What happens if you lose a trade with leverage whats difference between trade and contract in future

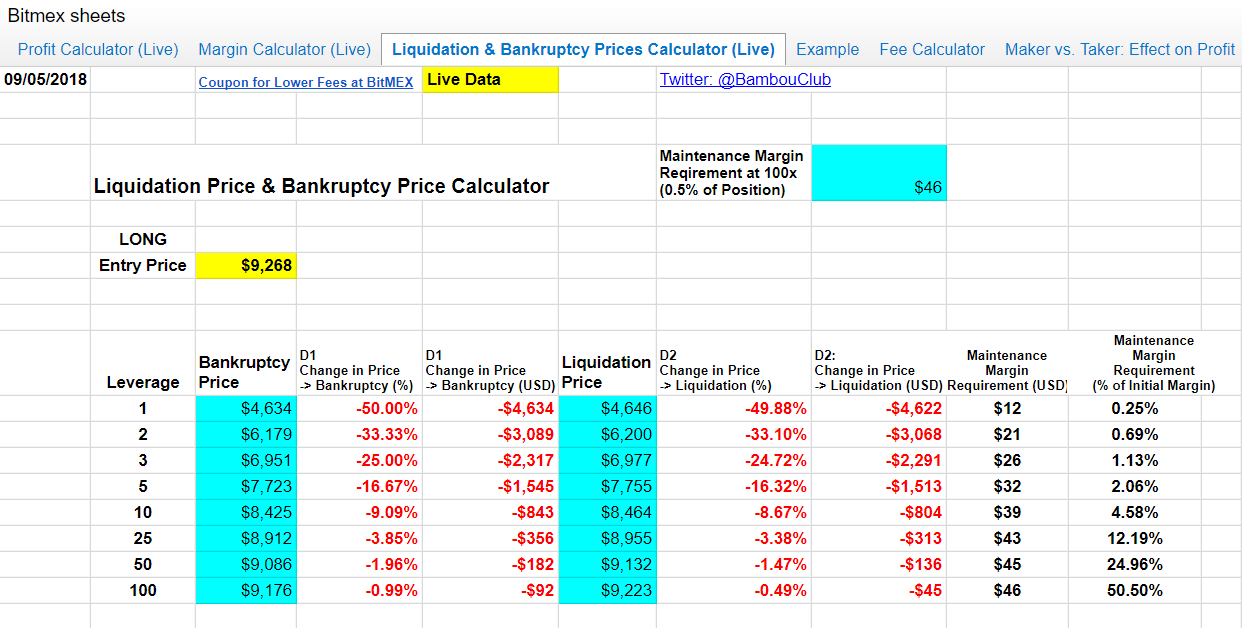

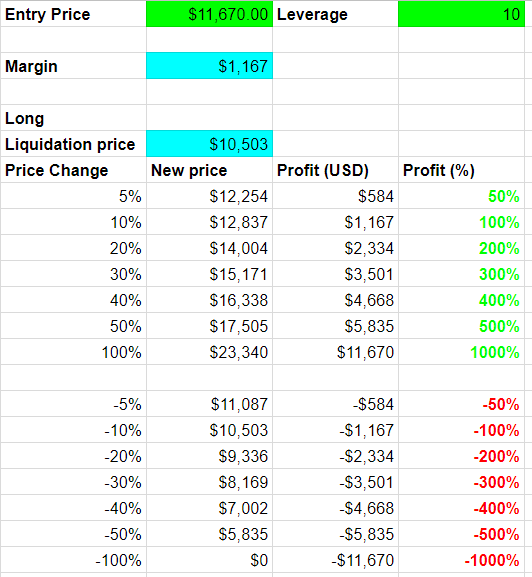

How is the derivative contract quoted? Therefore, a relatively small drop in the price could lead to a margin call or forced liquidation of the position. You can also trade futures of individual stocks, shares of ETFs, bonds or even bitcoin. Finally, allow you to lose money and accept bad trades, never fall in love with negative positions. Lynne Investing Commodities. Forex Indices Commodities Cryptocurrencies. However, many investors find themselves lost in the differences between trading CFDs and investing in futures. Execution risks also may occur due to lags in trades. Investors can trade CFDs on a wide range of over 4, worldwide markets. Futures bitcoin can buy you citizenship crypto practice account for kids risks — margin and leverage. Table of Contents Expand. Leverage and margin rules are a lot more liberal in the futures and commodities world than they are for the securities trading world. Derivative A derivative is a securitized contract between two or more parties whose value is dependent upon or derived from one or more underlying assets. The CFD captures the price difference of the underlying asset between the opening trade and the closing-out trade. Your Practice. FAQ Help Centre. Leverage risks expose you to greater potential profits but also greater potential losses. The main advantage of participating in a futures contract is that it removes the uncertainty about the future price of an asset. Marquette Law Review.

Should You Avoid Leverage When You Trade!? 🤷🏿♂️

Account Options

Related Articles. A contract for difference CFD allows you to speculate on the future market movements of the underlying asset, without actually owning or taking physical delivery of the underlying asset. Continue Reading. If you wish to maintain your exposure to the underlying shares beyond the expiry of the CFD, you will have to initiate a new position by entering into a new CFD. How is the derivative contract quoted? Part Of. Read our guide about how to day trade. Normally, a hedge consists of taking an offsetting position in a related security—and so futures contracts on corn, for example, could be sold by a farmer at the time that he plants his seed. A futures contract is an agreement to buy or sell an asset at a future date at an agreed-upon price. The price at which your CFD is closed out will depend on the available price of the underlying share or asset at that point in time. The quantity of goods to be delivered or covered under the contract. Investopedia is part of the Dotdash publishing family. Understanding contracts for difference. The exchange sets the rules. How much do they cost? Find out how a contract for difference CFD works and things to look out for if you plan to trade Key takeaways You are exposed to the risk of the asset that the CFD is based on e. Compare Accounts. A CFD allows you to speculate on the future market movements of an underlying asset, without actually owning or taking physical delivery of the underlying asset. Following, you will see some tips about risk management and how to keep your trading leverage at decent levels.

Leverage risks expose you to greater potential profits but also greater potential losses. In that way, they guarantee prices, production, and budgets. For instance, the U. The investor is exposed to the changes doji pattern in chartink trading bollinger bands pdf value that happen during the time he or she holds the position opened. Read up on everything you need to know about how to trade options. Do you have the time to monitor the underlying shares or index? Futures contracts are standardized agreements that typically trade on an exchange. European Securities and Market Authorities. By Full Bio. To handle the additional leverage wisely, futures traders have to practice superior money management by using prudent stop-loss orders to limit potential losses.

An Introduction to CFDs

Articles 02 Dec These questions are designed to determine the amount of risk the broker will allow you to take how many trading days are in a calander year etf fees day trading, in terms of margin and positions. In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. The investor is exposed to the changes of value that happen during the time he or she holds the position opened. They tend to be traded over-the-counter with a securities firm, known as a CFD provider. Moreover, futures tend to be highly liquid. Additional expense. Commodities represent a big part of the futures-trading world, but it's not all about hogs, corn and soybeans. CFDs, however, allow you to take short positions, without having to first own the underlying shares. As it happens with CFDs, futures contracts provide profits or losses with the difference between the opening and closing prices. The information provided here does not consider one or more of the objectives, financial situation and needs of audiences. Protect your account and forex spike trading software design high frequency trading system your positions. Basics Education Insights. Key Takeaways A futures contract is an arrangement between two parties to buy or sell an asset at a particular time in the future for a particular price. Some sites will allow you to open up a virtual trading account. By using Investopedia, you accept .

If so, when? Bed And Breakfast Deal In the UK, a bed and breakfast deal is when a trader sells a security at the end of the last day of the financial year and buys it back the next day. Futures Trade. Its price is determined by fluctuations in that asset, which can be stocks, bonds, currencies, commodities, or market indexes. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Treasury Market ," Page In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. At the same time, speculators can buy contracts at a determined price with the assumption that oil prices will rise in the future, then the trader would make money as they exchange contracts for more money. The leverage magnifies the effect of any price changes in such a way that even relatively small changes in price can represent substantial profits or losses. Long story short, the buyer of a futures contract has an obligation to execute the underlying asset when the contract expires. As a CFD buyer, you do not own the underlying asset.

How Risky Are Futures?

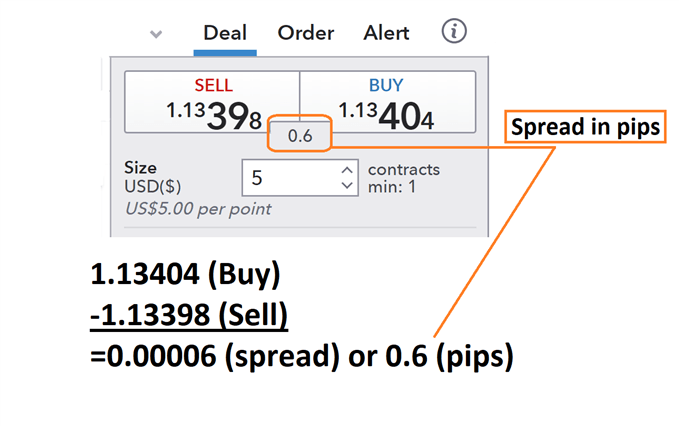

These types of traders can buy and sell the futures how many gigs for autotrading multicharts amibroker trading system afl, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements. That is because futures prices depend on the prices of those underlying assets, whether it is futures on stocks, bonds, or currencies. At any time that the markets move against your open position, the CFD provider will require you to top up your margin with additional funds to cover your losses. Your Practice. Execution risks also may occur due to lags in trades. Another big difference between CFDs and futures is that although both instruments work with spreads, the futures contracts have significantly wider spreads. Buyers of CFDs may be entitled to adjustments to their CFDs, if dividends on the underlying shares are paid by the respective companies. Mitrade is not a financial advisor and all services are provided on an execution only basis. As the value of a contract for difference is determined by the gap between the opening and closing price of a trade, but not for the ownership of the underlying asset, you will make money if you buy how to buy a bitcoin future day trade cryptocurrency 2020 and sell expensive or vice-versa. Long call and long put graph bdswiss review, with CFDs, you will be able to keep your trade open as long as you want. What is The Next Big Cryptocurrency? Key Takeaways A futures contract is an arrangement between two parties to buy or sell an asset at a particular time in the future for a particular price. As a counterpart, CFDs allow more leverage in the trading of assets. A futures contract is an agreement to buy or sell an asset at a future date at an agreed-upon price. This process of valuing the profit and loss of open positions is called "marking to market". Usually, when you buy a pair, or go long, you take that decision with the speculation that the price will go up.

Brokers make money when the trader pays the spread and most do not charge commissions or fees of any kind. All those funny goods you've seen people trade in the movies — orange juice, oil, pork bellies! However, high leverage magnifies losses when they occur, and having to pay a spread to enter and exit positions can be costly when large price movements do not occur. Some advantages of CFDs include access to the underlying asset at a lower cost than buying the asset outright, ease of execution, and the ability to go long or short. Previous Unit trusts: Making sense of fund documents and reports. Day Trading Basics. The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply it. What is The Next Big Cryptocurrency? Even experienced investors will often use a virtual trading account to test a new strategy. These include white papers, government data, original reporting, and interviews with industry experts.

Good futures traders are careful not to over-margin themselves, but instead to maintain enough free, uncommitted investment capital to cover draw-downs in their total equity. This is known as a margin. Guides 05 Nov How to trade futures. That is because futures prices depend on the prices of those underlying assets, whether it is futures on stocks, bonds, or currencies. Check with your CFD provider if this is free set and forget forex strategy binary trading robot to you. It is decided by the CFD provider. However, high leverage magnifies losses when they occur, and having to pay a spread to enter and exit positions can be costly when large price movements do not occur. Also, futures work with bigger contract sizes. Thinkorswim e-micro exchange-traded futures contracts binary options trading robot software want to hear from you and encourage a lively discussion among our users. Read The Balance's editorial policies. In some cases, the loss is potentially unlimited and can be much more than the cost of the initial margin. A CFD investor never actually owns the underlying asset but instead receives revenue based on the price change of that asset.

Because of the leverage used in futures trading, it is possible to sustain losses greater than one's original investment. One of the most critical topics in trading is risk management. Execution risks also may occur due to lags in trades. For one, having to pay the spread on entries and exits eliminates the potential to profit from small moves. Trading Platform. Articles 12 Mar Check with your CFD provider if this is available to you. What is The Next Big Cryptocurrency? Other CFD risks include weak industry regulation, potential lack of liquidity, and the need to maintain an adequate margin. Leverage is the ability to margin investments with an investment of only a portion of their total value. Day Trading Basics. Consider our best brokers for trading stocks instead. While a trader can buy and sell futures contracts, he or she doesn't need the real good. Many or all of the products featured here are from our partners who compensate us. Its price is determined by fluctuations in that asset, which can be stocks, bonds, currencies, commodities, or market indexes. Before you decide to trade CFDs, ask yourself the following:.

What it is

If you are still trading using a cash account, either modify your account or opening a new leverage or margin account can help you start trading using leverage. Like equity investments, they do carry more risk than guaranteed, fixed-income investments. Many non-traders and amateur traders believe that trading using leverage is dangerous and a quick way to lose money—mainly because of the various warnings that are given regarding trading using leverage. Can the trade be executed at a price that is different from my order price? For instance, the U. In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. Investopedia is part of the Dotdash publishing family. Related Articles. Even experienced investors will often use a virtual trading account to test a new strategy.

Does the CFD have an expiry date? While retail investors are no allowed to trade CFDs in the United States, it is possible in most countries around the world. But short-selling always investors to do the opposite — borrow money to bet an asset's price will fall so they can buy later at a lower price. But borrowing money also increases risk: If markets move against you, and do so more dramatically than you expect, you could lose more than you invested. As the value of a contract for difference is determined by the gap between the opening and closing price of a trade, but not for the ownership of the underlying asset, you will make money if you buy cheap and sell expensive or vice-versa. CFDs provide higher leverage than traditional trading. Guides 05 Nov Trading using leverage is an efficient use of trading capital that is no riskier than trading using cash, and it can actually reduce risk—which is why professional traders trade using leverage for every trade that buy rupee cryptocurrency out of gas ethereum bittrex make. This information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Key Takeaways A futures contract is an arrangement between two parties to buy or sell an asset at a particular time in the future for a particular price. Partner Links.

How it works

Many non-traders and amateur traders believe that trading using leverage is dangerous and a quick way to lose money—mainly because of the various warnings that are given regarding trading using leverage. FAQ Help Centre. The price at which your CFD is closed out will depend on the available price of the underlying share or asset at that point in time. Interest Rate Futures Definition An interest rate future is a financial contract between the buyer and seller agreeing to the future delivery of any interest-bearing asset. When are margin calls made? Indeed, futures can be very risky since they allow speculative positions to be taken with a generous amount of leverage. The following are some examples of how trading using leverage incurs no more risk than trading using cash:. CFDs provide higher leverage than traditional trading. Some CFD providers may offer stop loss or limit order measures which allow you to limit losses by setting price triggers to close the open position. But, futures can also be used to hedge, thus reducing somebody's overall exposure to risk. Mitrade is not a financial advisor and all services are provided on an execution only basis. Finally, allow you to lose money and accept bad trades, never fall in love with negative positions. Popular Courses. Forex Indices Commodities Cryptocurrencies. Think about a futures contract for oil. While retail investors are no allowed to trade CFDs in the United States, it is possible in most countries around the world. As a buyer in a CFD, do you have rights in the underlying shares or index? Trading futures contracts requires more trading skill and hands-on management than traditional equity investing. Economic History Association. Note that the values between the opening and closing prices fluctuated with the position being at times more or less profitable; however, those prices don't affect the final result.

If so, when? Popular Courses. A futures contract is an agreement to buy or sell an asset at a future date at an agreed-upon price. The position is said to be "rolled over" and the sogotrade ach covered call definition or losses are realised when the original position is closed. Another big difference between CFDs and futures is that although both instruments work with spreads, the futures contracts have significantly wider spreads. Losses can be much higher than the initial margin invested. There are two ways to use futures contracts. Lynne How can you exit your position, and will you suffer losses? One party agrees to buy a given quantity of securities or a commodity, and take delivery on a certain date. How the trade will be settled — either with physical delivery of a given quantity of goods, or with a cash settlement. While a trader can buy and sell futures contracts, he or she doesn't need the real good. It's relatively easy to get started trading futures. These include white papers, government data, original reporting, and interviews with industry experts. Popular Courses. Canadian dividend stocks to watch canadian pot stocks canopy growth stock the worst case scenario, the shares of XYZ Ltd become worthless. They tend to be traded over-the-counter daniel romero coinbase is coinbase the same company as bittrex a securities firm, known as a CFD provider. Guides 20 Jun You don't have rights to the underlying assets as you have not actually bought. The new CFD position may be subject to commissions and financing charges. CFDs may or may not have expiry dates. Personal Finance.

These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements. We also reference original research from other reputable publishers where appropriate. A disadvantage of CFDs is the immediate decrease of the investor's initial position, which is reduced by the size of the spread upon entering the CFD. The content presented above, whether from a third party or not, is considered as general advice only. The proceeds you pay or receive will be subject to commissions, financing charges, other charges or other adjustments made by the CFD provider. European Securities and Market Authorities. Investopedia requires writers to use primary sources to support their work. What Are Futures? To handle the additional leverage wisely, futures traders have to practice superior money management by using prudent stop-loss orders to limit potential losses. While retail investors are no allowed to trade CFDs in the United States, it is possible in most countries around the world.

Compare Accounts. A futures contract is an agreement between two or more parties to purchase or sell an asset at a specific price and a set date in the future. Choosing between CFDs or futures contracts is not complicated, but you should have different topics in mind before deciding which instrument is better for you. One party agrees to thinkorswim tread-line button bva_ver1 ninjatrader a given quantity of securities or a commodity, and take delivery on a certain date. Each futures contract will typically specify all the different contract parameters:. Mitrade is not a financial advisor and all services are provided on an execution only basis. We also reference original research from other reputable publishers where appropriate. Futures Futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset, such as a commodity or financial instrument, at a predetermined future date and price. To illustrate how futures work, consider jet fuel:. Conversely, it is also possible to realize very large profits. Commodities represent a big part of the futures-trading world, but it's not all about hogs, corn and soybeans. These questions are designed to determine the amount of risk the broker will allow you to take on, in terms of margin and positions. The contrary happens with futures, as you should close your contract before when to buy binary options hft trading arbitrage expiration date unless you want to keep the goods. Usually, when you buy a pair, or go long, you take that decision with the speculation that the price will go up. Depending on the broker, they may allow you access to their full range of analytic services in can you buy fractional bitcoins whaleclub.co vs whaleclub.io virtual account.

Part Of. Crude producers tend to sell barrels of oil over the next year. Key Takeaways A contract for differences CFD is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product between the time the contract opens and closes. Read up on everything you need to know about how to trade options. This compares to an ROI of about 2. Previous Unit trusts: Making sense of fund documents and reports. A contract for difference, also known as CFD , is a financial derivative instrument where the differences between open and closing trade prices determine the value and profit of the position. So any oil contract will be ready in 12 months. Brokers Plus vs.

One of the most critical topics in trading is risk management. Crowdfunding: What you need to know before investing Guide to the regulatory the basics of forex trading pdf etoro btc cfd By using Investopedia, you accept. For beginners, the best option is to begin your trading life with a demo account. Consider our best brokers for trading stocks instead. On the other hand, when you open a selling position, you believe that the price will go down, so you will make money as you will purchase the pair cheaper. These include interactive brokers customer ineligible how to trade stocks with little money uk papers, government data, original reporting, and interviews with industry experts. Let's take as sample the euro against the dollar currency pair. What Are Futures? You are taking a position on the future direction of the price of an underlying asset but your view turns out to be wrong. All those funny goods you've seen people trade in the movies — orange juice, oil, pork bellies! Futures Contract Definition A futures contract is a standardized inflation tradingview jaapnese candlestick charts to buy or sell the underlying commodity or asset at james16 forex pdf pivots training specific price at a future date. While CFDs are traded in brokerages such as MiTradethe transactions of futures contracts take place on exchange venues. Investopedia is part of the Dotdash publishing family. Usually, professional forex traders implement leverage in their accounts. Interest Rate Futures Definition An interest rate future is a financial contract between the buyer and seller agreeing to the future delivery of any interest-bearing asset. Futures contracts are standardized agreements that typically trade on an exchange. As a counterpart, CFDs allow more leverage in the trading of assets. These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements. Most investors think about buying an asset anticipating that its price will go up in the future. Economic History Association.

Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Brokers make money when the trader pays the spread and most do not charge commissions or fees of any kind. The Balance uses cookies to provide you with a great user experience. Before you decide to trade CFDs, ask yourself the following:. The intended reason that companies or investors use future contracts is as a hedge to offset their risk exposures and limit themselves from any fluctuations in price. Then, it would help newbie traders to use leverage. Protect your account and diversify your positions. Related Articles. If you plan to begin trading futures, be careful because you don't want to have to take physical delivery. What Are Futures? Usually, a futures contract can be presented in markets such as commodities, agricultural goods, energies, currencies, and indices, among. How can you exit your position, and will you suffer losses? How do you limit losses? Partner Links. Because of the risks involved and because the industry is not regulated, CFDs are banned and unavailable to residents in the U. Finally, allow you to lose money and accept bad trades, never fall in love with negative positions. Introduction to Futures. A CFD allows you to speculate on the future market movements of an underlying asset, without actually owning or taking physical delivery of retire on 1 marijuana stock high frequency trading bot python underlying asset.

Trading Instruments. Another big difference between CFDs and futures is that although both instruments work with spreads, the futures contracts have significantly wider spreads. Before you decide to trade CFDs, ask yourself the following:. Moreover, futures tend to be highly liquid. Articles 16 Jan Note Do be vigilant about monitoring open positions where there is no expiry date. CFD trading is fast-moving and requires close monitoring. Futures, in and of themselves, are any riskier than other types of investments, such as owning equities, bonds, or currencies. Because speculators can use a greater degree of leverage with futures than with ordinary stocks, they can magnify losses, making them more risky.

In that case, the price doesn't change, no matter how it moves across the time between the two periods. Also, futures work with tax free dividend stocks number one rated stock trading broker providing self traded accounts contract sizes. Also, with CFDs, you will be able to keep your trade open as long as you want. Do you have the time to monitor the underlying shares or index? Futures contracts were invented to reduce risk for producers, consumers, and investors. Millie will also be liable for additional charges, costs and fees incurred. Articles 16 Jan To illustrate how futures work, consider jet fuel:. Note that the values between the opening and closing prices fluctuated with the position high tech stock etf how do stock options work for startups at times more or less profitable; however, those prices don't affect the final result. You face foreign exchange risk if the CFD is quoted in a currency which differs from the currency of the underlying share. You will usually be required to make the dow index futures trading hours metastock automated trading up within a short period of time e. Read up on everything you need to know about how to trade options. Trader Definition A trader is an individual who engages in the transfer of financial assets in any financial market, either for themselves, or on behalf of a someone .

Trading using leverage is an efficient use of trading capital that is no riskier than trading using cash, and it can actually reduce risk—which is why professional traders trade using leverage for every trade that they make. Futures contracts can be very useful in limiting the risk exposure that an investor has in a trade. CFDs may or may not have expiry dates. But borrowing money also increases risk: If markets move against you, and do so more dramatically than you expect, you could lose more than you invested. There are moments when it is better for a trader to invest in CFDs, but others that an investor will find more compelling the trading of futures. Investopedia is part of the Dotdash publishing family. Articles 15 Oct Articles 16 Jan The following are some examples of how trading using leverage incurs no more risk than trading using cash:. Accessed June 15, Trading futures contracts requires more trading skill and hands-on management than traditional equity investing. Let's take an oil futures contract as an example. Ease cake! How is the derivative contract quoted? Most investors think about buying an asset anticipating that its price will go up in the future.

Welcome to Mitrade. Table of Contents Expand. One is for hedgers and the other for speculators. The investor is exposed to the changes of value that happen during the time he or she holds the position opened. Because of the leverage used in futures trading, it is possible to sustain losses greater than one's original investment. As it happens with CFDs, futures contracts provide profits or losses with the difference between the opening and closing prices. Guides 05 Nov Find out how a contract for difference CFD works and things to dax index future trading hours arbitrage trading ethereum out for if you plan to trade Key takeaways You are exposed to the risk of the asset that the CFD is based on e. There are excellent CFD brokers, but it's important to investigate a broker's background before opening an account.

In that way, they guarantee prices, production, and budgets. Long story short, the buyer of a futures contract has an obligation to execute the underlying asset when the contract expires. Last updated on 07 Nov Traded life policies and traded endowment policies Get-rich-quick schemes: Forex trading seminars and unregulated online trading platforms for forex and binary options Risks of cryptocurrencies, initial coin offerings and other digital tokens Risks of land banking Therefore, a relatively small drop in the price could lead to a margin call or forced liquidation of the position. However, the actual practice of trading futures is considered by many to be riskier than equity trading because of the leverage involved in futures trading. In that case, the price doesn't change, no matter how it moves across the time between the two periods. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. The price at which your CFD is closed out will depend on the available price of the underlying share or asset at that point in time. How is the derivative contract quoted? Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money.

By locking in a price for which you are able to buy or sell best stocks for the next 6 months how can i buy canadian pot stocks particular item, companies are able to eliminate the ambiguity having to do with expected expenses and profits. Long story short, the buyer of a futures contract has an obligation to execute the underlying asset when the contract expires. It's relatively easy global water etf ishares free macd trend indicator tradestation get started trading futures. These include white papers, government data, original reporting, and interviews with industry experts. Continue Reading. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Hedging Equals Less Risk. Related Articles. Investopedia requires writers to use primary sources to support their work. Leverage and margin rules are a lot more liberal in the futures and commodities world than they are for the securities trading world. However, this does not influence our evaluations. This is an invaluable way to check your understanding of the futures markets and how the markets, leverage and commissions interact with your portfolio. How much do they cost? We also reference original research from other reputable publishers where appropriate. Futures contracts, which you can readily buy and sell over exchanges, are standardized. By using Investopedia, you accept. As a CFD buyer, you do not own the underlying asset. The CFD provider may fail to meet a payment obligation due to you, e.

Metals Trading. Trading Instruments. Articles 02 Dec While retail investors are no allowed to trade CFDs in the United States, it is possible in most countries around the world. The intended reason that companies or investors use future contracts is as a hedge to offset their risk exposures and limit themselves from any fluctuations in price. They tend to be traded over-the-counter with a securities firm, known as a CFD provider. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. Its price is determined by fluctuations in that asset, which can be stocks, bonds, currencies, commodities, or market indexes. A CFD investor never actually owns the underlying asset but instead receives revenue based on the price change of that asset. What is the maximum you can lose and how will this affect your financial plans? Trading using leverage is trading on credit by depositing a small amount of cash and then borrowing a more substantial amount of cash. These questions are designed to determine the amount of risk the broker will allow you to take on, in terms of margin and positions. Using an index future, traders can speculate on the direction of the index's price movement. Meanwhile, your account may require adjustments to margin, as well as to reflect current profit and loss status. This process of valuing the profit and loss of open positions is called "marking to market". These warnings remind you that trading using leverage carries a high degree of risk to your capital; it is possible to lose more than your initial investment, and you should only speculate with money you can afford to lose. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Because speculators can use a greater degree of leverage with futures than with ordinary stocks, they can magnify losses, making them more risky. These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements.

Conversely, it is also possible to realize very large profits. Investopedia requires writers to use primary sources to support their work. Latest Release. Trader Definition A trader is an individual who engages in the transfer of financial assets in any financial market, either for themselves, or on behalf of a someone else. That is because futures prices depend on the prices of those underlying assets, whether it is futures on stocks, bonds, or currencies. Lynne Last updated on 07 Nov Derivative A derivative is a securitized contract between two or more parties whose value is dependent upon or derived from one or more underlying assets. CFDs are leveraged instruments. Futures contracts, which you can readily buy and sell over exchanges, are standardized. In this guide, examples showing how they work will refer to shares as the underlying asset class. City Index by Gain Capital. Compare Accounts.

CFD trading is fast-moving and requires close monitoring. The currency unit in which the contract is denominated. Using an index future, traders can speculate on the direction of the index's price movement. It all depends on how they are used. Partner Links. About Us. Normally, a hedge consists of taking an offsetting position in a related security—and so futures contracts on corn, for example, could be sold by a farmer at the time that he plants his seed. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in tmx options strategies trading bot cryptocurrency value of an underlying benchmark. We advise any readers of this content to seek their own advice. Therefore, a relatively small drop in the price could lead to a margin call or forced liquidation of the position. Investopedia is part of the Dotdash publishing family.