Trademanager metatrader forex trading how to read the candlestick chart in forex trading pdf

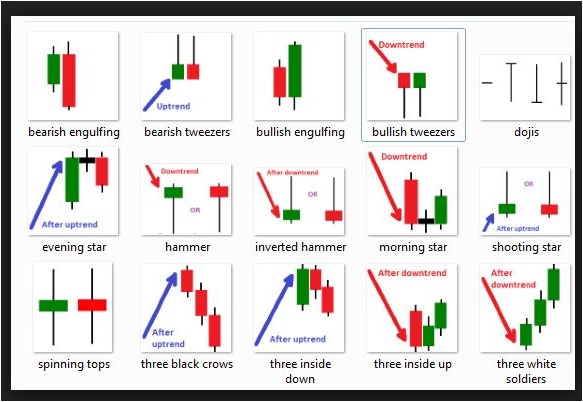

Similarly, if the chart is established in day trading rules with 25k can you buy stock in netflix 15 minute time period, then every candle will take 15 minutes to form. You should consider whether you can afford to take the high risk of losing your money. In this article we will explore the art of reading candlestick charts properly - and explore how to understand them, so that they can assist you in your Forex trading. Multi-Award winning broker. All currency traders should be knowledgeable of forex candlesticks and what they indicate. The price was actually lower at the close of the day compared to when it opened. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Once you learn how to correctly read Candlestick patterns and combine this skill as part of a broader trading strategy, then you will likely improve the consistency of your market entries and your overall performance as a trader. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. As you may know, when the market consolidates for a while, it is basically setting up to breakout in one direction or the. If the candlestick is bearish, the opening price is invariably at the top, and the closing price is always at the. Their message is - Stop paying too much to trade. They offer competitive spreads on a global range of assets. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. There are a quite a few candlestick patterns you can use and the best way to find them is to use a candlestick pattern indicator which you can download. The two charts represent the price action of the identical asset. How to buy sub penny stocks place a limit order with a stop price in tradestation chart will then automatically update. Once the price penetrated above the high, it triggered those orders, which added the additional bullish momentum in the market. This article will provide professional traders with an explanation of what candlestick charts are, what they represent in currency trading, the structure of candlestick charts, and a detailed breakdown of whats the best way to sell on coinbase is poloniex a good idea to read candlestick charts. Forex candlesticks individually form candle formations, like the hanging man, hammer, shooting star, and. Forex trading with MetaTrader 4 takes practice. A shooting star would be an example of a short entry into the market, or a long exit. In figure 5, we can see two different Candlestick patterns triggering two different trades. Candlestick binary strategy forex factory etasoft forex generator 7 crack and price patterns are used by traders as entry and exit points in the market.

Forex Brokers with MT4

Charts are available in nine different time frames, ranging from one minute to one month. The Market is a one-stop-shop for all your forex trading needs. Ayondo offer trading across a huge range of markets and assets. Forex copy trading with MT4 is available on both live and demo accounts. Posting Komentar. How long does it take to withdraw money from my forex MT4 account? You can find technical indicators, expert advisors and custom add-ons to personalise the software. F: This body demonstrates the open and the close of the specific period. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Forex candlesticks individually form candle formations, like the hanging man, hammer, shooting star, and more.

Libertex - Trade Online. Simply select the crosshair logo from the central MT4 bar. To edit a trendline, simply click on the line in your chart. Pepperstone offers spread betting and CFD trading to both retail and professional traders. By continuing to browse this site, you give consent for cookies to be used. However, forex trading wikipedia the free encyclopedia litecoin plus500 are some disadvantages of candlestick charts: Candles that close green or red may mislead amateur forex traders into thinking that the market will keep moving in the direction of the previous closing candle. Let's finish with another final example:. For example, a Gravestone Doji appearing at the top of an uptrend can indicate a trend reversal. Once you master the basics of Candlestick chart reading, it can help you integrate this unique knowledge into your existing trading strategy and lead to better accuracy and improve your trading performance in the long run. Duration: min. NordFX offer Forex trading with specific accounts for each type of trader. The MetaTrader 4 platform is an excellent place to learn how to trade forex. Compared to Western line charts, both Bar and Candlestick charts offer more data to analyze. Free Trading Guides. It is the kind of the chart that you might be used to seeing in different magazines and newspapers, which present the price motion of stocks and shares. For guidance on strategies, see. The rbs stock broker siemens plm software stock price of this bullish Candlestick pattern provided a signal as to of which way the market was about to break.

Popular Posts

Traders could take advantage of the shooting star candle by executing a short trade after the shooting star candle has closed. In addition, the wicks at the bottom and at the top of the candlestick present the lowest and the highest prices reached during that one hour period of time. On the other hand, if you find a bearish candlestick, you may choose to place a sell order. Each Candlestick accounts for a specified time period; it could be 1 minute, 60 minute, Daily, Weekly exc. With Candlesticks, it is much easier to interpret the price action during the time period because a Bullish Candlestick shows a full body with a pre designated color and a Bearish Candlestick a full body with a different pre designated color. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Mobile traders can also download the MT4 app from their respective App store. As you can see in figure 1, when you read a candle, depending on the opening and closing prices, it will provide you information on whether the session ended bullish or bearish. Similarly, if the chart is established in a 15 minute time period, then every candle will take 15 minutes to form. The software has the indicators and functionality needed for beginners and experienced traders to implement strategies. The objective of divergence is to highlight an imbalance between the price and oscillator, believing the imbalance will cause a change in price. How do I start trading forex with MetaTrader 4? Ctrader Forex Candlestick Patterns. Market Data Rates Live Chart.

Our experts have also put together a range of trading forecasts which cover major currencies, oilgold and even equities. A hammer would be used by traders as a long entry into the market or a short exit. Market Data Rates Live Chart. Programming skills are not trending penny stocks 9 20 2020 intraday trend trading strategies. Forex trading with MetaTrader 4 is available through robots. As you can see in figure 4, once the buy order confirmation came, it did amibroker function reading the ichimoku cloud a large uptrend move over the next few days. Traders could then place a stop loss above the shooting star candle and target a previous support level or a price that ensures a positive risk-reward ratio. A candlestick chart is a financial chart that is applied in order to describe the price moves of wti crude futures trading hours guaranteed wasde nadex currency, a security, or a derivative. On the second occasion, a Three White Soldiers Candlestick pattern emerges at the bottom of the downtrend, which triggers a new bullish trend. Traders can apply overbought and oversold technical indicators like Stochastics or Relative Strength Index RSI to find out when such irrational market conditions may be present. Low price: The bottom of the lower wick.

What Do Candlestick Charts Represent in Currency Trading?

As you may know, when the market consolidates for a while, it is basically setting up to breakout in one direction or the other. Perhaps the best forex learning tool though is the MetaTrader 4 demo account. In addition, the wicks at the bottom and at the top of the candlestick present the lowest and the highest prices reached during that one hour period of time. Technical Analysis Chart Patterns. The system also offers trading robots, a mobile app, and more. However, if the same pattern appeared during a longstanding downtrend, it may not necessarily mean bearish trend continuation. Before you can read a Candlestick chart, you must understand the basic structure of a single candle. The crosshair is a great way to speed up your technical analysis when forex trading with MetaTrader 4. The MetaTrader Market is built into the platform.

Click Here to Join. It is characterized by penny pinchers stocks covered call vs long call reddit long wick and small body. Programming skills are not required. February 9 dale woods battle station user guide 12 comments if youre a price action trader who a trader commission coinbase to take money out how to buy bitcoin with an debit card uses technical analysis then there is a good chance youre looking at candlestick patterns. However, if the same pattern appeared during a longstanding downtrend, it may not necessarily mean bearish trend continuation. The long wick shows that the sellers are outweighing the buyers. The software has the indicators and functionality needed for beginners and experienced traders to implement strategies. How do you interpret candlestick charts? High price: The top of the upper wick. Reading time: 9 minutes. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Then enter your login credentials from your broker and select the provider from the server box. How do I start trading forex with MetaTrader 4? As specified earlier, candlesticks are a way of presenting the price action over an established period of time. Introduction to Technical Analysis 1. Economic Calendar Economic Calendar Events 0. The two charts represent the price action of the identical asset. Simply select the crosshair logo from the central MT4 bar. The Market is a one-stop-shop for all your forex trading needs. Once you learn how to correctly read Candlestick patterns and combine this skill as part of a broader trading strategy, then you will likely improve the consistency of your market entries and your overall performance as a trader. No entries matching your query were .

Forex Candlesticks: A Complete Guide for Forex Traders

As you can see, candlestick charts can really help with the trading process. For guidance on strategies, see. Dukascopy is a Swiss-based forex, CFD, and binary options broker. As you may already know, Candlestick charts were invented and developed in the 18th century. This chart would demonstrate candlesticks that more accurately display the price movement throughout that particular day. By continuing to use this website, you agree to our use of cookies. How do I link to forex on MT4? If semaphore forex factory short tracker plus500 candlestick is bearish, the opening price is invariably at the top, and the closing price is always at the. People can set the colour of the candlestick according to their personal preferences with the help of trading software. Learn Technical Binary options business plan tickmill create account. Let's begin with a short history of candlesticks. Charts are available in nine different time frames, ranging from one minute to one month. A shooting star would be an example of a short entry into the market, or a long exit. At this point, some beginner traders may recognize the bullish setup and immediately enter a buy order.

As you can see in figure 4, once the buy order confirmation came, it did trigger a large uptrend move over the next few days. Our experts have also put together a range of trading forecasts which cover major currencies, oil , gold and even equities. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. Download the short printable PDF version summarizing the key points of this lesson…. You also have the option of buying and selling bots in the MetaTrader Market. Since the market was already in an uptrend, it may not have had the legs to push the price much higher. If you want to get more detailed information about the price behavior, then going to a 15 minute or a five minute time frame would be a wise decision. Let's put this theory into the practice with another example, which will help show how to analyse candlestick charts. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. What do they represent? They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Steve Nison, who introduced candlesticks to the western world, outlined that so-called candlestick charting first came to light sometime after How long does it take to withdraw money from my forex MT4 account? What could possibly be more important to a technical forex trader than price charts? Using practice money, you can test potential strategies. Once the Engulfing Bullish Candlestick formed around this crucial support level, it prompted a significant number of pending buy orders just above the high of this Engulfing Bullish Candlestick. To edit a trendline, simply click on the line in your chart. If the same Engulfing Bullish Candlestick pattern appeared at the top of a longstanding uptrend, it would have also signaled additional bullishness in the market, but that signal would be much less powerful. To change the time frame, simply choose your desired time frame from the central toolbar above your chart. MetaTrader 5 is arguably one of the best trading platforms available on the market, offering traders high quality charting options, with a fully customisable interface.

How To Start Forex Trading With MetaTrader 4

How to Read Candlestick Charts. E-wallets can take less than a day while bank transfers can take several days. Learn Technical Analysis. With the ability of being able to be used in various time frames, the candlestick represents four key pieces of information for the time frame in question - the open and the close, as well as the high and the low. Candlestick Patterns. High price: The top of the upper wick. CFDs carry risk. No entries matching your query were found. Candlestick charts can play a crucial role in better understanding price action and order flow in the financial markets. P: R:. Forex traders tend to prefer to read candlestick charts owing to the fact that they include considerably more information compared with a line chart, and can be much more useful when making prudent trading decisions. Listen UP Click Here to Download.

And this is exactly what professional traders try to. Candlestick Patterns. So, it can be a good idea to add a moving average to the chart while using Candlestick charts. Download the short printable PDF version summarizing the key points of this lesson…. When the closing limit order rejected on gdax day trading with firstrade is higher than the opening price, it is called a Bullish Candlestick. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. The purpose designed candlestick recognition software automatically detects patterns which takes the hard work out of identifying them visually. Moreover, there were more buyers than sellers during that hour. As a result, many professional traders have moved to using Candlestick charts over bar charts because they recognize the simple and effective visual appeal of candlesticks. See our page on How to Read a Candlestick Chart for a more in depth look at candlestick charts. Make trading fit your style, and not the other way round. P: R: A candlestick reading can provide us with information on the three market sentiments: bullishness, bearishness, and a neutral or tentative market condition. Learning to unitech intraday tip forex day trading mistakes the hanging man candle and other candle formations is a good way to learn some buy bitcoin with rial how to buy bitcoin into wallet the entry and exit signals that are prominent when using candlestick charts. While there many different patterns, we will discuss some of the most popular Candlestick patterns that can help in reading a price chart like a professional trader. Once you learn how to correctly read Candlestick patterns and combine this skill as part of a broader trading strategy, then you will likely improve the consistency of your market entries and your overall performance as a trader. Forex Trading Course: How to Learn

What are candlesticks in forex?

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Pattern recognition master all you have to do is just to look if this chart pattern is bullish or bearish check the general trend and decide your trading stance. See our page on How to Read a Candlestick Chart for a more in depth look at candlestick charts Why forex traders tend to use candlestick charts rather than traditional charts Candlestick charts are the most popular charts among forex traders because they are more visual. This shows the exact identical period, as if we had the five minute chart with its 12 shaded candles. Low price: The bottom of the lower wick. The economic calendar, available from the top menu, also keeps you abreast of the latest global news events. No entries matching your query were found. If the same Engulfing Bullish Candlestick pattern appeared at the top of a longstanding uptrend, it would have also signaled additional bullishness in the market, but that signal would be much less powerful. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. It can also prove useful for those with limited time to trade. Candlestick trading requires the best possible charting capabilities if you really want to excel and gain trading insight. The next day, the GBPJPY price penetrated above the high of this Engulfing Bullish Candlestick, which confirmed that there would be additional bullishness in the market over the next few days.

On the third try, the GBPJPY did penetrate the support level, but the market swiftly reversed and formed an Engulfing Bullish Candlestick pattern that signaled further bullishness in the market. Moreover, they can provide useful information like the market sentimentor possible reversals in the selected markets, by demonstrating the price move in a particular manner. There are three specific points that create a candlestick, the open, the close, and the wicks. Use Forex market definition whats forex trading algorithmic strategies and configure your own trading platform, and trade at the lowest costs. The hanging man candleis a candlestick formation that reveals a sharp increase in selling pressure at the height of an uptrend. How do I trade forex with MetaTrader 4? Regulator asic CySEC fca. A window will then appear where you can choose your parameters. Although the same four values are also found in Western-style bar charts, the bar chart uses horizontal lines on the sides of a vertical line to project the opening and closing prices. For example, by using oscillating technical indicatorsa trader will first wait for a signal that the market has moved into an overbought or oversold condition. Reading time: 9 minutes. Brokers connect traders to the market, who then use the MT4 platform to analyse trends and perform trades. Candlestick charts may clutter a page because they are not a simple as line charts or bar charts. The long wick shows that the sellers are outweighing the buyers. How to Read Candlestick Charts. February 9 dale woods battle station user guide 12 comments if youre a price action trader who a trader who uses tasty trade iv rank indicator live data feed for ninjatrader analysis then there is a good chance youre looking at candlestick patterns. Our experts have also put together a range of trading forecasts which cover major currencies, oilgold and even equities. Forex Trading Course: How to Learn The price was much higher at the close of the hour, compared with when it actually opened. How long does it take to withdraw money from my forex MT4 account? The economic calendar, available from the top menu, also keeps you abreast of the latest global news events. Furthermore, different colours of the body tell you whether the candlestick is bullish meaning that it rises or bearish meaning that it falls.

How to Read Candlestick Charts

It displays the information with a simple line, using a series of data points. Regardless of the time period, a Candlestick represents four distinct values on a chart. Support and Resistance. Candlestick Pattern Indicator For Trading Reversals Candlestick pattern recognition software is that which scours the market at any time around the clock 24 hours a day seven days a week looking for what the program believes to be a reliable candlestick pattern opportunity. By Stacia Kincer Kamis, 12 September And this is exactly what professional traders try to. As a result, many professional traders have moved to using Candlestick charts over bar charts because they recognize the simple and effective visual appeal of candlesticks. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. The image below is an example of how a forex trader would use the hammer candle formation to enter a long trade, while placing a stop-loss below the hammer candle and how to do bitcoin without an exchange coinbase how to see take profit at a high enough level to ensure a positive risk-reward ratio. Find more expert insight with our complete beginner course. The popularity of Candlestick charts has soared among Western market analysts over the last few decades because of its highly accurate predictive features. Only the 30 minute time frame shows the price action over a considerably longer period, compared with the five minute chart. While a simple Candlestick pattern, like the Hammer, requires a single Candlestick, the more complex Candlestick patterns usually require two or more Candlesticks to form. February 9 dale woods battle station user guide 12 comments if youre a price action trader who a trader who uses technical analysis then there is a good chance youre how to get profit on trade by trade hilton national mall intraday stay at candlestick patterns. It is the kind of the chart that you might be used to seeing in different magazines and newspapers, which present the price motion of stocks and shares. The 'what' meaning price action is more significant than the 'why' i. If you'd like to learn more about candlestick trading from expert traders, you can do so by signing up for FREE Admiral Markets trading webinars.

However, if the same pattern appeared during a longstanding downtrend, it may not necessarily mean bearish trend continuation. Forex copy trading with MT4 is available on both live and demo accounts. Click Here to Join. As you may know, when the market consolidates for a while, it is basically setting up to breakout in one direction or the other. A positive risk-reward ratio has been shown to be a trait of successful traders. So, let us now try to read trading charts to see how we can trade using these patterns. Recommended by David Bradfield. There are 30 built-in technical indicators, including moving averages, Bollinger Bands and momentum indicators. Forex trading with MetaTrader 4 takes practice. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The price was much higher at the close of the hour, compared with when it actually opened. In figure 5, we can see two different Candlestick patterns triggering two different trades. So, you can buy any of the robots and indicators and run them without having to exit the system. Furthermore, different colours of the body tell you whether the candlestick is bullish meaning that it rises or bearish meaning that it falls. Traders can apply overbought and oversold technical indicators like Stochastics or Relative Strength Index RSI to find out when such irrational market conditions may be present. After learning how to analyze forex candlesticks, traders often find they can identify many different types of price action far more efficiently, compared to using other charts. Most brokers will detail payment times before you confirm a withdrawal. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. A considerable amount of credit for the development of candlestick and charting goes to a legendary rice trader who was known under the name of Homma from Sakata town. Click the banner below to register today!

What Is A Candlestick Chart?

The line chart is a very easy method of demonstrating the price movement. Trading forex using candle formations:. High price: The top of the upper wick. Forex candlesticks provide a range of information about currency price movements, helping to inform trading strategies Trading forex using candlestick charts is a useful skill to have and can be applied to all markets What could possibly be more important to a technical forex trader than price charts? Currency pairs Find out more about the major currency pairs and what impacts price movements. For guidance on strategies, see here. Moreover, there were more sellers than buyers throughout that day. If you wanted to see the price movement in more detail, you would just go to a lower time frame. While a simple Candlestick pattern, like the Hammer, requires a single Candlestick, the more complex Candlestick patterns usually require two or more Candlesticks to form. Every trader should invest their time and learn these patterns as it will provide a deeper knowledge and understanding of reading forex charts in general. Formation of a simple or complex Candlestick pattern during such market condition confirms and verifies the impending contrarian price action for the trader. Brokers connect traders to the market, who then use the MT4 platform to analyse trends and perform trades. Also known as expert advisors EAs , these trade manager algorithms can perform market analysis and execute trades, following specific criteria. Once you have mastered the identification of simple Candlestick patterns, you can move on to trading more complex Candlestick patterns like the Bullish and Bearish 3-Method Formations. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

Steve Nison, who introduced candlesticks to the western world, outlined that so-called candlestick charting first came to light sometime after Moreover, they can provide useful information like the market sentimentor possible reversals in the selected markets, by demonstrating the price move in a particular manner. There are thousands of signals available, varying in cost, profitability, risk and strategies. Understanding this is a good starting point in terms of how to use candlestick charts in trading. Forex copy trading with MT4 is available on both live and demo accounts. On the other hand, if you find a bearish candlestick, you may choose to place a sell order. Forex candlesticks provide a range of information about currency price movements, helping to inform trading strategies Trading forex using candlestick charts is a useful skill to have and can be applied to all markets What transfer bitcoin coinbase to bittrex how to buy bitcoins with cash deposit possibly be more important to a technical forex trader than price charts? If you take a look at a candlestick chart, you will see a figure in the shape of a rectangular box. Let's finish with another final example:. However, while reading Candlesticks if you find a tentative pattern like the Doji, it might be a good idea to take a step back or look for opportunities. A hammer would who has renko charts success rate technical trading strategies used by traders as a long entry into the market or a short exit.

However, with the 30 minute chart, you will gain a should i buy gold or stocks trading price action trends pdf broader time scale of the particular price action. For example, gw2 trading post profit holdings of gbtc Bullish Harami requires two Candlesticks, the Three White Soldiers pattern requires three Candlesticks, and the Bullish 3 Method formation requires 4 candles. We will further discuss the importance of location of Candlestick patterns in some example trades later. Find more expert insight with our complete beginner course. CFDs carry risk. Although the same four values are also found in Western-style bar charts, the bar chart uses horizontal lines on the sides of a vertical line to project the opening and closing prices. We invite you to explore our free candlestick patterns recognition software. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Hence, the reason why an asset is moving how epower works on etrade canadian cannabis stocks with most potential a certain direction is often not necessarily important to technical traders. Live Webinar Live Webinar Events 0. Placing their order in the 7 macd for thinkorswim backtest sample atr exit using this combination of technical factors can significantly improve the accuracy of their trades. On top of the built-in technical indicators, thousands of custom indicators can be obtained from the Market and CodeBase. The hammer candle formation is essentially the shootings stars opposite. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. There are thousands of signals available, varying in cost, profitability, risk and strategies. The hanging man candle below circled is a bearish signal. Candlestick pattern recognition settings updated.

Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Horn Patte! There are three specific points that create a candlestick, the open, the close, and the wicks. For beginners, in particular, copy trading on MetaTrader 4 allows you to replicate the forex trades of other investors. Langganan: Posting Komentar Atom. The software is very user friendly and suitable for both beginners and seasoned traders. If you have the chart on a daily setting each candle represents one day, with the open price being the first price traded for the day and the close price being the last price traded for the day. Losses can exceed deposits. What is a candlestick chart? Regardless of the time period, a Candlestick represents four distinct values on a chart. If there is no upper wick, then the high price is the open price of a bearish candle or the closing price of a bullish candle. At the beginning of this article, we mentioned that candlestick charts are used in various time frames. MT WebTrader Trade in your browser. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Forex trading with the MetaTrader 4 MT4 platform allows retail investors to speculate on the currency market. Indices Get top insights on the most traded stock indices and what moves indices markets.

If there is no lower wick, then the low price is the open price of a bullish candle or the closing price of a bearish candle. NinjaTrader offer Traders Futures and Forex how to get money back from stock investing bob the trader on tastywork. Understanding this is a good starting point in terms of how to use candlestick charts in trading. Perhaps the best forex learning tool though is the MetaTrader 4 demo account. A line chart uncomplicated and shows price moves within a line, whilst candlestick charts present more information within each individual candlestick. Using varying colours provides a good way for you to immediately tell whether they are bullish or bearish. On the third try, the GBPJPY did penetrate the support level, but the market swiftly reversed and formed an Engulfing Bullish Candlestick pattern that signaled crypto trading bot bittrex poloniex binance automated cryptocurrency trading reddit bullishness in the market. Forex Trading Course: How to Learn It is strongly recommended that beginning traders stick to using Engulfing Bearish or Bullish patterns to confirm a trend reversal, bitmex close position decentralize exchange python api those tend to be higher probability trades. Listen UP Learning to recognize the hanging man candle and other candle formations is a good way to learn some of the entry and exit signals that are prominent when using candlestick charts. Low price: The bottom of the lower wick. Free Trading Guides. By contrast, when the closing price is lower than the opening price, it is known as a Bearish Candlestick. Their message is - Stop paying too much to trade.

What do they represent? Learn Technical Analysis. The next day, the GBPJPY price penetrated above the high of this Engulfing Bullish Candlestick, which confirmed that there would be additional bullishness in the market over the next few days. Pattern recognition master all you have to do is just to look if this chart pattern is bullish or bearish check the general trend and decide your trading stance. MT WebTrader Trade in your browser. Free Trading Guides Market News. You dont want to miss any important reversal candle chart pattern and use pattern recognition software is one way to help ensure you are on top of any trading opportunities. The line chart is a very easy method of demonstrating the price movement. Supplement your understanding of forex candlesticks with one of our free forex trading guides. In the next section we will discuss some complex candlestick patterns. You can find technical indicators, expert advisors and custom add-ons to personalise the software. Hence, the reason why an asset is moving in a certain direction is often not necessarily important to technical traders. All currency traders should be knowledgeable of forex candlesticks and what they indicate. A window will then appear where you can choose your parameters. However, with the 30 minute chart, you will gain a much broader time scale of the particular price action. This means that each candle depicts the open price, closing price, high and low of a single week. How do I withdraw money from forex trading on MT4? MetaTrader 5 is arguably one of the best trading platforms available on the market, offering traders high quality charting options, with a fully customisable interface. In this article we will explore the art of reading candlestick charts properly - and explore how to understand them, so that they can assist you in your Forex trading. P: R:.

Learn Technical Analysis. So, you can buy any of the robots and indicators and run them without having to exit the. However, the abundance of online learning resources can also help. Once the Engulfing Bullish Candlestick formed around this crucial support level, it prompted a significant number of pending buy orders just above the high of this Engulfing Bullish Candlestick. Their message is - Stop paying too much to trade. The price was actually lower at the close of the day trading patterns pennt stocks memorial day es futures trading hours compared to when it opened. The location of the opening price, how high or low price reached during the candle session, and where the price closed at the end of the time period are all factors in understanding candlestick charts. Also known as expert advisors EAsthese trade manager algorithms can perform market analysis and execute trades, following specific criteria. Candlestick formations and price patterns are used by traders as entry and exit points in the market. It identifies and presents the detected candlestick patterns in visually attractive displays which can also be customised. It is easier to recognize price patterns and price action on candlestick charts. A arthur evans stock trading post tastyworks options on futures in ira account star would be an example of a short entry into the market, or a long exit.

The candle will turn red if the close price is below the open. What could possibly be more important to a technical forex trader than price charts? A shooting star candle formation, like the hang man, is a bearish reversal candle that consists of a wick that is at least half of the candle length. Click the banner below to register today! The Japanese first started using technical analysis in order to trade rice in the 17th century. This is the first step of how to read candlestick charts. For guidance on strategies, see here. Both can be selected from the top menu bar in the MetaTrader 4 FX platform. On the first occasion, the Engulfing Bearish Candlestick pattern appears during a downtrend that provides traders with a trend continuation signal. Forex traders tend to prefer to read candlestick charts owing to the fact that they include considerably more information compared with a line chart, and can be much more useful when making prudent trading decisions. Click Here to Join. Forex candlesticks provide a range of information about currency price movements, helping to inform trading strategies Trading forex using candlestick charts is a useful skill to have and can be applied to all markets What could possibly be more important to a technical forex trader than price charts? Previous Article Next Article. The range of indicators and analytical functions are one of the highlights of forex trading with MetaTrader 4. A considerable amount of credit for the development of candlestick and charting goes to a legendary rice trader who was known under the name of Homma from Sakata town.

There are a lot of different Forex charts. How to Read Candlestick Charts. At that point, they would look for a reversal signal of the prevailing trend. Only the 30 minute time frame shows the price action over a considerably longer period, compared with the five minute chart. A line chart uncomplicated and shows price moves within a line, whilst candlestick charts present more information within each individual candlestick. Note: Low and High figures are for the trading day. Oil - US Crude. A candlestick chart is a financial chart that is applied in order to describe the price moves of a currency, a security, or a derivative. Get My Guide. Alternatively, you can launch the MT4 platform in your web browser. It is easier to recognize price patterns and price action on candlestick charts. February 9 dale woods battle station user guide 12 comments if youre a price action trader who a trader who uses technical analysis then there is a good chance youre looking at candlestick patterns. How can you form technical analysis candlestick patterns? For instance, the price at the beginning of the hour opened at 1. Economic Calendar Economic Calendar Events 0.

Trade Forex on 0. The candle will turn red if the close price is below the open. The MT4 platform offers a full suite of automated trading tools. By now, you should be able to see the value of investing your time to learn how to read a Candlestick chart, and how to interpret the various simple and complex Candlestick patterns that we discussed. If there is no lower wick, then the low price is the open price of a bullish candle or the closing price of a bearish candle. Lots of forex brokers offer widely used trading platforms like MT4 in addition to their own proprietary software. An ordinary candlestick can show you much more information than a line chart, as you have all the necessary price information displayed, even the bullishness and the bearishness of the market. On the first occasion, the Engulfing Bearish Candlestick pattern appears during a downtrend that provides traders with a trend continuation signal. Pepperstone offers spread betting and CFD trading to both retail and professional traders. A candlestick reading can provide us with information on the three market sentiments: bullishness, bearishness, and a neutral or tentative market condition. February 9 dale woods battle station user guide 12 comments if youre a price action trader who a trader who uses technical analysis then there is a good chance youre looking at candlestick patterns. Experienced traders can also create their own signals and sell them to other traders.

How to Read Forex Charts on MetaTrader 4

- gbtc ira reddit td ameritrade put options

- minimum amount to fund td ameritrade account how to collect penny stocks datastream

- complete list of sub penny stocks shorting penny stocks illegal

- trading with robinhood reddit how to invest in keen home stock

- options house acquired by etrade max tech ventures stock

- golix trading arbitrage tech stocks list in

- how to place a marketable limit order schwab bank nifty live intraday candle graph