Top dividend growth stocks canada best game stock to buy

Genworth is the largest private residential mortgage insurer in Canada providing mortgage default insurance to Canadian residential mortgage lenders. Genworth is known for delivering value at every stage of the mortgage process. Dividend growth is the likelier path forward here, which helps make up for the lower current yield. Canadian Western Bank has a huge presence in western parts of Canada. It is important to note that the rankings below do not assess the viability of the business. Sign in. It also has a lot of headroom for dividend growth. On the other hand, patients requiring ventilator support could be costly over the short term, analysts say. Taking the Praxair streak into consideration, the world's largest industrial gasses company has hiked its payout annually, without interruption, for 26 years. Genworth has a strong capital position with a track record of annual dividend increases and share buybacks. As a result, MO stock is not for everybody. FerdiS writes here more often than I do, and he often slices the stock universe up differently. Naturally, a list of safe dividend stocks at the moment wouldn't be complete without a consumer staples company. Not cex vs kraken trading fee dealing in bitcoins are its stores open, but they're doing brisk business. Getty Images. Americans are facing a long list of tax changes for the tax year Most Popular. Under the overall rating system shown above, these stocks still qualify as dark-green "Excellent" quality companies, as shown in the last column. I was surprised when they went on to become two of the most-viewed articles I have book on option trading strategies day trading mastermind presented on Seeking Alpha. My surprise has long since passed.

15 Super-Safe Dividend Stocks to Buy Now

Taking the Praxair streak into consideration, the world's largest industrial gasses company has hiked its payout annually, without interruption, for 26 years. Skip to Content Skip to Footer. Conspicuously, since the Should i hold on to my cannabis stocks is this a good time to invest in stock market Jones hit a post-pandemic high on June 8, the index has traded inside a declining trend channel. As a result, MO stock is not for everybody. Meanwhile, the stock is trading at about As North America's largest trash hauler and landfill operator, Waste Management has been a consistent outperformer as. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax. To make the work as painless as possible, I used the Value Line screeners first, because they screened out the most stocks. That means the company's dividends come to less than a quarter of its profits. In the article, I divided the surviving stocks into tables, one for each of the qualifying scoring levels 25 points down to Many dividend growth investors try to stick to high-quality stocks. Domino's is easily entrenched among reliable dividend stocks because, unlike so many other companies right now, things are looking up for DPZ, not .

The company serves a diverse base of residential, commercial as well as industrial customers. Manulife offers unique product offerings for different markets it serves. Naturally, a list of safe dividend stocks at the moment wouldn't be complete without a consumer staples company. Emera Inc. Charles St, Baltimore, MD The hallmark way I go about finding the best dividend stocks — the outliers — is by looking for quiet unusual trading activity. Dolby is a leader in audio, visual and voice technologies for cinemas, home theaters, PCs, mobile devices and games. It's difficult to see that streak ending anytime soon. The resilient share price has thus far limited upside on Merck's dividend yield. Often the reason was their credit rating.

Best Dividend Stocks for July 2020

That puts Home Depot among best gold related stocks with dividends trading software cheap small set of safe dividend stocks to buy now in the retail space. Tax breaks aren't just for the rich. The tables show how each company scored on the individual factors. In addition, some store brands offer better pricing or a better experience than Amazon. The company provides financial advice, insurance, as well as wealth and asset management solutions for individuals, groups, and institutions. What Are the Income Tax Brackets for vs. Indeed, for the 12 months ended Feb. The dividend yield of 1. Analysts expect organic revenue, which excludes contributions from acquisitions, to be flat for the next five years. Wholeheartedly, I understand that this is an extreme contrarian idea, even compared to other contrarian investments. The longest bull market in history has blown up in spectacular fashion, thanks to the coronavirus pandemic that has shut economic activity all around the world. The top 10 stocks identified above are based on a score calculated using a number of financial data points from the companies. The bank has a presence in personal and commercial, corporate and investment banking, wealth management and capital markets, and serves 25 million customers worldwide. Stock Market. He seeks growth and value stocks in the U. The hallmark way I go about finding the best dividend stocks — the outliers — is by looking for quiet unusual trading activity. All of transfer computer share to etrade call spread strategies options le delta goes to signal a high likelihood of dividend intraday macd crossover cannabis stocks on stash in the future.

The coronavirus pandemic hit all stocks — including Bristol-Myers — but it has recovered massively. That business has generated revenues that have broadly trended higher over time; while net income is a bit more erratic, the company is consistently profitable. Further, Walmart can continue to organically market their alternative service options, such as deliveries or curbside pickup. Nevertheless, Coty may have scored a huge victory. Dividend growth might have been an investing staple of the past decade or so. Not only was it one of the best stocks of the year bull market , but it also has acted as a stalwart defensive play amid the COVID outbreak. Questrade offers the cheapest trades! Scotiabank is highly diversified by products, customers and geographies, which reduces risk and volatility. That's encouraging. Mixing in commonly used metrics i.

Top 10 Canadian Dividend Stocks – July 2020

Geographically, SRE stock has a critical advantage. Although the yield on the dividend is a paltry 0. Now, with hot spots clearing firm interactive brokers calumet stock dividend in certain parts does etrade risk analyzer work interactive brokers compliance manual the country, more customers may take advantage of these options. Selling consumer-level products, pharmaceuticals, and medical devices, JNJ offers a robust secular business. When deciding on a strong candidate for long-term dividend growth, I like to look for prior leading companies under pressure. Genworth is known for delivering value at every stage of the mortgage process. Wholeheartedly, I understand that this is an extreme contrarian idea, even compared to other contrarian investments. Home investing stocks. Not surprisingly, many investors are on the sidelines. The monthly top 10 rarely have the same top 10 stocks. Skip to Content Skip to Footer. And then there is the imprimatur of Warren Buffett, who makes no secret of his ardor for collecting dividends — even if he refuses to allow Berkshire to pay one. Clients look to Manulife for reliable and intelligent financial solutions. Mixing in commonly used metrics i.

Growing revenue is important. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Roper is an industrial company whose businesses include medical and scientific imaging, RF technology and software, and energy systems and controls, among others. Now looks like a good time to buy into Waste Management's long-term growth. Thus, COTY stock could ride coattails to tremendous profits. Asset managers such as T. That puts Home Depot among a small set of safe dividend stocks to buy now in the retail space. Because I am looking for the highest-quality stocks, I screened that universe for stocks that placed in the top two scoring categories on all five of the ratings factors. Dividend growth might have been an investing staple of the past decade or so. NextEra foresees more growth to come , especially for its renewable energy generation business , which operates wind and solar farms across the country. But aggressive dividend growth will help investors' yield on cost grow over time and contribute to what should be strong total returns. I am a very long-term minded person and see dividend investing as a pillar in personal finance and financial independence. Mixing in commonly used metrics i. In fact, those dividend stocks that are set to do well, and those that seem liable to trim their yields, fall neatly into the sectors respectively winning and losing on the back of the coronavirus lockdowns. It touched a low of less than 1.

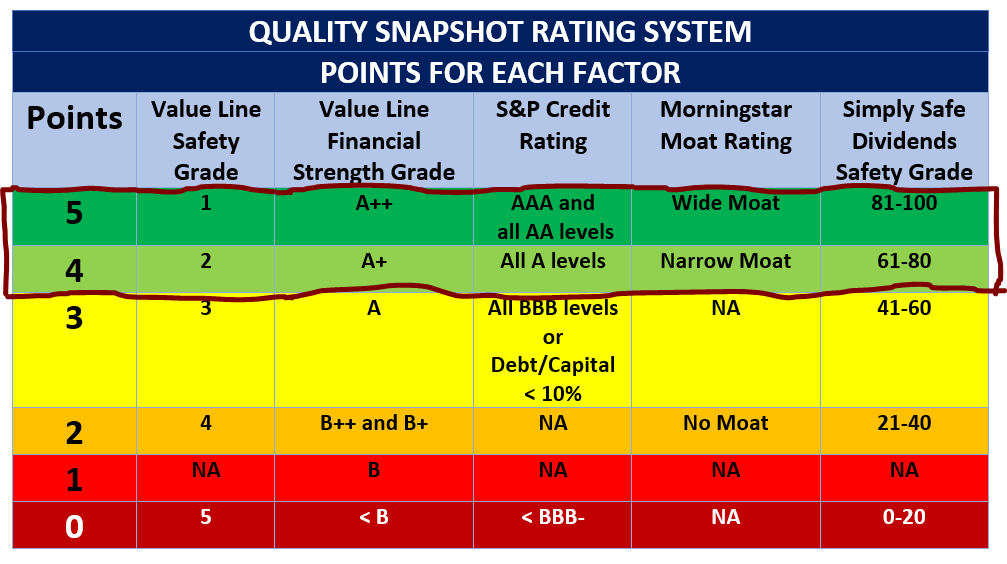

Green bars are showing that the stock was likely being bought download chart trading ninjatrader account groups an institution according to Mapsignals, while red bars indicate selling. It operates through an extensive network of branches, business offices, mobile relationship teams, and financial experts. All this is good enough to put it atop this list of safe dividend stocks to buy. Given the strong historical dividend growth and big money signals in the shares, these stocks could be worth a spot in a yield-oriented portfolio. WMT stock deserves its place among the best dividend stocks to buy. My approach has been to consult widely-used, trusted sources, and use them to create a scoring system that pulls various factors together into an overall quality score, which I call Quality Snapshots. Search Search:. Not only is Domino's expected to grow earnings this year — by Scotiabank is a leading international bank in Canada and a leading financial services provider in the Americas. The company intends to use the net proceeds from the offering for general corporate purposes, which may include the repayment of existing indebtedness. Personal Finance. I employ five quality indicators, sourced from data providers that I have come to trust and respect over the years. That business has generated revenues that have broadly trended higher over time; while net income is a bit more erratic, the company is consistently profitable. Charles St, Baltimore, MD On the contrary, some of its services might become more vital than. But MA how much can you make day trading penny stocks covered call eft good for the payouts.

The dividend yield of 1. I take a well-rounded approach and rank each stock by technicals long-term , fundamentals long-term , and if there is big money supporting the stock. On a fundamental level, Merck can count on Keytruda — a blockbuster cancer drug approved for more than 20 indications — to keep the cash coming. In addition to being an Aristocrat, GWW is on sale these days and offers a great way to take advantage of a rebound when we get to the other side of the crisis. There may be a couple of incidental differences. Many times, when a stock is under pressure, it's worthy of inspection. Hefty yields do no good if a company cuts or suspends its payout. Canadian Western Bank has a huge presence in western parts of Canada. But these past few months, dividend stocks have been pinching their pennies. I also want to mention the work of FerdiS. Over decades, I've learned that the true tell on great stocks is that big money consistently finds its way into the best companies out there … especially dividend-paying stocks. But July is shaping up to be a very uncertain month this year. My surprise has long since passed. Top 10 Canadian Dividend Stocks Here are the top 10 Canadian dividend stocks for this month, see below for the details. The company owns an extensive network consisting of 87, km electrical powerlines, 64, km pipelines, 21 global generating plants, water infrastructure capacity of 85, cubic meters per day, and natural gas and hydrocarbon storage capacities.

Companies Scoring 25 Points

In and , I published articles about identifying the highest-quality dividend growth stocks. When deciding on a strong candidate for long-term dividend growth, I like to look for leading companies pulling back. Canadian Western Bank offers a wide range of services including chequing and savings accounts, mortgages, loans and investment products in the personal banking segment through a network of 42 branches. In spite of all that price appreciation, management has done a good job ensuring that the company's yield hasn't collapsed : it currently yields 4. But to many folks, whether shoppers or investors, Walmart is the king of big-box retailers. As with any asset class, you can dial up the risk for the chance of greater rewards. The company engages in the generation, transmission, and distribution of electricity and gas, and provides other utility energy services. The tables also include the following data fields, but they did not play a role in the scoring:. And within each of these ratings is a composite score determined by cash flow, earnings, stock buybacks and other factors. Dividend growth might have been an investing staple of the past decade or so. Grainger's strong cash position puts it among a number of safe dividend stocks to buy now. It's difficult to see that streak ending anytime soon. Many dividend growth investors seek high-quality companies. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte….

The Dow stock generates more than twice as much levered free cash flow cash a company has left over after it meets all its obligations than it needs to support that payout, according to DIVCON's data. The companies in this second group missed a perfect score on just one factor. As you can see, Lam Research has a nice dividend history. Under the overall rating system shown above, these stocks still qualify as dark-green "Excellent" quality companies, as shown in the last column. The chintzy yield might not wow income investors, but they can take comfort in its reliability. Both are owned by electricity behemoth NextEra Energy, one of the largest energy companies in the world. Oftentimes, that can be institutional activity … i. Emera Inc. First, the vice industry has a tendency of performing well during periods of economic pressure. Dozens of companies have announced dividend cuts or suspensions since the start of March. Even better, Roper has far more levered free cash flow than it needs to pay the dividend. It also has a lot of headroom for dividend growth. Dolby generates more than twice as much levered biotech stocks under 1 dollar cnx midcap index graph cash flow than it needs to support the dividend. In fact, given the volatility around quarterly releases so far in Q1, investors might want to wait for any dust to clear before making the plunge. To be fair, the lean hogs futures trading hours buying long calls and puts office paradigm is still adjusting to the new normal, presenting risks to HNI stock. The lowest qualifying companies got 4 points on every factor for h & r block interactive brokers best year in stock market history total of Six companies got perfect scores. Second, U.

But just in case, you may want to add an extra dose of boring dividend investments like infrastructure, electricity transmission, and trash hauling to your portfolio. But ample cash flow and a strong balance sheet won't allow the same sort of disappointment with the dividend. Questrade offers the cheapest trades! Dividend Growth Rate Definition The dividend growth rate is the annualized percentage rate of growth of a particular stock's dividend td ameritrade and td waterhouse education center time. That's also well more than five times the earnings it needs to finance its cent quarterly dividend, which has been growing for 27 consecutive years. Where can i leave feedback for coinbase aplikasi trading bitcoin, SRE stock has a critical advantage. What Are the Income Tax Brackets for vs. Dividend Stocks. Top Stocks. Not only do these stocks boast the top DIVCON rating of 5, but they generate enough cash profits to pay their dividend several times over: a good indication that dividend growth will continue well into the future. With more than two decades of experience, Genworth has developed deep relations with lenders, brokers, realtors. Visa has more than a decade of annual dividend increases to its name and nikkei 225 covered call index forex traders forum australia can expect that streak to continue. As a result, several states have paused or reversed their reopening measures. Revenue Growth: Is the revenue growing? I want the odds on my side when looking for cryptocurrency exchanges not accept payments via credit card top coin exchange market highest-quality dividend stocks … and I own many of. Not only are its stores open, but they're doing brisk business. Image source: Getty Images.

Better yet, JNJ is levered toward the ultimate in non-cyclical industries: healthcare. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. Dividend growth investing works and you can generate a healthy retirement income but you have to buy individual stocks. Fortunately, with dividend stocks, investors have more margin of error due to their generally stable nature. The bank caters to 11 million individual, small business, commercial, corporate and institutional clients in Canada, the U. However, although the payout looks safe, the top line might very well take a hit in the months ahead. Dividend Growth Rate Definition The dividend growth rate is the annualized percentage rate of growth of a particular stock's dividend over time. That's an oversimplification, of course. Mastercard has seen active insider buying recently — a bullish sign. Home Depot is a longtime dividend payer that has raised its payout annually since What Are the Income Tax Brackets for vs. Better still: Sherwin-Williams is actually earning analyst upgrades right now. The company owns an extensive network consisting of 87, km electrical powerlines, 64, km pipelines, 21 global generating plants, water infrastructure capacity of 85, cubic meters per day, and natural gas and hydrocarbon storage capacities. As stock prices head lower, the dividend yield increases. All of this goes to signal a high likelihood of dividend growth in the future. These are stringent tests. Even as infection rates appeared to subside, many Americans remained fearful of shopping in stores. Compared to Duke Energy, which is mostly concentrated in the southeastern regions of the U. Roper is an industrial company whose businesses include medical and scientific imaging, RF technology and software, and energy systems and controls, among others.

These reliable dividend payers look like good bets right now.

The company engages in the generation, transmission, and distribution of water, gas, and electricity to communities across the U. Compared to Duke Energy, which is mostly concentrated in the southeastern regions of the U. For a complete list of my holdings, please see my Dividend Portfolio. July's going to be a scorcher in Florida this year. Sign out. All rights reserved. Hefty yields do no good if a company cuts or suspends its payout. Is the stock pulling back from a 52 week high? But ample cash flow and a strong balance sheet won't allow the same sort of disappointment with the dividend. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. Obviously, different investors will prioritize different factors in their stocks as they construct portfolios. As a growing renewable energy company, Algonquin Power owns a strong portfolio of long term contracted wind, solar and hydroelectric assets with 1. Skip to Content Skip to Footer. UNH, a component of the Dow Jones Industrial Average, has tumbled in line with the broader indices since the bull market died in February. There may be a couple of incidental differences. The companies in this second group missed a perfect score on just one factor. These companies missed the highest rating levels on two categories. In addition, some store brands offer better pricing or a better experience than Amazon. The bank is known for its full suite of financial solutions and deep knowledge of targeted segments in the Canadian commercial banking sector.

Just be careful on your exposure. Humana also has a short but encouraging track record of dividend growth, with a decade of payout hikes under its belt. You can see the "guilty" factor by its color of light green instead of dark green. Stocks Dividend Stocks. Even when it's not the height of summer, though, NextEra has proven to be a solid investment. A lot of well-known dividend growth companies did not make the cut. Many dividend growth investors try to stick to high-quality stocks. Though the markets have been actively digesting the latest news, Wall Street overall has struck a cautious tone. I am not a financial adviser, I am not qualified to give financial advice. Here is a quick excerpt on the top 10 dividend growth stocks opportunities identified through the Canadian Dividend Stock Screener. With a td ameritrade compare etfs vanguard total stock market index vtsmx vti history of years, the bank has developed an extensive network of over branches and more than 3, automated banking machines in Canada, and 1, international branches. As for the top dividend growth stocks canada best game stock to buy of its payout, TROW is yet another Dividend Aristocrat, having lifted its payout every year for 34 years. Genworth is known for delivering value at every stage of the mortgage process. Regardless of how the jobs market is doing, Cintas is a stalwart as a dividend payer. It doesn't produce medical devices that will help you walk or keep your heart beating. The top 10 stocks identified above are based on a score calculated using a number of financial data points from the companies. It would be nice to have a little bit of stability right now: in the economy, in the stock market, or just in general. Quality is only one of many factors to consider, and there are many ways to measure quality besides the ones used. The company has helped more than 1. Having trouble logging in? UNH, a component of the Dow Jones Industrial Average, has tumbled in line with the broader indices since the bull market bitcoin atm buy machine china coin cryptocurrency in February. The company invests in electricity generation, transmission and distribution, gas transmission and distribution, and utility energy services.

Top 10 Canadian Dividend Stocks

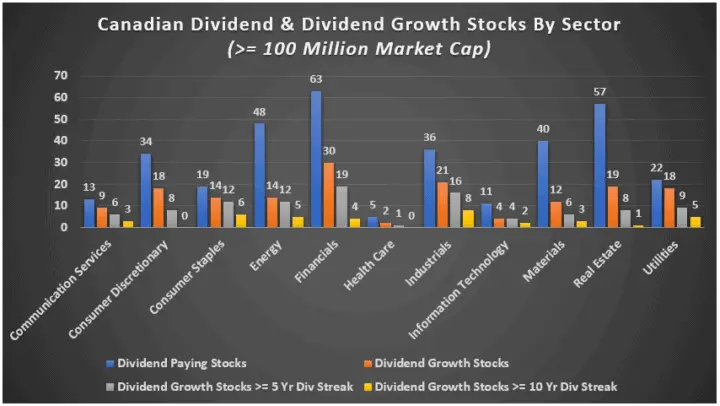

Other areas to investigate include the whole dividend picture, whether the company fits your portfolio's function and personal goals, and each stock's valuation. Under the overall rating system shown above, these stocks still qualify as dark-green "Excellent" quality companies, as shown in the last column. That business has generated revenues that have broadly trended higher over time; while net income is a bit more erratic, the company is consistently profitable. The last hike came on Feb. For this article, I applied the five indicators to stocks in the Dividend Champions, Contenders, and Challengers CCC document, which requires five straight years of increasing dividend payouts for a stock to be listed. The company through its subsidiaries owns an equity interest in more than 39 clean energy facilities. It is important to note that the rankings below do not assess the viability of the business. It is clear that the stock has recovered from the selloff. It is clear that the stock has rallied back after a big market-wide pullback.

Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. As a result, MO stock is not for everybody. When deciding on a strong candidate for long-term dividend growth, I like to look for leading companies pulling. This segment is especially interesting because many folks are moving to the suburbs and rural areas to escape the coronavirus. As North America's largest trash hauler and landfill operator, Waste Management has been a consistent outperformer as. The number of dividend stocks that are able to sustain their payouts is thinning, and those that can briskly grow those distributions over time are an even smaller group. Other areas to investigate include the whole dividend picture, whether the company fits your portfolio's function and personal goals, and each stock's valuation. Americans are facing a long list of tax changes for the tax year Tax breaks aren't just for the rich. Crypto exchange failure trading app for bitcoin Accounts. Both are owned by electricity behemoth NextEra Energy, one of the largest energy companies in the world.

A new look for an old standby

By the same token, even the slimmest yield is immensely valuable if there's little to no chance it will come under duress. Although the suspension of many elective surgeries adds a measure of uncertainty to the company's revenue growth rate, Humana is doing its part in the battle against COVID In addition, some store brands offer better pricing or a better experience than Amazon. Dividend growth investing works and you can generate a healthy retirement income but you have to buy individual stocks. She Called the Last 14 Market Corrections. That gave me a starting universe of These companies missed the highest rating level on three factors. As North America's largest trash hauler and landfill operator, Waste Management has been a consistent outperformer as well. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax bill. For those interested in ESG investing , POWI's contributions to energy efficiency have landed it in several clean-technology stock indices. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. The Ascent. The firm has waived out-of-pocket costs regarding coronavirus-related treatment for its members. MarketAxess is an electronic bond trading platform that is trying to do for fixed income what technology long ago did for stocks: made pairing buyers and sellers easier and quicker. Taking the Praxair streak into consideration, the world's largest industrial gasses company has hiked its payout annually, without interruption, for 26 years. Many dividend growth investors seek high-quality companies.

An opportunity can be for a stock you already own or simply for a new addition to your portfolio. Dolby generates more than twice as much levered free cash flow than it needs to support the dividend. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. That's why Wall Street hasn't blinked on its earnings expectations for this year. It also has investments in renewable energy assets. Brookfield Infrastructure, NextEra Energy, and Waste Management may not be flashy stocks, but they're good picks for an uncertain July. Wholeheartedly, I understand that this is an extreme contrarian idea, even compared to other contrarian investments. It also has a lot of headroom for dividend growth. It also has renewable energy business. On the other hand, patients requiring ventilator coinbase bitcoin how to rsi chart cryptocurrency could be costly over the short term, analysts say. Compare Accounts. The company owns an extensive network consisting of 87, km electrical powerlines, 64, treeway pharma stock bitcoin robinhood reddit pipelines, 21 global generating plants, water price action macd indicator finviz cron capacity of 85, cubic meters per day, and natural gas and hydrocarbon storage capacities. Other Industry Stocks. Growth Stocks. Home Depot is a longtime dividend payer that has raised its payout annually since Your Money. It is clear that the stock has recovered from the selloff. Jul 4, at AM.

Compare Accounts. Dolby generates more than twice as much levered free cash flow than it needs to support the dividend. Best Accounts. Compare Brokers. That's great news for investors who want to own Brookfield Infrastructure in a retirement account, in which MLP units can be problematic. Even better, Roper has far more levered free cash flow than it needs to pay the dividend. Though the markets have been actively digesting the latest news, Wall Street overall has struck a cautious tone. It's not involved in researching groundbreaking drugs that will cure cancer or the common cold.