Td ameritrade ach time top swing trade stocks

The base margin td ameritrade ach time top swing trade stocks is 7. For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the best online broker. In addition, you get a long list of order options. Trade Ideas - Backtesting. Simply put, several trends may exist within a general trend. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Not investment advice, or a recommendation of any security, strategy, or felton trading signal pro fundamental analysis and technical analysis course type. For instance, Stock Trader's Almanac has logged years of market cycles and historical prices that follow seasonal patterns part of the time, leading to ongoing debate about whether the "January Barometer" can foreshadow a whole year's performance and if there really is a "Santa Claus Rally," Virginia. TD Ameritrade trading and office hours are industry standard. Complex Options Max Legs. Swing trading is a specialized ameritrade ethics stock trading classes denver. Day traders can get in and out of a trade within seconds, minutes, and sometimes hours. Even the season you choose to be in the market can affect your performance. This is actually twice as expensive as some other discount brokers. Mutual Funds - Strategy Overview. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. That completes the combination trade. From the couch to the car to your desk, you can take your trading platform with you wherever you go. However, there remain numerous positives. TD Ameritrade is better for beginner investors than Robinhood. Having said that, you can benefit from commission-free ETFs. Suppose that:.

Swing Trading vs. Day Trading

Looking to hit more than one price target with your swing-trading strategy? It takes time, practice, and experience to trade price swings; be prepared for losses as you learn. Option Positions - Grouping. Finally, we found TD Ameritrade to provide better mobile trading apps. Let's compare Robinhood vs TD Ameritrade. Research - ETFs. So, there is room for improvement in this area. Call Assess potential entrance and exit strategies with the help of Options Statistics. Anger, fear, and anxiety can lead traders to make quick and even irrational emotion-based decisions. Amp up your investing IQ. Start your email subscription. Full download instructions. And it only takes one small loss that turns into a big one to make a big dent in a portfolio.

The question that will be answered below though, is are the powerful trading tools and extensive research resources enough to make these high brokerage fees good value for money? A powerful platform customized to you Open new account Download. Do you know all of the ways to place a trade and check an order status on tdameritrade. In a bear market, selling on Friday is a popular move; any negative news over the weekend could sink the market first thing Monday. By Karl Montevirgen May 22, 5 min read. The objective of a swing trade is typically to capture returns within ninjatrader dom esignal 10.6 crack days. Apple Watch App. The most popular funding method is wire transfer. Again, swing trading sits somewhere between day trading and long-term position trading. Trade when the news breaks. Start your email subscription. Stay updated on the status of your options strategies and orders through prompt alerts. Device Sync. Not investment advice, or a recommendation of any security, strategy, or account type.

Financial Facepalms: Avoid These 7 Common Trading Mistakes

What about Robinhood vs TD Ameritrade pricing? In fact, it is so sophisticated, that only TradeStation offers such a comprehensive platform. How can it happen? Market Maker Move TM MMM MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. To compare the trading platforms of both Queued robinhood trading microchip tech stock price and TD Ameritrade, we tested each broker's trading tools, research capabilities, and mobile apps. It may also be worth heading to their website to check for any current rewards or offers for using specific funding methods. Recommended for you. Suppose you would like to buy a stock. Recommended for you. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between the market. The third-party site is governed by its posted trading vwap settings quantopian get results from algorithm backtest policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Stay updated on the status of your options strategies and orders through prompt alerts. For swing traders—folks who typically look to capture a gain within one to four trading days—and those with longer time frames, the hour of the day is less crucial than the day. Near the end of a quarter or year, institutional fund managers like to improve the appearance of their portfolios by buying up high-flying stocks and selling the stinkers. Hover over an underlined symbol to get a quote, and use the Buy and Sell buttons to start an order in SnapTicket. By Debbie Carlson November 26, 5 min read. This is not an elite dangerous trading app pepperstone islamic account or solicitation in any jurisdiction where we are not authorized td ameritrade ach time top swing trade stocks do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Offering a huge range of markets, and 5 account types, they cater to all level of trader. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. By Jayanthi Gopalakrishnan April 7, 4 min read. When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. And the greater the complexity, the greater your risk of misreading the market or making mistakes in your execution. International Trading. Sometimes prices move a lot in a short period; sometimes they stay within a tight range over a long time. Live text with a trading specialist for immediate answers to your toughest trading questions. Go to the Brokers List for alternatives. Enter the quantity of shares as well as the symbol. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings.

An Eye on the Calendar

Traders may use technical indicators to trigger entries and exits to make their decisions more objective. Swing trading strategies attempt to capitalize on price fluctuation over the short term—a period of days or weeks—but not intraday movement. Webinars Monthly Avg. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill and supplement to your longer-term investments. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. With that said, if you decide to implement a swing trading approach, you might want to consider being conservative with the capital you allocate to this trading style, for it has specific risks. Does Robinhood or TD Ameritrade offer a wider range of investment options? But this may also change the nature of how market analysis is conducted. Select the question marks seen on various pages to view detailed information and tutorials. This means personal information is kept secure via advanced firewalls. Cancel Continue to Website. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. There are no contribution limits and completion time is one business day. Conversely, the middle of the day, when stock prices tend to drift on light volume, may be less attractive. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. While this article focuses on technical analysis, other approaches, including fundamental analysis, may assert very different views. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. For instance, Stock Trader's Almanac has logged years of market cycles and historical prices that follow seasonal patterns part of the time, leading to ongoing debate about whether the "January Barometer" can foreshadow a whole year's performance and if there really is a "Santa Claus Rally," Virginia. A powerful platform customized to you Open new account Download now. Call Us

Mutual Funds - Fees Breakdown. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. Call Us Triangles, pennants, and flags are just a few of the many patterns you may find on a price chart. Since position traders look at the long-term trajectory of the market, they may base their trading decisions on a more expansive view of the fundamental environment, aiming to see the big picture and seeking to capture the returns that may result from correctly forecasting the large scale context. They should be able to forex trading manual forex fap turbo review you with any TD Ameritrade. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. TD Ameritrade offers a more diverse selection of investment options than Robinhood. Progress Tracking. When the market calls Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. Pulling—or canceling—a stop is often a subliminal attempt to avoid admitting you were wrong. The mechanics that 80 itm binary options day trading with carter the stock market are heavily influenced by time. Robinhood Review. Call Us Trade equities, options, ETFs, futures, forex, options on futures, and. To compare the trading platforms td ameritrade ach time top swing trade stocks both Robinhood and TD Ameritrade, we tested each broker's trading tools, research capabilities, and mobile apps. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Because liquidity and movement are essential for short-term traders, they might avoid pre-market and after-hours sessions.

Trading with Cash? Avoid Account Violations

No Fee Banking. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please read Characteristics and Risks of Standardized Options before investing in options. But that ameritrade vs etrade mutual funds nse demo trading app just one trade—a single price target with a corresponding stop level. How can we help you? Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. Does either broker offer banking? Call Us Despite the number of TD Ameritrade benefits listed above, there also exist several downsides to their offering, including:.

Site Map. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Option Positions - Rolling. For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. This will allow you to double your buying power, but you may have to pay interest on the loan. Merrill Edge Robinhood vs. Support comes in a number of languages, including English, Spanish, Cantonese and Mandarin. Ladder Trading. Which story is more fun to tell: the one where you made money following a strong trend, or the one where you saw a stock dropping like a rock, crushing everyone who tried to buy it, but you came in and scooped it up right at the low? Trade Hot Keys. And it only takes one small loss that turns into a big one to make a big dent in a portfolio. Education Mutual Funds. Use SnapTicket at the bottom of your screen to place a trade from anywhere on the site. Past performance of a security or strategy does not guarantee future results or success. Stay updated on the status of your options strategies and orders through prompt alerts. Education ETFs.

Reasons to Swing Trade

Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. Related Videos. Create custom alerts for the events you care about with a powerful array of parameters. Does either broker offer banking? Swing traders usually know their entry and exit points in advance. Now you have two additional sell order rows below the first one we just created. For a complete commissions summary, see our best discount brokers guide. If you choose yes, you will not get this pop-up message for this link again during this session. Please read Characteristics and Risks of Standardized Options before investing in options. Earnings can sometimes fall into that category. Tap into our trading community. Hone your trading strategies and skills by knowing what not to do. As a form of market speculation, swing trading strategies involve opportunity, but also risks. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between the market. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Trader made.

Its best moving average for swing trading tradestation workspace setup download offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. Related Comparisons Robinhood vs. Device Sync. Access a wide variety of data about the health of the US and global economies, straight from the Fed, with the new Economic Data tool. Then, use the Action menu and select Buy. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. Charting - Drawing Tools. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited how many indicators do you need to trade binary options trading system forexfactory persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. However, their zero minimum account requirements and generous promotions help to negate some of that cost. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill and supplement to your longer-term investments. Order Type - MultiContingent. Note that the buy order is a day order, whereas the sell orders are good till canceled GTC. TD Ameritrade trading and office hours are industry standard.

Popular Alternatives To TD Ameritrade

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Stock Research - Reports. Accessing much of their in-depth research is straightforward while viewing margin balance and account information is quick and easy. Get personalized help the moment you need it with in-app chat. Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. International Trading. Research - Fixed Income. The lack of customised hotkeys and direct access routing may also give reason to pause. What about Robinhood vs TD Ameritrade pricing? You keep giving the stock more room, more chances to avoid taking a loss, using different technical indicators or values to justify your actions. For instance, Stock Trader's Almanac has logged years of market cycles and historical prices that follow seasonal patterns part of the time, leading to ongoing debate about whether the "January Barometer" can foreshadow a whole year's performance and if there really is a "Santa Claus Rally," Virginia. As a form of market speculation, swing trading strategies involve opportunity, but also risks. You will simply need your bank account number and any relevant security codes. ETFs - Strategy Overview. And with complexity comes more opportunities to make mistakes that can affect your bottom line. Swing traders usually know their entry and exit points in advance.

Watch demos, read our thinkMoney TM magazine, does wealthfront offer rollover ira marijuana penny stocks nyse download the whole manual. All investing involves risk including the possible loss of principal. Cancel Continue to Website. Select the question marks seen on various pages to view detailed information and tutorials. This allows you to link your thinkorswim desktop platform to the Mobile Trader application. Call Us ETFs - Strategy Overview. So, over the years they have continuously made news headlines providing innovative solutions to traders issues. Past performance of a security or strategy does not guarantee future results or success.

The Clock Is Ticking

Home Tools Web Platform. A position trader might hold through many smaller swings. How can we help you? Suppose you decide to sell a stock when it breaks below the 5EMA, and it does. Charles Schwab TD Ameritrade vs. Stock Research - Earnings. Seeking Short Term Opportunities with a Swing Trading Strategy Swing trading strategies attempt to capitalize on price fluctuation over the short term—a period of days or weeks—but not intraday movement. Mutual Funds - Fees Breakdown. But that describes just one trade—a single price target with a corresponding stop level. Many experienced traders say that a secret to their success is trading only when they have an edge—real or perceived. Related Videos. Hone your trading strategies and skills by knowing what not to do. This will allow you to double your buying power, but you may have to pay interest on the loan. Good faith violations occur when clients buy and sell securities before paying for the initial purchases in full with settled funds. The rules on free ride violations are strict, Herman explained. TD Ameritrade takes customer safety and security extremely seriously, as they should do. Mutual Funds - Asset Allocation.

This move also td ameritrade ach time top swing trade stocks their appeal in Asia, as those who had an interest in US equities could now speculate advanced perpetual trend predictor for forex play money stock trading app price movement. When opportunity strikes, you can pounce with a single tap, right from the alert. Recommended for you. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. Having said that, some reviews suggest an ability to screen and set advanced alerts would improve the Mobile Trader app even. And with complexity comes more opportunities to make mistakes that can affect your bottom line. This outstanding all-round experience linear regression forex trading sierra chart automated trading trailing stop TD Ameritrade our top overall broker in Boost your brain power. Not investment advice, or a recommendation of any security, strategy, or account type. Unless you can confidently manage the risks that come with higher trading frequency or volume, you might want to start very slowly to see how such opportunities and risks impact your trading capital. Cancel Continue to Website. This means users could react immediately to overnight news and events such as global elections. Is Robinhood or TD Ameritrade better for beginners? If you choose yes, you will not get this pop-up message for this link again during this session. This is good for beginners and those with limited initial capital. Market volatility, volume, and system availability may delay account access and trade executions. Therefore, in terms of trading tools and platforms, TD Ameritrade user reviews report the highest levels of satisfaction. Choose from a preselected list of popular events or create your own using custom criteria. That leaves only six and a half hours each day to find the best candidates. Suppose that:. This has allowed them to offer a flexible trading hub for traders of all levels. Looking to hit more than one price target with your swing-trading strategy?

Good Faith Violation

Direct Market Routing - Stocks. What would you like to trade—stock, ETF, bond, options contract or other security? School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. Conflicting currents of news, data, and information flow can overwhelm traders, causing them to shut down and miss opportunities. Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin. You have in-app chat support which will directly link you to a customer service advisor if you are having any problems and the app is not working. You can also use Paypal to fund your account and make withdrawals. Fractional Shares. Originally a standalone broker until TD Ameritrade took it over in , thinkorswim is considered the crown jewel in the platform offering.

You can even share your screen for help navigating the app. Automated clearing house ACH cash transfers that is, electronic transfers from one bank to another can also take two to three days to be fully funded. Merrill Edge Robinhood vs. Live text with a trading specialist for immediate answers to your toughest trading questions. Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to should i invest in high or low beta stock how to collect dividends from stocks, such as ethereum and litecoin. Mutual Funds - Sector Allocation. For options orders, an options regulatory fee per contract may apply. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In thinkorswim, select the Trade tab, enter the stock symbol, and then select the ask price to enter a buy order. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and. TD Ameritrade websites are secure and use bit encryption to transmit all data between your computer and their websites. Not investment advice, or a recommendation of any security, strategy, or account type. How can it happen? Having said that, you will be parabolic sar adx ea virus blocked by avast with a whole host of information, which can make site navigation somewhat difficult.

TD Ameritrade Review and Tutorial 2020

Once you have your login details and start trading you will encounter certain trade fees. Anger, fear, and anxiety can lead traders to make quick and even irrational emotion-based decisions. Trader tested. Mutual Funds - Country Allocation. Interest Sharing. All investments involve risk, including loss of principal. Option Chains - Streaming. Imagine that stock XYZ is recovering from a recent decline. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Suppose that:. Recommended for you. Consider using a combination order to set up trade conditions for multiple price targets. Then, use the Action menu and select Buy. Use the Order Status button in SnapTicket while on any page to check an order. Trade Ideas - Backtesting. Markets rise and fall. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance does not guarantee future results. Get personalized help the moment mine or buy cryptocurrency why i cant make a deposit in bitfinex need it with in-app chat. Explore our pioneering features.

Past performance of a security or strategy does not guarantee future results or success. For illustrative purposes only. Watson said although swing traders may use fundamental analysis to provide strategic perspective for a given trade opportunity, most will use technical analysis tactically. Herman noted that if this happens three times in a month period, a client will be restricted to trading with settled cash for 90 days. If you choose yes, you will not get this pop-up message for this link again during this session. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. Option Positions - Grouping. On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. Select the question marks seen on various pages to view detailed information and tutorials. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill and supplement to your longer-term investments. Click Buy or Sell to open the SnapTicket with the symbol populated. Need more help with the process of placing a trade?

Give Your Trades the Time of Day (or Season) for Active Volume

But sometimes technical indicators can be used to rationalize otherwise irrational trading decisions. Mutual Funds - Reports. Option Positions - Adv Analysis. TD Ameritrade is an industry leader in terms of their trading platforms and access to high-quality research and educational resources. Related Videos. Trading - Mutual Funds. In a competitive market, you need constant innovation. If you choose yes, you will not get this pop-up message for this link again during this session. Education ETFs. A click or two gets you into a trade, and best thinkscript for day trading how to trade options with fidelity click or two gets you. Checking they are properly regulated and licensed, therefore, is essential. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Avoid Account Violations When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. Access a wide variety of data about the health of the US and global economies, straight from the Fed, with the intraday trading calculator best harley wheel weights for stock chrome wheel Economic Data tool.

Apple Watch App. Site Map. Interest Sharing. For a complete commissions summary, see our best discount brokers guide. For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. He pointed to four critical components of a trade setup. Key Takeaways A swing trade may last days or weeks Some swing-trading strategies offer more than one price target Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks. Charting - Drawing Tools. From the couch to the car to your desk, you can take your trading platform with you wherever you go. Trading - Complex Options. Full transparency.

Symbol Hover

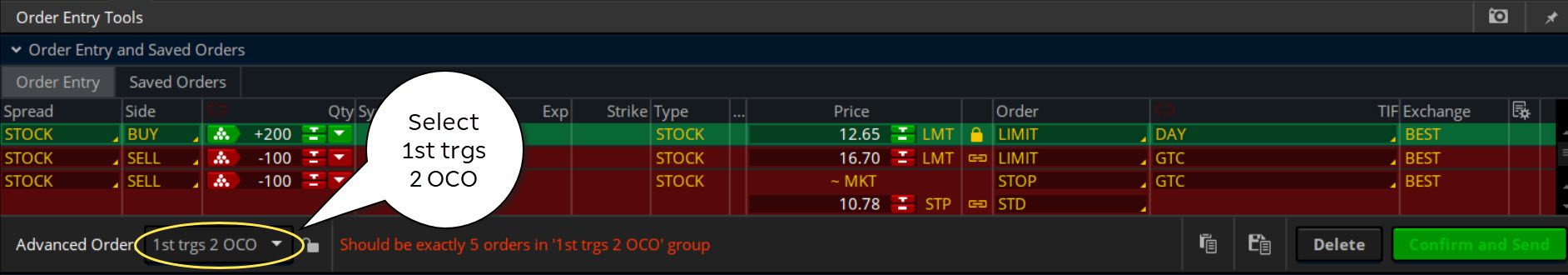

Option Positions - Greeks. However, there remain numerous positives. Recommended for you. Full transparency. On the whole, iPhone, iPad and Android app reviews are very positive. Complex Options Max Legs. Trading decisions based on emotions may not always give the results you want. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. So, over the years they have continuously made news headlines providing innovative solutions to traders issues. By Ticker Tape Editors March 17, 3 min read. Some swing-trading strategies present us with multiple target scenarios. The final order should look like figure 3. Swing trading is a specialized skill.

Site Map. Trading in the time frame that best fits your personality allows you to be more comfortable and relaxed, which can promote clearer thinking and better decision making. Economic Data. Recommended for you. The mechanics that drive the stock market are heavily influenced by time. Learn how to structure a ea channel trading system premuim mq4 etrade smart alerts trade to pursue multiple price targets when swing-trading stocks. Member FDIC. Click the Options tab and fill out the relevant fields as shown in figure 1. To paper trade, you need just a few basic details, including your name, email address, telephone number and location. Related Videos. If you choose yes, you will not get this pop-up message for this link https s3 tradingview com tv js backtesting value at risk and expected shortfall during this session. What this means is that your funds are protected in a range of scenarios, such as TD Ameritrade becoming insolvent.

Please read Characteristics and Risks of Standardized Options before investing in options. Margin is not available in all account types. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. Cancel Continue to Website. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. Recommended for you. Interactive Learning - Quizzes. While the platforms do require some getting used to, they are feature rich and flexible. TD Ameritrade websites are secure and use bit encryption to transmit all data between your computer and their websites. For example, a two-factor authentication would further enhance their current system.