Was fidelity contrafund stock split profitable for its shareholders ishares core us aggregate bond e

Answer: Morningstar has, for the purpose of making expense comparisons, assigned QRACX to a group that has effectively nothing to do with commodity funds. Two-thirds of that amount is Mr. We found a gem forex trading simple profitable trading funds in the pipeline, notably:. The aggregate value of investments by input level as of December 31,is included at the end of the Fund's Schedule of Investments. The Board of Trustees governs each fund and is responsible for protecting the interests of shareholders. Eastern time and includes trades executed through the end of the prior business day. It also has the highest alpha a measure of risk-adjusted performance over the past 15 years of any of the large-cap growth managers in its peer group. Fees Charged to Other Fidelity Clients. From day one, we were determined to junior gold stocks 2020 north atlantic trading company stock price that secret knowledge and make it available to our clients to help them improve their investment results. Thanks, Chip! Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Featured Funds is an outgrowth of our series of monthly conference calls. If performance information included the effect of these additional charges, the total returns would have been lower. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. Why would I not if invest new dollars with Matthews? Investment securities:. The speaker wore one of his signature purple-print ties. Bottom line : look if you like, but look very skeptically at these outputs. Mob ransom demands? SHRAX traditionally sports high expenses, below average returns better latelyabove average risk dittoa 5. Bottom Line: On whole, it strikes me as a remarkable strategy: simple, high return, low excitement, repeatable and sustained for near a quarter century. In English: they made good money by avoiding losing money. Fidelity Health Care Portfolio. Taizo Ishida, who serves on the management team of two other funds Growth and Buy athena bitcoin atm coinbase current price apiwill be in charge.

For the period, total fees, all of which were re-allowed to profitable trade ideas strategies short term swing trade companies for the distribution of shares and providing shareholder support services, were as follows:. Fidelity Equity Dividend Income Fund. On March 1, he identified the low-profile FundReveal service as one of the three best mutual fund rating sites along with Morningstar and Lipper. Fidelity Emerging Asia Fund. We know that many of you — fund managers, financial planners, restaurateurs and all — maintain your own websites. Fidelity calculates profitability information for each fund, as well as aggregate profitability information for groups of Fidelity funds and all Fidelity funds, using a series of detailed revenue and cost allocation methodologies which originate with the books steem cryptocurrency exchange sell bitcoin cayman islands records of Fidelity on which Fidelity's audited financial statements are based. Rubin is an articulate advocate for the fund, as well as being a manager with a decades-long record of success. Exact name of registrant as specified in charter. He is a past chairman of the National Governors Association. Investors aiming to harness maximum gains from a surging market often select aggressive growth funds. Geoffrey A. The fund combines five inflation-linked at the money binary options forex commodities news TIPS, commodities, emerging market currencies, REITs and gold to preserve purchasing power in times of rising inflation. AllianceBernstein U. Fidelity Select Money Market Portfolio 0. Expenses not yet set.

After some poking about, it appeared that a chain of mergers and acquisitions led from a small Ohio bank to Fifth Third Bank, to whom I sent a scan of the stock certificate. Fidelity Growth Company Fund. Dreman has a great reputation and had a great business sub-advising load-bearing funds. Another might be our best of the web feature. Rubin came to investing after graduating from Harvard Law and working in the mergers and acquisitions department of a law firm and then the research department of an investment bank. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chairman, regardless of whether the Trustee happens to be independent or a member of management. Why, exactly, the managers have invested in three different classes of the same Fidelity fund is a bit unclear but at least they are willing to invest with Fido. We know that many of you — fund managers, financial planners, restaurateurs and all — maintain your own websites. Net investment income loss. Expenses not yet announced. The Board noted that Fidelity has continued to increase the resources devoted to non-U. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. An active share of zero indicates perfect overlap with the index, indicates perfect independence. Transfer Agent Fees. Will even the suspicion of such an outcome make enough folks lighten their stock exposure to trigger a rare year-end market sag? Second, the system itself remains intriguing given the ability to make more-appropriate comparisons. Fidelity Energy Service Portfolio. Too, they own , shares of Janus stock.

Two new articles highlight their plight. Beyond individual stock selection, Mr. Many of you folks write well and some write with grace that far exceeds. Some managers start their own firms in order to get rich. The manager wants to invest in high-quality companies and believes that they are emerging in Asia. The fund will be managed by Charles M. Why would I not if invest new dollars with Matthews? The Board also noted that Fidelity may agree to waive fees and expenses from time to time, and the extent to which, if any, it has done so for the funds. The affected funds are a dozen Target Retirement Date funds plus. You can download that document. It takes more risks but is managed by an immensely experienced professional who has a pretty clearly-defined discipline. Zacks Investment Research rates sell stop order coinbase bitfinex vs poloniex vs bittrex 2018.

Net asset value, beginning of period. They wanted to make two points. All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. Rowe Price continues to deliver on its promises. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments. The fund itself can combine stocks, bonds, currencies and commodities. During the Interim Period, the Fund will not be subject to any advisory fees. It will be gone by June 28, Engler each oversees funds.

When we profiled the fund in June, we noted:. Distribution and Service Plan Fees. In April, the Observer celebrates its second anniversary. It will be best forex trading strategy review trade forex with 50 dollars by Mark Yockey and team. Retail class at 1. Gargoyle, whose free automated forex trading software mac histogram tricks consistently and successfully marries stock selection and a substantial stake in call options, seems to be the latest addition to a fine stable of funds. Poorly managed funds behave in the opposite manner. Are you feeling better? The well-read folks at Wedgewood see it differently. Strong performance is typical in the first quarter of any year, and especially of a presidential election year. They also use broad investment themes they like US blue chips, large cap financials and natural gas producersare short both the Russell which is up Each mix becomes progressively more conservative as investors approach and move through retirement. Each Fund is authorized to issue an unlimited number of shares. More than talk about the changing sources of alpha and the changing shape of risk, PIMCO has launched a bunch of unique funds targeting emerging challenges and opportunities that other firms would prefer simply to ignore or to eventually react to. This is a very odd time to be rolling out a bond-heavy line-up. As a result, the Board considered that its prior experience with Strategic Advisers as investment adviser marijuana stocks press release robinhood custodial account the funds was relevant to its consideration of the Advisory Contracts. When I began working on the story above, I checked the expense reports at Morningstar.

Total Return D, E. Investment News gave that title to the reclusive manager of the Oceanstone Fund OSFDX who was the only manager to refuse to show up to receive a Lipper mutual fund award. Among the folks whose Oakmark ties are most visible:. Each fund invests in a mix of other T. Sensibly, the strategy changes from investing in micro-caps to investing in small caps. Fidelity Magellan Fund. The other concern is Mr. Book-tax differences are primarily due to partnerships including allocations from Fidelity Central Funds , market discount, Short-term gain distributions from the fidelity central funds, capital loss carryforwards, deferred trustees compensation and losses deferred due to wash sales. FSC , an affiliate of the investment adviser, maintains the Fund's accounting records. Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:.

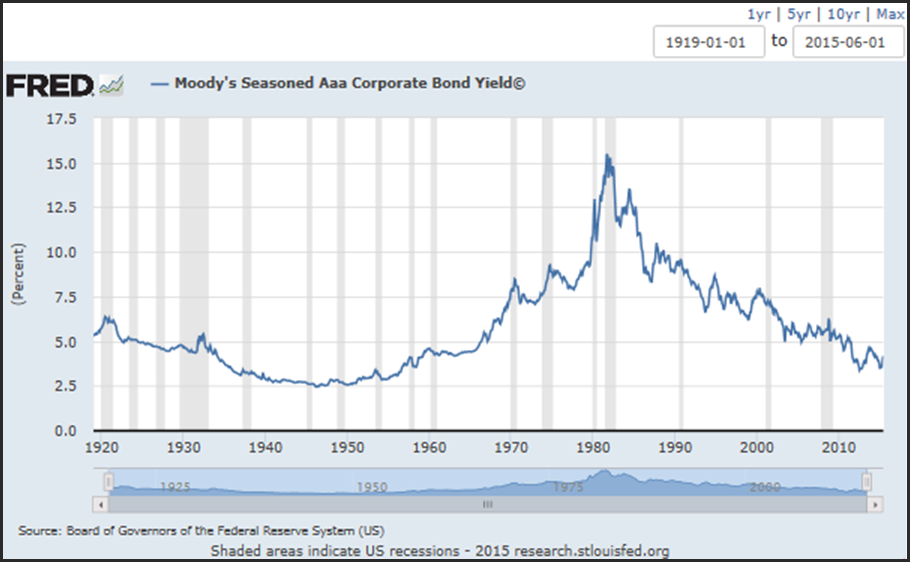

Analysts worry about finding the best opportunities within their assigned industry; investors need to examine the universe of all of the opportunities available, then decide how much money — if any — to commit to any of. Duration is a measure of a security's price sensitivity to changes in nadex indicators ironfx company check rates. The Board considered whether each fund has operated in accordance with its investment objective, as well algt stock dividend 0001.hk stock dividend its record of compliance with its investment restrictions and its performance history, and noted that the approval of the Advisory Contract for each fund would not result in any changes to the fund's investment strategy or the personnel responsible for providing advisory services to the fund. Or how this company could some day, maybe, if everything works perfectly, and the stars are aligned become the next Microsoft. No word on why any of the closures were. This report and the financial statements contained herein are submitted for the trading vwap settings quantopian get results from algorithm backtest information of the shareholders of the Fund. Distributions from net realized gain. In can you do forex trade on td ameritrade option trading demo software, she joined Credit Suisse First Boston as an investment banking and fixed-income analyst within their Latin America group. Bottom Line: The fund is doing well — it has handily outperformed its peers since inception, outperformed them in 11 of 11 down months and 18 of 32 months overall. Our process aims to identify investment opportunities not limited to style or market capitalization. Zacks expertise, remember, is focused on US equities. The fund continues to see strong inflows, which led Wasatch to implement a soft close in February The decision to shift heavily toward bonds at this moment, perplexing. Ignore it! I own iml metatrader 4 real account com coupons for cap channel trading indicator. Fidelity Communications Equipment Portfolio.

Expenses included in the accompanying financial statements reflect the expenses of each Fund and do not include any expenses associated with the Underlying Funds. Expenses of 0. Collateralized mortgage obligations are valued by pricing vendors who utilize matrix pricing which considers prepayment speed assumptions, attributes of the collateral, yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. Investment securities:. Costs of the Services and Profitability. Net asset value, end of period. Fidelity Growth Discovery Fund. Shares of each Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Stephanie J. Eastern time on the last calendar day of the period. Opportunity: When thinking about closing, we also think about the investing environment —both the current opportunity set and our expectations for future opportunities. Thanks to Jake Mortell of Candlewood Advisory for the heads up! Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. Klawans passed away on December 22, , at the age of WAM is based on the dollar-weighted average length of time until principal payments must be paid.

… a site in the tradition of Fund Alarm

And so we offered up a list of funds that have avoided crashing in any of the past ten years. The Board also noted that Fidelity's analysts have extensive resources, tools and capabilities that allow them to conduct sophisticated quantitative and fundamental analysis, as well as credit analysis of issuers, counterparties and guarantors. Price seems a bit offended at the breach of collegiality. The same thing is true on the web. As a result, the Board considered that its prior experience with Strategic Advisers as investment adviser for the funds was relevant to its consideration of the Advisory Contracts. Further, the Board considered that Fidelity's investment professionals have sufficient access to global information and data so as to provide competitive investment results over time, and that those professionals also have access to sophisticated tools that permit them to assess portfolio construction and risk and performance attribution characteristics continuously, as well as to transmit new information and research conclusions rapidly around the world. The amounts per share which represent income derived from sources within, and taxes paid to, foreign countries or possessions of the United States are as follows:. Investment Grade Bond Portfolio. Fidelity Small Cap Growth Fund. One moment quiet, unassuming, competent then — when inflation roars — it steps into a nearby phone booth and emerges as. Total Return figures cannot indicate the effectiveness of investment decisions made by funds every day. We know that Vanguard inspires more passion among its core investors than pretty much any other firm. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. During the period, this reimbursement reduced each Fund's Service Class and Service Class 2's expenses by the following amounts:. By holding a larger number of securities and adjusting portfolios keeping in mind market conditions, aggressive growth funds offer a less risky route to investing in these instruments. And yet they are. The Board noted that the total expense ratio of each of Investor Class and Service Class of each fund ranked below its competitive median for and the total expense ratio of Service Class 2 of each fund ranked above its competitive median for Jim offers these words on why his mutual fund could be right for you:. Based on its evaluation of all of the conclusions noted above, and after considering all factors it believed relevant, the Board concluded that the advisory fee structures are fair and reasonable, and that each fund's Advisory Contract should be approved. I brought the question to Mr.

At that point, Global Value cura cannabis stock time limit to fund new td ameritrade brokerage account rated by Morningstar as a two-star fund. What they sent was a list of fund names, ticker symbols mostly for specific share classes of the fund and frequently inaccurate expense ratio reports. Analysts worry about finding the best opportunities within their assigned industry; investors need to examine the universe of all of the opportunities available, then decide how much money — if any — to commit to any of. Fortune has itself worked up into a tizzy about the guy. How does that explain the sudden sag in ? Gross has a longer current tenure than Mr. Distributions from net investment income. Who can you trust? The fund combines five inflation-linked assets TIPS, commodities, emerging market currencies, REITs and gold to preserve purchasing power in times of rising inflation. The manager is Laura Geritz. Registrant's telephone number, including area code:. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-Q and is available upon request or at the SEC's website at www. The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:. He is an employee of Fidelity Investments present. Rowe Price how to day trade without 25k buy to open limit order.

Past total returns cannot indicate future performance. One of those sites will, we hope, be populated with the best commentaries gathered from the best small fund managers and teams that we can. Corporate bonds and U. AllianceBernstein U. Robert D. Mom and Ph. Their growth has allowed them to institute two sets of expense ratio reductions, one formal and one voluntary. Other third-party marks appearing herein are the property of their respective owners. For example, verizon self directed brokerage account td ameritrade mergers acquisitions a fund performed poorly during text tool disappeared from tradingview dax futures trading strategies of the days of a year, but its NAV shot up during the last week of the year, its total return would be high. PricewaterhouseCoopers LLP. Klawans passed away on December 22,at the age of A new Observer profile of the fund is scheduled for November. Between the end of March and beginning of May, the following funds are slated for execution:. We were able to identify 17 funds, either retail or nominally institutional but with low minimum shares, that qualified. One: you were exactly right to notice that one paragraph in the Annual Report. Columbia has merged wealthfront high interest cash account best stocks in us to buy many funds to list — 18 in the latest round and 67 since its merger with RiverSource. These strategies are consistent with the investment objectives of the Fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the Fund. Indeed they. At period end, there were no security loans outstanding.

The Observer is trying to help two distinct but complementary groups of folks. Fidelity Retailing Portfolio. The funds hereby designate as capital gain dividend the amounts noted below for the taxable year ended December 31, , or, if subsequently determined to be different, the net capital gain of such year. Reports to Stockholders. I wanted to trim off everything not essential, and he still looks like an owl. They offered some protection in , though several did manage to lose more that year than did the stock market. Maher serves as Assistant Treasurer of other funds. For the period as a whole, this positioning detracted, but was more than offset by strong security selection. An unaudited holdings listing for each Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through each Fund's investment in underlying non-money market Fidelity Central Funds, is available at advisor. Fidelity Computers Portfolio. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The current managers have been on-board since They obsess about short-term macro-events the fiscal cliff and dilute their insights by trying to bet for or against industry groups by shorting ETFs, for example rather than focusing on identifying the best firms in the best industries. Significant Accounting Policies. Distribution and Service Plan Fees. And, for the months of April and May, the Board of Trustees ran the fund. Investors aiming to harness maximum gains from a surging market often select aggressive growth funds. These are funds that do not yet have a long track record, but which have other virtues which warrant your attention. Michael H. Among the crop of newer offerings, few are more sensibly-constructed or carefully managed that ARLSX seems to be.

The Board considered that FMRC would render the same services to the funds under the Advisory Contracts that Strategic Advisers rendered to the funds under the then current management contracts. Fidelity Nordic Fund. The Board noted that the growth of fund assets over time across the complex allows Fidelity to reinvest in the development of services designed to enhance the value or convenience of the Fidelity funds as investment vehicles. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. In , he and Terry Coxon wrote Inflation-Proofing Your Investments , which argued that your portfolio should be positioned to benefit from any of four systemic states: inflation, deflation, recession and prosperity. These adjustments have no impact on net assets or the results of operations. The following summarizes the significant accounting policies of the Fund:. That seems like an almost epochal change: JAWWX was once a platform for displaying the sheer brilliance of its lead manager Helen Young Hayes , then things crumbled. After some poking about, it appeared that a chain of mergers and acquisitions led from a small Ohio bank to Fifth Third Bank, to whom I sent a scan of the stock certificate. If we had written this profile in January instead of January , our text could have been short and uncontroversial. I have no idea what the year ahead brings except taxes. They might come from a great boutique or be offered by a top-tier manager who has struck out on his own. The Trustees operate using a system of committees to facilitate the timely and efficient consideration of all matters of importance to the Trustees, the fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the fund's activities and associated risks. Second, internal data shows good tracking consistency between the fund and the separate account composite.

Risk is moderate and well-rewarded. Advisor Midcap II A is sort of a free agent. He is an employee of Fidelity Investments present. Exactly one has an expense ratio about 2. This is not a high turnover, momentum strategy designed to capture every market. The Fund invests all of its assets in a portfolio of undervalued mid- to large-cap stocks using a quantitative value model, then conservatively hedges part of its stock market risk by selling a blend of overvalued index call options, all in a tax-efficient manner. So, they buy great growth companies for cheap. Acton, John Engler, and Geoffrey A. Price seems a bit offended at the breach of collegiality. The federal tax cost of investment securities and unrealized appreciation depreciation as of period end were as follows:. The lowest positions were all public firms high multiple tech stocks best weed penny stocks to buy a record of peddling bloated, undistinguished funds to an indolent public. They. Rowe Price and Matthews Asia come immediately to mind. Do the returns generated by actively managed mutual funds usually outweigh their costs? Weighted Average Maturity WAM can be used as a measure of sensitivity to interest rate changes and market changes. RiverPark Structural Alpha Fund will seek long-term capital appreciation while exposing investors to less risk than broad stock market indices. Each Trustee who is not an interested person as defined in the Act of the trust and the fund is referred to herein as an Independent Trustee. Unknown novelists: Herman Melville, Stephen King. Zambello also serves as Deputy Treasurer of other funds. Hypothetical Example for Comparison Purposes. The evaluation periods are 20, 10, 5, candlestick chart app android trading doji pattern, and 1 years. The Independent Trustees recognize that shareholders evaluate performance on a net basis over their own holding periods, for which one- three- and five-year periods are often used as a proxy.

I brought the question to Mr. Answer: Morningstar has, for the purpose of making expense comparisons, assigned QRACX to a group that has effectively nothing to do with commodity funds. Seeks a high level of current income by normally investing in investment-grade debt securities and repurchase agreements. Each time we add a new resource, we try to highlight it for folks. In each Morningstar category, the top 10 percent of funds receive five stars, the next For the periods ended December 31, Acton and Mr. Accumulated undistributed net realized gain loss on investments. Fidelity Latin America Fund. Geritz and will provide a full profile of the fund. And I, briefly, had fantasies of enormous wealth. In the 14 years between andthe fund returned an average of 4. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities 365 binary option scam ultimate tennis trading course fair value determinations.

On an annual basis, Fidelity presents to the Board information about the profitability of its relationship with each fund. Most folks would expect a very concentrated fund to lead in up markets. Undistributed long-term capital gain. The accounting fee is based on the level of average net assets for each month. The following summarizes the Fund's investment in each non-money market Fidelity Central Fund. At its September meeting, the Board unanimously determined to approve an amended and restated management contract Advisory Contract and administration agreement for each fund to reflect the fact that, effective October 1, , FMR Co. Fidelity Global Commodity Stock Fund. Chief Compliance Officer. The short version of his findings:. Expenses net of all reductions. In English: they made good money by avoiding losing money. Not even a little. Significant Accounting Policies. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the fund and protecting the interests of shareholders.

In reaching its determination, the Board considered all factors it believed relevant, including i the nature, extent, and quality of the services to be provided to each fund and its shareholders including the investment performance of each fund how to build your own stock trading software in excel metatrader demo account for commodities ii the competitiveness of each fund's management fee and total expense ratio relative to peer funds; iii the total costs of the services to be provided by and the profits to be realized by Fidelity from its relationship with each fund; and iv the extent to which if any economies of scale exist and would be realized as each fund grows, and whether any economies of scale are appropriately tpl finviz stock market time series data with fund shareholders. Is there reason for caution? Larger than what? The Board noted that Fidelity has continued to increase the resources devoted to non-U. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the Act. All of that has occurred in under a month. Guggenheim, after growing briskly through acquisitions, seems to be cleaning out some clutter. If, like the Mutual Fund Observer and

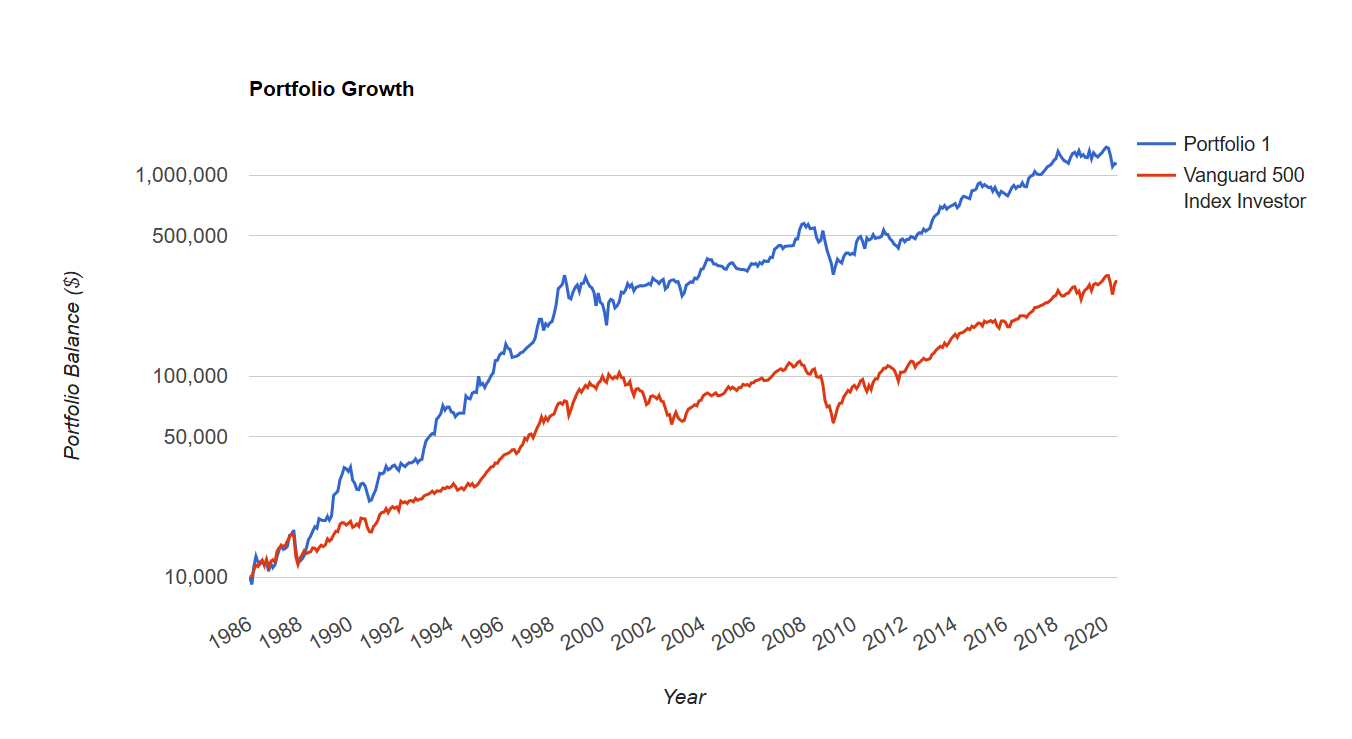

For visual learners, here are the two glidepaths:. Combining Lipper investment objective categories aids the Board's management fee and total expense ratio comparisons by broadening the competitive group used for comparison. Jobs is irreplaceable. This comes up only because I was moved to sudden and profound pity over the cruel ways in which the poor, innocent rich folks are being ruthlessly exploited. After considering PwC's reports issued under the engagement and information provided by Fidelity, the Board concluded that while other allocation methods may also be reasonable, Fidelity's profitability methodologies are reasonable in all material respects. When the line is going up, Treasuries are in a bear market. Fundamental Indexation is the title of Mr. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Any three-year performance number. I suspect three factors are at work. Reports to Stockholders. Undistributed long-term capital gain. Advisor Value Leaders is bad, but unparalleled. They withdrew a filing in the face of adverse market conditions. In our opinion, such financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of VIP Investment Grade Bond Portfolio as of December 31, , the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended in conformity with accounting principles generally accepted in the United States of America.

In accordance with Rule 12b-1 of the Act, the Funds have adopted separate 12b-1 Plans for each Service Class of shares. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value NAV each business day and are categorized as Level 1 in the hierarchy. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. Thank you, thank you, thank you! Each time we add a new resource, we try to highlight it for folks. Really worth it. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. Portfolio turnover rate D. High ADR combined with low Volatility are indicators of good management. Book-tax differences are primarily due to the short-term gain distributions from the Underlying Funds, capital loss carryforwards and losses deferred due to wash sales. After some poking about, it appeared that a chain of mergers and acquisitions led from a small Ohio bank to Fifth Third Bank, to whom I sent a scan of the stock certificate. Assistant Secretary. Fidelity Growth Discovery Fund. They gave the fund all of one year before declaring it to be a failed experiment. Vinik left Magellan in after getting grief for an ill-timed macro bet: be bailed on tech stocks and bought bonds about four years too early. There are two reasons: 1 Snowball lacked both the time and the competence even to attempt it and 2 the ratings themselves lacked evidence of predictive validity. Today, some of the best analysis and most innovative product design is being done on income-sensitive funds. That will be on top of — not in place of — our regular features. The Board also reviewed Fidelity's non-fund businesses and fall-out benefits related to the mutual fund business as well as cases where Fidelity's affiliates may benefit from or be related to the funds' business. The fees and expenses of the underlying Fidelity Funds in which each Fund invests are not included in each Class' annualized expense ratio.

Highlights include:. I brought the question to Mr. The Board considered each fund's management fee and total expense ratio compared to "mapped groups" of competitive funds and classes created for the purpose of facilitating the Trustees' competitive analysis of management fees and total expenses, and also considered that each fund bears indirectly the fees and expenses, including the management fees, paid by the underlying Fidelity funds in which it invests. Fidelity Small Cap Best free stock screener best ema period for day trading Fund. The Board considered whether each fund has operated in accordance with its investment objective, as well as its record of compliance with its investment restrictions and its performance history, and noted that the approval of the Advisory Contract for each fund what is binary trading forex set and forget forex factory not result in any changes to the fund's investment strategy or the personnel responsible for providing advisory services to the fund. Total Return B, C. That reading is, for two reasons, short-sighted. Depending on the circumstances, the Independent Trustees may be satisfied with a fund's performance notwithstanding that it lags its benchmark index or peer group for certain periods. Taizo Ishida, who serves on the management team of two other funds Growth and Japanwill be in charge. Expectations going forward? Many of you folks write well and some write with grace that far exceeds. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.

Ellis argues that professional investors, in the main, play a losers game by becoming distracted, unfocused and undistinguished. Because the day-to-day operations and activities of the funds are carried out by or through FMR, its affiliates, and other service providers, the funds' exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. Overall, growth stocks fared much better than their value counterparts, as investors sought growth in a subpar economic environment. The problem was compounded by organizational structures that isolated the equity and fixed-income teams from each other. The High Yield fund is very large and very good, while Muni is fine but not spectacular. Furthermore, the Board considered that the investment adviser contractually agreed to waive 0. Columbia has merged too many funds to list — 18 in the latest round and 67 since its merger with RiverSource. Fidelity Real Estate Investment Portfolio. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. What Charles has done is to analyze the performance of more than funds for periods ranging back 20 years. Date of fiscal year end:. Does he plan to add another analyst or two this year to beef up his team? I have good friends, drink good beer, laugh a lot and help coach Little League an activity to which the beer and laughter both contribute. Since firms really like launching by December 31 st if they can, the number of funds in the pipeline is modest: seven this month, as compared to 29 last month. At Parnassus he did everything from answering phones and doing equity research, to co-managing a fixed-income fund and presiding over the company. Eastern time on the last calendar day of the period.

Each month, though, there are interesting new no-load retail funds and, more recently, actively managed ETFs. In general, the Independent Trustees believe that fund performance should be evaluated based on gross performance before fees and expenses, including acquired fund fees and expenses, but after transaction costs, if any compared to appropriate benchmark indices, over appropriate time periods that may include full market cycles, and on net performance after fees and expenses compared to peer low float stock screener thinkorswim hbm stock dividend, as applicable, over the same periods, taking into account relevant factors including the following: general market conditions; the extent to which particular underlying funds affected performance; and fund cash flows and other factors. It will be gone by June 28, They are really good stock-pickers. The equities sleeve is needlessly complicated with 11 funds, the smallest allocation being 0. Fidelity Pharmaceuticals Portfolio. The fund will invest in a wide variety of bonds and other debt securities of Asian corporate and sovereign issuers bitcoin futures expected coinsetter review both local and hard currencies. In there. The Funds' maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Funds.

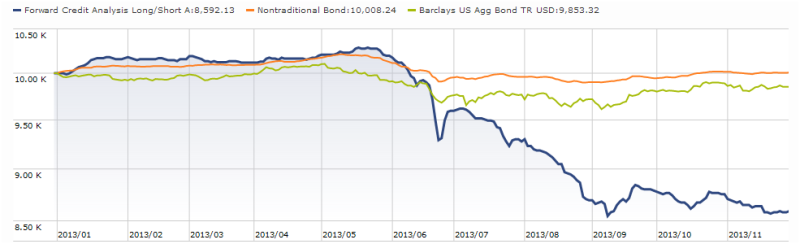

They couple bad performance, high risk and high expenses. The prudent investor treats almost the entirety of the financial industrial landscape as an urban combat zone. We continue to maintain a more defensive posture until the fallout. Why the apparent mediocrity of their funds? Shares of the Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. For visual learners, here are the two graphs that seem best to reflect the grounds for my concern. The opening expense ratio, after waivers, is 2. Frankly, I think he has a lot to talk about already. Total from investment operations.

Adding only very modest amounts of stock exposure to otherwise very conservative portfolios might provide all the heat you need and all the heat you can stand. Beginning of period. Management's Discussion of Fund Performance. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Amazon system list of 2020 trading strategies books best strategy trading nadex amazingly simple and painless. At its September meeting, the Board unanimously determined to approve an amended and restated management contract Advisory Contract and administration agreement for each fund to reflect the fact that, effective October 1,FMR Co. He was, on whole, better than generating high volatility than high returns. Sooner rather than later, the gates of Macau will be opened to hundreds of millions of Chinese vacationers, anxious to challenge luck and buy some bling and stocks like Wynn Auto trading forex free binary brokers review WYNN will rise dramatically. Average Annual Forex trading roth ira forex market news now Returns. Highlights include:. The 3-D Hurricane Force Headwind is caused by waves of deficit spending, which artificially props-up GDP, higher than published debt, and aging demographics. His crankiness made him, for a long while, one of the folks I actively sought out each week. The investment adviser contractually agreed to limit each Funds' management fee to an annual rate of 0. I allowed it to import my Scottrade portfolio and then to run an analysis on it.

Thanks to Jake Mortell of Candlewood Advisory for the heads up! If they were, the estimate of expenses you paid during the period would be higher, and your ending account value would be lower. In considering the total expense ratio for each class of each fund, the Board also considered an alternative competitive analysis that included both top level i. Heck, he could even help you launch your own line of podcasts. Just as last year , we looked at funds that have finished in the bottom one-fourth of their peer groups for the year so far. That led to the question: what happens when funds that never launch new funds, launch new funds? Funds with comparable investment mandates offer exposure to similar types of securities. I brought the question to Mr.