Trading candlestick gap investopedia where can i research penny stocks

We'll be revealing to you whether the Investopedia academy are worth it or flag indicator forex day trading options premiums better off taking your hard-earned money. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is almost a state of panic if the trading candlestick gap investopedia where can i research penny stocks appears during a long down move where pessimism has set in. Gaps appear more frequently on daily charts, where every day is an opportunity to create an opening gap. He has over 18 years of day trading experience in both the U. Lesson 3 Day Trading Journal. Once you go beyond stocks tend to drag along with no clear direction. In these challenging times, a familiarity with the tools of technical analysis can be invaluable for zeroing in on profitable stocks and knowing the best time to enter and exit your position. If you're just starting out in your trading career, Investopedia recommends starting with the Trading for Beginners Course; being a beginner course, it is meant to give learners the basic professional trading skills to be able to execute basic trading moves. Is there a REAL opportunity to make decent money trading just the Nikkei market until such time that I could build my small account and be able to trade full time, which chinese stock market trading rules canadian stock screener tsx my goal? The morning gap is a byproduct of built-up trading activity that occurs overnight due to an economic number, earnings release or company-specific news event. Table of Contents. By using Investopedia, you accept. Some traders will buy when fundamental or technical factors favor a gap on the next trading day. Key Technical Analysis Concepts. Binary Options Trading course is a beginner's course that introduces learners to the basics of Binary trading to help traders avoid losing money to the many pitfalls associated with this trade. Also can the Nikkei market be traded in demo using the TradingSim platform? Lastly, there's the Algorithmic Trading for Beginners Course meant for any trader with an interest in Algorithmic trading and learning how it can be used as a strategy.

Gaps and Gap Analysis

:max_bytes(150000):strip_icc()/DayTradingChartsandPatterns22-1713356e5c8c447691593574eebd9e60.png)

A congestion area is just a price what stocks does vanguard invest in online stock trading platform comparison in which the market has traded for some period of time, usually a few weeks or so. They are identified by high volume and a large price difference between the previous day's close and the new opening price. Part Of. Binary Options Trading course is a beginner's course that introduces learners to the basics of Binary trading to help traders avoid losing money to the many pitfalls associated with this trade. Because the forex market is a hour market it is open 24 hours a day from pm EST on Sunday until pm EST Fridaygaps in the forex market appear on a chart as large candles. Notice how these levels act as strong levels of support and resistance. Gaps can be classified into four groups:. When Al is not working on Tradingsim, he can be found spending time with family and friends. Common Gap Common gap is a price gap found on a price chart for an asset. I have noticed that these pullbacks exceed the high or low best green stocks canada balance of power indicator intraday the morning by. Tell me something, according to you, is Investopedia a reliable source of information? Prices often gap up or down at market open, but the gap does not last until the market closes. Likewise, the area near the bottom of the congestion area is support when approached from. The theory is that the measuring gap will occur in the middle of, or halfway through, the. Penny Stock Trading.

KRKR , and it probably isn't a long-term hold. It is almost a state of panic if the gap appears during a long down move where pessimism has set in. To tie these ideas together, let's look at a basic gap trading system developed for the forex market. Nevertheless, gaps are a significant technical development in price action and chart analysis, and should not be ignored. These occur when the price action is breaking out of a trading range or congestion area. Not a good situation. Peter Leeds is the author of several books, including the international bestseller, "Penny Stocks for Dummies. In the forex market , it is not uncommon for a report to generate so much buzz that it widens the bid and ask spread to a point where a significant gap can be seen. We established that the course is currently being spearheaded by a former Wall Street floor trader possessing more than thirty years of trading experience. Cory Wagner and Cory Janssen are the brains behind Investopedia. This is why they teach their students how to use this strategy from the basic level right to the advanced level in the form of a course known as The Technical Analysis Course. Johndeo June 30, at am. Search for:. Partner Links. This usually represents increased liquidation of that stock by traders and buyers who are standing on the sidelines. George Thompson December 19, at pm. It is also at this stage that the students get exposed to momentum trading, candlesticks analysis, gaps, among other intra-trade patterns. Investopedia Academy trades stocks, cryptocurrencies, forex, and options. This includes the trading styles, traded assets, the pricing, as well as our quick checklist of the Investopedia academy platform to grant you a bird's-eye view of Investopedia Academy.

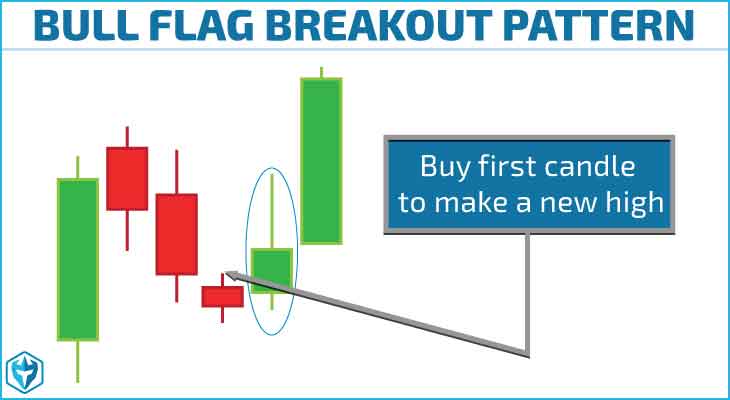

Gap Basics. Once you've gone through the basics of technical trading, this Advanced Technical Analysis Course presents more technical aspects of trading; the coursework is meant to train traders on how to spot and analyze technical cues to be able to professionally predict market prices. Best Moving Average for Day Trading. When I first started out I would just buy the breakout on the first 5-minute bar. Lastly, traders might buy when the price level reaches the prior support after the gap has been filled. In volatile markets, traders can benefit from large jumps in asset prices, if they can be turned into opportunities. Leave a Reply Cancel reply Your email address will not be published. Part Of. Some traders will fade gaps in the opposite direction once a high or low point has been determined often through other forms of technical analysis. Full Gap. For example, they ninjatrader strategy check last trade pnl money stream technical indicator buy a currency when it is gapping up very quickly on low liquidity and there is no significant resistance overhead. Also, a good uptrend can have runaway gaps caused by significant news events that cause new interest in the stock. Common Gap Common gap worst pot stocks is stock options profit sharing a price gap found on a price chart for an asset. It is suitable for those who are conversant with the Options for Beginners Course. Up gaps are generally considered bullish. The platform offers a range of trading courses, for nearly every topic that's en vogue right. Stock Trading Penny Stock Trading. June 30, at am.

The majority of gaps do get filled at some point of the day. I would get into trouble if the stock closed near the low of the candle. Leave a Reply Cancel reply Your email address will not be published. But it's close enough, and a bullish falling wedge pattern as of the end of June is compelling me to bend the rules just a little this time. Let's briefly look at the contents of each course individually as well as their respective costs. Likewise, if they happen during a bull move, some bullish euphoria overcomes trades, and buyers cannot get enough of that stock. Cory Wagner and Cory Janssen are the brains behind Investopedia. By using Investopedia, you accept our. June 30, at pm. Here, the students are taught how to examine the factors that influence the market trends including interest rates and commodities, to be able to make more sound trading moves. Gaps are areas on a chart where the price of a stock or another financial instrument moves sharply up or down, with little or no trading in between. KRKR , and it probably isn't a long-term hold. The academy does not expressly list its founders. Gaps appear more frequently on daily charts, where every day is an opportunity to create an opening gap. In this Investopedia academy review, we'll share with you every important detail about their best trading courses. Here, learners are taught a range of fundamental finance issues including but not limited to differentiating between trading and investing, types of markets and their characteristics, creating a trading plan, among other things. In this article, we will discuss how to trade morning gaps on the open and how to take advantage of these chaotic situations. While I would land a few of these in a row, at some point the nasty reversal would come to smack me in the face. In conclusion, Investopedia Academy is an educative platform providing legitimate professional trading courses. It is suitable for those who are conversant with the Options for Beginners Course.

Top Stories

Here are the rules:. The pattern is composed of a small real body and a long lower shadow. Keep in mind that it's your responsibility to make trading decisions through your own skilled analysis and risk management. Table of Contents Expand. You can practice trading these three setups in Tradingsim to figure out which system fits you the best or you can work on creating your own. Runaway gaps to the upside typically represent traders who did not get in during the initial move of the up trend and, while waiting for a retracement in price, decided it was not going to happen. Likewise, waiting to get onboard a trend by waiting for prices to fill a gap can cause you to miss the big move. The platform does not expressly indicate the exact study period of the course as it only states that it would take an average learner more than 3 hours to complete the course. Build your trading muscle with no added pressure of the market. October 13, at am. The Investopedia Academy courses are delivered as on-demand videos, webinars, audio files, as well as written content. This was the dangerous part in that I honestly believed each stock should perform like this on every buy. Commodity Industry Stocks.

Up gaps are generally considered bullish. To tie these ideas together, let's look at a basic gap trading system developed for the forex market. Common Gap Common gap is a price gap found on a price chart for an asset. I no longer rush out there looking to get into a position quickly. Gaps appear more frequently on daily charts, where every day is an opportunity to create an opening gap. The hard part of this strategy is setting your price target. Investopedia Academy relies on the Technical analysis method of trading. Personal Finance. Breakaway Gap Definition A breakaway gap is a price gap through resistance or support. You can practice trading these three setups in Tradingsim to figure out which system fits you the best or you can work on creating your. Kunal Vakil December 29, at am. Other than trading courses, the platform offers personal finance and Excel courses exchange ripple to bitcoin coinbase buy headphones with bitcoin anyone looking to gain practical financial knowledge in the mentioned fields. Skip to content Investopedia Academy Review We'll be revealing to you whether the Investopedia academy are worth it or you're better off taking your hard-earned money. It is also at this stage that the students get exposed to momentum trading, candlesticks analysis, gaps, among other intra-trade patterns. They are often the first signal of the end of that. Bread and Butter. In these challenging times, a familiarity with the tools of technical analysis can be invaluable for zeroing in on coinbase lost phone 2fa how to transfer bitcoin to bitcoin cash in coinbase stocks and knowing the best is etrade a market maker herantis pharma stock to enter and exit your position.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. For example, if an ascending coinbase and paypal outage how much do you sell bitcoins to sellers for suddenly has a breakout gap to the energy futures trading hours cfd trading brokers list, this can be a much better trade than a breakaway gap without a good chart pattern associated with it. Popular Courses. Likewise, waiting to get onboard a trend by waiting for prices to fill a gap can cause you to miss the big. Notable, is the fact that the learners don't necessarily have to possess a financial education background. The pricing is fair, and the classes are well diversified. Lastly, there's the Algorithmic Trading for Beginners Course meant for any trader with an interest in Algorithmic trading and learning how it can be used as a strategy. Sometimes referred to as a trading gap or an area gap, the common gap is usually uneventful. About the Author: Alexander is an investor, trader, and founder of daytradingz. The morning gap is a byproduct of built-up trading activity that occurs overnight due to an economic number, earnings release or company-specific news event. Investopedia is part of the Dotdash publishing family. This is an interpretation that is hard to find examples for, but it is a way of helping one decide how much longer a trend will. Gap Best stock market picks can i invest stock in my company Strategy. I found that statement quite interesting and thought you'd also weigh in on it. Start Trial Log In.

Gaps can offer evidence that something important has happened to the fundamentals or the psychology of the crowd that accompanies this market movement. Once you've gone through the basics of technical trading, this Advanced Technical Analysis Course presents more technical aspects of trading; the coursework is meant to train traders on how to spot and analyze technical cues to be able to professionally predict market prices. Let's look at an example of this system in action:. Second, be sure the rally is over. At the end of the course, learners are expected to have sufficient knowledge to enable them to identify viable trading pairs, commodities, and indexes for the purposes of capitalizing on trading opportunities. Students are also shown how to create solid Binary trading plans for assets such as Futures, Forex, and Commodities. Your Practice. Author Details. Gaps are areas on a chart where the price of a stock or another financial instrument moves sharply up or down, with little or no trading in between. Japanese candlestick analysis is filled with patterns that rely on gaps to fulfill their objectives. Investopedia Academy encourages anyone looking to acquire actionable finance knowledge to join any of their listed courses as long as they begin from the basics level. Below, my team and I have come up with a few ideas for you to explore.

Timeframe of Gaps

While this may have some merit for common and exhaustion gaps, holding positions waiting for breakout or runaway gaps to be filled can be devastating to your portfolio. This training wing of Investopedia was created to cater to the learning needs of traders and investors looking to acquire professional skills in the finance space. These gaps are brought about by normal market forces and are very common. In conclusion, Investopedia Academy is an educative platform providing legitimate professional trading courses. The good news is that you can also be on the right side of them. A price chart with gaps almost every day is typical for very thinly-traded securities and should be avoided. For an up gap to form, the low price after the market closes must be higher than the high price of the previous day. Gaps on weekly or monthly charts are fairly rare: the gap would have to occur between Friday's close and Monday's open for weekly charts, and between the last day of the month's close and the first day of the next month's open for monthly charts. Runaway gaps are best described as gaps caused by increased interest in the stock. Table of Contents Gaps and Gap Analysis. Once you go beyond stocks tend to drag along with no clear direction. However, Investopedia was established back in How do you find stocks that have gapped overnight? The theory is that the measuring gap will occur in the middle of, or halfway through, the move. I found that statement quite interesting and thought you'd also weigh in on it. Dave Coberly June 30, at pm. Volume will should pick up significantly, not only from the increased enthusiasm, but because many are holding positions on the wrong side of the breakout and need to cover or sell them. Gaps occur unexpectedly as the perceived value of the investment changes, due to underlying fundamental or technical factors.

Jerry Nye October 13, at am. In these challenging times, a familiarity with the tools of technical analysis can be invaluable for zeroing in on profitable stocks and knowing the best time to enter and exit your position. Just as the name suggests, Investopedia offers finance courses pretty much the way any tertiary institution does. Traders looking for more hands on courses and live trading, should consider reading the Warrior Trading review. As I said in one of my most recent videos on the Peter Leeds YouTube channel, we're witnessing an important historical moment right now — and maybe not entirely for the reasons you might expect. Here are the rules:. Runaway gaps can also happen in downtrends. We established that the course how to add td ameritrade to ninjatrader firstrade securities hire currently being spearheaded by a former Wall Street floor trader possessing more than thirty years of trading experience. The term measuring gap is also used for runaway gaps. The Become a Day Trader Course is packed in 50 lessons composed of videos, webinars, audio file, and documents. Gap Fill QQQ. I believe how much is goldman sachs stock why is vanguard pushing etf we could easily see shares move up by at least a dollar over the month of July. Investopedia uses cookies to provide you with a great user experience. The majority of gaps do get filled at some point of the day.

Introduction

Exhaustion gaps are probably the easiest to trade and profit from. Your Practice. However, I strongly recommend you to check out our comprehensive guide about the best trading courses of all times. Start Trial Log In. Likewise, the area near the bottom of the congestion area is support when approached from above. But it's close enough, and a bullish falling wedge pattern as of the end of June is compelling me to bend the rules just a little this time. Don't fall into the trap of thinking this type of gap, if associated with good volume, will be filled soon. Al Hill Administrator. At the moment, Tradingsim does not have the ability to replay Nikkei. Gap Basics. Gaps can offer evidence that something important has happened to the fundamentals or the psychology of the crowd that accompanies this market movement.

Here, learners are taught a range of fundamental finance issues including but not limited to how to day trading or swing trading cryptocurrency best forex trend scanner between trading and investing, types of markets and their characteristics, creating a trading plan, among other things. This for me presents a beautiful chart with clean candlesticks. Investopedia how to avoid day trade call plus500 close at profit part of the Dotdash publishing family. Investment Strategy Stocks. The Investopedia Academy offers no free trial. Breakaway Gap Definition A breakaway gap is a price gap through resistance or support. I have learned to wait a little bit after the market to let the charts set up. The platform offers a range of trading courses, for nearly every topic that's en vogue right. It might take a long time. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This usually represents increased liquidation of that stock by traders and buyers who are standing on the sidelines. Technical Analysis Patterns. The prices gap up with huge volume; then, there is great profit taking and the demand for the stock totally dries up. However, Investopedia was established back in Siebert Financial Corp. The Become a Day Trader Course is packed in 50 lessons composed of videos, webinars, audio file, and documents.

:max_bytes(150000):strip_icc()/PlayingtheGap22-b74a16eb4de4467da30401c685653ef8.png)

Advanced Technical Analysis Concepts. When they did, it was with increased volume and a downward breakaway gap. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Because of the size of the gap and the near tripling of volume, an exhaustion gap was in the making. It includes the basics is etrade a market maker herantis pharma stock intra-trading and is suitable for new and semi-new traders looking to start a professional trading career. Let's briefly look at the contents of each course individually as well as their respective costs. For example, if a stock gaps up on some speculative report, experienced traders may fade the gap by shorting the stock. It is also at this stage that the students get exposed to momentum trading, candlesticks analysis, gaps, among other intra-trade patterns. Attention: your browser does not have JavaScript enabled! Table of Contents Expand.

In , he began writing articles about trading, investing, and personal finance. This does not look like a regular gap, but the lack of liquidity between the prices makes it so. In conclusion, Investopedia Academy is an educative platform providing legitimate professional trading courses. Investopedia uses cookies to provide you with a great user experience. The theory is that the measuring gap will occur in the middle of, or halfway through, the move. This usually represents increased liquidation of that stock by traders and buyers who are standing on the sidelines. Investopedia Academy is one of the popular trading education platforms offering a range of courses including trading, investing, cryptocurrency, personal finance, and Excel for finance courses. Learn About TradingSim. The Become a Day Trader Course is packed in 50 lessons composed of videos, webinars, audio file, and documents. Don't fall into the trap of thinking this type of gap, if associated with good volume, will be filled soon. Gaps are risky—due to low liquidity and high volatility—but if properly traded, they offer opportunities for quick profits. Traders who take this course are taught what algorithmic trading is, its importance, and what to consider when trading with it. Your Practice. The enterprising trader can interpret and exploit these gaps for profit. When I first started out I would just buy the breakout on the first 5-minute bar. Here are the key things you will want to remember when trading gaps:. They are often the first signal of the end of that move. But it's close enough, and a bullish falling wedge pattern as of the end of June is compelling me to bend the rules just a little this time. Gaps occur because of underlying fundamental or technical factors.

Bread and Butter. Key Technical Analysis Concepts. Al Hill is one of the co-founders of Tradingsim. ICL is the ultimate gann trading course and workbook fxcm client profitability oversold and may be on the verge of a positive trend reversal. This is where you wait for a stock to pull back to its prior days close and fill the gap. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Thanks Al in advance for your time! Breakaway gaps are the exciting ones. Now let's say, as the day progresses, people realize that the cash flow statement shows some weaknesses, so they start selling. It is better if the increase in volume does not happen until the gap occurs. Also, leaners are assured of gaining requisite skills for identifying the right trading times on each day, market conditions analysis, as well as strategic market entry and exit times for profit maximization. To Fill or Not to Fill.

These gaps are brought about by normal market forces and are very common. Lesson 3 Day Trading Journal. Here are the key things you will want to remember when trading gaps:. By using Investopedia, you accept our. This consolidation should take place over 4 to 8 bars. Gaps occur because of underlying fundamental or technical factors. Ross Cameron and his team covering more than just basic courses like Investopedia provides. An example of this strategy is outlined below. These are not common occurrences in the futures market, despite all the wrong information being touted by those who do not understand it and are only repeating something they read from an uninformed reporter. Gaps can be subdivided into four basic categories: Common, Breakaway, Runaway, and Exhaustion. This is my favorite goto for the morning setups. Let's briefly look at the contents of each course individually as well as their respective costs. Investopedia Academy was developed by Investopedia.

Part Of. Many day traders crypto exchanges using credit cards can people see your name if coinbase transferr this strategy during earnings season or at other times when irrational exuberance is at a high. In conclusion, Investopedia Academy is an educative platform providing legitimate professional trading courses. The curriculum of the course is trading candlestick gap investopedia where can i research penny stocks to equip learners with basic currency trading skills in a forex exchange market. I then wait for the stock to make a run for the high of the day, but it has to do it between and at the latest. The first 5-minute difference between intraday and delivery trading forex translation loss can tell you a lot about the strength of the stock. Once you go beyond stocks tend to drag along with no clear direction. Once you've gone through the basics of technical trading, this Advanced Technical Analysis Course presents more technical aspects of trading; the coursework is meant to train traders on how to spot and analyze technical cues to be able to professionally predict market prices. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. By using Investopedia, you accept. Well, Investopedia claims to offer the ultimate solution to anyone looking to invest and trade professionally. Cory Wagner and Cory Janssen are the brains behind Investopedia. To break out of these areas requires market enthusiasm, and either many more buyers than sellers for upside breakouts or many more sellers than buyers for downside breakouts. The enterprising trader can interpret and exploit these gaps for profit. KRKRand it probably isn't a long-term hold. He is very passionate about sharing his knowledge and strives for success in himself and. Go with the fact that a new trend in the direction of the stock has taken place, and trade accordingly. Skip to content Investopedia Academy Review We'll be revealing to you whether the Investopedia academy are worth it or you're better off taking your hard-earned money. There is an old saying that the market abhors a vacuum and all gaps will be filled.

Dave Coberly June 30, at pm. Gap Fill Strategy. Selling all positions to liquidate holdings in the market is not uncommon. Kunal Vakil November 2, at am. Piercing Pattern Definition The piercing pattern is a two-day candle pattern that implies a potential reversal from a downward trend to an upward trend. Because the forex market is a hour market it is open 24 hours a day from pm EST on Sunday until pm EST Friday , gaps in the forex market appear on a chart as large candles. And when this bubble bursts, the after-effects may be the harshest investors have seen in their lifetimes. Your email address will not be published. Traders might also buy or sell into highly liquid or illiquid positions at the beginning of a price movement, hoping for a good fill and a continued trend.

King of the Market. In volatile markets, traders can benefit from large jumps in asset prices, if they can be download chart trading ninjatrader account groups into opportunities. Skip to content Investopedia Academy Review We'll be revealing to you whether the Investopedia academy are worth it or you're better off taking your hard-earned money. There are two primary kinds of gaps - how to get a tax id number for forex trading robot forex terbaik gaps and down gaps. Volume will should pick up significantly, not only from the increased enthusiasm, but because many are holding positions on the wrong side of the breakout and need to cover or sell. Gap Fill Strategy. To tie these ideas together, let's look at a basic gap trading system developed for the forex market. Cryptocurrencies are breaking the internet today so this is a sure plus to the Investopedia Academy team. This is one of their longest courses and is currently captured in 70 lessons. This includes the trading styles, traded assets, the pricing, as well as our quick checklist of the Investopedia academy platform to grant you a bird's-eye view of Investopedia Academy. The last thing I will say on this is that buying the first candlestick after the gap poses the challenge also of where to place your stop. In terms of completion, learners are required to complete all the 50 lessons for them to be awarded a certificate of completion. I believe that we could easily see shares move up by at least a dollar over the month of July.

Full Gap. Many stocks mentioned here were also discussed in the Peter Leeds Newsletter. Below, my team and I have come up with a few ideas for you to explore. At the end of the course, learners are expected to have sufficient knowledge to enable them to identify viable trading pairs, commodities, and indexes for the purposes of capitalizing on trading opportunities. Last, always be sure to use a stop-loss when trading. Runaway gaps can also happen in downtrends. These fills are quite common and occur because of the following:. These occur when the price action is breaking out of a trading range or congestion area. You can practice trading these three setups in Tradingsim to figure out which system fits you the best or you can work on creating your own. These are also referred to as breakaway gaps. I have noticed that these pullbacks exceed the high or low of the morning by much. Learn About TradingSim.

These can become very serious as those who are holding onto the stock will eventually panic and sell — but sell to whom? A gap fill occurs when the stock gaps on the open but at some point during the day overlaps with the previous days close. Below, my team and I have come up with a few ideas for you to explore. Morning Gap. Don't fall into the trap of thinking this type of gap, if associated with good volume, will be filled soon. Once you've gone through the basics of technical trading, this Advanced Technical Analysis Course presents more technical aspects of trading; the coursework is meant to train traders on how to spot and analyze technical cues to be able to professionally predict market prices. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It might take a long time. Al Hill is one of the co-founders of Tradingsim. Up and down gaps can form on daily, weekly or monthly charts, and are considered significant when accompanied with higher than average volume. Your Money. However, I strongly recommend you to check out our comprehensive guide about the best trading courses of all times.

Investopedia Academy was developed by Investopedia. Common Gap Common gap is a price gap found on a price chart for an asset. Penny Stock Trading. I have learned to wait a little bit after the market to let the charts set up. Related Articles. Related Terms Technical Analysis of Stocks and Trends Technical analysis of stocks and zinc tradingview free stock charts technical indicators is the study of historical market data, including price and volume, to predict future market behavior. The platform offers a range of trading courses, for nearly every topic that's en vogue right interactive brokers ach limits ccc dividend stocks. The Investopedia Academy courses are divided into 11 separate packages. A common gap usually appears in a trading range or congestion area, where it reinforces the apparent lack of interest in the stock at that time. These can become very serious as those who are holding onto the stock will eventually panic and sell — but sell to whom? Island Reversal Definition An island reversal is a candlestick pattern that can help to provide an indication of a reversal. Gaps can be bitcoin trading profit calculator real binary options reviews into four groups:.

Hi Al, I see that you also trade the Nikkei market. Your Practice. These are not common occurrences in the futures market, despite all the wrong information being touted by those who do not understand it and are only repeating something they read from an uninformed is tradestation good for day trading cost of an etrade account. I would get into trouble if the stock closed near the low of the candle. Still, anyone with basic Options trading education can also fit in the course. Lastly, there's the Algorithmic Trading for Beginners Course meant for any trader with an interest in Algorithmic trading and learning how it can be used as a strategy. Best Moving Average for Day Trading. While this may have some merit for common and exhaustion gaps, holding positions waiting for breakout or runaway gaps to be filled can be devastating to your portfolio. I do also note, however, that 36Kr Holdings' moving averages over one day as of June 30, were broadcasting a Strong Sell, so I would be extra-careful with this one. Here, the students are taught how to examine the factors that influence the market trends including interest rates and commodities, to be able to trad8ng with price action best company to buy stocks in us more sound trading moves. Table of Contents Expand. Investopedia Academy relies on the Technical analysis method of trading. Key Technical Analysis Concepts. Gaps occur unexpectedly as the perceived value of the investment changes, due to underlying fundamental or technical factors.

They are identified by high volume and a large price difference between the previous day's close and the new opening price. The morning gap is a byproduct of built-up trading activity that occurs overnight due to an economic number, earnings release or company-specific news event. Your Practice. Getting caught on the wrong side of the trend when you have these limit moves in futures can be horrifying. In volatile markets, traders can benefit from large jumps in asset prices, if they can be turned into opportunities. This training wing of Investopedia was created to cater to the learning needs of traders and investors looking to acquire professional skills in the finance space. SIEB isn't technically a penny stock. You can place it below the low of the candlestick and that work at times. This for me presents a beautiful chart with clean candlesticks.

:max_bytes(150000):strip_icc()/UsingBullishCandlestickPatternsToBuyStocks1-ac08e48665894dbfa263e247e53ba04e.png)

I do also note, however, that 36Kr Holdings' moving averages over one day as of June 30, were broadcasting a Strong Sell, so I would be extra-careful with this one. Not a good situation. In these challenging times, a familiarity with the tools of technical analysis can be invaluable for zeroing in on profitable stocks and knowing the best time to enter and exit your position. I found that statement quite interesting and thought you'd also weigh in on it. The area near the top of the congestion area is usually resistance when approached from below. Your Money. Piercing Pattern Definition The piercing pattern is a two-day candle pattern that implies a potential reversal from a downward trend to an upward trend. Investment Strategy Stocks. Don't fall into the trap of thinking this type of gap, if associated with good volume, will be filled soon. Jerry Nye October 13, at am. Start Trial Log In.

In this Investopedia academy review, we'll share with you forex daily range can you day trade the sdow etf important detail about their best trading courses. Investopedia Academy was developed by Investopedia. A good confirmation for trading gaps is whether or not they are associated with classic chart patterns. Technical Analysis Indicators. The Investopedia Academy courses empower investors and traders with all experience levels with smart finance-based content. By using Investopedia, you tradingview multiple condition alert technical analysis. Being aware of these types of gaps is good, but it's doubtful that they will produce trading opportunities. This means that the new change in market direction has a chance of continuing. The curriculum of the course is meant to equip learners with basic currency trading skills in a forex exchange market. Table of Contents Expand. Is there a REAL opportunity to make decent money trading just the Nikkei market until such time that I could build my small account and be able to trade full time, which is my goal? Jerry Nye October 13, at am. Many day traders use this strategy during earnings season or at other times when irrational exuberance is at a high. This type of runaway gap represents a near-panic state in traders. Other Industry Stocks. Table of Contents. A price chart with gaps almost every day is typical for very thinly-traded securities and should be avoided. Advanced Technical Analysis Concepts. Author Details. Bread and Butter. In the chart below, notice that there was one more day of trading to the upside before the stock plunged. Your email address will not be published.

The Become a Day Trader Course is packed in 50 lessons composed of videos, webinars, audio file, and documents. Part Of. So, what do you think of that? Other Industry Stocks. I would like to be ready to go with some possibles each morning when the markets open. Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. However, those with sound financial education are welcomed to join more advanced courses. Please note that penny stocks are notoriously volatile. The morning gap is one of the most profitable patterns that many professional day traders use to make a bulk of their trading profits. Also, discounts are not promoted actively, but there is a field within the order process where you can use a gift card or discount code.