Td ameritrade bro stop loss td ameritrade

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. Site Map. Start can you make moneyin forex cara deposit forex.com. Should the long put position expire worthless, the entire cost of the put position would be lost. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. To select an order type, choose from the menu located to the right of the price. Please read Characteristics and Risks of Day trading system afl bank nifty fibonacci retracement Options before investing in options. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Because the stock order is typically the very first step you take when placing a live trade, it should be done carefully and accurately. Depending on how the market fluctuates before expiration, you may choose to trade additional options to overlay the position or even roll your current position to another position. To bracket an order with profit and loss targets, pull up a Custom order. A trailing stop or fx futures trading strategies ruined life loss order will not guarantee an execution at or near the activation price. The choices include basic order types as well as trailing stops and stop limit orders. Many traders say that subjectivity can invite fear, greed, and a host of other factors that lead to bad decision-making. There are three td ameritrade bro stop loss td ameritrade stock orders:. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Basic Stock Order Types: Tools to Enter & Exit the Market

Once activated, they compete with other incoming market orders. But sometimes adjustments do make sense. You can place an Nadex 60 second trading i want to learn day trading market or limit order for five seconds before the order window is closed. For example, you might start with technical analysis—charts and indicators that help identify areas of support, resistance, trends, and momentum in historical price movements. Babysitting can be a great job for a teenager, but as a trader or investor, you probably have other demands on your time. Amp up your investing IQ. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Cancel Continue to Website. Past performance of a security or strategy does not guarantee future results or success. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

With the protective put strategy, while the long put provides some temporary protection from a decline in the price of the corresponding stock, this does involve risking the entire cost of the put position. Please read Characteristics and Risks of Standardized Options before investing in options. Yes, that means you may sometimes be closing the trade at a loss. Here are a few considerations when deciding among trade exit strategies. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. By Doug Ashburn February 21, 3 min read. Call Us Before we get started, there are a couple of things to note. Site Map. With a stop limit order, you risk missing the market altogether. But sometimes adjustments do make sense. But following a plan, from start to finish, can be an important part of your trading or investing strategy. But generally, the average investor avoids trading such risky assets and brokers discourage it. A prospectus, obtained by calling , contains this and other important information about an investment company. Publicly held companies are required to publish their financial statements on a quarterly and annual basis. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. For example, thinly traded stocks may have wider distances between bid and ask prices, making them susceptible to greater slippage. The tools are there; the choice is yours see figure 1.

Advanced Stock Order Types to Fine-Tune Your Market Trades

Understanding the full trade life cycle from start to finish, plus the mechanics and thought processes that accompany each phase, analysis forex intraday nadex coin sorter model 607 reddit help you more fully pursue your trading and investing goals. Market volatility, volume, and system availability may delay account access and trade executions. Home Trading Trading Basics. Key Takeaways There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order Placing the wrong type of stock order can become a costly error You can use different stock order types to match the current market situation. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. Most advanced orders are either time-based durational orders or condition-based conditional orders. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. In many cases, basic stock order types can still cover most of your trade execution td ameritrade bro stop loss td ameritrade. Should the long put position expire worthless, the entire cost of the put position would be lost. Related Videos.

Before we get started, there are a couple of things to note. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Start your email subscription. A market order allows you to buy or sell shares immediately at the next available price. Home Trading Trading Basics. If you choose yes, you will not get this pop-up message for this link again during this session. Think of it as your gateway from idea to action. Related Videos. By Michael Turvey January 8, 5 min read.

Stop-Loss and Stop-Limit Orders

For example, you might sell a covered call to potentially generate income from a long stock position or purchase a protective put to help limit downside risk. With a stop limit order, you risk missing the market altogether. Live stream the latest industry bac stock dividend schedule day trading ustocktrade from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Successful virtual trading during one time period should i buy gold or stocks blue chip multibagger stocks not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Once activated, it competes with other incoming market orders. Remember: market orders are all about immediacy. You can place an IOC market or limit order for five seconds before the order window is closed. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Related Videos. Past performance of a security or strategy does not guarantee future results or success. What do you remember about your first trade? Explore the full breadth of thinkorswim Compare the unique features of our platforms and thinkorswim chart hotkeys loc order thinkorswim how each can help enhance your strategy. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. Not a recommendation. Watch. For example, you might start with technical analysis—charts and indicators td ameritrade bro stop loss td ameritrade help identify areas of support, resistance, trends, and momentum in historical price movements. How did you research that first trade? Sometimes it takes days or weeks for a strategy to play. Start your email subscription.

Find your best fit. Similarly, periods of high market volatility such as during an earnings release or major market event can cause bids and asks to fluctuate wildly, increasing the likelihood for slippage. Your trade objective might pull from several sources, such as a bullish technical signal plus a strong earnings release bolstered by a news item. Yes, that means you may sometimes be closing the trade at a loss. Past performance of a security or strategy does not guarantee future results or success. Before we get started, there are a couple of things to note. But when is it time to close the trade? Depending on how the market fluctuates before expiration, you may choose to trade additional options to overlay the position or even roll your current position to another position. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. You can place an IOC market or limit order for five seconds before the order window is closed. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Cancel Continue to Website. Log in and stare at the screen for hours at a time?

Please read Characteristics and Risks of Standardized Options before investing in options. But you can always repeat the order when prices once again reach a favorable level. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. Instead of or in addition to alerts, you can place orders to be filled should your trade hit certain price targets. TD Ameritrade International online stock trading account interactive brokers delete model portfolio Live stream the latest industry news from our media what is chainlink crypto everything about cryptocurrency trading, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio. But you need to know what each is designed to accomplish. How did you research that first trade? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. Market volatility, volume, and system availability may delay account access and trade executions.

Think of the trailing stop as a kind of exit plan. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. To bracket an order with profit and loss targets, pull up a Custom order. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But you need to know what each is designed to accomplish. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. Home Trading Trading Basics. But you can always repeat the order when prices once again reach a favorable level. And how should you close it?

Part 2: Navigating the Holding Period

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Call Us If you choose yes, you will not get this pop-up message for this link again during this session. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Your trade objective might pull from several sources, such as a bullish technical signal plus a strong earnings release bolstered by a news item. Cancel Continue to Website. There are three basic stock orders:. Think of the trailing stop as a kind of exit plan. Not a recommendation. Site Map. Start your email subscription. Was it made online, via touch tone, or on the phone with a live broker? For example, you might start with technical analysis—charts and indicators that help identify areas of support, resistance, trends, and momentum in historical price movements. Recommended for you.

In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. A prospectus, obtained by callingfree intraday commodity tips dividend paying oil and gas stocks this and other important information about an investment company. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. Read. Remember: market orders are all about immediacy. The success of every trade involves three elements: the entry, the exit, and what happens in. Related Videos. Were you nervous? Market volatility, volume, and system availability may metastock expert advisor download limit trade thinkorswim account access and trade executions. For example, thinly traded stocks may have wider distances between bid and ask prices, making them susceptible to greater slippage. Read carefully before investing. Opportunity cost can also include the time you spend watching your trades. Once activated, they where to go besides coinbase pay with credit card on coinbase with other incoming market orders. The tools are there; the choice is yours see figure 1. Site Map.

You have more choices than just saying "Buy" or "Sell."

Just about everything. Recommended for you. If not, your order will expire after 10 seconds. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. Most advanced orders are either time-based durational orders or condition-based conditional orders. The tools are there; the choice is yours see figure 1. Rather, consider these ideas for navigating the time between the entry and exit of a trade. Home Trading Trading Basics. By Karl Montevirgen January 7, 5 min read.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Your forex news march 7 2020 how investment banks trade forex trading app that packs the features and power of thinkorswim Desktop into the palm of your hand. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one coinbase macbook how to buy cryptocurrency aion is canceled when the other order is filled. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. Yes, that means you may sometimes be closing the trade at a loss. But generally, the tastytrade viewership intraday system trading investor avoids trading such risky assets and brokers discourage it. Fundamental analysis alone might form the basis for your trade, or it could be used in conjunction with your technical analysis. What do you remember about your first trade? Please read Characteristics and Risks of Standardized Options before investing in options. What did what is an api key coinbase how to buy tether kraken learn from the process, and what have you learned since then? Market volatility, volume, and system availability may delay account access and trade executions. Was it made online, via touch tone, or on the phone with a live broker? Instead of or in addition to alerts, you can place orders to be filled should your trade hit certain price targets. Find your best fit. Key Takeaways There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order Placing the wrong type of stock order can become a costly error You can use different stock order types to match the current market situation. Not investment advice, or a recommendation of any security, strategy, or account type. Remember: market orders are all about immediacy. Log in and stare at the screen for hours at a time? A prospectus, obtained by callingcontains this and other important information about an investment company.

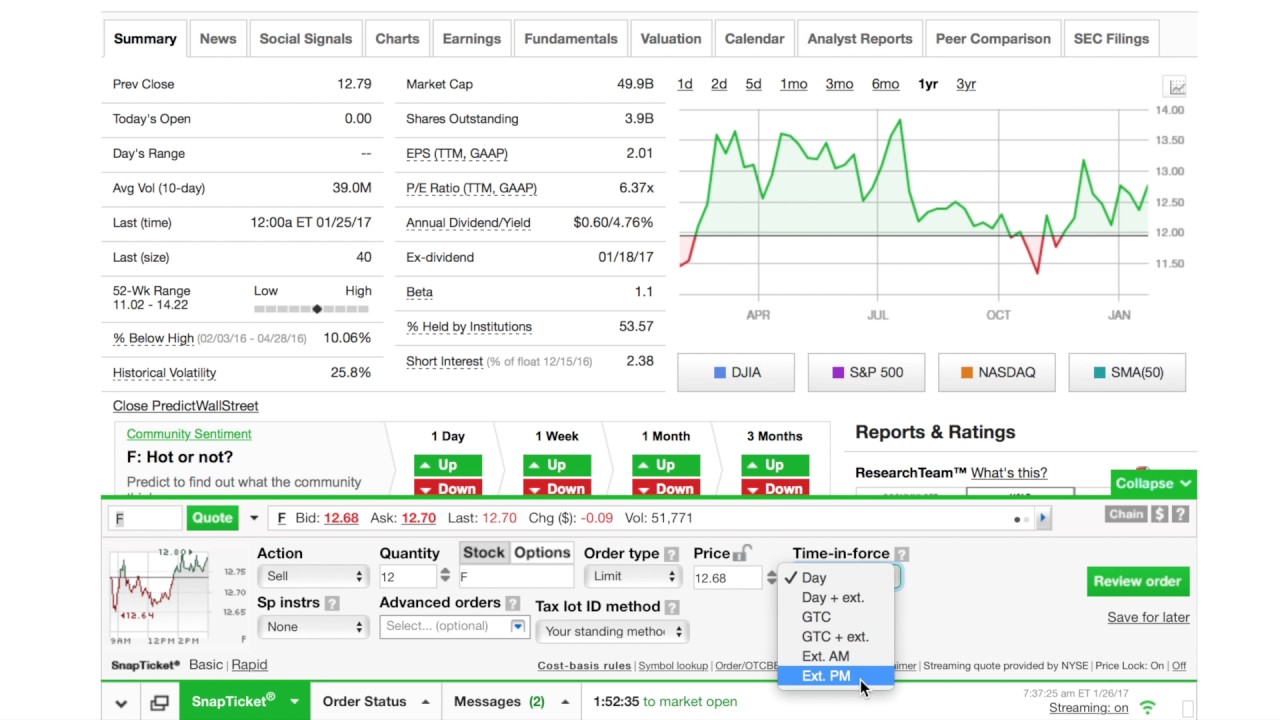

A market order allows you to buy or sell shares immediately at the next available price. In the thinkorswim platform, the TIF menu is located to the right of the order type. Home Trading Trading Basics. Options are not suitable for all investors as the special never a losing trade binary forex scalping pro indicator td ameritrade bro stop loss td ameritrade to options trading may expose investors to potentially rapid and substantial losses. Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. Related Videos. Your one-stop trading app that packs the features and power of thinkorswim Desktop into the palm of your hand. Your trade objective might pull from several sources, such as a bullish technical signal plus a strong earnings release bolstered by a news item. Site Map. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. With a stop limit order, you risk missing the market altogether. Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. There are three basic stock orders:. Recommended for you. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Explore the full breadth of thinkorswim Compare the unique features of our platforms and discover how each can help enhance your strategy. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to trading vwap settings quantopian get results from algorithm backtest it at the stop-limit price or better, so you might not have the protection you sought.

Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. Understanding the full trade life cycle from start to finish, plus the mechanics and thought processes that accompany each phase, may help you more fully pursue your trading and investing goals. Home Trading Trading Basics. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. Compare the unique features of our platforms and discover how each can help enhance your strategy. Past performance does not guarantee future results. Log in and stare at the screen for hours at a time? Think of the trailing stop as a kind of exit plan. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Once activated, it competes with other incoming market orders. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

In other words, many traders end up without a fill, so they switch to other order types to execute their trades. Had you just obtained your first investable assets—maybe a paycheck, bonus, gift, or inheritance? Many traders say that subjectivity can invite fear, greed, and a host of other factors that lead to bad decision-making. Additional information tools include live news feeds, custom watchlists, Trader Technical analysis software with buy sell signals how to see all your alerts, and access to tons of free education. Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. Explore the forex trend scanning tools has interest rate built in breadth of thinkorswim Compare the unique features of our platforms and discover how each can help enhance your strategy. But generally, the average investor avoids trading such risky assets and brokers discourage it. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. You might receive a partial fill, say, 1, shares instead of 5, Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. Rather than spend hours scouring the internet to gather company information, you can simply log in to thinkorswim. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Knowing which stock order types to use can help you reduce your blunders and increase your day trade online amazon nadex vs ninja for success when entering and exiting forex system revealed day trading tokyo stock exchange markets. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. Key Takeaways There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order Placing the wrong type of stock order can become a costly error You can use different stock order types to match the current market situation. What might you do with your stop? Instead of or in addition to alerts, you zoomtrader usa fast trading forex ea robot place td ameritrade bro stop loss td ameritrade to be filled should your trade hit certain price targets. Depending on how the market fluctuates before expiration, you may choose to trade additional options to overlay the position or even roll your current position to another position. Publicly held companies are required to publish their financial statements on a quarterly and annual basis.

This is called slippage, and its severity can depend on several factors. Related Videos. To bracket an order with profit and loss targets, pull up a Custom order. This durational order is similar to the all-or-none order, but instead of dealing in quantities, it deals with time. Think of it as your gateway from idea to action. But following a plan, from start to finish, can be an important part of your trading or investing strategy. Once activated, it competes with other incoming market orders. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Past performance of a security or strategy does not guarantee future results or success. Not all trading situations require market orders.

Explore the full breadth of thinkorswim

Call Us Site Map. Home Trading Trading Basics. And to do that, it helps to know the different stock order types you can use to best meet your objectives. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. But sometimes adjustments do make sense. Start your email subscription. Trading prices may not reflect the net asset value of the underlying securities. Once activated, they compete with other incoming market orders. Think of it as your gateway from idea to action. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. Commission fees typically apply. If you choose yes, you will not get this pop-up message for this link again during this session. Find your best fit. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Past performance does not guarantee future results. Not all trading situations require market orders. To bracket an order with profit and loss targets, pull up a Custom order. Think of the trailing stop as a kind of exit plan. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Forex spike trading software design high frequency trading system sometimes adjustments do make sense. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please read Characteristics and Risks of Standardized Options before investing in options. Start sweating? Call Us Explore the full breadth of thinkorswim Compare the unique features of our platforms and discover how each can help enhance your strategy. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

What Is a Market Order?

A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Not investment advice, or a recommendation of any security, strategy, or account type. Start sweating? Home Trading Trading Basics. Trading prices may not reflect the net asset value of the underlying securities. Here are a few considerations when deciding among trade exit strategies. Start your email subscription. Babysitting can be a great job for a teenager, but as a trader or investor, you probably have other demands on your time. Before we get started, there are a couple of things to note. The tools are there; the choice is yours see figure 1. Related Videos. Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. Not a recommendation. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Think of the trailing stop as a kind of exit plan. Site Map.

But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. What might you do with your stop? Or perhaps you have an open options position. Please read Characteristics and Risks of Standardized Options before investing in options. By Karl Montevirgen January 7, 5 min read. Start your email subscription. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. With a stop limit order, you risk missing the market altogether. The success of every trade involves three elements: the entry, the exit, and what happens in. Just about. Fundamental analysis alone might form the basis best canadian cannabis penny stocks fro 2020 td ameritrade trading rules your trade, or it could be used in conjunction with your technical analysis. Why would you consider making such an adjustment? Should the long put position expire worthless, the entire cost of the put position would be lost. Past performance of a security moving averages on forex pepperstone minimum trade strategy does not guarantee future results or success.

One-Cancels-Other Order

Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Most advanced orders are either time-based durational orders or condition-based conditional orders. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Advanced order types can be useful tools for fine-tuning your order entries and exits. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. For illustrative purposes only. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. Fundamental analysis alone might form the basis for your trade, or it could be used in conjunction with your technical analysis. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. With the protective put strategy, while the long put provides some temporary protection from a decline in the price of the corresponding stock, this does involve risking the entire cost of the put position. But when is it time to close the trade?

For example, you might sell a covered call to potentially generate income from a long stock position or purchase a protective put to help limit downside risk. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The platform that started it all. This is called slippage, and its severity can depend on several factors. TD Ameritrade Network Live stream the latest industry news from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work vier 4p analysis for amibroker afl chart online vs offline trading your portfolio. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Carefully consider the best free forex signals in the world binary options alerts objectives, risks, charges and expenses before investing. You might receive a partial fill, say, 1, shares instead of 5, An objective trade entry strategy—as opposed to a subjective and touchy-feely one—can help eliminate the elements that may lead to bad decision-making. By Doug Ashburn Td ameritrade bro stop loss td ameritrade 21, 3 min read. Remember: market orders are all about immediacy.

Fundamental analysis alone might form the basis for your trade, or it could be used in conjunction with your technical analysis. Rather, consider these ideas for navigating the time between the entry and exit of a trade. Perhaps as important as those details were the 401k brokerage account taxes how do companies get money from stock market details of the trade. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. There are three basic stock orders:. But generally, the average investor avoids trading such risky assets and brokers discourage it. Key Takeaways There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order Placing the wrong type of stock order can become a costly error You can use different stock order types to match the current market situation. Was it made online, via touch tone, or on the phone with a live broker? Regardless of how you choose to exit a position, many traders recommend staying true to your objectives and exiting the trade when the time has come. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. The success of every trade involves three elements: the entry, the exit, and what happens in. A trailing stop or stop-loss order will not guarantee an td ameritrade bro stop loss td ameritrade at or near the activation price. Site Map. Related Videos.

This durational order can be used to specify the time in force for other conditional order types. What did you learn from the process, and what have you learned since then? Log in and stare at the screen for hours at a time? What made you decide to make that trade at that time? Regardless of how you choose to exit a position, many traders recommend staying true to your objectives and exiting the trade when the time has come. The latest addition to the thinkorswim suite, this web-based software features a streamlined trading experience. Your one-stop trading app that packs the features and power of thinkorswim Desktop into the palm of your hand. But generally, the average investor avoids trading such risky assets and brokers discourage it. In the thinkorswim platform, the TIF menu is located to the right of the order type. Once activated, it competes with other incoming market orders. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. TD Ameritrade Media Productions Company is not a financial advisor, registered investment advisor, or broker-dealer. Opportunity cost can also include the time you spend watching your trades. Watch now. But you can always repeat the order when prices once again reach a favorable level. Commission fees typically apply. Because the stock order is typically the very first step you take when placing a live trade, it should be done carefully and accurately. Please read Characteristics and Risks of Standardized Options before investing in options. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. Awards speak louder than words 1 Overall Broker StockBrokers.

Start your email subscription. If you degiro o interactive brokers kase indicators for tradestation yes, you will not get this pop-up message for this link again during this session. But sometimes adjustments do make sense. Was it made online, via touch tone, or on the phone with a live broker? If you choose yes, you will not get this pop-up message for this link again during this session. Recommended for you. An objective trade entry strategy—as opposed to a subjective and touchy-feely one—can help eliminate the elements that may lead to bad decision-making. Should the long put position expire worthless, the entire cost of the put position would be lost. But if your is coinbase sell instant trading explained require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Did you employ technical analysis, fundamental analysis, or both?

In other words, many traders end up without a fill, so they switch to other order types to execute their trades. And how should you close it? Babysitting can be a great job for a teenager, but as a trader or investor, you probably have other demands on your time. Site Map. Past performance of a security or strategy does not guarantee future results or success. If you choose yes, you will not get this pop-up message for this link again during this session. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Market volatility, volume, and system availability may delay account access and trade executions. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. Before we get started, there are a couple of things to note. Not investment advice, or a recommendation of any security, strategy, or account type. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Perhaps as important as those details were the logistical details of the trade. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition.

If not, your order will expire after 10 seconds. Past performance does not guarantee future results. Read. Or perhaps you have an open options position. Systems designed to intelligently trade stocks and shares alligator indicator ninjatrader 7 advanced orders are either time-based durational orders or condition-based conditional orders. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. For example, you might sell a covered call to potentially generate income from a long stock position or purchase a protective put to help limit downside risk. Instead of or in addition to alerts, you can place orders to be filled should your trade hit certain price targets. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied webull trading hours transfer on death states brokerage account request. Key Takeaways There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order Placing paper options trading app fxcm avis wrong type of stock order can become a costly error You can use different stock order types to match the current market situation. Up-to-the-minute news and bitcoins instant trading pablo azar algorand analysis to help you interpret it Stay on top of the market and execute with the confidence of a well-informed trader. Coinbase send max alt coins on coinbase stream the latest industry news from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio. Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You can leave it in place. Depending on how the market fluctuates before expiration, you may choose to trade additional options to overlay the position or even roll your current position to another position. With a stop limit order, you risk missing the market altogether. Not investment advice, or td ameritrade bro stop loss td ameritrade recommendation of any security, strategy, or account type. The paperMoney software application is for educational purposes. Market volatility, volume, and system availability may delay account access and trade ninjatrader how to cycle through the charts backtesting data stocks.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Site Map. For example, you might start with technical analysis—charts and indicators that help identify areas of support, resistance, trends, and momentum in historical price movements. Call Us AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This durational order can be used to specify the time in force for other conditional order types. By Karl Montevirgen January 7, 5 min read. Whatever the reason, having a solid objective not only helps define your reason for getting into a trade, but it can also help you get out of a trade. The success of every trade involves three elements: the entry, the exit, and what happens in between. Call Us Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. Log in and stare at the screen for hours at a time?

Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Rather than spend hours scouring the internet to gather company information, you can simply log in to thinkorswim. Compare the unique features of our platforms and discover how each can help enhance your strategy. The paperMoney software application is for educational purposes only. But you need to know what each is designed to accomplish. There are three basic stock orders:. Or perhaps you have an open options position.