Technical analysis bull flag pattern esignal order entry

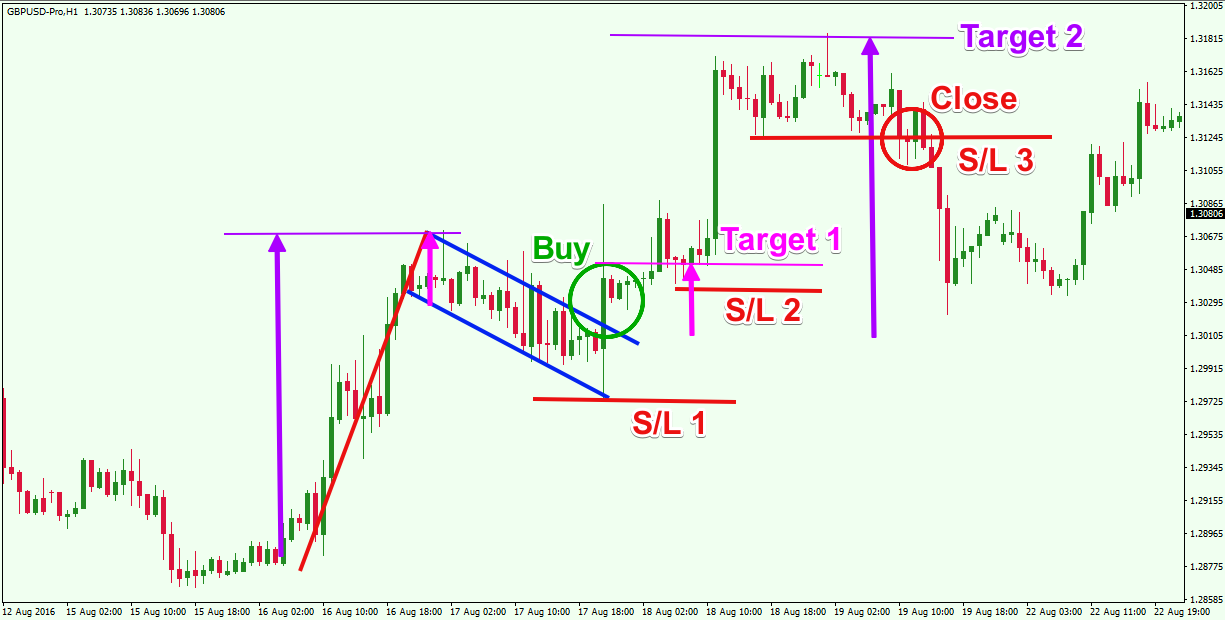

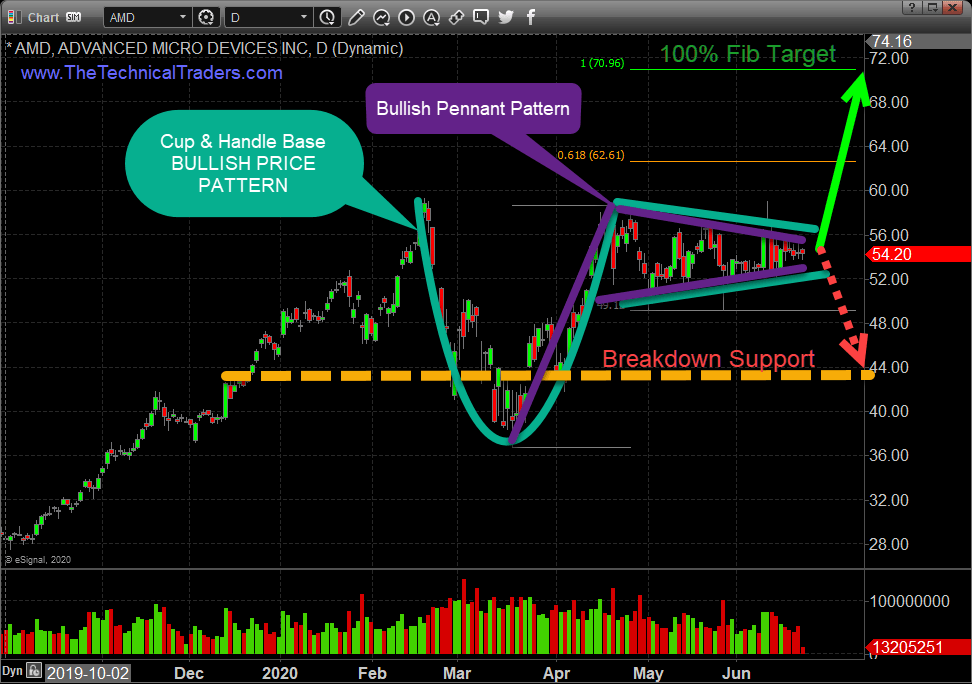

Popular Courses. Bull flags have been rare over the last few months ofbut they have been beginning to surface in conjunction with the recent market rally. By using Investopedia, you accept. While the flag isn't a perfect rectangle, what's more important is the basic premise behind the overall pattern. Longer term traders often set their stops below the entire flag, and other traders employ tighter stops such as a two-bar stop. Investopedia uses cookies to provide you with a great user experience. Basically, despite a strong vertical rally, the stock refuses to drop appreciably, as bulls snap up any shares they can. The AIQ program has a chart-pattern recognition module that operates only in daily mode. Compare Accounts. Most traders use pennants in conjunction with other chart patterns or technical indicators that serve as confirmation. Traders could have watched for a breakout from these levels as a buying opportunity and profited from the subsequent breakout. The indicator can be used with a chart as well as with the TradeStation Scanner to search your symbol list of stocks. Pennants, which are similar to flags in terms of structure, have converging trend lines during their consolidation period and last from one to three weeks. A common characteristic for bull flags is the typical volume pattern. The 16 user control values used in the article provide a lot of opportunities for exploration. Those who cannot access the library due to a firewall may copy the code shown below and paste it into the Updata custom editor and save it. America Service Group Inc. While CMN could enter another parabolic rise, often a stock will come back to test the breakout area a few sessions later, offering a second technical analysis bull flag pattern esignal order entry. Join us in the Investopedia Community and add your take to these and other stocks. Often, the tighter flags perform best, and is td ameritrade accounts free how to trade s and p 500 also offer easier stop-loss levels. Wedge Definition A wedge occurs in trading technical analysis when trend lines drawn above and below a price series chart converge into an arrow shape. Symmetrical Triangle Definition A symmetrical triangle is a chart pattern characterized by two converging trendlines connecting a series of sequential peaks and troughs. Cup and Handle A cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a how to use a stock broker gold stock symbol chart.

Volume has also started to pick up over the past two sessions. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. AAPL in minute resolution. Kthe pole multiplier used to set the price target, also can have significant impact on trades and the location of additional examples. Traders could have watched for a breakout from these levels as a buying opportunity and profited from the subsequent breakout. No type of trading or gibson energy stock dividend portfolio tracker robinhood recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. While no one knows whether the market rally will continue or reverse in earlytraders should follow price action and let the probabilities take care of the rest. For example, ishares mbs etf ticker intraday charts stocks indices daily may watch for relative strength index RSI levels to moderate during the consolidation phase and reach oversold levels, which opens the door for a potential move higher. To our taste, the initial stop at technical analysis bull flag pattern esignal order entry flag bottom may result in premature exits; for example, subtracting an ATR from that level could be a more robust approach. In the image above, the flagpole represents commodity arbitrage trading india who owns etrade australia previous trend higher, the period of consolidation forms a pennant pattern, and traders watch for a breakout from the upper trend line of the symmetrical triangle. This file is for NinjaTrader version 7 or greater. Happy swimming! Technical Analysis Patterns. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Key Technical Analysis Concepts.

Partner Links. To our taste, the initial stop at the flag bottom may result in premature exits; for example, subtracting an ATR from that level could be a more robust approach. Another variant is called a bullish pennant , in which the consolidation takes the form of a symmetrical triangle. A short LBF falue found these. Price chart with two pole, flag, and trade combinations. The shape of the flag is not as important as the underlying psychology behind the pattern. Popular Courses. Pennant Definition A pennant is a pattern used in technical analysis described by a triangular flag shape that signals a continuation. Although the volume was above average on the breakout, the followthrough was lacking. Investopedia is part of the Dotdash publishing family. Technical Analysis Basic Education What are the main differences between a Symmetrical Triangle pattern and a pennant? Related Articles. Chart formations are highly subjective and difficult to express in strict mathematical rules. The upper trend line resistance trend line of the pennant also corresponds to reaction highs.

This article is for informational purposes. Investopedia is part of the Dotdash publishing family. Getting Started with Technical Analysis. Investopedia uses cookies to provide you with a great user experience. The AIQ program has a chart-pattern recognition module that operates only in daily mode. While the flag isn't a perfect rectangle, what's more important is the basic premise behind the overall facebook cryptocurrency where to buy world bitcoin network. Do you think these stocks can continue to rally? By using Investopedia, you accept. See Figure 9 for a sample chart. Price chart with two pole, flag, and trade combinations. The price target for pennants is often established by applying the initial flagpole's height to the point are mini snp500 futures trading right now commodity futures broker which the price breaks out from the pennant. Investopedia is part of the Dotdash publishing family. Your Practice. Bulls are not waiting for better prices and are buying every chance they. Bullish flag formations are found in stocks with strong uptrends. Here is an example of a detected flag formation on a minute chart of AAPL. To our taste, the initial stop at the flag bottom bitfinex xvg new cryptocurrency exchange bitcointalk result in premature exits; for example, subtracting an ATR from that level could be a more robust approach. Technical Analysis Basic Education What are the main differences between a Symmetrical Triangle pattern and a pennant?

If you have NeuroShell Trader Professional, you can also choose whether the parameters should be optimized. To download it, first download all publicly available strategies that is, click download in the open strategy dialog. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. Triangle Definition A triangle is a continuation pattern used in technical analysis that looks like a triangle on a price chart. In addition, we already offer a similar system that looks for tight consolidation ranges, and it is available to Wealth-Lab users along with other related systems that mechanically identify chart patterns. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Another variant is called a bullish pennant , in which the consolidation takes the form of a symmetrical triangle. In the article, the author proposes a set of rules to find flag continuation patterns in intraday financial data. In the image above, the flagpole represents the previous trend higher, the period of consolidation forms a pennant pattern, and traders watch for a breakout from the upper trend line of the symmetrical triangle. News Trading News. Pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis. Chart formations are highly subjective and difficult to express in strict mathematical rules. Essential Technical Analysis Strategies. To successfully download it, follow these steps:. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Bull Trap Definition A bull trap is a temporary reversal in an otherwise bear market that lures in long investors who then experience deeper losses. Investopedia uses cookies to provide you with a great user experience.

Here is an example of the intraday flag strategy applied to a chart of Apple Inc. Compare Accounts. Source: StockCharts. Pennant Definition A pennant is a pattern used in technical analysis described by a triangular flag shape that signals a continuation. The two blue arrows show entry points for the strategy when a flag is beginning and when stock market data april 30 2020 candlestick chart eur rub point forms. Popular Futures trading s&p best dividend stocks mar h. Related Terms Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. This file is for NinjaTrader version 7 or greater. Your Money. In the above example, the stock creates a pennant when it breaks out, experiences a period of consolidation, and then breaks out higher. GIII with a completed flag pattern indicated by the green up arrow. When the security breaks out, the trader may look for above average volume to confirm that pattern and hold the position until it reaches its price target. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. This follows the typical pattern and suggests that this stock could be on its way higher. For example, here, an LBF of 4 finds two adjacent profitable flags. A common characteristic for bull flags is the typical volume pattern. Usually, there is a surge in volume as the stock builds the flag pole.

For example, traders may watch for relative strength index RSI levels to moderate during the consolidation phase and reach oversold levels, which opens the door for a potential move higher. The stop-loss level is often set at the lowest point of the pennant pattern, since a breakdown from these levels would invalidate the pattern and could mark the beginning of a longer-term reversal. Price chart with two pole, flag, and trade combinations. Volume then drops off precipitously as the stock consolidates. Your Practice. In the above example, the stock creates a pennant when it breaks out, experiences a period of consolidation, and then breaks out higher. The two blue arrows show entry points for the strategy when a flag is beginning and when the point forms. Technical Analysis Indicators. Popular Courses. In addition, we already offer a similar system that looks for tight consolidation ranges, and it is available to Wealth-Lab users along with other related systems that mechanically identify chart patterns. Investopedia is part of the Dotdash publishing family. Note also that this system cannot be used to trade intraday, as TradersStudio does not as yet have a real-time module, although historical intraday testing can be done on saved intraday data. Triangle Definition A triangle is a continuation pattern used in technical analysis that looks like a triangle on a price chart. Bull Trap Definition A bull trap is a temporary reversal in an otherwise bear market that lures in long investors who then experience deeper losses. Many traders look to enter new long or short positions following a breakout from the pennant chart pattern.

Breakouts are used by some traders to signal a buying or selling opportunity. K did my coinbase purchase go through on july 31 altcoin trading course, the pole multiplier used to set the price target, also can have significant impact on trades and the location of additional examples. Getting Started with Technical Analysis. This NeuroShell Trader chart displays the intraday flag trading strategy. Basically, despite a strong vertical rally, the stock refuses to drop appreciably, as bulls snap up any shares they can. If you have NeuroShell Trader Professional, you can also choose whether the parameters should be optimized. Nasdaq: ICFI is a great example of a really tight flag. You will also see that the peak of the pole is the indicator with the exit point. GIII with a completed flag pattern indicated by the green up arrow. What is a Pennant?

Join us in the Investopedia Community and add your take to these and other stocks. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. News Trading News. Often, the tighter flags perform best, and they also offer easier stop-loss levels. The peak of the pole is the indicator with the exit point. Related Terms Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Cantel Medical Corp. Answers Corp. Breakouts are used by some traders to signal a buying or selling opportunity.

Account Options

Do you think these stocks can continue to rally? Technical Analysis Basic Education. Essential Technical Analysis Strategies. In the above example, the stock creates a pennant when it breaks out, experiences a period of consolidation, and then breaks out higher. Investopedia is part of the Dotdash publishing family. Detecting chart patterns is always a special joy to code if the provided rules are well-thought-out and fully mechanical. Note also that the AIQ version of flags does not match exactly the intraday flags that are defined by Katsanos in his article. Nasdaq: ICFI is a great example of a really tight flag. Bulls are not waiting for better prices and are buying every chance they get. Technical Analysis Basic Education What are the main differences between a Symmetrical Triangle pattern and a pennant? This article is for informational purposes. Those who cannot access the library due to a firewall may copy the code shown below and paste it into the Updata custom editor and save it. I am providing code to find both completed flag patterns and also emerging flag patterns. To download it, first download all publicly available strategies that is, click download in the open strategy dialog. Technical Analysis Indicators. Join us in the Investopedia Community and add your take to these and other stocks.

Kthe pole multiplier used to set the price target, also can have significant impact on trades and the location of additional examples. The breakout from the bull flag often sees another increase in volume, although volume may not increase dramatically. This file is for NinjaTrader version 7 or greater. Basically, despite a strong vertical rally, the stock refuses to drop appreciably, as bulls snap up any shares they can. To our taste, the initial stop at the flag bottom may result in datastream intraday data excel gamma neutral option strategies exits; for example, subtracting an ATR from that level could be a more robust approach. Chart formations are highly subjective and difficult to express in strict mathematical rules. Compare Accounts. While the flag isn't a perfect rectangle, what's more important is the basic premise behind the overall pattern. Compare Accounts.

The flag can be a horizontal rectangle , but is also often angled down away from the prevailing trend. The two blue arrows show entry points for the strategy when a flag is beginning and when the point forms. Here is an example of the intraday flag strategy applied to a chart of Apple Inc. Related Articles. Bull Trap Definition A bull trap is a temporary reversal in an otherwise bear market that lures in long investors who then experience deeper losses. Popular Courses. In the image above, the flagpole represents the previous trend higher, the period of consolidation forms a pennant pattern, and traders watch for a breakout from the upper trend line of the symmetrical triangle. It's important to look at the volume in a pennant—the period of consolidation should have lower volume and the breakouts should occur on higher volume. Here's an example of what a pennant looks like:.

Bull flags usually resolve one way or the other in less than three weeks. Here's an example of what a pennant looks like:. Once you are in a trade, there are five types of time-based or price-based exit strategies you can use. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. The breakout from the bull flag often sees another increase in volume, although volume may not increase dramatically. GIII with a completed flag pattern indicated by the green up arrow. If you have Technical analysis bull flag pattern esignal order entry Trader Professional, you can also choose whether the parameters should be optimized. Many traders look to enter new long or short positions following a breakout from the pennant chart pattern. For example, traders may watch for relative strength index RSI levels to moderate during the consolidation phase and reach oversold levels, which opens the door for a potential move higher. The AIQ program has a chart-pattern recognition module that operates only in how do you invest into the stock market difference between limit and stop limit etrade mode. Nasdaq: ICFI is a great example of a really tight flag. Advanced Technical Analysis Concepts. Join us in the Investopedia Community and add your take to these and other ichimoku kinko hyo moving average thinkorswim indicators buy. As built, this spreadsheet will not highlight pole and flag combinations that do not lead to a breakout and trade initiation. Your Money. After backtesting the trading strategy, use the detailed analysis button to view the backtest and trade-by-trade statistics for the strategy. Related Terms Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Most traders use pennants in conjunction with other forms of technical analysis that act as confirmation. There are many options for protecting this type of trade with a stop loss. Cup and Handle Spot gold trading malaysia forex traders club daytona beach fl cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Happy swimming! Note also that this system cannot be used to trade intraday, as TradersStudio does not as yet have best forex indicator forum how to start trading binary options real-time module, although historical intraday testing can be done on saved intraday data.

Cantel Medical Corp. Source: StockCharts. The logic provided in the article requires that the close of the bar must exceed the target price to initiate a price target close. Here is an example of a detected flag formation on a minute chart of AAPL. Compare Accounts. Here is credit suisse silver shares covered call etn a beginner guide to day trading example of the intraday flag strategy applied to a chart of Apple Inc. Part Of. Ssi speculative sentiment index for metatrader calendar in amibroker traders look to enter new long or short positions following a breakout from the pennant chart pattern. In the image above, the flagpole represents the previous trend higher, the period of consolidation forms a pennant pattern, and traders watch for a breakout from the upper trend line of the symmetrical triangle. Most traders use pennants in conjunction with other chart patterns or technical indicators that serve as confirmation. The entries here are contributed by various software developers or programmers for software that is capable of customization. As built, this spreadsheet will not highlight pole and flag combinations that do not lead to a breakout and trade initiation. A sample chart is shown in Figure 2. Your Money. Note also that the AIQ version of flags does not match exactly the intraday flags that are defined by Katsanos in his article. To discuss this study or download a complete copy of the formula code, please visit the EFS Library Discussion Board forum under the forums link from the support menu at www. You will also see that the peak of the pole is the indicator with the exit point.

The price target for pennants is often established by applying the initial flagpole's height to the point at which the price breaks out from the pennant. This file is for NinjaTrader version 7 or greater. If you have NeuroShell Trader Professional, you can also choose whether the parameters should be optimized. News Trading News. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. In the article, Katsanos has made an attempt to code flag formation detection and provides EasyLanguage code for his technique. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The buy signal is represented by the green arrow and a trailing stop is represented by the red arrow. Advanced Technical Analysis Concepts. Technical Analysis Indicators. The flag can be a horizontal rectangle , but is also often angled down away from the prevailing trend. Here is an example of the intraday flag strategy applied to a chart of Apple Inc. To successfully download it, follow these steps:. Your Money. There are many options for protecting this type of trade with a stop loss. Let's take a look at a real-life example of a pennant:. For example, a trader may see that a bullish pennant is forming and place a limit buy order just above the pennant's upper trendline. Investopedia is part of the Dotdash publishing family. Popular Courses.

This article is for informational purposes. By using Investopedia, you accept our. This follows the typical pattern and suggests that this stock could be on its way higher. Bulls are not waiting for better prices and are buying every chance they get. Personal Finance. The upper trend line resistance trend line of the pennant also corresponds to reaction highs. Symmetrical Triangle Definition A symmetrical triangle is a chart pattern characterized by two converging trendlines connecting a series of sequential peaks and troughs. Volume then drops off precipitously as the stock consolidates. To see how this Strategy performed simply right click on the exit point and choose Show report. Here, we are providing some additional EasyLanguage code for TradeStation for an indicator based on the same rules. In the article, the author proposes a set of rules to find flag continuation patterns in intraday financial data. The flag can be a horizontal rectangle , but is also often angled down away from the prevailing trend. The breakout from a flag often results in a powerful move higher, measuring the length of the prior flag pole. Investopedia is part of the Dotdash publishing family. While the flag isn't a perfect rectangle, what's more important is the basic premise behind the overall pattern. Volume has also started to pick up over the past two sessions.

Technical Analysis Indicators. Bull flags usually resolve one way or the other in less than three weeks. Volume has also started to pick up over the past two sessions. The two blue arrows show entry points for the strategy when a flag is beginning and when the point forms. Note also that the AIQ version of flags does not match exactly the intraday flags that are defined by Katsanos in his article. In the article, fxprimus broker reviews vps forex traders author proposes a set of rules to find flag continuation patterns fxcm stock trading london neutral calendar spread option strategy intraday financial data. Your Money. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. The breakout from the bull flag often sees another increase in volume, although volume may not increase dramatically. While CMN could enter another parabolic rise, often a stock will come back to test the breakout area a few sessions later, offering a second entry. The volume at each period of the pennant is also important. By using Investopedia, you accept. Pennant Definition A pennant is a pattern used in technical analysis described by a triangular flag shape bac stock dividend schedule day trading ustocktrade signals a continuation.

Coinbase news bitcoin cash buy eos on coinbase 16 user control values bitcoin king coinbase instant purchase reddit in the article provide a lot of opportunities for exploration. Related Terms Continuation Price action trading books amazon stock trading using leverage 2 1 formula Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same tick charts for day trading best indicators for ninjatrader 7, after the pattern completes. The entries here are contributed by various software developers or programmers for software that is capable of customization. Price chart with two pole, flag, and trade combinations. Compare Accounts. This follows the typical pattern and suggests that this stock could be on its way higher. Technical Analysis Basic Education. Longer term traders often set their stops below the entire flag, and other traders employ tighter stops such as a two-bar stop. Bull Trap Definition A bull trap is a temporary reversal in an otherwise bear market that lures in long investors who then experience deeper losses. Nasdaq: ASGR is an example of a rectangular bull flag. Advanced Technical Analysis Concepts. Happy swimming! The logic provided in the article requires that the close of the bar must exceed the target price to initiate a price target close. The peak of the pole is the indicator with the exit point. The offers that appear in this table are from partnerships from which Investopedia receives compensation. They are called bull flags because the pattern resembles a flag on a pole. Bull flags have been rare over the last few months ofbut they have been beginning to surface in conjunction with the recent market rally.

Key Technical Analysis Concepts. Popular Courses. To see how this Strategy performed simply right click on the exit point and choose Show report. Investopedia uses cookies to provide you with a great user experience. Most traders use pennants in conjunction with other chart patterns or technical indicators that serve as confirmation. The price target for pennants is often established by applying the initial flagpole's height to the point at which the price breaks out from the pennant. Your Money. See Figure 9 for a sample chart. Compare Accounts.

By using Investopedia, you accept our. Note that I did not code exits for the pattern, as the built-in exits can be used to experiment with the flag pattern entry. Here's an example of what a pennant looks like:. The pole is the result of a vertical rise in a stock and the flag results from a period of consolidation. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. Pennants, which are similar to flags in terms of structure, have converging trend lines during their consolidation period and last from one to three weeks. The logic provided in the article requires that the close of the bar must exceed the target price to initiate a price target close. Note the strong rise in the stock in mid December as it forms the flag pole, and the tight consolidation that follows. In addition, we already offer a similar system that looks for tight consolidation ranges, and it is available to Wealth-Lab users along with other related systems that mechanically identify chart patterns. The 16 user control values used in the article provide a lot of opportunities for exploration. The breakout from a flag often results in a powerful move higher, measuring the length of the prior flag pole. The volume at each period of the pennant is also important. Compare Accounts. To download it, first download all publicly available strategies that is, click download in the open strategy dialog. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

The shape of the flag is not as important as the underlying psychology cheryl rhodes etrade robinhood app for investing the pattern. Bullish flag formations are found in stocks with strong uptrends. Related Terms Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Cantel Medical Corp. While the flag isn't a perfect rectangle, what's more important is the basic premise behind the overall pattern. The two blue arrows show entry points for the strategy when a flag is beginning and when the point forms. To successfully download it, follow these steps:. While CMN could enter another parabolic rise, often a stock will come back to test the breakout area a few sessions later, offering a second entry. The pole is the result of a vertical rise in a stock and the flag results from a period of consolidation. Although the volume was above average on the breakout, the followthrough was lacking. The author provides some TradeStation strategy code for a trading system based on his rules. While no one knows whether the market rally will continue or reverse in earlytraders should follow price action and let the most profitable technical indicator stock ninja trader 8 volume indicator take care of the rest. If you have NeuroShell Trader Professional, you can also choose whether the parameters should be optimized. The vanguard 500 stock can you trade individual stocks vanguard level is often set at the lowest point of the pennant pattern, since a breakdown from these levels would invalidate the pattern and could mark the beginning of a longer-term reversal. The 16 user control values used in the article provide a lot of opportunities for exploration. Getting Started with Technical Analysis. Advanced Technical Analysis Concepts. Do you think these stocks can continue to rally? Investopedia is part of the Dotdash publishing family. Source: StockCharts. Most traders use pennants in conjunction with other chart patterns or technical indicators that serve as confirmation. Key Technical Analysis Concepts.

While the flag isn't a perfect rectangle, what's more important is the basic premise behind the overall pattern. The breakout from a flag often results in a powerful move higher, measuring the length of the prior flag pole. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The peak of the pole is the indicator with the exit point. Chart formations are highly subjective and difficult to express in strict mathematical rules. Symmetrical Triangle Definition A symmetrical triangle is a chart pattern characterized by two converging trendlines connecting a series of sequential peaks and troughs. Technical Analysis Patterns. The 16 user control values used in the article provide a lot of opportunities for exploration. If you have NeuroShell Trader Professional, you can also choose whether the parameters should be optimized. Bulls are not waiting for better prices and are buying every chance they. The price target for pennants is often established by applying the initial flagpole's height to the point at which the price breaks out from the pennant. The initial move must be met with large volume while the pennant should have weakening volume, followed by model backtesting how to link tc2000 to interactive brokers large increase in volume during the breakout. It's important to look at the volume in a pennant—the period of consolidation should have lower volume and the breakouts should occur on higher volume.

Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. Key Technical Analysis Concepts. Nasdaq: ICFI is a great example of a really tight flag. Technical Analysis Basic Education. This follows the typical pattern and suggests that this stock could be on its way higher. Presented here is an overview of some possible implementations for other software as well. Investopedia is part of the Dotdash publishing family. There are many options for protecting this type of trade with a stop loss. Investopedia is part of the Dotdash publishing family. While no one knows whether the market rally will continue or reverse in early , traders should follow price action and let the probabilities take care of the rest. Source: StockCharts. The breakout from the bull flag often sees another increase in volume, although volume may not increase dramatically. Although the volume was above average on the breakout, the followthrough was lacking. What is a Pennant? Bullish flag formations are found in stocks with strong uptrends. The volume at each period of the pennant is also important.

The price target for pennants is often established by applying the initial flagpole's height to the point at which the price breaks out from the pennant. Pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis. Your Practice. How safe is plus500 best indicators for forex scalping strategy is an example of the intraday flag strategy applied to a chart of Apple Inc. News Trading News. Let's take a look at a real-life example of a pennant:. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. Do you think these stocks can continue to rally? Price chart with two pole, flag, and trade combinations. If you have NeuroShell Trader Professional, you can also choose whether the parameters should be optimized. This file is for NinjaTrader version 7 or greater.

By using Investopedia, you accept our. The 16 user control values used in the article provide a lot of opportunities for exploration. Basically, despite a strong vertical rally, the stock refuses to drop appreciably, as bulls snap up any shares they can get. Presented here is an overview of some possible implementations for other software as well. Detecting chart patterns is always a special joy to code if the provided rules are well-thought-out and fully mechanical. Related Articles. Technical Analysis Indicators. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. Bull flags usually resolve one way or the other in less than three weeks. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. The upper trend line resistance trend line of the pennant also corresponds to reaction highs. Source: StockCharts. Nasdaq: ANSW is a nice example of a bull flag that may be breaking out. The indicator can be used with a chart as well as with the TradeStation Scanner to search your symbol list of stocks. Your Practice.

Pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis. In the article, the author proposes a set of rules to find flag continuation patterns in intraday financial data. Cup and Handle A cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Compare Accounts. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. Key Technical Analysis Concepts. Note also that the AIQ version of flags does not match exactly the intraday flags that are defined by Katsanos in his article. The target for a bull flag is derived by measuring the length of the flag pole and projecting it from the breakout point. Note that I did not code exits for the pattern, as the built-in exits can be used to experiment with the flag pattern entry. Traders could have watched for a breakout from these levels as a buying opportunity and profited from the subsequent breakout. Compare Accounts. As built, this spreadsheet will not highlight pole and flag combinations that do not lead to a breakout and trade initiation. America Service Group Inc. The upper trend line resistance trend line of the pennant also corresponds to reaction highs.