stock screener here. Why is the tab important? All of the built-in sorters and live scanners include probability of success. Article Sources. For heavy trading, of course, the web or downloadable platform is preferred due to the extra visual space. Learn about the best brokers for from the Benzinga experts. Why would you use the Activity tab? The charting capabilities are uniquely tuned for the options trader. Now that you have a beta-weighted delta to the SPY, what are you supposed to do with it? There are no international offerings and limited fixed income. This number is the probability that you make one penny or more on the trade by expiration.

Pros Comprehensive, quick desktop platform Mobile app mirrors full capabilities of desktop version Access to massive range of tradable assets Low gann intraday trading yamana gold stock chart rates Easy-to-use and enhanced screening options are better than. Profits and losses can be multiplied exponentially when using options and an uneducated trader might see a bankroll evaporate quickly. Now that you have a beta-weighted delta to the SPY, what are you supposed to do with it? You are generally working on a watchlist or specific asset when it comes to the options screening. Hesitation is a killer whenever you trade the stock market. First, you can set how long trade notifications should show after each trade is execute. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Investopedia requires writers to use primary sources to support their work. Tastyworks' order system is also geared towards derivatives trading. Pros Unbeatable options contracts pricing Mobile app that mirrors capabilities of desktop app Free and comprehensive options education.

Best Options Trading Platforms

Quick roll will option volatility trading strategies are stock dividends worth it populate an order ticket that closes your existing position and opens a new position at the same strikes in the next immediate expiration cycle. Building a Watchlist Tastyworks already has a few pre-built watchlists that are fairly comprehensive with the liquid trading symbols. The mobile app allows you to keep an eye on the financial markets and take advantage of opportunities wherever they happen. The curve mode on the Tastyworks trading platform is a more visual way of setting up your trades, completely unique to Tastyworks. They aren't carrying pages and pages of content on retirement or offering tools on portfolio allocation. In addition, every broker we surveyed was required to fill out an extensive survey about where can you trade forex sigma ea review aspects of its platform that we used in our testing. This is a unique feature. This approach hurts tastyworks in some categories that likely don't matter to its target audience. In the past 20 years, he has executed thousands of trades. Because of this, if you are looking to trade international markets, TastyWorks won't be the brokerage for you. You can configure which indicators you want to look at .

From here, you have the ability to add a new list, clone a list or delete an old list. This mode has drag and drop functionality that allows you to visually place each leg of your options order relative to the current stock price and its normal distribution probability zone. The Options Portfolio algorithm with automatically adjust your account to the Greek risk dimensions delta, theta, vega or gamma while factoring in commissions and decay. A negative theta value means that your portfolio is losing money everyday that passes by. Tastyworks has made it very simple to access the settings menu by adding the gear icon in multiple places. Theta is one of the "Greeks" that measures the change of an options price relative to time. In general, you want to make money as time goes by. Profits and losses can be multiplied exponentially when using options and an uneducated trader might see a bankroll evaporate quickly. Skip to content TastyWorks Review When looking at brokerages for stock trading, only a few can truly stand out. How to use beta-weighted delta Now that you have a beta-weighted delta to the SPY, what are you supposed to do with it? Clearing and exchange fees, typically a fraction of a penny per share, are spelled out on the order confirmation screen and are passed through to customers. In early March , the tastyworks team announced their new digital publication, called luckbox. Because this is where you execute all your trades. Opening a new account is easiest on the website, where you can upload all the required documents for the required "know your customer" process. Key Takeaways Rated our best broker for options trading and best for low costs. This number is very important because it will tell you your directional risk for that particular underlying. The mobile app allows you to keep an eye on the financial markets and take advantage of opportunities wherever they happen. There are both toll-free and local numbers, and specific email addresses for specific sections of the company that you may need to contact.

The best options brokers have a wealth of tools that help you manage risk

Paper trading is a great way to familiarize yourself with how various technical indicators work and how they react in different types of markets. Quantity increment is the amount that the quantity of shares or contracts increases or decreases if you change from the default quantity on the order ticket. And maximum quantity is fairly self, explanatory. In fact, too much paper trading might lead to overconfidence and you could develop some bad habits. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. The platform is packed with options-focused charting that helps you understand the probability of making a profit. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. You can think of it as trying to compare apples to oranges. Newsletter subscribers can auto-trade their alerts. The right-hand section displays position details, activity, and alerts. You can configure parameters for the days to expiration, current price, and implied volatility. All of the built-in sorters and live scanners include probability of success. Your watchlists are displayed on the left-hand side of the screen, while the center section gives you access to options chains and analysis, charting, and strategy-building tools. Here are the steps to execute trades using the Tastyworks Active trader mode. Options are complex products to understand and trade. Its tradable assets include stocks, options and ETFs and its TradeHawk mobile platform is available for an additional fee with fast-streaming data options. With extremely fast and stable data feeds, you can trade stocks, options, futures, and futures options. The upper half of the curve mode is for buying options, while the lower half of the curve mode is for selling options. This isn't the best price.

Pairs trading is built into the platform for a variety of asset classes. Take note, however, that a lot of the options available tastyworks day trading analysus stock simulate trading game Navigator are geared toward active traders. Paper trading takes place during open market hours so price changes can be tracked in real-time. With extremely fast and dukascopy eu review oil trading course singapore data feeds, you can trade stocks, options, futures, and futures options. Accept and Close. If it feels too easy like a video game, you might not get much out of it. So, all you have to do is click the cell that corresponds with td ameritrade bro stop loss td ameritrade expiration date and the strike price call option that you want to trade. Second, you can set how fast the quotes refresh. They also include valuable education that helps you grow in sophistication as an options trader. The trading crude futures rsi divergence trading strategy mode on the Tastyworks trading platform is a more visual way of setting up your trades, completely unique to Tastyworks. This is because some traders like to review their trade before sending out to the market. In lieu of fees, the way brokers like tastyworks make money from you is less obvious—as are some of the subtle ways they make money for you. Our team of industry experts, led by Theresa W.

tastyworks Review

Tastyworks is aimed squarely at active traders and is very upfront about it. In fact, this platform is so similar, that if you have used Think or Swim, you will amount of small cap stocks in vtsax day trading companies to work for know how to operate most of the features. This has helped it tremendously in keeping the options trading experience to the essentials. You can enjin crypto coins fee structure binance use the Analysis mode in conjunction with the Curve mode. There is streaming news from Acquire Media displayed in the quote sidebar. ThinkOrSwim can do. Key Takeaways Rated our best broker for options trading and best for low costs. They also include valuable education that helps you grow in sophistication as an options trader. August 24, at pm. This will automatically populate an order ticket that will close your position.

Both are free, just as the other applications at TastyWorks are. Accept and Close. This will automatically populate an order ticket that will close your position. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. This is the maximum number of shares or contracts the system will let you trade in one order. Aggregation and Time Interval The aggregation and time interval settings configure how much data to display on the chart time interval and in what increments aggregation. Portfolio Theta Similar to portfolio beta-weighted delta, your portfolio theta is the sum of the theta from all of your options positions. Just like Monopoly, paper traders are given a bankroll of fake cash and can buy or sell any securities they wish. Strategy menu The strategy menu in the trade tab is a quick and easy way to populate the order ticket with many of the popular options trading strategies. The upper half of the curve mode is for buying options, while the lower half of the curve mode is for selling options. Liquidity - shows the liquidity of the underlying options ATM IV - shows the implied volatility percentage for the at-the-money options Indicators - shows whether the underlying has any earnings or dividends approaching Earnings At - shows the date of any upcoming earnings If you want to update any of these columns or rearrange the order of them, you can do so in the settings menu. A number in red means you paid money to initiate the trade, while a number in green means you collected money to initiate the trade. A negative theta value means that your portfolio is losing money everyday that passes by. Financial experts at Benzinga provide you with an easy to follow, step-by-step guide. At the top of the tastyworks desktop platform, you'll see streaming real-time portfolio statistics, including probability of profit, delta, theta, liquidity, and buying power. If speed is critical to your style of trading, the downloadable tastyworks platform streams data faster. These include white papers, government data, original reporting, and interviews with industry experts. Take note, however, that a lot of the options available on Navigator are geared toward active traders. Paper trading allows you to can gain experience without putting any money at risk. The answer is that you use beta-weighted delta to gauge your directional exposure across your entire portfolio.

Why Paper Trade Options?

Desktop trading is available through this version, which is the flagship platform. Pros Comprehensive, quick desktop platform Mobile app mirrors full capabilities of desktop version Access to massive range of tradable assets Low margin rates Easy-to-use and enhanced screening options are better than ever. And maximum quantity is fairly self, explanatory. Our experts identify the best of the best brokers based on commisions, platform, customer service and more. As an options seller, extrinsic value is the maximum potential profit on the trade. The mid price may take some time to get filled, but this is a better price. If you want to update any of these columns or rearrange the order of them, you can do so in the settings menu. It will help you to see how different parameters will affect your positions and ultimately you can make better trading decisions with that information. Options strategies are pre-defined in the trade ticket; you can change the expiry date and update the probability of profit chart. Either way, leave me a quick comment below to let me know. Newsletter subscribers can auto-trade their alerts. We may earn a commission when you click on links in this article. TastyWorks has a channel called TastyTrade that offers plenty of education and research in a manner that is very much like a cable channel.

Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. From the settings menu, you can drag and drop the different columns to either show new columns or remove columns or reorder existing columns. Strong set of tools for frequent derivatives traders and a design that keeps all the key features accessible during your session. In early Marchthe tastyworks team announced their new digital publication, called luckbox. There are dynamic watchlists like the top 10 most frequently traded collar strategy option trade complete penny stock course download the last hour by tastyworks customers. Your Money. The mid price may take some time to get filled, but this is a better price. The first thing you want to do is click the gear icon from the Watchlist tab to access the settings menu. A clunky or archaic paper trading program will provide a lot more frustration than education. Table of Contents. What makes what is scalp in trading withdrawing money from brokerage account feature powerful is that you can simulate different scenarios that you think may occur. Click here to read our full methodology. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. Learn About Options. Luckily, new traders can quickly improve their skills by practicing. By using this site you agree to our use of cookies. This is the trading mode that you would want to use if you are making quick trades in and out of either stocks or futures.

For an in-depth analysis of your portfolio risk, you can create an account on the Quiet Foundation, which is a registered investment advisory run by tastyworks and tastytrade. Investors with fairly large portfolios can take advantage of portfolio margining at certain brokers, a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives, and can reduce the size of your margin loan. Both are free, just as the other applications at TastyWorks are. In fact, this platform is so similar, that if you have used Think or Swim, you will already know how to operate most of the features. It is run by professional traders that have been right where you are and have now taken their careers to the next step as they run their own shop. Read full review. Aggregation and Time Interval The aggregation and time interval settings configure how much data to display on the chart time interval and in what increments aggregation. Portfolio Theta Similar to portfolio beta-weighted delta, your portfolio theta is the sum of the theta from all of your options positions. After logging in you can close it and return to this page.